|

시장보고서

상품코드

1641846

주택용 라우터 : 시장 점유율 분석, 산업 동향과 통계, 성장 예측(2025-2030년)Residential Routers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

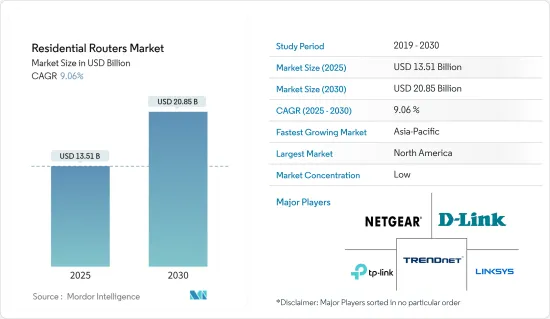

주택용 라우터 시장 규모는 2025년에 135억 1,000만 달러, 2030년에는 208억 5,000만 달러에 이를 것으로 예상됩니다. 예측 기간(2025-2030년)의 CAGR은 9.06%을 나타낼 것으로 전망됩니다.

주요 하이라이트

- IoT 장치를 가정에 통합하는 것은 강력한 인터넷 연결과 네트워크에 크게 의존합니다. 스마트 홈이 원활하게 작동하는 것은 모든 자동화 장치가 설치 위치에서 인터넷에 제대로 연결되어 있는 경우에만 가능합니다. 거기서 활약하는 것이, 가정 내의 인터넷 접속을 관리하는 라우터입니다. 따라서 라우터는 중단 없는 원활한 네트워크 기능을 확보하는 데 중요한 역할을 합니다.

- 2022년 3월, Vodafone-Idea는 최대 10대의 Wi-Fi 지원 장치를 연결할 수 있는 포켓 크기의 4G 라우터, Vi MiFi를 출시했습니다. 이 라우터는 2,700mAh의 대용량 배터리를 자랑하며 한 번의 충전으로 최대 5시간까지 사용할 수 있습니다. 또한 2022년 8월, Reliance Jio는 Jio Wi-Fi 메쉬 라우터를 출시했습니다. 이 라우터는 가정 내 네트워크 커버리지를 확장하고 원 플로어에서 최대 1,000 평방 피트의 영역을 커버합니다.

- COVID-19의 유행으로 인해 네트워크 트래픽이 크게 증가했으며 처음 몇 주 동안 40% 급증했습니다. 팬데믹이 확대됨에 따라 트래픽 패턴은 비즈니스 파크에서 주거 지역으로 이동하여 컨텐츠 소비, 게임 및 OTT 수요의 지속적인 급증으로 이어졌습니다. 이것은 효율적인 가정용 라우터의 필요성을 돋보이게 합니다.

- 라우터와 장치 사이의 거리가 Wi-Fi 속도와 연결 강도에 큰 영향을 미친다는 것은 주목할 가치가 있습니다. 따라서 라우터는 집의 모든 곳에 도달하도록 강하고 넓은 신호를 제공하도록 설계되는 것이 필수적입니다. 경쟁이 치열한 시장을 견디기 위해 라우터 제조업체는 끊임없는 기술 혁신과 기술 발전이 요구되고 있습니다.

주택용 라우터 시장 동향

무선 연결이 시장 성장을 견인

- 인터넷은 오랜 세월에 걸쳐, 특히 도시에서는 보다 저렴한 가격으로 이용할 수 있게 되어, 무선 기술의 보급에 따라 준도시나 농촌에서도 이용되게 되었습니다. 무선 연결은 케이블을 필요로 하지 않고 유선 연결보다 빠르기 때문에 사람들의 삶에 편의성을 가져왔을 뿐만 아니라 생산성도 크게 향상되었습니다. 그 결과 Wi-Fi 라우터는 대부분의 가정에서 당연한 것이 되었습니다.

- 2023년 3월 Qualcomm은 WeSchool, Telecom Italia(TIM), Acer와 공동으로 이탈리아 학교에 차세대 무선 기술 솔루션을 제공하는 5G Smart Schools 프로그램을 시작했습니다. 이 프로그램은 중고생의 디지털 기술을 향상시키고 교사에게 전문 능력 개발 기회를 제공하는 것을 목표로합니다.

- 또한 Cox Private Networks는 지역에서 고속 인터넷을 제공하기 위해 고정 무선(FWA) 검사를 실시했습니다. 이 노력은 디지털 데바이드를 해소하고 원격지에 사는 사람들에게 인터넷에 대한 액세스를 제공하는 데 도움이 됩니다.

- 2022년 3월 미국 정부는 농촌 지역의 인터넷 서비스 요금을 지원하기 위해 Affordable Connectivity Program(ACP)에 142억 달러를 조달했습니다. 미드밴드 주파수에서 CBRS(Citizens Band Radio Service)는 농촌 지역에 광대역을 설명합니다. 지역 인터넷 제공업체인 브로드밴드는 농촌 지역에 특화된 CBRS 기반 고정 무선 액세스 서비스를 데뷔하여 원격지에서 인터넷에 대한 액세스를 더욱 개선했습니다.

- 전반적으로 인터넷 접근성과 활용도 향상은 새로운 무선 기술의 개발과 함께 사람들의 삶에 많은 혜택을 제공하고 교육, 커뮤니케이션, 경제 성장 기회를 향상시키고 있습니다.

북미가 큰 시장 점유율을 차지할 전망

- GSMA의 최신 보고서에 따르면, 5G는 현재 북미에서 활황을 보이고 있으며, 2025년까지 무선 서비스 부문을 지배할 것으로 예상됩니다. 미국의 5G 보급률은 세계 2위로, 이를 웃도는 것은 한국으로 예상되고 있습니다. 2025년까지는 통신 사업자가 미드밴드 주파수 대역의 도입을 늘리기 때문에 모바일 설비 투자의 거의 모든 것을 5G가 차지할 것으로 예측되고 있습니다. 그 결과 5G 매출은 2021년 2,940억 달러에서 2025년 3,330억 달러로 증가할 것으로 예상되며, 이는 해당 기술의 거대한 성장 가능성을 보여줍니다.

- 또한 5G는 캐나다 인구의 92%, 미국 인구의 100%를 커버할 것으로 예상됩니다. 미국의 주요 통신사는 5G 고정 무선 액세스(FWA) 기술을 활용하여 고정 광대역 부문에서 케이블 공급자로부터 시장 점유율을 얻으려고 합니다. 그 중에서도 2022년 1분기 시점에서 FWA 가입자 수 98만명의 T-Mobile은 5G FWA서비스의 단일 제공업체로서는 최대입니다.

- 2022년 10월, 트랜잭션 네트워크 서비스(TNS)는 세계 무선 액세스를 위한 스마트 심 기능을 시작했습니다. TNS의 광범위한 지역과 국제 무선 커버리지를 통해 북미 고객들은 24시간 체제 지원과 함께 배포가 필요한 곳이면 어디에서나 동일한 신뢰할 수 있는 안전한 무선 연결을 활용할 수 있어 다양한 지역에서 로밍 및 국내 연결 옵션에 대한 액세스를 제공할 수 있습니다.

- 요약하면 5G는 북미에서 빠르게 성장하고 있으며 2025년까지 무선 서비스 부문을 계속 지배할 것으로 예상됩니다. 미국은 T-Mobile이 5G FWA 서비스를 선도하고 있으며 5G의 보급률이 세계적으로 가장 높은 나라 중 하나가 되고 있습니다. TNS의 Smart Sim 기능을 통해 북미 고객은 종합적인 커버리지 및 지원을 지원하는 비즈니스 요구를 충족하는 안정적이고 안전한 무선 연결의 혜택을 누릴 수 있습니다.

주택용 라우터 산업 개요

새로운 대역폭 사용 및 서비스 제공 시나리오가 네트워크 인프라를 재구성하기 때문에 주택용 라우터 시장은 큰 변화를 경험하고 있습니다. 장비 제조업체는 보다 광범위한 서비스 및 용도을 지원하고 용량 확장성과 높은 데이터 전송 속도를 제공하는 캐리어급 라우터를 개발함으로써 대응하고 있습니다. 이 부문에는 많은 진출 기업이 진입하고 있기 때문에 시장은 매우 세분화되어 있으며, 제조업체가 제품의 혁신적인 하드웨어 및 소프트웨어 기능에 투자함으로써 더욱 성장할 가능성이 있습니다. 이 부문에서 서비스를 제공하는 주요 기업으로는 D-Link Corporation, Netgear Inc., Linksys Group(Foxconn), Synology Inc. 등이 있습니다.

2022년 5월, HFCL Limited는 Wipro와 협력하여 기업이 5G 대응 비전을 실현하고 고품질 5G 솔루션을 시장에 투입하는 속도를 높이는 5G 전송 솔루션을 발표했습니다. 2022년 10월, MediaTek은 Invendis와 협력하여 Made in India의 5G 라우터와 Wi-Fi 솔루션을 발표하고 소비자와 기업 고객에게 안전하고 강력하고 원활한 무선 네트워킹 솔루션을 제공합니다. 또한 2023년 2월에는 Telecom26과 Trasna Solutions가 제휴하여 휴대전화 라우터용 eSIM 관리 솔루션을 개발하고 라우터 제조업체에 기존 SIM 기반 장치에서 eSIM을 관리하는 효율적이고 사용자 친화적인 방법을 제공했습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 산업의 매력 - Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

- 시장에 대한 COVID-19의 영향

- 시장 성장 촉진요인

- 커넥티드 디바이스 수요 증가와 스마트 홈 시장의 확대

- IP 트래픽 증가

- 시장의 과제

- 보안 침해의 위협 증가

제5장 시장 세분화

- 접속 유형

- 유선

- 무선

- 표준규격

- 802.11b/g/n

- 802.11ac

- 802.11ax

- 지역

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 기타 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 기업 프로파일

- Netgear Inc.

- D-Link Corporation

- TP-Link Technologies Co. Ltd

- Linksys Group(Foxconn)

- TRENDnet Inc.

- Synology Inc.

- AsusTek Computer Inc.

- Google Inc.

- Nokia Networks

- Xiaomi Inc.

제7장 투자 분석

제8장 시장의 미래

KTH 25.02.17The Residential Routers Market size is estimated at USD 13.51 billion in 2025, and is expected to reach USD 20.85 billion by 2030, at a CAGR of 9.06% during the forecast period (2025-2030).

Key Highlights

- The integration of IoT devices into households is heavily reliant on robust internet connections and networks. A smart home can only function seamlessly if all automation devices are properly connected to the internet at the location where they are installed. This is where the router comes into play as it manages internet connectivity within the home. Thus, a router plays a crucial role in ensuring uninterrupted and smooth network functioning.

- In March 2022, Vodafone-Idea launched the Vi MiFi, a pocket-sized 4G router that enables users to connect up to 10 Wi-Fi-enabled devices. This router boasts a high battery capacity of 2700 mAh, which can last for up to 5 hours on a single charge. Additionally, in August 2022, Reliance Jio launched the Jio Wi-Fi Mesh router, which expands network coverage across homes, covering an area of up to 1000 sq ft across a single floor.

- The Covid-19 pandemic led to a significant increase in network traffic, with a 40% surge observed in the first few weeks. As the outbreak spread, traffic patterns shifted from business parks to residential areas, leading to a continued surge in content consumption, gaming, and OTT demand. This highlights the need for efficient home routers.

- It is worth noting that the distance between the router and the device can greatly impact Wi-Fi speed and connection strength. Therefore, it is essential that routers are designed to provide a strong and wide signal to reach all areas of the house. To withstand the competitive market, router manufacturers require constant innovation and technological advancements.

Residential Router Market Trends

Wireless Connectivity to Witness the Market Growth

- The Internet has become more affordable and accessible over the years, particularly in urban areas, and has even made its way to semi-urban and rural areas with the widespread adoption of wireless technology. This has not only brought convenience to people's lives but has also significantly improved productivity, as wireless connections do not require cables and are faster than wired connections. As a result, Wi-Fi routers have become a norm in most houses.

- In March 2023, Qualcomm, in partnership with WeSchool, Telecom Italia (TIM), and Acer, launched the 5G Smart Schools program to provide next-generation wireless technology solutions to schools in Italy. The program aims to develop digital skills among secondary school students and provide professional development opportunities for teachers.

- Moreover, Cox Private Networks is running Fixed Wireless (FWA) trials to deliver high-speed internet in rural areas. This initiative will help bridge the digital divide and provide access to the internet to people living in remote areas.

