|

시장보고서

상품코드

1640660

북미의 머신 비전 시스템 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)NA Machine Vision Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

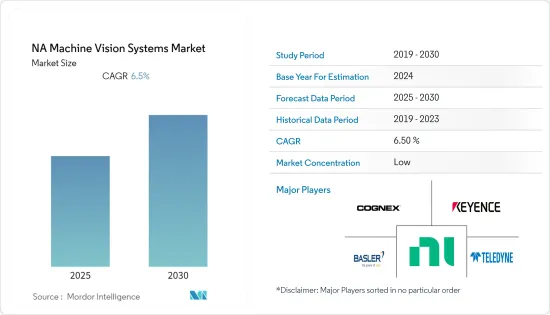

북미의 머신 비전 시스템 시장은 예측 기간 동안 CAGR 6.5%를 기록할 전망

주요 하이라이트

- 북미는 머신 비전 솔루션을 제공하는 기업에게 큰 시장입니다. 이 지역 시장은 제조업에서의 자동화의 조기 도입과 지역 발상의 벤더가 다수 존재하기 때문에 예측 기간 중에 대폭적인 성장이 예상됩니다. Association for Advancing Automation에 따르면 로봇 및 기타 기계에 비전 인텔리전스를 제공하는 머신 비전 컴포넌트 및 시스템 매출은 2020년 상반기로 감소했지만 하반기에는 북미에서 시장이 회복되었습니다.

- 예를 들어 캐나다에 본사를 두고 있는 iENSO는 최근 임베디드 비전을 위한 앰버렐라 기반 플랫폼 생태계를 시작했습니다. AI, 머신 러닝, 딥러닝과 결합된 비가시 계산 및 3D 이미징과 같은 신흥 머신 비전 기술을 통해 머신 비전은 계속 확장되는 새로운 용도에 대응할 수 있습니다.

- 머신 비전 시스템은 품질 검사에서 제품 분류, 로봇 유도에 이르기까지 자동화 기술이 위험하고 지루한 작업에서 인간 노동자를 구할 수 있도록 도와줍니다. 머신 비전은 보안 시스템이 위협을 발견하고 자율주행 차량을 운전하며 세계의 많은 인프라를 검사하는 데에도 도움이 됩니다.

- 머신 비전 시스템 시장은 많은 부문와 자동차 및 산업과 같은 일반적인 산업에서 더 많은 변화가 일어나면서 속도를 높이고 있습니다.

- 예를 들어, 2022년 3월, Zebra Technologies는 플랫폼 독립적 소프트웨어, 소프트웨어 개발 키트(SDK), 스마트 카메라, 3D 센서, 비전 컨트롤러, 입출력(I/O) 카드, 프레임 그래버를 제공하는 Matrox Imaging을 인수할 의향을 발표했습니다. Matrox Imaging은 공장 자동화, 전자 장비 및 의약품 포장, 반도체 검사 등 산업용 비전 시스템에서 데이터를 검색, 검사, 평가 및 기록하는 데 사용됩니다.

- COVID-19의 유행은 조사 대상 시장의 다양한 산업에서 공급망과 생산을 크게 혼란시켰습니다. 그러나 이 팬데믹은 효율성을 높이고 안전 문제를 해결하기 위한 산업 자동화 및 머신 비전의 범위를 확대했습니다. COVID-19에 대응하는 파트너십, 신제품 출시, 개발이 중요한 지역 동향이었습니다.

북미 머신 비전 시스템 시장 동향

스마트 카메라 베이스가 크게 성장할 전망

- 혁신적인 카메라 기반 제품은 많은 최종 사용자 산업에서 제품 혁신과 기존 용도의 확대 비율이 높기 때문에 산업에서 인기를 끌고 있습니다. 또한 스마트 카메라는 머신 비전 시스템의 설계를 용이하게 했습니다. 최근에는 더 큰 이미지 센서를 탑재한 모델, 스마트 카메라로서 기능하는 신흥의 내장 비전 카메라, 딥러닝이나 AI 태스크를 실행할 수 있는 새로운 카메라 등 지속적인 기술 혁신을 볼 수 있습니다.

- 스마트 카메라의 이미지 센서 해상도 향상, MIPI 인터페이스를 갖춘 초고속 프로세서와 임베디드 비전 카메라의 통합, 특히 COVID-19 발생 후 인기가 높아지고 있는 컬러와 흑백 선택 증가 등은 모두 시장에서의 기술 혁신이었습니다.

- 머신 비전 시스템은 생산 공정을 통해 제품, 원료 및 포장을 추적하고 그 경로를 적극적으로 추적함으로써 높은 수준의 품질과 안전을 보장할 수 있습니다. 예를 들어 미국 인구조사국에 따르면 2022년 3월 미국 음식점에서 월간 소매 매출은 약 763억 달러로 추정됩니다. 이 통계는 지난달 2022년 2월부터 약 10% 증가한 것으로 나타났습니다.

- 캐나다에 본사를 두고 있는 Matrox Imaging은 최근 에지 IoT 디바이스와 차세대 지능형 카메라용 Matrox Iris GTX 모델을 발표했습니다. 이 회사의 Matrox Iris GTX 스마트 카메라는 Intel Atom x6,000 임베디드 프로세서를 자랑하며 기존의 머신 비전 작업과 Matrox Design Assistant X 온디바이스 소프트웨어를 사용한 이미지 분류 및 세분화의 형태로 딥러닝 추론에 모두 사용할 수 있습니다.

미국이 큰 시장 점유율을 획득할 전망

- 이 나라는 자동화와 제품 혁신의 최전선에 있으며 경쟁 우위를 제공합니다. 또한 Microchip Technology Corporation은 Smart Embedded Vision Initiative를 발표했습니다. 이 생태계는 Microchip의 저전력 PolarFire FPGA와 고속 영상 처리 인터페이스, 영상 처리용 지적 재산, 외부 파트너와의 생태계 확대를 결합합니다. 이 이니셔티브는 산업, 의료기기, 자동차 및 항공우주를 위한 머신 비전의 진화를 가속화하는 것을 목표로 합니다. 하드웨어 및 소프트웨어 공급업체의 이러한 혁신은 예측 기간 동안 시장 수요를 확대할 것으로 예상됩니다.

- 고급 제조 파트너십(Advanced Manufacturing Partnership)과 같은 정부 이니셔티브는 산업, 다양한 대학 및 연방 정부가 새로운 자동화 기술에 투자하기 위해 시행되고 있으며, 머신 비전 시스템의 생산을 증가시킬 것으로 기대됩니다.

- 또한 많은 벤더들이 파트너십과 인수 전략을 채택하여 경쟁 우위를 차지하고 있습니다. 하드웨어 공급업체의 대부분은 시장에서 우위를 유지하기 위해 파트너십과 인수를 통해 강력한 소프트웨어 개발자를 획득했습니다.

- 생산을 계속하고 더 높은 품질을 보장하기 위해, 식품 및 식품 제조 업체는 기계 비전 검사 시스템의 동력원으로 인공지능(AI)에 주목하고 있습니다. AI는 패턴을 학습 및 분류하는 능력이 있기 때문에 머신 비전 기술에 의해 병의 파손이나 포장의 찢어짐 등, 생산 정지나 폐기의 원인이 되는 문제를 발견할 수 있습니다.

- 최근 미국의 Zebra Technologies Corporation은 그래픽 머신 비전 소프트웨어 개발 기업인 Adaptive Vision을 인수하여 머신 비전 스마트 카메라와 고정식 산업용 스캐너의 새로운 제품군을 출시했습니다. Adaptive Vision과 Adaptive Vision Studio and Library, Deep Learning Add-on, WEAVER 추론 엔진 인수로 Zebra Technologiesn은 머신 비전 하드웨어 및 소프트웨어 시장에서의 존재를 확대합니다. 이 회사는 또한 PartnerConnect 프로그램에서 산업 자동화 비즈니스 파트너, 리셀러 및 시스템 통합사업자를 위한 새로운 전문 트럭을 도입하고 있습니다.

북미의 머신 비전 시스템 산업 개요

북미의 머신 비전 시스템 시장 경쟁은 완만합니다. 제품 조사, 연구 개발 비용, 파트너십 및 인수는 이 지역의 기업이 치열한 경쟁을 유지하기 위해 채택하는 주요 성장 전략입니다. 이 시장의 주요 기업은 Cognex Corporation, Keyence Corporation, Basler AG, National Instruments Corporation, Teledyne DALSA, Flir Systems Inc., Datalogic SpA, Perceptron Inc.입니다.

2022년 9월-데이터 로직은 최첨단 뉴로모픽 비전 시스템의 발명가인 Prophesee SA와 제휴하여 차세대 산업 제품에 대한 최근 협력 관계를 발표했습니다. 이 회사에 따르면, 뉴로모픽 비전은 인간의 생물학적 시스템의 동작에 영감을 얻은 매력적인 기술이며, 정확하게는 신경망과 같습니다. Prophesse는 컴퓨터 비전에 대한 획기적인 이벤트 기반 비전 접근법을 개발했습니다. 이 새로운 비전 카테고리는 전력 소비, 대기 시간 및 데이터 처리 요구 사항을 크게 줄일 수 있어 기존의 프레임 기반 센서에서는 보이지 않는 것을 드러냅니다.

2022년 3월-RG Group은 머신 비전 공급업체인 Cognex와의 제휴를 확대하였습니다. Cognex Corporation은 광범위한 이미지 기반 제품을 설계, 개발, 제조 및 시장 개척하고 있으며 모든 제품에 인공지능(AI) 기술을 사용합니다. Cognex 제품에는 머신 비전 시스템과 머신 비전 센서 등이 있습니다. RG 그룹에 따르면 첨단 비전 시스템 기술은 고객을 위한 솔루션의 핵심이며, Cognex는 빠르게 진화하는 이 부문을 계속 이끌고 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업의 매력-Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 진입업자의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- COVID-19의 북미의 머신 비전 시스템 시장에 대한 영향

제5장 시장 역학

- 시장 성장 촉진요인

- 품질 검사와 자동화에 대한 요구 증가

- 정확한 결함 검출에 대한 수요 증가

- 시장의 과제

- Mv 시스템 도입의 복잡성

제6장 시장 세분화

- 컴포넌트별

- 하드웨어

- 비전 시스템

- 카메라

- 광학 및 조명 시스템

- 프레임 그래버

- 기타

- 소프트웨어

- 하드웨어

- 제품별

- PC 베이스

- 스마트 카메라 베이스

- 최종 사용자 산업별

- 음식

- 의료 의약품

- 물류 및 소매

- 자동차

- 일렉트로닉스 및 반도체

- 기타

- 국가별

- 미국

- 캐나다

제7장 경쟁 구도

- 기업 프로파일

- Cognex Corporation

- Keyence Corporation

- Basler AG

- National Instruments Corporation

- Teledyne DALSA

- Flir Systems Inc

- Datalogic SpA

- Perceptron Inc

- Baumer Ltd.

- Optel Group

- Uss Vision Inc

제8장 투자 분석

제9장 시장의 미래

AJY 25.02.14The NA Machine Vision Systems Market is expected to register a CAGR of 6.5% during the forecast period.

Key Highlights

- North America is a sizable market for companies providing machine vision solutions. The regional market is expected to grow substantially over the forecast period, owing to the early introduction of automation in manufacturing and the presence of a significant number of market vendors of regional origin. According to the Association for Advancing Automation, sales of machine vision components and systems that offer vision intelligence to robots and other machines dropped in the first half of 2020; however, the market recovered in North America in the second half.

- Various innovations are also being seen in the market.For instance, recently, Canada-based iENSO launched an Ambarella-based platform ecosystem for embedded vision applications. AI vision processors for the Edge are provided by Ambarella Inc.Emerging machine vision technologies such as non-visible computational and 3D imaging combined with AI, machine learning, and deep learning enable machine vision to address an ever-expanding range of new applications.

- Machine vision systems have helped automation technologies save human workers from dangerous and dull jobs, from quality inspection to sorting products to guiding robots. Machine vision has even helped security systems find threats, driven self-driving cars, and inspected a lot of the world's infrastructure.

- The machine vision systems market is picking up speed as more changes are made in a number of areas and as more changes are made in its usual industries, such as automotive and industrial.

- For instance, in March 2022, Zebra Technologies announced its intent to acquire Matrox Imaging, a provider of platform-independent software, software development kits (SDKs), smart cameras, 3D sensors, vision controllers, input/output (I/O) cards, and frame grabbers that are used to capture, inspect, assess, and record data from industrial vision systems in factory automation, electronics and pharmaceutical packaging, semiconductor inspection, and more.

- The outbreak of COVID-19 significantly disrupted the supply chain and production in various industries of the studied market. However, the pandemic also expanded the scope of industrial automation and machine vision to enhance efficiency and address safety concerns. Partnerships, new product launches, and developments addressing COVID-19 were significant regional trends.

North America Machine Vision Systems Market Trends

Smart Camera-based Expected to Witness Significant Growth

- Innovative camera-based products are gaining popularity in industries due to the high rate of product innovation and expansion of existing applications in many end-user industries. Also, smart cameras have long eased the task of designing machine vision systems. The segment has witnessed continuous innovation in recent years, including models with larger image sensors, emerging embedded vision cameras that function as smart cameras, and new cameras capable of performing deep learning and AI tasks.

- Increased image sensor resolution in smart cameras, the integration of much faster processors or embedded vision cameras with MIPI interfaces, and the increasing availability of color and monochrome options in the market, which are also gaining popularity, especially after the COVID-19 outbreak, were all innovations in the market.

- Machine vision systems can track products, raw ingredients, and packaging throughout the production process and actively trace the paths to ensure high levels of quality and safety. For instance, according to the U.S. Census Bureau, the monthly retail sales from U.S. food and beverage stores were estimated at approximately USD 76.3 billion in March 2022. These statistics indicated an increase of about 10 percent from the previous month, February 2022.

