|

시장보고서

상품코드

1651042

오프쇼어 파이프라인 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Offshore Pipeline - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

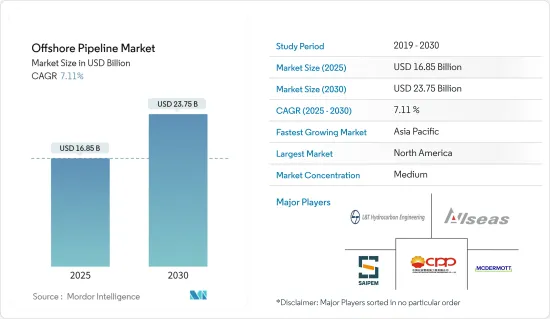

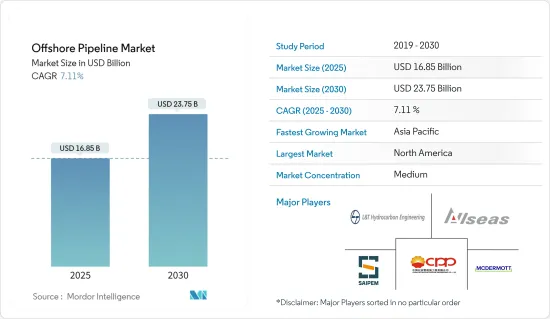

오프쇼어 파이프라인 시장 규모는 2025년에 168억 5,000만 달러로 추정되고, 예측 기간 중(2025-2030년) CAGR은 7.11%로 전망되며, 2030년에는 237억 5,000만 달러에 이를 것으로 예측됩니다.

장기적으로는 특히 아시아태평양으로부터의 원유 및 천연가스 수요 증가나 석유 및 가스 탐사에 있어서의 안전성, 경제성 및 신뢰성이 높은 접속성의 중시의 고조 등의 요인이 예측 기간중 시장을 견인할 것으로 예상됩니다.

한편, 건설, 심해에서의 과제, 건설 비용의 높이 등의 기술적 과제는 시장의 성장을 억제할 것으로 예상됩니다.

유럽과 아시아태평양에서는 오프쇼어 파이프라인을 통한 석유 및 가스의 수입이 증가하고 있으며, 예측 기간 동안 오프쇼어 파이프라인 시장에 큰 비즈니스 기회가 생길 것으로 기대되고 있습니다.

미국과 캐나다로 견인되는 북미는 해양 탐사 활동의 활성화로 예측 기간 동안 오프쇼어 파이프라인 시장을 독점할 가능성이 높습니다.

오프쇼어 파이프라인 시장 동향

가스 부문이 큰 성장을 이룰 전망

- 천연가스 수요가 증가함에 따라 새로운 가스전의 발견과 해저 파이프라인을 이용한 심플하고 저비용 천연가스 수출수송의 채용이 진행되어, 이것이 오프쇼어 파이프라인 시장을 견인할 것으로 예상됩니다.

- 2022년 세계 천연가스 생산량은 4조 438억 입방미터를 기록했습니다. 북미가 천연가스 생산량의 톱으로 약 1조 2,039억 입방미터, 그 다음 중동 및 아프리카의 9,703억 입방미터가 되고 있습니다. 이것은 예측 기간 동안 오프쇼어 파이프라인 시장을 견인할 것으로 예상됩니다.

- 2022년 9월 독일에 위치한 EUROPIPE는 북미 TC 에너지(TCE)에서 멕시코만 사우스 이스트 게이트웨이 파이프라인 프로젝트에 대한 파이프 공급 계약을 수주했습니다. TCE는 멕시코 남동부의 전력 공급을 보장하기 위해 멕시코 국영 전력 회사 Comision Federal de Electricidad(CFE)와 공동으로 45억 달러의 해상 가스 파이프라인을 건설하고 있습니다. 이 프로젝트는 잘츠기터 만네스만(Salzgitter Mannesmann)과 딜린저 하텐베르케(Aktien-Gesellschaft der Dillinger Huttenwerke)의 합작회사인 유로파이프(EUROPIPE)가 8월 말에 수주했습니다. 이 프로젝트의 범위는 방청 코팅이 적용된 26만 5,000톤(365킬로미터)의 파이프를 공급하는 것입니다.

- 게다가 2023년 1월, 에니는 동지중해의 이집트 해안에 있는 나르기스 해안구의 나르기스-1 시굴에서 새롭게 중요한 가스 발견을 보고했습니다. 나르기스-1 갱정은 수심 1,014피트(309m)로 드릴링되었으며 순 약 200피트(61m)의 중신세와 점신세의 가스 함유 사암을 만났습니다. 이 발견은 Eni의 현재 시설을 활용하여 개발할 수 있습니다.

- 게다가 최근의 비용 절감 파도와 중요한 기술적 획기적인 덕분에 많은 석유, 가스 탐사 및 생산 회사들이 지속가능 심해 및 초심해 개발로 다각화할 수 있게 되었습니다.

- 그 결과, 오프쇼어 파이프라인 시장은 가까운 미래에 급속히 확대될 것으로 예상됩니다. 전술한 결과, 가스 부문은 예측 기간 동안 빠른 속도로 성장할 것으로 예상됩니다.

북미가 시장을 독점할 전망

- 예측 기간 동안 북미는 세계의 오프쇼어 파이프라인 시장을 독점할 것으로 예상됩니다. 이 지역의 일부 국가는 석유 및 가스의 해양 탐사에 투자하려고 합니다. 예측 기간 동안 미국과 캐나다와 같은 국가의 석유 및 가스 파이프라인 인프라는 전체 가동을 유지할 것으로 예상됩니다.

- 멕시코만에서의 활동이 활발해지고 있기 때문에 미국의 오프쇼어 파이프라인 시장은 크게 확대될 것으로 예상됩니다. 향후 예정된 새로운 가스 생산 프로젝트를 통해 이 지역의 해저 파이프라인 네트워크는 크게 확대될 것으로 예상됩니다.

- 예를 들어 2023년 1월 휴스턴에 본사를 두고 있는 Talos Energy는 미국 멕시코만의 2개 심해에서 상업량의 석유 및 천연 가스를 발견하고 람파웰 텐션 레그 플랫폼(TLP)에 대한 해저 타이백으로 개발할 예정입니다. 미국에 따르면 라임록과 베니스의 주요 대상에서 각각 78피트와 72피트의 페이존이 발견되었습니다.

- 2021년 12월 현재 TC Energy Corp.와 멕시코 국영 전력 회사 CFE(Comision Federal de Electricidad)는 국내 생산 정체로 인해 만성 가스 부족에 직면한 유카탄 반도에 가스를 공급하기 위해 새로운 해상 가스 파이프라인의 건설에 대해 협의 중입니다. 또한 Sempra의 325만 톤/년(mmty)의 에너지아 코스타아울(ECA) 액화천연가스(LNG) 1단계 터미널은 2021년 최종투자 결정에 이르렀습니다. 2024년까지 조업을 시작할 예정입니다.

- 게다가 기술적 진보로 캐나다의 파이프라인 사업은 향후 수년간 안정적이고 강력한 성장이 예상됩니다. 파이프라인은 캐나다의 석유 및 가스 부문에서 고가치 최종 사용자 시장의 에너지 수요를 충족하는 가장 안전하고 안정적이며 비용 효율적인 방법으로 간주됩니다.

- 그 결과 북미는 석유 및 가스 프로젝트에 대한 투자 증가로 예측 기간 동안 오프쇼어 파이프라인 시장의 주요 지역이 될 것으로 예상됩니다.

오프쇼어 파이프라인 산업 개요

오프쇼어 파이프라인 시장은 적당하게 분할됩니다. 이 시장의 주요 기업(순부동)에는 Saipem SpA, L&T Hydrocarbon Engineering Limited, McDermott International Ltd., Allseas Group SA, China Petroleum Pipeline Engineering 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 서문

- 시장 규모 및 수요 예측(단위 : 달러)(-2029년)

- 세계의 원유 역사 동향 및 생산량 예측(단위 : 100만 배럴/일)(-2029년)

- 브렌트 원유와 헨리 허브의 스팟 가격(-2023년)

- 세계 천연가스의 역사 동향 및 생산량 예측(단위 : 10억 입방 피트/일)(-2029년)

- 최근 동향 및 개발

- 정부의 규제 및 시책

- 시장 역학

- 성장 촉진요인

- 석유 및 천연가스 수요 증가

- 석유 및 가스 탐사에 있어서 안전성, 경제성, 신뢰성이 높은 접속성의 중시 고조

- 성장 억제요인

- 건설 등의 기술적 과제, 심해에 대한 과제, 높은 건설 비용

- 성장 촉진요인

- 공급망 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 제품 유형별

- 석유

- 가스

- 시장 규모 및 수요 예측 : 지역별(-2029년)

- 북미

- 미국

- 캐나다

- 기타 북미

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 노르웨이

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 한국

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 이란

- 카타르

- 사우디아라비아

- 아랍에미리트(UAE)

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- M&A, 합작사업, 제휴 및 협정

- 주요 기업의 전략

- 기업 프로파일

- Saipem SpA

- L&T Hydrocarbon Engineering Limited

- McDermott International Ltd.

- Allseas Group SA

- Bourbon Corporation SA

- Enbridge Inc.

- Subsea 7 SA

- Genesis Energy LP

- China Petroleum Pipeline Engineering Co. Ltd.

- Atteris LLC

- 시장 랭킹 및 점유율 분석

제7장 시장 기회 및 향후 동향

- 오프쇼어 파이프라인을 통한 유럽 및 아시아태평양의 석유 및 가스 수입 증가

The Offshore Pipeline Market size is estimated at USD 16.85 billion in 2025, and is expected to reach USD 23.75 billion by 2030, at a CAGR of 7.11% during the forecast period (2025-2030).

Over the long term, factors such as increasing demand for crude oil and natural gas, especially from the Asia-Pacific region, and growing emphasis on safe, economic, and reliable connectivity for oil and gas exploration are expected to drive the market during the forecast period.

On the other hand, technical challenges like construction, deep-water challenges, and high construction costs are expected to restrain market growth.

Nevertheless, increasing oil and gas imports in the European and Asia-Pacific regions through subsea (offshore) pipelines are expected to create huge opportunities for the offshore pipeline market during the forecast period.

North America, led by the United States and Canada, would likely dominate the offshore pipeline market during the forecast period due to the increased offshore exploration activities.

Offshore Pipeline Market Trends

The Gas Segment is Expected to Witness Significant Growth

- The rising demand for natural gas has resulted in the discovery of new gas fields as well as the adoption of simple and low-cost transportation of natural gas exports via subsea (offshore) pipelines, which are anticipated to drive the offshore pipeline market.

- Global natural gas production was recorded at 4043.8 billion cubic meters in 2022. North America is the leading natural gas producer, accounting for about 1203.9 billion cubic meters, followed by the Middle East and Africa with 970.3 billion cubic meters. This is expected to drive the offshore pipeline market during the forecast period.

- In September 2022, EUROPIPE, located in Germany, was awarded by North American TC Energy (TCE) a contract to supply pipe for the Southeast Gateway Pipeline project in the Gulf of Mexico. TCE is constructing the USD 4.5 billion offshore gas pipeline in collaboration with the Mexican state-owned power utility Comision Federal de Electricidad (CFE) to ensure southeastern Mexico's electricity supply. The project was awarded to EUROPIPE, a joint company of Salzgitter Mannesmann and Aktien-Gesellschaft der Dillinger Huttenwerke, at the end of August. The project's scope involves supplying 265,000 metric tons of pipe (365 kilometers) with anti-corrosion coating.

- Additionally, in January 2023, Eni reported a significant new gas discovery at the Nargis-1 exploration well in the Nargis Offshore Area Concession off the coast of Egypt in the Eastern Mediterranean Sea. The Nargis-1 well was drilled in 1,014 feet (309 m) of water and encountered roughly 200 net feet (61 m) of Miocene and Oligocene gas-bearing sandstones. The discovery can be developed by taking advantage of Eni's current facilities.

- Furthermore, recent waves of cost reductions and key technological breakthroughs have allowed many oil and gas exploration and production companies to diversify into sustainable deepwater and ultra-deepwater developments.

- As a result, the offshore pipeline market is anticipated to expand rapidly in the near future. As a result of the preceding, the gas segment is anticipated to grow at a rapid pace during the forecast period.

North America is Expected to Dominate the Market

- During the forecast period, North America is anticipated to dominate the global offshore pipeline market. Several countries in the area are attempting to invest in offshore oil and gas exploration. During the forecast period, oil and gas pipeline infrastructure in countries such as the United States and Canada is anticipated to remain fully operational.

- With increased activity in the Gulf of Mexico, the offshore pipeline market in the United States is anticipated to expand significantly. The forthcoming new gas production projects are expected to significantly expand the region's subsea pipeline network.

- For instance, in January 2023, Talos Energy, headquartered in Houston, discovered commercial quantities of oil and natural gas in two deepwater discoveries in the United States Gulf of Mexico, which it intends to develop as subsea tie-backs to its Ram Powell tension-leg platform (TLP). According to the US player, 78 feet and 72 feet of net pay zone thickness were discovered in the main targets at Lime Rock and Venice, respectively, with excellent geologic qualities.

- As of December 2021, TC Energy Corp. and Mexican state power utility Comision Federal de Electricidad (CFE) were in talks to build a new offshore gas pipeline to supply the Yucatan Peninsula, which has faced chronic gas shortages due to stagnant domestic production. Also, Sempra's 3.25 million metric tons/year (mmty) Energia Costa Azul (ECA) liquefied natural gas (LNG) Phase 1 terminal reached a final investment decision in 2021. It is expected to start operation by 2024.

- Furthermore, technological advancements are anticipated to drive stable and robust growth in the Canadian pipeline business over the next several years. Pipelines are regarded as the safest, most dependable, and most cost-effective way of meeting the energy needs of high-value end-user markets in the Canadian oil and gas sector.

- As a result, North America is anticipated to be the major region in the offshore pipeline market during the forecast period, owing to increased investment in oil and gas projects.

Offshore Pipeline Industry Overview

The offshore pipeline market is moderately fragmented. Some of the major players in the market (in no particular order) include Saipem SpA, L&T Hydrocarbon Engineering Limited, McDermott International Ltd., Allseas Group SA, and China Petroleum Pipeline Engineering Co. Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Crude Oil Historic Trend and Production Forecast in million barrels per day, Global, until 2029

- 4.4 Brent Crude Oil and Henry Hub Spot Prices, until 2023

- 4.5 Natural Gas Historic Trend and Production Forecast in billion cubic feet per day (bcf/d), Global, until 2029

- 4.6 Recent Trends and Developments

- 4.7 Government Policies and Regulations

- 4.8 Market Dynamics

- 4.8.1 Drivers

- 4.8.1.1 Increasing Demand for Crude Oil and Natural Gas

- 4.8.1.2 Growing Emphasis on Safe, Economic, and Reliable Connectivity for Oil and Gas Exploration

- 4.8.2 Restraints

- 4.8.2.1 Technical Challenges Like Construction, Deep-Water Challenges, and High Construction Costs

- 4.8.1 Drivers

- 4.9 Supply Chain Analysis

- 4.10 Porter's Five Forces Analysis

- 4.10.1 Bargaining Power of Suppliers

- 4.10.2 Bargaining Power of Consumers

- 4.10.3 Threat of New Entrants

- 4.10.4 Threat of Substitute Products and Services

- 4.10.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Oil

- 5.1.2 Gas

- 5.2 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2029 (for regions only)})

- 5.2.1 North America

- 5.2.1.1 United States of America

- 5.2.1.2 Canada

- 5.2.1.3 Rest of the North America

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 Germany

- 5.2.2.3 France

- 5.2.2.4 Italy

- 5.2.2.5 Norway

- 5.2.2.6 Rest of the Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 South Korea

- 5.2.3.4 Rest of the Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of the South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Iran

- 5.2.5.2 Qatar

- 5.2.5.3 Saudi Arabia

- 5.2.5.4 United Arab Emirates

- 5.2.5.5 Rest of the Middle-East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Saipem SpA

- 6.3.2 L&T Hydrocarbon Engineering Limited

- 6.3.3 McDermott International Ltd.

- 6.3.4 Allseas Group SA

- 6.3.5 Bourbon Corporation SA

- 6.3.6 Enbridge Inc.

- 6.3.7 Subsea 7 SA

- 6.3.8 Genesis Energy LP

- 6.3.9 China Petroleum Pipeline Engineering Co. Ltd.

- 6.3.10 Atteris LLC

- 6.4 Market Ranking/Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Oil and Gas Imports in the European and Asia-Pacific Regions Through Subsea (offshore) Pipelines