|

시장보고서

상품코드

1851775

여객 서비스 시스템 시장 : 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Passenger Service System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

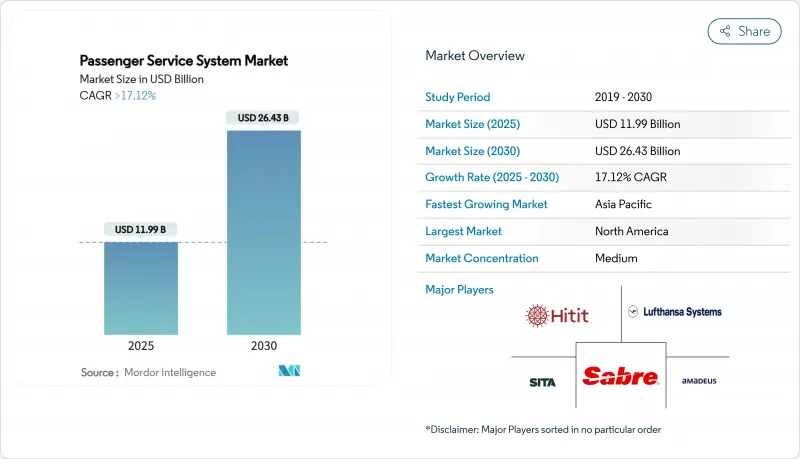

세계의 여객 서비스 시스템 시장 규모는 2025년 119억 9,000만 달러로, 2030년까지 264억 3,000만 달러로 확대될 것으로 예상되며, CAGR은 17.12%로 예상됩니다.

이 활발한 확장은 항공사가 클라우드 네이티브 아키텍처, AI 중심 리테일링, 오퍼 및 주문 관리 플랫폼으로의 전환을 가속화하고 있음을 반영합니다. 항공사는 2024년에 발표된 370억 달러의 기술 예산의 일부를 레거시 인프라 지출을 줄이고 역동적인 수익원을 풀어주는 차세대 여객 서비스 시스템 시장의 업그레이드로 향하고 있습니다. 풀서비스 항공사는 메인프레임에 묶인 용도를 현대화하기 위해 대규모 전환을 수행하는 반면, 저렴한 항공사는 새로운 부대 제품 시장 출시 시간을 단축하는 기동적인 롤아웃을 선도하고 있습니다. 지역별로는 북미의 기존 항공사가 계속 IATA ONE Order를 중심으로 한 표준화를 선도하고 있습니다만, 아시아태평양의 항공사가 가장 강력한 볼륨 업을 실현해 신시스템의 채용률도 높아지고 있습니다. 클라우드 태생의 전문가가 모듈형 API를 기존 여객 서비스 시스템 시장에 통합하여 기존 공급업체가 R&D 및 하이퍼스케일 제공업체와의 전략적 파트너십에 엄청난 투자를 하게 됨에 따라 경쟁이 치열해지고 있습니다.

세계 여객 서비스 시스템 시장 동향과 통찰

항공 여객 수 증가

세계 여객 수는 2025년 52억 명에 달할 것으로 예측되며 레거시 예약 아키텍처에 전례 없는 부하가 걸립니다. United Airlines이 50년 전 메인프레임에서 Amazon Bedrock 지원 스택으로 이동한 것은 항공사가 복잡한 여객 이름 레코드를 일반 언어 객체로 변환하고 탄력적으로 확장하는 방법을 보여줍니다. 방콕의 수완나품과 푸켓과 같은 아시아태평양 공항은 1억 3,000만 명 이상의 여객을 대상으로 하고 있으며, PSS와 연계한 인프라 프로그램에 180억 달러를 투자하고 있습니다. 여객 수가 늘어나면 거래 요구도 늘어나기 때문에 항공사는 실시간 재고 오케스트레이션과 동적 가격 책정이 가능한 클라우드 네이티브 여객 서비스 시스템 시장의 도입을 강요하고 있습니다.

