|

시장보고서

상품코드

1640518

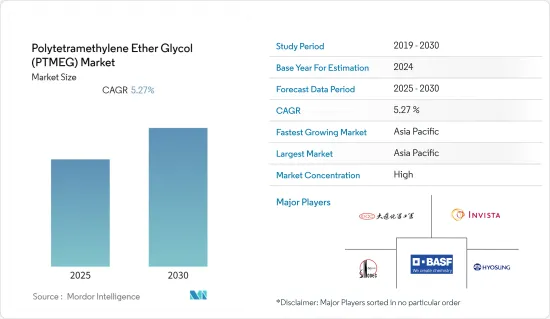

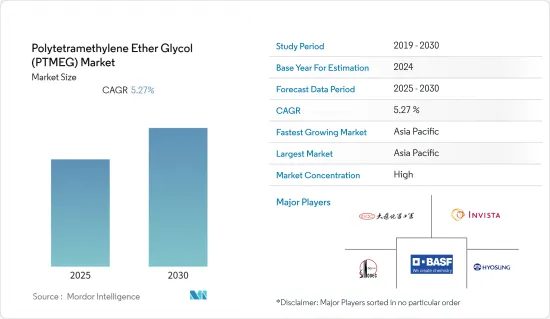

폴리테트라메틸렌 에테르 글리콜(PTMEG) 시장 전망 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Polytetramethylene Ether Glycol (PTMEG) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

폴리테트라메틸렌 에테르 글리콜(PTMEG) 시장은 예측 기간 동안 5.27%의 연평균 성장률(CAGR)을 나타낼 것으로 예상됩니다.

코로나19 확산으로 인해 전 세계적으로 전국적인 봉쇄령, 제조 활동 및 공급망의 중단, 생산 중단이 시장에 부정적인 영향을 미쳤습니다. 하지만 시간이 지나면서 상황이 회복되기 시작하면서 시장의 성장 궤도가 회복되었습니다.

주요 하이라이트

- 중기적으로는 열가소성 폴리우레탄(TPU)에 대한 수요 증가와 의류 및 의류 산업의 성장이 시장 성장을 견인할 것으로 예상됩니다.

- 그러나 유럽 경제의 침체가 시장 성장을 방해할 것으로 예상됩니다.

- 의료 산업에서 스판덱스 섬유의 새로운 사용과 바이오 기반 제품으로의 트렌드 변화는 시장에 기회를 제공 할 것으로 예상됩니다.

폴리테트라메틸렌 에테르 글리콜(PTMEG) 시장 동향

섬유산업이 시장을 독점할 가능성

- 섬유산업은 ASEAN 국가, 인도, 방글라데시 등과 같은 신흥 경제국에서 건전한 속도로 성장하고 있습니다. 예측 기간 동안 더 성장할 것으로 예상됩니다. 이는 낮은 제조 비용과 무역, 고용, 투자 및 수익에 대한 업계의 중요한 역할 때문입니다.

- 다양한 섬유 응용 분야에서 향상된 품질의 신축성 직물에 대한 수요가 증가함에 따라 폴리테트라메틸렌 에테르 글리콜(PTMEG)에 대한 수요가 증가하고 있습니다.

- 세계 스포츠용품 산업 연맹에 따르면, 다른 산업에 비해 지난 2년간 이 부문은 높은 성장률을 기록하며 팬데믹 이전 수준과 같거나 그 이상의 성과를 거둠으로써 높은 회복세를 보였습니다. 연맹에 따르면 2022년 기업들은 상반기 매달 개선되는 소비자 심리 동향으로 인해 수요를 예상하고 2021년의 공급망 문제를 피하기 위해 대량 주문을 진행했습니다.

- 중국은 세계 최대의 섬유 원자재 및 의류 생산국이자 수출국입니다. 중국 국가통계국 데이터에 따르면, 섬유 부문은 2022년 첫 10개월 동안 꾸준히 성장했습니다. 2022년 12월 중국에서는 약 34억 7천만 미터의 의류 원단이 생산되었습니다. 또한 경쟁력 있는 의류 제품으로 유명한 베트남은 2021년 섬유 수출액이 115억 달러로 최고치를 달성하며 전 세계 6위를 기록했습니다.

- 독일, 프랑스, 스페인, 이탈리아, 네덜란드, 폴란드는 유럽 최대 시장이며 EU 스포츠웨어 수입의 75% 가까이를 차지하고 있습니다.

- 인도에서는 해외 섬유 브랜드의 증가에 따른 소비자 선호도 증가로 의류 수요가 증가하고 있습니다. 이러한 수요는 디지털화, 소셜 네트워킹 사이트 및 앱으로 인해 더욱 증가하여 의류 판매 증가에 도움이 되었습니다. 인도의 일부 의류 제조업체에 따르면 남성복 브랜드의 성장률은 7-10%인 반면, 여성복과 아동복의 성장률은 15-20% 정도입니다.

- 따라서 위에서 언급한 요인으로 인해 섬유 산업은 예측 기간 동안 연구된 시장을 지배할 가능성이 높습니다.

시장을 독점하는 아시아태평양

- 현재 아시아태평양 지역은 가장 높은 시장 점유율을 차지하고 있습니다. 중국, 인도, 일본 및 아세안 국가와 같은 국가의 섬유 산업 수요 증가로 인해 폴리테트라메틸렌 에테르 글리콜에 대한 수요가 증가하고 있습니다.

- 중국은 글로벌 섬유, 자동차, 페인트 및 코팅 분야의 중요한 시장입니다. 중국에 진출한 기업, 다국적 기업, 현지 기업들은 생산 능력을 확대하고 새로운 프로젝트에 투자하여 수입 의존도를 낮춤으로써 지역 에너지 안보와 자립에 박차를 가하고 있습니다.

- 중국은 운동복, 액세서리, 신발 판매에 있어 매력적인 시장입니다. 다국적 기업들은 인건비 상승으로 인해 중국 밖으로 사업장을 이전하고 있으며, 중국은 스포츠웨어와 액티브웨어에 대한 수요가 높습니다.

- 현재 아시아태평양 지역은 전 세계에서 가장 큰 섬유 생산지입니다. 특히 중국, 인도, 베트남, 한국, 일본을 비롯한 아시아태평양 국가들은 섬유를 대량으로 수출하는 몇 안 되는 국가 중 하나입니다.

- 세계무역 통계 검토 2022와 유엔(UNComtrade)에 따르면 2021년에도 중국, 유럽연합(EU), 인도가 세계 3대 섬유 수출국이었습니다. 이들 상위 3개국을 합치면 2021년 세계 섬유제품 수출의 68%를 차지하고 있습니다.

- 또한 ASEAN 국가에서는 섬유, 페인트, 코팅 등 산업에서 사용하는 PTMEG 수요가 증가하고 있습니다.

- 따라서 위에서 언급 한 요인으로 인해 아시아 태평양 지역은 예측 기간 동안 연구 된 시장을 지배 할 가능성이 높습니다.

폴리테트라메틸렌 에테르 글리콜(PTMEG) 산업 개요

세계의 폴리테트라메틸렌 에테르 글리콜(PTMEG) 시장은 시장 점유율의 대부분이 소수의 진출기업으로 나뉘어져 있기 때문에 적당히 통합되어 있습니다. 시장의 주요 기업으로는 BASF SE, DCC(Dairen Chemical Corporation), INVISTA, Sinopec Great Wall, HYOSUNG 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 열가소성 폴리우레탄(TPU) 수요 증가

- 신흥국의 의류 수요 증가

- 기타 촉진요인

- 성장 억제요인

- 엄격한 환경 규제

- 유럽 경제의 감속

- 산업 밸류체인 분석

- 산업의 매력 - Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 진입업체의 위협

- 대체품의 위협

- 경쟁도

제5장 시장 세분화(수량 기준 시장 규모)

- 용도별

- 폴리우레탄 섬유(스판덱스)

- 열가소성 우레탄 엘라스토머

- 기타

- 최종 사용자 산업별

- 페인트 및 코팅

- 자동차

- 섬유

- 기타

- 지역별

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- ASEAN 국가

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 이탈리아

- 프랑스

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 시장 점유율, 랭킹 분석

- 주요 기업의 전략

- 기업 프로파일

- BASF SE

- Chang Chun Group

- Henan Energy Chemical Group Hebi

- Hyosung Corporation

- INVISTA

- 한국 PTG

- LyondellBasell Industries Holdings BV

- Mitsubishi Chemical Corporation

- Sinopec Great Wall Energy & Chemical Co. Ltd(Sinopec Corp.)

- Shanxi Sanwei Group Co. Ltd

제7장 시장 기회와 앞으로의 동향

- 바이오 글리콜 유도체 개발

- 의료 산업에 있어서의 스판덱스 섬유의 새로운 용도

The Polytetramethylene Ether Glycol Market is expected to register a CAGR of 5.27% during the forecast period.

Due to the COVID-19 outbreak, nationwide lockdowns worldwide, disruption in manufacturing activities and supply chains, and production halts negatively impacted the market. However, the conditions started recovering over time, restoring the market's growth trajectory.

Key Highlights

- Over the medium term, the increasing demand for thermoplastic polyurethane (TPU) and the growth in the apparel and clothing industry is expected to drive the market growth.

- However, the economic downfall in the European economies is expected to hinder the growth of the market studied.

