|

시장보고서

상품코드

1850169

바이오 윤활유 시장 : 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Bio-Lubricants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

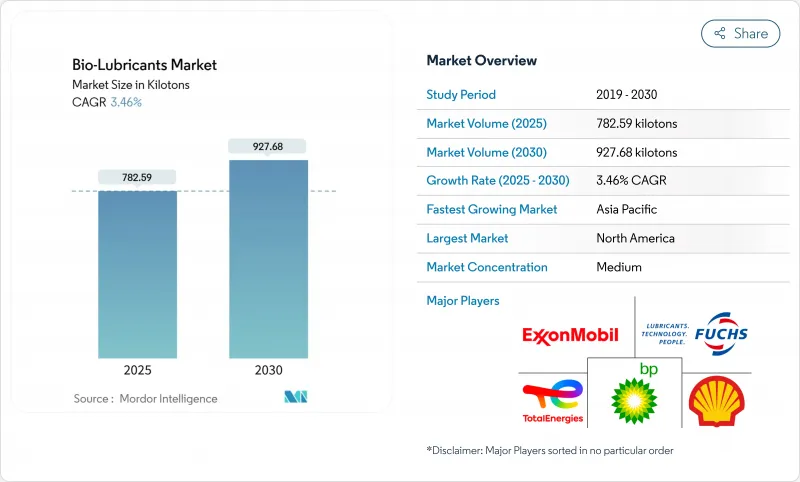

바이오 윤활유 시장 규모는 2025년에 782.59킬로톤, 2030년에는 927.68킬로톤에 이르고, 예측기간(2025-2030년)의 CAGR은 3.46%를 나타낼 전망입니다.

꾸준한 성장은 환경 규제 강화, 기업의 지속가능성 목표 강화, 고성능 식물 유래 제형에 대한 신뢰 증가를 반영합니다. 수요는 윤활유 손실이 토양과 물을 오염시킬 수 있는 곳에서 가장 급속히 확대되고 있으며, 업계 추정에 따르면 이러한 용도로 지금까지 사용되어 온 석유유의 약 50%가 궁극적으로 환경으로 유출되고 있습니다. 상대방 상표 제품 제조업체(OEM)는 서비스 매뉴얼에 생분해성 유체를 공식적으로 기재하고 있으며, 해상 풍력 발전, 임업 및 해양 사업자는 유출과 관련된 벌칙을 피하기 위해 조달 정책을 다시 작성하고 있습니다. 금속 산화물 나노입자 패키지와 같은 첨가제 화학의 병행 진보로 산화 안정성과 열 안정성이 향상되고 광물유와의 역사적인 성능 차이가 줄어들고 있습니다. 경쟁의 중심은 규모의 경제성, 지적 재산권으로 보호되는 에스테르 화학, 성장 현저한 재생에너지 자산에 장기 공급을 가능하게 하는 제휴 관계입니다.

세계 바이오 윤활유 시장 동향과 통찰

엄격한 환경 규제 및 친환경 의무화

윤활유의 EU 에코라벨은 수생독성, 생물농축성, 유해성분에 대한 제한을 정하고 미네랄 오일과의 기능적 동등성을 요구하는 지속가능성 인증의 벤치마크로 발전했습니다. 미국에서는 EPA(미국 환경보호청)의 선박 일반 허가(Vessel General Permit)에 의해 선박은 석유에서 바다로의 인터페이스에서 환경적으로 허용되는 윤활유(EALs)를 사용하도록 의무화되어 선주들에게 컴플라이언스 주도 구매 레인이 형성됩니다. 이전의 단일 매개변수에 의한 생분해성 시험과는 달리, 최신 기준은 전체 라이프사이클의 환경 독성 분석을 통합하여 제품 개선을 가속화합니다. 규제 당국은 추가 강화를 시사하고 있으며, 아시아의 일부 관할 구역에서는 EU를 따른 친환경 라벨 초안을 다루고 있습니다. 시행이 확대됨에 따라 제3자 인증을 받은 제품 라인을 갖춘 공급업체는 공공 입찰 및 주요 인프라 프로젝트에서 우선 순위를 얻고 장기 자본 예산에 바이오 윤활유 시장 수요를 통합하고 있습니다.

