|

시장보고서

상품코드

1639419

중동 및 아프리카의 유해폐기물 처리 자동화 시장 전망 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Middle-East and Africa Hazardous Waste Handling Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

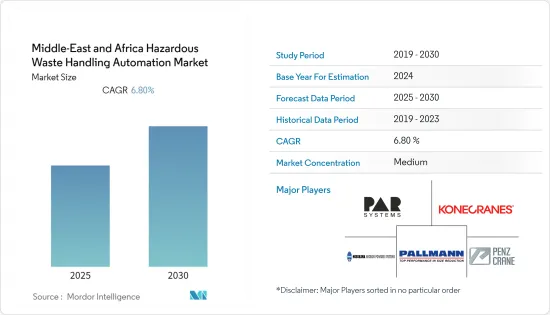

중동 및 아프리카의 유해폐기물 처리 자동화 시장은 예측기간 동안 연평균 성장율(CAGR) 6.8%를 기록할 전망입니다.

유해 폐기물은 독성, 인화성, 전염성, 방사능 등의 특성으로 인해 인간의 건강과 다른 생물체 또는 환경에 실제적 또는 잠재적 위험을 초래할 수 있습니다.

중동 및 아프리카 지역의 유해 폐기물 관리 규제 조치가 아직 국제법에 부합하지 않아 선진국 기업들이 수년 동안 아프리카에 독성 폐기물을 버려왔기 때문에 유해 폐기물 관리는 중동 및 아프리카 지역에서 새롭게 떠오르는 문제 중 하나입니다. 그러나 이제 이 지역 정부들은 건강에 대한 우려가 커짐에 따라 이러한 관행을 금지하는 조치를 취하고 있습니다.

중동 지역에서는 석유 제품에서 발생하는 유해 폐기물의 상당 부분이 포격, 탄피 등 잦은 전쟁으로 인해 발생하고 있습니다.

이러한 폐기물 중 일부는 수동으로 처리할 수 있지만, 일부는 사람의 접촉을 최소화하기 위해 전문 지식과 자동화 솔루션이 필요할 수 있습니다. 이러한 자동화 솔루션을 사용하여 폐기물을 처리하면 프로세스 효율성이 향상되고 수동 개입에 대한 의존도가 줄어듭니다. 따라서 이러한 유해 물질의 적절한 취급에 대한 우려를 없앨 수 있습니다.

유해 폐기물 처리 자동화에 사용되는 다양한 제품에는 크레인, 조작기 암, 크기 감소 암 등이 있습니다.

코로나19가 중동과 아프리카 지역에 영향을 미치면서 감염된 마스크, 장갑 및 기타 보호 장비를 포함하여 많은 유형의 의료 및 유해 폐기물이 추가로 발생했습니다. 이로 인해 이 지역에서 효과적인 위험 폐기물 처리 관행에 대한 수요가 더욱 증가했습니다.

또한, 미국 국제개발처(USAID)와 다양한 파트너가 주도하는 Power Africa와 같은 정책은 2030년까지 아프리카 전역에 2,500만-3,000만 개의 새로운 태양광 연결을 목표로 하고 있습니다. 이는 수명이 다한 납축 배터리와 전력 백업 시스템을 포함하여 상당한 양의 폐기물을 발생시킬 것으로 예상됩니다. 이에 따라 효율적이고 안전한 처리를 위한 자동화된 유해 폐기물 처리 솔루션에 대한 수요가 증가할 것으로 예상됩니다

중동 및 아프리카의 유해 폐기물 처리 자동화 시장 동향

전자 폐기물의 안전한 처리 및 폐기를 위한 자동화 처리 솔루션 수요 증가 전망

전자폐기물(E-waste)이란 휴대폰, 컴퓨터, 형광등 및 백열전구, 자동차에 사용되는 전자 기기, 텔레비전, 냉장고, 세탁기 등의 대형 가전제품 등 전자 기기의 잔여물 중 작동하지 않거나 수명이 다한 제품을 말합니다.

UN의 보고서에 따르면 매년 약 5천만 톤의 전자 폐기물이 발생하고 있으며, 2050년에는 두 배 이상 증가한 1억 1천만 톤으로 세계에서 가장 빠르게 증가하는 폐기물 흐름이 될 것으로 예상됩니다. 하지만 현재 중고 전자제품의 20% 미만이 재활용되고 있습니다. 아프리카의 공식적인 전자 폐기물 재활용률은 세계에서 가장 낮습니다.

Environmental Health Perspectives지에 게재된 논문에 의하면, 나이지리아의 라고스 항만에서도 매월 10만대의 사용한 PC가 도착하고 있습니다. 가나는 또한 수입된 전자 폐기물 관리의 과제에 직면하고 있습니다. 보통, 이러한 전자 폐기물은 매립지에 접근합니다.

전자제품에서 발견되는 납, 카드뮴, 수은, 브롬계 난연제, 폴리염화비닐(PVC) 등의 중금속과 기타 유해 화학물질은 지하수를 오염시키고 기타 환경 및 공중 보건 위험을 초래합니다.

이러한 위험을 방지하고 사람들의 안전을 보장하기 위해 이 지역 정부는 유해 폐기물의 안전한 처리를 위해 단독으로 또는 외부 기관과 협력하여 정책을 추진하고 있습니다. 예를 들어, 두바이에 위치한 중동 최초의 지속 가능한 커뮤니티인 지속 가능한 도시(TSC)는 커뮤니티를 위한 새로운 전자폐기물(E-waste) 수거 및 관리 솔루션을 도입했습니다. EFATE와 협력하여 만든 24시간 전자 폐기물 반납 스테이션은 주민과 일반 대중에게 무료로 효율적인 전자 폐기물 관리 솔루션을 제공할 것입니다.

사우디아라비아가 큰 시장 점유율을 차지할 전망

사우디아라비아는 중동 및 아프리카 지역에서 가장 큰 국가 중 하나이며 여러 산업이 존재하기 때문에 상당한 양의 유해 폐기물을 발생시킵니다. 이러한 산업의 대부분은 석유 및 가스, 자동차 부문에서 발생합니다.

OPEC에 따르면 사우디 아라비아는 전 세계 석유 매장량의 약 17%를 보유하고 있습니다. 석유 및 가스 부문은 국내총생산의 약 50%, 수출 수입의 약 70%를 차지합니다. 석유 외에도 사우디아라비아의 다른 천연자원으로는 천연가스, 철광석, 금, 구리 등이 있습니다.

가처분 소득의 증가로 인해 전자 기기의 소비가 크게 증가하고 있으며, 이는 전자 폐기물 발생의 주요 원인이기도 합니다.

UNITAR에 의한 아랍 국가 2021년 지역 전자 폐기물 모니터링 보고서에 따르면 사우디아라비아는 아랍 국가 중 가장 큰 전자 폐기물 배출국이었으며 2019년 전자 폐기물 배출량은 595킬로톤(kt)(또는 13.2kg/inh)이었습니다.

폐기물의 안전한 처리를 규제하기 위해 정부는 여러 가지 정책을 취하고 있습니다. 예를 들어, 정부는 2021년 9월 폐기물의 운송, 분리, 보관, 수입, 수출, 안전한 폐기 및 이와 관련된 기타 모든 활동을 규제하는 것을 목표로 하는 새로운 폐기물 관리법을 발표했습니다. 이러한 추세는 예측 기간 동안이 지역의 시장 성장을 주도 할 것으로 예상됩니다.

중동 및 아프리카의 유해폐기물 처리 자동화 산업의 개요

중동 및 아프리카의 유해 폐기물 처리 자동화 시장은 안전한 유해 폐기물 처리를 위한 이러한 솔루션에 대한 수요가 증가함에 따라 경쟁이 증가하고 있습니다. 이 시장에 진입하는 주요 기업으로는 PAR Systems, Konecranes, Pallmann Maschinenfabrik GmbH & Co.KG 등이 있습니다.

- 2022년 1월 : Ramky Enviro Engineers 중동과 라스 알하이마 에미리트의 폐기물 관리국(공공 서비스부)은 UAE의 RAK에 전용 산업용 유해 폐기물 관리 시설을 설치하기 위한 전략적 파트너십을 체결.

- 2022년 1월 :물류 허브 및 유통 센터의 자재 취급을 혁신하는 자동 창고 컨테이너 취급 기술을 공급하기 위해 Pesmel과 파트너십을 체결한 Konecranes. 자동화된 컨테이너 추적은 시설의 전체 물류 관리 시스템과 쉽게 통합할 수 있는 관리 시스템의 일부입니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 업계의 매력도 - Porter's Five Forces 분석

- 신규 진입업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

- 시장에 대한 COVID-19의 영향 평가

제5장 시장 역학

- 시장 성장 촉진요인

- 정부와 업계의 규제

- 폐기물 관리에 대한 관심 증가

- 시장 성장 억제요인

- 높은 비용

제6장 시장 세분화

- 오토메이션 제품별

- 매니퓰레이터 암

- 신축 마스트

- 크레인

- 트러스

- 사이즈 축소 시스템

- 기타 자동화 제품

- 폐기물 유형별

- 상장 폐기물

- 특성 폐기물

- 일반폐기물

- 혼합폐기물

- 산업폐기물별

- 제조업

- 화학폐기물

- 에너지

- 소비자 케어

- 관공청

- 기타 산업

- 지역별

- 사우디아라비아

- 아랍에미리트(UAE)

- 이스라엘

- 남아프리카

- 기타 중동 및 아프리카

제7장 경쟁 구도

- 기업 프로파일

- PAR Systems

- Konecranes

- DX Engineering

- Floatograph Technologies

- Pallmann Maschinenfabrik GmbH & Co. KG

- Hosokawa Micron Powder Systems

- PENZ Crane GmbH

- ACE Inc.

- Terex MHPS GmbH

- Hiab

- Ramky Enviro Engineers Ltd

제8장 투자 분석

제9장 시장의 미래

HBR 25.02.17The Middle-East and Africa Hazardous Waste Handling Automation Market is expected to register a CAGR of 6.8% during the forecast period.

Hazardous waste poses an actual or potential hazard to humans' health and other living organisms or the environment, owing to its toxic, flammable, infectious, and radioactive properties.

The management of hazardous waste is one of the emerging issues in the Middle-East and African region as companies from the developed regions have been dumping their toxic waste in Africa for many years, as regulating measures for hazardous waste management in the region are still not on a par with international legislation. However, the governments in the region are now taking initiatives and are banning this practice as a result of their awareness of growing health concerns.

In the Middle East, a large percentage of hazardous waste is produced from petroleum products and from frequent wars, including shellings, casings, and other types of war remain.

Some of these wastes can be handled manually, while some may require expertise and automation solutions to minimize human contact with the waste. The use of such automation solutions for handling waste also improves process efficiency and reduces the reliance on manual intervention. Thus, concerns about the proper handling of these harmful substances can be eliminated.

Different products used in hazardous waste handling automation include cranes, manipulator arms, and size reduction arms.

As the outbreak of COVID-19 impacted the Middle-East and African region, many types of additional medical and hazardous wastes were generated, including infected masks, gloves, and other protective equipment. This has further augmented the demand for effective hazardous waste handling practices in the region.

Moreover, initiatives such as Power Africa, taken by the United States Agency for International Development (U.S.A.I.D.) and various partners, aim to have 25 million to 30 million new solar connections across Africa by 2030. Such initiatives are expected to generate a significant amount of waste, including expired lead-acid batteries and power backup systems. This is expected to drive the demand for automated hazardous waste handling solutions for efficient and safe handling.

Middle-East and Africa Hazardous Waste Handling Automation Market Trends

Demand for Automated Handling Solutions May Increase Safer Handling and Disposable of E-waste

Electronic waste (e-waste) is defined as the remains of electronic gadgets such as mobile phones, computers, fluorescent and incandescent light bulbs, electronic gadgets used in automobiles, and large household appliances such as television sets, refrigerators, washing machines, etc., which are not working or are nearing their end of life.

According to a report by the UN, about 50 million ton of e-waste is generated every year, which will more than double to 110 million ton by 2050, making it the fastest-growing waste stream in the world. However, less than 20% of used electronics are currently recycled. Africa holds the lowest rate of formal e-waste recycling in the world.

An article published by Environmental Health Perspectives shows that 100,000 used personal computers arrive at the Nigerian port of Lagos alone each month. Ghana also faces challenges in managing the e-waste imported. Usually, these e-wastes end up in landfills.

Heavy metals and other hazardous chemicals such as lead, cadmium, mercury, brominated flame-retardants, and polyvinyl chloride (PVC), found in electronics, contaminate groundwater and pose other environmental and public conditions health risks.

To avoid such risks and ensure the safety of people, the governments in the region are taking initiatives both standalone and in collaboration with external agencies for the safe disposal of hazardous waste. For instance, Sustainable City (TSC), the Middle East's first fully-operational sustainable community located in Dubai, has introduced new electronic waste (e-waste) collection and management solutions for the community. The 24-Hour e-Waste drop-off station, created in collaboration with EFATE, will provide a free and efficient e-waste management solution to residents and the general public.

Saudi Arabia is Expected to Hold a Significant Market Share

Saudi Arabia is among the largest countries in the Middle-East and African region and generates a significant amount of hazardous waste due to the presence of several industries. The majority of these industries are from the oil and gas and automotive sectors.

According to OPEC, Saudi Arabia possesses around 17% of the world's proven petroleum reserves. The oil and gas sector accounts for about 50% of gross domestic product and about 70% of export earnings. Apart from petroleum, the Kingdom's other natural resources include natural gas, iron ore, gold, and copper.

Owing to the rising disposable income, the consumption of electronic gadgets in the country is increasing significantly, which is also the primary contributor to the generation of e-waste in the country.

According to the regional e-waste monitor report for the Arab States 2021, by UNITAR, Saudi Arabia is the largest generator of e-waste among Arab countries, with 595 kilotons (kt) (or 13.2 kg/inh) of e-waste in 2019.

To regulate the safe disposal of waste, the government is taking several initiatives. For instance, the government published a new Waste Management Law in September 2021, which aims to regulate the transport, segregation, storage, import, export, safe disposal of waste, and all other activities related to it. Such trends are expected to drive the market growth in the region during the forecast period.

Middle-East and Africa Hazardous Waste Handling Automation Industry Overview

The Middle-East and Africa hazardous waste handling automation market has increased competition due to the rising demand for such solutions for safe hazardous waste disposal. Some of the major players operating in the market include PAR Systems, Konecranes, and Pallmann Maschinenfabrik GmbH & Co. KG, among others.

- January 2022 - Ramky Enviro Engineers Middle East and Waste Management Agency (Public Services Department) of the Emirate of Ras Al Khaimah entered a strategic partnership to set up an exclusive Industrial Hazardous Waste Management facility in RAK, UAE.

- January 2022 - Konecranes partnered with Pesmel to supply automated warehouse container handling technology that revolutionizes material handling in logistics hubs and distribution centers. Automated container tracking is part of a management system that can be integrated easily with the facility's overall logistics management system.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Government and Industry Regulations

- 5.1.2 Growing Concerns about Waste Management

- 5.2 Market Restraints

- 5.2.1 High Costs Involved

6 MARKET SEGMENTATION

- 6.1 Automation Product

- 6.1.1 Manipulator Arms

- 6.1.2 Telescoping Masts

- 6.1.3 Cranes

- 6.1.4 Trusses

- 6.1.5 Size Reduction Systems

- 6.1.6 Other Automation Products

- 6.2 Type of Waste

- 6.2.1 Listed Wastes

- 6.2.2 Charecteristic Wastes

- 6.2.3 Universal Waste

- 6.2.4 Mixed Waste

- 6.3 Industry

- 6.3.1 Manufacturing

- 6.3.2 Chemical

- 6.3.3 Energy

- 6.3.4 Consumer Care

- 6.3.5 Government

- 6.3.6 Other Industries

- 6.4 Geography

- 6.4.1 Saudi Arabia

- 6.4.2 United Arab Emirates

- 6.4.3 Israel

- 6.4.4 South Africa

- 6.4.5 Rest of Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 PAR Systems

- 7.1.2 Konecranes

- 7.1.3 DX Engineering

- 7.1.4 Floatograph Technologies

- 7.1.5 Pallmann Maschinenfabrik GmbH & Co. KG

- 7.1.6 Hosokawa Micron Powder Systems

- 7.1.7 PENZ Crane GmbH

- 7.1.8 ACE Inc.

- 7.1.9 Terex MHPS GmbH

- 7.1.10 Hiab

- 7.1.11 Ramky Enviro Engineers Ltd