|

시장보고서

상품코드

1642024

ASEAN 국가의 창고 및 유통 물류 시장 : 시장 점유율 분석, 산업 동향, 성장 예측(2025-2030년)ASEAN Warehousing And Distribution Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

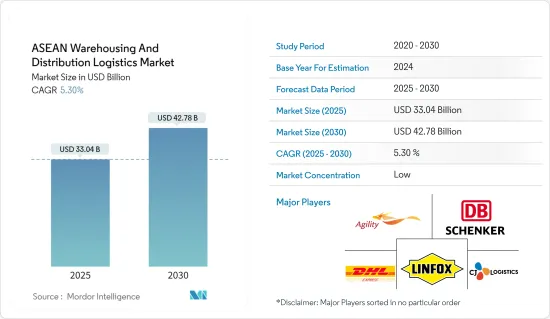

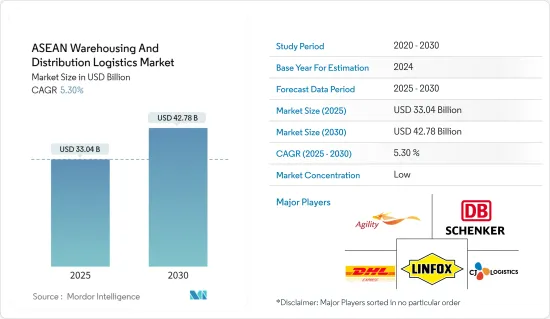

ASEAN 국가의 창고 및 유통 물류 시장 규모는 2025년에 330억 4,000만 달러로 추정되고, 예측 기간(2025-2030년)의 CAGR은 5.3%로 전망되며, 2030년에는 427억 8,000만 달러에 달할 것으로 예측됩니다.

세계에서 가장 급성장하고 있는 경제의 하나인 동남아시아는 세계무역, 대내투자, 밸류체인에 대한 지역적 및 세계적 통합에 의한 광범위한 경제 성장모델의 혜택을 받고 있습니다. 그러나 이 성장세를 지속시키기 위해서는 지역의 경제적, 사회적 회복력을 강화하기 위한 몇 가지 개혁이 필요합니다. 이러한 개혁에는 혁신, 생산성 및 효율성을 촉진하기 위해 경쟁 및 시장 진입에 대한 규제 장벽을 낮추는 것이 포함됩니다.

전자상거래 부문의 급성장으로 ASEAN의 창고 및 유통 물류는 급성장할 것으로 예상됩니다. 라스트원 마일 물류에 대한 높은 수요와 급속히 발전하는 교통 인프라는 ASEAN의 창고 및 유통 물류 시장의 개척에 공헌하고 있습니다. 이 지역의 외자계 기업의 존재인 Adapt와 Grow &Go Digital 같은 정부의 이니셔티브는 물류 산업의 성장과 더불어 이 지역의 창고 및 유통 시장의 성장을 가속하고 있습니다. 싱가포르는 ASEAN의 주요 국가 중 하나입니다. 그 지리적 위치와 강력한 화물 및 물류 비즈니스에 의해 이 지역에서 가장 급성장하고 있는 국가의 하나입니다. 이 지역의 대기업은 창고 인프라에 많은 돈을 투자하고 있습니다.

주로 전자상거래 성장으로 인해 일부 지역에서는 창고 수요가 증가하고 있습니다. 전년 대여창고와 대여공장 개발을 전문으로 하는 BW(베트남 No.1 대여공장 개발회사)는 전례없는 의뢰를 받았습니다. BW의 장기 개발 전략을 통해 제조업 수요 증가와 전자상거래의 폭발적인 성장에 대응하기 위해 가볍고 현대적인 산업용 창고를 건설함으로써 이러한 단기적인 기회를 효과적으로 이용할 수 있었습니다.

냉장 창고에 대한 수요가 높아지면서 기업은 공급망 전략을 조정해야 합니다. 산업 보고서에 따르면 외국인 투자자들은 도시화 과정과 소매 근대화의 혜택을 누리며 베트남의 대도시가 신선한 식품을 얻는 방법을 바꾸기 때문에 베트남에서 냉장 창고 건설에 점점 관심을 보이고 있습니다. 대망의 론타인 국제공항 건설과 같은 대규모 인프라 투자와 개발로 인해 공급망은 앞으로 더욱 효율적일 것으로 예상됩니다.

ASEAN 국가의 창고 및 유통 물류 시장 동향

태국의 창고 공간 증가

창고는 단순한 창고가 아닙니다. 저스트 인 타임의 포장, 조립, 제품의 커스터마이즈 등, 부가 가치가 높은 업무가 행해지고 있습니다. 지난 5년간 태국에서는 전자상거래가 놀라운 성장을 이루고 있습니다. 전자상거래 창고의 집적지역은 방콕의 배너 트랏 거리를 따라 15km에서 23km 사이에 있습니다.

태국에서는 최근 몇 년동안 소매 시장이 크게 성장하고 있습니다. 전국적으로 조직형 소매업과 현대적인 쇼핑이 꾸준히 증가하고 있습니다. 태국 국민의 가처분 소득이 증가하고, 젊은이의 인구가 많아 관광산업이 활황을 보이고 있기 때문에 많은 외국 브랜드가 태국에 진출하고 있습니다. 이것은 창고 서비스 증가로 이어집니다.

태국에서는 예측기간 중 수출 산업의 호전과 국내 소매업의 회복을 주인으로 하는 완만한 경기회복에 따라 임대 창고 사업자의 사업 확대가 이어질 것으로 예상됩니다. 신규 공급에 대한 투자는 향후 3년간 증가하는 경향이 있습니다. 주요 사업자가 이 최전선에 서게 되어 일부 지방 시장에서는 공급 과잉이 생겨 가격 경쟁이 격화되어 사업자의 임대 인상 능력이 제한되게 됩니다.

현재 대부분의 사업자는 현대적인 창고 솔루션을 제공하기 위해 시설의 현대화를 진행하고 있으며, 그 결과 고객 기반을 확대하고 추가 서비스를 통해 수익을 올릴 수 있습니다. 진출기업은 또한 산업 표준(예 : LEED 체계)을 충족하도록 창고 건물을 업그레이드하고, 에너지 효율과 환경 보호에 투자하고, 홍수와 지진과 같은 자연 재해에 대한 내성을 높이는 시설을 설치하는 등 다른 수단으로 시설을 현대화하고 있습니다. 창고는 바닥 면적과 천장 면적을 확대하여 물품의 이동 속도와 용이성을 높입니다.

전자상거래 성장이 시장을 견인하는 ASEAN 국가

동남아시아의 전자상거래의 현재 단계는 단순히 가치를 높이는 것 이상입니다. 이 지역의 소비자들은 다양한 채널을 통해 보다 폭넓은 제품을 온라인으로 구매하게 되었습니다. 이 지역공급망은 이러한 수요 증가에 대응하기 때문에 새로운 물류 능력이 필요할 가능성이 높습니다. 이미 이러한 능력을 가지고 있는 기업도, 새롭게 참가하는 기업도, 이러한 변화로부터 가장 혜택을 받게 된다고 생각됩니다.

동남아시아는 다양한 발전 단계에 있는 경제 국가의 패치워크와 같은 퀼트이며, 전자상거래의 보급률이 국가마다 다르다는 것은 당연합니다. 인도네시아와 싱가포르는 이 지역의 전자상거래 보급률의 약 30%를 차지하고 있으며, 필리핀, 태국, 베트남은 각각 약 15%로 이를 이탈하고 있습니다. 동남아시아 최대 경제대국인 인도네시아는 대규모 소비자 시장으로 인해 이 지역의 GMV 성장의 51%를 차지하고 있습니다.

동남아시아 전자상거래 시장이 다음 성장 단계로 전환함에 따라 고객은 모든 상품 카테고리와 채널에서 더 많은 디지털 구매를 할 수 있을 뿐만 아니라 새롭고 선진적인 물류 솔루션에 더 많은 요구와 결제를 할 것입니다. 반면, 판매자는 중국에서 수입품에 대한 의존도를 낮추고 공급망의 전환에 따라 조달 경로를 더 많은 동남아시아 국가로 확대할 것으로 예상됩니다. 그 결과, 보다 폭넓은 가치 믹스에 액세스하기 위해 업스트림 기능을 확장하는 것이 고려되고, 물류 제공업체에게 더 많은 채널이 열립니다.

ASEAN 국가의 창고 및 유통 물류 산업 개요

ASEAN 국가의 창고 및 유통 물류 시장은 부문화되어 있으며, 많은 진출기업이 신흥국 시장의 중요한 위치를 차지하고 있습니다. 인도네시아와 필리핀과 같이 ASEAN 지역의 일부 국가는 완만하게 성장하고 있으며, 많은 지역 진출기업과 일부 국제 진출기업이 존재합니다. 그러나 싱가포르, 베트남, 태국은 매우 경쟁이 치열한 시장이며, 다수의 국제적인 진출기업들이 존재하고 있습니다. CEVA, Yusen Logistics, Kerry Logistics, DHL은 이 지역에 진출한 대기업 중 하나입니다. 전자상거래와 국제무역으로부터의 압력이 높아짐에 따라 진입기업은 이 지역에 많은 창고를 개발할 수 있었습니다. 장기적인 국내 존재로 현지 참가 기업과 유통업체는 국제 참가 기업과 경쟁할 수 있게 되었습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

- 분석 방법

- 조사 단계

제3장 주요 요약

제4장 시장 역학 및 인사이트

- 현재의 시장 시나리오

- 시장 역학

- 성장 촉진요인

- 주요 입지에의 전략적 창고 배치가 중요한 역할 담당

- 전자상거래 증가로 창고 공간 증가

- 억제요인

- 물류 및 창고 시장은 경쟁이 심하고, 국내외의 참가 기업 존재

- 세금, 허가, 라이선스 요건 등 복잡한 규제 프레임워크이 진입 장벽이 될 가능성 존재

- 기회

- 자동화는 미래의 창고를 구축하는데 중요한 역할 담당

- 성장 촉진요인

- 산업의 매력-Porter's Five Forces 분석

- 밸류체인 및 공급망 분석

- ASEAN 국가의 정부 규제

- 창고의 기술 개발

- 창고 임대에 관한 인사이트

- 일반 창고업에 관한 인사이트

- 위험물 창고에 관한 인사이트

- 냉장 창고에 관한 인사이트

- 전자상거래의 성장 효과에 대한 인사이트

- 프리존과 공업단지에 대한 인사이트

- COVID-19가 시장에 미치는 영향

제5장 시장 세분화

- 지역별

- 싱가포르

- 태국

- 말레이시아

- 베트남

- 인도네시아

- 필리핀

- 기타 ASEAN 국가

제6장 경쟁 구도

- 기업 프로파일

- DHL Supply Chain

- Ceva Logistics

- CJ Century Logistics

- DB Schenker

- Agility

- Linfox

- Kuehne Nagel

- Yusen Logistics

- Kerry Logistics

- CWT Ltd

- Gemadept

- Tiong Nam Logistics

- Ych Group

- Singapore Post

- WHA Corporation

- Keppel Logistics*

- 기타 기업(주요정보 및 개요)

제7장 향후의 동향 및 기회

제8장 부록

AJY 25.02.20The ASEAN Warehousing And Distribution Logistics Market size is estimated at USD 33.04 billion in 2025, and is expected to reach USD 42.78 billion by 2030, at a CAGR of 5.3% during the forecast period (2025-2030).

As one of the world's fastest-growing economies, Southeast Asia has benefitted from a broad-based economic growth model based on global trade, inward investment, and regional and global integration into value chains. However, sustaining this growth momentum will necessitate several reforms to strengthen the region's economic and social resilience. These reforms will include lowering regulatory barriers to competition and market entry to promote innovation, productivity, and efficiency.

Warehousing and distribution logistics in ASEAN are expected to experience rapid growth due to the rapid growth of the e-commerce sector. The high demand for last-mile logistics and the fast-developing transportation infrastructure contribute to the development of ASEAN's warehousing and distribution logistics market. The presence of foreign firms in the region, as well as government initiatives like Adapt and Grow & Go Digital, in addition to the growing logistics industry, is driving the growth of the warehousing and distribution market in the region. Singapore is one of the major countries in ASEAN. With its geographical location and strong freight and logistics business, it is one of the fastest-growing countries in the region. Major players in the region have significantly funded the warehouse infrastructure.

Warehousing demand has been on the rise in some regions, mainly due to the growth of e-commerce. The previous year, BW (Vietnam's #1 Industrial For-Rent Developer), specializing in developing warehouses and factories to rent, received unprecedented requests. BW's long-term development strategy allowed it to take advantage of these short-term opportunities effectively by constructing light and contemporary industrial warehouses to cater to the growing manufacturing demand and the explosion of e-commerce growth.

The demand for cold storage is rising, forcing companies to adjust their supply chain strategies. According to the industry report, foreign investors are increasingly interested in building cold storage facilities in Vietnam to benefit from the urbanization process and retail modernization, changing how Vietnam's big cities get fresh food. The supply chains are expected to become more efficient in the future due to significant infrastructure investment and development, including the construction of the long-awaited Long Thanh International Airport.

ASEAN Warehousing And Distribution Logistics Market Trends

Increase in Warehousing Space in Thailand

Warehouses are not just storage rooms. They house value-added operations such as just-in-time packing, assembly, product customization, etc. Over the past five years, Thailand has seen incredible growth in e-commerce. The e-commerce warehousing cluster is between 15 and 23 km along Bang Na-trat Road in Bangkok.

Thailand has seen massive growth in the retail market in recent years. There has been a steady rise in organized retail or contemporary shopping nationwide. The increasing disposable income of the people in Thailand, the large youth population, and the booming tourism industry have attracted a lot of foreign brands. This has led to an increase in warehousing services.

During the forecast period in Thailand, operators of leased warehouse space will continue to experience business growth in line with a gradual economic upturn, driven mainly by an upturn in the export industry and a recovery in domestic retail. Investment in new supply tends to increase over the next three years. Large players will be at the forefront of this, leading to oversupply in some local markets, increasing competition on pricing, and limiting operators' ability to increase rents.

Currently, the majority of operations are modernizing their facilities to provide modern warehousing solutions, which, in turn, allows them to expand their client base and generate revenue through additional services. Players are also modernizing their facilities through other means, such as upgrading their warehouse buildings to meet industry standards (for example, the LEED scheme), investing in energy efficiency and environmental protection, and installing facilities that enhance resilience to natural disasters, such as flooding and earthquakes. Warehouses have expanded their floor and ceiling space, increasing the speed and ease of goods movement.

E-commerce Growth in the ASEAN Region is Driving the Market

The current phase of e-commerce in Southeast Asia is about more than just increasing value. Consumers in the region increasingly purchase a wider range of products online through various channels. The region's supply chains will likely require new logistics capabilities to meet this growing demand for fulfillment. Those who already possess these capabilities and those new to the market will benefit the most from these changes.

Southeast Asia is a patchwork quilt of economies at various stages of development; it is only natural that e-commerce penetration rates vary from country to country. Indonesia and Singapore account for approximately 30% of the region's e-commerce penetration, with the Philippines, Thailand, and Vietnam trailing at around 15% each. The largest Southeast Asian economy, Indonesia, accounts for 51 of the region's GMV growth due to its large consumer market.

As Southeast Asia's e-commerce market moves into the next phase of growth, customers will make more digital purchases across all product categories and channels, and they will also demand and pay more for new and advanced logistics solutions. On the other hand, merchants will be less reliant on Chinese imports and expand their sourcing channels to more Southeast Asian countries as they migrate their supply chains. As a result, they will look to extend their upstream capabilities to access a wider value mix, which will open up more channels for logistics providers.

ASEAN Warehousing And Distribution Logistics Industry Overview

The warehousing and distribution market in the ASEAN region is fragmented, with many players trying to grab a significant chunk of the developing market. Some of the countries in the ASEAN region, like Indonesia and the Philippines, are moderately growing, with many local players and some international players. However, Singapore, Vietnam, and Thailand are highly competitive markets, with the presence of a large number of international players. CEVA, Yusen Logistics, Kerry Logistics, and DHL are among the major players present in the region. Increasing pressure from e-commerce and international trade has allowed the players to develop many warehouses in the region. Due to the long-term domestic presence, local players and distributors have been able to compete with international players.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMERY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 The strategic placement of warehouses in key locations plays a crucial role

- 4.2.1.2 Warehousing Spaces are Increasing in the region due to the rise in e-commerce

- 4.2.2 Restraints

- 4.2.2.1 The logistics and warehouse distribution market is highly competitive, with both domestic and international players

- 4.2.2.2 Complex regulatory frameworks, including taxes, permits, and licensing requirements, can create barriers to entry

- 4.2.3 Opportunities

- 4.2.3.1 Automation plays a significant role in building the warehouse of the future

- 4.2.1 Drivers

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Government Regulations in ASEAN Countries

- 4.6 Technological Developments in Warehousing

- 4.7 Insights into Warehousing Rents

- 4.8 Insights into General Warehousing

- 4.9 Insights into Dangerous Goods Warehousing

- 4.10 Insights into Refrigerated Warehousing

- 4.11 Insights into the Effects of E-commerce Growth

- 4.12 Insights into Free Zones and Industrial Parks

- 4.13 Impact of COVID-19 on the market

5 MARKET SEGMENTATION

- 5.1 By Geography

- 5.1.1 Singapore

- 5.1.2 Thailand

- 5.1.3 Malaysia

- 5.1.4 Vietnam

- 5.1.5 Indonesia

- 5.1.6 Philippines

- 5.1.7 Rest of ASEAN

6 COMPETITIVE LANDSCAPE

- 6.1 Overview (Market Concentration and Major Players)

- 6.2 Company Profiles

- 6.2.1 DHL Supply Chain

- 6.2.2 Ceva Logistics

- 6.2.3 CJ Century Logistics

- 6.2.4 DB Schenker

- 6.2.5 Agility

- 6.2.6 Linfox

- 6.2.7 Kuehne + Nagel

- 6.2.8 Yusen Logistics

- 6.2.9 Kerry Logistics

- 6.2.10 CWT Ltd

- 6.2.11 Gemadept

- 6.2.12 Tiong Nam Logistics

- 6.2.13 Ych Group

- 6.2.14 Singapore Post

- 6.2.15 WHA Corporation

- 6.2.16 Keppel Logistics*

- 6.3 Other Companies (Key Information/Overview)