생분해성 작동유의 OEM 사양

예를 들어, 제트 에프 프리드리히스하펜은 공인 환경 기준으로 인증된 윤활유 전용 클래스 03H를 도입했습니다. 임업용 수확기, 건설용 굴삭기, 항만용 크레인 등에서는 공장에서 생분해성 작동유를 충전하여 출하하는 케이스가 늘어나고, 오퍼레이터가 미네랄 오일로 되돌릴 경우 보증이 무효가 될 가능성이 있습니다. 각 장비는 수백 리터의 작동유를 소모하기 때문에 OEM의 채택은 세계 서비스 네트워크를 통해 연결되어 장비 수명주기에 걸쳐 반복적으로 수요가 발생합니다. 이러한 사양의 구조적 특성은 소비 패턴을 안정시키고 바이오 윤활유 시장을 단기적인 상품 가격 변동으로부터 보호합니다.

기존 윤활유와 비교하여 바이오 윤활유의 고가

에스테르계 작동유의 평균 판매 가격은 높은 원료 비용, 적은 배치 생산량, 특수 첨가제 패키지를 반영하여 그룹 II 광물계 동등유의 1.5-2.5배에 그치고 있습니다. 규모의 경제성이 개선될 때까지는 규제된 틈새 분야를 제외하고 비용이 결정적인 장벽으로 남아 있다는 것이 학술 검토에서 반복적으로 지적되었습니다. 소규모 어선단이나 개인경영의 금속가공점 등 영업이익률이 낮은 최종 사용자는 법률이나 고객과의 계약에서 생분해성 등급이 의무화되지 않는 한 채택을 늦추는 경우가 많습니다. 생산량이 증가하고 폐유 에스테르화 기술이 성숙함에 따라 비용 차이가 줄어들 것으로 예상되지만, 가격 설정은 중기 바이오 윤활유 시장의 CAGR에 부담을 줄 것입니다.

부문 분석

2024년의 바이오 윤활유 시장에서의 변속기액과 유압작동유의 점유율은 31.19%로, 2030년까지의 CAGR은 3.58%를 나타낼 전망입니다. 이 진보는 바이오 윤활유 시장 규모에서 제품 카테고리 중 가장 큰 슬라이스에 해당하며, 임업 수확기, 항만 크레인, 하천 준설선의 엄격한 누출 방지 규칙을 반영합니다. 이러한 시스템은 한 번의 고장으로 수십 리터를 배출할 수 있기 때문에 사업자는 청소 의무를 줄이고 민감한 습지대를 보호하는 생분해성이 높은 등급으로 진행하여 프리미엄을 지불합니다. 첨가제의 획기적인 진보(예: 아연이 없는 내마모성 화학물질 조정)는 변동하는 하중 하에서도 5,000시간의 교환 간격을 지원하며 OEM은 공장 충전 오일을 바이오 라인으로 전환하도록 설득되었습니다.

그리스, 엔진 오일, 금속 가공유제는 모두 급속하게 다양화하는 클러스터를 형성하고 있습니다. 특히 그리스는 베어링의 하우징이 수면에서 수 미터 정도 높은 곳에 위치하며, 누출 경로를 모니터링하기 어려우므로 해상 풍력 발전의 배치로 이익을 얻고 있습니다. 금속가공유는 미스트의 독성이 낮고 작업자의 안전성을 높이는 정밀가공센터에서 지지를 모으고 있습니다. 각 범주에서 공급업체는 일반적인 '녹색' 대체품이 아닌 용도에 특화된 처방을 판매하도록 되어 있으며, 이 전략은 전환율을 높이고 장기적인 고객 계약을 견고하게 만듭니다.

지역 분석

2024년의 바이오 윤활유 시장 점유율은 북미가 36.19%의 점유율로 선두를 차지했습니다. 미국에서는 선박 일반 허가증이 시행되고 캐나다에서는 선진적인 임업 관행과 함께 수로와 삼림 지대에서 EAL 적합 기기의 안정된 설치 베이스가 확보되고 있습니다. 광업 기업은 광산 재생 협정의 일환으로 운반 트럭과 굴삭기에 생분해성 유압 작동유를 도입하고 있으며, 이 동향은 'North American Mining'지에서 소개되고 있습니다. 높은 기술 리터러시와 조밀한 대리점망이 더욱 전환을 용이하게 하고 있습니다.

아시아태평양은 CAGR 4.45%에서 가장 급성장하고 있는 지역이지만, 각국의 움직임은 다양합니다. 중국은 수입 제제에 대한 의존도를 줄이기 위해 국내 에스테르 생산 능력과 첨가제 연구에 투자하고 있습니다. 랭크세스는 중국 및 동남아시아의 기계가공 클러스터에서 환경에 최적화된 금속가공첨가제 수요가 급증하고 있다고 보고했습니다. 일본은 바이오 윤활유의 연구 개발을 고정밀도의 로봇 공학에 돌려, 인도의 농업 섹터는 밭의 오염을 막는 생분해성의 트랙터용 유압 오일에 의해 생산량의 성장을 전망하고 있습니다. 중국의 동해안과 대만 해협을 따라 해상 풍력 발전소에서는 25년 사용 사이클 동안 환경 위험을 최소화하기 위해 고급 바이오 그리스가 채택되었습니다.

유럽은 EU 에코 라벨 시스템에 의해 지원되고 성숙하면서도 혁신적인 시장을 유지하고 있습니다. 독일과 북유럽 국가들은 임업용 수확기와 수력 발전소에서의 채택을 추진하고 있습니다. 라이프치히에서 개최된 2025년 트라이볼로지와 지속가능한 윤활에 관한 국제회의에서는 순환형 경제목표에 맞춘 차세대 생분해성 화학물질에 스포트라이트가 적용되었습니다. 남미와 중동, 아프리카는 전체적으로 초기 단계의 채택권을 형성하고 있습니다. 브라질의 풍력 발전소와 멕시코만의 해수 담수화 플랜트와 같은 다국적 인프라 프로젝트에서는 해외 투자자들이 생분해성 윤활제를 의무화하는 ESG 조항을 부과합니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 엄격한 환경규제와 에코라벨의 의무화

- 생분해성 유압 작동유의 OEM 사양

- 기업의 넷 제로와 ESG 조달 목표

- 해상 풍력 발전용 기어 박스에서의 긴 수명 바이오 그리스 수요

- 해양산업에서의 수요 증가

- 시장 성장 억제요인

- 종래의 윤활유와 비교한 바이오 윤활유의 고가격

- 산화 및 열안정성의 제한

- 바이오 윤활유의 유효기간

- 밸류체인 분석

- Porter's Five Forces

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁도

제5장 시장 규모와 성장 예측

- 제품 유형별

- 엔진 오일

- 변속기와 유압 작동유

- 금속가공유

- 일반 공업용 오일

- 기어 오일

- 그리스

- 프로세스 오일

- 기타 제품 유형

- 최종 사용자 업계별

- 발전

- 자동차 및 기타 수송

- 중장비

- 식음료

- 금속학과 금속가공

- 화학제조

- 기타 최종 사용자 업계

- 베이스 오일 유형별

- 식물성 기름

- 동물성 지방

- 합성 에스테르

- 지역별

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 이탈리아

- 프랑스

- 러시아

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율(%)/랭킹 분석

- 기업 프로파일

- Axel Christiernsson

- BP plc

- Cargill, Incorporated.

- Carl Bechem Lubricants

- Chevron Corporation

- Cortec Corporation

- Croda International plc

- Emery Oleochemicals

- Environmental Lubricants Manufacturing, Inc.

- Exxon Mobil Corporation

- FUCHS

- KCM Petro Chemicals

- Lubrication Engineers

- Novvi LLC

- Quaker Chemical Corporation

- Renewable Lubricants Inc.

- Saudi Arabian Oil Co.

- Shell plc

- TotalEnergies SE

제7장 시장 기회와 장래의 전망

SHW 25.11.17The Bio-Lubricants Market size is estimated at 782.59 kilotons in 2025, and is expected to reach 927.68 kilotons by 2030, at a CAGR of 3.46% during the forecast period (2025-2030).

Steady growth reflects tightening environmental rules, stronger corporate sustainability targets, and rising confidence in high-performance, plant-derived formulations. Demand is expanding fastest where lubricant losses can contaminate soil or water, and industry estimates indicate that roughly 50% of the petroleum oil historically used in such applications eventually escapes into the environment. Original equipment manufacturers (OEMs) are formally listing biodegradable fluids in service manuals, while offshore wind, forestry, and marine operators are rewriting procurement policies to avoid penalties linked to spills. Parallel progress in additive chemistry, such as metal-oxide nanoparticle packages, has lifted oxidative and thermal stability, narrowing the historic performance gap with mineral oils. Competitive dynamics now center on scale-up economics, intellectual-property-protected ester chemistries, and partnerships that lock in long-term supply to high-growth renewable-energy assets.

