|

시장보고서

상품코드

1637854

중동의 유전 서비스 시장 : 점유율 분석, 산업 동향, 성장 예측(2025-2030년)Middle-East Oilfield Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

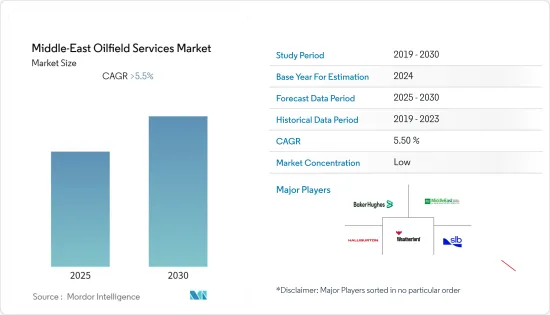

중동 유전 서비스 시장은 예측 기간 동안 5.5% 이상의 CAGR로 추이할 전망입니다.

COVID-19는 2020년 시장에 부정적인 영향을 미쳤습니다. 현재 시장은 대유행 전 수준에 도달하고 있습니다.

중기적으로는 생산능력 향상을 목표로 하는 투자 증가가 중동의 유전 서비스 시장 수요를 증가시킬 것으로 예상됩니다.

한편, 태양에너지나 풍력에너지 등 재생 가능 에너지원의 확대가 시장 성장의 방해가 될 것으로 예상됩니다.

보다 효율적인 석유 생산 및 드릴링 프로세스 개발을 위한 기술 투자 증가는 중동 유전 서비스 시장에 큰 기회를 가져올 것으로 예상됩니다.

사우디아라비아는 대량의 석유 및 가스 매장량이 확인되었기 때문에 예측 기간 동안 시장을 독점할 것으로 예상됩니다.

중동 유전 서비스 시장 동향

완성·생산 서비스가 대폭적인 성장을 이룰 전망

- 갱정 완성 서비스는 갱정의 복잡성에 관계없이 원래 존재하는 석유를 경제적으로 최대량(OOIP) 추출하는 것을 목적으로 하고 있습니다. 갱정이 드릴링, 평가, 케이스 및 시멘트로 굳어진 후, 완성 서비스는 생산을 최적화하기 위한 장비의 추가를 포함합니다. 갱정이 완성되고 생산이 시작되면 탄화수소의 지표 반출이 시작됩니다. 생산 서비스는 갱정의 가동과 지속성을 장기간 유지합니다.

- 예측기간 동안 완성서비스 수요는 급증할 것으로 예상되지만, 이는 주로 중동에서의 탐사·생산 프로젝트 증가로 인한 것입니다. 예를 들어, 중동에서는 2021년에 약 41건의 석유 및 가스 계약에 종사해, 업스트림 프로젝트가 31건 이상으로 계약의 대부분을 차지하고 있습니다.

- Baker Hughes의 장비 수에 따르면 중동의 평균 장비 수는 2021년에 비해 2022년에 크게 증가했습니다. 2022년 평균 리그 수는 308기로 2021년 대비 16.3% 증가했습니다.

- 또한 중동의 해양광구 확대가 인공양력 생산 서비스에 대한 수요를 높일 것으로 예상됩니다. 2022년 사우디아라비아와 쿠웨이트는 하루 10억 입방 피트의 가스와 8만 4,000 배럴의 응축물을 생산할 것으로 예상되는 Durra 근해 가스전 개발 계획을 발표했습니다.

- 2022년, Abu Dhabi National Oil Company(ADNOC)는 아부다비 에미리트 연합 앞바다에서 천연 가스 자원을 발견했다고 발표했습니다. 이것은 이 나라의 해안 탐광광구에서 최초의 발견이며, ADNOC의 블록 입찰 라운드의 성공을 돋보이게합니다. 이 시굴에는 1.5-2조 표준 입방 피트(TSCF)의 원시 가스가 확인되었습니다.

- 이 때문에 예측기간 중 중동의 완성·생산 서비스는 세계 탄화수소 수요와 가격 상승에 따른 업스트림 프로젝트의 급증에 힘입어 확대될 것으로 예상됩니다.

현저한 성장을 이루는 사우디아라비아

- 2021년 베네수엘라에 이어 세계 2위 확인 매장량을 자랑하는 사우디아라비아는 세계 2위 원유 생산국이며 세계 원유 생산량의 약 11%를 차지하고 있습니다. 또한 세계 최대의 원유 수출국이기도 합니다.

