|

시장보고서

상품코드

1642096

행동 바이오메트릭스 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Behavioral Biometrics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

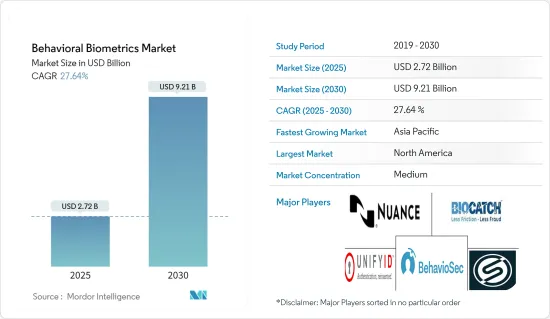

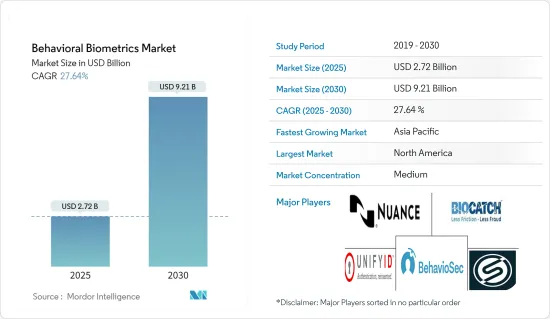

행동 바이오메트릭스 시장 규모는 2025년에 27억 2,000만 달러로 추정되고, 예측기간(2025-2030년)의 CAGR은 27.64%로 전망되며, 2030년에는 92억 1,000만 달러에 달할 것으로 예측됩니다.

최근 COVID-19 팬데믹의 발생으로 세계 조직은 팬데믹 중에 급증한 사이버 위협에 적극적으로 대응해야 했습니다. 따라서 사이버 탄력성(사이버 공격에 대한 대응, 준비, 회복을 위한 부서 및 조직의 능력)은 현재 시나리오에서는 옵션이 아니라 절대적으로 필요합니다.

주요 하이라이트

- 행동 바이오메트릭스는 스마트폰, 태블릿, 마우스 화면 및 키보드와 같은 컴퓨터 장치와의 독특한 관계를 기반으로 개인을 식별하는 차세대 사용자 보안 솔루션을 제공합니다.

- 사용자가 휴대전화를 사용하는 방법, 화면을 스와이프하는 방법, 어떤 키보드 또는 제스처 바로 가기를 사용하는지 등 모든 것을 측정하여 소프트웨어 알고리즘이 고유한 사용자 프로파일을 구축하고 후속 상호작용에서 사용자의 신원을 확인하는 데 사용할 수 있습니다.

- 행동 바이오메트릭스는 비밀번호 및 기타 기존 ID 인증을 대체하지는 않지만 비밀 데이터를 보호하기 위해 비밀번호에 부담을 덜어줍니다. 아무리 강력한 비밀번호라도 비밀이면 안전합니다. 행동 바이오메트릭스는 ID 보증의 추가적이고 지속적인 계층을 제공하여 암호가 보안의 단일 장애 지점이 되는 것을 방지합니다.

- 데이터 유출과 관련된 위협의 수가 증가하고 있습니다. 이는 조직에 상당한 손실을 가져오고 사용자 자격 증명의 유출은 세계 사이버 위협의 주요 원인 중 하나로 강조됩니다.

- 마찬가지로 2020년 IBM의 보고서에 따르면 주요 악의적인 침해는 유출된 자격 증명으로 인해 발생합니다. 게다가 2020년에는 악의적인 침해의 약 19%가 악의적인 공격 뒤에 있는 원인이었습니다.

행동 바이오메트릭스 시장 동향

BFSI의 데이터 유출 증가로 시장 성장을 견인

- 사기와 사이버 범죄가 증가함에 따라 고객 경험이 향상됨에 따라 고객이 위험에 노출되는 것을 방지하는 것이 은행의 가장 중요한 과제입니다. 거의 매일처럼 새로운 위협이 나타나는 동안 해킹과 사기로부터 최종 사용자를 보호하는 대책은 소비자 경험을 해치지 않고 제공되어야 합니다.

