|

시장보고서

상품코드

1640416

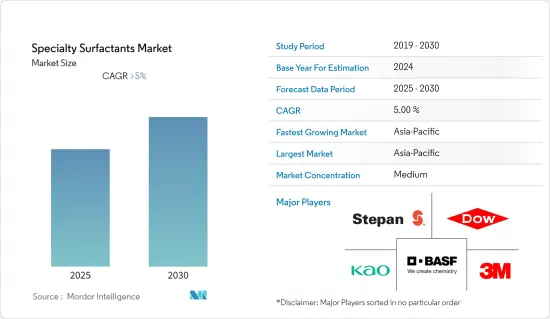

특수 계면활성제 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Specialty Surfactants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

특수 계면활성제 시장은 예측 기간 중에 5% 이상의 CAGR로 추이할 전망입니다.

COVID-19는 특수 계면활성제 시장에 상당히 복잡한 영향을 미쳤습니다. 가정용 세제 및 퍼스널케어 제품 수요 증가로 인해 시장은 활발해졌습니다. 한편, 단단한 체결이나 여행 제한의 결과, 공업용 및 업무용 클리너, 농산물, 윤활유, 연료 첨가제 수요가 감소했습니다. 그러나 규제가 완화되면서 시장은 2021년 이후 페이스를 되찾기 시작했으며, 예측 기간 동안에도 비슷한 궤적을 따라갈 가능성이 높습니다.

주요 하이라이트

- 시장을 견인하는 주요 요인은 아시아태평양에서 개인 관리 산업의 성장과 올레오 화학 시장의 성장입니다.

- 그러나 환경 규제에 대한 관심 증가는 시장 성장을 방해하고 있습니다.

- 가까운 미래에 식품 가공 업계의 특수 계면 활성제에 대한 요구가 증가함에 따라 조사 대상 시장의 성장 가능성이 높아질 것으로 보입니다.

- 아시아태평양이 가장 큰 점유율을 차지하고 있으며 향후 몇 년동안 그 경향이 계속 될 것으로 보입니다.

특수 계면활성제 시장 동향

가정용 비누 및 세제 용도가 시장을 독점한다.

- 세제나 비누에 배합되는 특수 계면활성제는 물과 섞여 의류나 기타 세정 표면의 얼룩에 부착합니다. 이렇게하면 표면 장력을 낮추고 먼지를 떨어 뜨릴 수 있습니다.

- 자동 식기세척기 세제의 계면활성제 수준은 식기세척기 내에서의 거품을 최소화하기 때문에 손세탁 세제보다 낮습니다. 주요 계면활성제는 LAS와 알코올 에톡시 황산염(AES)입니다.

- 국제 비누, 세제, 유지보수 제품 협회(International Association for Soaps, Detergents, and Maintenance Products)에 따르면, 2021년에는 유럽 가정용 케어 제품의 총 시장 가치는 400억 달러를 넘는다고 합니다. 시장의 80% 이상이 가정용 케어 제품으로 구성됩니다.

미국에서는 최근 몇 년동안 세제 수요가 증가하고 있습니다. 전염병 증가와 더불어 건강과 위생에 대한 관심 증가는 세제의 판매를 더욱 늘릴 것으로 보입니다. 미국의 주요 세제 브랜드로는 Tide, Gain, Arm & Hammer, All, Purex, Xtra, Persil, Dreft, Seventh Generation 등이 있습니다. Tide는 2022년 미국 세제 산업을 석권하고 약 24억 달러의 매출을 기록했습니다.

아시아태평양이 시장을 독점

- 아시아태평양은 2022년 특수 계면활성제 시장을 독점하고 예측 기간 동안에도 지배를 유지할 것으로 예상됩니다. 인도, 중국, 일본의 퍼스널케어 산업과 산업용 세정 산업의 성장이 향후 시장을 끌어올릴 것입니다.

- 인구의 지속적인 증가가 이 나라의 화장품 수요를 부추기는 요인이 되고 있습니다. 중국은 미국과 같은 신흥 경제 국가에서 화장품 수출의 주요 시장 중 하나입니다. 중국 국가 통계국에 따르면 2021년 중국 화장품 소매 매출은 580억 달러를 넘어 세계 화장품 시장의 17% 이상을 차지했습니다.