항공사의 IT 스택 전반에 클라우드를 신속하게 도입

항공사의 95%가 클라우드 마이그레이션을 CIO의 최우선 사항으로 꼽고 있으며, 메인프레임에 의존이 없어지면 총 소유 비용이 40% 삭감되어 릴리스 사이클이 단축된다고 합니다. Sabre는 Google Cloud를 채택하여 자체 메인프레임 폐기를 완료하고 연간 운영 비용을 1억 달러 절감하고 개인화된 오퍼를 위한 마이크로서비스를 확보했습니다. Delta Air Lines은 AWS와의 파트너십을 통해 좌석 수준의 가격 결정을 위한 온디맨드 계산 능력을 수익 관리 알고리즘에 장착했습니다. 이러한 움직임을 종합하면 클라우드 네이티브 여객 서비스 시스템 시장의 프레임워크를 채택한 항공사는 측정 가능한 민첩성과 이익률 향상을 얻을 수 있음을 확인할 수 있습니다.

고가의 라이선스 비용 및 이전 비용

종합적인 PSS의 현대화는 대형 항공사에서 1억 달러를 초과할 수 있으며 많은 지역 항공사가 레거시 계약을 폐기하는 것을 망설이고 있습니다. 항공사는 현금흐름에 대한 영향을 억제하기 때문에 3-5년에 걸쳐 전환을 단계적으로 수행하는 경우가 많지만, 컷오버 기간 중에는 이중 비용이 발생합니다. 소규모 항공사는 지배적인 벤더와 유리한 조건을 협상하는 데 어려움을 겪고 있으며, 여객 서비스 시스템 시장 전반에 벤더가 둘러싸여 있습니다. 클라우드의 OPEX 모델은 자본 부담을 어느 정도 상쇄하지만, 고급 오퍼 앤 오더 모듈의 라이선스료는 거래량이 충분히 확대될 때까지 장애물로 남습니다.

부문 분석

여객 서비스 시스템 시장 규모는 2024년 소프트웨어 매출 공헌률이 69.5%임을 뒷받침하고 있습니다. 항공사는 Amadeus Altea 및 SabreSonic과 같은 플랫폼의 핵심 라이선스를 계속 업데이트하고 있지만 컨설팅 및 마이그레이션 지원을 다년간의 서비스 계약에 번들하는 경우가 늘고 있습니다. 서비스 부문의 CAGR이 18.4%에 달하는 것은 항공사가 단순한 구현에 그치지 않고 클라우드 아키텍처 설계, NDC 스키마 매핑, AI 모델 교육을 요구하고 있기 때문입니다. Tier 1 통신 사업자는 현재 공유 코드 기반과 공급업체의 DevOps 부대를 결합한 파트너십을 구축하고 기능 릴리스를 가속화하는 지식을 이전하고 있습니다.

조달 믹스의 변화는 부수적인 수익 증가와 가동 중지 시간을 줄임으로써 측정 가능한 성과 기반 계약에 중심을 부각시킵니다. 공급업체는 업타임 SLA와 지속적인 최적화 사이클을 갖춘 관리형 서비스를 패키징하여 대응합니다. 그 결과, 소프트웨어 수입은 꾸준히 성장하고 있지만, 서비스 중심의 차별화가 경쟁의 템포를 결정하고 있습니다. 고품질 통합 지원을 보장하는 항공사는 마이그레이션 일정을 단축하고 동적 리테일링의 선행자 이익을 이끌어 냅니다.

클라우드 도입은 2024년 여객 서비스 시스템 시장 점유율의 53.2%를 차지했고 CAGR은 18.9%로 선도하고 있습니다. 항공사는 항공권의 발권 매수에 맞게 확장할 수 있고 자본 부담이 큰 데이터센터 업그레이드를 피할 수 있는 OPEX에 따른 구독 모델을 선호합니다. Sabre는 Google Cloud와 전략적 파트너십을 맺고 있으며, 항공사는 On-Premise 인프라를 제공하지 않고 자연 언어 AI API를 활용할 수 있습니다. 유나이티드 항공은 AWS에서 쇼핑 엔진을 리팩토링한 후 복잡한 여정 검색 응답 시간을 초 이하로 단축했다고 보고하고 있으며, 하이퍼스케일 리소스에서만 액세스할 수 있는 운영 개선을 입증했습니다.