- 핀테크 스타트업의 대두와 PSD2(결제 서비스 지령의 개정) 규제가 눈앞에 다가오고, 이 부문에서의 경쟁이 격화하는 가운데, 고객 경험은 점점 중요한 차이가 되고 있으며, 보다 미묘한 접근이 필요해지고 있습니다.

- 젬알트가 위탁한 최근 조사에 따르면 보안 침해가 발생하면 소비자의 44%가 은행을 그만두고 38%가 더 나은 서비스를 제공하는 경쟁업체로 갈아탈 것이라고 답했습니다. 이러한 배경에서 은행 및 기타 금융기관은 바이오메트릭스 기술의 이용에 관심을 갖고 있으며, 보안 및 기술에 대한 전문 지식을 가진 파트너와 전략적으로 협력함으로써 체인의 모든 연결을 안전하게 보호하고 있습니다.

- 대부분의 BFSI 부서는 고객 데이터의 보안을 강화하기 위해이 행동 바이오메트릭스 시장을 도입했습니다. 2019년 National Australian Bank(NAB)는 사기 방지를 위해 행동 바이오메트릭스를 도입했습니다. 또한 Wells Fargo Company는 거래 인증 및 서비스에 액세스하기 위해 고객의 목소리를 활용하는 결제 솔루션을 추진하고 있습니다. 또한 이 회사는 인공지능을 활용하여 iPhone의 Sir 및 Amazon의 Alexa와 같은 대화형 뱅킹을 가능하게 하는 방법을 모색하고 있습니다.

- 미국의 상위 5개 은행 중 하나인 재무부는 최근 바이오캐치 행동 바이오메트릭스 모델을 도입했습니다. 이와 같이 행동 바이오메트릭스 시스템의 채용률이 높아지고 있는 것이 이 시장의 성장을 가속하고 있습니다.

북미가 가장 높은 점유율을 차지

- 북미의 BFSI와 ICT에서는 행동 바이오메트릭스의 채용이 현저하기 때문에 이 지역은 조사 대상 시장에서 큰 점유율을 차지할 것으로 예측되고 있습니다. 이 지역에서는 보안 솔루션에 대한 지출이 증가하고 있습니다. 2019년 미국은 사이버 보안에 150억 달러를 지출할 것이라고 발표했으며, 2018년 대비 5억 8,340만 달러(4.1%) 증가했습니다.

- 사이버 보안 벤처스는 사이버 범죄가 늘어나고 있으며 2021년까지 전 세계에서 연간 6조 달러 이상의 비용이 기업에 소요될 것으로 예측됩니다. 이 추정은 최근 전년 대비 성장, 적대국가가 후원하는 해킹 활동의 극적인 증가, 조직 범죄 집단의 해킹 활동 등 과거의 사이버 범죄 수치를 기반으로 합니다. 이로 인해 예측 기간 동안 사이버 보안 지출이 증가할 수 있습니다.

- 게다가 이 지역 정부는 바이오메트릭스 용도에 강한 관심을 보이고 있습니다. 중요한 공공 부문에서 선진적 행동 바이오메트릭스 애플리케이션을 개발하기 위해 여러 연구 프로그램과 신흥 기업에 적극적으로 자금을 제공합니다. CIRA(Canadian Internet Registration Authority)의 최근 조사에 따르면 2019년에는 71%의 조직이 데이터 침해 행위에 휩쓸리고 있습니다. 게다가 이 조직의 거의 43%는 개인정보보호와 전자문서법(PIPEDA)의 의무적 침해 요건을 알지 못했습니다. 따라서 이러한 사이버 도둑질을 줄이기 위한 정부 캠페인은 이 지역의 행동 바이오메트릭스 시장을 견인하는 것으로 예상됩니다.

행동 바이오메트릭스 산업 개요

행동 바이오메트릭스 시장은 전략적으로 기술 혁신과 새로운 솔루션을 시작하는 데 주력하는 기업으로 구성되며 경쟁은 중간 정도입니다. 각사는 또한 전략적 제휴 및 협업 이니셔티브 및 자금 조달 활동에도 주력하여 제공 제품의 확대와 시장 점유율의 확대를 도모하고 있습니다.

