|

시장보고서

상품코드

1640656

라틴아메리카의 연포장 : 시장 점유율 분석, 산업 동향, 성장 예측(2025-2030년)Latin America Flexible Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

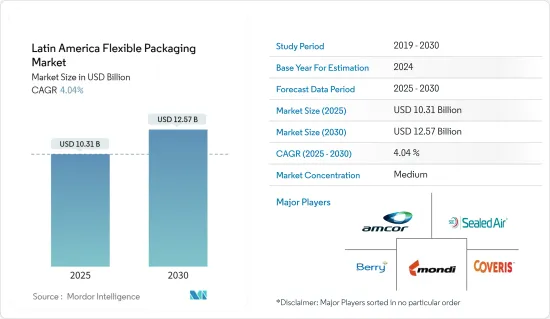

라틴아메리카의 연포장 시장 규모는 2025년에 103억 1,000만 달러로 추정되고, 예측 기간(2025-2030년)의 CAGR은 4.04%로 전망되며, 2030년에는 125억 7,000만 달러에 달할 것으로 예측됩니다.

주요 하이라이트

- 연포장은 생산시에 소비하는 원료나 에너지가 적기 때문에 제조업체는 대폭적인 코스트 삭감의 혜택을 받습니다. 효율적인 포장 기능과 저장 공간 절감은 시장 수요를 더욱 높여줍니다.

- 혁신적인 포장 및 디지털 인쇄와 같은 동향이 시장을 활성화하고 기술의 진보를 보여줍니다. 여기에는 직렬화된 QR 코드와 같은 독창적인 소비자 참여 솔루션도 포함됩니다. 또한, 연포장은 경량이기 때문에 운송 비용과 연료 사용량이 삭감되어, 조사 대상 지역의 스낵 과자나 감자 칩의 포장에 선호되고 있습니다.

- 수요가 증가함에 따라 여러 시장 진출 기업들이 수익 강화를 위해 제휴와 파트너십을 맺고 있습니다. 예를 들어 2024년 5월 브라질의 SGK 팀은 Johnson & Johnson Brazil과 제휴하여 SEMPRE LIVRE를 출시했습니다. 이 지속가능성에 대한 대처에 의해 제20회 ABRE 브라질 포장 어워드의 인기 투표 부문에서 수상했습니다. SGK와 존슨 엔드 존슨은 첫 연질 필름 포장으로 새로운 경지를 열었습니다. 여성용 케어 제품용 얇은 인서트를 개발하고 33% 포스트 컨슈머 수지를 사용하여 기존 포장에 비해 10.25% 탄소 발자국 감소를 달성했습니다.

- 아르헨티나의 포장 부문은 팬데믹에 의해 악화된 경기 후퇴기에 어려움을 겪었습니다. 중저소득층의 구매력이 현저하게 저하되었기 때문에 기술 혁신과 고급포장 벤처가 저해되었습니다. 임금이 급락하고, 실업률이 상승하고, 소비 습관이 변화하는 가운데, 그 영향은 다양한 포장 유형 및 사이즈에 이르렀습니다.

- 지난 10년간, 플라스틱의 유해한 영향에 대한 시민의 의식이 현저하게 높아졌습니다. 라틴아메리카 정부는 수많은 공공 캠페인과 이니셔티브를 선도하여 이 의식을 증폭시켜 왔습니다. 그 결과, 플라스틱 포장의 소비는 최근 몇 년간 현저한 변화를 겪고 있습니다.

라틴아메리카의 연포장 시장 동향

파우치 부문이 크게 성장할 전망

- 유럽에서 널리 사용되는 파우치는 스탠드 유형과 플랫 유형으로 분류할 수 있습니다. 스탠드업 파우치에는 레토르트 파우치, 바닥 가젯 파우치, 평저 파우치, 사이드 가젯 파우치, 스파우트 파우치, 변형 파우치 등이 있습니다. 평봉은 베개 유형, 사방 씰 유형, 삼방 씰 유형, 진공 유형으로 나뉩니다.

- 시장에서 파우치 수요는 내구성과 물류의 편의성을 뒷받침하고 있습니다. 그 비용 효율성은 제조업체가 점점 더 파우치 포장을 채택하도록 촉구하고 있으며, 이 유연한 형식의 성장을 더욱 촉진하고 있습니다. 또한, 파우치는 경량이기 때문에 플라스틱 병과 같은 기존 포장 형태보다 선호되는 선택입니다.

- 크래프트 종이는 포장, 파우치, 가방 등의 용도로 높은 수요가 있습니다. 환경 친화적인 포장 동향 증가는 크래프트 종이에 대한 관심을 높이고 특히 펄프화 프로세스는 폐기물의 회수와 재활용을 용이하게 하기 때문입니다. 이 추세에 따라 2020년 미국과 라틴아메리카에서 사업을 전개하는 몬트리올의 포장업체 TC 트랜스컨티넨탈은 파우치 등의 연질 제품에서 소비자 사용 후 재생지 함량을 높일 계획을 발표했습니다. 이 회사는 또한 선별 시설 등에서 조달한 연질 플라스틱을 변환하기 위한 설비에 투자하고 있습니다.

- 2023년 2월, 부드러운 포장 및 재료 과학의 최고 주자인 ProAmpac은 ProActive Sustainability 포트폴리오에 새로운 제품을 추가했습니다.

- 파우치는 전자상거래 제품을 포장하기 위한 유력한 옵션으로 등장했습니다. 파우치는 음식 및 음료, 개인 관리 및 의약품의 각 부문에서 특히 전자상거래 시장을 대상으로 한 제품에 점점 더 선호되고 있습니다. 전자상거래의 진출기업은 효율성과 비용 효과로 파우치 포장에 끌려가고 있습니다.

브라질이 시장에서 큰 점유율을 차지할 전망

- 브라질은 라틴아메리카 톱 러너이며 강력한 경제 성장을 보여주고 많은 양의 외국 직접 투자(FDI)를 유치하고 있습니다. 식료품과 산업 제품에 대한 왕성한 구매 의욕을 가진 국가는 수입에 크게 의존하고 있습니다. 이 지역에서는 이러한 제품을 손상으로부터 보호하기 위해 부드러운 포장 솔루션에 대한 관심이 높아지고 있습니다. 중산 계급이 확대됨에 따라 포장 식품에 대한 식욕도 높아지고 연포장 시장 확대에 길을 열고 있습니다.

- Beautycare Brazil(ABIHPEC & ApexBrasil)의 보고서에 따르면, 2023년 브라질은 미용 및 개인 관리 제품의 무역 흑자를 달성했습니다. 이 남미의 대국은 9억 1,100만 달러 이상의 화장품과 위생 용품을 세계 시장에 수출했습니다.

- 2024년 3월 무균 판지의 주요 기업인 SIG는 유명한 유업 회사인 DPA Brasil과 제휴하여 Chamyto 요구르트 브랜드를 위한 혁신적인 파우치 파우치 포장을 전개했습니다. SIG CloverCap 85RO 클로저와 SIG Prime 120 충전 장치를 채용한 이 새로운 포장은 경량이면서도 견고한 디자인으로, 특히 어린이에게 사용하기 쉽습니다. 딸기 맛을 가진 Chamyto 요구르트는 DPA Brasil를 위한 이 최첨단 포장 형식을 채택한 첫번째 제품입니다. DPA Brasil은 Chamyto 과일 비타민 요구르트, Chambinho Recreio, Ninho Lancheirinha 등 다른 제품에도 이 포장 혁신을 확대할 계획입니다.

- 또한 시장에서 프리미엄화의 동향도 볼 수 있습니다. 브라질 사람들은 일반적으로 가격에 민감하지만 화장품에 대한 투자 의욕은 높아지고 있습니다. 이 시프트는 연포장 수요를 견인하고 있습니다. 폴리아민과 폴리프로필렌과 같은 연질 플라스틱 재료는 포장의 가시성과 소구력을 높이고 필수적인 안전 기능을 통합합니다.

라틴아메리카의 연포장 산업 개요

라틴아메리카의 연포장 시장은 다수의 세계적 및 지역적 진출기업으로 구성되어 적당히 통합되어 있습니다. 이 시장은 신규 참가 기업에 있어서 참가 장벽이 낮기 때문에 복수의 신규 참가 기업이 견인역이 되고 있습니다. 이 시장 특징은 제품 차별화가 낮고 제품의 보급이 진행되고 경쟁이 많다는 것입니다. 지속 가능한 경쟁 우위는 설계, 기술 및 용도 혁신을 통해 얻을 수 있습니다. 시장에 진입하는 주요 진출기업으로는 Amcor PLC, Berry Global Inc., Mondi Group, Sealed Air Corporation 등이 있습니다.

- 2024년 5월-브라질의 SGK팀은 Johnson & Johnson Brazil과 협력하여 SEMPRE LIVRE를 도입했습니다. 그 지속가능성에 대한 대처가 평가되어 제20회 ABRE 브라질 포장 어워드의 인기 투표 부문에서 수상했습니다. SGK는 Johnson & Johnson과의 협력하에 최초의 연질 필름 포장을 개발하여 혁신의 선두에 섰습니다. SGK는 여성용 케어 제품을 위해 33% 포스트 컨슈머 수지를 사용한 얇은 인서트를 설계하여 기존 포장에 비해 탄소 실적를 10.25% 절감하는 데 성공했습니다.

- 2023년 10월-PAC Worldwide는 중미에서 제조 능력을 강화하는 전략의 일환으로 멕시코의 Pedro Escobedo에서 Vista San Juan Del Rio로 8만 3,000평방피트의 신공장으로 이전했습니다. 이 종합적인 연포장 시설은 멕시코 시티에서 북쪽으로 2시간 거리에 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 편의성이 높은 포장에 대한 수요 증가

- 시장의 과제

- 환경과 재활용에 대한 우려

- 산업의 매력-Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 산업 밸류체인 분석

- 산업에 대한 마이크로 경제적 요인의 평가

제5장 라틴아메리카의 연포장 시장에서의 지속 가능한 포장 및 기술의 진보

- 경량화

- 재활용 및 재활용 폴리머

- 파우치 포장용의 지속가능한 코팅

- 배리어 개발

- 액티브 포장

제6장 시장 세분화

- 재료 유형별

- 플라스틱

- 폴리에틸렌(PE)

- 2축 연신 폴리프로필렌(BOPP)

- 캐스트 폴리프로필렌(CPP)

- 폴리염화비닐(PVC)

- 에틸렌비닐알코올(EVOH)

- 종이

- 알루미늄박

- 플라스틱

- 제품 유형별

- 파우치

- 가방

- 필름 및 랩

- 기타

- 최종 사용자 산업별

- 식품

- 냉동식품

- 유제품

- 과일 및 야채

- 고기, 닭고기 및 해산물

- 구운 과자 및 스낵 과자

- 캔디 및 과자

- 기타

- 음료

- 의약품 및 의료품

- 가정용품 및 퍼스널케어

- 기타

- 식품

- 지역별

- 브라질

- 아르헨티나

- 멕시코

- 기타 라틴아메리카(콜롬비아, 베네수엘라 등)

제7장 경쟁 구도

- 기업 프로파일

- Amcor PLC

- Berry Global Inc.

- Mondi Group

- Sealed Air Corporation

- Coveris Holdings SA

- Tetra Pak International SA

- Cascades Flexible Packaging

- Novolex Holdings Inc.

- WIPF Doypack(Wipf AG)

- FlexPak Services LLC

- Transcontinental Inc.

- American Packaging Corporation

- Sonoco Products Company

- Inteplast Group

- Oben Holding Group

- Toray Plastics(America) Inc.

- Sigma Plastic Group

- Clifton Packaging SA De CV

- PO Empaques Flexibles SA De CV

- ProAmpac LLC

제8장 투자 분석

제9장 시장의 미래

AJY 25.02.14The Latin America Flexible Packaging Market size is estimated at USD 10.31 billion in 2025, and is expected to reach USD 12.57 billion by 2030, at a CAGR of 4.04% during the forecast period (2025-2030).

Key Highlights

- Manufacturers benefit from substantial cost savings as flexible packaging consumes less raw materials and energy during production. Its efficient wrapping capabilities and reduced storage space requirements further boost its demand in the market.

- Trends like innovative packaging and digital printing are energizing the market, showcasing technological advancements. These include creative consumer engagement solutions, such as serialized QR codes. Additionally, the lightweight nature of flexible packaging cuts down transportation costs and fuel usage, making it a favored choice for snacks and potato chip packaging in the studied regions.

- In response to rising demand, several market players are forging collaborations and partnerships to enhance their revenues. For example, in May 2024, SGK's team in Brazil partnered with Johnson & Johnson Brazil to launch SEMPRE LIVRE. Their sustainability efforts earned them the Popular Vote category at the 20th ABRE Brazilian Packaging Award. SGK and Johnson & Johnson broke new ground with their first flexible film packaging. They crafted a thinner insert for female care products, using 33% post-consumer resin, and achieved a commendable 10.25% carbon footprint reduction over traditional packaging.

- The Argentine packaging sector grappled with challenges during the economic downturn, worsened by the pandemic. A significant drop in purchasing power among low and middle-income groups stifled innovation and premium packaging ventures. With wages plummeting, unemployment rising, and consumption habits shifting, the effects were felt across various packaging types and sizes.

- In the past decade, there has been a marked surge in public awareness about the detrimental effects of plastic. Latin American governments have spearheaded numerous public campaigns and initiatives, amplifying this awareness. Consequently, the consumption of plastic packaging has seen a pronounced shift in recent years.

Latin America Flexible Packaging Market Trends

The Pouches Segment is Expected to Grow Significantly

- Pouches, widely utilized across Europe, can be categorized into stand-up and flat types. Stand-up pouches encompass a range of varieties, including retort, bottom gusset, flat bottom, side gusset, spouted, and shaped pouches. Flat pouches are divided into pillow, four-side seal, three-side seal, and vacuum pouches.

- The demand for pouches in the market is fueled by their durability and logistical convenience. Their cost-effectiveness is prompting manufacturers to increasingly adopt pouch packaging, further propelling the growth of this flexible format. Additionally, pouches' lightweight nature makes them a preferred choice over traditional packaging formats like PET bottles.

- Kraft paper is in high demand for applications like wrapping, pouches, and sacks. The rising trend of eco-friendly packaging has spurred interest in kraft papers, especially since their pulping process facilitates easy waste recovery and recycling. In line with this trend, in 2020, TC Transcontinental, a Montreal-based packaging manufacturer with operations in the United States and Latin America, unveiled plans to boost post-consumer recycled content in its flexible offerings, including pouches. The company has also invested in equipment to convert flexible plastics sourced from sorting facilities and other avenues.

- In February 2023, ProAmpac, a frontrunner in flexible packaging and material science, introduced new additions to its ProActive Sustainability Portfolio: ProActive Recyclable R-2050 and ProActive Post Industrial Recycled Content (PIR).

- Pouches emerged as a dominant choice for packaging e-commerce products. They are increasingly favored in the food, beverage, personal care, and pharmaceutical sectors, especially for products targeting the e-commerce market. E-commerce players are gravitating toward pouch packaging due to its efficiency and cost-effectiveness.

Brazil is Expected to Hold a Significant Share in the Market

- Brazil is a frontrunner in Latin America, showcasing robust economic growth and attracting significant foreign direct investment (FDI). The nation, with its substantial appetite for food and industrial goods, heavily relies on imports. The region is increasingly turning to flexible packaging solutions to safeguard these products from damage. As the middle class expands, so does the appetite for packaged foods, paving the way for the expanding flexible packaging market.

- In 2023, Brazil achieved a trade surplus in beauty and personal care products, as per a report by Beautycare Brazil (ABIHPEC & ApexBrasil). The South American powerhouse exported cosmetics and hygiene products worth over USD 911 million to global markets.

- In March 2024, SIG, a leading supplier of aseptic cartons, partnered with DPA Brasil, a prominent dairy company, to roll out innovative spouted pouch packaging for the Chamyto yogurt brand. This new packaging, featuring the SIG CloverCap 85RO closure and SIG Prime 120 filling equipment, has a lightweight yet robust design, making it especially user-friendly for children. The strawberry-flavored Chamyto yogurt marks DPA Brasil's inaugural product to adopt this cutting-edge packaging format. DPA Brasil also plans to expand this packaging innovation to other offerings, including Chamyto fruit vitamin yogurts, Chambinho Recreio, and Ninho Lancheirinha.

- Additionally, the market is witnessing a trend towards premiumization. While Brazilians are generally price-sensitive but increasingly willing to invest in cosmetics. This shift is driving the demand for flexible packaging. Flexible plastic materials like polyamine and polypropylene enhance package visibility and appeal and incorporate essential safety features.

Latin America Flexible Packaging Industry Overview

The Latin American flexible packaging market comprises several global and regional players and is moderately consolidated. As the market poses low barriers to entry for the new players, several new entrants have gained traction. This market is characterized by low product differentiation, growing levels of product penetration, and high levels of competition. Sustainable competitive advantage can be gained through design, technology, and application innovation. Some of the major players operating in the market are Amcor PLC, Berry Global Inc., Mondi Group, and Sealed Air Corporation.

- May 2024: SGK's team in Brazil collaborated with Johnson & Johnson Brazil to introduce SEMPRE LIVRE. Their sustainability initiatives garnered them the Popular Vote category at the 20th ABRE Brazilian Packaging Award. In partnership with Johnson & Johnson, SGK spearheaded innovation by developing the inaugural flexible film packaging. They designed a thinner insert, incorporating 33% post-consumer resin for female care products, achieving a notable 10.25% reduction in carbon footprint compared to existing packaging.

- October 2023: PAC Worldwide relocated its operations from Pedro Escobedo, Mexico, to a new 83,000 sq. ft plant in Vistha San Juan Del Rio as part of its strategy to enhance manufacturing capabilities in Central America. This comprehensive, flexible packaging facility is two hours north of Mexico City.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased Demand for Convenient Packaging

- 4.3 Market Challenges

- 4.3.1 Concerns Regarding Environment and Recycling

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Industry Value Chain Analysis

- 4.6 Assessment of the Microeconomic Factors on the Industry

5 SUSTAINABLE PACKAGING AND TECHNOLOGICAL ADVANCEMENTS IN THE LATIN AMERICAN FLEXIBLE PACKAGING MARKET

- 5.1 Light Weighting

- 5.2 Recycled and Recyclable Polymers

- 5.3 Sustainable Coatings for Pouch Packaging

- 5.4 Barrier Developments

- 5.5 Active Packaging

6 MARKET SEGMENTATION

- 6.1 Material Type

- 6.1.1 Plastics

- 6.1.1.1 Polyethene (PE)

- 6.1.1.2 Bi-orientated Polypropylene (BOPP)

- 6.1.1.3 Cast Polypropylene (CPP)

- 6.1.1.4 Polyvinyl Chloride (PVC)

- 6.1.1.5 Ethylene Vinyl Alcohol (EVOH)

- 6.1.2 Paper

- 6.1.3 Aluminum Foil

- 6.1.1 Plastics

- 6.2 Product Type

- 6.2.1 Pouches

- 6.2.2 Bags

- 6.2.3 Films and Wraps

- 6.2.4 Other Product Types

- 6.3 End-user Industry

- 6.3.1 Food

- 6.3.1.1 Frozen Food

- 6.3.1.2 Dairy Products

- 6.3.1.3 Fruits and Vegetables

- 6.3.1.4 Meat, Poultry, and Seafood

- 6.3.1.5 Baked Goods and Snack Foods

- 6.3.1.6 Candy and Confections

- 6.3.1.7 Other Food Products

- 6.3.2 Beverage

- 6.3.3 Pharmaceutical and Medical

- 6.3.4 Household and Personal Care

- 6.3.5 Other End-user Industries

- 6.3.1 Food

- 6.4 Geography

- 6.4.1 Brazil

- 6.4.2 Argentina

- 6.4.3 Mexico

- 6.4.4 Rest of Latin America (Colombia, Venezuela, etc.)

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor PLC

- 7.1.2 Berry Global Inc.

- 7.1.3 Mondi Group

- 7.1.4 Sealed Air Corporation

- 7.1.5 Coveris Holdings SA

- 7.1.6 Tetra Pak International SA

- 7.1.7 Cascades Flexible Packaging

- 7.1.8 Novolex Holdings Inc.

- 7.1.9 WIPF Doypack (Wipf AG)

- 7.1.10 FlexPak Services LLC

- 7.1.11 Transcontinental Inc.

- 7.1.12 American Packaging Corporation

- 7.1.13 Sonoco Products Company

- 7.1.14 Inteplast Group

- 7.1.15 Oben Holding Group

- 7.1.16 Toray Plastics (America) Inc.

- 7.1.17 Sigma Plastic Group

- 7.1.18 Clifton Packaging SA De CV

- 7.1.19 PO Empaques Flexibles SA De CV

- 7.1.20 ProAmpac LLC