- The emerging usage of spandex fibers in the healthcare industry and shifting trends toward bio-based products are expected to provide opportunities for the market.

Polytetramethylene Ether Glycol (PTMEG) Market Trends

Textile Industry is Likely to Dominate the Market

- The textile industry has been growing at a healthy rate in emerging economies like ASEAN countries, viz., India, Bangladesh, etc. It is expected to grow further over the forecast period. This is due to low manufacturing costs and the industry's significant role in trade, employment, investment, and revenue.

- Increasing demand for enhanced quality stretch fabric across various textile applications drives the demand for polytetramethylene ether glycol (PTMEG).

- According to the World Federation of the Sporting Goods Industry, compared to other industries, the past two years have shown a high recovery rate in this segment by recording high growth and equaling or outperforming pre-pandemic levels. According to the federation, in 2022, companies placed large orders in anticipation of demand and to avoid the supply chain challenges of 2021 owing to the improving consumer sentiment trends seen every month in the first half of the year.

- China is the world's largest producer and exporter of raw textile materials and garments. According to the National Bureau of Statistics of China data, the textile sector grew steadily in the first ten months of 2022. In December 2022, approximately 3.47 billion meters of clothing fabric were produced in China. In addition, Vietnam, known for its competitive clothing products, achieved a new high of USD 11.5 billion in textile exports in 2021 and ranked sixth globally.

- Germany, France, Spain, Italy, the Netherlands, and Poland are the largest European markets, accounting for nearly 75% of all EU sportswear imports worldwide.

- In India, the demand for apparel has increased with the growing consumer preference in response to the growing number of foreign textile brands. The demand has been augmented by digitalization, social networking sites, and apps, which help increase garments sales. As per some apparel manufacturers in India, the growth rate in menswear brands is 7-10%, while the growth rate of women's and kids' apparel is around 15-20%.

- Hence, owing to the abovementioned factors, the textile industry will likely dominate the market studied during the forecast period.

Asia-Pacific Region to Dominate the Market

- Currently, the Asia-Pacific region accounts for the highest market share. Due to the increasing demand from the textile industry in countries such as China, India, Japan, and the ASEAN countries, the demand for polytetramethylene ether glycol is increasing.

- China is a significant market for global textiles, automotive, and paints and coatings. Companies present in the country, multinationals, and locals are expanding their production capacities and investing in new projects to decrease their dependence on imports, thereby fueling regional energy security and autonomy.

- China has been an attractive market for athletic apparel, accessories, and footwear sales. Multinational companies are shifting operations outside China due to rising labor costs; the country has a high demand for sportswear and activewear.

- Currently, Asia-Pacific is the largest producer of textiles globally. The Asia-Pacific countries, notably China, India, Vietnam, South Korea, and Japan, are among the few that export textiles in substantial quantities.

- According to the World Trade Statistical Review 2022 and the United Nations (UNComtrade), China, the European Union (EU), and India remained the world's three largest textile exporters in 2021. Together, these top three accounted for 68% of the world's textile exports in 2021.

- Additionally, there has been an increasing demand for PTMEG in the ASEAN countries for usage in industries like textiles, paints and coatings, etc.

- Hence, owing to the abovementioned factors, Asia-Pacific will likely dominate the market studied during the forecast period.

Polytetramethylene Ether Glycol (PTMEG) Industry Overview

The global polytetramethylene ether glycol (PTMEG) market is moderately consolidated as the majority of the market share is divided among a few players. Some of the key players in the market include BASF SE, DCC (Dairen Chemical Corporation), INVISTA, Sinopec Great Wall, and HYOSUNG, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Thermoplastic Polyurethane (TPU)

- 4.1.2 Growing Demand for Apparels and Clothing in Emerging Economies

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations

- 4.2.2 Slowdown in the European Economy

- 4.3 Industry Value-chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Application

- 5.1.1 Polyurethane Fibers (Spandex)

- 5.1.2 Thermoplastic Urethane Elastomers

- 5.1.3 Other Applications

- 5.2 By End-user Industry

- 5.2.1 Paints and Coatings

- 5.2.2 Automotive

- 5.2.3 Textiles

- 5.2.4 Other End-user Industries

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Chang Chun Group

- 6.4.3 Henan Energy Chemical Group Hebi

- 6.4.4 Hyosung Corporation

- 6.4.5 INVISTA

- 6.4.6 Korea PTG

- 6.4.7 LyondellBasell Industries Holdings BV

- 6.4.8 Mitsubishi Chemical Corporation

- 6.4.9 Sinopec Great Wall Energy & Chemical Co. Ltd (Sinopec Corp.)

- 6.4.10 Shanxi Sanwei Group Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Bio-based Glycol Derivatives

- 7.2 Emerging Usage of Spandex Fibers in the Healthcare Industry