On-Premise의 도입은 역사적인 투자와 엄격한 데이터 거주 규칙에 묶인 대서양 횡단 레거시 경력 사이에서 주로 존속합니다. 여기에서도 하이브리드적인 도입을 볼 수 있습니다. 트랜잭션 코어는 대기 시간을 위해 로컬에 배치되고 예측 및 개인화는 클라우드에서 실행됩니다. 클라우드 계약 비율이 증가함에 따라 향후 여객 서비스 시스템 시장 업그레이드가 마이크로서비스 아키텍처를 기본으로 하여 항공사가 대규모 코드 재작성이 아닌 단순한 API 토글을 통해 새로운 모듈(사용료, 혼란 관리, 지속가능성 보고서)을 활성화할 수 있음을 보여줍니다.

지역 분석

북미는 2024년 세계 매출의 33.8%를 차지했으며 클라우드 네이티브 스택의 조기 채용과 Southwest의 17억 달러 현대화 로드맵과 같은 지속적인 투자 프로그램에 힘쓰고 있습니다. 항공사는 지역의 견고한 하이퍼스케일 인프라를 활용하여 AI를 활용한 혁신 관리, 동적 가격정책, 생체인식 탑승을 광범위한 국내 네트워크에 전개하고 있습니다. 하지만 메인프레임의 잔해와 관련된 깊은 커스터마이징은 ONE Order의 전반적인 채용을 늦추고 단기적인 민첩성 향상을 억제하는 단계적 전환 전략을 필요로 합니다. 레거시 메이저가 모듈식 아키텍처를 목표로 하는 한편, 신규 진출기업은 오퍼 & 오더 모델로 직접 이행하고 있습니다.

표준화된 CUPPS와 CUSS 인터페이스를 통합한 공항의 개수에, 각국 정부가 180억 달러 이상을 투입하고 있기 때문입니다. 중간층의 레저 수요 증가와 적극적인 장비 확대가 그린필드 디지털 스택의 비옥한 토양을 만들어 내고 있습니다. Riyadh Air, Vietravel Akasa 등의 항공사는 설립 초기부터 클라우드 네이티브 플랫폼을 채택하여 다른 지역에서 직면하는 메인 프레임의 발판을 피하고 있습니다. 또한, 이 지역의 저렴한 항공권의 급증은 정교하고 보조적인 머천다이징을 촉진하고, 좌석수의 성장만으로는 알 수 없을 정도로 많은 거래를 여객 서비스 시스템 시장에 흘리고 있습니다.

유럽은 옴니 채널과 ESG 기능을 추진하는 엄격한 데이터 보호 및 여객 권리의 틀 덕분에 중요한 혁신 실험실이기도 합니다. British Airways의 Nevio 채용은 오퍼와 오더의 컨버전스를 대륙 전체에서 중시하고 있는 것을 부각하고 있으며, Air France-KLM의 SAS에 대한 과반수 출자 계획은 추가적인 통합과 플랫폼의 조화를 시사하고 있습니다. 한편, 중동 및 아프리카의 일부에서는 레거시 장애물을 제거한 새로운 클라우드 플랫폼을 탑재한 국가 주도 항공사의 출시에 주목을 받고 있습니다. 이러한 역학을 종합하면 규제의 성숙도, 투자 사이클, 여객의 인구통계가 채용 속도와 기능의 초점을 형성하는 다극화된 여객 서비스 시스템 시장이 강화되게 됩니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 및 지원