- 2020년 2월-Biocatch Ltd는 AimBrain과의 전략적 인수를 완료하고 전 세계에서 디지털 ID 확인의 지위를 강화합니다. Biocatch에 따르면 이 인수는 사기 감지 능력을 강화하고 사용자에게 더 나은 경험을 제공함으로써 회사의 솔루션을 더욱 심화시킵니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 산업의 매력-Porter's Five Forces 분석

- 신규 진입업자의 위협

- 구매자 및 소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 시장 성장 촉진요인

- 상업 및 정부 부문에서의 바이오메크릭스 기술 용도 확대

- 온라인거래와 부정행위 증가

- 시장 성장 억제요인

- 프라이버시 침해에 대한 우려

- COVID-19가 행동 바이오메트릭스 산업에 미치는 영향

제5장 시장 세분화

- 유형별

- 서명 분석

- 키스트로크 동태

- 음성 인식

- 보행 분석

- 전개별

- 온프레미스

- 온클라우드

- 용도별

- ID 확인 증명

- 지속적 인증

- 리스크 및 컴플라이언스

- 부정 검지 및 방지

- 최종 사용자별

- BFSI

- 소매 및 전자상거래

- 의료

- 정부 및 공공기관

- 기타 산업별 최종 사용자

- 지역별

- 북미

- 유럽

- 아시아태평양

- 기타

제6장 경쟁 구도

- 기업 프로파일

- BioCatch Ltd

- Nuance Communications Inc.

- SecureAuth Corporation

- Mastercard Incorporated(NuData Security)

- BehavioSec Inc.

- Threat Mark SRO

- UnifyID Inc.

- Zighra Inc.

- Plurilock Security Solutions Inc.

- SecuredTouch Inc.

제7장 투자 분석

제8장 시장의 미래

AJY 25.02.20The Behavioral Biometrics Market size is estimated at USD 2.72 billion in 2025, and is expected to reach USD 9.21 billion by 2030, at a CAGR of 27.64% during the forecast period (2025-2030).

With the recent outbreak of the COVID-19 pandemic, organizations across the world must respond proactively to cyber threats that have witnessed a spike during the pandemic. Owing to this, cyber resilience, which refers to a sector or organization's ability to respond to, prepare for, and recover from cyberattacks, has become an absolute necessity rather than an option in the current scenario.

Key Highlights

- Behavioral biometrics provides a new generation of user security solutions that identify individuals based on the unique way they interact with computer devices, such as smartphones, tablets, or mouse-screen-and-keyboard.

- By measuring everything from how the user holds the phone or how they swipe the screen, to which keyboard or gestural shortcuts they use, software algorithms build a unique user profile, which can then be used to confirm the user's identity on subsequent interactions.

- Behavioral biometrics does not replace the password or other legacy forms of identity authentication, but it does reduce the burden placed on them to protect sensitive data. Even the strongest password is only secure so long as it is secret. By offering an additional, continuous layer of identity assurance, behavioral biometrics prevents the password from being a single point of security failure.

- A growing number of threats are associated with the data compromising. This is resulting in significant loss to organizations, and compromising user credentials being highlighted as one of the major causes of global cyber threat.

- Similarly, according to the IBM report in 2020, major malicious breaches were caused by compromised credentials. Moreover, about 19% of all the malicious breaches were the cause behind malicious attacks in 2020.

Behavioral Biometrics Market Trends

Increasing Data Breaches in BFSI will Drive the Growth of this Market

- With the increasing fraud and cybercrime, along with improving the customer experience, preventing customers from being exposed to risk has become a top concern of banks' agendas. With new threats emerging almost daily, measures to protect end-users from hacking and fraud have to be delivered without jeopardizing the consumer experience.

- With the rise of fintech start-ups and the imminent PSD2 (Revised Payment Service Directive) regulations set to increase competition in the sector, the customer experience is becoming an increasingly important differential, so a more nuanced approach is necessary.

- A recent study commissioned by Gemalto showed that 44% of consumers would leave their bank in the event of a security breach, and 38% would switch to a competitor offering a better service. It has driven the interest of banks and other financial institutions in using biometric technology for which they are strategically working with partners who have the security and technology expertise to ensure every link in the chain is protected.

