|

시장보고서

상품코드

1851259

인도의 플라스틱 산업 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)India Plastic Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

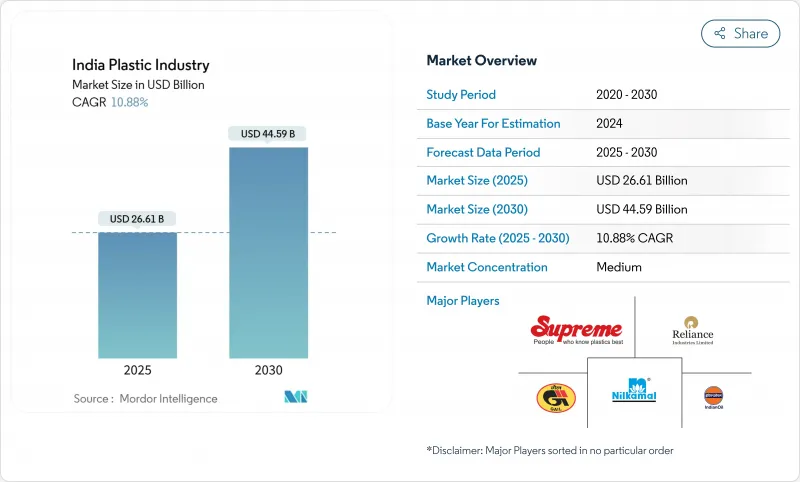

인도 플라스틱 산업 시장의 2025년 시장 규모는 현재 266억 1,000만 달러로, 2030년에는 445억 9,000만 달러에 달할 것으로 예상되며, CAGR은 10.88%를 나타낼 전망입니다.

생산 연동 장려금 제도 등의 강력한 공적 인센티브, 대규모 인프라 프로그램, 포장, 건설, 이동성 등 소비자 수요의 가속이 이 두 자릿수 성장을 지원하고 있습니다. 인도 서부는 구자라트와 마하라슈트라의 밀집된 석유화학 클러스터를 원동력으로 하여 여전히 소비의 중심지인 반면 경량화와 재활용성을 요구하는 브랜드에 의해 특수 등급의 점유율이 확대되고 있습니다. 폴리올레핀과 PVC공급 측면은 최근 브라운필드와 그린필드에 대한 투자로 확대되어 오랜 수입 의존도를 완화하고 있습니다. 한편, 폐기물 관리 규제 증가, 불안정한 원료 비용, 디지털 생산 관리의 급속한 도입으로 운영 효율성과 순환성에 더욱 초점을 맞추었습니다.

인도의 플라스틱 산업 시장 동향과 인사이트

정부의 PLI 제도가 구자라트의 폴리머 생산 능력 확장을 가속

PLI 프로그램에 의한 투자 우대 조치로 구자라트 주 잼나가루다 헤지 석유화학 회랑에 전례없는 자본이 유입되고 있습니다. 릴라이언스 인더스트리즈의 1.5 MTPA PVC 콤플렉스와 아다니의 2 MTPA PVC 증설 등의 프로젝트에 의해 2027년까지 250만 톤의 국내 공급 갭이 축소될 것으로 예상되고 있습니다. 생산량 증가와 병행하여, 기업은 혼합 플라스틱 폐기물을 ISCC 플러스 인증 수지로 전환하는 화학 재활용 기술을 도입하여 구자라트 주를 지역 서큘러 이코노미의 허브로 자리잡고 있습니다. 고분자 전용 철도 회랑을 포함한 물류 개선은 서해안 항구에서 내륙 가산업자로의 원료 흐름을 더욱 강화합니다.

퀵 커머스 붐이 고강성 식품 용기 수요를 견인

식료품의 당일 배송은 단단한 포장 사양을 재형성합니다. 사업자는 충격을 견디고, 급격한 온도 변화 하에서도 장벽 무결성을 유지하며, 마이크로플루필먼트 센터에서 효율적으로 쌓을 수 있는 용기를 필요로 합니다. 사출 등급 폴리프로필렌과 클라리파이드 랜덤 공중합체가 현재 공급의 대부분을 차지하고 있지만, 브랜드 소유자는 2026년 재활용 가능성 목표를 준수하기 위해 단일 소재 디자인을 시험적으로 채택하고 있습니다. 주요 경질 포장 컨버터는 마하라슈트라주와 테랑가나주에서 연률 15% 이상의 용기 수요 증가의 예측에 대응하기 위한 능력 증강을 발표했습니다.

