|

시장보고서

상품코드

1637771

아시아태평양의 폴리염화비닐(PVC) 시장 - 점유율 분석, 산업 동향, 성장 예측(2025-2030년)Asia-Pacific Polyvinyl Chloride (PVC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

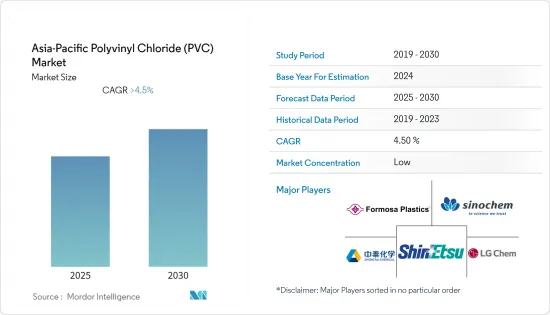

아시아태평양의 PVC 시장은 예측 기간 동안 4.5% 이상의 CAGR로 추이할 전망입니다.

주요 하이라이트

- COVID-19는 2020년 시장에 부정적인 영향을 미쳤습니다. 그러나 시장은 2022년에는 유행 전 수준에 이르렀으며 앞으로도 안정된 성장이 예상됩니다.

- 전기차 이용이 가속화되고 건설산업 수요가 증가하고 있는 것으로 시장 성장을 뒷받침할 것으로 예상됩니다. 그러나 PVC의 생산, 사용 및 폐기 과정에서 인체와 환경에 해로운 영향을 미치는 것은 시장 성장을 방해할 것으로 예상됩니다.

- PVC 재활용 프로세스 증가는 시장에 기회를 창출하는 것으로 간주됩니다. PVC 파이프와 피팅에 대한 수요는 인도, 중국, 인도네시아 등 신흥 국가 수요 증가가 견인하고 있습니다.

아시아태평양 PVC(시장 동향)

건설 부문에서의 수요 증가

- 아시아태평양 건설 부문은 세계 최대 규모를 자랑합니다. 이 지역의 인구 증가, 중간 소득층 증가, 도시화에 의해 견실한 성장률을 나타내고 있습니다.

- 아시아태평양은 최근 오피스 스페이스 시장으로 활기차며, 상업 건설 부문의 가장 큰 시장 중 하나입니다. 인도와 중국의 사무실 공간 수요는 계속 성장하고 있습니다.

- 기술, 전자상거래, 은행 및 금융서비스 기업 수요에 따라 오피스 스페이스의 필요성이 현저하게 높아지고 있어, 이 지역에 새로운 오피스가 건설되고 있습니다. 예를 들어, 중국은 쇼핑 센터 건설에서 최고 수준의 국가입니다. 중국에는 약 4,000개의 쇼핑센터가 있으며, 2025년까지 추가로 7,000개가 오픈할 것으로 추정됩니다.

- 중국의 성장의 원동력이 되는 것은 주로 주택과 상업시설의 급속한 확대입니다. 중국은 지속적인 도시화 과정을 장려하고 이를 견뎌내고 있으며, 그 비율은 2030년까지 70%를 나타낼 것으로 예상됩니다. 또한 중국의 건설생산액은 2021년 약 4조 2,700억 달러로 최고조에 달했습니다. 그 결과 이러한 요인이 이 지역의 PVC 수요를 증가시키는 경향이 있습니다. 게다가 한국 통계청에 따르면 2021년 국내외 건설업체의 건설 수주액은 2,459억 달러에 이릅니다.

- 또한 인도는 상업 부문을 확대하고 있습니다. 이 나라에서는 여러 프로젝트가 진행 중입니다. 예를 들어, 2022년 1분기에 9억 달러의 CommerzIII 상업 사무소 건설이 시작되었습니다. 이 프로젝트는 뭄바이의 골레가온에 43층, 허용 바닥 면적 2,60,128㎡의 상업 오피스 복합 시설을 건설합니다. 완성 예정은 2027년 4분기입니다.

- 따라서 앞서 언급한 요인들로부터 예측기간 동안 PVC 수요가 증가할 것으로 예상됩니다.

시장을 독점하는 중국

- 중국은 건설, 자동차, 일렉트로닉스, 포장 및 기타 최종 사용자 산업 수요 증가로 인해 큰 성장이 예상됩니다.

- 건설 부문에서의 PVC 사용량 증가는 PVC의 거대한 시장을 제공하는 것으로 예상됩니다. 중국국가통계국(NBS)에 따르면 2021년 동국 건설공사 생산액은 25조 9,200억 위안(4조100억 달러)에 이르며 2020년 대비 11% 이상 증가하기 때문에 이 시장 수요가 높아지고 있다

- 중국은 전기자동차 시장의 세계 리더이기도 하며, 전기자동차의 신차 판매량이 크게 증가하고 있습니다. 2021년에는 중국에서 총 330만대의 전기자동차(EV)가 판매되어 2020년 130만대에 비해 154% 증가를 기록했습니다.

- 또한 중국기차제조협회(CAAM)에 따르면 2022년 12월 신형 전기자동차(NEV) 생산 대수는 전년 동월 대비 96.9% 증가했습니다. 이와 같이 EV 시장의 확대는 이 나라의 PVC 수요를 증가시킬 것으로 예상됩니다.

- 그러므로 위의 모든 요인은 예측기간동안 국가의 PVC 수요를 촉진할 것으로 예상됩니다.

아시아태평양 PVC 산업 개요

아시아태평양의 PVC(PVC) 시장은 그 특성상 세분화되어 있습니다. 시장의 주요 기업으로는 Formosa Plastics Corporation, Shin-Etsu Chemical, LG Chem, Xinjiang Zhongtai Chemical, Sinochem Holdings Corporation Ltd. 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 건설 섹터로부터 수요 증가

- 기타 촉진요인

- 억제요인

- 인체나 환경에 유해한 영향

- 기타 억제요인

- 산업 밸류체인 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 진입업자의 위협

- 대체품의 위협

- 경쟁도

제5장 시장 세분화(시장 규모(수량 기준))

- 제품 유형

- 경질 PVC

- 연질 PVC

- 저발연 PVC

- 염소화 PVC

- 용도

- 파이프와 피팅

- 필름 및 시트

- 와이어·케이블

- 병

- 프로파일, 호스, 튜브

- 기타

- 최종 사용자 산업

- 건축 및 건설

- 자동차

- 전기 및 전자

- 포장

- 양말

- 의료

- 기타

- 지역

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 시장 점유율(%)**/랭킹 분석

- 주요 기업의 전략

- 기업 프로파일

- Chemplast Sanmar Limited

- East Hope Group

- Formosa Plastics Corporation

- Hanwha Solutions

- INEOS

- LG Chem

- Reliance Industries Limited

- Shin-Etsu Chemical Co., Ltd.

- Sinochem Holdings Corporation Ltd.

- Westlake Corporation

- Xinjiang Zhongtai Chemical Co. Ltd

제7장 시장 기회와 앞으로의 동향

- PVC 재활용 프로세스 증가

The Asia-Pacific Polyvinyl Chloride Market is expected to register a CAGR of greater than 4.5% during the forecast period.

Key Highlights

- COVID-19 negatively impacted the market in 2020. However, the market reached pre-pandemic levels in 2022 and is expected to grow steadily in the future.

- The accelerating usage of electric vehicles and growing demand from the construction industry is expected to fuel the market's growth. However, hazardous impacts on humans and the environment during PVC production, usage, and disposal are projected to hinder the market's growth.

- The rising PVC recycling processes shall create opportunities in the market. The demand for PVC pipes and fittings is driven by increasing demand from developing countries such as India, China, Indonesia, etc.

Asia-Pacific Polyvinyl Chloride (PVC) Market Trends

Growing Demand from the Construction Sector

- The construction sector in the Asia-Pacific region is the largest in the world. It is growing at a healthy rate, owing to the region's rising population and increasing middle-class incomes and urbanization.

- The Asia-Pacific region has been a thriving market for office spaces in recent years and one of the largest markets for the commercial construction sector. The demand for office spaces in India and China has been growing for many years.

