|

시장보고서

상품코드

1640483

해저 시스템 : 시장 점유율 분석, 산업 동향과 통계, 성장 예측(2025-2030년)Subsea Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

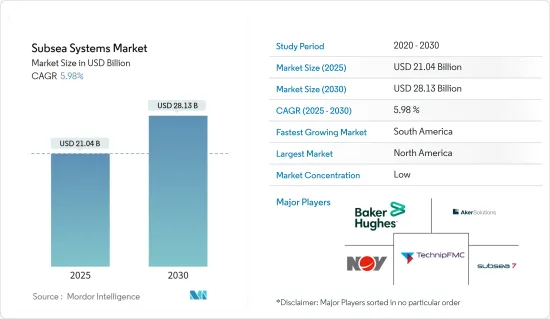

2025년 해저 시스템 시장 규모는 210억 4,000만 달러로 추정되고, 2030년에는 281억 3,000만 달러에 이를 것으로 예측되며, 예측 기간(2025-2030년)의 CAGR은 5.98%입니다.

시장은 COVID-19의 발생, 원유 가격 폭락, 진행 중인 프로젝트의 지연에 의해 부정적인 영향을 받았으나 현재 시장은 팬데믹 전 수준까지 회복하고 있습니다.

주요 하이라이트

- 경기 후퇴 이후 석유 및 가스 가격 상승, 해양 석유 및 가스 부문에 대한 투자 증가 등의 요인이 예측 기간 중 해외 석유 및 가스 기기 서비스 시장, 나아가 해저 시스템 시장의 주요 촉진요인이 될 것으로 보입니다. 또한 해외 프로젝트의 실행 가능성이 향상되고 심해 및 초심해 매장량에 관한 활동이 활발해지고 있는 점도 시장을 밀어 올릴 가능성이 높습니다.

- 그러나 해저 장비의 설치 비용이 높고 해양 드릴링 및 생산과 관련된 위험이 해저 시스템 시장의 성장을 방해할 것으로 예상됩니다.

- 브라질, 이집트, 미국, 이란, 카타르와 같은 국가에서 심해 활동이 증가하고 있다는 점은 해저 시스템 시장의 진출기업에 여러가지 기회를 창출할 가능성이 높습니다.

- 남미는 해저 시스템 시장의 급성장이 기대됩니다. 수요의 대부분은 심해 및 초심해에서의 최근 활동과 일부 미래 프로젝트를 위해 브라질에서 발생하고 있습니다.

해저 시스템 시장 동향

시장을 독점하는 해저 생산 부문

- 최근 성장하고 있는 육상 유전 증가에 따라, 해양 탐사 생산(E&P) 활동이 증가하고 있습니다. 예를 들어, 원유 생산의 가장 중요한 유역인 퍼미안 분지는 오래된 유정에서 생산량이 감소하기 시작하면서 지역 내 발견을 늘려야 합니다.

- Baker Hughes Company에 따르면 2023년 3월 현재, 아시아태평양에서는 90기의 해양 리그가 가동하고 있습니다. 탐사가 증가함에 따라 해양에서의 발견이 늘어나면 리그 수는 대폭 증가할 것으로 예상되며, 따라서 해저 생산 시스템 수요를 끌어올리게 됩니다.

- 예를 들어, 2022년 2월, EniSpA는 아부다비에서 최초의 탐사정을 시추했다고 발표했습니다. 이 회사는 또한 아부 다비 해안 블록 2(아랍에미리트(UAE))에서 수심 115 피트에서 시추 중 첫 번째 탐사정 XF-002에서 긍정적인 결과를 기록했습니다.

- 남미, 북미, 유럽에서 심해 및 초심해 활동이 활발해짐에 따라 심해 유전 생산량은 2025년까지 일량 760만 배럴, 2040년까지 일량 900만 배럴에 이를 것으로 예상됩니다. 따라서 해저 생산 시스템 수요가 증가하고 시장을 더욱 견인할 것으로 예상됩니다.

- 따라서 석유 및 가스산업은 수요 증가에 대응하기 위해 석유 및 가스 탐사를 보다 깊은 지역으로 이동하고 있습니다. 따라서 해저 생산 시스템의 점유율은 해저 시스템 부문 중 최대가 되어 시장을 견인할 것으로 예상됩니다.

시장 성장을 지배하는 남미

- 에너지 수요가 급증함에 따라 다양한 국가, 대기업, 투자자들이 심해에 관심을 갖고 있습니다. 심해는 수십년에 걸쳐 석유 및 가스공급을 보장할 가능성을 갖고 있기 때문입니다. 그러나 이를 위해서는 해저 깊이 수천 미터에 매장된 석유 및 가스를 생산하는 기술을 채용할 필요가 있습니다. 그 때문에 회수율을 향상시켜 전체적인 비용을 절감하기 위한 해저 시스템의 필요성이 높아지고 있습니다.

- 2021년 브라질의 원유 및 콘덴세이트 생산량은 일량 평균 299만 배럴로, 2019년에 비해 일량 평균 15만 배럴 이상 증가했습니다. EIA에 따르면 브라질은 심해 및 초심해 프로젝트 개발로 세계를 선도하고 있습니다. 또한 최근 석유 및 가스 섹터의 자유화 등 정부의 시책 변경에 의해 외국으로부터의 투자가 유치되고 있습니다.

- 세계의 많은 외국 기업들이 향후 10년간 해양 탄화수소 활동에 대한 투자 시장으로 브라질을 탐색하고 있습니다. 예를 들어, 2022년 10월, ONGC Videsh Ltd(OVL)는 브라질의 해양 탄화수소 블록에 10억 달러의 투자를 계획하고 있습니다. 이러한 프로젝트는 예측 기간 동안 해저 시스템 시장에 긍정적인 영향을 미칠 가능성이 높습니다.

- 마찬가지로 아르헨티나의 국영 에너지 회사 YPF는 첫 해외 프로젝트에서 일량 200,000 배럴을 예상하고 있으며, 이 나라에서의 생산 재개에 따라 해저 시스템 수요가 높아질 것으로 예상됩니다.

- 따라서 심해와 초심해의 미래 프로젝트는 남미 지역의 예측 기간 동안 해저 시스템 시장의 성장을 견인할 가능성이 높습니다.

해저 시스템 산업 개요

해저 시스템 시장은 적정 수준으로 통합되어 있습니다. 이 시장의 주요 기업(순서부동)에는 Subsea 7 SA, TechnipFMC PLC, Akastor ASA, National-Oilwell Varco Inc., Baker Hughes Co. 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 조사 방법

제3장 주요 요약

제4장 시장 개요

- 소개

- 2028년까지 시장 규모(10억 달러)와 수요 예측

- 오프쇼어 CAPEX의 과거 실적과 수요 예측(10억 달러)(수심별, 2019-2028년)

- 오프쇼어 CAPEX의 과거 실적과 수요 예측(10억 달러)(지역별, 2019-2028년)

- 최근 동향과 개발

- 정부의 규제와 시책

- 시장 역학

- 촉진요인

- 해외 석유 및 가스 프로젝트의 실행 가능성 향상

- 아메리카, 아시아태평양, 중동, 아프리카의 심해 석유, 가스 탐사, 생산 활동의 활성화

- 억제요인

- 일부 지역의 해양 탐사 생산 활동 제한

- 촉진요인

- 공급사슬 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 시장 유형

- 해저 생산 시스템

- 해저 처리 시스템

- 컴포넌트

- 해저 엄빌리컬 라이저 및 플로우라인(SURF)

- 트리

- 유정

- 매니폴드

- 기타

- 지역

- 북미

- 캐나다

- 멕시코

- 미국

- 기타 북미

- 유럽

- 노르웨이

- 영국

- 프랑스

- 이탈리아

- 아시아태평양

- 중국

- 인도

- 일본

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 이란

- 이라크

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 주요 기업의 전략

- 기업 프로파일

- Akastor ASA

- Subsea 7 SA

- TechnipFMC PLC

- National-Oilwell Varco Inc.

- Baker Hughes Co.

- Schlumberger Ltd

- Halliburton Co.

- Oceaneering International

- Kerui Group Co. Ltd

- Dril-Quip Inc.

제7장 시장 기회와 앞으로의 동향

- 해저 생산 처리 시스템의 기술 진보

The Subsea Systems Market size is estimated at USD 21.04 billion in 2025, and is expected to reach USD 28.13 billion by 2030, at a CAGR of 5.98% during the forecast period (2025-2030).

The market was negatively impacted by the outbreak of COVID-19, the crash in the price of crude oil, and delays in ongoing projects. Currently, the market has rebounded to pre-pandemic levels.

Key Highlights

- Factors such as the increase in oil prices after the downturn period and growing investments in the offshore oil and gas sector are expected to be major drivers for the offshore oil and gas equipment and services market and, in turn, the subsea systems market during the forecast period. Moreover, the improving viability of offshore projects and rising activity in deepwater and ultra-deepwater reserves are likely to boost the market.

- However, the high installation cost of subsea equipment and risks associated with offshore drilling and production are expected to hinder the growth of the subsea systems market.

- Increasing deepwater activities in countries like Brazil, Egypt, the United States, Iran, and Qatar is likely to create several opportunities for the players in the subsea systems market.

- South America is expected to be the fastest-growing market for subsea systems. The majority of the demand comes from Brazil due to its recent activities in deepwater and ultra-deepwater and several upcoming projects.