- In March 2022, the US Government raised 14.2 billion USD for the Affordable Connectivity Program (ACP) to help rural communities pay for their internet service. With mid-band frequencies, Citizens Band Radio Service (CBRS) will offer broadband in rural communities. Broadband, a regional internet provider, debuted CBRS-based Fixed Wireless Access services focused on rural areas, further improving access to the internet in remote locations.

- Overall, the increasing accessibility and affordability of the Internet, along with the development of new wireless technologies, are bringing numerous benefits to people's lives and improving opportunities for education, communication, and economic growth.

North America Is Expected to Hold Significant Market Share

- Based on the latest report from GSMA, 5G is currently booming in North America and is projected to dominate the wireless services sector by 2025. The United States is expected to have the world's second-highest 5G adoption rate, with only South Korea surpassing it. By 2025, 5G is forecasted to account for almost all mobile capex as operators increase mid-band spectrum deployments. As a result, 5G revenues are expected to increase from 294 billion USD in 2021 to 333 billion USD in 2025, showing the immense growth potential for this technology.

- Moreover, 5G is expected to cover 92% of the Canadian population and 100% of the US population. Major telcos in the US are leveraging 5G Fixed Wireless Access (FWA) technology to gain market share from cable providers in the fixed broadband sector. Among them, T-Mobile, with 0.98 million FWA subscribers as of Q1 2022, is the largest single provider of 5G FWA services.

- In October 2022, Transaction Network Services (TNS) launched its Smart Sim capability for Global Wireless Access, which benefits processors, ISOs, and merchants across the US. TNS's extensive local and international wireless coverage allows North American customers to take advantage of the same dependable and secure wireless connectivity, with round-the-clock assistance, wherever they need to deploy, providing access to roaming and domestic connectivity choices in various geographies.

- In summary, 5G is experiencing rapid growth in North America and is expected to continue to dominate the wireless services sector by 2025. The US is poised to have one of the highest 5G adoption rates globally, with T-Mobile leading the charge in 5G FWA services. With TNS's Smart Sim capability, North American customers can benefit from reliable and secure wireless connectivity for their business needs, backed by comprehensive coverage and support.

Residential Router Industry Overview

The residential router market is experiencing significant changes as new bandwidth usage and service delivery scenarios are reshaping network infrastructures. Equipment manufacturers are responding by developing carrier-class routers that support a broader range of services and applications and offer capacity scalability and higher data rates. With many players involved in this sector, the market is highly fragmented and has the potential to grow further as manufacturers invest in innovative hardware and software features in their products. Some significant players offering their services in this sector include D-Link Corporation, Netgear Inc., Linksys Group (Foxconn), Synology Inc., and more.

In May 2022, HFCL Limited collaborated with Wipro to introduce 5G transport solutions that enable enterprises to realize their 5G-enabled vision and increase the speed with which they can bring high-quality 5G solutions to the market. In October 2022, MediaTek partnered with Invendis to launch Made in India 5G Routers and Wi-fi solutions, providing consumers and enterprise customers with secure, strong, and seamless wireless networking solutions. And in February 2023, Telecom26 and Trasna Solutions partnered to develop eSIM management solutions for cellular routers, offering router manufacturers an efficient and user-friendly way to manage eSIMs on their existing SIM-based devices.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

- 4.4 Market Drivers

- 4.4.1 Increasing Demand of Connected Devices and Proliferating Smart Homes Market

- 4.4.2 Growth in IP Traffic

- 4.5 Market Challenges

- 4.5.1 Increasing Threat of Security Breaches

5 MARKET SEGMENTATION

- 5.1 Connectivity Type

- 5.1.1 Wired

- 5.1.2 Wireless

- 5.2 Standard

- 5.2.1 802.11b/g/n

- 5.2.2 802.11ac

- 5.2.3 802.11ax

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Netgear Inc.

- 6.1.2 D-Link Corporation

- 6.1.3 TP-Link Technologies Co. Ltd

- 6.1.4 Linksys Group (Foxconn)

- 6.1.5 TRENDnet Inc.

- 6.1.6 Synology Inc.

- 6.1.7 AsusTek Computer Inc.

- 6.1.8 Google Inc.

- 6.1.9 Nokia Networks

- 6.1.10 Xiaomi Inc.