Global Bio-Lubricants Market Trends and Insights

Stringent Environmental Regulations & Eco-labeling Mandates

The EU Ecolabel for lubricants has evolved into the benchmark sustainability certification, setting limits on aquatic toxicity, bioaccumulation, and hazardous components while demanding functional parity with mineral oils. In the United States, the EPA's Vessel General Permit obliges vessels to use Environmentally Acceptable Lubricants (EALs) across oil-to-sea interfaces, creating a compliance-driven purchasing lane for shipowners. Unlike earlier single-parameter biodegradability tests, modern standards incorporate full life-cycle eco-toxicity analysis, accelerating product reformulation. Regulators have signaled additional tightening, and several Asian jurisdictions are working on EU-aligned eco-label drafts. As enforcement widens, suppliers with third-party certified lines enjoy preferred status in public tenders and major infrastructure projects, embedding bio-lubricants market demand into long-term capital budgets.

OEM Specifications for Biodegradable Hydraulic Fluids

Major machinery brands now codify bio-hydraulic fluid classes inside their technical manuals; ZF Friedrichshafen, for example, introduced class 03H exclusively for lubricants certified under recognized environmental standards. Forestry harvesters, construction excavators, and port cranes increasingly ship with factory fills of biodegradable fluids, and warranty coverage can be voided if operators revert to mineral oils. Because each piece of equipment can consume several hundred liters of fluid, OEM adoption cascades through global service networks and drives repeat demand over the equipment life cycle. The structural nature of these specifications stabilizes consumption patterns and insulates the bio-lubricants market from short-term commodity price swings.

High Price of Bio-lubricants in Comparison to Conventional Lubricants

Average selling prices for ester-based hydraulic oils remain 1.5-2.5 times those of Group II mineral equivalents, reflecting higher feedstock costs, smaller batch runs, and specialized additive packages. Academic reviews reiterate that until economies of scale improve, cost remains a decisive barrier outside regulated niches. End-users with thin operating margins, such as small fishing fleets or independent metalworking shops, often delay adoption unless legislation or client contracts mandate biodegradable grades. While the cost delta is projected to narrow as production volumes climb and waste-oil-to-ester technologies mature, pricing will weigh on the bio-lubricants market CAGR over the medium term.

Other drivers and restraints analyzed in the detailed report include:

- Corporate Net-zero & ESG Procurement Targets

- Offshore-Wind Gearbox Demand for Long-life Bio-greases

- Oxidative & Thermal Stability Limitations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Transmission and hydraulic fluids commanded 31.19% of the bio-lubricants market in 2024 and are forecast to grow at 3.58% CAGR to 2030. This advance equates to the largest slice of bio-lubricants market size among product categories and mirrors strict leakage-prevention rules in forestry harvesters, harbor cranes, and river dredgers. Because these systems can discharge dozens of liters per failure, operators willingly pay premiums for readily biodegradable grades that reduce cleanup obligations and protect sensitive wetlands. Additive breakthroughs-such as tailored zinc-free antiwear chemistries-now support 5,000-hour change intervals even under fluctuating loads, convincing OEMs to switch factory fill fluids to bio-based lines.

Greases, engine oils, and metalworking fluids together form a fast-diversifying cluster. Greases in particular benefit from offshore-wind deployments because bearing housings often sit meters above water and leak paths are hard to monitor. Metalworking fluids gain traction inside precision machining centers, where low mist toxicity enhances worker safety. Across categories, suppliers increasingly sell application-specific formulations rather than generic "green" substitutes, a strategy that bolsters switching rates and cements long-term customer contracts.

The Bio-Lubricants Market Report Segments the Industry by Product Type (Engine Oil, Transmission and Hydraulic Fluid, Metalworking Fluid, and More), End-User Industry (Power Generation, Automotive and Other Transportation, Heavy Equipment, and More), Base Oil Type (Vegetable Oils, Animal Fats and Synthetic Esters), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa).

Geography Analysis

North America led the bio-lubricants market with 36.19% share in 2024. Enforcement of the U.S. Vessel General Permit, combined with progressive forestry practices in Canada, ensures a stable installed base of EAL-compliant equipment across waterways and timberlands. Mining companies are retrofitting haul trucks and drills with biodegradable hydraulic fluids as part of mine-reclamation agreements, a trend profiled by North American Mining magazine. High technical literacy and dense distributor networks further ease conversions.

Asia-Pacific, the fastest-growing region at a 4.45% CAGR, shows divergent national dynamics. China invests in domestic ester capacity and additive research to reduce reliance on imported formulations. Lanxess reports surging demand for environmentally-optimized metalworking additives across Chinese and Southeast Asian machining clusters. Japan channels bio-lubricant R&D into high-precision robotics, whereas India's agriculture sector seeds volume growth via biodegradable tractor hydraulic oils that prevent field contamination. Offshore wind farms along China's eastern seaboard and Taiwan Strait are adopting premium bio-greases to minimize environmental risk during 25-year service cycles.

Europe maintains a mature but innovative market underpinned by the EU Ecolabel scheme. Germany and the Nordic nations drive uptake in forestry harvesters and hydro-electric plants. The 2025 International Conference on Tribology and Sustainable Lubrication in Leipzig spotlighted next-generation biodegradable chemistries tailored for circular-economy targets. South America and the Middle East & Africa collectively form an early-stage adoption bloc. Uptake often aligns with multinational infrastructure projects-such as Brazilian wind farms or Gulf desalination plants-where foreign investors impose ESG clauses mandating biodegradable lubricants.

- Axel Christiernsson

- BP p.l.c.

- Cargill, Incorporated.

- Carl Bechem Lubricants

- Chevron Corporation

- Cortec Corporation

- Croda International plc

- Emery Oleochemicals

- Environmental Lubricants Manufacturing, Inc.

- Exxon Mobil Corporation

- FUCHS

- KCM Petro Chemicals

- Lubrication Engineers

- Novvi LLC

- Quaker Chemical Corporation

- Renewable Lubricants Inc.

- Saudi Arabian Oil Co.

- Shell plc

- TotalEnergies SE

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent Environmental Regulations and Eco-labeling Mandates

- 4.2.2 OEM Specifications for Biodegradable Hydraulic Fluids

- 4.2.3 Corporate Net-zero and ESG Procurement Targets

- 4.2.4 Offshore-wind Gearbox Demand for Long-life Bio-Greases

- 4.2.5 Increasing Demand from Marine Industry

- 4.3 Market Restraints

- 4.3.1 High Price of Bio lubricants in Comparison to Conventional Lubricants

- 4.3.2 Oxidative and Thermal Stability Limitations

- 4.3.3 Limited Shelf Life of Bio-Lubricants

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 Engine Oil

- 5.1.2 Transmission and Hydraulic Fluid

- 5.1.3 Metalworking Fluid

- 5.1.4 General Industrial Oil

- 5.1.5 Gear Oil

- 5.1.6 Grease

- 5.1.7 Process Oil

- 5.1.8 Other Product Types

- 5.2 By End-user Industry

- 5.2.1 Power Generation

- 5.2.2 Automotive and Other Transportation

- 5.2.3 Heavy Equipment

- 5.2.4 Food and Beverage

- 5.2.5 Metallurgy and Metalworking

- 5.2.6 Chemical Manufacturing

- 5.2.7 Other End-user Industries

- 5.3 By Base Oil Type

- 5.3.1 Vegetable Oils

- 5.3.2 Animal Fats

- 5.3.3 Synthetic Esters

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Russia

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Axel Christiernsson

- 6.4.2 BP p.l.c.

- 6.4.3 Cargill, Incorporated.

- 6.4.4 Carl Bechem Lubricants

- 6.4.5 Chevron Corporation

- 6.4.6 Cortec Corporation

- 6.4.7 Croda International plc

- 6.4.8 Emery Oleochemicals

- 6.4.9 Environmental Lubricants Manufacturing, Inc.

- 6.4.10 Exxon Mobil Corporation

- 6.4.11 FUCHS

- 6.4.12 KCM Petro Chemicals

- 6.4.13 Lubrication Engineers

- 6.4.14 Novvi LLC

- 6.4.15 Quaker Chemical Corporation

- 6.4.16 Renewable Lubricants Inc.

- 6.4.17 Saudi Arabian Oil Co.

- 6.4.18 Shell plc

- 6.4.19 TotalEnergies SE

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Growing Advancements in Technological Developments