일회용 플라스틱 금지는 FMCG 포장업자의 컴플라이언스 비용을 상승시킨다.

금지령의 시행에 의해 19의 일회용 아이템이 합법적인 유통으로부터 배제되고, 브랜드는 종이 라미네이트, 생분해성 필름, 보다 두꺼운 재이용 가능한 포맷으로 축발을 옮겨야 합니다. 대체 소재는 기존의 LDPE 유연성보다 적어도 40% 높기 때문에 조미료 및 귀환 음료와 같은 가격에 민감한 카테고리를 압박합니다. 소규모 컨버터는 대체 기판용으로 압출 코팅 및 라미네이션 라인을 개조하기 위한 자본 지출 장애물을 보고합니다.

부문 분석

폴리에틸렌은 필름과 블로우 성형 용기 수요에 힘입어 2024년 인도 플라스틱 산업 시장에서 34%의 점유율을 유지했습니다. 고밀도 등급은 파이프, 뚜껑 및 마개 용도로 저밀도 등급보다 빠르게 성장했습니다. 생분해성/바이오플라스틱 인도의 플라스틱 산업 시장 규모는 CAGR 12.3%로 확대되어 2030년에는 18억 1,000만 달러에 달할 것으로 예상됩니다. 폴리프로필렌은 여전히 짠 직물 가방, 가전제품 인클로저 및 자동차 트림에 필수적이며 PVC의 미래는 국내 크롤링 알칼리 증설의 시기 적절한 시동에 달려 있습니다.

기계적 재활용과 화학 재활용을 통해 순환 형 사회는 기세를 늘리고 있습니다. 인도의 PET 병 회수율은 이미 95%에 달했으며, 이는 잘 조직된 비공식 회수 네트워크에 의해 지원됩니다. 구자라트의 새로운 해중합 벤처는 폴리에스터 섬유의 루프를 닫기 위한 것으로, 수출 지향 병플레이크에서 국내 수지의 순환형으로의 이동을 시사합니다.

생분해성 등급은 벤처기업의 주목을 받고 있지만, 바이오 PE 및 바이오 PET 등의 바이오 드롭인 수지는 공정 변경 없이 기존 금형에 적합하기 때문에 음료 및 퍼스널케어 라인에서 급속히 확대되고 있습니다. 현지의 컴파운드 제조업체는 리그닌 충전 PLA나 전분 그래프트 PBAT를 시험하고 있어, 화석 유래의 동등품에 비해 코스트 프리미엄을 70% 이하로 억제하고 있습니다. India Plastics Pact에 근거한 인증 제도는 2030년까지 경질 포장재에 50%의 재활용 함량 또는 생물 유래 원료를 요구하고 있으며, 브랜드 소유자를 공급 계약의 앞으로 추구하고 있습니다.

카르나타카와 타밀 나두의 조종사 규모 프로젝트는 다층 필름의 효소 재활용에서 원료 단량체로의 전환을 입증합니다. 그 양은 아직 적지만, 상업화에 성공하면 연간 200만 톤의 복합폐기물을 회수하는 길이 열려 매립처분의 압력을 완화할 수 있습니다.

인도의 플라스틱 산업 시장 세분화에서는 업계를 폴리머 유형별(폴리에틸렌, 폴리프로필렌 등), 특수 플라스틱과 바이오플라스틱유형별(생분해성 바이오플라스틱, 바이오 베이스의 비생분해성 플라스틱), 가공 기술별(사출 성형, 블로우 성형 등), 용도별(포장, 자동차, 수송 등)으로 분류하고 있습니다. 시장 예측은 금액(달러)으로 제공됩니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 지원

목차

제1장 서론

- 조사 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 구자라트 주에서 폴리머 생산 능력 확장을 가속화하는 정부 PLI 방식

