|

시장보고서

상품코드

1641941

하이브리드 복합재료 : 시장 점유율 분석, 산업 동향과 통계, 성장 예측(2025-2030년)Hybrid Composites - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

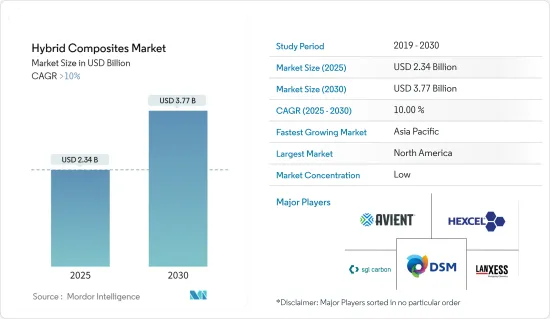

하이브리드 복합재료 시장 규모는 2025년에 23억 4,000만 달러로 추정되며, 예측기간(2025-2030년)의 CAGR은 10%를 넘어 2030년에는 37억 7,000만 달러에 달할 것으로 예측되고 있습니다.

COVID-19의 대유행이 하이브리드 복합재료 시장에 미치는 영향은 긍정적 측면과 부정적 측면 모두 존재했습니다. 코로나19 팬데믹은 단기적인 어려움을 야기했지만, 동시에 하이브리드 복합재의 잠재력을 부각하고 장기적인 성장에 기여할 수 있는 트렌드를 촉발했습니다.

락다운이나 여행 제한으로 원료와 완제품의 흐름이 끊어져 생산 지연이나 재료 부족으로 이어졌습니다. 항공우주, 자동차, 풍력에너지 등 하이브리드 복합재료에 크게 의존하는 산업은 여행 제한과 경기 감속으로 인해 상당한 경기 침체로 인해 물자 수요가 감소했습니다. 반면에 팬데믹은 의료기기와 장비에서 첨단재료의 필요성을 부각시켰고, 인공장비, 임플란트, 수술기구에 생체적합성 하이브리드 복합재료의 비즈니스 기회를 만들어 냈습니다.

주요 하이라이트

- 경자동차 부문에서 복합재료의 채용이 확대되고 있어, 종래의 복합재료에 비해 하이브리드 복합재료가 나타내는 뛰어난 특성이 조사 대상 시장의 주요 촉진요인이 되고 있습니다.

- 반면, 하이브리드 복합재료의 가공과 제조는 복잡하고 노동 집약적인 기술을 수반하는 경우가 많아 비용을 증가시켜 조사 대상 시장의 성장 억제요인이 될 수 있습니다.

- 복합재 제조를 위한 자동화, 디지털화, 부가제조 기술의 탐구는 공정을 간소화하고, 비용을 절감하고, 제품 일관성을 개선할 수 있으며, 세계 시장에 유리한 기회를 제공할 수 있습니다.

- 아시아태평양은 중국의 높은 수요로 예측 기간 동안 가장 높은 성장률을 보일 것으로 예상됩니다.

하이브리드 복합재료 시장 동향

탄소/유리가 시장을 독점

- 가장 일반적으로 사용되는 하이브리드 복합재료는 유리 섬유 강화 폴리머(GFRP) 복합재료와 탄소섬유 강화 폴리머(CFRP) 복합재료로, 아라미드 섬유와 천연섬유로 강화된 복합재료가 이어집니다.

- 탄소섬유와 유리 섬유의 하이브리드 재료는 자동차, 운송, 건축, 건설 및 기타 산업 시장에서 기존의 유리 섬유 및 금속 용도를 대체하는 경량의 고강도 대체 재료입니다.

- 이 하이브리드 재료는 고성능 유리 섬유와 비슷한 비용으로 탄소섬유의 성능 이점을 설명합니다.

- 하이브리드 복합재료는 자동화 및 고속 제조 공정에 대한 응용이 증가하고 있으며 자동차 및 기타 부문의 대량 생산 요구에 부응하고 있습니다.