- 도시화의 진전과 지출 증가에 의해 최근 몇 년, 보다 양질의 제품에 대한 수요가 높아지고 있습니다. 주요 가정용 청소기업에 의한 혁신적인 제품 제공은 향후 수년간 시장 집중도를 높일 것으로 예상됩니다. 예를 들어, 2022년 7월, Godrej Consumer Products는 인도 최초의 혼합만 바디 비누 Godrej Magic Bodywash를 불과 0.57 달러로 발표했습니다. 또한 2021년 9월에는 RP-Sanjiv Goenka Group이 스킨 케어 제품과 헤어 케어 제품을 출시하여 퍼스널케어 분야에 진출했습니다.

특수 계면활성제 산업 개요

세계의 특수 계면활성제 시장은 시장 점유율의 대부분이 많은 기업들로 나뉘어져 있기 때문에 적당히 단편화됩니다. 시장의 주요 기업으로는 BASF SE, Dow, 3M, Stepan Company, Koa Corporation 등이 있습니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 아시아태평양의 개인 관리 산업 성장

- 유지 화학제품 시장의 성장

- 억제요인

- 환경 규제에 대한 관심 증가

- 업계의 밸류체인 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 진입업자의 위협

- 대체품의 위협

- 경쟁도

제5장 시장 세분화(금액 베이스 시장 규모)

- 유래별

- 합성 계면활성제

- 바이오계 계면활성제

- 유형별

- 음이온 계면활성제

- 양이온 계면활성제

- 비이온 계면활성제

- 양성 계면활성제

- 실리콘계 계면활성제

- 기타 유형

- 용도별

- 가정용 비누 및 세제

- 퍼스널케어

- 윤활유와 연료 첨가제

- 산업 및 시설용 세정제

- 식품가공

- 유전용 화학제품

- 농업용 화학제품

- 섬유가공

- 기타 용도

- 지역별

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- ASEAN 국가

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 이탈리아

- 프랑스

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 시장 점유율/랭킹 분석

- 주요 기업의 전략

- 기업 프로파일

- 3M

- Akzo Nobel NV

- Arkema

- Ashland

- BASF SE

- Clariant

- Croda International Plc

- Dow

- ELEMENTIS PLC

- Emery Oleochemicals

- Evonik Industries AG

- GALAXY

- GEO

- Godrej Industries Limited

- Huntsman International LLC

- Innospec

- KAO CORPORATION

- KLK OLEO

- Lonza

- Mitsui & Co., Ltd.

- Nouryon

- Reliance Industries Limited

- Sanyo Chemical Industries, Ltd.

- Sasol

- Solvay

- Stepan Company

- Sumitomo Corporation

제7장 시장 기회와 앞으로의 동향

- 식품 가공 업계에서 특수 계면 활성제 수요 증가

The Specialty Surfactants Market is expected to register a CAGR of greater than 5% during the forecast period.

COVID-19 had a rather mixed impact on the market for specialty surfactants. The market experienced a boom as a result of the rise in demand for household cleaning and personal care products. On the other hand, the market also saw a decrease in demand for industrial and institutional cleaners, agricultural products, lubricants, and fuel additives as a result of lockdowns and travel restrictions. However, with the ease in regulations, the market has started to gather pace since 2021, and the market is likely to follow a similar trajectory during the forecast period as well.

Key Highlights

- The major factors driving the market are the growing personal care industry in Asia-Pacific and the growth of the oleochemicals market.

- However, increasing focus on environmental regulations is hindering the growth of the market studied.

- In the near future, the growing need for specialty surfactants in the food processing industry is likely to give the market under study a number of chances to grow.

- Asia-Pacific had the biggest share of the market, and it's likely that it will continue to do so for the next few years.

Specialty Surfactants Market Trends

Household Soap and Detergent Application to Dominate the Market

- Applications in laundry detergents and soaps for use in the home accounted for the majority of the specialty surfactant market.The specialty surfactants incorporated in detergents and soaps mix with water and attach themselves to the dirt on clothes and other cleaning surfaces. This helps reduce the surface tension and remove the dirt from the concerned surface.

- The surfactant level in automatic dishwasher detergents is lower than in hand dishwashing detergents to minimize foaming in the dishwasher. The major surfactants used are LAS and alcohol ethoxy sulfates (AES).

- The International Association for Soaps, Detergents, and Maintenance Products says that the total market value of household care products in Europe will be more than USD 40 billion in 2021. More than 80% of the market will be made up of household care products.

Demand for detergent has increased in the United States in recent years. The rising prevalence of infectious diseases, coupled with growing concerns related to health and hygiene, will further increase the sales of detergent. Leading detergent brands in the United States include Tide, Gain, Arm & Hammer, All, Purex, Xtra, Persil, Dreft, and Seventh Generation. Tide dominated the U.S. detergent industry in 2022 and generated sales of nearly $2.40 billion.

Asia-Pacific to Dominate the Market

- Asia-Pacific dominated the specialty surfactants market in 2022 and is expected to continue its dominance over the forecast period. Growing personal care and industrial cleaning industries in India, China, and Japan will propel the market in the future.

- Continuous population growth is a factor fueling the demand for cosmetics in the country. China is one of the leading markets for cosmetics exports from developed economies, such as the United States. According to the National Bureau of Statistics of China, in 2021, the retail sales of cosmetics in China surpassed USD 58 billion and accounted for more than 17% of the global cosmetics market.

- Increasing urbanization followed by rising expenditure has increased the demand for better-quality products over the past few years. Innovative product offerings by leading household cleaning companies are expected to increase market concentration over the coming years. For instance, in July 2022, Godrej Consumer Products unveiled Godrej Magic Bodywash, India's first ready-to-mix body wash, at just USD 0.57. Furthermore, in September 2021, the RP-Sanjiv Goenka Group entered the personal-care segment by launching skin and hair care products.

Specialty Surfactants Industry Overview

The global specialty surfactants market is moderately fragmented, as the majority of the market share is divided among many players. Some of the key players in the market include BASF SE, Dow, 3M, Stepan Company, and Koa Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Personal Care Industry In Asia-pacific

- 4.1.2 Growth Of The Oleo Chemicals Market

- 4.2 Restraints

- 4.2.1 Increasing Focus On Environmental Regulations

- 4.3 Industry Value-chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market size in Value)

- 5.1 Origin

- 5.1.1 Synthetic Surfactants

- 5.1.2 Bio-based Surfactants

- 5.2 Type

- 5.2.1 Anionic Surfactants

- 5.2.2 Cationic Surfactants

- 5.2.3 Non-ionic Surfactants

- 5.2.4 Amphoteric Surfactants

- 5.2.5 Silicone Surfactants

- 5.2.6 Other Types

- 5.3 Application

- 5.3.1 Household Soap and Detergent

- 5.3.2 Personal Care

- 5.3.3 Lubricants and Fuel Additives

- 5.3.4 Industry and Institutional Cleaning

- 5.3.5 Food Processing

- 5.3.6 Oilfield Chemicals

- 5.3.7 Agricultural Chemicals

- 5.3.8 Textile Processing

- 5.3.9 Other Applications

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Akzo Nobel N.V.

- 6.4.3 Arkema

- 6.4.4 Ashland

- 6.4.5 BASF SE

- 6.4.6 Clariant

- 6.4.7 Croda International Plc

- 6.4.8 Dow

- 6.4.9 ELEMENTIS PLC

- 6.4.10 Emery Oleochemicals

- 6.4.11 Evonik Industries AG

- 6.4.12 GALAXY

- 6.4.13 GEO

- 6.4.14 Godrej Industries Limited

- 6.4.15 Huntsman International LLC

- 6.4.16 Innospec

- 6.4.17 KAO CORPORATION

- 6.4.18 KLK OLEO

- 6.4.19 Lonza

- 6.4.20 Mitsui & Co., Ltd.

- 6.4.21 Nouryon

- 6.4.22 Reliance Industries Limited

- 6.4.23 Sanyo Chemical Industries, Ltd.

- 6.4.24 Sasol

- 6.4.25 Solvay

- 6.4.26 Stepan Company

- 6.4.27 Sumitomo Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rise in Demand for Specialty Surfactants in Food Processing Industry