|

시장보고서

상품코드

1641946

실리콘카바이드전력반도체 시장 점유율 분석, 산업 동향과 통계, 성장 예측(2025-2030년)Silicon Carbide Power Semiconductor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

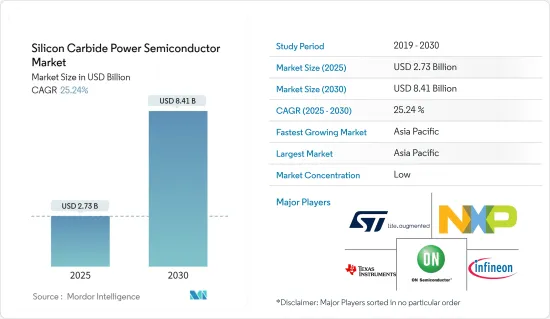

실리콘 카바이드 파워 반도체 시장 규모는 2025년에 27억 3,000만 달러로 추정되며, 예측 기간(2025-2030년)의 CAGR은 25.24%로, 2030년에는 84억 1,000만 달러에 달할 것으로 예측되고 있습니다.

팬데믹의 발생은 세계의 중소,대규모 산업에 경제적 혼란을 가져왔습니다. 제조업의 대부분은 생산성을 높이기 위해 사람들이 밀접하게 접촉하는 공장 현장에서의 작업을 포함하기 때문입니다.

주요 하이라이트

- SiC(실리콘 카바이드)는 밴드 갭이 넓기 때문에 고출력 용도로 사용되고 있습니다. SiC에는 다양한 폴리 유형(다형)이 존재하지만 4H-SiC는 파워 디바이스에 가장 이상적입니다. 재료 능력 향상을 목표로 하는 R&D 활동 증가는 시장 성장의 강력한 원동력이 될 것으로 예상됩니다. 예를 들어, 미국 에너지부(DOE)의 Advanced Research Projects AgencyEnergy(ARPA-E)는 Creation Innovative and Reliable Circuits Using Inventive Topologies and Semiconductors(CIRCUITS) 프로그램의 일환으로 21개 프로젝트에 3,000만 달러의 자금 제공을 발표했습니다. 또한 SiC 파워 일렉트로닉스의 제조 비용 절감을 목표로 하는 NREL 주도 연구에 대한 미국 DOE 투자와 같은 이니셔티브는 이러한 추세를 더욱 향상시키고 보다 견고한 SiC 기반 디바이스의 범위를 확대할 수 있습니다.

- 전기자동차는 자동차 산업에서 항속거리, 충전시간, 성능 향상 등 고객의 기대에 부응하는 일정한 이점을 기재하고 있습니다. 그러나 전기자동차에는 고온에서 효율적이고 효과적으로 작동하는 전력 전자 장치가 필요합니다. 따라서 와이드 밴드갭 SiC 기술을 이용한 파워 모듈의 개발이 진행되고 있습니다.

- 전기자동차는 가격 하락과 항속거리가 늘어남에 따라 오늘날에는 흔히 사용되고 있습니다. 국제에너지기구의 보고서 Global EV 전망 2021에 따르면 2020년에는 1,020만대 이상의 소형 전기승용차가 도로를 달리고 있었습니다. 또한 전기차 등록 대수는 2020년에 41% 증가하여 시장에 성장 기회를 가져오고 있습니다.

- 반도체는 또한 에너지 손실을 줄이고 태양에너지와 풍력에너지의 전력 변환기를 긴 수명화하기 위해 SiC를 사용합니다. 예를 들어, 태양광 에너지는 주로 효율, 전력 밀도 및 신뢰성을 높이기 위해 고출력, 저손실, 고속 스위칭 및 고신뢰성 반도체 장치가 필요합니다. 따라서 SiC 디바이스는 증가하는 에너지 수요를 충족시키기 위한 태양광 에너지 요구사항에 대한 유망한 솔루션을 기술하고 있습니다.

- 클린텍 수요가 가져올 가능성을 활용하기 위해 여러 기업이 SiC 파워 반도체 시장에 진출하고 있습니다. 예를 들어, 2021년 4월, 뉴욕 주립대학 폴리테크닉 랩(SUNY Poly)에서 스핀오프한 NoMIS Power Group은 SiC 파워 반도체 디바이스, 모듈 및 전력 관리 제품 개발자에게 지원을 제공하는 서비스를 설계, 제조 및 판매할 계획이라고 발표했습니다.

- 또, SiC 파워 반도체는 고주파가 되면 기생 용량이나 인덕턴스가 커져, 본래의 성능을 발휘할 수 없게 됩니다. 이러한 점에서 SiC의 보급에는 제조 설비의 갱신이 필요할 가능성이 있어, 현재의 개발 페이스에서는 실현할 수 없습니다.

실리콘 카바이드 파워 반도체 시장 동향

자동차산업이 큰 성장을 기록할 전망

- 자동차 파워트레인 내에서 실리콘 카바이드(SiC) 디바이스의 사용에 관한 조사 활동이 진행되고 있습니다. 그러나 최근의 발전으로 점차 실현 가능한 솔루션이 되고 있습니다. 예를 들어, 빠른 충전 솔루션을 채택한 Tesla는 현재 SiC를 자동차 아키텍처에 사용하고 있습니다. 게다가 전기차는 가격이 하락하고 항속거리가 늘어나기 때문에 최근에는 일반적으로 되고 있습니다. 국제에너지기구(IEA)에 따르면 2021년 전 세계 플러그인 전기차 판매량은 약 660만대에 달할 전망입니다.

- SiC 반도체는 플러그인 하이브리드 자동차(PHEV) 및 완전 전기자동차(EV)에서 사용되는 자동차 충전기 및 인버터와 같은 용도에 이상적입니다. 그 에너지 효율은 기존 실리콘에 비해 훨씬 높기 때문입니다.

- 또한 EV가 장거리를 주행하고 합리적인 시간 프레임 내에서 충전할 수 있도록 하려면 차량의 파워 일렉트로닉스가 고온에 대응할 수 있어야 합니다. SiC 반도체는 95% 이상의 에너지 효율이라는 장점이 있습니다. 고출력 급속 충전기에 의한 충전 등 전력 변환 시 열로 손실되는 에너지는 불과 5%입니다.

- 일본에서는 도쿄대학이 Mitsubishi Electric Corporation과 공동으로 SiC 반도체 디바이스의 신뢰성 향상을 위해 노력하고 있습니다. 이에 앞서 Mitsubishi Electric은 하이브리드 자동차용으로 설계된 새로운 초소형 SiC 인버터를 공개해 2021년경의 양산화를 목표로 하고 있습니다.

- 또한 Delphi Technologies와 Cree는 제휴하여 Cre의 SiC MOSFET을 결합한 전자 인버터를 개발했습니다. 이를 통해 하이브리드 자동차 및 완전 전기자동차의 항속 거리 연장을 지원하는 고출력을 가능하게 하면서 전체 파워 모듈의 온도를 크게 줄였습니다. 또한 이러한 인버터는 경쟁 모델보다 40% 가볍고 30% 컴팩트합니다.

- 또한 Infineon Technologies는 2021년 5월 자동차용 CoolSiC MOSFET 기술을 탑재한 새로운 파워 모듈을 발표했습니다. Si 대신 SiC를 사용하여 전기자동차 컨버터의 고효율화를 실현하고 있습니다. 예를 들어 현대차그룹은 인피니언의 CoolSiC 파워모듈을 탑재한 트랙션 인버터를 통해 Si 기반 솔루션에 비해 이 SiC 솔루션의 저손실로 인한 효율 향상으로 차량의 항속거리를 5% 이상 늘릴 수 있었습니다고 보고했습니다.

- 게다가 2021년 3월 영국 정부는 영국 연구,이노베이션 주도의 산업 전략 챌린지 기금의 일환으로서 실리콘 카바이드(SiC) 파워 반도체 디바이스를 제조해, 수송, 가정, 산업용의 보다 효율적인 파워 일렉트로닉스를 작성해, 국가가 넷 제로의 야망을 달성할 수 있도록 돕습니다.

아시아태평양이 가장 빠른 성장을 보이고 있습니다.

- 아시아태평양은 세계의 SiC 파워 반도체 시장을 독점하고 있으며, 이는 세계 반도체 시장의 성장과 관련이 있으며 정부 시책에도 뒷받침됩니다. 게다가 이 지역의 반도체 산업은 중국, 대만, 일본, 한국이 견인하고 있으며, 이들을 합치면 세계의 반도체 시장의 약 65%를 차지합니다. 이와는 대조적으로 태국, 베트남, 싱가포르, 말레이시아 등도 이 지역 시장 지배에 크게 기여하고 있습니다.

- 인도 전자 반도체 협회에 따르면 인도의 반도체 부품 시장은 2025년까지 323억 5,000만 달러 규모가 되고, CAGR은 10.1%(2018-2025년)가 될 것으로 예상되고 있습니다. 이 나라는 세계의 연구개발센터에 유리한 진출처입니다. 따라서 정부가 진행하는 Make In India 이니셔티브는 반도체 시장에 대한 투자로 이어질 것으로 기대됩니다.

- 또한, 이 지역은 전자의 허브이며, 기타 국가로의 수출과 이 지역의 소비를 위해 매년 수백만 개의 전자 기기를 생산하고 있습니다. 이러한 전자부품 및 전자기기의 높은 생산량은 조사 대상 시장 점유율에 크게 기여하고 있습니다. 예를 들어 인도의 소비자 전자기기 수요 증가도 이 지역 시장 성장을 가속하고 있습니다. IBEF에 따르면 인도의 전자기기 하드웨어에 대한 수요는 2024년도까지 4,000억 달러에 달할 것으로 예상되며, 이는 시장 성장을 더욱 촉진합니다.

- 중국은 세계 최대의 전력 생산국입니다. 이 나라의 에너지 수요는 증가하고 그 결과 에너지 생산량도 증가할 것으로 예상됩니다. 예를 들어 IEA에 따르면 중국에서는 전기차 판매 대수가 2배 이상으로 증가하고 있으며, 2021년에는 기타 국가보다 약 330만대 많은 전기차가 판매됩니다.

- 중국에서는 자동차 산업이 증가하고 있으며 세계 자동차 시장에서 점점 더 중요한 역할을 하고 있습니다. 중국 정부는 자동차 부품 부문을 포함한 자동차 산업을 기간 산업의 하나로 자리 매김하고 있습니다. 정부는 중국의 자동차 생산량이 2020년까지 3,000만대, 2025년까지 3,500만대에 이를 것으로 전망하고 있습니다.

- 또한 인도에서는 정부의 야심찬 계획과 노력으로 전기자동차 시장이 기세를 늘리고 있습니다. 인도의 공공기관은 지난 몇 년간 전기차 관련 시책을 발표하고 있으며, 이 나라에서 전기차의 보급에 대한 강한 헌신, 구체적인 행동, 큰 야심을 보여주고 있습니다.

실리콘 카바이드 파워 반도체 산업 개요

실리콘 카바이드 파워 반도체 시장의 경쟁은 치열합니다. Infineon Technologies AG, Texas Instruments Inc., ST Microelectronics NV, Hitachi Power Semiconductor Device Ltd., NXP Semiconductor, 후지 전기, Semikron International GmbH, Cre Inc., ON Semiconductor Corporation, Mitsubishi Electric Corporation 등입니다. 이 회사들은 시장 점유율을 확대하기 위해 신제품을 투입, 제휴 및 인수합니다.

- 2021년 6월 - 일본의 일렉트로닉스 기업인 Hitachi는 힐즈버러에서 기존의 존재를 확대하고 미국의 제조 고객과 협력하여 신기술을 창출하기 위한 대규모 반도체 실험실을 건설할 계획을 발표.

- 2021년 4월 - Infineon TechnologiesAG는 1200V 제품 라인에 새로운 EasyPACK 2B 모듈을 출시했습니다. 이 모듈은 CoolSiC MOSFET, TRENCHSTOP IGBT7 디바이스, NTC 온도 센서, PressFIT 접촉 기술 핀을 포함한 3레벨 액티브 NPC(ANPC) 토폴로지를 제공합니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업 밸류체인 분석

- 산업의 매력 - Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 진입업자의 위협

- 경쟁 기업간 경쟁 관계

- 대체품의 위협

- 시장에 대한 COVID-19의 영향

- 기술 스냅샷

제5장 시장 역학

- 시장 성장 촉진요인

- 소비자 일렉트로닉스와 무선 통신 수요 증가

- 에너지 효율이 높은 배터리 구동 휴대 기기에 대한 수요 증가

- 시장의 과제

- 실리콘 웨이퍼의 부족과 구동 요건의 변화

제6장 시장 세분화

- 최종 사용자 산업별

- 자동차(xEV 및 EV 충전 인프라)

- IT 및 통신

- 전력(전원, UPS, PV, 풍력 등)

- 산업용(모터 드라이브)

- 기타 최종 사용자 산업(철도, 석유 및 가스, 군사, 의료, 연구 개발 등)

- 지역별

- 아메리카

- 유럽, 중동 및 아프리카

- 아시아태평양

제7장 경쟁 구도

- 기업 프로파일

- Infineon technologies AG

- UnitedSiC

- ST Microelectronics NV

- ON Semiconductor Corporation

- GeneSiC Semiconductor Inc.

- Danfoss A/S

- Microsemi Corporation

- Toshiba Corporation

- Mitsubishi Electric Corporation

- Fuji Electric Co. Ltd

- Semikron International

제8장 투자 분석

제9장 시장의 미래

SHW 25.02.19The Silicon Carbide Power Semiconductor Market size is estimated at USD 2.73 billion in 2025, and is expected to reach USD 8.41 billion by 2030, at a CAGR of 25.24% during the forecast period (2025-2030).

The pandemic outbreak created economic turmoil for small, medium, and large-scale industries worldwide. Adding to the woes, the country-wide lockdown inflicted by the governments across the globe (to minimize the spread of the virus) further resulted in industries taking a hit and disruption in supply chain and manufacturing operations across the world, as a large part of manufacturing includes the work on the factory floor, where people are in close contact as they collaborate to boost the productivity.

Key Highlights

- SiC (Silicon Carbide) is used for high-power applications due to the wide bandgap offered. While various polytypes (polymorphs) of SiC exist, 4H-SiC is the most ideal for power devices. The increase in R&D activities that target enhanced material capabilities is expected to provide a strong impetus for market growth. For instance, the United States Department of Energy's (DOE) Advanced Research Projects AgencyEnergy (ARPA-E) has announced a funding of USD 30 million for 21 projects as part of the Creating Innovative and Reliable Circuits Using Inventive Topologies and Semiconductors (CIRCUITS) program. Also, initiatives such as investment by US DOE for NREL-Led research with an intent to reduce SiC power electronics manufacturing costs could further support such trends and expand the scope of more robust SiC-based devices.

- Electric vehicles provide certain advantages within the automotive industry, such as increased range, charge-time, and performance, to meet customer expectations. However, they require power electronic devices capable of efficient and effective operation at elevated temperatures. Hence, power modules are being developed using wide-bandgap SiC technologies.

