|

시장보고서

상품코드

1637751

태국의 태양에너지 시장 : 점유율 분석, 산업 동향, 성장 예측(2025-2030년)Thailand Solar Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

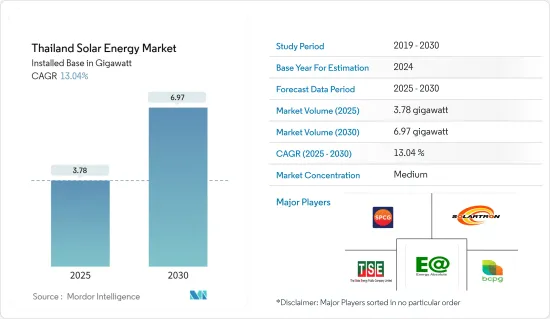

태국의 태양에너지 시장 규모(설치 기반)는 2025년 3.78기가와트에서 2030년에는 6.97기가와트로 확대되어, 예측 기간(2025-2030년) CAGR은 13.04%로 예측됩니다.

주요 하이라이트

- 장기적으로는 지원 시책, 전력 가격 상승, 기술 진보, 기업 수요, 에너지 안보 목표 등의 요인이 예측 기간 중 태국의 태양에너지 시장을 견인할 것으로 보입니다.

- 한편, 송전망의 제한, 인프라 격차, 에너지 저장 과제는 예측 기간 동안 태양에너지 시장의 성장을 크게 방해합니다.

- 2037년까지 재생가능 에너지 30%를 달성하는 태국의 목표는 태양에너지 시장에 큰 기회를 가져다줍니다. 게다가 스마트 그리드 기술, 에너지 저장 시스템의 통합, Energy Absolute와 같은 기업에 의한 대규모 배터리 생산에 대한 투자는 태양광 발전 프로젝트와 송전망의 안정성을 더욱 향상시킵니다.

태국의 태양에너지 시장 동향

태양광 발전(PV) 부문이 시장을 독점할 전망

- 태양전지 모듈의 비용 저하와 발전이나 급탕 등 다양한 용도에 대응하는 시스템의 범용성에 의해 예측 기간 중에는 태양광 발전(PV) 부문이 큰 시장 점유율을 차지할 것으로 보입니다.

- 국제재생가능에너지기구(IRENA)에 따르면 2019-2023년에 걸쳐 태국의 태양광발전(PV) 설치 용량은 2979MW에서 3181MW로 증가했으며 이 기간의 성장률은 6.78%였습니다. 게다가 태국에서는 정부 주도로 인한 태양광 발전 증가와 태양광 발전 비용의 저하로 인해 태양광 발전 부문이 크게 성장할 것으로 예상됩니다.

- 최근 태국에서는 태양광 발전 프로젝트가 크게 증가하고 있습니다. 이러한 이니셔티브는 자연에너지에 대한 정부의 야심적인 헌신과 일치하고 있으며, 2037년까지 발전믹스에서 차지하는 비율을 기존의 20%에서 50%로 끌어올리겠다는 목표를 내걸고 있습니다.

- 예를 들어, 2024년 10월, Total Energies ENEOS는 S. Kijchai Enterprise와의 두 번째 프로젝트로서 태국에서 1.8MWp 부유식 태양광 발전 시스템을 완성했습니다. 3,000장 이상의 모듈을 탑재한 이 시스템은 연간 2,650MWh를 발전시켜 CO2 배출량을 1,125톤 감소시킵니다. 이 프로젝트는 TotalEnergies ENEOS가 장기 PPA 하에서 자금을 제공하고 운영하고 있습니다.

- 게다가 2024년 5월 Gulf Energy Development Private Limited는 태국 발전공사(EGAT)와 25년간 장기매전계약(PPA)을 체결하여 총 1,353MW의 태양광 발전소 25개소를 건설했습니다. 에너지규제위원회에 의한 대규모 자연에너지계획의 일환인 이 프로젝트는 고정가격임베디드제도의 적용을 받아 2024-2029년 사이에 상업운전을 시작할 예정이며 비용효율적인 전력 솔루션을 제공합니다.

- 이러한 개발로 태국에서는 예측 기간 동안 태양광 발전 부문이 압도적인 시장 점유율을 차지할 것으로 예상됩니다.

시장을 견인하는 정부의 지원 시책

- 태국 정부는 7년간 온실가스 배출량을 20-25% 삭감하기 위해 국가 전체에서 재생가능 에너지 도입을 장려하고 있습니다. 정부는 또한 다양한 인센티브와 규제 지원을 제공함으로써 태양광 발전 시장을 지원합니다.