- With the demand from technology, e-commerce, and banking-financial service companies, office space requirements are significantly rising, resulting in the construction of new offices in the region. For example, China is one of the leading countries with respect to the construction of shopping centers. China has almost 4,000 shopping centers, while 7,000 more are estimated to be open by 2025.

- China's growth is fueled mainly by rapid residential and commercial building expansion. China is encouraging and enduring a continuous urbanization process, with a projected rate of 70% by 2030. Also, China's construction output peaked in 2021 at a value of about USD 4.27 trillion. As a result, these factors tend to increase the demand for PVC in the region. Furthermore, according to Statistics Korea, construction orders collected by local builders at home and overseas totaled USD 245.9 billion in 2021.

- Also, India is expanding its commercial sector. Several projects have been going on in the country. For instance, the CommerzIII Commercial Office Complex construction worth USD 900 million started in Q1 2022. The project involves the construction of a 43-story commercial office complex with a permissible floor area of 2,60,128 m2 in Goregaon, Mumbai. The project is expected to be completed in Q4 2027.

- Therefore, the aforementioned factors, the demand for PVC is expected to increase during the forecast period.

China to Dominate the Market

- China is expected to witness significant growth with the increasing demand from construction, automotive, electronics, packaging, and other end-user industries.

- The increasing usage of PVC in the construction sector will provide a huge market for PVC. According to the National Bureau of Statistics (NBS) of China, the output value of the construction works in the country accounted for CNY 25.92 trillion (USD 4.01 trillion) in 2021, representing an increase of more than 11% compared to 2020, thereby enhancing the demand for the market studied.

- China is also a global leader in the electric car market, with a significant increase in the sales of new electric vehicles. A total of 3.3 million units of electric vehicles (EVs) were sold in China in 2021, registering an increase of 154% compared to 1.3 million units sold in 2020.

- Further, according to the China Association of Automobile Manufacturing (CAAM), the production of new electric vehicles (NEVs) in the country witnessed a year-on-year increase of 96.9% in December 2022. Thus, the expanding EV market is expected to increase the demand for PVC in the country.

- Hence, all the abovementioned factors are expected to drive the demand for PVC in the country during the forecast period.

Asia-Pacific Polyvinyl Chloride (PVC) Industry Overview

The Asia-Pacific polyvinyl chloride (PVC) market is fragmented in nature. Some of the major players in the market include Formosa Plastics Corporation, Shin-Etsu Chemical Co. Ltd, LG Chem, Xinjiang Zhongtai Chemical Co. Ltd, and Sinochem Holdings Corporation Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Construction Sector

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Hazardous Impact on Humans and the Environment

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Rigid PVC

- 5.1.2 Flexible PVC

- 5.1.3 Low-smoke PVC

- 5.1.4 Chlorinated PVC

- 5.2 Application

- 5.2.1 Pipes and Fittings

- 5.2.2 Films and Sheets

- 5.2.3 Wires and Cables

- 5.2.4 Bottles

- 5.2.5 Profiles, Hoses, and Tubings

- 5.2.6 Other Applications

- 5.3 End-User Industry

- 5.3.1 Building and Construction

- 5.3.2 Automotive

- 5.3.3 Electrical and Electronics

- 5.3.4 Packaging

- 5.3.5 Footwear

- 5.3.6 Healthcare

- 5.3.7 Other End-User Industries

- 5.4 Geography

- 5.4.1 China

- 5.4.2 India

- 5.4.3 Japan

- 5.4.4 South Korea

- 5.4.5 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Chemplast Sanmar Limited

- 6.4.2 East Hope Group

- 6.4.3 Formosa Plastics Corporation

- 6.4.4 Hanwha Solutions

- 6.4.5 INEOS

- 6.4.6 LG Chem

- 6.4.7 Reliance Industries Limited

- 6.4.8 Shin-Etsu Chemical Co., Ltd.

- 6.4.9 Sinochem Holdings Corporation Ltd.

- 6.4.10 Westlake Corporation

- 6.4.11 Xinjiang Zhongtai Chemical Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising PVC Recycling Processes

샘플 요청 목록