|

시장보고서

상품코드

1849862

왁스 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Wax - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

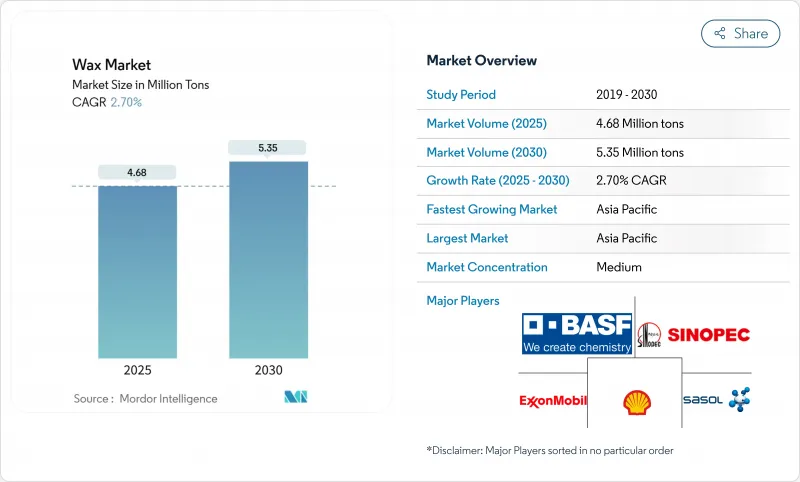

왁스 시장 규모는 2025년에 468만톤으로 평가되었고, 2030년에 535만톤에 이를 것으로 예측되며, 예측기간(2025-2030년)의 CAGR은 2.70%를 나타낼 전망입니다.

왁스 시장은 석유 중심의 공급 기반에서 천연 및 고성능 합성 등급을 포함한 더 넓은 혼합 구조로 전환되고 있습니다. 성숙한 양초, 포장, 고무 용도가 정체되는 가운데, 더 깨끗한 제형, 신속한 전자상거래 물류, 신규 에탄 분해 설비에서 생산되는 비용 경쟁력 있는 폴리에틸렌 왁스가 생산자들에게 새로운 성장 기회를 제공하고 있습니다. 아시아태평양 지역의 우위는 통합 정유 능력, 대규모 소비재 부문, 그리고 세계에서 가장 빠르게 성장하는 온라인 유통 채널에 기반을 두고 있습니다. 유럽의 다환 방향족 탄화수소(PAHs) 및 일회용 플라스틱 규제는 수요를 식물성 대체재와 식품 등급 코팅제로 지속적으로 유도하고 있습니다. 북미에서는 셰일 유래 에탄이 생산 경제성을 유리하게 유지하여 지역 업체들이 코팅, 복합재, 핫멜트 접착제를 겨냥한 맞춤형 등급으로 수출 시장에 진출할 수 있게 합니다.

세계의 왁스 시장 동향 및 인사이트

아시아태평양 지역의 전자상거래 붐이 핫멜트 접착제 등급 FT 왁스 수요를 주도

중국, 인도, 동남아시아 전역에서 폭발적으로 증가하는 온라인 소매는 더 강력한 골판지 밀봉 및 라벨 접착력을 요구하며, 이는 피셔-트로프쉬(FT) 왁스로 개질된 핫멜트 접착제에 대한 수요를 증가시킵니다. 이 FT 등급은 높은 용융점과 응집력을 제공하여 습한 몬순 지역과 콜드체인 운송 경로 모두에서 포장을 견고하게 유지합니다. 포장 변환업체들은 FT 왁스 첨가제가 포함된 제형 사용 시 배송 실패율이 최대 35% 감소한다고 보고합니다. 따라서 왁스 시장은 물량 증가와 고가성능 블렌드 수요 증가라는 이중 혜택을 누리고 있습니다. 지역별 창고 재고를 보유한 공급업체들은 납기 기간을 단축하고, 견고하고 내습성 포장 솔루션을 찾는 물류 네트워크로부터 반복 계약을 확보하고 있습니다.

