|

시장보고서

상품코드

1637882

프랑스의 풍력에너지 시장 : 점유율 분석, 산업 동향과 통계, 성장 예측(2025-2030년)France Wind Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

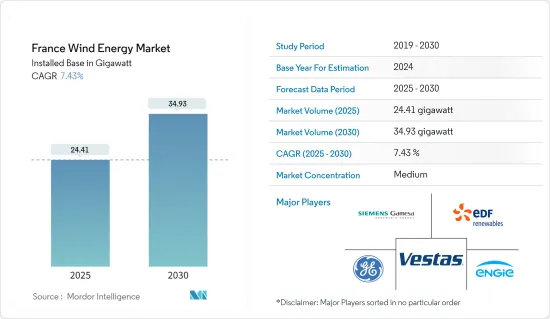

프랑스의 풍력에너지 시장 규모는 설치 기준으로 2025년 24.41기가와트에서 2030년에는 34.93기가와트로, 예측 기간(2025-2030년) CAGR은 7.43%로 성장할 것으로 예측됩니다.

중기적으로는 투자 증가, 향후 예정되고 있는 풍력발전 프로젝트나 진행중인 풍력발전 프로젝트, 풍력발전 용량의 확대 등의 요인이 예측기간 중 프랑스의 풍력에너지 시장의 큰 촉진요인이 될 것으로 예상됩니다.

한편, 수력발전이나 태양광발전 등의 대체 재생가능에너지 발전이나 원자력발전 등의 다른 에너지원에 의한 발전의 보급은 프랑스의 풍력에너지 시장의 성장에 큰 억제요인이 될 것으로 예상됩니다.

신재생에너지, 특히 풍력에너지 생산을 지원하는 정부의 시책과 관련된 장려제도는 이산화탄소 배출량을 줄이기 위해 프랑스가 강력히 백업하고 있습니다. 이것은 향후 몇 년동안 프랑스의 풍력에너지 시장에 기회를 가져올 것으로 예상됩니다.

프랑스의 풍력에너지 시장 동향

육상 부문이 시장을 독점할 전망

- 2022년 현재 풍력 발전 설비 용량의 대부분은 육상 풍력 발전에 의한 것으로, 해상 풍력 발전에 의한 것은 극히 일부입니다. 프랑스에서는 지난 10년간 풍력에너지 생산이 확대되어 왔습니다. 프랑스의 풍력에너지 부문은 수력 발전에 이어 두 번째로 큰 재생 가능 에너지입니다.

- 2022년 프랑스의 육상 풍력에너지 설비 용량은 2063만kW를 차지했으며 2019년에는 1642만kW였습니다. 육상 풍력에너지는 2019년에 비해 25.6% 증가했습니다. 2022년 현재, 풍력에너지의 총 설비 용량은 프랑스의 재생 가능 에너지 설비 용량의 약 31.5%를 차지합니다.

- 국가기후에너지계획에 따르면 프랑스는 2020년 시점의 17GW부터 2028년까지 최대 35GW의 육상풍력발전의 도입을 목표로 하고 있습니다. 이로 인해 예측 기간 동안 육상 풍력에너지의 이용이 증가할 것으로 기대됩니다.

- 2023년 11월, SSE Renewables는 27.2MW Chaintrix-Bierges and Velye Wind Farm의 건설을 시작했습니다. 이 풍력발전소는 마른느의 Chaintrix-Bierges와 Velye 사이에 위치한 이 회사 최초의 프랑스 육상풍력발전소로 Siemens Gamesa SG 3.4-132 풍력터빈 8기로 구성되어 1기당 3.4MW의 출력 가능합니다. 이 풍력발전소는 SSE Renewables가 영국과 아일랜드 이외에 건설을 시작하는 최초의 프로젝트이자 지난해 인수한 남유럽·파이프라인의 첫 프로젝트이기도 합니다.

- 게다가 2023년 11월, RWE AG와 그 프로젝트 파트너는 119MW의 글로스 용량(80MW)을 비례 배분으로 획득했습니다. RWE는 3개의 프로젝트의 소유자이며, 2개의 프로젝트가 Vent du Nord와 David Energies/Energiter와 공동으로 개발됩니다. 전반적으로 37개의 터빈이 상트르 발 드 루아르, 오 드 프랑스, 페이 드 라 루아르, 누벨 아키텐의 각 지역에 설치되며, 첫 번째 프로젝트는 2024년 말에 시작됩니다. 풍력발전소는 이르면 2025년부터 가동할 예정입니다.

- 따라서 향후 예정되고 있으며 현재 진행중인 육상 풍력 발전 프로젝트가 예측 기간 동안 프랑스의 풍력에너지 시장을 독점하게 될 것으로 예상됩니다.

대체 신재생에너지원 채용 증가가 시장성장 억제

- 프랑스의 재생 가능 에너지 믹스는 풍력, 수력 및 원자력으로 구성됩니다. 그러나 이 시나리오는 태양에너지와 바이오에너지의 성장에 의해 급속히 변화하기 시작하고 있습니다.

- 프랑스는 비 화석 연료, 즉 재생 가능 에너지로 최대 전력을 생산하는 세계에서 몇 안되는 국가 중 하나입니다.

- 프랑스에서는 최근 몇 년동안 태양에너지가 크게 성장하고 있습니다. 이 나라의 태양광 발전 잠재력은 국가 전체에 퍼져 있습니다. 국제재생가능에너지기구에 따르면 2022년 태양광 발전 용량은 1,741만 kW였습니다.

- 2022년 2월 프랑스 정부는 2050년까지 태양광 발전 설치 용량을 100GW 이상으로 할 계획을 세웠습니다. 다음과 같은 주요 개발이 프랑스의 풍력에너지 시장을 억제할 것으로 예상됩니다.

- 게다가 이 나라의 바이오에너지 용량은 2020년 1,931MW에서 2022년에는 2,051MW로 증가하여 2019년에서 6.21% 증가를 차지했습니다.

- 2023년 1월 TotalEnergies는 프랑스 남서부의 Mourenx에 연간 생산 능력 160기가와트(GWh)의 바이오가스 생산 유닛 BioBearn을 가동시켰습니다. BioBearn은 Lacq 분지의 중심에 위치한 7 헥타르의 오래된 재개발용지에 건설되었으며 TotalEnergies의 18번째 프랑스 바이오가스 생산 시설1입니다. 이 설비는 현지 농업 활동과 농업 식품 산업에서 배출되는 연간 22만 톤의 유기 폐기물을 전환할 수 있습니다.

- 이에 따라 이 나라에서 대체 재생가능에너지의 도입은 지난 10년간 급속히 확대되고 있으며, 예측기간 동안 프랑스의 풍력발전시장을 억제할 것으로 예상됩니다.

프랑스의 풍력에너지 산업 개요

프랑스의 풍력에너지 시장은 반고정적입니다. 이 시장의 주요 기업(순부동)에는 Engie SA, EDF Renewables, Vestas Wind Systems AS, General Electric Company, Siemens Gamesa Renewable Energy SA 등이 포함됩니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 소개

- 2028년까지의 풍력 발전 설비 용량과 예측(단위:GW)

- 재생 가능 에너지 믹스(2022년)

- 최근 동향과 개발

- 정부의 규제와 시책

- 시장 역학

- 성장 촉진요인

- 신재생에너지에 대한 유리한 정부 시책

- 보다 깨끗한 발전원의 채용

- 억제요인

- 원자력이나 다른 재생 가능 에너지와의 경쟁

- 성장 촉진요인

- 공급망 분석

- PESTLE 분석

제5장 시장 세분화

- 도입 장소

- 온쇼어

- 오프쇼어

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 주요 기업의 전략

- 기업 프로파일

- Engie SA

- EDF Renewables

- Vestas Wind Systems AS

- General Electric Company

- Siemens Gamesa Renewable Energy SA

- Albioma SA

- TotalEnergies SE

- Voltalia SA

- Neoen SA

- EOLFI SA

제7장 시장 기회와 앞으로의 동향

- 국내에서의 엄격한 배출량 목표의 존재

The France Wind Energy Market size in terms of installed base is expected to grow from 24.41 gigawatt in 2025 to 34.93 gigawatt by 2030, at a CAGR of 7.43% during the forecast period (2025-2030).

Over the medium term, factors such as increasing investments, upcoming and ongoing wind energy projects, and expansion of wind energy capacities are expected to be significant drivers for the French wind energy market during the forecast period.

On the other hand, the widespread electricity generation from alternative renewable energy sources such as hydropower and solar and other sources such as nuclear energy are expected to be a significant restraint for the growth of the French wind energy market.

Nevertheless, the supportive government policies and related incentive schemes to support renewable energy production, particularly wind energy, have a strong backhold by the country to reduce its carbon footprints. This will create opportunities for the French wind energy market in the coming years.

France Wind Energy Market Trends

The Onshore Segment is Expected to Dominate the Market

- As of 2022, the majority of the wind energy installed capacity came from onshore wind farms, and a tiny portion came from offshore wind energy. Wind energy production has been growing in France over the past decade. France's wind energy sector is the second-largest renewable energy source after hydropower.

- In 2022, France's installed onshore wind energy capacity accounted for 20.63 GW, compared to 16.42 GW in 2019. Onshore wind energy increased by 25.6% as compared to 2019. As of 2022, the total wind energy installed was about 31.5% of France's renewable installed capacity.

- According to the National Climate and Energy Plan, France aims to install up to 35 GW of onshore wind by 2028, up from 17 GW as of 2020. This is expected to increase the use of onshore wind energy during the forecast period.

- In November 2023, SSE Renewables started construction of the 27.2 MW Chaintrix-Bierges and Velye Wind Farm, its first French onshore wind farm located between Chaintrix-Bierges and Velye in the Marne departement and comprises eight Siemens Gamesa SG 3.4-132 wind turbines, each capable of producing 3.4MW of output. The site is SSE Renewables' first project to enter construction outside of the UK and Ireland and the first from its Southern Europe pipeline acquired last year.

- Further, in November 2023, RWE AG and its project partners have been awarded 119 MW of gross capacity, or 80 MW, on a pro-rata basis. RWE is the controlling owner of three winning projects, while two more will be developed in partnership with Vent du Nord and David Energies/Energiter. Overall, 37 turbines will be installed across the regions of Centre-Val de Loire, Hauts-de-France, Pays de la Loire, and Nouvelle-Aquitaine, with the first projects to be launched at the end of 2024. The wind farms are planned to go online by 2025 at the earliest.

- Therefore, forthcoming and ongoing onshore wind energy projects will dominate the French wind energy market during the forecast period.

Increasing Adoption of Alternative Renewable Energy Sources is Restraining the Market Growth

- France's renewable energy mix is dominated by wind, hydropower, and nuclear energy. But this scenario has begun changing fast with solar energy and bioenergy growth.

- France is one of the few countries in the world which produces the largest source of electricity by nonfossil fuel, i.e., renewable energy sources.

- Solar energy has been growing significantly in France in recent years. The country's solar potential is widespread throughout the country. The solar power capacity in 2022 was 17.41 GW, according to the International Renewable Energy Agency.

- In February 2022, the French government planned to have more than 100GW of installed solar PV capacity by 2050. The following key developments are expected to restrain the wind energy market in the country.

- Further, Bioenergy capacity in the country increased from 1931 MW in 2020 to 2051 MW in 2022, which accounted for a 6.21 % increase from 2019.

- In January 2023, TotalEnergies commissioned the BioBearn biogas production unit in Mourenx, southwest of France, with an annual production capacity of 160 gigawatt hours (GWh). BioBearn has been built on a seven-hectare former brownfield site in the center of the Lacq basin and represents TotalEnergies' 18th biogas production unit1 in France. The unit will be capable of converting 220,000 tons of organic waste every year from local farming activities and the agri-food industry.

- Therefore, the adoption of alternative renewable energy sources in the country has been growing faster during the last decade, and it is expected to restrain the French wind market during the forecast period.

France Wind Energy Industry Overview

The French wind energy market is semi-consolidated. The key players in the market include (in no particular order) include Engie SA, EDF Renewables, Vestas Wind Systems AS, General Electric Company, and Siemens Gamesa Renewable Energy SA, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Wind Energy Installed Capacity and Forecast in GW, till 2028

- 4.3 Renewable Energy Mix, 2022

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 Favorable Government Policies for Renewable Energy

- 4.6.1.2 Adoption of Cleaner Power Generation Sources

- 4.6.2 Restraints

- 4.6.2.1 Competition from Nuclear Energy and Other Renewable Energy Alternatives

- 4.6.1 Drivers

- 4.7 Supply Chain Analysis

- 4.8 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Location of Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Engie SA

- 6.3.2 EDF Renewables

- 6.3.3 Vestas Wind Systems AS

- 6.3.4 General Electric Company

- 6.3.5 Siemens Gamesa Renewable Energy SA

- 6.3.6 Albioma SA

- 6.3.7 TotalEnergies SE

- 6.3.8 Voltalia SA

- 6.3.9 Neoen SA

- 6.3.10 EOLFI SA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Presence of Strict Emission Targets in the Country