- Most of BFSI sectors are implementing this behavioral biometric market to increase the security of their customer's data. In 2019, National Australian Bank(NAB) implemented behavioral biometrics for fraud prevention. Additionally, Wells Fargo Company is working on a payment solution that will make use of the voice of its customers to authenticate transactions and access services. Further, the company is exploring how it can leverage artificial intelligence to make it able to perform conversational banking, much like iPhone's Sir or Amazon's Alexa.

- The Treasury arm, One of the top five banks of the United States, recently deployed Biocatch's behavioral biometric modality, which can able to detect 95% of all malware cases with a false positive rate of less than 0.05%. This increasing adoption rate of behavioral biometric systems is driving the growth of this market.

North America to Hold Highest Share

- Owing to the significant adoption of behavioral biometrics in BFSI and ICT in North America, the region is anticipated to hold a substantial share in the market studied. The area is witnessing an increase in spending on security solutions. In 2019, the United States announced to spend USD 15 billion for cybersecurity, a USD 583.4 million (4.1 %) increase over 2018.

- Cybersecurity Ventures predicts cybercrime would continue rising and cost businesses globally more than USD 6 trillion annually by 2021. The estimate is based on historical cybercrime figures, including recent year-over-year growth, a dramatic increase in the hostile nation state-sponsored, and organized crime gang hacking activities. This would increase cybersecurity spending over the forecast period.

- Furthermore, the government across the region has taken a keen interest in biometric applications. It is aggressively funding multiple research programs and startups to develop advanced behavioral biometrics applications in crucial public sector departments. According to a recent survey by CIRA (Canadian Internet Registration Authority), 71 percent of organizations are suffered from data breach activities in 2019. Additionally, almost 43 % of those organizations were unaware of the mandatory breach requirements of the Personal Information Protection and Electronic Documents Act (PIPEDA). Hence the government campaigns to reduce these cyber thefts will drive the market of behavioral biometrics for this region.

Behavioral Biometrics Industry Overview

The behavioral biometrics market is moderately competitive, consisting of players strategically focusing on innovation and new solution launches. The companies are also focusing on strategic partnership & collaboration initiatives and fund-raising activities to expand their offerings and increase their market share.

- Feb 2020 - Biocatch Ltd completed its strategic acquisition with AimBrain to enhance its digital identity position in all over the world. According to the Biocatch, this acquisition will deepen its solution by enhancing its fraud detection capabilities and by also providing a better experience to its users.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters 5 Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Market Drivers

- 4.3.1 Growth in Applications of Biometric Technology in the Commercial and Government Sectors

- 4.3.2 Increase in Online Transactions and Fraudulent Activities

- 4.4 Market Restraints

- 4.4.1 Privacy Intrusion Concerns

- 4.5 Impact of COVID-19 on the Behavioral Biometrics Industry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Signature Analysis

- 5.1.2 Keystroke Dynamics

- 5.1.3 Voice Recognition

- 5.1.4 Gait Analysis

- 5.2 Deployment

- 5.2.1 On-premise

- 5.2.2 On-cloud

- 5.3 Application

- 5.3.1 Identity Proofing

- 5.3.2 Continuous Authentication

- 5.3.3 Risk and Compliance

- 5.3.4 Fraud Detection and Prevention

- 5.4 End-User

- 5.4.1 BFSI

- 5.4.2 Retail and E-commerce

- 5.4.3 Healthcare

- 5.4.4 Government and Public Sector

- 5.4.5 Other End-user Verticals

- 5.5 Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia Pacific

- 5.5.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 BioCatch Ltd

- 6.1.2 Nuance Communications Inc.

- 6.1.3 SecureAuth Corporation

- 6.1.4 Mastercard Incorporated (NuData Security)

- 6.1.5 BehavioSec Inc.

- 6.1.6 Threat Mark SRO

- 6.1.7 UnifyID Inc.

- 6.1.8 Zighra Inc.

- 6.1.9 Plurilock Security Solutions Inc.

- 6.1.10 SecuredTouch Inc.