목차

제1장 서론

- 시장 정의와 조사의 전제

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 항공 여객수 증가

- 항공사 IT 스택에서 클라우드의 급속한 도입

- 부대 수익형 머천다이징에 대한 의욕의 고조

- 원활한 옴니채널 여객 체험의 의무화

- IATA ONE 오더가 엔드 투 엔드의 PSS 업그레이드를 가속

- 공항 CUTE/CUPPS의 일몰이 항공사를 최신 PSS API를 견인

- 시장 성장 억제요인

- 고액의 초기 라이선스 비용과 이행 비용

- Tier-1 캐리어의 레거시 메인프레임 록인

- 국경을 넘어서는 호스팅을 복잡화하는 데이터 주권 규칙의 고조

- 신유통기능(NDC) 통합에서 인재 부족

- 밸류체인 분석

- 중요한 규제 프레임워크의 평가

- 주요 이해관계자의 영향 평가

- 기술의 전망

- Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 거시경제 요인의 영향

제5장 시장 규모와 성장 예측

- 유형별

- 소프트웨어

- 서비스

- 전개별

- On-Premise

- 클라우드

- 용도별

- 예약 관리

- 재고 관리

- 체크인 및 탑승

- 로열티 관리

- 기타

- 항공사 유형별

- 풀 서비스 캐리어

- 저비용 항공사

- 하이브리드 캐리어

- 전세 및 지역 운영자

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 호주 및 뉴질랜드

- 기타 아시아태평양

- 중동 및 아프리카

- 중동

- 사우디아라비아

- 아랍에미리트(UAE)

- 튀르키예

- 기타 중동

- 아프리카

- 남아프리카

- 나이지리아

- 이집트

- 기타 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Amadeus IT Group SA

- Sabre Corporation

- Societe Internationale de Telecommunications Aeronautiques(SITA) NV

- Hitit Bilgisayar Hizmetleri AS

- Radixx International Inc.

- Takeflite Solutions Limited

- Bravo Passenger Solutions Pte. Limited

- Collins Aerospace(Raytheon Technologies)

- Enoyaone Ltd.

- InteliSys Aviation Systems Inc.

- Unisys Corporation

- Videcom International Limited

- Lufthansa Systems GmbH & Co. KG

- Travel Technology Interactive SA

- Navitaire LLC

- Mercator Solutions FZE

- IBS Software Services Pvt. Ltd.

- AeroCRS Ltd.

- TravelSky Technology Limited

- WorldTicket A/S

제7장 시장 기회와 앞으로의 동향

- 화이트 스페이스와 미충족 요구 평가

The Passenger Service System market size stands at USD 11.99 billion in 2025 and is forecast to advance to USD 26.43 billion by 2030, translating into a 17.12% CAGR.

This vigorous expansion reflects airlines' accelerated shift toward cloud-native architectures, AI-driven retailing and offer-and-order management platforms. Airlines are routing part of the USD 37 billion technology budget released in 2024 toward next-generation Passenger Service System market upgrades that cut legacy infrastructure outlays and unlock dynamic revenue streams. Full-service carriers rely on large-scale migrations to modernize mainframe-bound applications, while low-cost carriers spearhead agile roll-outs that shorten time-to-market for new ancillary products. Regionally, North American incumbents continue to lead standardization around IATA ONE Order, yet Asia-Pacific airlines supply the strongest volume uplift and the highest rate of new system adoptions. Competitive intensity rises as cloud-born specialists integrate modular APIs into existing Passenger Service System market deployments, pushing traditional vendors to invest heavily in R&D and strategic partnerships with hyperscale providers.

Global Passenger Service System Market Trends and Insights

Rise in Air-Travel Passengers

Global passenger numbers are projected to reach 5.2 billion in 2025, placing unprecedented load on legacy reservation architectures. United Airlines' migration from 50-year-old mainframes to an Amazon Bedrock-enabled stack shows how carriers now translate complex passenger name records into plain-language objects that scale elastically . Asia-Pacific airports such as Bangkok's Suvarnabhumi and Phuket are targeting over 130 million passengers, prompting USD 18 billion in PSS-aligned infrastructure programs. Larger trip volumes multiply transaction requests, forcing airlines to adopt cloud-native Passenger Service System market deployments capable of real-time inventory orchestration and dynamic pricing.

Rapid Cloud Adoption Across Airline IT Stacks

Ninety-five percent of airlines list cloud migration as a top CIO priority, citing 40% cuts in total cost of ownership and faster release cycles once mainframe dependencies disappear. Sabre completed retirement of its proprietary mainframe in favor of Google Cloud, removing USD 100 million in annual operational costs while unlocking micro-services for personalized offers Delta Air Lines' AWS partnership equips its revenue-management algorithms with on-demand compute power for seat-level pricing decisions. Together, these moves confirm that airlines embracing cloud-native Passenger Service System market frameworks gain measurable agility and margin upside.

High Upfront Licence and Migration Costs

Comprehensive PSS modernization can exceed USD 100 million for a major carrier, discouraging many regionals from abandoning legacy contracts. Airlines often phase migrations over 3-5 years to contain cash-flow shocks, yet still face dual-run expenses during cut-over periods. Smaller operators struggle to negotiate favorable terms with dominant vendors, perpetuating vendor lock-in across the Passenger Service System market. Cloud OPEX models offset some capital burden, but licence fees for sophisticated offer-and-order modules remain a hurdle until transaction volumes scale sufficiently.

Other drivers and restraints analyzed in the detailed report include:

- Growing Appetite for Ancillary-Revenue Merchandising

- IATA ONE Order Accelerating End-to-End PSS Upgrades

- Legacy Mainframe Lock-in Among Tier-1 Carriers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Passenger Service System market size figures underline software's 69.5% revenue contribution in 2024. Airlines continue renewing core licences for platforms such as Amadeus Altea and SabreSonic, yet they increasingly bundle consulting and migration assistance in multi-year service engagements. The services segment's 18.4% CAGR stems from carriers demanding cloud architecture design, NDC schema mapping and AI model training beyond mere implementation. Tier-one carriers now structure partnerships that combine shared code-bases with DevOps squads from suppliers, transferring knowledge that accelerates feature releases.

The changing procurement mix highlights a pivot to outcome-based contracts measurable by ancillary revenue uplift or downtime reduction. Vendors respond by packaging managed services with uptime SLAs and continuous optimization cycles. As a result, software revenues grow steadily, but service-driven differentiation sets the competitive tempo. Airlines that secure high-quality integration support compress migration timelines and unlock early mover gains in dynamic retailing-advantages that ripple through the wider Passenger Service System market.

Cloud deployments claimed 53.2% of the Passenger Service System market share in 2024 and they lead with an 18.9% CAGR. Carriers prefer OPEX-aligned subscription models that scale with ticket volumes and sidestep capital-heavy data-center upgrades. Sabre's strategic partnership with Google Cloud allows airlines to plug into natural-language AI APIs without provisioning on-prem infrastructure. United Airlines reports sub-second response times for complex itinerary searches after refactoring its shopping engine on AWS, demonstrating operational upside accessible only via hyperscale resources.

On-premise installations persist mainly among transatlantic legacy carriers bound by historical investments and strict data-residency rules. Even here, hybrid deployments emerge: transactional cores stay local for latency, while forecasting and personalization run in the cloud. The growing proportion of cloud contracts signals that future Passenger Service System market upgrades will default to micro-service architectures, allowing airlines to activate new modules-loyalty, disruption management, sustainability reporting-through simple API toggles rather than extensive code rewrites.

The Passenger Service System Market Report is Segmented by Type (Software, Services), Application (Reservation and Booking Management, Inventory Management, Check-In and Boarding, and More), Deployment (On-Premise, Cloud), Airline Type (Full-Service Carrier, Low-Cost Carrier, Hybrid Carrier, Charter and Regional Operator), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America controlled 33.8% of global revenue in 2024, propelled by early adoption of cloud-native stacks and sustained investment programs such as Southwest's USD 1.7 billion modernization roadmap. Carriers exploit robust regional hyperscale infrastructure to deploy AI-enhanced disruption management, dynamic pricing and biometric boarding across extensive domestic networks. However, deep customization around mainframe remnants slows down full adoption of ONE Order, requiring phased migration strategies that temper short-term agility gains. The Passenger Service System market now experiences a dual-speed trajectory in the region: legacy majors inch toward modular architectures while newer entrants leapfrog directly to offer-and-order models.

Asia-Pacific is the fastest-growing theatre, posting a 19.5% CAGR as governments pour over USD 18 billion into airport upgrades that embed standardized CUPPS and CUSS interfaces. Rising middle-class leisure demand and aggressive fleet expansion create fertile ground for greenfield digital stacks. Airlines such as Riyadh Air, Vietravel and Akasa opt for cloud-native platforms from inception, avoiding the mainframe drag faced elsewhere. The region's surge in low-cost travel also encourages sophisticated ancillary merchandising, channeling more transactions into the Passenger Service System market than seat growth alone would indicate.