유럽의 클린 라벨 화장품, 식물성 카르나우바 왁스 및 밀랍으로의 전환 가속화

유럽의 뷰티 브랜드들은 투명한 성분 표기로 빠르게 전환하며, 제형 개발자들이 합성 왁스와 파라핀 왁스를 카르나우바 왁스, 칸델릴라 왁스, 밀랍으로 대체하도록 촉진하고 있습니다. 이러한 바이오 기반 옵션들은 립 케어, 밤, 스틱 타입 스킨케어 제품에 필요한 자연스러운 광택, 필름 형성, 보습 특성을 제공합니다. 2025년 연구에 따르면 카르나우바 왁스를 기반으로 적절히 구조화된 비건 립스틱은 밀랍으로 달성된 경도, 발색력, 용융 안정성과 동등한 성능을 보입니다. 소매업체들이 친환경 인증 제품 진열 공간을 확대함에 따라, 브라질과 동남아시아에서 추적 가능한 공급망을 확보한 왁스 시장 참여자들은 가격 프리미엄을 유지하는 반면, 유럽의 계약 제조업체들은 소량 배치 생산을 위한 납기 단축을 모색하고 있습니다.

유럽의 장난감 및 화장품 분야 파라핀 왁스에 대한 REACH PAH 제한 강화

유럽의 REACH 개정 PAH 기준이 이제 장난감 및 지속형 스킨 제품에 사용되는 파라핀 왁스에도 적용되어 정제업체들은 심층 수소화 처리 설비 투자 또는 대체 원료 조달을 강요받고 있습니다. 적합성 인증서 요구로 비용과 복잡성이 증가하는 반면, 미준수 수입품은 관세 압류 및 유통업체 리스팅 중단에 직면합니다. 다국적 브랜드 소유사들은 투명한 상류 공급망이 입증된 왁스 등급만 사전 승인하여 구매자들이 합성 피셔-트로프쉬(Fischer-Tropsch) 방식 또는 식물성 대체재로 전환하도록 유도하고 있습니다. 따라서 정유사들이 기술 업그레이드를 완전히 실행할 때까지 왁스 시장은 기존 파라핀 부문에서 마진 압박에 직면하게 됩니다.

부문 분석

파라핀 및 미네랄 왁스는 2024년 왁스 시장 점유율 58%를 유지했으며, 이는 양초, 보드 사이징, 고무 컴파운딩 등 다양한 분야에서 광범위한 공급 가능성과 비용 경쟁력에 힘입은 결과입니다. 그러나 카르나우바, 칸델릴라, 밀랍을 중심으로 한 천연 왁스 부문은 3.43%의 연평균 성장률(CAGR)로 성장할 전망이며, 이는 재생 가능 원료에 대한 소비자의 확고한 선호를 보여줍니다. 추적 가능한 공급망, 저 PAH 함량, 비건 인증에 대한 수요 증가로 브라질과 멕시코의 인증 농장이 전략적 자산으로 부상하고 있습니다. 피셔-트로프쉬 및 폴리에틸렌 계열을 중심으로 한 합성 왁스는 맞춤형 용융 프로파일과 경도 수준을 제공하여 고온 또는 습도에 민감한 응용 분야를 해결하는 혁신의 최적 지점을 차지하고 있습니다.

프리미엄 클린 라벨 화장품, 식용 농산물 코팅, 특수 포장 코팅이 천연 왁스 수요를 가장 강력하게 주도하고 있습니다. 반면 골판지 박스 접착제와 같은 비용 민감 분야는 여전히 파라핀 혼합물을 선호합니다. 예측 기간 동안 가스-액체 전환(GTL) 시설의 생산 능력 확대로 합성 등급의 가격 변동성이 완화될 전망이며, 새로운 무용제 추출 기술은 식물 기반 공정의 수율 향상을 목표로 합니다. 재배자와 유럽 뷰티 기업 간의 전략적 공급 계약은 공급 안정성을 확보하여 천연 대체재의 왁스 시장 내 입지를 더욱 공고히 할 것입니다.

양초는 연료 매트릭스와 향기 전달체 모두에 고체 왁스가 필수적이라는 특성 덕분에 2024년 왁스 시장 규모의 60%를 차지했습니다. 이 오랜 우위는 분위기 제품을 중시하는 성숙 경제권과 가정용 장식 지출이 증가하는 신흥 시장에서 지속되고 있습니다. 그럼에도 화장품 부문은 제형 개발자들이 립, 헤어, 바디 제품에서 구조, 발색력, 피부 감촉을 위해 왁스를 활용함에 따라 3.65%라는 가장 높은 연평균 성장률(CAGR)을 보입니다. 직거래 브랜드들은 소량 생산 출시를 가속화하며, 클린 뷰티 포지셔닝에 부합하는 고순도 또는 바이오 유래 왁스 등급을 선택하고 있습니다.

전자상거래 포장용 핫멜트 접착제, 카톤용 차단 코팅, PVC 프로파일용 압출 윤활제는 성장 중인 틈새 응용 분야를 대표합니다. 과일과 치즈의 석유화학 포장재를 대체하는 식용 코팅은 지속가능성 시너지를 보여주며 왁스의 다용도성을 입증합니다. 기능성과 순환성의 교차점에서 왁스 시장 제형을 연구하는 접근은 브랜드 소유자들이 응용 분야별 맞춤형 블렌드를 공동 개발하도록 장려하여 파일럿 생산을 기록적인 시간 내에 규모화합니다.

지역 분석

아시아태평양 지역은 2024년 왁스 시장 점유율의 45%를 차지했으며, 2030년까지 연평균 3.2%의 가장 빠른 성장률을 기록할 것으로 전망됩니다. 중국은 방대한 양초, 포장, 개인 위생 용품 클러스터로 수요를 주도하는 반면, 인도의 급증하는 중산층은 화장품 및 홈 프래그런스 전반의 소비를 촉진하고 있습니다. 아세안(ASEAN) 물류 허브는 핫멜트 접착제 사용을 촉진하며, 왁스 시장 성장을 택배 물량과 직접 연결합니다. 인도네시아와 말레이시아의 다운스트림 석유화학 산업에 대한 정부 인센티브는 합성 왁스 설비에 대한 투자를 지속적으로 유치하여 현지화된 공급을 제공하고 선적에서 매장 진열까지의 주기를 단축합니다.

북미는 성숙한 양초 및 보드 응용 분야와 특수 폴리에틸렌 왁스 분야의 혁신적 발전을 결합하여 균형 잡힌 왁스 시장을 유지합니다. 저비용 셰일 에탄이 신규 크래커 설비에 공급되며, 미국 및 캐나다 생산업체들은 특히 라틴 아메리카와 유럽으로의 수출 증가를 기대할 수 있게 되었습니다. 자동차 경량화, 분체 도료, 3D 프린팅 필라멘트 첨가제는 정밀 분획된 합성 왁스 스트림의 차세대 용도를 개척하고 있습니다. 미국-멕시코-캐나다 협정(USMCA) 내 국경 간 물류는 상류 중간재 및 완제품 왁스 블렌드의 관세 없는 흐름을 보장합니다.

유럽의 왁스 시장은 가장 엄격한 규제 환경 하에서 운영되며, 소비를 저PAH 파라핀, 완전 합성 피셔-트로프쉬, 인증 천연 등급으로 유도합니다. 독일과 네덜란드는 고급 화장품 시장에 공급하는 정제 허브를 보유하고 있으며, 이탈리아 과일 수출 부문은 유통기한 기준 충족을 위해 식용 카나우바 코팅 시험을 확대하고 있습니다. 일회용 플라스틱 금지 조치는 바이오 왁스 장벽 코팅이 적용된 종이 기반 포장재 수요를 촉진하여 유화 제형에 대한 수요 창구를 열어줍니다. 연구에 따르면 왁스 코팅 농산물 포장재는 소매 식품 폐기물을 두 자릿수 비율로 감소시켜 EU의 ‘농장에서 식탁까지(Farm-to-Fork)’ 목표 달성에 기여합니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 아시아태평양 지역 전자상거래 붐이 핫멜트 접착제 등급 FT 왁스 수요 촉진

- 유럽의 클린 라벨 화장품 시장이 식물성 카르나우바 왁스와 밀랍으로의 전환 가속화

- 북미의 에탄 분해 설비 확대로 인한 PE 왁스 생산 비용 하락

- 아시아태평양 지역의 성장하는 개인 위생 산업

- 유럽의 신선 농산물 공급망에서 플라스틱 필름을 대체하는 식품 등급 왁스 코팅

- 시장 성장 억제요인

- 유럽의 장난감 및 화장품 산업에서 파라핀 왁스에 대한 REACH PAH 제한 강화

- 원유 및 가스 가격 변동성이 아시아태평양 지역의 합성 및 파라핀 왁스 마진에 미치는 영향

- 비건 화장품 트렌드로 꿀벌 왁스를 올레오케미컬 유화제로 대체

- 밸류체인 분석

- Porter's Five Forces

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁도

제5장 시장 규모와 성장 예측(음량)

- 유형별

- 파라핀 및 미네랄 왁스

- 합성 왁스

- 천연 왁스

- 용도별

- 양초 제조

- 포장

- 화장품

- 접착제

- 고무

- 기타 용도

- 등급별

- 식품 등급

- 산업용 등급

- 화장품 및 제약

- 형태별

- 고체

- 분말

- 에멀젼 및 액체

- 지역별

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- ASEAN

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- BASF SE

- BP plc

- Calumet, Inc.,

- CALWAX

- China Petrochemical Corporation

- CLARIANT

- Evonik Industries AG

- Exxon Mobil Corporation

- H&R GROUP

- Honeywell International Inc.

- Ilumina Wax doo

- Koster Keunen

- Moeve

- NIPPON SEIRO CO., LTD.

- Petrobras

- Petro-Canada Lubricants Inc.

- Sasol Ltd.

- Shell plc

- Strahl & Pitsch LLC

- The International Group, Inc.

제7장 시장 기회와 장래의 전망

HBR 25.11.12The Wax Market size is estimated at 4.68 Million tons in 2025, and is expected to reach 5.35 Million tons by 2030, at a CAGR of 2.70% during the forecast period (2025-2030).

The Wax market is moving from a petroleum-centric supply base toward a wider mix that includes natural and high-performance synthetic grades. Cleaner formulations, fast-moving e-commerce logistics, and cost-advantaged polyethylene wax from new ethane crackers are giving producers fresh avenues for growth even as mature candle, packaging, and rubber uses level off. Asia-Pacific's dominance rests on its integrated refining capacity, large consumer goods sector, and the world's fastest-growing online retail channel. Europe's regulations on polycyclic aromatic hydrocarbons (PAHs) and single-use plastics continue to funnel demand toward plant-based alternatives and food-grade coatings. In North America, shale-derived ethane keeps production economics favorable, allowing regional players to penetrate export markets with tailored grades that target coatings, composites, and hot-melt adhesives.

Global Wax Market Trends and Insights

Asia-Pacific E-commerce Boom Driving Hot-Melt Adhesive-Grade FT Waxes Demand

Explosive online retail growth across China, India, and Southeast Asia requires stronger carton sealing and label adhesion, which in turn raises demand for Fischer-Tropsch (FT) wax-modified hot-melt adhesives. These FT grades deliver higher melting points and cohesive strength, containing packages in humid monsoon zones and cold-chain routes alike. Packaging converters report up to 35% fewer shipment failures when formulations include FT wax additives. The Wax market therefore benefits from both higher volume of parcels and premium-priced performance blends. Suppliers that offer regionally warehoused inventories shorten lead times and secure repeat contracts from logistics networks seeking robust, moisture-resistant packaging solutions.

Clean-Label Cosmetics in Europe Accelerating Shift to Plant-Based Carnauba & Beeswax

European beauty brands have moved rapidly to transparent ingredient statements, pushing formulators to swap synthetic and paraffin waxes for carnauba, candelilla, and beeswax. These bio-based options supply natural gloss, film-forming, and emollient properties required in lip care, balms, and skin sticks. A 2025 study shows properly structured vegan lipsticks based on carnauba wax can match hardness, pay-off, and melting stability achieved with beeswax. As retailers widen eco-certified shelf space, Wax market participants that secure traceable supply chains in Brazil and Southeast Asia hold a pricing premium, while contract manufacturers in Europe seek shorter lead times for boutique batches.

REACH PAH Limits Tightening on Paraffin Wax in Europe Toys & Cosmetics

Europe's updated PAH thresholds under REACH now apply to paraffin wax used in toys and leave-on skin products, compelling refiners to invest in deep-hydrotreatment or source alternative feedstock. Compliance certificates drive up cost and complexity, while non-compliant imports face customs seizures and retailer delistings. Multinational brand owners pre-qualify only wax grades with transparent upstream provenance, encouraging buyers to shift toward synthetic Fischer-Tropsch or plant-based substitutes. The Wax market therefore confronts margin compression in conventional paraffin segments until refiners fully execute technology upgrades.

Other drivers and restraints analyzed in the detailed report include:

- North American Ethane Cracker Expansions Lowering PE Wax Production Costs

- Growing Personal Care Industry in the Asia-Pacific Region

- Vegan Cosmetics Trend Substituting Beeswax with Oleochemical Emulsifiers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Paraffin and mineral waxes retained a 58% Wax market share in 2024, buoyed by their broad availability and cost competitiveness across candles, board sizing, and rubber compounding. Yet the natural wax segment, anchored by carnauba, candelilla, and beeswax, is set to grow at a 3.43% CAGR, highlighting a decisive consumer tilt toward renewable ingredients. Heightened demand for traceable supply, low-PAH content, and vegan compliance positions certified plantations in Brazil and Mexico as strategic assets. Synthetic waxes, principally Fischer-Tropsch and polyethylene variants, occupy an innovation sweet spot, offering custom melting profiles and hardness levels that address high-temperature or moisture-sensitive applications.

Premium clean-label cosmetics, edible produce coatings, and specialty packaging coatings drive the strongest natural wax pull-through. Conversely, cost-sensitive sectors such as corrugated box sizing still prefer paraffin blends. Over the forecast window, capacity expansions in gas-to-liquids (GTL) facilities are expected to temper price volatility for synthetic grades, while new solvent-free extraction technologies aim to raise yields in plant-based operations. Strategic offtake agreements between growers and European beauty houses lock in supply assurance, embedding natural alternatives more firmly into the Wax market.

Candles commanded 60% of the Wax market size in 2024 by virtue of their fundamental dependence on solid wax as both fuel matrix and fragrance carrier. This long-standing dominance persists in mature economies that value ambience products and in emerging markets experiencing rising home decor spending. Nonetheless, cosmetics exhibits the highest 3.65% CAGR as formulators exploit waxes for structure, payoff, and skin feel in lip, hair, and body products. Direct-to-consumer brands accelerate small-batch launches, selecting high-purity or bio-origin wax grades that align with clean beauty positioning.

Hot-melt adhesives for e-commerce packaging, barrier coatings for cartons, and extrusion lubricants for PVC profiles represent rising application niches. Edible coatings demonstrate sustainability synergy by replacing petrochemical wraps on fruit and cheese, underscoring wax versatility. Research placing Wax market formulations at the intersection of functionality and circularity encourages brand owners to co-develop application-specific blends, bringing pilot runs to scale in record timelines.

The Wax Market Report Segments the Industry by Type (Paraffin and Mineral Wax, Synthetic Wax, and More), Application (Candle Making, Packaging, Cosmetics, and More), Grade (Food Grade, Industrial Grade, and More), Form (Solid, Powdered, Emulsions and Liquids) and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (tons).

Geography Analysis

Asia-Pacific secured 45% of the Wax market share in 2024 and is forecast to record the fastest 3.2% CAGR through 2030. China anchors demand with its vast candle, packaging, and personal care clusters, while India's surging middle class elevates consumption across cosmetics and home fragrance. ASEAN logistics hubs propel hot-melt adhesive usage, linking Wax market growth directly to parcel volumes. Government incentives for downstream petrochemicals in Indonesia and Malaysia continue to attract investment in synthetic wax units, delivering localized supply and shortening ship-to-shelf cycles.

North America maintains a balanced Wax market, coupling mature candle and board applications with innovative strides in specialized polyethylene waxes. Low-cost shale ethane feeds new cracker capacity, positioning U.S. and Canadian producers for export gains, especially to Latin America and Europe. Automotive lightweighting, powder coatings, and 3D-printing filament additives open next-generation uses for finely fractionated synthetic wax streams. Cross-border logistics within the United States-Mexico-Canada Agreement (USMCA) ensure duty-free flow of upstream intermediates and finished wax blends.

Europe's Wax market operates under the strictest regulatory environment, steering consumption toward low-PAH paraffin, fully synthetic Fischer-Tropsch, and certified natural grades. Germany and the Netherlands host refinement hubs that feed high-end cosmetics, while Italy's fruit-export sector scales trials of edible carnauba coatings to meet retailer shelf-life mandates. Single-use plastic bans energize paper-based packaging coated with bio-wax barriers, opening demand pockets for emulsified formulations. Research indicates that wax-coated produce packs cut retail food waste by double-digit percentages, supporting EU Farm-to-Fork objectives.

- BASF SE

- BP p.l.c.

- Calumet, Inc.,

- CALWAX

- China Petrochemical Corporation

- CLARIANT

- Evonik Industries AG

- Exxon Mobil Corporation

- H&R GROUP

- Honeywell International Inc.

- Ilumina Wax d.o.o.

- Koster Keunen

- Moeve

- NIPPON SEIRO CO., LTD.

- Petrobras

- Petro-Canada Lubricants Inc.

- Sasol Ltd.

- Shell plc

- Strahl & Pitsch LLC

- The International Group, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Asia-Pacific E-commerce Boom Driving Hot-Melt Adhesive-Grade FT Waxes Demand

- 4.2.2 Clean-Label Cosmetics in Europe Accelerating Shift to Plant-Based Carnauba and Beeswax

- 4.2.3 North American Ethane Cracker Expansions Lowering PE Wax Production Costs

- 4.2.4 Growing Personal Care Industry in the Asia-Pacific Region

- 4.2.5 Food-Grade Wax Coatings Replacing Plastic Films in Europe Fresh Produce Supply Chain

- 4.3 Market Restraints

- 4.3.1 REACH PAH Limits Tightening on Paraffin Wax in Europe Toys and Cosmetics

- 4.3.2 Crude and Gas Price Volatility Impacting Synthetic and Paraffin Wax Margins in APAC

- 4.3.3 Vegan Cosmetics Trend Substituting Beeswax with Oleochemical Emulsifiers

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Type

- 5.1.1 Paraffin and Mineral Wax

- 5.1.2 Synthetic Wax

- 5.1.3 Natural Wax

- 5.2 By Application

- 5.2.1 Candle Making

- 5.2.2 Packaging

- 5.2.3 Cosmetics

- 5.2.4 Adhesives

- 5.2.5 Rubber

- 5.2.6 Other Applications

- 5.3 By Grade

- 5.3.1 Food Grade

- 5.3.2 Industrial Grade

- 5.3.3 Cosmetic and Pharmaceutical garde

- 5.4 By Form

- 5.4.1 Solid

- 5.4.2 Powdered

- 5.4.3 Emulsions and Liquids

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 BASF SE

- 6.4.2 BP p.l.c.

- 6.4.3 Calumet, Inc.,

- 6.4.4 CALWAX

- 6.4.5 China Petrochemical Corporation

- 6.4.6 CLARIANT

- 6.4.7 Evonik Industries AG

- 6.4.8 Exxon Mobil Corporation

- 6.4.9 H&R GROUP

- 6.4.10 Honeywell International Inc.

- 6.4.11 Ilumina Wax d.o.o.

- 6.4.12 Koster Keunen

- 6.4.13 Moeve

- 6.4.14 NIPPON SEIRO CO., LTD.

- 6.4.15 Petrobras

- 6.4.16 Petro-Canada Lubricants Inc.

- 6.4.17 Sasol Ltd.

- 6.4.18 Shell plc

- 6.4.19 Strahl & Pitsch LLC

- 6.4.20 The International Group, Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Increasing Use of Mineral Wax in Rubber Production