- 태국은 2037년까지 재생 가능 에너지가 전력 구성의 30%를 차지한다는 목표를 세웠습니다. 2023년에는 1만 2,547MW의 재생 가능 에너지 용량을 도입하여 2015년 7,902MW를 상회했습니다.

- 2024년 8월, 태국은 공공 부문을 대상으로 한 에너지 절약 계획을 승인하고 연간 5억 8,500만 kWh의 절전을 목표로 했습니다. 이 프로그램은 에너지 서비스 회사(ESCO) 모델을 채택하고 장기 계약을 통해 태양전지판 및 기타 에너지 절약 대책을 도입합니다.

- 2024년 7월 태국에서 지속가능한 개발 목표(SDGs)와 탄소 중립에 초점을 맞춘 순환 경제를 추진하기 위해 핌핏라 위차이쿤 공업부 장관이 일본에 왔습니다. 이 협력에는 지속 가능한 자원 관리를 강화하기위한 Bio, Circular 및 Green(BCG) 경제 모델의 일환으로 태양전지판 재활용도 포함됩니다.

- 2023년 5월, Electricity Generating Authority of Thailand(EGAT)는 매홍손슨 스마트 그리드 파일럿 프로젝트 하에 3MW 태양광 발전소와 4MW 축전지(BESS) 프로젝트의 상업 운전 개시(COD) 행사를 개최했습니다.

- 게다가 2023년 3월, 태국의 국가에너지시책심의회(NEPC)는 고정가격임베디드제도에 따른 청정전력 임베디드 계획을 도입했습니다. 고정가격임베디드제도의 세율은 지상설치형 태양광발전이 1기당 2.1679바트, 태양광발전+축전지가 1기당 2.8331바트입니다. 두 유형의 발전소 모두 고정 가격 구매 시스템의 기간은 25년입니다.

- 이러한 이유로 정부 시책과 이니셔티브가 예측 기간 동안 태국의 태양에너지 시장을 이끌 것으로 예상됩니다.

태국의 태양에너지 산업 개요

태국의 태양에너지 시장은 반 집중형입니다. 시장의 주요 기업(순부동)에는 Energy Absolute Public Company Limited, SPCG Public Company Limited, Solartron PCL, Thai Solar Energy PLC, BCPG Public Company Limited 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 소개

- 태양에너지 설치 용량과 2029년까지의 예측

- 최근 동향과 개발

- 정부의 규제와 시책

- 시장 역학

- 성장 촉진요인

- 태국의 전기요금 상승과 에너지 안보 목표

- 태양에너지 도입에 대한 정부의 지원 시책

- 억제요인

- 송전망의 제한, 인프라 격차, 에너지 저장의 과제

- 성장 촉진요인

- 공급망 분석

- PESTLE 분석

- 투자 분석

제5장 시장 세분화 - 기술

- 태양광 발전(PV)

- 집광형 태양열 발전(CSP)

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 주요 기업의 전략과 SWOT 분석

- 기업 프로파일

- SPCG Public Company Limited

- BCPG Public Company Limited(BCPG)

- Thai Solar Energy PLC

- B. Grimm Power Public Company Limited

- Solaris Green Energy Co. Ltd.

- Energy Absolute PCL

- Solartron PLC

- Marubeni Corporation

- Black & Veatch Holding Company

- Jinkosolar Holding Co. Ltd.

- Trina Solar Co., Ltd.

- 기타 저명한 기업 일람

- 시장 랭킹 분석

제7장 시장 기회와 앞으로의 동향

- 스마트 그리드 개발과 그리드 확대

The Thailand Solar Energy Market size in terms of installed base is expected to grow from 3.78 gigawatt in 2025 to 6.97 gigawatt by 2030, at a CAGR of 13.04% during the forecast period (2025-2030).

Key Highlights

- Over the long term, factors such as supportive policies, rising electricity prices, technological advancements, corporate demand, and energy security goals will likely drive Thailand's solar energy market during the forecast period.

- On the other hand, grid limitations, infrastructure gaps, and energy storage challenges significantly hinder the growth of the solar energy market during the forecast period.

- Nevertheless, Thailand's goal of achieving 30 percent renewable energy by 2037 presents significant opportunities for the solar energy market. Furthermore, The integration of smart grid technologies, energy storage systems, and Investments by companies like Energy Absolute in large-scale battery production further support solar projects and grid stability.

Thailand Solar Energy Market Trends

Solar Photovoltaic (PV) Segment Expected to Dominate the Market

- The solar PV segment is likely to hold the major market share during the forecast period, owing to the declining costs of solar modules and the versatility of these systems for various applications, like electricity generation and water heating.

- According to the International Renewable Energy Agency (IRENA), From 2019 to 2023, Thailand's Solar Photovoltaic (PV) Installed Capacity increased from 2979 MW to 3181 MW, with the growth rate over this period being 6.78 percent. Moreover, the solar PV segment is expected to witness massive growth with the increasing solar PV encouraged by government initiatives and falling solar PV costs in Thailand.

- In recent years, Thailand has seen a significant uptick in solar energy projects. These initiatives align with the government's ambitious commitment to renewables, which targets a 50 percent share in the power generation mix by 2037, up from an earlier goal of 20 percent.

- For instance, in October 2024, TotalEnergies ENEOS completed a 1.8 MWp floating solar PV system in Thailand, their second project with S. Kijchai Enterprise. The system, with over 3,000 modules, generates 2,650 MWh annually, reducing CO2 emissions by 1,125 tons, equivalent to planting 16,800 trees. This project is funded and operated by TotalEnergies ENEOS under a long-term PPA.

- Additionally, in May 2024, Gulf Energy Development Private Limited finalized 25-year-long power purchase agreements (PPAs) with the Electricity Generating Authority of Thailand (EGAT) to construct 25 solar PV farms, totaling 1,353 MW. These projects, part of a larger renewables scheme by the Energy Regulatory Commission, will receive feed-in tariffs and are expected to start commercial operations between 2024 and 2029, offering a cost-effective power solution.

- Owing to such developments, the solar PV segment is expected to have a dominant market share in Thailand during the forecast period.

Supportive Government Policies to Drive the Market

- The Thai government is encouraging renewable energy installations across the country to reduce greenhouse gas emissions by 20-25% in seven years. The government has also supported the solar power market by providing various incentives and regulatory support.

- Thailand has set a target for renewables to account for 30 percent of the power mix by 2037. In 2023, the country installed 12,547 MW of renewable energy capacity, which was higher than the 7,902 MW installed in 2015.

- In August 2024, Thailand approved an energy-saving scheme targeting public sector agencies, aiming to save 585 million kWh annually. The program will use the energy service company (ESCO) model to install solar panels and other energy-saving measures through long-term contracts.

- In July 2024, Industry Minister Pimphattra Wichaikul visited Japan to promote a circular economy in Thailand, focusing on sustainable development goals (SDGs) and carbon neutrality. The collaboration includes recycling solar panels as part of the Bio, Circular, and Green (BCG) economy model, aiming to enhance sustainable resource management.

- In May 2023, the Electricity Generating Authority of Thailand (EGAT), under the Smart Grid Pilot Project in Mae Hong Son Province, held a Commercial Operation Date (COD) ceremony for the 3 MW Solar Power Plant and 4 MW Battery Energy Storage System (BESS) Project.

- Moreover, in March 2023, Thailand's National Energy Policy Council (NEPC) introduced quotas for purchasing clean electricity via the Feed-in-Tariff Scheme, which will be implemented in two phases. The feed-in tariff rates are 2.1679 THB per unit for ground-mounted solar and 2.8331 THB per unit for solar + storage. Both types of power plants will have a 25-year term for the feed-in tariff.

- Therefore, supportive government policies and initiatives are expected to drive the Thailand solar energy market in the forecast period.

Thailand Solar Energy Industry Overview

The Thailand solar energy market is semi-concentrated. Some of the major companies in the market (in no particular order) include Energy Absolute Public Company Limited, SPCG Public Company Limited, Solartron PCL, Thai Solar Energy PLC, BCPG Public Company Limited, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Solar Energy Installed Capacity and Forecast, until 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Rising Electricity Prices and Energy Security Goals in Thailand

- 4.5.1.2 Supportive Government Policies to Adopt Solar Energy

- 4.5.2 Restraints

- 4.5.2.1 Grid Limitations, Infrastructure Gaps, and Energy Storage Challenges

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION - TECHNOLOGY

- 5.1 Solar Photovoltaic (PV)

- 5.2 Concentrated Solar Power (CSP)

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted & SWOT Analysis for Leading Players

- 6.3 Company Profiles

- 6.3.1 SPCG Public Company Limited

- 6.3.2 BCPG Public Company Limited (BCPG)

- 6.3.3 Thai Solar Energy PLC

- 6.3.4 B. Grimm Power Public Company Limited

- 6.3.5 Solaris Green Energy Co. Ltd.

- 6.3.6 Energy Absolute PCL

- 6.3.7 Solartron PLC

- 6.3.8 Marubeni Corporation

- 6.3.9 Black & Veatch Holding Company

- 6.3.10 Jinkosolar Holding Co. Ltd.

- 6.3.11 Trina Solar Co., Ltd.

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Smart Grid Development and Grid Expansion