|

시장보고서

상품코드

1639484

해양 오염방지 코팅 시장 전망 : 시장 점유율 분석, 산업 동향과 통계, 성장 예측(2025-2030년)Marine Anti-fouling Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

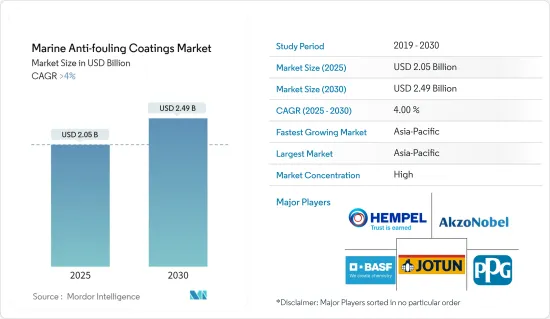

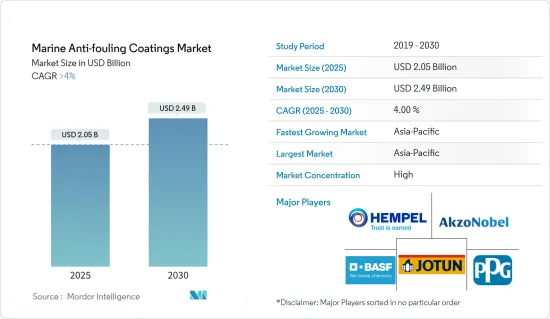

해양 오염방지 코팅 시장 규모는 2025년에 20억 5,000만 달러로 추정되며, 예측기간(2025-2030년)의 연평균 성장율(CAGR)은 4%를 넘어 2030년에는 24억 9,000만 달러에 달할 것으로 예측됩니다.

코로나19는 전 세계적인 봉쇄, 공급망과 제조업의 중단, 생산 중단으로 이어지며 시장에 부정적인 영향을 미쳤습니다. 하지만 2021년 중반부터 상황이 나아지기 시작하면서 남은 예상 기간 동안 시장은 상승 추세를 재개할 수 있었습니다.

주요 하이라이트

- 레저 보트와 유람선이 더 많이 만들어지고, 선박 수리 및 유지 보수 작업이 더 많아지고, 석유 및 가스 산업에서 더 많이 구매하고 있기 때문에 시장이 성장하고 있습니다.

- 한편 엄격한 정부 규정과 고품질의 오래 지속되는 제품을 구매하는 사람들이 늘어나면서 둔화되고 있습니다.

- 그러나 사람들은 명품에 더 많은 돈을 지출하고 있으며 새로운 코팅 및 응용 기술은 예측 기간 동안 연구 된 시장에 기회를 열어 줄 것입니다.

- 조선업계 수요가 증가함에 따라 아시아태평양은 시장을 독점하고 있습니다.

해양 오염방지 코팅

시장을 지배하는 선체 코팅 부문

- 오염방지 선체 코팅 적용 분야는 조사 대상 시장의 대부분을 차지했습니다. 화물선, 여객선, 해양 시추선 등 해양 선박의 수가 증가하고 있기 때문입니다.

- 대부분의 오염방지 선체 코팅은 수중에 있는 선박이나 요트의 부품에 도포됩니다. 이는 선체에 부착된 부품에서 유기체와 미생물이 자라는 것을 방지합니다. 코팅은 외관을 개선하고 오래 사용할 수 있게 해줍니다. 또한 스스로 청소할 수 있고 낙서에 저항하는 등의 다른 이점도 있습니다.

- 유엔 무역개발회의 통계에 따르면 2023년 1월 전 세계 총 선박 수는 약 105,500척으로 이 중 총톤수 100톤(gt) 이상의 선박은 56,500척이며, 이 중 1,000톤 이상 선박은 56,500척에 달합니다. 벌크선, 유조선, 화물선이 전체의 대부분(20%)을 차지했습니다. 선단이 많을수록 부식을 방지하고 잘 붙는 오염방지 선체 코팅에 대한 수요도 늘어날 것입니다.

- UNCTAD 통계에 따르면 2023년 전 세계 선박 톤수의 절반 이상을 아시아 기업이 소유할 것으로 예상되며, 유럽이 38%, 북미가 5%를 차지할 것으로 전망됩니다.

- 2022년에는 중국, 한국, 일본이 전 세계 선박의 약 93%를 건조할 것으로 예상되었습니다. UNCTAD 통계에 따르면 선박 재활용의 86%는 방글라데시, 인도, 파키스탄이 공동으로 수행한 것으로 나타났습니다.

- 미국 경제분석국에 따르면 미국의 수상 운송 산업은 2022년 1분기 경제에 약 540억 달러를 추가했습니다. 이는 전년도 같은 기간보다 약 35% 증가한 수치입니다.

- 이러한 세계 동향으로 조선업계는 계속 성장하고 있으며, 오염방지 선체 코팅 수요는 향후 수년간 증가할 것으로 예상됩니다.

아시아태평양이 시장을 독점

- 아시아태평양 지역은 전 세계 시장 점유율에서 압도적인 우위를 점하고 있습니다. 아시아태평양은 세계에서 가장 큰 선박 생산 및 선박 수리 지역으로 소형 보트, 페리, 예인선, 어선, 예인선부터 석유 산업용 선박, 벌크선, 여객선, 화물선, 컨테이너선에 이르기까지 다양한 유형의 선박에 대한 높은 수요를 충족하고 있습니다.

- 아시아태평양에서는 일본, 중국, 한국과 같은 국가가 선박의 주요 생산국입니다. 동시에 이 지역의 다른 여러 국가에도 대형 조선소가 존재합니다.

- 유엔 무역개발회의 통계에 따르면 아시아 태평양 지역은 2023년 전 세계 선박 수의 50% 이상을 차지할 것으로 예상됩니다. 이 지역은 총 105,500척의 선박 중 약 52,750척 이상의 선박을 소유하고 있습니다.

- 중국, 한국, 일본은 선박 건조의 약 93%가 이 세 나라에서 이루어졌기 때문에 선박 건조의 허브로 간주되었습니다. 그 외에도 선박 재활용은 2021년 파키스탄, 방글라데시, 일본에서 주로 이루어졌습니다.

- 또한, 중국 공업정보화부(MIIT)는 2023년에도 중국이 계속해서 세계 최고의 조선업국이 될 것이라고 보고했습니다. 예를 들어 2023년 중국의 신규 수주량, 선박 건조량, 수주잔량은 전 세계 조선 시장 점유율의 각각 50.2%, 66.6%, 55%를 차지할 것으로 예상했습니다. 또한 2023년 중국의 조선 생산량은 전년 대비 11.8% 증가한 4,232만 dwt(재화중량톤수)로 전망됩니다.

- 중국 공학원의 연구에 따르면, 2023년 중국의 선박 건조 완료량은 전년 대비 약 12% 증가한 4,232만 톤으로 다른 모든 국가를 합친 것보다 높을 것으로 예상됩니다.

- 따라서 생산에 따른 대량 주문은 예측 기간 동안 이 지역에서 가장 빠른 속도로 조선 산업의 오염방지 코팅제 수요를 견인할 수 있습니다.

해양 오염방지 코팅 산업의 개요

해양 오염방지 코팅 시장은 본질적으로 통합되어 있으며 소수의 플레이어가 시장 수요의 상당 부분을 차지하고 있습니다. 시장의 주요 기업에는 PPG Industries Inc., Akzo Nobel NV, Hempel A/S, Jotun, BASF SE가 포함된다(특정한 순서 없음).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 성과

- 조사의 전제

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 레저보트와 크루즈선의 생산 증가

- 선박의 수리, 유지보수 활동 증가

- 석유 및 가스 산업에서의 수요 급증

- 억제요인

- 엄격한 정부 규제

- 고수준 내구제품의 사용 증가

- 업계 밸류체인 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 진입업체의 위협

- 대체품의 위협

- 경쟁도

제5장 시장 세분화(금액 기준 시장 규모)

- 유형별

- 구리 기반

- 셀프 폴리싱(은계)

- 하이브리드

- 기타 유형(유기 금속, 실란)

- 용도별

- 선저 코팅

- 탱크 코팅

- 기타 용도(요트, 선박)

- 지역별

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 태국

- 베트남

- 인도네시아

- 말레이시아

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 북유럽 국가

- 터키

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 콜롬비아

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 나이지리아

- 아랍에미리트(UAE)

- 카타르

- 이집트

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 시장 점유율, 시장 순위 분석

- 주요 기업의 전략

- 기업 프로파일

- Akzo Nobel NV

- Axalta Coatings Systems

- BASF SE

- Boero

- Chugoku Marine Paints Ltd

- Hempel A/S

- Jotun

- Kansai Paint Co. Ltd

- Lanxess

- Nippon Paint Marine Coatings Co. Ltd

- PPG Industries Inc.

- RPM International Inc.

- The Sherwin-Williams Company

제7장 시장 기회와 앞으로의 동향

- 고급품에 대한 지출 증가

- 새로운 혁신적인 코팅 및 응용 기술

The Marine Anti-fouling Coatings Market size is estimated at USD 2.05 billion in 2025, and is expected to reach USD 2.49 billion by 2030, at a CAGR of greater than 4% during the forecast period (2025-2030).

The COVID-19 outbreak in 2020 caused a global lockdown, a break in supply chains and manufacturing, and a stop in production, all of which negatively impacted the market. However, things started to get better in mid-2021, which allowed the market to resume its upward trend for the remainder of the projected period.

Key Highlights

- The market is growing because more leisure boats and cruise ships are being made, there are more ship repairs and maintenance jobs, and the oil and gas industry is buying more.

- On the other hand, the growth of the market studied is being slowed down by strict government rules and more people buying high-quality, long-lasting products.

- However, people are spending more money on luxury goods, and new coatings and application technology are likely to open up opportunities for the market studied during the forecast period.

- Due to the rising demand from the shipbuilding industry, Asia-Pacific dominated the market.

Marine Anti-fouling Coatings Market Trends

Hull Coatings Segment to Dominate the Market

- Antifouling hull coating applications make up most of the market that was looked at. This is because the number of offshore ships, such as cargo and passenger ships, and offshore drilling is growing.

- Most antifouling hull coatings are put on the parts of a ship or yacht that are underwater. This keeps organisms and microbes from growing in the parts that are attached to the hull. The coatings make things look better and last longer. They also have other benefits, like being able to clean themselves and resisting graffiti.

- According to the United Nations Conference on Trade and Development statistics, the total number of ships in the world in January 2023 was about 1,05,500 vessels of at least 100 gross tons (gt), of which 56,500 ships were over 1000 gt. Bulk carriers, oil tankers, and cargo ships made up the majority of the total (20%). With more fleets, there would be more demand for antifouling hull coatings, which protect against corrosion and stick well.

- The UNCTAD statistics also showed that just over half of the world's tonnage in 2023 was owned by Asian companies, followed by Europe, which accounted for 38%, and North America, which accounted for 5%.

- In 2022, China, the Republic of Korea, and Japan were anticipated to build about 93% of all ships in the world. UNCTAD statistics also showed that 86% of ship recycling was done by Bangladesh, India, and Pakistan together.

- According to the Bureau of Economic Analysis, the water transportation industry in the United States added close to USD 54 billion to the economy in the first three quarters of 2022. This is about 35% more than what was added in the same time period the year before.

- Because of these global trends, the shipbuilding industry has been growing, and the demand for antifouling hull coatings is expected to increase in the coming years.

Asia-Pacific to Dominate the Market

- Asia-Pacific dominated the global market share. Asia-Pacific is the largest ship-producing and ship-repairing region in the world, thereby catering to the high demand for various types of vessels, ranging from small boats, ferries, towboats, fishing vessels, and tugboats to vessels for the oil industry, bulk carriers, passenger ships, cargo ships, and container ships.

- In Asia-Pacific, countries such as Japan, China, and South Korea are the leading producers of vessels. At the same time, large shipyards also exist in various other nations of the region.

- According to the United Nations Conference on Trade and Development statistics, Asia-Pacific accounted for over 50% of the number of ships worldwide in 2023. The region had approximately more than 52,750 ships under its ownership out of a total of 105,500 ships.

- China, the Republic of Korea, and Japan were considered the hubs for shipbuilding, as approximately 93% of the shipbuilding happened in these three countries. Apart from that, the recycling of ships was mostly done in Pakistan, Bangladesh, and Japan in 2021.

- Moreover, the Ministry of Industry and Information Technology (MIIT) reported that China continued to be the world's leading shipbuilder in 2023. For instance, in 2023, the country's newly received orders, shipbuilding output, and orders on hand accounted for 50.2%, 66.6%, and 55%, respectively, of the global shipbuilding market share. Furthermore, China's shipbuilding output for 2023 was 42.32 million dwt (deadweight tonnage), a rise of 11.8% Y-o-Y.

- According to research by the Chinese Academy of Engineering, Chinese shipbuilding completions in 2023 grew by about 12% Y-o-Y to 42.32 million deadweight tonnes, higher than all other countries combined.

- Hence, bulk orders in line for production may drive the demand for antifouling coatings from the shipbuilding industry at the fastest rate in the region during the forecast period.

Marine Anti-fouling Coatings Industry Overview

The marine antifouling coatings market is consolidated by its very nature, with a small number of players accounting for a sizable portion of market demand. Some of the major players in the market include (not in any particular order) PPG Industries Inc., Akzo Nobel NV, Hempel A/S, Jotun, and BASF SE.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Production of Leisure Boats and Cruise Ships

- 4.1.2 Increase in Ship Repairs and Maintenance Activities

- 4.1.3 Surging Demand from Oil and Gas Industry

- 4.2 Restraints

- 4.2.1 Stringent Government Regulations

- 4.2.2 Increased Usage of High-standard Durable Products

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Type

- 5.1.1 Copper-based

- 5.1.2 Self-polishing (Silver-based)

- 5.1.3 Hybrid

- 5.1.4 Other Types (Organo Metallic, Silane)

- 5.2 By Application

- 5.2.1 Hull Coatings

- 5.2.2 Tank Coatings

- 5.2.3 Other Applications (Yachts and Vessels)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Thailand

- 5.3.1.6 Vietnam

- 5.3.1.7 Indonesia

- 5.3.1.8 Malaysia

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 NORDIC Countries

- 5.3.3.8 Turkey

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 United Arab Emirates

- 5.3.5.5 Qatar

- 5.3.5.6 Egypt

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis**/Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Akzo Nobel NV

- 6.4.2 Axalta Coatings Systems

- 6.4.3 BASF SE

- 6.4.4 Boero

- 6.4.5 Chugoku Marine Paints Ltd

- 6.4.6 Hempel A/S

- 6.4.7 Jotun

- 6.4.8 Kansai Paint Co. Ltd

- 6.4.9 Lanxess

- 6.4.10 Nippon Paint Marine Coatings Co. Ltd

- 6.4.11 PPG Industries Inc.

- 6.4.12 RPM International Inc.

- 6.4.13 The Sherwin-Williams Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Expenditure on Luxury Goods

- 7.2 New Innovative Coatings and Application Technology