- 퀵·커머스·붐이 고강성 식품 용기 수요를 견인

- Swachh Bharat Phase-II가 도시의 HDPE 파이프 교환을 촉진

- EV 경량화 전략이 이륜차의 엔지니어링 플라스틱스 촉진

- 서인도에 있어서 의약품 수출의 급증이 의료 그레이드 수지 소비 촉진

- Tier-II 몰의 건설 러시로 PVC 프로파일과 클래딩 수요가 증가

- 시장 성장 억제요인

- 일회용 플라스틱 금지가 FMCG 포장 제조업체의 컴플라이언스 코스트 증대

- 중동 정세 긴박화에 의한 나프타 원료 가격의 변동

- 물류병과 생산 능력 부족을 일으키는 주간 폐기물 규제

- 식수 중 마이크로 플라스틱에 대한 소비자의 반발

- 가치/공급망 분석

- 규제 또는 기술적 전망

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

제5장 시장 규모와 성장 예측

- 폴리머 유형별

- 폴리에틸렌(LDPE, LLDPE, HDPE)

- 폴리프로필렌

- 폴리염화비닐

- 폴리에틸렌 테레프탈레이트(PET)

- 폴리스티렌 및 EPS

- 아크릴로니트릴 부타디엔 스티렌(ABS)

- 폴리카보네이트

- 기타(PMMA, POM 등)

- 특수성 및 바이오플라스틱 유형별

- 생분해성 바이오플라스틱(PLA, PHA, 전분 블렌드)

- 바이오 비생분해성 플라스틱(바이오 PE, 바이오 PET)

- 가공 기술별

- 사출 성형

- 블로우 성형

- 압출 성형

- 열성형

- 회전 성형

- 압축 성형

- 적층 제조(3D 프린팅)

- 용도별

- 포장

- 경질 포장

- 연성 포장

- 건축 및 건설

- 자동차 및 운송

- 전기 및 전자

- 농업 및 관개

- 헬스케어 및 의약품

- 소비재 및 가정용품

- 가구 및 침구

- 기타(섬유, 스포츠 및 레저)

- 포장

- 지역별(인도)

- 서인도(구자라트주, 마할라슈트라주, 고아주)

- 북인도(델리-NCR, 우타르프라데시, 펀자브, 하리야나, 라자스탄)

- 남인도(타밀나두, 카르나타카, 테랑가나, 안도라프라데시, 케랄라)

- 동부 및 북동부 인도(서벵골, 오디샤, 비하르, 아삼 및 북동부 주)

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Reliance Industries Ltd

- Indian Oil Corporation Ltd

- GAIL(India) Ltd

- Haldia Petrochemicals Ltd

- Supreme Industries Ltd

- Nilkamal Ltd

- Time Technoplast Ltd

- Jain Irrigation Systems Ltd

- Kingfa Science and Technology India Ltd

- Mayur Uniquoters Ltd

- Plastiblends India Ltd

- Responsive Industries Ltd

- Safari Industries(India) Ltd

- VIP Industries Ltd

- Wim Plast Ltd(Cello)

- Cosmo Films Ltd

- Manjushree Technopack Ltd

- Ester Industries Ltd

- SRF Ltd

- Jindal Poly Films Ltd

제7장 시장 기회와 향후 전망

KTH 25.11.12The India plastic industry market is currently valued at USD 26.61 billion in 2025 and is forecast to reach USD 44.59 billion by 2030, translating to a 10.88% CAGR.

Strong public-sector incentives such as the Production-Linked Incentive scheme, large-scale infrastructure programs and accelerating consumer demand across packaging, construction and mobility are sustaining this double-digit trajectory. Western India remains the consumption epicenter, powered by Gujarat's and Maharashtra's dense petrochemical clusters, while specialty grades are gaining share as brands look for lightweighting and recyclability. Supply-side additions in polyolefins and PVC, amplified by recent brownfield and greenfield investments, are easing the country's long-standing dependence on imports. Meanwhile, rising waste-management regulations, volatile feedstock costs and rapid adoption of digital production controls are shaping a sharper focus on operational efficiency and circularity.

India Plastic Industry Market Trends and Insights

Government PLI Scheme Accelerating Polymer Capacity Expansions in Gujarat

Investment incentives under the PLI program are funneling unprecedented capital into Gujarat's Jamnagar-Dahej petrochemical corridor. Projects such as Reliance Industries' 1.5 MTPA PVC complex and Adani's 2 MTPA PVC build-out are expected to narrow the 2.5 million-tonne local supply gap by 2027. Alongside output gains, firms are deploying chemical-recycling technologies that convert mixed plastic waste into ISCC-Plus certified resins, positioning Gujarat as a regional circular-economy hub. Allied logistics upgrades, including dedicated polymer rail corridors, further strengthen the material flow from western coast ports to inland processors.

Quick-Commerce Boom Driving Demand for High-Rigidity Food Containers

Same-hour grocery delivery is reshaping rigid packaging specifications. Operators require containers that resist impact, maintain barrier integrity under rapid temperature swings and stack efficiently in micro-fulfilment centers. Injection-grade polypropylene and clarified random copolymers dominate current supply, but brand owners are piloting mono-material designs to comply with 2026 recyclability targets. Major rigid packaging converters have announced capacity additions in Maharashtra and Telangana to address forecast container demand growth above 15% annually.

Single-Use Plastic Ban Escalating Compliance Costs for FMCG Packagers

Ban enforcement has removed 19 disposable items from legal circulation, forcing brands to pivot toward paper laminates, biodegradable films or thicker reusable formats. Substitute materials cost at least 40% more than legacy LDPE flexibles, squeezing price-sensitive categories such as condiments and on-the-go beverages. Smaller converters report capital-expenditure hurdles in retrofitting extrusion-coating and lamination lines for alternative substrates.

Other drivers and restraints analyzed in the detailed report include:

- Swachh Bharat Phase II Fueling Urban HDPE Pipe Replacement

- EV Lightweighting Strategy Boosting Engineering Plastics in Two-Wheelers

- Volatile Naphtha Feedstock Prices from Middle-East Tensions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polyethylene retained a 34% slice of the India plastic industry market in 2024, anchored by film and blow-molded container demand. High-density grades grew faster than low-density grades owing to pipe, cap and closure applications. The India plastic industry market size for biodegradable/bio-plastics is projected to widen at a 12.3% CAGR, reaching USD 1.81 billion by 2030, as brands adopt PLA, PBS and PHA blends in serviceware and personal-care packaging. Polypropylene remains intrinsic to woven sacks, appliance housings and automotive trim, while PVC's future hinges on the timely start-up of domestic chlor-alkali expansions.

Circularity gains momentum through mechanical and chemical recycling. India's PET bottle stream already touches a 95% recovery rate, supported by well-organized informal collection networks. New depolymerization ventures in Gujarat intend to close the loop on polyester textiles, signalling a shift from export-oriented bottle flakes toward domestic resin circularity.

Biodegradable grades capture most venture attention, yet bio-based drop-in resins such as bio-PE and bio-PET are scaling faster in beverage and personal-care lines because they slot into existing molds without process change. Local compounders are experimenting with lignin-filled PLA and starch-grafted PBAT to cut cost premiums below 70% versus fossil-based equivalents. Certification schemes under the India Plastics Pact require 50% recycled content or biogenic feedstock in rigid packaging by 2030, pushing brand owners to lock in forward supply contracts.

Pilot-scale projects in Karnataka and Tamil Nadu demonstrate enzymatic recycling of multilayer films into feedstock monomers. Although volumes remain small, successful commercialization would open pathways to recover up to 2 million tonnes of composite waste annually, mitigating landfill pressure.

India Plastic Industry Market Report Segments the Industry Into by Polymer Type (Polyethylene, Polypropylene, and More), by Specialty and Bioplastics Type (Biodegradable Bioplastics, Bio-Based Non-Biodegradable Plastics), by Processing Technology (Injection Molding, Blow Molding, and More), and by Application (Packaging, Automotive and Transportation, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Reliance Industries Ltd

- Indian Oil Corporation Ltd

- GAIL (India) Ltd

- Haldia Petrochemicals Ltd

- Supreme Industries Ltd

- Nilkamal Ltd

- Time Technoplast Ltd

- Jain Irrigation Systems Ltd

- Kingfa Science and Technology India Ltd

- Mayur Uniquoters Ltd

- Plastiblends India Ltd

- Responsive Industries Ltd

- Safari Industries (India) Ltd

- VIP Industries Ltd

- Wim Plast Ltd (Cello)

