|

시장보고서

상품코드

1640455

말레이시아의 재생에너지 : 시장 점유율 분석, 산업 동향과 통계, 성장 예측(2025-2030년)Malaysia Renewable Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

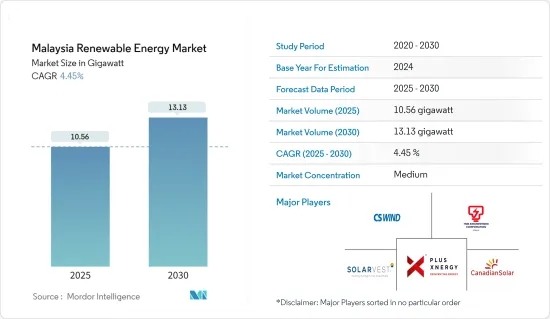

말레이시아의 재생에너지 시장 규모는 2025년에 10.56 기가와트로 추정되고, 2030년에는 13.13 기가와트에 이를 것으로 예측되며, 예측기간(2025-2030년)의 CAGR은 4.45%입니다.

COVID-19의 확산으로 인해 투자가 감소하고 봉쇄 지역이 증가하여 시장은 타격을 받았습니다.

주요 하이라이트

- 예측 대상 기간 동안 시장은 투자 증가와 화석 연료에서 재생에너지로 전력원을 전환하고자 하는 말레이시아 정부의 이니셔티브 등에 의해 견인될 것으로 보입니다.

- 그러나 한편으로 가스화력발전소나 원자력 프로젝트 등의 청정 대체전원 채용이 증가하고 있는 것 등이 조사기간 중 시장 성장을 방해할 가능성이 높습니다.

- 말레이시아는 2050년까지 9GW의 태양에너지 용량을 도입하고자 합니다. 따라서 이 나라의 야심찬 태양에너지 목표와 태양광 리스와 같은 비즈니스 모델은 가까운 미래에 큰 비즈니스 기회를 창출할 것으로 기대됩니다.

말레이시아의 재생에너지 시장 동향

시장을 독점하는 태양광 발전(PV)

- 태양광 발전이 말레이시아의 재생에너지 시장을 석권하는데에는 몇 가지 중요한 요인이 있습니다. 첫째, 말레이시아는 적도 근처에 위치하며 일년 내내 햇빛이 많기 때문에 태양 자원이 풍부합니다. 이러한 자연적 우위는 태양광 발전 설비에 있어서 강력한 기반이 되어 재생에너지로서 매우 현실적인 선택을 제공합니다. 태양광 발전 기술의 비용 절감은 비용 경쟁력을 현저하게 향상시켜 투자자와 에너지 소비자에게 점점 매력적이 되고 있습니다.

- 말레이시아 정부는 태양광 발전 개발을 촉진하기 위한 지원 시책과 인센티브를 실시했습니다. 넷 에너지 미터링(NEM)과 같은 시스템을 통해 소비자는 태양광 발전 시스템을 설치하고 잉여 전력을 송전망에 판매할 수 있습니다. 동시에 고정가격임베디드제도와 세제우대조치는 태양광발전 프로젝트에 대한 투자를 장려하고 있습니다.

- 예를 들어, 2022년 10월 말레이시아 정부는 4차 LSS4 입찰에서 대규모 태양광 발전(PV) 프로젝트의 판매 계약 기간 연장을 결정하여 처음 21년에서 25년으로 연장하였습니다. LSS4 프로그램은 30개 프로젝트에서 총 823.06MW의 용량 할당에 성공했습니다. 전체 LSS4 프로그램에서는 2,457MW의 발전 용량이 할당되었지만, 2022년 6월 현재 1,160MW만 작동하고 있습니다.

- 기술 발전도 태양광 발전의 혁신에 중요한 역할을 합니다. 산업은 태양전지판의 효율성과 전반적인 성능의 대폭적인 향상을 목격하고 비용 절감과 발전 능력 향상을 추진해 왔습니다.

- 국제재생에너지기구(International Renewable Energy Agency)에 의하면, 말레이시아 태양광 발전 설비 용량은 2021-2022년에 걸쳐 8% 이상 증가하여 태양광 발전의 채용이 증가하고 있음을 알 수 있습니다.

- 따라서 위의 요인들로부터 예측기간 동안 유틸리티부문이 말레이시아의 재생에너지 시장을 독점할 것으로 예상됩니다.

시장을 견인하는 정부의 지원 시책

- 말레이시아의 신재생에너지 시장을 견인하기 위해 정부의 조치는 매우 중요한 역할을 합니다. 정부는 신재생에너지의 성장을 자극하기 위해 고정가격임베디드제도의 확립과 신재생에너지 생산자에게 안정된 장기계약을 제공하는 전력구매계약 등 다양한 시책조치를 실시하여 이 부문에 대한 투자를 촉진하고 있습니다. 야심찬 신재생에너지 목표를 세우는 것은 투자자들에게 명확한 방향을 제시하여 시장에 참여하는 인센티브가 됩니다.

- 말레이시아는 2025년까지 에너지의 20%를 신재생에너지로 충당한다는 목표를 세우고 있습니다. 이 목표를 달성하기 위해서는 신재생에너지 부문에 약 80억 달러의 투자가 필요합니다. 예상되는 투자는 정부 자금, 민관 파트너십, 민간 대출의 조합으로 기대됩니다.

- 정부는 민간대출을 장려하고 신재생에너지 부문에 대한 민간 진입을 강화할 계획으로 그린기술대출제도, 그린투자세제, 그린소득세 면제 등 현재 진행되고 있는 정부의 우대조치에 더해 재생에너지의 추가 성장을 지지하는 제도개혁의 실시에 중점을 두고 있습니다.

- 국제재생에너지기구에 따르면 말레이시아의 재생에너지의 설비용량은 2018-2022년에 걸쳐 크게 증가했습니다. 이 기간 동안의 성장률은 20% 이상을 기록했으며, 이는 이 지역에서 신재생에너지의 견고한 성장을 보여줍니다.

- 합리적인 허가 프로세스를 수반하는 지원 규제 프레임워크은 개발자의 장벽과 관료적 장애물을 줄임으로써 재생에너지 프로젝트의 개발을 촉진하고 있습니다.

- 예를 들어, 2023년 3월, 말레이시아의 사바주 라부안에 있는 10MWAC 태양광 프로젝트는 Solar PV Power Sdn Bhd(SPP)를 통해 재무 결산을 달성했습니다. SPP는 Jetama Energy Sdn Bhd(Jetama)와 Symbior Solar Limited(Symbior)의 합작 회사입니다.

- 이로 인해 정부의 지원 시책이나 이니셔티브가 태양광 및 재생에너지의 점유율을 높일 것으로 예상됩니다.

말레이시아의 재생에너지 산업 개요

말레이시아의 신재생에너지 시장은 적당히 세분화되어 있습니다. 이 시장의 주요 기업(순서부동)에는 JA Solar Technology, Solarvest Holdings Berhad, TNB Engineering Corporation Sdn Bhd, CS Wind Malaysia, Plus Xnergy Holding Sdn Bhd 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 조사 방법

제3장 주요 요약

제4장 시장 개요

- 소개

- 재생에너지 믹스(말레이시아, 2022년)

- 재생에너지 설비 용량과 2028년까지의 예측(단위 : MW)

- 정부의 규제와 시책

- 최근 동향과 개발

- 시장 역학

- 촉진요인

- 정부의 지원 시책과 인센티브

- 신재생에너지 프로젝트에 대한 투자 증가

- 억제요인

- 그리드 통합의 과제

- 촉진요인

- 공급사슬 분석

- PESTLE 분석

제5장 시장 세분화 : 유형별

- 태양광

- 수력

- 바이오에너지

- 기타

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 주요 기업의 전략

- 기업 프로파일

- First Solar Inc.

- Canadian Solar Inc.

- Plus Xnergy Holding Sdn Bhd

- TNB Engineering Corporation Sdn Bhd

- Solarvest Holdings Berhad

- KO SOLAR Technology Co. Ltd

- SunPower Corporation

- Trina Solar Co. Ltd

- CS Wind Malaysia

- TS Solartech Sdn Bhd

제7장 시장 기회와 앞으로의 동향

- 다양한 부문에서 에너지 효율 개선

The Malaysia Renewable Energy Market size is estimated at 10.56 gigawatt in 2025, and is expected to reach 13.13 gigawatt by 2030, at a CAGR of 4.45% during the forecast period (2025-2030).

The spread of COVID-19 hurt the market because investments dropped and some regions had to close down.Currently, the market has rebounded from pre-pandemic levels.

Key Highlights

- During the period covered by the forecast, the market is likely to be driven by things like more investments and the country's efforts to switch from fossil fuels to renewable energy as a source of power.The government of Malaysia has also put in place policies and incentives to help solar energy grow, which is expected to drive the market even more.

- However, on the other hand, factors such as the rising adoption of alternate clean power sources, such as gas-fired power plants and nuclear energy projects, are likely to hinder the market's growth during the study period.

- Malaysia is aiming to install 9 GW of solar energy capacity by 2050. Therefore, the country's ambitious solar energy targets and business models such as solar leasing are expected to create significant opportunities in the near future.

Malaysia Renewable Energy Market Trends

Solar Photovoltaic (PV) to Dominate the Market

- Solar PV is poised to dominate the renewable energy landscape in Malaysia due to several key factors. First and foremost, Malaysia enjoys abundant solar resources due to its location near the equator and high levels of sunlight throughout the year. This natural advantage provides a strong foundation for solar PV installations, making it a highly viable renewable energy option. The declining costs of solar PV technology have significantly improved its cost competitiveness, making it increasingly attractive for investors and energy consumers.

- The Malaysian government has implemented supportive policies and incentives to foster solar energy development. Programs like Net Energy Metering (NEM) allow consumers to install solar PV systems and sell excess electricity back to the grid. At the same time, feed-in tariffs and tax incentives encourage investment in solar PV projects.

- For instance, in October 2022, the Malaysian government decided to extend the duration of power purchase agreements for large-scale photovoltaic (PV) projects under the fourth LSS4 tender. The original period of 21 years was increased to 25 years. The LSS4 program successfully allocated a total capacity of 823.06 MW across 30 projects. Overall, the program has awarded 2,457 MW of capacity, but as of June 2022, only 1,160 MW of that capacity was operational.

- Technological advancements have also played a crucial role in the prominence of solar PV. The industry has witnessed significant improvements in solar panel efficiency and overall performance, driving down costs and enhancing power generation capabilities.

- According to the International Renewable Energy Agency, the installed capacity of solar photovoltaics in the country increased by more than 8% between 2021 and 2022, signifying the increasing adoption of solar photovoltaics in the country.

- Therefore, based on the factors above, the utility sector is expected to dominate the Malaysian renewable energy market during the forecast period.

Supportive Government Policies to Drive the Market

- Government policies play a pivotal role in driving the renewable energy market in Malaysia. The government has implemented various policy measures to stimulate the growth of renewable energy, including the establishment of feed-in tariffs and power purchase agreements that provide stable and long-term contracts for renewable energy producers, encouraging investment in the sector. Setting ambitious renewable energy targets provides a clear direction and incentive for investors to participate in the market.

- Malaysia has set a target to derive 20% of its energy from renewable sources by 2025. The country will require an investment of approximately USD 8 billion in its renewable energy sector to achieve this goal. The expected investments are anticipated to come from a combination of government funding, public-private partnerships, and private financing.

- The government intends to encourage private financing and enhance private participation in the renewable energy sector. In addition to the ongoing government incentives like the Green Technology Financing Scheme, the Green Investment Tax Allowance, and the Green Income Tax Exemption, the emphasis will be on implementing institutional reforms to support the growth of renewable energy further.

- According to the International Renewable Energy Agency, the installed capacity of renewable energy in the country increased significantly between 2018 and 2022. The growth rate during this period was recorded at more than 20%, signifying healthy growth of renewables in the region.

- A supportive regulatory framework with streamlined permitting processes has also reduced barriers and bureaucratic hurdles for developers, facilitating the development of renewable energy projects.

- For instance, in March 2023, the 10 MWAC Solar Project in Labuan, Sabah, Malaysia, achieved financial close through Solar PV Power Sdn Bhd (SPP). SPP is a joint venture between Jetama Energy Sdn Bhd (Jetama) and Symbior Solar Limited (Symbior).

- Therefore, supportive government policies and initiatives are expected to drive the share of solar and renewable energy.

Malaysia Renewable Energy Industry Overview

The Malaysian renewable energy market is moderately fragmented. Some of the major players in the market (in no particular order) include JA Solar Technology Co. Ltd, Solarvest Holdings Berhad, TNB Engineering Corporation Sdn Bhd, CS Wind Malaysia, and Plus Xnergy Holding Sdn Bhd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Renewable Energy Mix, Malaysia, 2022

- 4.3 Renewable Energy Installed Capacity and Forecast in MW, till 2028

- 4.4 Government Policies and Regulations

- 4.5 Recent Trends and Developments

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 Supportive Government Policies and Incentives

- 4.6.1.2 Increasing Investments in Renewable Energy Projects

- 4.6.2 Restraints

- 4.6.2.1 Grid Integration Challenges

- 4.6.1 Drivers

- 4.7 Supply Chain Analysis

- 4.8 PESTLE Analysis

5 MARKET SEGMENTATION - BY TYPE

- 5.1 Solar

- 5.2 Hydro

- 5.3 Bio-energy

- 5.4 Other types

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 First Solar Inc.

- 6.3.2 Canadian Solar Inc.

- 6.3.3 Plus Xnergy Holding Sdn Bhd

- 6.3.4 TNB Engineering Corporation Sdn Bhd

- 6.3.5 Solarvest Holdings Berhad

- 6.3.6 JA SOLAR Technology Co. Ltd

- 6.3.7 SunPower Corporation

- 6.3.8 Trina Solar Co. Ltd

- 6.3.9 CS Wind Malaysia

- 6.3.10 TS Solartech Sdn Bhd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Improving Energy Efficiency Across Various Sectors