- OICA(Organisation Internationale des Constructeurs d'Automobiles)에 따르면 2022년에는 전 세계 약 8,501만 대의 자동차가 생산되었으며, 2021년 8,020만 5,000대에 비해 5.99%의 성장률을 보였습니다. 2022년에는 전 세계적으로 약 6,000만대의 승용차가 생산되어 2021년에 비해 7.35% 가까이 증가했습니다.

- 이용 사례는 탄소섬유를 사용하는 것보다 훨씬 낮은 비용으로 탄소 이점의 최대 90%를 얻을 수 있습니다.

- 이 하이브리드 복합재료로 만든 부품은 높은 강도 대 중량비를 제공하며 부식이 없습니다. 수명도 길고 유지 보수도 적습니다. 그 특수한 특성은 안전성과 강도를 가장 중시하는 용도의 요구에 부합합니다.

- 건축 및 건설 부문에서는 많은 복합재 제품과 용도가 독특한 특성(내식성, 단열성, 경량성 등) 덕분에 점점 더 많은지지를 얻고 있습니다. 콘크리트 보강용 복합 철근부터 창틀용 인발형재 및 복합 지붕 타일에 이르기까지 복합제품은 보다 지속가능한 설계를 가능하게 할 뿐만 아니라 기존의 건물이나 다리 등의 보수, 업그레이드, 보강에 효과적인 솔루션을 기재하고 있습니다.

- JEC Composites에 따르면 재료 재활용과 재사용에 대한 관심이 높고 복합재료 산업의 주요 기업들은 많은 노력을 하고 있습니다. 예를 들어, 유럽의 풍력 산업은 2025년까지 터빈 블레이드의 100%를 재사용, 재활용 및 회수할 것을 약속합니다.

- 위의 요인들로부터 예측 기간 동안 탄소/유리 섬유 유형이 시장을 독점할 가능성이 높습니다.

아시아태평양 성장률이 가장 높습니다.

- 아시아태평양 인프라 산업은 최근 건전한 성장을 계속하고 있습니다. 그러므로 이 지역은 평가 기간 동안 시멘트 보드 시장에서 엄청난 성장률을 보일 것으로 추정됩니다.

- 아시아태평양에서는 현재 특히 중국, 일본, 대만, 한국, 인도, 말레이시아, 인도네시아, 베트남 등 신흥 경제 국가에서 주택 및 상업시설 건설에 높은 투자가 이루어지고 있습니다.

- JEC Composites에 따르면 앞으로 장기적인 동향은 아시아 신흥국이 경제 성장을 견인하는 형태로 재개될 것입니다. 중국의 성장률은 CAGR 연률 5%를 넘어 유럽과 미국을 상회할 것으로 예상되며 인도, 필리핀, 인도네시아, 말레이시아도 같은 정도의 성장이 예상됩니다. 중기(2021-2026년)에는 복합재료 시장이 모든 지역에서 성장을 재개해야 하며, 특히 아시아(에너지, E&E,...)에서는 장기적 성장 가능성이 여전히 남아 있습니다.

- 자동차 부문에서 다양한 섬유와 수지의 장점을 결합한 이러한 독특한 재료는 경량화, 성능 향상, 연비 개선이라는 최상의 조합을 제공하여 아시아태평양 시장에서 하이브리드 복합재료의 소비 확대로 이어집니다.

- 중국의 자동차 제조 산업은 세계 최대입니다. 이 산업은 2022년에 약간 성장하면서 생산과 판매가 증가했습니다. 같은 동향은 2021년에도 계속되었고, 2022년 생산대수는 3% 증가했습니다. 중국 기차공업협회(CAAM)에 따르면 BYD, SAIC Motors 등의 기업들이 연료주행차와 전기자동차 부문에서 자동차 생산 매출을 늘리고 있으며, 자동차 생산은 앞으로도 성장할 것으로 예상됩니다.

- 중국 기차 산업 협회에 따르면 중국 자동차 제조업체는 2022년 690만대에서 전년에는 약 940만대의 전기자동차와 하이브리드 자동차 판매를 보고할 것으로 예상됩니다. 이 협회는 2024년에도 판매량이 계속 증가해서1,150만대에 달할 것으로 예측했습니다.