- Cosmo Films Ltd

- Manjushree Technopack Ltd

- Ester Industries Ltd

- SRF Ltd

- Jindal Poly Films Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government PLI Scheme Accelerating Polymer Capacity Expansions in Gujarat

- 4.2.2 Quick-Commerce Boom Driving Demand for High-Rigidity Food Containers

- 4.2.3 Swachh Bharat Phase-II Fueling Urban HDPE Pipe Replacement

- 4.2.4 EV Lightweighting Strategy Boosting Engineering Plastics in Two-Wheelers

- 4.2.5 Pharma Export Surge in West India Raising Medical-Grade Resin Consumption

- 4.2.6 Tier-II Mall Construction Upsurge Increasing PVC Profiles and Cladding Demand

- 4.3 Market Restraints

- 4.3.1 Single-Use Plastic Ban Escalating Compliance Costs for FMCG Packagers

- 4.3.2 Volatile Naphtha Feedstock Prices from Middle-East Tensions

- 4.3.3 Inter-State Waste Rules Causing Logistic Bottlenecks and Capacity Under-Utilization

- 4.3.4 Consumer Backlash on Microplastics in Packaged Drinking Water

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory or Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Polymer Type

- 5.1.1 Polyethylene (LDPE, LLDPE, HDPE)

- 5.1.2 Polypropylene

- 5.1.3 Polyvinyl Chloride

- 5.1.4 Polyethylene Terephthalate (PET)

- 5.1.5 Polystyrene and EPS

- 5.1.6 Acrylonitrile Butadiene Styrene (ABS)

- 5.1.7 Polycarbonate

- 5.1.8 Others (PMMA, POM, etc.)

- 5.2 By Specialty and Bioplastics Type

- 5.2.1 Biodegradable Bioplastics (PLA, PHA, Starch Blends)

- 5.2.2 Bio-Based Non-Biodegradable Plastics (Bio-PE, Bio-PET)

- 5.3 By Processing Technology

- 5.3.1 Injection Molding

- 5.3.2 Blow Molding

- 5.3.3 Extrusion

- 5.3.4 Thermoforming

- 5.3.5 Rotational Molding

- 5.3.6 Compression Molding

- 5.3.7 Additive Manufacturing (3D Printing)

- 5.4 By Application

- 5.4.1 Packaging

- 5.4.1.1 Rigid Packaging

- 5.4.1.2 Flexible Packaging

- 5.4.2 Building and Construction

- 5.4.3 Automotive and Transportation

- 5.4.4 Electrical and Electronics

- 5.4.5 Agriculture and Irrigation

- 5.4.6 Healthcare and Pharmaceuticals

- 5.4.7 Consumer Goods and Housewares

- 5.4.8 Furniture and Bedding

- 5.4.9 Others (Textiles, Sports and Leisure)

- 5.4.1 Packaging

- 5.5 By Region (India)

- 5.5.1 West India (Gujarat, Maharashtra, Goa)

- 5.5.2 North India (Delhi-NCR, Uttar Pradesh, Punjab, Haryana, Rajasthan)

- 5.5.3 South India (Tamil Nadu, Karnataka, Telangana, Andhra Pradesh, Kerala)

- 5.5.4 East and North-East India (West Bengal, Odisha, Bihar, Assam and NE States)

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Reliance Industries Ltd

- 6.4.2 Indian Oil Corporation Ltd

- 6.4.3 GAIL (India) Ltd

- 6.4.4 Haldia Petrochemicals Ltd

- 6.4.5 Supreme Industries Ltd

- 6.4.6 Nilkamal Ltd

- 6.4.7 Time Technoplast Ltd

- 6.4.8 Jain Irrigation Systems Ltd

- 6.4.9 Kingfa Science and Technology India Ltd

- 6.4.10 Mayur Uniquoters Ltd

- 6.4.11 Plastiblends India Ltd

- 6.4.12 Responsive Industries Ltd

- 6.4.13 Safari Industries (India) Ltd

- 6.4.14 VIP Industries Ltd

- 6.4.15 Wim Plast Ltd (Cello)

- 6.4.16 Cosmo Films Ltd

- 6.4.17 Manjushree Technopack Ltd

- 6.4.18 Ester Industries Ltd

- 6.4.19 SRF Ltd

- 6.4.20 Jindal Poly Films Ltd

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment