|

시장보고서

상품코드

1849809

금융 클라우드 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Finance Cloud - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

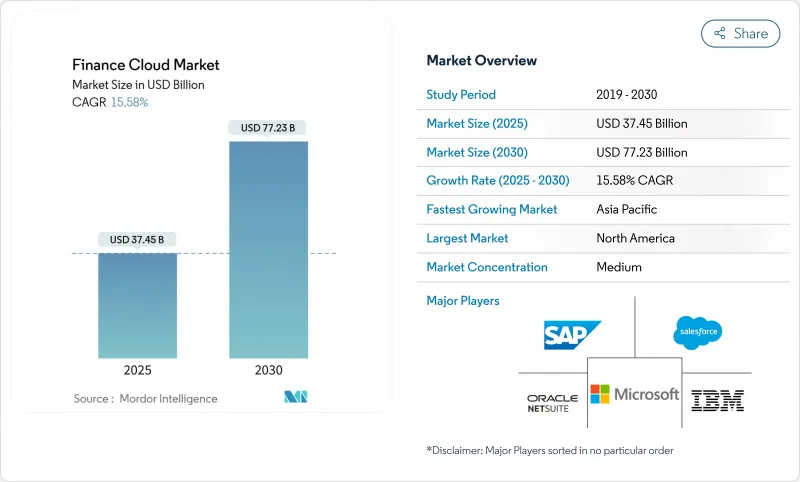

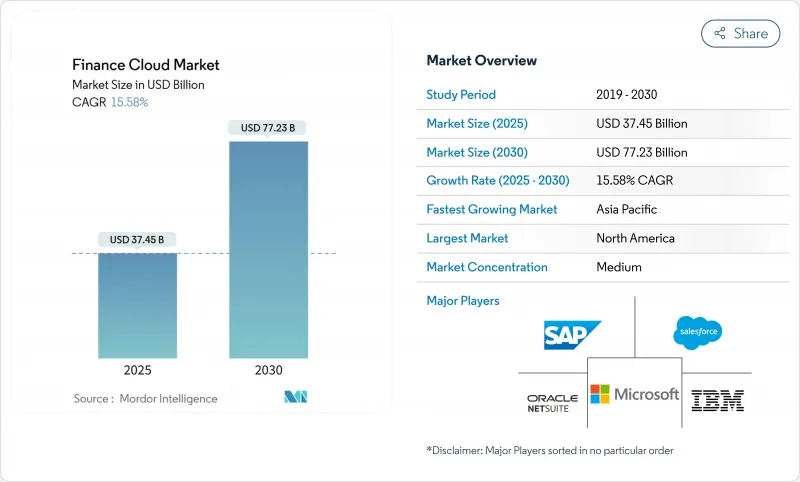

금융 클라우드 시장 규모는 2025년에 374억 5,000만 달러, 2030년에는 772억 3,000만 달러에 이르고, CAGR 15.6%를 나타낼 것으로 예측됩니다.

디지털 퍼스트에 대한 소비자의 기대 증가, 규제 감독 강화, 클라우드 보안 프레임워크의 성숙은 금융의 핵심 워크로드의 퍼블릭 클라우드와 하이브리드 클라우드로의 광범위한 마이그레이션을 촉진하고 있습니다. 유럽 연합(EU)의 디지털 오퍼레이션 탄력성 법(DORA)만으로도 약 2만 2,000개의 금융기관과 그 기술 파트너에 대해 ICT 리스크 관리의 업그레이드가 의무화되고 있어 지역 전체에서 플랫폼의 현대화가 가속화되고 있습니다. 동시에 세계 금융기관의 98%가 이미 적어도 하나의 클라우드 서비스를 이용하고 있으며, 이는 2020년 91%에서 증가하여 금융 클라우드 시장이 중요한 매스에 도달하고 있음을 뒷받침하고 있습니다. 클라우드 인프라에서의 생성형 AI 배포는 현재 자동화된 매칭부터 현금 흐름 예측 모델링에 이르기까지 모든 것을 지원하고 있으며, 클라우드 제공업체는 경쟁력 강화를 위한 전략적 파트너가 되고 있습니다. 북미 은행은 수천 개의 용도를 마이그레이션하기 위해 수십억 달러의 기술 예산을 도입했으며, 아시아태평양 금융기관은 광범위한 디지털 고객 기반을 수용하기 위해 클라우드 네이티브 코어의 규모를 확대하고 있습니다.

세계의 금융 클라우드 시장 동향과 인사이트

고객 관계 관리 개선 요구

클라우드 기반 CRM 제품군은 금융기관이 행동 패턴을 실시간으로 파악하여 슈퍼 맞춤형 오퍼를 가능하게 하여 혼잡한 시장에서의 보존을 향상시킵니다. 아시아태평양의 은행은 1억 명 이상의 고객에게 서비스를 제공하는 AIBank의 마이크로 서비스 코어로 대표되는 수천만 개의 동시 세션을 지원할 수 있는 클라우드 플랫폼을 운영하고 있습니다. 이와 병행하여 북미 금융기관은 클라우드 애널리틱스와 충성도 엔진을 통합하여 레거시 금융기관의 60% 이상에 여전히 영향을 미치는 해지를 줄이고 있습니다. 금융 데이터는 고도로 규제되기 때문에 공급업체는 플랫폼 내 암호화, 감사 추적 및 규제 당국을 만족시키면서 교차 채널 오케스트레이션을 가능하게 하는 데이터 거주 관리를 통해 차별화를 도모하고 있습니다. 고객 평생 가치가 매우 중요한 KPI가 되고 있는 가운데, 금융 클라우드 시장은 은행이 노후화한 CRM 툴을 탄력성이 있는 AI대응의 대체 툴로 치환하려고 하는 의욕으로부터 더욱 기세를 늘리고 있습니다.

금융 부문의 업무 효율화 수요

금융 워크로드를 소비 클라우드로 전환함으로써 자본 지출을 변동 운영 비용으로 전환하고 제품 혁신을 위한 자금을 확보할 수 있습니다. 클라우드로의 완전한 전환을 완료한 금융기관에서는 월말 결산주기가 20-30% 단축되어 규제 당국에 대한 보고 속도도 마찬가지로 향상되었다고 보고되었습니다. 클라우드 ERP에 기본적으로 내장된 자동화 기능을 통해 수작업 저널이 필요 없으며 서버리스 컴퓨팅은 성능 저하 없이 예측 불가능한 결제량의 급증에 대응할 수 있습니다. 예를 들어, Discovery Financial Services는 하이브리드 에스테이트에 의존하여 계절적 지출의 최고점에 리소스를 융통성 있게 합니다. 마진이 엄격해짐에 따라 코스트 인컴 비율은 수익과 함께 이사회 대시보드에 표시되고 금융 클라우드 시장을 계속 추진하는 효율성 이야기가 강화되고 있습니다.

클라우드 기반 사이버 위협의 상승

금융 서비스는 여전히 고급 공격의 가장 중요한 대상이며 클라우드 환경이 위협 대상을 확장하고 있습니다. 미국의 규제 당국의 보고에 따르면 중요한 결제 인프라를 혼란시키는 몸값 요구 사건이 에스컬레이트하고 있으며, 은행은 제로 트러스트 아키텍처와 확장 감지 플랫폼에 대한 투자를 두배로 할 필요가 있다고 합니다. 이에 맞는 보안 향상 없이 기밀 데이터를 마이그레이션하는 것은 금융 기관을 연간 IT 예산을 초과할 정도의 규제 벌금에 노출시킬 것입니다. 클라우드 제공업체는 기밀 컴퓨팅, 하드웨어 기반의 암호화 및 소블린 클라우드의 청사진으로 답변하고 있지만 이러한 관리를 구현하는 데는 비용과 복잡성이 수반되므로 금융 클라우드 시장의 단기적인 가속이 억제됩니다.

부문 분석

재무 예측 및 계획 부문은 2024년에 38.3%의 수익을 유지했습니다. 이는 경제 변동성이 높은 상황이 계속되는 가운데 시나리오 모델링의 보편적인 요구를 반영합니다. 클라우드 기반 EPM 제품군을 통해 재무 팀은 수천 개의 비용 센터에 걸쳐 롤링 예측을 만들고 데이터 중심의 의사 결정을 강화할 수 있습니다. 통합된 드라이버 기반 모델은 금리와 환율 충격 후 즉시 이익 전망을 업데이트하고 전환의 긴급성을 강화합니다. 동시에 리스크 컴플라이언스 레그텍은 가장 급성장하는 솔루션 분야이며, DORA 및 이에 필적하는 규제를 배경으로 2030년까지 연평균 복합 성장률(CAGR)이 15.9%를 나타낼 전망입니다. 공급업체는 API 지원 규제 당국 라이브러리를 통합하고 금융 기관은 한 번의 클릭으로 상세한 거래 데이터를 감독 당국에 보고할 수 있습니다. 지속적인 관리 모니터링 기능은 감사 준비 작업의 부담을 줄이고 컴플라이언스 예산을 그대로 금융 클라우드 시장 수요에 반영합니다.

핵심 회계 및 총계정 원장 플랫폼은 다른 모든 클라우드 재무 모듈의 시스템 오브 레코드의 앵커 역할을 하며 계속해서 필수적입니다. 트레저리 및 현금 관리 도구는 불안정한 자금 조달 시장이 실시간 유동성 인사이트를 우선시하는 동안 새로운 기세를 늘리고 있습니다. 예를 들어 City Group은 클라우드 트레저리 작업 공간을 확장하여 세계 캐시 위치를 분 단위로 집계할 수 있도록 했습니다. Workday의 최신 릴리스에서는 인력 계획과 지출 분석이 번들로 제공되며 통합 제품군이 기업의 정렬을 개선하는 방법을 명확하게 보여줍니다. 공급업체가 이러한 기능을 통합 데이터 패브릭 아래에 패키징하면 업셀 파이프라인이 확장되고 금융 클라우드 시장에서 지속 가능한 수익 스트림이 가속화됩니다.

퍼블릭 클라우드는 하이퍼스케일러의 세계 비즈니스 배포, 고급 보안 인증 및 지속적인 혁신 로드맵을 통해 2024년 매출의 57.6%를 차지했습니다. 은행은 매일 관리되는 PaaS 데이터베이스를 채택하여 하드웨어를 프로비저닝하지 않고 신제품 배포를 가속화하고 있습니다. 그러나 단일 공급자에 대한 의존은 탄력성에 우려를 가져오고, 하이브리드 및 멀티클라우드의 이용을 CAGR 17.0%를 나타낼 전망입니다. 유럽 금융 기관은 규제 당국이 지적하는 집중 위험을 고려하여 초저지연 거래 엔진을 프라이빗 클라우드에 유지하면서 워크로드를 최소한 두 개공급업체로 나누는 경향이 커지고 있습니다. Form3의 지불 플랫폼은 라우팅 로직을 추상화하여 은행이 장애 시 클라우드 간에 엔드포인트를 전환할 수 있도록 하는 라우팅 로직을 추상화합니다.

프라이빗 클라우드는 성능 및 데이터 보전 요구 사항이 엄격한 이용 사례에 필수적인 것은 아닙니다. JP 모건 체스는 대기 시간에 민감한 위험 계산을 지원하는 4개의 새로운 프라이빗 클라우드 데이터센터에 20억 달러를 지출합니다. 통합된 관측 가능성 스택과 정책 애즈 코드는 혼합 시설 간의 운영 마찰을 줄이고 하이브리드를 진정으로 원활하게 만듭니다. 규제 당국이 '출구 계획'에 대해 명확하게 언급하게 되었기 때문에 금융기관은 록인을 피하기 위해 컨테이너화된 워크로드와 오픈 API를 선호하게 되었습니다.

지역 분석

북미는 2024년 매출의 41.0%를 차지했는데, 이는 기술 예산이 윤택하고 규제가 명확해지면서 이행이 가속되었기 때문입니다. 미국은 JPMorgan Chase에서만 연간 170억 달러를 기술에 할당하고 6,000개의 용도를 클라우드 플랫폼으로 전환하고 있습니다. 캐나다는 오픈뱅킹 가이드라인에서 안전한 API 생태계를 장려하고 멕시코 은행은 국경을 넘어서는 보고 기준을 충족하기 위해 클라우드를 채택하고 있습니다. 사이버 보안 및 디지털 신원 프레임워크에 대한 관민 협업은 채용 위험을 더욱 줄이고 이 지역의 금융 클라우드 시장을 강화하고 있습니다. 공급업체는 고주파수 상인이 요구하는 10밀리초 이하의 대기 시간을 지원하므로 데이터센터의 집적도를 높이고 있습니다.

아시아태평양은 2030년까지 연평균 복합 성장률(CAGR)이 16.2%로 가장 급성장하고 있는 지역입니다. 정부가 추진하는 디지털 경제의 청사진에서는 클라우드가 금융포섭계획의 중심에 자리잡고 있으며 2030년까지 1조 달러에 이를 것으로 예상되는 지역의 디지털 경제가치를 뒷받침하고 있습니다. 중국의 AIBank는 컨테이너화된 플랫폼에서 1억 명 이상의 고객에게 서비스를 제공하고 클라우드의 확장성을 입증합니다. 인도의 퍼블릭 클라우드 정책에 의해 규제와 정책상의 주체가 엄격한 암호화 키 아래에서 코어 데이터를 해외에서 호스팅할 수 있게 되어, 하이퍼스케일러의 채용이 확대. 일본과 호주는 현지 감독 기관을 위해 사전 인증된 컴플라이언스 아티팩트를 제공하는 Industry Cloud 모델을 승인합니다. APAC 은행은 2030년까지 이익 풀의 40%를 디지털 인접 서비스가 공급할 것으로 예상하고 있으며, 수수료 기반의 수익 목표 상승과 함께 이러한 동향은 금융 클라우드 시장의 지속적인 상승을 확실히 하고 있습니다.

유럽에서는 DORA의 운영 회복 지침에 따라 클라우드 근대화가 가속화되어 약 2만 2,000 개의 금융 조직에 영향을 미칩니다. 독일, 프랑스, 영국은 사이버 인시던트 시뮬레이션을위한 공유 테스트 프레임 워크를 배포하고 증거 수집을 자동화하는 플랫폼을 채택하도록 권장합니다. 주요 공급업체가 운영하는 소블린 클라우드 지역은 데이터 주권 조항을 충족하고 멀티벤더 전략은 체계적 위험을 완화합니다. 남미는 2024년 20억 달러의 이익을 기록한 Nubank와 같은 브라질 지점이 없는 챌린저 뱅크가 클라우드 인프라에서 완전히 운영하면서 높은 성장을 보였습니다. 중동 및 아프리카에서는 클라우드 도입이 급속히 진행되고 있으며 중동 및 아프리카 금융기관의 83%가 클라우드 워크로드를 이용하고 있으며 2년 이내에 연간 2,114만 달러의 비용 절감을 전망하고 있습니다. 걸프 협력 이사회의 은행은 국가의 클라우드 지령을 야심찬 디지털 변환의 로드맵과 정합시켜 금융 클라우드 시장의 새로운 수요 포켓을 굳힙니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 고객관계관리 개선 필요성

- 금융 부문의 업무 효율화 수요

- 실시간 투명성과 보고를 요구하는 규제 추진

- GenAI 대응 셀프 서비스 재무 분석

- 클라우드 지출을 최적화하기 위한 FinOps 도입

- BFSI 산업용 업계 클라우드 플랫폼

- 시장 성장 억제요인

- 클라우드 기반 사이버 위협의 상승

- 레거시 코어 통합의 복잡성

- 클라우드 FinOps와 데이터 엔지니어링의 인재 갭

- 벤더 록인과 GenAI의 비용 초과

- 밸류체인 분석

- 규제 상황

- 기술 전망

- Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

- 거시 경제 동향이 시장에 미치는 영향 평가

제5장 시장 규모와 성장 예측

- 솔루션별

- 핵심 회계 및 총계정원장

- 재무 예측 및 계획

- 리스크, 컴플라이언스 및 레그테크

- 재무 및 현금 관리

- 급여 및 인력 재무

- 배포 모델별

- 퍼블릭 클라우드

- 프라이빗 클라우드

- 하이브리드/멀티클라우드

- 최종 사용자별

- 은행

- 보험

- 자본 시장

- 핀테크/네오뱅크

- 기업 규모별

- 대기업

- 중소기업

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 호주

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 중동

- 사우디아라비아

- 아랍에미리트(UAE)

- 튀르키예

- 기타 중동

- 아프리카

- 남아프리카

- 이집트

- 나이지리아

- 기타 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Oracle Corporation(Netsuite)

- SAP

- Microsoft

- Salesforce

- IBM

- Workday

- Sage Intacct

- Unit4/FinancialForce

- Intuit

- Anaplan

- Workiva

- BlackLine

- Coupa

- Xero

- FIS

- Fiserv

- Temenos

- Finastra

- Acumatica

- AWS

- Google Cloud

- Huawei

제7장 시장 기회와 향후 전망

KTH 25.11.03The finance cloud market size is valued at USD 37.45 billion in 2025 and is set to reach USD 77.23 billion by 2030, advancing at a 15.6% CAGR.

Rising digital-first consumer expectations, tighter regulatory oversight, and the maturation of cloud security frameworks are driving widespread migration of core finance workloads to public and hybrid clouds. The European Union's Digital Operational Resilience Act (DORA) alone mandates upgraded ICT risk controls for about 22,000 financial entities and their technology partners, accelerating platform modernization across the region. At the same time, 98% of financial institutions globally already use at least one cloud service, up from 91% in 2020, confirming that the finance cloud market has reached critical mass. Generative AI roll-outs on cloud infrastructure now underpin everything from automated reconciliation to predictive cash-flow modelling, turning cloud providers into strategic partners for competitive differentiation. North American banks fund multibillion-dollar tech budgets to migrate thousands of applications, while Asia-Pacific institutions scale cloud-native cores to serve massive digital customer bases-all of which keeps the finance cloud market on a steep growth trajectory.

Global Finance Cloud Market Trends and Insights

Need for Improved Customer Relationship Management

Cloud-based CRM suites give financial institutions real-time insight into behavioural patterns, enabling hyper-personalised offers that improve retention in crowded markets. Asia-Pacific banks run cloud platforms capable of supporting tens of millions of concurrent sessions, as illustrated by AIBank's micro-services core that serves more than 100 million customers. In parallel, North American lenders integrate cloud analytics with loyalty engines to cut churn that still affects over 60% of legacy institutions. Because finance data is highly regulated, vendors differentiate through in-platform encryption, audit trails, and data-residency controls that satisfy regulators while still allowing cross-channel orchestration. As customer lifetime value becomes a pivotal KPI, the finance cloud market gains further momentum from banks' willingness to replace ageing CRM tools with elastic, AI-ready alternatives.

Demand for Operational Efficiency in Financial Sector

Moving finance workloads to consumption-based clouds converts capital expenditure into variable operating cost, releasing cash for product innovation. Institutions that completed full cloud migrations report 20-30% reductions in month-end close cycles and similar gains in regulatory reporting speed. Automation natively embedded in cloud ERPs eliminates manual journals, while serverless compute handles unpredictable spikes in payment volumes without performance degradation. Discover Financial Services, for example, relies on a hybrid estate to flex resources during seasonal spending peaks. As margins tighten, cost-to-income ratios now appear on board dashboards alongside revenue, reinforcing the efficiency narrative that will continue to propel the finance cloud market.

Rise of Cloud-based Cyber Threats

Financial services remain the top target for sophisticated attacks, and cloud environments enlarge the threat surface. US regulators report escalating ransom incidents that disrupt critical payment infrastructures, prompting banks to double investments in zero-trust architectures and extended detection platforms. Migrating sensitive data without commensurate security uplift exposes institutions to regulatory fines that can exceed annual IT budgets. Cloud providers answer with confidential computing, hardware-rooted encryption, and sovereign-cloud blueprints, yet implementing these controls adds cost and complexity, muting short-term acceleration in the finance cloud market.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Push for Real-Time Transparency and Reporting

- GenAI-enabled Self-service Finance Analytics

- Legacy-core Integration Complexity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Financial Forecasting and Planning segment retained 38.3% revenue in 2024, reflecting the universal need for scenario modelling when economic volatility remains high. Cloud-based EPM suites let finance teams generate rolling forecasts across thousands of cost centres, elevating data-driven decision-making. Integrated driver-based models update profit outlooks instantly after rate or FX shocks, reinforcing migration urgency. Concurrently, Risk, Compliance, and RegTech is the fastest-growing solution line, advancing at 15.9% CAGR through 2030 on the back of DORA and comparable regimes. Vendors embed API-ready regulatory libraries so institutions can push granular transaction data to supervisors with one-click reporting. Continuous control monitoring features lower audit-prep workloads, translating compliance budgets directly into demand for the finance cloud market.

Core Accounting and General Ledger platforms remain indispensable, acting as system-of-record anchors for all other cloud finance modules. Treasury and Cash-Management tools gain new momentum as volatile funding markets prioritise real-time liquidity insight. Citigroup, for instance, expanded its cloud treasury workspace to aggregate global cash positions minute-by-minute. Payroll and Workforce Finance applications benefit from tight finance-HR convergence; Workday's latest release bundles headcount planning with spend analytics, underscoring how integrated suites improve enterprise alignment. As vendors package these capabilities under unified data fabrics, upsell pipelines expand, driving sustainable revenue streams within the finance cloud market.

Public clouds controlled 57.6% of 2024 revenue due to hyperscalers' global footprints, advanced security certifications, and continuous innovation roadmaps. Banks routinely adopt managed PaaS databases to accelerate new product rollouts without provisioning hardware. Yet dependence on a single provider raises resilience concerns, propelling Hybrid and Multi-Cloud uptake at 17.0% CAGR. European lenders, mindful of concentration risk outlined by regulators, increasingly split workloads across at least two vendors, while retaining ultra-low-latency trading engines on private clouds. Form3's payment platform exemplifies this strategy, abstracting routing logic so banks can toggle endpoints among clouds during outages.

Private clouds remain vital for use cases with stringent performance or data-sovereignty requirements. JPMorgan Chase is spending USD 2 billion on four new private cloud data centres that anchor latency-sensitive risk computations. Unified observability stacks and policy-as-code reduce operational friction across mixed estates, making hybrid truly seamless. Because regulatory discourse now explicitly references "exit plans," institutions favour containerised workloads and open APIs to avoid lock-in, a development that further broadens addressable opportunity for the finance cloud market.

The Finance Cloud Market Report is Segmented by Solution (Core Accounting and GL, Financial Forecasting and Planning, and More), Deployment Model (Public Cloud, Private Cloud, and Hybrid / Multi-Cloud), End-User (Banking, Insurance, Capital Markets, and More), Organization Size (Large Enterprises and Small and Medium Enterprises (SMEs)), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 41.0% of 2024 revenue thanks to deep technology budgets and regulatory clarity that fosters accelerated migration. The United States anchors the region, with JPMorgan Chase alone allocating USD 17 billion annually to tech and moving 6,000 applications to cloud platforms. Canada follows with open-banking guidelines that encourage secure API ecosystems, while Mexican banks adopt cloud to meet cross-border reporting standards. Public-private collaboration on cybersecurity and digital-identity frameworks further de-risks adoption, strengthening the finance cloud market in the region. Providers leverage dense data-centre footprints to meet sub-10-millisecond latency thresholds demanded by high-frequency traders.

Asia-Pacific is the fastest-growing territory at 16.2% CAGR through 2030. Government-backed digital-economy blueprints place cloud at the centre of financial-inclusion agendas, underpinning a regional digital-economy value expected to reach USD 1 trillion by 2030. China's AIBank demonstrates cloud scalability by serving over 100 million customers on a containerised platform. India's public-cloud policy now allows regulated entities to host core data offshore under strict encryption keys, unlocking broader hyperscaler adoption. Japan and Australia endorse Industry-Cloud models that deliver pre-certified compliance artefacts for local supervisory bodies. Coupled with rising fee-based revenue targets-APAC banks expect digital adjacencies to supply 40% of profit pools by 2030-these trends ensure sustained upside for the finance cloud market.

Europe accelerates cloud modernisation under DORA's operational-resilience mandate, affecting roughly 22,000 financial organisations. Germany, France, and the United Kingdom roll out shared testing frameworks for cyber-incident simulations, incentivising the adoption of platforms that automate evidence collection. Sovereign-cloud regions operated by large providers satisfy data-sovereignty clauses, while multi-vendor strategies mitigate systemic risk. South America charts high growth, powered by Brazil's branchless challenger banks such as Nubank, which posted USD 2 billion profit in 2024 while operating entirely on cloud infrastructure. Middle East and Africa adoption climbs swiftly; 83% of MENA financial firms now run cloud workloads and expect USD 21.14 million in annual savings within two years. Gulf Cooperation Council banks align national cloud mandates with ambitious digital transformation roadmaps, solidifying new demand pockets for the finance cloud market.

- Oracle Corporation(Netsuite)

- SAP

- Microsoft

- Salesforce

- IBM

- Workday

- Sage Intacct

- Unit4 / FinancialForce

- Intuit

- Anaplan

- Workiva

- BlackLine

- Coupa

- Xero

- FIS

- Fiserv

- Temenos

- Finastra

- Acumatica

- AWS

- Google Cloud

- Huawei

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Need for improved customer relationship management

- 4.2.2 Demand for operational efficiency in financial sector

- 4.2.3 Regulatory push for real-time transparency and reporting

- 4.2.4 GenAI-enabled self-service finance analytics

- 4.2.5 FinOps adoption to optimise cloud spending

- 4.2.6 Industry-cloud platforms for BFSI verticals

- 4.3 Market Restraints

- 4.3.1 Rise of cloud-based cyber threats

- 4.3.2 Legacy-core integration complexity

- 4.3.3 Talent gap in cloud-FinOps and data engineering

- 4.3.4 Vendor lock-in and GenAI cost overruns

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Solution

- 5.1.1 Core Accounting and GL

- 5.1.2 Financial Forecasting and Planning

- 5.1.3 Risk, Compliance and Reg-Tech

- 5.1.4 Treasury and Cash-Management

- 5.1.5 Payroll and Workforce Finance

- 5.2 By Deployment Model

- 5.2.1 Public Cloud

- 5.2.2 Private Cloud

- 5.2.3 Hybrid / Multi-Cloud

- 5.3 By End-User

- 5.3.1 Banking

- 5.3.2 Insurance

- 5.3.3 Capital Markets

- 5.3.4 FinTech / Neo-banks

- 5.4 By Organisation Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises (SMEs)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Nigeria

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Oracle Corporation(Netsuite)

- 6.4.2 SAP

- 6.4.3 Microsoft

- 6.4.4 Salesforce

- 6.4.5 IBM

- 6.4.6 Workday

- 6.4.7 Sage Intacct

- 6.4.8 Unit4 / FinancialForce

- 6.4.9 Intuit

- 6.4.10 Anaplan

- 6.4.11 Workiva

- 6.4.12 BlackLine

- 6.4.13 Coupa

- 6.4.14 Xero

- 6.4.15 FIS

- 6.4.16 Fiserv

- 6.4.17 Temenos

- 6.4.18 Finastra

- 6.4.19 Acumatica

- 6.4.20 AWS

- 6.4.21 Google Cloud

- 6.4.22 Huawei

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment