|

시장보고서

상품코드

1640410

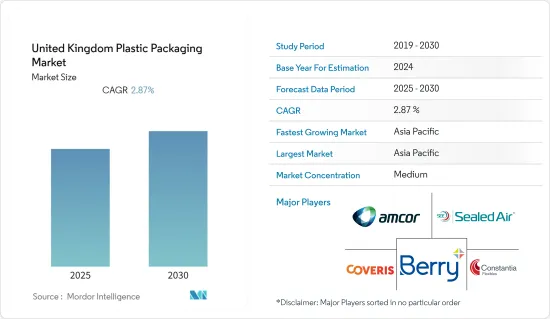

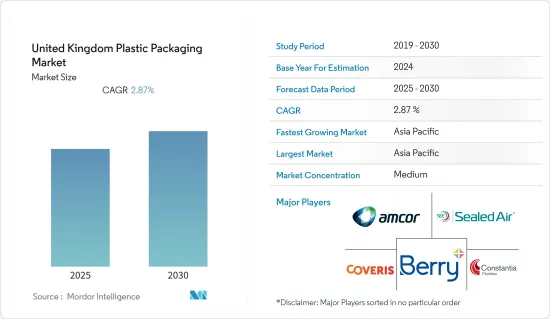

영국의 플라스틱 포장 시장 : 점유율 분석, 산업 동향, 성장 예측(2025-2030년)United Kingdom Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

영국의 플라스틱 포장 시장은 예측 기간 동안 CAGR 2.87%를 나타낼 것으로 예상됩니다.

영국의 포장 산업은 이 지역의 산업 부문이 확대됨에 따라 크게 확대되고 있으며, 이는 이 지역의 포장 서비스에 대한 수요를 높이고 있습니다. Packaging Federation of the United Kingdom에 따르면 영국의 포장 제조업 연간 매출은 110억 파운드(135억 9,000만 달러)입니다. 직원 수는 8만 5,000명 이상으로 영국 제조업의 3%를 차지하고 있습니다. 게다가 더 큰 패키징 공급망에서 중요한 역할을 하고 영국의 GDP에 크게 기여하고 있습니다.

영국 포장 섹터의 대부분은 플라스틱 포장으로 구성되어 있습니다. 또한, 광범위한 제조 능력으로 인해 플라스틱 포장의 영국 시장은 상당한 금액의 수입을 창출할 것으로 예상됩니다. 영국 의회는 연간 500만 톤의 플라스틱이 이 나라에서 사용되고 있으며 그 절반을 포장이 차지하고 있다고 추정합니다.

유연한 패키징 산업의 성장으로 플라스틱은 영국에서도 수요가 있습니다. 시장의 요구는 이 분야에서 국제적인 벤더의 진출과 현지 기업의 인수에 의해 지원됩니다.

플라스틱을 사용하는 다양한 산업 중에서도 낙농 산업은 플라스틱 사용량을 줄이는 데 주력하고 있습니다. 영국 식량 및 농업장관인 Rooker는 이 나라의 낙농 산업이 보다 지속가능하도록 요구하고 우유 포장에 사용되는 플라스틱의 수를 50% 삭감하는 것을 목표로 했습니다. 이는 이미 혁신적인 다양성을 보여주는 국가에서 더욱 친환경적인 패키징이 더욱 성장하고 있음을 보여줍니다.

Brexit은 EU와 영국 간의 무역 규제 증가, 숙련 노동자 부족, 현지 수지 생산자의 경쟁력 저하, 플라스틱 재활용률 감소 등으로 영국의 플라스틱 포장 비용을 상승시킬 것으로 예상되며, 이들 모두가 이 나라의 플라스틱 포장 산업에 영향을 미칠 수 있습니다.

COVID-19가 발생함에 따라 영국 포장 시장은 정부가 채택한 광범위한 봉쇄 조치와 공급망의 혼란으로 인해 성장 감소를 목격했습니다. 의료 및 음식을 제외한 모든 부문이 폐쇄되었습니다. 또한 러시아와 우크라이나 전쟁이 포장 생태계 전체에 영향을 미쳤습니다.

영국 플라스틱 포장 시장 동향

현저한 성장을 견인하는 식품 산업

식품 포장은 플라스틱의 가장 중요한 사용자 중 하나입니다. 식품 산업에서 플라스틱 포장 수요가 증가하고 있습니다. 경량화나 코스트 삭감 등, 그 유익한 특성에 의해 판지, 금속, 유리와 같은 종래의 소재를 대체하는 케이스가 증가하고 있습니다.

가공 식품 및 포장 식품에 대한 선호도는 라이프 스타일의 급속한 개척과 경제 성장으로 이 지역의 식품 포장 시장을 뒷받침하고 있습니다. 가공 식품에 대한 선호도가 높아지는 주된 이유는 인구 역학이 농촌 지역에서 도시 지역으로 이동하는 것입니다.

그러나 이 지역에서는 플라스틱 포장 폐기물의 양이 증가하고 있습니다(매년 2%씩). EU 위원회는 플라스틱 포장의 전면 금지를 검토하고 있으며, 이는 시장 성장을 억제할 것으로 예상됩니다. EU의 새로운 환경 담당 위원인 Virginijus Sinkevicius는 플라스틱 포장 또는 재생 플라스틱의 사용을 금지할 예정이라고 말했습니다.

예측 기간 동안, 스탠드업 파우치는 식품의 신선도를 유지하고 유통 기한을 연장하는 능력이 있기 때문에 식품 포장의 표준 형태가 될 것으로 예상됩니다. 또한 파우치는 눈에 보이는 아름다움을 제공하여 제품 마케팅 효과를 높입니다. 이러한 이유로 파우치는 다른 포장 형태를 대체하는 안정적인 포장 형태로 널리 채택되었으며, 예측 기간 동안 수요와 고객 수용 측면에서 더욱 기세를 높일 것으로 예상됩니다. 영국에서는 지속가능성과 재활용성이 브랜드에 대한 소비자 선호도를 높이는 데 중요한 역할을 합니다.

연포장은 현저한 성장이 예상됩니다.

영국의 연포장은 예측 기간 동안 안정적인 성장률을 나타낼 것으로 예상됩니다. 반려동물 먹이, 신선한 음식, 커피와 같은 최종 사용자 증가는 이 지역에서 더 높은 연포장을 제조할 필요성을 증가시키고 있습니다. 라이프 스타일의 변화에 따라 경질에서 연질로 이동하는 일반적인 동향은 소규모 가구가 증가함에 따라 한 번에 한 번씩 제공하는 선택적 요구를 높입니다.

연포장은 유통 기한을 연장하여 제품의 지속가능성을 높입니다. 또한 냉동식품과 같은 연포장으로만 실현할 수 있었던 신제품의 인트로덕션도 가능해졌습니다.

팬데믹이 시작된 당초 식품생산은 전례 없는 활황을 보였지만, 한편 생산 라인을 재이용한 패스트 무빙 소비재(FMCG) 업체도 있었습니다. 영국의 플렉서블 플라스틱 패키징 시장은 충실한 제조 설비에 의해 큰 수익을 올릴 것으로 예상되고 있습니다.

그러나 영국에서 연질 플라스틱 재활용을 재정적으로 지속 가능한 시스템으로 만들기 위해 2021년에 연포장 펀드가 시작되어 대단히 필요한 고용과 인프라에 대한 투자를 동기 부여하기 시작했습니다. Mars UK, Mondelez International, Nestle, PepsiCo, Unilever 등 FMCG와 소매 대기업이 협력하여 100만 영국 파운드(약 120만 달러)의 기금을 설립하여 연질 플라스틱의 재활용을 재활용 업체에게 경제적으로 실행할 수 있도록 하고 소비자에게 보다 용이하게 합니다. 제조업체, 소매업체 및 재활용 업체와 협력하여 이 펀드는 연질 플라스틱 재활용을 개선하고 소재에 안정적인 가치를 제공하여 플라스틱 오염을 줄이기 위한 것입니다.

가공식품 수요의 꾸준한 증가와 경량 플렉서블 플라스틱의 채용 증가 등 몇 가지 요인이 단기, 중기, 장기에 걸쳐 다양한 영향을 주면서 시장을 견인하고 있습니다. 또한 냉동 식품 포장 시장은 이 지역의 제품 품질에 대한 소비자의 평가와 함께 수요의 급증을 목표로 하고 있습니다. 경제의 성장과 라이프스타일의 변화에 따라 유럽에서는 냉동식품 포장 수요가 증가하고 있으며, 예측기간 동안 시장은 고성장이 예상되고 있습니다.

영국에서는 재활용률의 향상이 연질 플라스틱 포장의 이용을 촉진하고 있습니다. 2022년 7월에 발표된 폐기물에 대한 영국 통계에 따르면, 이 나라에서의 포장 폐기물의 재활용률은 2014년의 59.2%에서 2021년에는 63.2%로 상승했습니다. 민간 기업의 노력도 재활용률 향상에 기여하고 있으며, 이 나라에서의 연질 플라스틱 포장의 이용을 촉진하고 있습니다.

영국 플라스틱 포장 산업 개요

영국에서는 플라스틱 포장 수요가 크게 증가하고 있기 때문에 Amcor, Coveris Holding, Berry Global, Sealed Air Corporation, Constantia Flexibles와 같은 대기업이 존재하고 시장이 부드럽게 집중되고 있습니다.

2022년 10월 북아일랜드 단가논에서 창업 50주년을 맞이한 Greiner Packaging UK and Ireland는 1,000만 파운드(1,060만 달러)의 투자 프로그램을 발표하고 매출 1억 파운드(1억 630만 달러)의 목표를 설정했습니다. 이 회사는 또한 새로운 기계 설치, 새로운 제조 홀 시운전, 창고 용량을 3,000공간에서 11,000공간으로 늘리기 위해 1,000만 파운드(약 1,060만 달러) 이상을 투자할 계획도 밝혔습니다. Dungannon은 Dale Farm, Yeo Valley, Arla, Irish Yogurts와 같은 주요 유업 제조업체를 위해 매일 거의 500만 개의 플라스틱 용기를 생산합니다.

2022년 9월, 기업이 지속가능성 목표를 달성하는 것을 돕기 위해, Sealed Air는 BUBBLE WRAP 브랜드 하에서 재활용 소재를 통합한 다양한 새로운 보호 포장 옵션을 만들었습니다. 보다 친환경적인 패키징에 대한 요구를 충족시키기 위해 3개의 새로운 팽창식 필름이 도입되어 30% 또는 50% 재활용 플라스틱 폐기물을 사용합니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트·지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 밸류체인 분석

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

- 시장에 대한 COVID-19의 영향

- 세계의 플라스틱 포장 시장 개요

제5장 시장 역학

- 시장 성장 촉진요인

- 경량 포장 방법의 채용 증가

- 친환경 포장 및 재생 플라스틱 증가

- 시장 성장 억제요인

- 원재료(플라스틱 수지) 가격 상승

- 정부의 규제와 환경 문제

제6장 시장 세분화

- 포장 유형별

- 연질 플라스틱 포장

- 경질 플라스틱 포장

- 제품 유형별

- 경질 플라스틱 포장

- 병과 항아리

- 트레이와 용기

- 기타 제품 유형(캡, 마개 등)

- 연질 플라스틱 포장

- 파우치

- 가방

- 필름과 랩

- 기타 제품 유형

- 경질 플라스틱 포장

- 최종 사용자 산업별

- 식품

- 음료

- 헬스케어

- 퍼스널케어와 가정용품

- 기타 최종 사용자 산업

제7장 경쟁 구도

- 기업 프로파일

- Amcor PLC

- Coveris Holding

- Berry Global

- Sealed Air Corporation

- Constantia Flexibles

- Polystar Plastics Ltd

- Coda Plastics Limited

- Charpak Ltd

- Wipak UK Ltd

- Sonoco Products Company

- Tyler Packaging Limited(Macfarlane Group PLC)

- National Flexible

- Clifton Packaging Group Limited

제8장 투자 분석

제9장 시장의 미래

JHS 25.02.18The United Kingdom Plastic Packaging Market is expected to register a CAGR of 2.87% during the forecast period.

The UK packaging industry is expanding significantly due to the region's expanding industrial sector, which is driving up demand for packaging services there. The UK packaging manufacturing industry generated GBP 11 billion (USD 13.59 billion) in annual sales, according to the Packaging Federation of the United Kingdom. It employs more than 85,000 people, representing 3% of the manufacturing workforce in the United Kingdom. Furthermore, it plays a crucial role in the larger packaging supply chain and contributes significantly to the UK GDP.

The packaging sector in the United Kingdom is largely composed of plastic packaging. Furthermore, due to extensive manufacturing capabilities, it is expected that the UK market for plastic packaging would generate a sizeable amount of income. The UK Parliament estimates that five million tons of plastic are used there annually, with packaging accounting for approximately half of that.

Due to the growth of the flexible packaging industry, plastics are also in demand in the United Kingdom. The market need is being helped by both the expansion of international vendors in this area and the acquisition of local businesses.

Among various industries using plastic, the dairy industry is focusing on reducing plastic use. The UK's Food and Farming Minister, Lord Rooker, called for the country's dairy industry to become more sustainable, targeting a 50% reduction in the number of plastics used in milk packaging. That indicates even more growth for greener packaging in a country that has already shown innovative diversity.

Brexit is anticipated to increase plastic packaging costs in the United Kingdom due to rising trade regulations between the European Union and the United Kingdom, a shortage of skilled labor, a loss of competitiveness for local resin producers, and a decline in plastic recycling rates, all of which could potentially have an impact on the country's plastic packaging industry.

With the outbreak of COVID-19, the UK packaging market witnessed a decline in growth, owing to the widespread lockdown measures adopted by the government and supply chain disruptions. All the sectors, except healthcare and food and beverage, were shut down in the country. There has also been an impact of the Russia-Ukraine war on the overall packaging ecosystem.

UK Plastic Packaging Market Trends

Food Industry Driving Prominent Growth

Food packaging is one of the most significant users of plastics. The demand for plastic packaging in the food industry is increasing. They are increasingly replacing traditional materials, such as paperboard, metals, and glass, owing to their beneficial properties, such as lightweight and reduced cost.

The preference for processed and packaged foods has propelled the food packaging market in the region due to rapidly developing lifestyles and economic growth. The main reason for the increasing preference for processed food is the shifting population dynamics toward urban centers from rural areas.

However, the region is witnessing an increasing amount of plastic packaging waste (by 2% annually). The EU Commission is considering the general ban on plastic packaging, which is expected to constrain market growth. Virginijus Sinkevicius, the new EU Commissioner for Environment, stated that they are planning to ban plastic packaging or the usage of recycled plastic.

Over the forecast period, stand-up pouches are expected to become a standard form of food packaging due to their ability to retain the freshness of food products and extend the shelf life of products. In addition, the pouches also offer a great visible aesthetic, adding to the marketing benefits of products. This has led to the wide adoption of pouches as a stable alternative to other formats and is expected to take further momentum in terms of demand and customer acceptance during the forecast period. In the United Kingdom, sustainability and recyclability play a significant role in raising consumer preference toward brands.

Flexible Packaging is Expected to Observe Significant Growth

Flexible packaging in the United Kingdom is expected to witness a stable growth rate during the forecast period. The increasing number of end users, such as pet food, fresh food, and coffee, is driving the need for producing higher flexible packaging in the region. The general trend of the shift from rigid to flexible to fit the changing lifestyles, along with the growth of smaller households, is increasing the need for single-serve options.

Flexible packaging increases the sustainability of the products by increasing their shelf life. It has also enabled the introduction of new products, like frozen food, which has been realized only through flexible packaging.

Food production witnessed an unprecedented boom at the beginning of the pandemic, while some fast-moving consumer goods (FMCG) manufacturers repurposed production lines. The market for flexible plastic packaging in the United Kingdom is anticipated to register significant revenue due to substantial manufacturing facilities.

However, to motivate investment in much-needed jobs and infrastructure to make flexible plastic recycling a financially sustainable system in the United Kingdom, the Flexible Packaging Fund was launched in 2021. FMCG and retail leaders, including Mars UK, Mondelez International, Nestle, PepsiCo, and Unilever, teamed up to form a GBP 1 million (approximately USD 1.2 million) fund to help make flexible plastic recycling economically viable for recyclers and easier for consumers. In collaboration with manufacturers, retailers, and recyclers, the fund intends to improve flexible plastic recycling and reduce plastic pollution by giving the material a stable value.

Several factors, like a steady rise in the demand for processed food and increasing adoption of lightweight flexibles, drive the market with varying impacts over the short, medium, and long-term periods. Further, the market for frozen food packaging is witnessing an upsurge in demand with the consumer appreciation of the product quality in the region. With the growth in the economy and changing lifestyles, there is an increased demand for frozen food packaging in Europe, and the market is expected to grow lucratively during the forecast period.

Increasing recycling rates in the United Kingdom have been driving the use of flexible plastic packaging in the country. According to UK Statistics on Waste, published in July 2022, the recycling rate of packaging waste increased in the country from 59.2% in 2014 to 63.2% in 2021. Initiatives by private players are also helping the recycling rate to improve, driving the usage of flexible plastic packaging in the country.

UK Plastic Packaging Industry Overview

As the demand for plastic packaging has been increasing significantly in the United Kingdom, the market is mildly concentrated with the presence of major players like Amcor, Coveris Holding, Berry Global, Sealed Air Corporation, and Constantia Flexibles, among others.

In October 2022, Greiner Packaging UK and Ireland, which was celebrating its 50th anniversary in Dungannon, Northern Ireland, announced a GBP 10 million (USD 10.6 million) investment program and set a goal of GBP 100 million (USD 106.3 million) in revenue. The company also revealed plans to invest over GBP 10 million (about USD 10.6 million) in new machinery installation, a new manufacturing hall's commissioning, and an increase in the warehouse's capacity from 3,000 to 11,000 spaces. It produces almost five million plastic pots every day in Dungannon for significant dairy producers, including Dale Farm, Yeo Valley, Arla, and Irish Yogurts.

In September 2022, to assist businesses in achieving their sustainability objectives, Sealed Air created a variety of new protective packaging options under the BUBBLE WRAP brand that incorporate recycled content. To help businesses fulfill the rising need for packaging that is more environmentally friendly, three new inflatable films have been introduced that use 30% or 50% recycled plastic waste.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain Analysis

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of the COVID-19 on the Market

- 4.5 Overview of the Global Plastic Packaging Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Lightweight-packaging Methods

- 5.1.2 Increased Eco-friendly Packaging and Recycled Plastics

- 5.2 Market Restraints

- 5.2.1 High Price of Raw Material (Plastic Resin)

- 5.2.2 Government Regulations and Environmental Concerns

6 MARKET SEGMENTATION

- 6.1 Packaging Type

- 6.1.1 Flexible Plastic Packaging

- 6.1.2 Rigid Plastic Packaging

- 6.2 Product Type

- 6.2.1 Rigid Plastic Packaging

- 6.2.1.1 Bottles and Jars

- 6.2.1.2 Trays and containers

- 6.2.1.3 Other Product Types (Caps and Closures, etc.)

- 6.2.2 Flexible Plastic Packaging

- 6.2.2.1 Pouches

- 6.2.2.2 Bags

- 6.2.2.3 Films and Wraps

- 6.2.2.4 Other Product Types

- 6.2.1 Rigid Plastic Packaging

- 6.3 End-user Industry

- 6.3.1 Food

- 6.3.2 Beverage

- 6.3.3 Healthcare

- 6.3.4 Personal Care and Household

- 6.3.5 Other End-user Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor PLC

- 7.1.2 Coveris Holding

- 7.1.3 Berry Global

- 7.1.4 Sealed Air Corporation

- 7.1.5 Constantia Flexibles

- 7.1.6 Polystar Plastics Ltd

- 7.1.7 Coda Plastics Limited

- 7.1.8 Charpak Ltd

- 7.1.9 Wipak UK Ltd

- 7.1.10 Sonoco Products Company

- 7.1.11 Tyler Packaging Limited (Macfarlane Group PLC)

- 7.1.12 National Flexible

- 7.1.13 Clifton Packaging Group Limited