|

시장보고서

상품코드

1906980

유럽의 무인 운반차(AGV) 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2026-2031년)Europe Automated Guided Vehicle (AGV) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

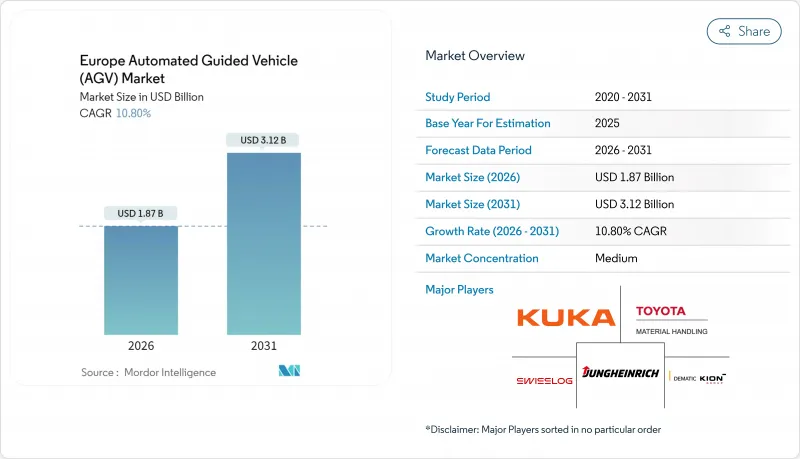

유럽의 무인 운반차(AGV) 시장 규모는 2026년에 18억 7,000만 달러로 추정되고 있습니다. 이는 2025년 16억 9,000만 달러에서 성장한 수치이며, 2031년에는 31억 2,000만 달러에 달할 것으로 예측되고 있습니다. 2026-2031년 연평균 성장률(CAGR)은 10.8%로 성장할 전망입니다.

성장의 주요 요인은 자동차 산업에서 유연한 제조 이니셔티브, 대규모 항만 자동화 프로그램 및 높은 처리량 인트라 물류가 필요한 지속적인 전자상거래의 확대입니다. 리튬 이온 구동 시스템, 5G를 활용한 차량군의 조정, AI 기반의 교통 관리 플랫폼이 융합하여 EU의 탈탄소화 목표를 달성하면서 설비 전체의 생산성을 향상시키고 있습니다. 독일의 자동화 분야에서의 리더십, 네덜란드의 항만 프로젝트, 심각한 노동력 부족에 대한 영국의 대응이 강력한 도입 촉진요인이 되는 한편, RF 스펙트럼의 단편화와 높은 통합 비용이 여전히 도입 속도를 억제하고 있습니다.

유럽의 무인 운반차(AGV) 시장 동향 및 인사이트

유럽 도시 지역의 EC 완성 센터 급증

도시 지역 완성 기반의 급성장으로 인해 AGV 설계의 우선순위는 컴팩트한 설치 면적과 24시간 365일 가동성으로 재설정되었습니다. 마그데부르크에 건설된 REWE 그룹의 2억 5,000만 유로 규모의 물류 허브는 내부 물류의 50%를 자동화하고 하루에 28만 6,000개의 패키지를 처리하고 있으며, AGV 중심 레이아웃에 따른 규모의 이점을 입증하고 있습니다. 전문 소매업체도 이에 따라, Dr. Max사의 새로운 이탈리아 창고에서는 이동 로봇을 활용하여 온라인 판매 55% 성장을 유지하고 있습니다. 물류 부동산의 공실률 안정화와 함께 소매업체는 현재 신속한 AGV 충전 인프라를 지원하는 자동화 대응 공간 확보를 협상 중입니다.

독일 자동차 공장의 Industry 4.0 대응 유연한 생산 라인

독일의 자동차 제조업체는 고정식 컨베이어 라인을 철폐하여 AGV군에 의한 매트릭스 생산 방식으로 이행하고 있습니다. 메르세데스 벤츠의 바디 인 화이트 공정에서는 약 100대의 KUKA제 차량이 자율적으로 부품의 흐름을 실시간으로 조정됩니다. BMW 공장에서는 AI군 제어 소프트웨어에 의해 모델 믹스 변경시에도 다운타임 없이 운송 루트를 적응시키고 있습니다. Durr의 EcoProFleet과 같은 도장 공장 전용 AGV는 이 개념을 마무리 라인으로 확대하여 여러 차종이 공유 리소스상에서 가동할 수 있도록 하고 있습니다.

중소기업의 초기 시스템 통합 및 맞춤형 비용 상승

많은 중소기업은 단 2대의 AGV 도입으로도 4만 9,000유로 이상의 통합 견적에 직면하여 시장 침투가 정체되고 있습니다. 최적화된 레이아웃에서는 8개월 이내의 투자 회수가 가능하지만, 사내의 전문 지식 부족이나 보조금 제도에 대한 인지도가 낮기 때문에 도입 상황은 변동을 보이고 있습니다. OECD의 조사에 따르면 유럽 중소기업의 72%가 디지털화의 이점을 이해하고 있는 것, 스킬 및 자금면의 갭으로부터 선진적인 자동화를 적극적으로 도입하고 있는 것은 불과 18%에 머물고 있습니다.

부문 분석

2025년 현재 자동 지게차는 유럽 AGV 시장 점유율의 37.60%를 차지했습니다. 이는 기존 팔레트 워크플로우와의 호환성과 성숙한 안전 인증이 기반이 되고 있습니다. 견인 트랙터와 태그 보트 차량은 대형 제조 캠퍼스의 주력이지만, 조립 라인 플랫폼은 자동차 업계의 저스트 인 타임 생산을 지원합니다. 유니트 로드 캐리어는 전자상거래의 완성 수요에 힘입어 2031년까지 연평균 복합 성장률(CAGR) 12.6%로 성장하여 유럽 AGV 시장 규모에 대한 기여도를 높일 것으로 예측됩니다.

기술 진화로 인해 기존 카테고리 경계가 모호해지고 있습니다. 키온의 KAnIS 프로젝트에서는 실내 차량군과 제휴하는 5G 접속형 옥외 지게차를 실증해, 자동화 범위를 야드 에리어까지 확대했습니다. 도요타와 기드온의 제휴는 포크리프트의 전통과 AI 구동형 자율이동 로봇(AMR)을 융합시켜 공급자가 적응성이 높은 다목적 플랫폼에 재배치하는 방향성을 보여줍니다.

레이저 유도 방식은 구조화된 통로에서 입증된 정밀도로 2025년에 41.40%의 점유율을 획득했습니다. 비전 유도 차량은 13.9%의 연평균 복합 성장률(CAGR)로 성장하여 SLAM과 센서 퓨전을 활용하여 예측 불가능한 환경을 자율적으로 매핑하여 인프라 리노베이션을 줄입니다. 자기 및 유도 경로는 콜드체인 터널과 같은 중요한 경로 추적 이용 사례에서 계속 사용됩니다. 플라운호퍼 IPA 연구소의 자유 항행 조사에서는 하이브리드 시각 및 레이저 방식이 고정 반사기를 불필요하게 하면서 mm 단위의 정밀도를 유지하는 방법을 실증하고 있습니다. 이녹 로보틱스는 LiDAR과 모션 트래커 융합 기술을 통해 이 모델을 기복이 많은 야외 환경으로 확장하고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 애널리스트 서포트(3개월간)

자주 묻는 질문

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 유럽 도시에서의 EC 풀필먼트 센터 급증

- 독일 자동차 공장의 인더스트리 4.0 대응의 플렉서블 생산 라인

- 서유럽의 물류 노동력에 있어서 인건비 상승 및 인구동태적 부족

- 저배출형 인트라로지스틱스 기기에 대한 EU 그린딜 장려책

- 로테르담 및 앤트워프의 항만 자동화 프로젝트가 해상 AGV 도입 촉진

- 차세대 군중 내비게이션 알고리즘에 대한 호라이즌 유럽 자금 제공

- 시장 성장 억제요인

- 중소기업용 시스템 통합 및 커스터마이즈의 높은 초기 비용

- 유럽의 RF 스펙트럼이 세분화되어 있기 때문에 고밀도 창고에서 네트워크 지연 발생

- CE 마크 및 ISO 3691-4 안전 인증 리드 타임이 길이

- 숙련된 AGV 시스템의 한정된 통합자 공급

- 밸류체인 및 공급망 분석

- 규제와 기술 전망

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

- 업계 밸류체인 분석

제5장 시장 규모 및 성장 예측

- 차량 유형별

- 자동 지게차

- 견인차, 트랙터 및 태그보트

- 유닛 로드 캐리어

- 조립 라인 차량

- 특수 용도 및 커스텀 사양

- 네비게이션 기술별

- 레이저 유도식

- 자기 유도 방식 및 유도 방식

- 비전 가이드식

- 자연 지형 인식 및 SLAM

- 배터리 유형별

- 납축전지

- 리튬 이온

- 니켈 수소 전지

- 슈퍼커패시터 및 고속 충전

- 운용 모드별

- 수동 조작

- 하이브리드 및 듀얼 모드

- 완전 자율형

- 용도별

- 수송 및 유통

- 보관 및 취출

- 조립 및 키트 조립

- 포장 및 팔레타이징

- 최종 사용자 업계별

- 자동차

- 식품 및 음료

- 소매 및 전자상거래

- 전자 및 전기

- 일반 제조업

- 의약품

- 항공우주 및 방위

- 국가별

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 네덜란드

- 기타 유럽

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Swisslog Holding AG

- KUKA AG

- Jungheinrich AG

- Toyota Material Handling Europe AB

- Dematic(KION Group)

- SSI Schaefer AG

- Murata Machinery Ltd

- ABB Ltd

- Seegrid Corporation

- AGILOX Services GmbH

- Balyo SA

- Elettric 80 SpA

- Linde Material Handling GmbH

- STILL GmbH

- Mobile Industrial Robots(MiR)

- Fives Intralogistics SAS

- Euroimpianti SpA

- Oceaneering International(AGV Systems)

- Transbotics Corporation

- Amerden Inc.

제7장 시장 기회 및 장래 전망

AJY 26.01.26European AGV market size in 2026 is estimated at USD 1.87 billion, growing from 2025 value of USD 1.69 billion with 2031 projections showing USD 3.12 billion, growing at 10.8% CAGR over 2026-2031.

Growth is driven by flexible manufacturing initiatives in the automotive sector, large-scale port automation programs, and sustained e-commerce expansion that demands high-throughput intralogistics. Lithium-ion powertrains, 5G-enabled fleet orchestration, and AI-based traffic management platforms are converging to raise overall equipment productivity while meeting EU decarbonization targets. Germany's automation leadership, the Netherlands' port projects, and the United Kingdom's response to acute labor shortages serve as powerful adoption catalysts, whereas fragmented RF spectrum and high integration costs still moderate deployment velocity.

Europe Automated Guided Vehicle (AGV) Market Trends and Insights

E-commerce fulfilment centres' surge across urban Europe

Rapid growth in urban fulfilment hubs is resetting AGV design priorities toward compact footprints and 24/7 availability. REWE Group's EUR 250 million logistics hub in Magdeburg automates 50% of intralogistics and handles 286,000 packages per day, proving the scale advantages of AGV-centric layouts. Specialty retailers follow suit; Dr. Max's new Italian warehouse uses mobile robots to sustain 55% online-sales growth. Combined with stabilizing logistics-real-estate vacancies, retailers now negotiate for automation-ready space that supports rapid AGV charging infrastructure.

Industry 4.0-enabled flexible manufacturing lines in German automotive plants

German automakers are dismantling rigid conveyor lines in favor of matrix production orchestrated by AGV fleets. Mercedes-Benz's body-in-white operations run nearly 100 KUKA vehicles that autonomously synchronize component flows in real time. BMW's factory implementations rely on AI fleet control software to adapt transport routes to model-mix changes without downtime. Purpose-built paint-shop AGVs such as Durr's EcoProFleet expand the concept to finishing lines, allowing multiple vehicle types to run on shared resources.

High up-front system integration & customisation costs for SMEs

Many SMEs confront integration quotations exceeding EUR 49,000 for a modest two-AGV installation, stalling broader market penetration. Although payback can arrive within eight months in optimized layouts, limited in-house expertise and low awareness of subsidy programs leave uptake uneven. OECD surveys show 72% of European SMEs understand digital benefits, yet only 18% actively deploy advanced automation due to skills and funding gaps.

Other drivers and restraints analyzed in the detailed report include:

- Labour-cost inflation & demographic shortages in Western Europe's logistics workforce

- EU Green Deal incentives for low-emission intralogistics equipment

- Fragmented European RF spectrum causing network latency in dense warehouses

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Automated forklifts captured 37.60% of the European AGV market share in 2025, underpinned by drop-in compatibility with existing pallet workflows and mature safety certifications. Tow tractors and tug vehicles remain staples in large manufacturing campuses, whereas assembly line platforms support just-in-time automotive sequencing. Unit-load carriers, propelled by e-commerce fulfilment needs, are forecast to grow at a 12.6% CAGR, increasing their contribution to the European AGV market size through 2031.

Technical evolution blurs legacy categories: KION's KAnIS project demonstrates 5G-linked outdoor forklifts that coordinate with indoor fleets, extending automated coverage to yard areas. Toyota's alliance with Gideon blends forklift heritage with AI-driven AMRs, revealing how suppliers reposition toward adaptable multi-purpose platforms.

Laser guidance commanded 41.40% share in 2025 thanks to proven precision in structured aisles. Vision-guided vehicles, growing at 13.9% CAGR, leverage SLAM and sensor fusion to self-map unpredictable environments, reducing infrastructure retrofits. Magnetic and inductive paths persist in critical path-following use cases such as cold-chain tunnels. Free-navigation research at Fraunhofer IPA shows how hybrid vision-laser stacks eliminate fixed reflectors while preserving millimetric accuracy. Innok Robotics extends this model outdoors with LiDAR plus motion-tracker fusion for rough terrain.

The European AGV Market Report is Segmented by Vehicle Type (Automated Forklift, Unit-Load Carrier, and More), Navigation Technology (Laser Guided, Magnetic/Inductive Guided, and More), Battery Type (Lead-Acid, Lithium-Ion, Nickel-Metal Hydride, and More), Mode of Operation (Manual Override, Hybrid/Dual-Mode, and More), Application, End-User Industry, and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Swisslog Holding AG

- KUKA AG

- Jungheinrich AG

- Toyota Material Handling Europe AB

- Dematic (KION Group)

- SSI Schaefer AG

- Murata Machinery Ltd

- ABB Ltd

- Seegrid Corporation

- AGILOX Services GmbH

- Balyo SA

- Elettric 80 SpA

- Linde Material Handling GmbH

- STILL GmbH

- Mobile Industrial Robots (MiR)

- Fives Intralogistics SAS

- Euroimpianti SpA

- Oceaneering International (AGV Systems)

- Transbotics Corporation

- Amerden Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce Fulfilment Centres Surge Across Urban Europe

- 4.2.2 Industry 4.0 Enabled Flexible Manufacturing Lines in German Automotive Plants

- 4.2.3 Labour-Cost Inflation and Demographic Shortages in Western Europes Logistics Workforce

- 4.2.4 EU Green Deal Incentives for Low-Emission Intralogistics Equipment

- 4.2.5 Port Automation Projects in Rotterdam and Antwerp Boosting Maritime AGV Adoption

- 4.2.6 Horizon Europe Funding for Next-Gen Swarm Navigation Algorithms

- 4.3 Market Restraints

- 4.3.1 High Up-front System Integration and Customisation Costs for SMEs

- 4.3.2 Fragmented European RF Spectrum Causing Network Latency in Dense Warehouses

- 4.3.3 Lengthy CE-Mark and ISO 3691-4 Safety Certification Lead-Times

- 4.3.4 Limited Availability of Skilled AGV Systems Integrators

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Industry Value-Chain Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Vehicle Type

- 5.1.1 Automated Forklift

- 5.1.2 Tow / Tractor / Tug

- 5.1.3 Unit-Load Carrier

- 5.1.4 Assembly Line Vehicle

- 5.1.5 Special-Purpose / Custom

- 5.2 By Navigation Technology

- 5.2.1 Laser Guided

- 5.2.2 Magnetic / Inductive Guided

- 5.2.3 Vision Guided

- 5.2.4 Natural Feature / SLAM

- 5.3 By Battery Type

- 5.3.1 Lead-acid

- 5.3.2 Lithium-ion

- 5.3.3 Nickel-Metal Hydride

- 5.3.4 Super-capacitor / Fast-Charge

- 5.4 By Mode of Operation

- 5.4.1 Manual Override

- 5.4.2 Hybrid / Dual-Mode

- 5.4.3 Fully Autonomous

- 5.5 By Application

- 5.5.1 Transportation and Distribution

- 5.5.2 Storage and Retrieval

- 5.5.3 Assembly and Kitting

- 5.5.4 Packaging and Palletising

- 5.6 By End-User Industry

- 5.6.1 Automotive

- 5.6.2 Food and Beverage

- 5.6.3 Retail and E-commerce

- 5.6.4 Electronics and Electrical

- 5.6.5 General Manufacturing

- 5.6.6 Pharmaceuticals

- 5.6.7 Aerospace and Defence

- 5.7 By Country

- 5.7.1 Germany

- 5.7.2 United Kingdom

- 5.7.3 France

- 5.7.4 Italy

- 5.7.5 Spain

- 5.7.6 Netherlands

- 5.7.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Swisslog Holding AG

- 6.4.2 KUKA AG

- 6.4.3 Jungheinrich AG

- 6.4.4 Toyota Material Handling Europe AB

- 6.4.5 Dematic (KION Group)

- 6.4.6 SSI Schaefer AG

- 6.4.7 Murata Machinery Ltd

- 6.4.8 ABB Ltd

- 6.4.9 Seegrid Corporation

- 6.4.10 AGILOX Services GmbH

- 6.4.11 Balyo SA

- 6.4.12 Elettric 80 SpA

- 6.4.13 Linde Material Handling GmbH

- 6.4.14 STILL GmbH

- 6.4.15 Mobile Industrial Robots (MiR)

- 6.4.16 Fives Intralogistics SAS

- 6.4.17 Euroimpianti SpA

- 6.4.18 Oceaneering International (AGV Systems)

- 6.4.19 Transbotics Corporation

- 6.4.20 Amerden Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment