|

시장보고서

상품코드

1640367

의료 영상 소프트웨어 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Medical Imaging Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

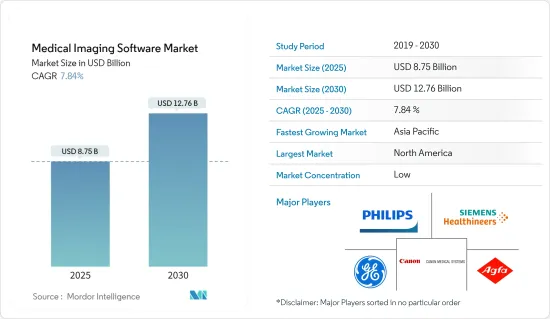

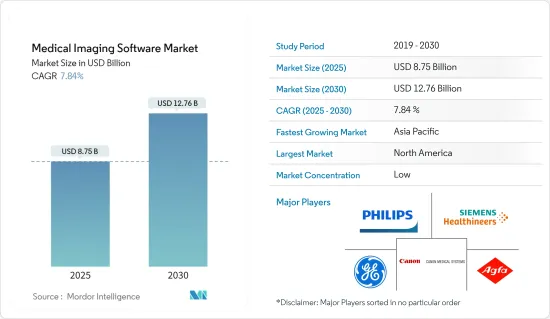

의료 영상 소프트웨어 시장 규모는 2025년에 87억 5,000만 달러로 추정되며, 예측 기간(2025-2030년)의 CAGR은 7.84%로, 2030년에는 127억 6,000만 달러에 달할 것으로 예측됩니다.

머신러닝 및 인공지능과 같은 혁신적인 분석 전략이 보다 정확하고 정밀화되면서 의료 산업의 관심을 끌고 있습니다.

주요 하이라이트

- 관절염과 암 등의 고도의 치료를 위해 의료 영상 소프트웨어에는 고도의 기술이 필요합니다. 고도의 영상 기술은 환자의 상태에 대한 자세한 정보를 제공하여 의사 및 기타 건강 관리 전문가가 환자의 치료를 진행하고 업무 생산성을 향상시키는 데 사용됩니다.

- 치과, 정형외과, 순환기내과, 산부인과, 유방 조영술, 비뇨기과, 신경과 등의 응용 분야에서 영상 소프트웨어 수요 증가가 시장 성장에 기여할 것으로 예상됩니다.

- 특히 만성 질환의 조기 진단을 위해 초음파 영상 진단 장치의 사용이 증가하고 있다는 점은 시장 수요를 견인하고 있는 것으로 보입니다. 또한, 컴퓨터 지원 진단(CAD)과 같은 영상 기술의 진보도 이러한 시스템에 대한 수요를 높일 것으로 예상됩니다. 의료 영상 진단 분야의 인공지능(AI) 채용은 최근 시장 동향을 일변시키고 향후 성장에 긍정적인 영향을 미칠 것으로 예상됩니다.

- 높은 영상 장비 비용은 소프트웨어 도입 비용과 라이선스 비용이 증가함에 따라 특히 상환 계획이 부족한 국가에서는 시장 확대의 가장 큰 제약이 되었습니다. 예를 들어 개발도상국의 병원과 진단센터와 같은 의료 시설의 대부분은 비용이 많이 듭니다.

- COVID-19의 대유행 동안 다양한 AI, 머신러닝, 딥러닝 기술이 의료 영상 처리에 응용되었고 이는 시장 확대를 더욱 촉진할 것으로 보입니다. 더 나은 환자 치료 결과를 위한 효율적인 솔루션에 대한 수요가 높아지고 있기 때문에 진단 및 연구 기관이 영상 분석 솔루션의 중요한 최종 사용자로 부상할 것으로 예상됩니다. 의료 응용 분야의 기술적 진보로 시장은 팬데믹 이후 상승하고 있습니다.

의료 영상 소프트웨어 시장 동향

시장 세분화 : 심장병 관련 애플리케이션이 주요 점유율을 차지

- 심장과 관련된 만성 질환의 빈도가 세계적으로 증가함에 따라 의료 영상 소프트웨어에 대한 수요가 증가하고 있습니다. 이러한 수요가 높아짐에 따라 시장개척을 진행하는 유력기업은 연구개발과 신제품 투입, 합작사업 및 인수에 주력하고 있습니다.

- 예를 들어, Philips는 2022년 3월 영상 처리 업계의 다양한 워크플로우 수요를 수용하도록 설계된 완전 통합 클라우드 지원 의료 IT 플랫폼인 'Health Suite Interoperability'를 발표했습니다.

- 의료 영상 소프트웨어는 분석 속도와 정확도를 향상시키는 것으로 알려져 있습니다. 세계 주요 기업들은 AI와 클라우드 컴퓨팅과 같은 신기술을 통합하고 새로운 의료 영상 소프트웨어 애플리케이션을 도입하고 있습니다. 예를 들어 샌프란시스코에 위치한 Arterys는 딥러닝 AI 알고리즘과 클라우드 컴퓨팅을 결합하여 심장 MRI를 위해 설계되었으며 심장의 이상 병변을 확인하는 데 도움이 됩니다.

- 2022년 2월, Cleery는 동맥 경화의 양과 유형에 따라 심장병을 추적하는 소프트웨어의 새로운 버전인 Cleery 2.2.0을 출시했습니다. 이러한 시장의 혁신과 신제품 출시는 의료 영상 소프트웨어 시장 규모 확대에 기여하고 있습니다.

- 심장 이식과 같은 심장 질병에서 의료 영상 소프트웨어는 체적 및 기능적 데이터 분석을 위해 사용됩니다. Scandiatransplant에 따르면 2021년 북유럽 국가의 심장 이식 환자 수는 스웨덴이 가장 많았으며 66명이 새로운 심장을 이식했습니다. 덴마크는 24명으로 두 번째로 이식 환자 수가 많았습니다.

북미가 최대 시장 규모를 기록할 전망

- 북미는 세계 최대의 의료 영상 소프트웨어 시장이 될 것으로 예상됩니다. 이 지역은 특히 미국, 멕시코, 캐나다 등 국가에서 의료 인프라에 대한 투자가 상당히 높은 수준에 있습니다. 이 시나리오는 이 지역에서 하드웨어가 증가함에 따라 의료 영상 소프트웨어 수요를 높일 것으로 예상됩니다.

- 이 지역에서는 최신 진단 기기를 갖춘 의료기관이 정비되어 있는 점과 의료 IT의 이용을 촉진하는 편리한 정부 시책이 수요 증가의 요인이 되고 있습니다. 또한 R&D 투자 증가와 경쟁사의 존재가 이 지역 시장 확대에 박차를 가하고 있습니다.

- 2022년 10월, 주요 의료 IT 기업 중 하나인 Enlitic은 본격적인 부품, 장비 및 서비스를 제공하는 의료 기술 제공업체인 MULTI Inc.와의 새로운 제휴를 발표했습니다. 양사는 미국 전역의 의료 제공업체에게 Enlitic Curie 플랫폼을 제공하고 방사선과의 업무 효율화를 지원하기 위해 협력했습니다. 고품질 환자 관리의 필요성이 높아짐에 따라 병원 업계는 보다 효율적인 업무를 구축하는 동시에 더 나은 환자 치료 결과에 기여하는 수익 전망을 확대하는 데 중점을 두고 있습니다. 이러한 목적을 달성하기 위해 Curie|ENDEX 애플리케이션은 방사선 부서 내의 여러 사용자의 워크 플로우에 영향을 미칩니다.

- 결과적으로, 많은 의료 영상 소프트웨어 공급업체는 여러 네트워크에서 영상에 액세스할 수 있고 타사 또는 중앙 집중식 전자 의료 기록(HER) 시스템과 통합할 수 있는 벤더 중립 아카이브(NVA) 기술로 전환하고 있습니다.

- 미국암 학회의 추계에 의하면, 2022년 1월에 미국에서 새롭게 등록되는 폐암과 기관지암의 증례 수는 2,36,740례입니다. 이러한 사례 수가 가장 많은 것은 플로리다 주로 추정됩니다. 암 환자 증가는 의료 영상 소프트웨어의 필요성으로 이어집니다.

의료 영상 소프트웨어 산업 개요

이 시장의 업체 간 경쟁도는 General Healthcare Company(GE), Koninklijke Philips NV, Siemens Healthcare, Canon Medical Systems Corporation, Agfa Gevaert HealthCare 등 유력 기업의 존재로 인해 높습니다. 업계 각사는 M&A, 파트너십, 끊임없는 혁신으로 경쟁 우위를 확보하기 위해 지속적으로 제품 포트폴리오를 개발하고 있습니다.

- 2022년 6월 - CT, MRI, 초음파, 눈 케어, 진단용 X선 장치, 인터벤션 X선 장치, 모바일 영상 솔루션, 헬스케어 IT 솔루션 세트 등 의료 영상 솔루션 전반을 제공하는 캐논 메디컬 시스템즈 주식회사는 2022년 비엔나에서 개최된 유럽 방사선 학회(European Society of Radiology)와의 파트너십을 통해 ESR 환자에게 의료 영상 솔루션을 제공합니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업 밸류체인 분석

- 업계의 매력도 - Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

- 시장에 대한 COVID-19의 영향 평가

제5장 시장 역학

- 촉진요인

- 컴퓨터 지원 진단법의 확대

- 억제요인

- 숙련된 전문가 부족과 높은 기기 설치 비용

제6장 시장 세분화

- 화상 유형별

- 2D 이미징

- 3D 이미징

- 4D 이미징

- 용도별

- 치과용도

- 정형외과

- 심장병 용도

- 산부인과 용도

- 유방 조영

- 비뇨기 및 신장 용도

- 기타 용도

- 지역별

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 프랑스

- 영국

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 기타 아시아태평양

- 세계 기타 지역

- 라틴아메리카

- 중동 및 아프리카

- 북미

제7장 경쟁 구도

- 기업 프로파일

- General Healthcare Company(GE)

- Koninklijke Philips NV

- Siemens Healthcare

- Canon Medical Systems Corporation

- Agfa Gevaert HealthCare

- Novarad Corporation

- Carestream Health Inc.

- Esaote SpA.

- MIM Software Inc.

- Fujifilm Holding Company

- Cerner Corporation

- Change Healthcare

제8장 투자 분석

제9장 시장 기회와 앞으로의 동향

CSM 25.02.17The Medical Imaging Software Market size is estimated at USD 8.75 billion in 2025, and is expected to reach USD 12.76 billion by 2030, at a CAGR of 7.84% during the forecast period (2025-2030).

Machine learning and artificial intelligence have attracted the healthcare industry as these innovative analytics strategies have become more accurate and precise.

Key Highlights

- The need for medical imaging software for advanced treatment for people with arthritis, cancer, etc., demands an advanced version. This advanced image is used to advance patient care and improve operating productivity by empowering doctors and other healthcare professionals by providing more details about patient conditions.

- An increase in demand for diagnostic imaging software in applications such as dental, Orthopedic, Cardiology, obstetrics and gynecology, Mammography, urology, and neurology, is expected to contribute to the market growth.

- The increasing use of ultrasonic imaging equipment for earlier diagnosis, particularly chronic disorders, is likely to drive the market's demand. Furthermore, ongoing advancements in imaging technologies, such as Computer-aided Diagnosis (CAD), are expected to boost demand for these systems. The adoption of Artificial Intelligence (AI) in medical imaging has transformed market trends in recent years and is expected to impact future growth positively.

- The high cost of imaging equipment, combined with the increased implementation and licensing fees of software, is the biggest constraint to market expansion, particularly in countries with poor reimbursement scenarios. For example, most healthcare facilities in developing nations, such as hospitals and diagnostic centers, have costs.

- During the COVID-19 pandemic, various AI, machine learning, and deep learning technologies were applied in medical image processing, which will drive market expansion further. Because of the increasing demand for efficient solutions for better patient outcomes, diagnostic and research institutes are expected to emerge as significant end users of image analysis solutions. Due to the technological advancements in medical applications, the market is increasing after the pandemic.

Medical Imaging Software Market Trends

Cardiology Applications Segment Holds Major Market Share

- As the frequency of chronic diseases related to the heart is increasing globally, the demand for medical imaging software is increasing. With such rising demand, prominent market players are focusing on R&D and new product launches, as well as joint ventures and acquisitions, to develop their businesses.

- For instance, in March 2022, Philips announced Health Suite Interoperability, a fully integrated cloud-enabled Health IT platform designed to address the different workflow demands of the imaging industry.

- Medical image software has been found to improve analysis speed and accuracy. Key players around the globe are integrating emerging technologies like AI and Cloud computing to introduce new medical imaging software applications. For instance, Arterys, located in San Francisco, combines deep learning AI algorithms with cloud computing. Arterys designed for cardiac MRIs to assist in identifying abnormal lesions in these areas.

- In February 2022, Cleery launched Cleerly 2.2.0, a new software version that tracks heart disease based on the quantity and kind of atherosclerosis. Such market innovations and new product releases contribute to expanding the Medical Imaging Software Market Size.

- In Cardiac problems like heart transplantation, medical imaging software is used to know the volumetric and functional data analysis. According to Scandiatransplant, the number of heart transplant recipients in the Nordic countries in 2021 Sweden had the most significant number of transplanted heart patients, with 66 individuals transplanted a new heart. Denmark had the second-highest number of transplants, with 24 patients.

North America is Expected to Register the Largest Market

- North America is expected to be the largest market for medical imaging software globally. The region has a considerably high level of investments in medical infrastructure, especially in countries like the United States, Mexico, and Canada. This scenario, coupled with the increasing multitude of hardware in the region, is expected to boost the demand for medical imaging software.

- The expansion can be attributed to the availability of well-established healthcare institutions equipped with modern diagnostic equipment and favorable government measures to boost the use of healthcare IT in this region. Furthermore, rising R&D investments and the presence of significant market competitors are fueling regional market expansion.

- In October 2022, Enlitic, one of the leading healthcare IT firms, announced a new partnership with MULTI Inc., a healthcare technology provider of authentic parts, equipment, and services. The two organizations collaborated to provide the Enlitic Curie platform to healthcare providers across the United States to assist radiology departments in driving operational efficiencies. As the need for high-quality patient care grows, hospital leaders focus on building more efficient operations while expanding revenue prospects that contribute to better patient outcomes. To achieve these aims, the Curie|ENDEX application impacts the workflows of several users within the radiology department.

- As a result, many medical imaging software vendors are moving towards vendor-neutral archive (VNA) technologies that enable access to images form several networks and the ability to integrate them with third-party or centralized Electronic Health Record (HER) systems.

- According to the American Cancer Society estimation in January 2022, the number of new lung and bronchus cancer cases registered in the United States is 2,36,740. The highest number of these cases is estimated to be in Florida. The increase in cancer patients necessitates the use of medical imaging software.

Medical Imaging Software Industry Overview

The competitive rivalry in this market is high because of dominant players like General Healthcare Company (GE), Koninklijke Philips N.V., Siemens Healthcare, Canon Medical Systems Corporation, and Agfa Gevaert HealthCare, among others. The industry players constantly develop their product portfolios to gain competitive advantages with mergers and acquisitions, partnerships, and constant innovations.

- June 2022 - Canon Medical Systems Corporation, which provides a full range of medical imaging solutions such as CT, MRI, Ultrasound, Eye Care, Diagnostic and Interventional X-Ray equipment, Mobile Imaging Solutions, and a full suite of Healthcare IT solutions, has expanded its partnership with the European Society of Radiology for the 2022 onsite edition in Vienna. Through the partnership, Canon Medical offers its medical imaging solutions to ESR patients.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Application of Computer-Aided Diagnostic Methods

- 5.2 Market Restraints

- 5.2.1 Dearth of Skilled Professionals and High Set-up Cost of the Equipment

6 MARKET SEGMENTATION

- 6.1 By Imaging Type

- 6.1.1 2D Imaging

- 6.1.2 3D Imaging

- 6.1.3 4D Imaging

- 6.2 By Application

- 6.2.1 Dental Applications

- 6.2.2 Orthopaedic Applications

- 6.2.3 Cardiology Applications

- 6.2.4 Obstetrics and Gynaecology Applications

- 6.2.5 Mammography Applications

- 6.2.6 Urology and Nephrology Applications

- 6.2.7 Other Applications

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 France

- 6.3.2.3 United Kingdom

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Rest of the World

- 6.3.4.1 Latin America

- 6.3.4.2 Middle-East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 General Healthcare Company (GE)

- 7.1.2 Koninklijke Philips N.V.

- 7.1.3 Siemens Healthcare

- 7.1.4 Canon Medical Systems Corporation

- 7.1.5 Agfa Gevaert HealthCare

- 7.1.6 Novarad Corporation

- 7.1.7 Carestream Health Inc.

- 7.1.8 Esaote SpA.

- 7.1.9 MIM Software Inc.

- 7.1.10 Fujifilm Holding Company

- 7.1.11 Cerner Corporation

- 7.1.12 Change Healthcare