- 사우디아라비아의 셰일가스 매장량은 세계 5위로 추정되고 있습니다. 따라서 미국의 비재래형 매장량 개발의 성장을 재현할 수 있는 큰 가능성을 가지고 있습니다.

- 2022년 2월, Saudi Aramco는 섀도우(중부), 셰합과 슐파(남동부), 움한살(이라크와 북부 국경 부근), 사무나(동부)의 4개 지역에서 천연가스전을 발견하여 천연가스 부문 개발에 크게 전진했습니다. 이 발견은 유전 서비스 수요를 높이고 예측 기간 동안 시장을 견인할 것으로 예상됩니다.

- 석유수출국기구(OPEC)에 따르면 사우디아라비아의 원유 생산량은 일량 912만 5,000배럴로 2020년에 비해 1% 감소했습니다. 그러나 석유 및 가스전의 확대로 생산량은 향후 증가할 것으로 예상되고 있습니다.

- 사우디아라비아는 기존의 석유 및 가스전의 확대를 진행하고 있습니다. 주요 확대 프로젝트에는 베리 유전과 마르장 유전이 있습니다. 베리 유전은 사우디아라비아 동해안의 일부 육상, 일부 앞바다에 위치하며, 베리 증산 프로그램(BIP) 아래, 2023년까지 원유 생산 능력을 일량 50만 배럴(Bpd)로 배증시키기 위해 확대가 진행되고 있습니다. 이 프로젝트는 2023년에 완성될 예정이며, 투자액은 60억 달러로 추정됩니다.

- 따라서 위의 점에서 사우디아라비아는 예측 기간 동안 유전 서비스 시장에서 큰 성장을 이룰 것으로 기대됩니다.

중동 유전 서비스 산업 개요

중동의 유전 서비스 시장은 세분화되어 있습니다. 이 시장의 주요 기업(순부동)에는 Baker Hughes Co., Halliburton Company, Schlumberger Limited, Weatherford International PLC 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사 범위

- 조사의 전제조건

제2장 조사 방법

제3장 주요 요약

제4장 시장 개요

- 소개

- 2028년까지 시장 규모와 수요 예측(단위: 10억 달러)

- 최근 동향과 개발

- 정부의 규제와 시책

- 시장 역학

- 성장 촉진요인

- 억제요인

- 공급망 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 서비스 유형

- 드릴링 서비스

- 굴착·마무리 유체

- 지층 평가

- 완성 및 생산 서비스

- 드릴링 폐기물 관리 서비스

- 기타

- 소재지

- 온쇼어

- 오프쇼어

- 지역

- 사우디아라비아

- 카타르

- 아랍에미리트(UAE)

- 이란

- 기타 중동지역

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 주요 기업의 전략

- 기업 프로파일

- Anton Oilfield Services(Group) Ltd.

- Baker Hughes Co.

- Denholm Oilfield Services

- Halliburton Company

- Middle East Oilfield Services

- Welltec A/S

- OiLServ Limited

- Schlumberger Limited

- Swire Oilfield Services Ltd.

- Weatherford International PLC

제7장 시장 기회와 앞으로의 동향

JHS 25.02.06The Middle-East Oilfield Services Market is expected to register a CAGR of greater than 5.5% during the forecast period.

COVID-19 negatively impacted the market in 2020. Presently, the market has reached pre-pandemic levels.

Over the medium term, the rising investments aimed at increasing production capacity are expected to increase the demand for the Middle East oilfield services market.

On the other hand, the increasing adaptation of renewable energy sources such as solar and wind energy is expected to hinder market growth.

Nevertheless, the increasing technological investments in the market to develop more efficient oil production and drilling processes are expected to create huge opportunities for the Middle-East oilfield services market.

Saudi Arabia is expected to dominate the market during the forecasted period due to the country's significant amount of proven oil and gas reserves.

Middle East Oilfield Services Market Trends

Completion and Production Services Expected to Witness Significant Growth

- Well-completion services aim to extract the maximum amount of original oil in place economically (OOIP), regardless of the complexity of the well. Once a well has been drilled, evaluated, cased, and cemented, completion services involve adding equipment to optimize production. Once the well is completed and production begins, bringing hydrocarbons to the surface will start. The production services keep the well running and sustaining for a long time.

- During the forecast period, the demand for completion services is anticipated to surge, primarily due to the increasing number of exploration and production projects in the Middle East. For example, in 2021, the Middle East region worked on approximately 41 oil and gas contracts, with upstream projects accounting for most of the contracts at over 31.

- According to Baker Hughes rig count, the average rig count in the Middle East increased significantly in 2022 compared to 2021. In 2022, the average number of rigs was 308, an increase of 16.3% compared to 2021.

- Moreover, expanding offshore fields in the Middle East is anticipated to bolster demand for artificial lift production services. In 2022, Saudi Arabia and Kuwait announced plans to develop the Durra offshore gas field, which was projected to yield 1 billion cubic feet of gas and 84,000 barrels of condensate per day.

- In 2022, the Abu Dhabi National Oil Company (ADNOC) announced the discovery of natural gas resources offshore the Emirates of Abu Dhabi. This is the first discovery from the country's offshore exploration concessions, highlighting the success of ADNOC's block bid rounds. This exploration well has indicated between 1.5 and 2 trillion standard cubic feet (TSCF) of raw gas in place.

- Therefore, in the forecast period, completion and production services in the Middle East are expected to expand, fueled by a surge in upstream projects as a result of the global increase in demand and price of hydrocarbons.

Saudi Arabia to Witness Significant Growth

- In 2021, Saudi Arabia, which is home to the second-largest proven oil reserves globally after Venezuela, was the world's second-largest crude oil producer, responsible for approximately 11% of global crude oil output. Additionally, the country holds the top spot as the largest crude oil exporter globally.

- Saudi Arabia is estimated to have the world's fifth-largest estimated shale gas reserve. Thus, it has great potential to replicate the United States' unconventional reserves' development growth.

- In February 2022, Saudi Aramco made significant strides in the development of its natural gas sector by discovering natural gas fields in four regions of the Kingdom, namely in Shadoon (the central region), Shehab and Shurfa (the southeast region), Umm Khansar (near the northern border with Iraq), and Samna (the eastern region). This discovery is expected to boost demand for oilfield services, driving the market in the forecast period.

- According to the Organization of the Petroleum Exporting Countries (OPEC), crude oil production in Saudi Arabia was 9,125 thousand barrels per day, which was a 1% drop compared to 2020. But production is expected to increase in the future due to oil and gas field expansion.

- Saudi Arabia is in the process of expanding its existing oil and gas fields. A few major expansion projects include the Berri field and the Marjan oil field. The Berri field is located partly onshore and partly offshore on the east coast of Saudi Arabia and is being expanded under the Berri Increment Program (BIP) to double its crude production capacity to 500,000 barrels per day (bpd) by 2023. The project is scheduled to be completed in 2023, with an estimated investment of USD 6 billion.

- Therefore, due to the above-mentioned points, Saudi Arabia is expected to witness significant growth in the oilfield services market during the forecasted period.

Middle East Oilfield Services Industry Overview

The Middle-East oilfield services market is fragmented in nature. Some of the major players in the market (in no particular order) include Baker Hughes Co., Halliburton Company, Schlumberger Limited, Middle-East Oilfield Services, and Weatherford International PLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Service Type

- 5.1.1 Drilling Services

- 5.1.2 Drilling and Completion Fluids

- 5.1.3 Formation Evaluation

- 5.1.4 Completion and Production Services

- 5.1.5 Drilling Waste Management Services

- 5.1.6 Other Services

- 5.2 Location

- 5.2.1 Onshore

- 5.2.2 Offshore

- 5.3 Geography

- 5.3.1 Saudi Arabia

- 5.3.2 Qatar

- 5.3.3 United Arab Emirates

- 5.3.4 Iran

- 5.3.5 Rest of the Middle-East

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Anton Oilfield Services (Group) Ltd.

- 6.3.2 Baker Hughes Co.

- 6.3.3 Denholm Oilfield Services

- 6.3.4 Halliburton Company

- 6.3.5 Middle East Oilfield Services

- 6.3.6 Welltec A/S

- 6.3.7 OiLServ Limited

- 6.3.8 Schlumberger Limited

- 6.3.9 Swire Oilfield Services Ltd.

- 6.3.10 Weatherford International PLC