- Electric cars are becoming common on the road nowadays with prices coming down and range going up. As per the International Energy Agency's report Global EV Outlook 2021, over 10.2 million light-duty electric passenger cars were on the roads in 2020. In addition, electric car registration increased by 41% in 2020, which creates growth opportunities for the market.

- Semiconductors also use SiC for reduced energy loss and longer life solar and wind energy power converters. For instance, photovoltaic energy mainly requires high power, low loss, faster switching, and reliable semiconductor devices to increase efficiency, power density, and reliability. Thus, SiC devices provide a promising solution to photovoltaic energy requirements to meet the increasing energy demand.

- To tap the potential brought by the demand for cleantech, several players are entering the market for SiC power semiconductors. For instance, in April 2021, NoMIS Power Group, a spin-off from the State University of New York Polytechnic Institute (SUNY Poly), announced that it plans to design, manufacture and sell SiC power semiconductor devices, modules, and services for providing support to power management product developers.

- Moreover, parasitic capacitance and inductance become too great as soon as high frequencies are used, preventing the SiC-based power device from realizing its full potential. In such a regard, widespread usage of SiC may require updates to manufacturing facilities, something which cannot be achieved at the current pace of development.

Silicon Carbide Power Semiconductor Market Trends

Automotive Industry is Expected to Register Significant Growth

- Research activities are being conducted into the usage of silicon carbide (SiC) devices within automotive powertrains. However, due to recent advancements, it is gradually becoming a feasible solution. For instance, Tesla, which uses a rapid charging solution, is already using SiC within their vehicle architectures currently. In addition, electric cars are becoming common on the road nowadays with prices coming down and range going up. According to the International Energy Agency, plug-in electric light vehicle sales across the globe reached around 6.6 million in 2021.

- SiC semiconductors are ideal for applications, such as onboard chargers and inverters, being used within the plug-in hybrid (PHEV) and fully electric vehicles (EVs). This is because their energy efficiency is significantly higher compared to traditional silicon.

- Also, to ensure that EVs can operate over long distances and charge within a reasonable timeframe, the vehicle's power electronics must be capable of handling high temperatures. SiC semiconductors benefit from more than 95% energy efficiency. Only 5% of energy is lost as heat during power conversion, such as recharging the vehicle with a high-power rapid-charger.

- In Japan, the University of Tokyo has been working with Mitsubishi Electric Corporation to enhance the reliability of SiC semiconductor devices. Earlier, Mitsubishi Electric revealed a new ultra-compact SiC inverter designed for hybrid vehicles, with mass commercialization targeted around 2021.

- Moreover, Delphi Technologies and Cree have partnered to create the former's inverters, combined with Cree's SiC MOSFETs. It has significantly reduced the power module's overall temperature while enabling higher power outputs to support an extended range for hybrid and fully electric automobiles. These inverters are also 40% lighter and 30% more compact than competing models.

- Further, in May 2021, Infineon Technologies launched a new power module with CoolSiC MOSFET technology for automotive applications. The use of SiC instead of Si ensures higher efficiency in converters in electric vehicles. For example, Hyundai Motor Group reported that it was able to increase the range of its vehicles by more than 5% because of efficiency gains resulting from the lower losses of this SiC solution compared to the Si-based solution, with the help of the traction inverters based on Infineon's CoolSiC power module.

- Moreover, in March 2021, as part of the Industrial Strategy Challenge Fund led by the UK Research and Innovation, the UK government awarded GBP 4.8 million to Swansea University to manufacture silicon carbide (SiC) power semiconductor devices and create more efficient power electronics for transportation, homes, and industry, and help the nation achieve its net-zero ambitions.

Asia Pacific to Witness the Fastest Growth

- The Asia Pacific dominates the global SiC power semiconductor market, pertaining to global semiconductor market growth, which is also supported by government policies. Furthermore, the region's semiconductor industry is driven by China, Taiwan, Japan, and South Korea, which together account for around 65% of the global discrete semiconductor market. In contrast, others like Thailand, Vietnam, Singapore, and Malaysia also contribute significantly to the region's dominance in the market.