- Matrox Imaging, based in Canada, recently introduced the Matrox Iris GTX model for edge IoT devices and the next generation of intelligent cameras. The company's Matrox Iris GTX smart cameras boast an Intel Atom x6000 embedded processor that can be used for both conventional machine vision operations and deep learning inference in the form of image classification and segmentation using Matrox Design Assistant X on-device software.

United States Expected to Witness Significant Market Share

- The country is at the forefront of automation and product innovation, providing a competitive advantage. Also, Microchip Technology Corporation introduced its Smart Embedded Vision Initiative. The ecosystem combines Microchip's low-power PolarFire FPGAs with high-speed imaging interfaces, intellectual property for image processing, and an expanded ecosystem of outside partnerships. This initiative aims to accelerate machine vision advancements for industrial, medical device, automotive, and aerospace applications. Such innovations by hardware and software vendors are expected to amplify market demand over the forecast period.

- Government initiatives, such as the Advanced Manufacturing Partnership, which is undertaken to make the industry, various universities, and the federal government invest in emerging automation technologies, are expected to increase the production of machine vision systems.

- Product innovation is still a key differentiator among market vendors.Also, many vendors are adopting partnership and acquisition strategies to gain a competitive advantage. Most hardware vendors have acquired strong software developers through partnerships or acquisitions to stay strong in the market.

- To keep production running and ensure higher quality, food and beverage manufacturers are turning to artificial intelligence (AI) to power machine vision inspection systems. AI's ability to learn and classify patterns lets machine vision technology find broken bottles, torn packaging, and other problems that can stop production and cause waste.

- Recently, a US-based company, Zebra Technologies Corporation, acquired graphical machine vision software developer Adaptive Vision and launched a new suite of machine vision smart cameras and fixed industrial scanners. With the acquisition of Adaptive Vision and its Adaptive Vision Studio and Library, Deep Learning Add-on, and WEAVER inference engine, Zebra Technologies expands its presence in the machine vision hardware and software marketplaces. The company is also introducing a new specialized track for industrial automation business partners, distributors, and systems integrators in its PartnerConnect program.

North America Machine Vision Systems Industry Overview

The North America Machine Vision Systems Market is moderately competitive in nature. Product launches, high expenses on research and development, partnerships, and acquisitions are the prime growth strategies adopted by the companies in the region to sustain the intense competition. Key players in the market are Cognex Corporation, Keyence Corporation, Basler AG, National Instruments Corporation, Teledyne DALSA, Flir Systems Inc., Datalogic SpA, and Perceptron Inc.

In September 2022, Datalogic partnered with Prophesee SA, inventor of the most advanced neuromorphic vision systems, to announce the recent collaboration regarding the next generation of industrial products. According to the company, neuromorphic vision is a fascinating technology inspired by the behavior of the human biological system, precisely like neural networks. Prophesse has developed a breakthrough event-based vision approach to computer vision. This new vision category enables significant reductions in power, latency, and data processing requirements to reveal what was previously invisible to traditional frame-based sensors.

In March 2022, RG Group expands its partnership with machine vision supplier Cognex. Cognex Corporation designs, develops, manufactures, and markets a wide range of image-based products, all of which use artificial intelligence (AI) techniques that give them the human-like ability to make decisions based on what they see. Cognex products include machine vision systems and machine vision sensors. According to RG Group, the advanced vision system technology is a cornerstone of the company's solutions for clients, and Cognex continues to lead this quickly evolving field.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the North America Machine Vision Systems Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Need for Quality Inspection and Automation

- 5.1.2 Rising Demand for Accurate Defect Detection

- 5.2 Market Challenges

- 5.2.1 Complications in the Implementation of Mv Systems

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.1.1 Vision Systems

- 6.1.1.2 Cameras

- 6.1.1.3 Optics and Illumination Systems

- 6.1.1.4 Frame Grabber

- 6.1.1.5 Other Types of Hardware

- 6.1.2 Software

- 6.1.1 Hardware

- 6.2 By Product

- 6.2.1 PC-based

- 6.2.2 Smart Camera-based

- 6.3 By End-User Industry

- 6.3.1 Food and Beverage

- 6.3.2 Healthcare and Pharmaceutical

- 6.3.3 Logistic and Retail

- 6.3.4 Automotive

- 6.3.5 Electronics and Semiconductors

- 6.3.6 Other End-User Industries

- 6.4 By Country

- 6.4.1 United States

- 6.4.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cognex Corporation

- 7.1.2 Keyence Corporation

- 7.1.3 Basler AG

- 7.1.4 National Instruments Corporation

- 7.1.5 Teledyne DALSA

- 7.1.6 Flir Systems Inc

- 7.1.7 Datalogic SpA

- 7.1.8 Perceptron Inc

- 7.1.9 Baumer Ltd.

- 7.1.10 Optel Group

- 7.1.11 Uss Vision Inc