Subsea Systems Market Trends

Subsea Production Segment to Dominate the Market

- With the rising number of maturing onshore oilfields in recent years, there has been growth in offshore exploration and production (E&P) activities. For instance, in the Permian Basin, the most critical basin in terms of crude oil production, the production from old wells has started to decline, and there needs to be more scope for discovery in these areas.

- According to Baker Hughes, as of March 2023, Asia-Pacific has 90 active offshore rigs. With the increasing exploration, rig counts are expected to grow significantly as more offshore discoveries are made, which, in turn, will boost the demand for the subsea production system.

- For instance, in February 2022, EniSpA announced its first exploration well in Abu Dhabi. The company also revealed that it had recorded positive results from its first exploration well, XF-002, currently under drilling in offshore Block 2 Abu Dhabi (UAE) at 115 feet of water depth.

- With the increasing deepwater and ultra-deepwater activities in the South American, North American, and European regions, the deepwater fields' production is expected to reach 7.6 million barrels per day by 2025 and 9 million barrels per day by 2040. Hence, the demand for subsea production systems is expected to increase and further drive the market.

- Therefore, the oil and gas industry is shifting toward deeper regions to search for oil and gas to meet the increasing demand. Hence, the subsea production systems share is expected to be the largest among subsea system segments and drive the market.

South America to Dominate the Market Growth

- As the energy demand increases rapidly, various countries, major companies, and investors are shifting their interest toward deep water, as it holds the potential for a guaranteed supply of oil and gas for a few decades. However, this requires employing technology to produce oil and gas reserves buried thousands of meters deep in the ocean floor. This has increased the need for subsea systems to improve recovery and reduce overall costs.

- In 2021, Brazil produced an average of 2.99 million barrels per day of crude oil and condensate, representing an average increase of more than 150,000 barrels per day compared with 2019. According to the EIA, Brazil is a global leader in developing deep and ultra-deepwater projects. In recent years, changes in government policies, such as liberalization in the oil and gas sector, have attracted foreign investment.

- Many foreign players worldwide are scouting Brazil for a potential investment market in offshore hydrocarbon activities during the next decade. For instance, in October 2022, ONGC Videsh Ltd (OVL) planned to invest USD 1 billion in a Brazilian offshore hydrocarbon block. Such projects are likely to impact the subsea systems market during the forecast period positively.

- Similarly, Argentina's state-backed energy company YPF expects its first offshore project to produce up to 200,000 barrels per day, which would drive the demand for subsea systems in the country as production resumes.

- Hence, the upcoming projects in deep-water and ultra-deep-water are likely to drive the growth of the subsea systems market during the forecast period in the South American region.

Subsea Systems Industry Overview

The subsea systems market is moderately consolidated. Some of the key players in the market (in no particular order) include Subsea 7 SA, TechnipFMC PLC, Akastor ASA, National-Oilwell Varco Inc., and Baker Hughes Co., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Historic and Demand Forecast of Offshore CAPEX in billions, by Water Depth, 2019-2028

- 4.4 Historic and Demand Forecast of Offshore CAPEX in billions, by Region, 2019-2028

- 4.5 Recent Trends and Developments

- 4.6 Government Policies and Regulations

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.1.1 Improved Viability Of Offshore Oil And Gas Projects

- 4.7.1.2 Rising Deep Water Oil & Gas Exploration And Production Activities In The Americas, Asia-pacific, And Middle-east & Africa Region

- 4.7.2 Restraints

- 4.7.2.1 Ban On Offshore Exploration And Production Activities In Multiple Regions

- 4.7.1 Drivers

- 4.8 Supply Chain Analysis

- 4.9 Porter's Five Forces Analysis

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Consumers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitute Products and Services

- 4.9.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Subsea Production Systems

- 5.1.2 Subsea Processing Systems

- 5.2 Component

- 5.2.1 Subsea Umbical Riser and Flowlines (SURF)

- 5.2.2 Trees

- 5.2.3 Wellhead

- 5.2.4 Manifolds

- 5.2.5 Other Components

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 Canada

- 5.3.1.2 Mexico

- 5.3.1.3 United States of America

- 5.3.1.4 Rest of the North America

- 5.3.2 Europe

- 5.3.2.1 Norway

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Rest of the Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of the South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Iran

- 5.3.5.4 Iraq

- 5.3.5.5 Rest of the Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Akastor ASA

- 6.3.2 Subsea 7 SA

- 6.3.3 TechnipFMC PLC

- 6.3.4 National-Oilwell Varco Inc.

- 6.3.5 Baker Hughes Co.

- 6.3.6 Schlumberger Ltd

- 6.3.7 Halliburton Co.

- 6.3.8 Oceaneering International

- 6.3.9 Kerui Group Co. Ltd

- 6.3.10 Dril-Quip Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technology Advancements In Subsea Production And Processing Systems