- According to the Indian Electronics and Semiconductor Association, India's semiconductor component market is expected to be worth USD 32.35 billion by 2025, displaying a CAGR of 10.1% (2018-2025). The country is a lucrative destination for worldwide R&D centers. Therefore, the government's ongoing Make In India initiative is expected to result in investments in the semiconductor market.

- Moreover, the region is an electronics hub that produces millions of electronic devices every year for exporting to other countries and consumption in the area. This high production of electronic components and devices largely contributes to the market share of the studied market. For instance, the increasing demand for consumer electronics in India has also facilitated the regional market's growth. According to IBEF, demand for electronics hardware in India is expected to reach USD 400 billion by FY2024, which will further drive market growth.

- China is the world's largest producer of electricity. The country's energy demand is expected to increase, thereby resulting in growth in energy production. For instance, according to the IEA, in China, sales of electric vehicles have more than doubled; further, in 2021, it sold approximately 3.3 million more electric cars than in other countries.

- The automotive industry has been increasing in China, and the country is playing an increasingly important role in the global automotive market. The Government of China sees its automotive industry, including the auto parts sector, as one of its pillar industries. The government expects China's automobile output to reach 30 million units by 2020 and 35 million units by 2025.

- Further, the electric vehicle market is gaining momentum in India, owing to the government's ambitious plans and initiatives. Public authorities in India have made several electric vehicle-related policy announcements over the past few years, showing strong commitment, concrete action, and significant ambition to deploy electric vehicles in the country.

Silicon Carbide Power Semiconductor Industry Overview

The silicon carbide power semiconductor market is highly competitive. It consists of several significant players, including Infineon Technologies AG, Texas Instruments Inc., ST Microelectronics NV, Hitachi Power Semiconductor Device Ltd, NXP Semiconductor, Fuji Electric Co. Ltd, Semikron International GmbH, Cree Inc., ON Semiconductor Corporation, Mitsubishi Electric Corporation, and others. These companies are introducing new products, partnerships, and acquisitions, to increase their market share.

- June 2021 - Hitachi, a Japanese electronics company, announced plans to extend its existing presence in Hillsboro by building a big semiconductor research lab to cooperate with manufacturing clients in the United States to create new technologies.

- April 2021 - Infineon Technologies AG launched a new EasyPACK 2B module to its 1200 V product line. The module offers a three-level Active NPC (ANPC) topology, including CoolSiC MOSFETs, TRENCHSTOP IGBT7 devices, NTC temperature sensor, and PressFIT contact technology pins.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

- 4.4 Impact of COVID-19 on the Market

- 4.5 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in the Demand for Consumer Electronics and Wireless Communications

- 5.1.2 Growing Demand for Energy-Efficient Battery-Powered Portable Devices

- 5.2 Market Challenges

- 5.2.1 Shortage of Silicon Wafers and Variable Driving Requirements

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 Automotive (xEVs and EV Charging Infrastructure)

- 6.1.2 IT and Telecommunication

- 6.1.3 Power (Power Supply, UPS, PV, Wind etc.)

- 6.1.4 Industrial (Motor drives)

- 6.1.5 Other End-user Industries (Rail, Oil & Gas, Military, Medical, R&D etc.)

- 6.2 By Geography

- 6.2.1 Americas

- 6.2.2 Europe, Middle East and Africa

- 6.2.3 Asia Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Infineon technologies AG

- 7.1.2 UnitedSiC

- 7.1.3 ST Microelectronics NV

- 7.1.4 ON Semiconductor Corporation

- 7.1.5 GeneSiC Semiconductor Inc.

- 7.1.6 Danfoss A/S

- 7.1.7 Microsemi Corporation

- 7.1.8 Toshiba Corporation

- 7.1.9 Mitsubishi Electric Corporation

- 7.1.10 Fuji Electric Co. Ltd

- 7.1.11 Semikron International