- 예를 들어, 중국의 자동차 대기업 BYD는 2023년에 300만대 이상의 배터리 구동 차량을 판매하고 있으며, 그 중 배터리와 가솔린 모두를 동력원으로 하는 완전한 전기자동차가 160만대, 하이브리드 자동차가 140만대입니다. 이는 2022년 대비 62% 증가한 수치입니다. BYD에 따르면 작년 상반기 이익이 15억 달러로 3배 증가했습니다.

- India Today에 따르면 2023년에는 국내 시장에서 410만 8,000대의 자동차가 판매되었습니다. 한 해 동안 400만대를 넘은 것은 이것이 처음입니다. 2022년 판매량은 379만 2,000대였습니다. 인도에서는 Maruti, Hyundai, Tata, Honda, Mahindra와 같은 선도적 인 자동차 제조업체가 판매 잔여 재고를 위해 생산을 중단했습니다. 이것은 가까운 미래에 인도의 자동차 생산에 큰 악영향을 미칠 것으로 예상됩니다.

- 중국은 세계 최대의 의료 부문 중 하나입니다. 13차 5개년 계획에서 중국 정부는 건강과 기술 혁신을 우선시하고 있으며 예측 기간 동안 의료기기 제조 부문에 대한 투자가 증가할 것으로 예상됩니다. 게다가 COVID-19가 발생함에 따라 이 나라에서는 의료 부문 투자가 점차 확대되고 있습니다.

- 하이브리드 복합재료는 경우에 따라 강철을 능가하는 매우 우수한 강도 대 중량비를 달성 할 수 있습니다. 따라서 내하중 구조물, 교량, 내진 건축물에 이상적입니다.

- 중국의 성장은 주택 및 상업 건축 부문의 급속한 확장과 중국 경제 확대에도 힘입은 바가 큽니다. 중국은 지속적인 도시화 과정을 장려하고 견디며 2030년까지 그 비율은 70%를 나타낼 것으로 예상됩니다. 그 결과, 중국과 같은 국가에서의 건축 활동의 활성화가 이 지역의 접착제 산업에 박차를 가할 것으로 예측되고 있습니다. 이러한 모든 요인은 전체 지역의 접착제 수요를 증가시키는 경향이 있습니다.

- 중국국가통계국에 따르면 건설생산액은 2021년 29조 3,100억 위안(4조 2,000억 달러)에서 증가하고, 2022년에는 31조 2,000억 위안(4조 5,000억 달러)을 차지합니다. 게다가 주택,도시,농촌개발성의 예측에 따르면 중국의 건설 부문은 2025년 이후에도 GDP의 6%를 유지할 것으로 예상되고 있습니다.

- Invest India에 따르면 인도 건설 산업은 2025년까지 1조 4,000억 달러에 이를 것으로 예상되고 있으며, 인도 건설 산업은 250개 하위 부문에 걸쳐 연계되어 있으며 PMAY-U의 기술 제출 하에 확인된 54개 이상의 세계 혁신 건설 기술이 인도 건설 부문에 새로운 시대를 열 것입니다.

- 또한 아시아, 북미, 태평양의 왕성한 수요로 인해 한국 건설업체의 해외건축수주는 2022년 3년 연속 300억 달러를 돌파했습니다.

- 이 모든 요인은 인구, 도시화 및 구매력 증가로 인해 지역에서 계속 증가하고 있습니다. VOC 배출에 관한 규제는 현재 아시아태평양의 여러 지역에서 시행되고 있으며, 이는 섬유 시멘트 플레이트(FCB) 및 시멘트 접착 입자 보드(CBPB)와 같은 시멘트 플레이트의 사용을 촉진할 수 있습니다.

- 따라서 위의 요인들로부터 아시아태평양은 예측 기간 동안 가장 높은 성장을 이룰 가능성이 높습니다.

하이브리드 복합재료 산업 개요

하이브리드 복합재료 시장은 적당히 세분화되어 있습니다. 주요 진출기업(특정 순서 없음)에는 LANXESS, DSM, Avient Corporation, Hexcel Corporation, SGL Carbon 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 성과

- 조사의 전제

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 경자동차 부문에서 복합재 사용 증가

- 특정의 하이브리드차가 복수의 위협으로부터 몸을 지킨다

- 기타 촉진요인

- 억제요인

- 높은 가공·제조 비용

- 지속가능성과 환경에 미치는 영향에 대한 우려

- 산업 밸류체인 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 진입업자의 위협

- 대체품의 위협

- 경쟁도

제5장 시장 세분화(금액 베이스 시장 규모)

- 섬유 유형

- 탄소/유리

- 카본/아라미드

- HMPP/카본

- 목재/플라스틱

- 기타 섬유 유형(천연섬유, 현무암 섬유 등)

- 수지 유형

- 열경화성 수지

- 열가소성 수지

- 기타 수지 유형(PEEK(폴리에테르에테르케톤) 등)

- 최종 사용자 산업

- 자동차 및 운송

- 건설 인프라

- 항공우주 및 방위

- 해양

- 기타 최종 사용자 산업(스포츠 용품, 의료 등)

- 지역

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 말레이시아

- 태국

- 인도네시아

- 베트남

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 노르딕

- 터키

- 러시아

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 콜롬비아

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 나이지리아

- 카타르

- 이집트

- 아랍에미리트(UAE)

- 중동 및 아프리카의 나머지 지역

- 아시아태평양

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 시장 점유율(%)**/랭킹 분석

- 주요 기업의 전략

- 기업 프로파일

- Avient Corporation

- DSM

- Gurit Services AG

- Hexcel Corporation

- Huntsman International LLC

- KINECO-KAMAN

- LANXESS

- Mitsubishi Chemical Carbon Fiber and Composites, Inc.

- RTP Company

- Owens Corning

- SABIC

- SGL Carbon

- Simcas Composites

- Solvay

- TEIJIN LIMITED

- Textum OPCO, LLC

- Toray Advanced Composites

제7장 시장 기회와 앞으로의 동향

- 다양한 시장에서의 하이브리드 복합재료의 채용 확대

- 복합재료 제조의 자동화, 디지털화, 적층 조형 기술의 탐구

The Hybrid Composites Market size is estimated at USD 2.34 billion in 2025, and is expected to reach USD 3.77 billion by 2030, at a CAGR of greater than 10% during the forecast period (2025-2030).

The impact of the COVID-19 pandemic on the hybrid composites market was mixed. While it presented immediate challenges, it also highlighted the potential of these materials and triggered trends that could contribute to long-term growth.

Lockdowns and travel restrictions disrupted the flow of raw materials and finished products, leading to production delays and material shortages. Industries heavily reliant on hybrid composites, such as aerospace, automotive, and wind energy, experienced significant downturns due to travel restrictions and economic slowdown, dampening demand for material. On the flip side, the pandemic highlighted the need for advanced materials in medical devices and equipment, creating opportunities for biocompatible hybrid composites in prosthetics, implants, and surgical instruments.

Key Highlights

- The growing adoption of composite materials in the light vehicle sector and compared to traditional composites, better properties exhibited by hybrid composites in comparison to the traditional composites is a major driving factor for the market studied.

- On the flip side, the processing and manufacturing of hybrid composites often involve complex and labor-intensive techniques, driving up costs and may act as a hindrance to the growth of the market studied.

- Exploring automation, digitalization, and additive manufacturing techniques for composite production can streamline processes, reduce costs, and improve product consistency can provide lucrative opportunities in the global market.

- Asia-Pacific is expected to witness the highest growth rate during the forecast period owing to the high demand from China.

Hybrid Composites Market Trends

Carbon/Glass to Dominate the Market

- The most commonly used hybrid composites are glass fiber-reinforced polymer (GFRP) and carbon fiber-reinforced polymer (CFRP) composites, followed by composites reinforced by aramid or natural fibers.

- Hybrid carbon fiber/glass fiber material is a lightweight and high-strength alternative for traditional fiberglass and metal applications in the automotive & transportation, building & construction, and other industrial markets.

- The hybrid material offers the performance benefits of carbon fiber at a cost similar to high-performance fiberglass.

- Increased application of hybrid composites in automation and fast-paced manufacturing processes meet mass production requirements in automotive and other sectors.

- According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), in 2022, around 85.01 million vehicles were produced across the globe, witnessing a growth rate of 5.99% compared to 80.205 million vehicles in 2021, thereby indicating an increased demand for metal hoses from the automotive industry. In 2022, around 60 million passenger cars were manufactured worldwide, up nearly 7.35% compared to 2021.

- Users can get up to 90% of carbon's benefits at a cost much lower than what they would have to incur in case of using carbon fiber.

- Parts made out of these hybrid composites provide a high strength-to-weight ratio and are devoid of corrosion. These have extended service life, requiring less maintenance. Their particular properties meet the needs of applications that lay utmost importance on safety and strength.

- In building and construction, many composite products and applications are gaining more and more traction thanks to their unique properties (e.g., corrosion resistance, insulation, lightweight). From composite rebars for reinforcing concrete to pultruded profiles for window frames and composite roofing tiles, composite products not only enable more sustainable designs but also provide an effective solution to repair, upgrade, or strengthen existing buildings, bridges, etc.

- As per JEC Composites, interest in recycling and reusing materials is high, and key players in the composites industry are involved in many initiatives. The application sectors are also setting ambitious goals in this area, e.g., Europe's wind industry is committing to reusing, recycling, or recovering 100% of turbine blades by 2025.

- Owing to the factors mentioned above, carbon/glass fiber type is likely to dominate the market during the forecast period.

Asia-Pacific to Witness the Highest Growth Rate

- The infrastructure industry in Asia-Pacific has been growing at a healthy rate in recent times. Hence, it is estimated that the region will witness a tremendous growth rate in the cement board market over the assessment period.

- The Asia-Pacific region is currently experiencing high investments in residential and commercial construction, especially in China, Japan, Taiwan, and South Korea, and in developing economies such as India, Malaysia, Indonesia, and Vietnam.

- According to JEC Composites, In the future, long-term trends should resume, with economic growth driven by emerging Asia: China's growth is expected to exceed 5% CAGR per annum, higher than Europe and the US; India, Philippines, Indonesia, and Malaysia should grow at a comparable rate. In the mid-term (2021-2026), the composites market should resume growth in all regions, and there is still substantial potential for long-term growth, especially in Asia (energy, E&E, ...).

- In automotive, these unique materials, combining the strengths of various fibers and resins, offer a winning combination of lightweight, enhanced performance, and improved fuel efficiency, leading to increased consumption of hybrid composites in the Asia-Pacific market.

- The Chinese automotive manufacturing industry is the largest in the world. The industry witnessed a slight growth in 2022, wherein production and sales increased. A similar trend continued in 2021, with production witnessing a 3% incline in 2022. According to the China Association of Automobile Manufacturers (CAAM), automotive production is expected to grow in the future, with companies like BYD, SAIC Motors, and more increasing their automotive production sales in the fuel-run and electric vehicles segment.

- According to the China Association of Automobile Manufacturers, Chinese automakers are anticipated to report sales of approximately 9.4 million electric vehicles and hybrids in the previous year, up from 6.9 million in 2022. The association further projects a continued increase in sales for 2024, reaching 11.5 million units.

- For Example, China's automotive giant BYD sold over 3 million battery-powered cars in 2023, of which both batteries and gasoline power 1.6 million fully electric vehicles and another 1.4 million hybrids. Together, that is a 62 percent increase over 2022. BYD is also making money, tripling its profit to USD 1.5 billion in the first half of last year, according to BYD.

- According to India Today, 4,108,000 cars were sold in the domestic market in 2023. This was the first time during a calendar year that over 4 million units were sold in the country. In 2022, the industry witnessed sales of 3,792,000 units. In India, major automotive manufacturers, like Maruti, Hyundai, Tata, Honda, and Mahindra, have shut down their production owing to the unsold stock. This is expected to have a substantial negative impact on India's automotive production in the near future.

- China has one of the largest healthcare sectors in the world. Under the 13th Five-Year Plan, the Government of China prioritized health and innovation, which is expected to increase investments in the medical device manufacturing sector during the forecast period. Additionally, due to the COVID-19 outbreak, investment in the healthcare sector has been gradually growing in the country.

- Hybrid composites can achieve exceptional strength-to-weight ratios, exceeding even steel in some cases. This makes them ideal for load-bearing structures, bridges, and earthquake-resistant buildings.

- China's growth is also fueled by rapid expansion in the residential and commercial building sectors and the country's expanding economy. China is encouraging and enduring a continuous urbanization process, with a projected rate of 70% by 2030. As a result, increased building activity in nations like China is projected to fuel the region's adhesive industry. All such factors tend to increase the demand for adhesives across the region.

- According to the National Bureau of Statistics of China, the value of construction output accounted for CNY 31.2 trillion (USD 4.5 trillion) in 2022, up from CNY 29.31 trillion (USD 4.2 trillion) in 2021. Moreover, as per the forecast given by the Ministry of Housing and Urban-Rural Development, China's construction sector is expected to maintain a 6% share of the country's GDP going into 2025.

- As per Invest India, the construction industry in India is expected to reach USD 1.4 Trillion by 2025, and the construction industry in India works across 250 sub-sectors with linkages across sectors and over 54 global innovative construction technologies identified under a Technology Sub-Mission of PMAY-U to start a new era in Indian Construction Sectors.

- Furthermore, South Korean builders' overseas building orders have surpassed 30 billion US dollars for the third consecutive year in 2022, owing to strong demand from Asia, North America, and the Pacific Ocean regions.

- All of these factors will be supported by the ever-increasing population in the region, urbanization, ion, and their increasing purchasing power. Regulations related to VOC emissions are currently being implemented in many regions of Asia-Pacific, and this might also drive the usage of cement boards such as fiber cement board (FCB) and cement bonded particleboard (CBPB).

- Hence, owing to the factors mentioned above, Asia-Pacific is likely to witness the highest growth during the forecast period.

Hybrid Composites Industry Overview

The hybrid composites market is moderately fragmented in nature. The major players (not in any order) include LANXESS, DSM, Avient Corporation, Hexcel Corporation, and SGL Carbon, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Use of Composite Material in Light Vehicle Segment

- 4.1.2 Specific Hybrids offer Multi-threat Protection

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 High Processing and Manufacturing Costs

- 4.2.2 Concerns about Sustainability and Environmental Impact

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size In Value)

- 5.1 Fiber Type

- 5.1.1 Carbon/Glass

- 5.1.2 Carbon/Aramid

- 5.1.3 HMPP/Carbon

- 5.1.4 Wood/Plastic

- 5.1.5 Other Fiber Types (Natural Fibers, Basalt Fibers, etc.)

- 5.2 Resin Type

- 5.2.1 Thermoset Resins

- 5.2.2 Thermoplastic Resins

- 5.2.3 Other Resin Types (PEEK(Polyether Ether Ketone), etc.)

- 5.3 End-user Industry

- 5.3.1 Automotive and Transportation

- 5.3.2 Construction and Infrastructure

- 5.3.3 Aerospace and Defense

- 5.3.4 Marine

- 5.3.5 Other End-user Industries (Sporting Goods, Medical, etc.)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 NORDIC

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle-East & Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Nigeria

- 5.4.5.4 Qatar

- 5.4.5.5 Egypt

- 5.4.5.6 UAE

- 5.4.5.7 Rest of Middle-East & Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Avient Corporation

- 6.4.2 DSM

- 6.4.3 Gurit Services AG

- 6.4.4 Hexcel Corporation

- 6.4.5 Huntsman International LLC

- 6.4.6 KINECO - KAMAN

- 6.4.7 LANXESS

- 6.4.8 Mitsubishi Chemical Carbon Fiber and Composites, Inc.

- 6.4.9 RTP Company

- 6.4.10 Owens Corning

- 6.4.11 SABIC

- 6.4.12 SGL Carbon

- 6.4.13 Simcas Composites

- 6.4.14 Solvay

- 6.4.15 TEIJIN LIMITED

- 6.4.16 Textum OPCO, LLC

- 6.4.17 Toray Advanced Composites

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Adoption of Hybrid Composites into Various Markets

- 7.2 Exploring Automation, Digitalization, and Additive Manufacturing Techniques for Composite Production