Europe remains a critical innovation lab thanks to stringent data-protection and passenger-rights frameworks driving omni-channel and ESG functionality. British Airways' Nevio adoption highlights a continent-wide emphasis on offer and order convergence, while Air France-KLM's planned majority stake in SAS signals further consolidation and platform harmonization . Meanwhile, the Middle East and parts of Africa attract attention for state-led airline launches equipped with brand-new cloud platforms that sidestep legacy hurdles. Collectively, these dynamics reinforce a multipolar Passenger Service System market in which regulatory maturity, investment cycles and passenger demographics shape adoption speed and functionality focus.

- Amadeus IT Group SA

- Sabre Corporation

- Societe Internationale de Telecommunications Aeronautiques (SITA) N.V.

- Hitit Bilgisayar Hizmetleri A.?.

- Radixx International Inc.

- Takeflite Solutions Limited

- Bravo Passenger Solutions Pte. Limited

- Collins Aerospace (Raytheon Technologies)

- Enoyaone Ltd.

- InteliSys Aviation Systems Inc.

- Unisys Corporation

- Videcom International Limited

- Lufthansa Systems GmbH & Co. KG

- Travel Technology Interactive S.A.

- Navitaire LLC

- Mercator Solutions FZE

- IBS Software Services Pvt. Ltd.

- AeroCRS Ltd.

- TravelSky Technology Limited

- WorldTicket A/S

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Market Definition and Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in air-travel passengers

- 4.2.2 Rapid cloud adoption across airline IT stacks

- 4.2.3 Growing appetite for ancillary-revenue merchandising

- 4.2.4 Mandates for seamless omni-channel passenger experience

- 4.2.5 IATA ONE Order accelerating end-to-end PSS upgrades

- 4.2.6 Airport CUTE/CUPPS sunset pushing airlines to modern PSS APIs

- 4.3 Market Restraints

- 4.3.1 High upfront licence and migration costs

- 4.3.2 Legacy mainframe lock-in among Tier-1 carriers

- 4.3.3 Growing data-sovereignty rules complicating cross-border hosting

- 4.3.4 Talent shortage in New Distribution Capability (NDC) integration

- 4.4 Value Chain Analysis

- 4.5 Evaluation of Critical Regulatory Framework

- 4.6 Impact Assessment of Key Stakeholders

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Impact of Macro-economic Factors

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Software

- 5.1.2 Services

- 5.2 By Deployment

- 5.2.1 On-premise

- 5.2.2 Cloud

- 5.3 By Application

- 5.3.1 Reservation and Booking Management

- 5.3.2 Inventory Management

- 5.3.3 Check-in and Boarding

- 5.3.4 Loyalty Management

- 5.3.5 Others

- 5.4 By Airline Type

- 5.4.1 Full-Service Carrier

- 5.4.2 Low-Cost Carrier

- 5.4.3 Hybrid Carrier

- 5.4.4 Charter and Regional Operator

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amadeus IT Group SA

- 6.4.2 Sabre Corporation

- 6.4.3 Societe Internationale de Telecommunications Aeronautiques (SITA) N.V.

- 6.4.4 Hitit Bilgisayar Hizmetleri A.?.

- 6.4.5 Radixx International Inc.

- 6.4.6 Takeflite Solutions Limited

- 6.4.7 Bravo Passenger Solutions Pte. Limited

- 6.4.8 Collins Aerospace (Raytheon Technologies)

- 6.4.9 Enoyaone Ltd.

- 6.4.10 InteliSys Aviation Systems Inc.

- 6.4.11 Unisys Corporation

- 6.4.12 Videcom International Limited

- 6.4.13 Lufthansa Systems GmbH & Co. KG

- 6.4.14 Travel Technology Interactive S.A.

- 6.4.15 Navitaire LLC

- 6.4.16 Mercator Solutions FZE

- 6.4.17 IBS Software Services Pvt. Ltd.

- 6.4.18 AeroCRS Ltd.

- 6.4.19 TravelSky Technology Limited

- 6.4.20 WorldTicket A/S

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-space and Unmet-need Assessment