|

시장보고서

상품코드

1639459

베트남의 태양에너지 - 시장 점유율 분석, 산업 동향과 통계, 성장 예측(2025-2030년)Vietnam Solar Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

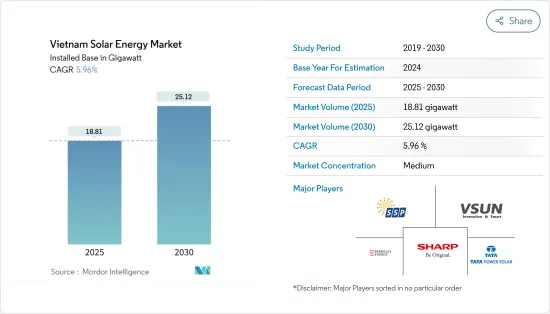

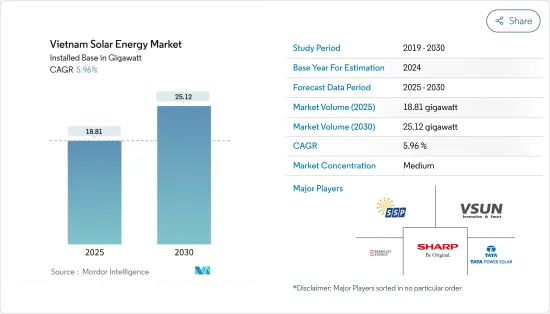

베트남의 태양에너지 시장 규모(설치 기반)는 2025년 19.26기가와트에서 2030년에는 21.73기가와로 확대될 예정입니다. 예측기간(2025-2030년)의 CAGR은 2.44%로 예측됩니다.

주요 하이라이트

- 중기적으로는 신재생에너지발전산업 투자 증가, 주요 지역 전력 수요 증가, 화석연료기반발전 이행을 위한 동국의 노력 증가 등이 예측기간 중 시장촉진요인으로 예상됩니다.

- 한편, 대체 클린 에너지원의 채용 증가나 조사 기간 중 태양광 발전 프로젝트의 초기 투자 비용의 높이가 시장 성장의 방해가 될 것으로 예상됩니다.

- 베트남의 전력 개발 계획 VII는 재생에너지의 비율을 8년 후에 10%까지 증가시키기 위한 것입니다. 이 나라는 또한 수입 석탄 화력 전력의 사용을 줄일 계획이며 태양에너지 시장에 큰 기회가 되고 있습니다.

베트남의 태양에너지 시장 동향

태양광 발전(PV) 부문이 시장을 독점할 전망

- 태양전지 모듈의 비용 저하와 발전이나 급탕 등 다양한 용도에의 범용성에 따라 예측 기간 중에는 태양광 발전(PV) 부문이 최대 시장 점유율을 차지할 것으로 보입니다.

- IRENA 신재생에너지 통계 2024에 따르면 베트남의 태양광 발전 설비 용량은 2022년 16,698MW에서 2023년 약 17,077MW로 증가했습니다. 이 성장은 특히 유틸리티을 위해 베트남에서 태양광 발전 설비가 대량으로 도입되었기 때문입니다. 산업무역성(MOIT)은 향후 수년간 태양광 발전의 설치 용량을 늘릴 계획을 추진하고 있습니다.

- 2023년 5월 베트남 정부는 1,350억 달러의 에너지 전략을 내놓았습니다. 넷미터링 제도를 통해 국내 주택 지붕의 절반에 태양광 발전(PV) 시스템을 설치할 예정입니다. 정부는 8년 후에 전력 수출국이 되기를 원합니다.

- 또한 베트남에서는 최근 몇 년간 태양광 발전 프로젝트가 크게 성장하고 있습니다. 정부는 또한 태양광 발전을 포함한 신재생에너지에 대한 투자를 장려하기 위해 지원 및 인센티브를 실시해 왔습니다. 정부는 전국 인프라를 개선하고 향후 1년간 전국의 에너지 생산을 증가시키기 위해 주요 태양광 발전 기업에 여러 프로젝트를 할당하고 있습니다.

- 예를 들어 2024년 2월 현재 정부는 용량 4,300MW로 2027년까지 시운전이 시작될 예정인 Hai Lang Green Hydrogen Solar PV Park, 용량 1,000MW에서 2025년까지 시운전이 시작될 예정인 Ho Chi Minh Rooftop Solar PV Park, 용량 630MW에서 2027년 프로젝트를 발표했습니다. 이 프로젝트는 향후 몇 년 동안 이 지역 전체의 태양에너지 생산을 증가시킬 것으로 예상됩니다.

- 앞서 언급한 개발은 예측 기간 동안 베트남에서 태양광 발전 부문이 가장 큰 시장 점유율을 차지할 것으로 예상했습니다.

전력 수요 증가가 시장 수요 견인

- 베트남 에너지부는 이 나라에서의 에너지 소비의 급증에 비해 신규 발전소의 개발이 늦어져 전력 부족에 처할 것으로 예측했습니다.

- 베트남의 에너지 수요는 산업화와 경제 근대화의 발전에 따라 향후 7년간 매년 8% 이상 증가할 것으로 예상됩니다.

- 정부는 계획을 수정해 2024년까지 전력 공급량을 전체적으로 4.4kWh 증가한 3,106억kWh로 끌어올리겠다고 발표했습니다. 이 조치는 전력 수요를 증가시키는 국가의 급속한 경제 회복과 일치합니다.

- 2024년 1분기 베트남 전력은 2023년 동기 대비 11.42% 증가한 626억 6,000만kWh의 상용 전력 출력을 달성했습니다. 2024년 4월부터 7월까지의 준비와 1,114억 6,800만kWh의 총 에너지 요구량으로 인해 이 계획은 이전 계획보다 23억kWh 증가했습니다.

- 게다가 베트남은 향후 2년간 9만 6,500MW, 향후 7년간 12만 9,500MW의 전력이 필요해, 수요 증가에 대응할 것으로 예상되고 있습니다. 향후 증가하는 전력 수요에 대응하기 위해 베트남은 2030년까지 매년 약 100억 달러를 필요로 합니다. 이러한 높은 자본 요건으로 인해 정부는 에너지 산업에서 베트남 기업의 100% 외자 소유를 인정하고 있습니다.

- 세계에너지 데이터 통계 검토에 따르면 2022년 베트남 전국의 발전량은 180.4테라와트시로 2021년에 비해 2.3% 증가했습니다. 태양에너지는 2023년 전국의 총 발전량에 차지하는 비율이 컸고, 향후 수년에 증가할 가능성이 높습니다.

- 태양광 발전 프로젝트의 구현은 베트남의 전력 수요 증가를 부분적으로 충족시킵니다. 이 프로젝트는 이 나라의 에너지 믹스를 다양화하고, 화석 연료에 대한 의존도를 줄이고, 증가하는 전력 수요를 충족시키는 데 중요한 역할을 합니다. 투자는 지난 몇 년 동안 이 지역 전체에서 크게 증가했습니다.

- 예를 들어 중국의 태양전지판 제조업체인 Trina Solar는 2023년 11월 향후 수년간 이 지역 전체의 지붕상 태양광 발전 프로젝트의 연구 개발에 4억 2,000만 달러를 투자한다고 발표했습니다. 이러한 투자는 미래에 예정된 태양광 발전 프로젝트가 예측 기간 동안 증가하는 전력 수요를 충족시키는 데 도움이 됩니다.

- 따라서 베트남은 미래의 전력 수요를 충족시키기 위해 신재생 에너지원에 주력하고 있으며, 이는 베트남의 태양에너지 시장의 성장을 가속하고 있습니다.

베트남의 태양에너지 산업 개요

베트남의 태양에너지 시장은 반고정적입니다. 이 시장에서 사업을 전개하는 주요 기업으로는 Song Giang Solar Power JSC, Vietnam Sunergy Joint Stock Company, Sharp Energy Solutions Corporation, Berkeley Energy Commercial & Industrial Solutions, Tata Power Solar Systems Ltd. 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 소개

- 재생에너지 믹스(베트남, 2023년)

- 2029년까지의 태양에너지 설치 용량과 예측(단위 : GW)

- 정부의 규제와 시책

- 최근 동향과 개발

- 시장 역학

- 성장 촉진요인

- 신재생에너지산업 투자 증가

- 주요 주에서 전력 수요 증가

- 억제요인

- 대체 클린 에너지원의 이용 증가

- 성장 촉진요인

- 공급망 분석

- PESTLE 분석

제5장 시장 세분화

- 기술 부문

- 태양광 발전(PV)

- 집광형 태양광 발전(CSP)

제6장 경쟁 구도

- 인수합병, 합작사업, 제휴, 협정

- 주요 기업의 전략

- 기업 프로파일

- SONG GIANG SOLARPOWER JSC

- Vietnam Sunergy Joint

- SONG GIANG SOLARPOWER JSC

- Vietnam Sunergy Joint

- Sharp Energy Solutions Corporation

- TATA POWER SOLAR SYSTEMS LTD

- Vivaan Solar Private Limited

- B.Grimm Power Public Co Ltd

- ACWA Power Company

- Wuxi Suntech Power Co. Ltd

- Berkeley Energy Commercial & Industrial Solutions

- 시장 랭킹 분석

제7장 시장 기회와 앞으로의 동향

- 재생에너지 비중을 늘리려는 베트남의 전력 개발 계획 VII

The Vietnam Solar Energy Market size in terms of installed base is expected to grow from 19.26 gigawatt in 2025 to 21.73 gigawatt by 2030, at a CAGR of 2.44% during the forecast period (2025-2030).

Key Highlights

- Over the medium period, the increasing investments in the renewable energy industry, increasing electricity demand in major provinces, and the country's growing efforts to transition from fossil fuel-based power generation are among the factors expected to drive the market during the forecast period.

- On the other hand, market growth is also expected to be hindered by the increasing adoption of alternative clean energy sources and high initial investment costs of solar projects during the study period.

- Nevertheless, Vietnam's Power Development Plan VII intends to boost the share of renewable energy to 10% in eight years. The country also plans to reduce the use of imported coal-fired electricity, culminating in a major opportunity for its solar energy market.

Vietnam Solar Energy Market Trends

The Solar Photovoltaic (PV) Segment is Expected to Dominate the Market

- The solar PV segment will likely account for the largest market share during the forecast period, in line with the declining costs of solar modules and their versatility in various applications, like electricity generation and water heating.

- According to the IRENA Renewable Energy Statistics 2024, the installed solar PV capacity in Vietnam was around 17,077 MW in 2023, up from 16,698 MW in 2022. The growth resulted from massive deployments of solar PV installations in Vietnam, particularly for utility projects. The Ministry of Industry and Trade (MOIT) has more plans to increase the solar PV installed capacity over the coming years.

- In May 2023, the Vietnamese government launched a USD 135 billion energy strategy. Through a net-metering scheme, half of the country's residential rooftops will be outfitted with photovoltaic (PV) systems. The government hopes to be a power exporter in eight years.

- Furthermore, Vietnam has experienced significant growth in solar PV projects in recent years. The government has also implemented supportive policies and incentives to encourage investments in renewable energy, including solar power. The government has allotted several projects to leading solar companies to improve infrastructure across the country and increase energy production over the coming year across the country.

- For instance, as of February 2024, the government announced several projects, including Hai Lang Green Hydrogen Solar PV Park, with a capacity of 4,300 MW and expected to be commissioned by 2027; Ho Chi Minh Rooftop Solar PV Park, with a capacity of 1,000 MW and to be commissioned by 2025; Thuan Nam Solar Power Plant Project, with a capacity of 630 MW and to be commissioned by 2027. These projects are likely to increase solar energy production across the region in the coming years.

- Owing to the aforementioned developments, the solar PV segment is expected to have the largest market share in Vietnam during the forecast period.

Increasing Electricity Demand is Driving Market Demand

- The Vietnamese Ministry of Energy has projected that the country is expected to suffer power shortages because the development of new power plants is lagging behind the rapidly expanding energy consumption in the country.

- Energy demand in Vietnam is expected to rise by more than 8% annually over the next seven years, in line with increasing industrialization and economic modernization.

- The government unveiled a revised plan to raise the supply of power by 2024 to 310.6 billion kWh overall, an increase of 4.4 kWh. This action is consistent with the nation's quick economic recovery, which has increased electricity demand.

- In the first quarter of 2024, Vietnam Power achieved a commercial power output of 62.66 billion kWh, an increase of 11.42% over the same period in 2023. With preparations spanning April through July 2024 and a total energy requirement of 111.468 billion kWh, the plan represents a 2.3 billion kWh increase over the prior plan.

- Moreover, Vietnam is expected to need 96,500MW of electricity in the next two years and 129,500MW in the next seven years to meet the rising demand. To meet the upcoming electricity demand, Vietnam requires around USD 10 billion annually until 2030 to cater to the growing demand. Owing to such high capital requirements, the government has allowed 100% foreign ownership of Vietnamese companies in the energy industry.

- According to the Statistical Review of World Energy Data, in 2022, electricity generation across the country was 180.4 Terawatt-hours, an increase of 2.3% compared to 2021. Solar energy registered a significant share in the total electricity generation across the country in 2023, which is likely to rise in the coming years.

- The implementation of solar PV projects has partly fulfilled Vietnam's increased electricity demand. These projects play a crucial role in diversifying the country's energy mix, reducing reliance on fossil fuels, and meeting growing electricity needs. Investments have risen significantly across the region in the past few years.

- For instance, in November 2023, Trina Solar, a Chinese solar panel manufacturer, announced an investment of USD 420 million for research and development in rooftop solar power projects across the region in the coming years. These types of investments help upcoming solar projects to fulfill the rising electricity demand during the forecast period.

- Thus, Vietnam is focusing on renewable energy sources to meet the future electricity demand, which is propelling the growth of its solar energy market.

Vietnam Solar Energy Industry Overview

The Vietnamese solar energy market is semi-consolidated. Some of the major companies operating in the market (in no particular order) include Song Giang Solar Power JSC, Vietnam Sunergy Joint Stock Company, Sharp Energy Solutions Corporation, Berkeley Energy Commercial & Industrial Solutions, and Tata Power Solar Systems Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Renewable Energy Mix, Vietnam, 2023

- 4.3 Solar Energy Installed Capacity and Forecast, in GW, till 2029

- 4.4 Government Policies and Regulations

- 4.5 Recent Trends and Developments

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 Increasing Investments in the Renewable Energy Industry

- 4.6.1.2 Increasing Electricity Demand in Major Provinces

- 4.6.2 Restraints

- 4.6.2.1 Increasing Adoption of Alternative Clean Energy Sources

- 4.6.1 Drivers

- 4.7 Supply Chain Analysis

- 4.8 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Solar Photovoltaic (PV)

- 5.1.2 Concentrated Solar Power (CSP)

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 SONG GIANG SOLARPOWER JSC

- 6.3.2 Vietnam Sunergy Joint

Stock Company

- 6.3.3 Sharp Energy Solutions Corporation

- 6.3.4 TATA POWER SOLAR SYSTEMS LTD

- 6.3.5 Vivaan Solar Private Limited

- 6.3.6 B.Grimm Power Public Co Ltd

- 6.3.7 ACWA Power Company

- 6.3.8 Wuxi Suntech Power Co. Ltd

- 6.3.9 Berkeley Energy Commercial & Industrial Solutions

- 6.4 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Vietnam's Power Development Plan VII Intends to Increase the Share of Renewable Energy