|

시장보고서

상품코드

1651052

유럽의 주차장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Europe Car Parking - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

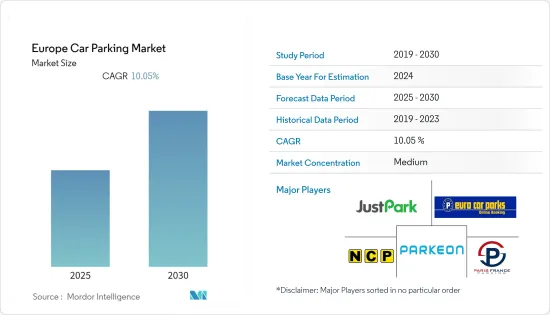

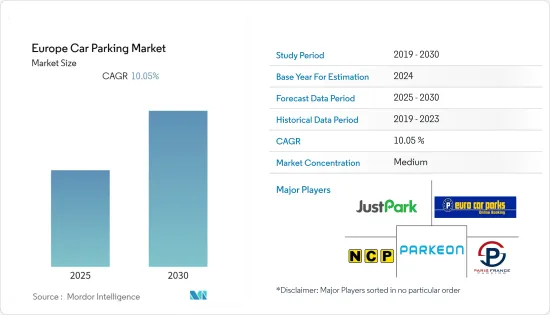

유럽의 주차장 시장은 예측 기간 동안 10.05%의 CAGR을 기록할 것으로 예상됩니다.

주요 하이라이트

- 유럽 각국에서 주차 요금이 대폭 인상될 것으로 예상됩니다. 자동차 이용자들의 주차비 지불 의향은 눈에 띄게 증가하고 있지만, 평균 이용시간은 감소하고 있습니다. 과거 주차 요금은 물가 상승률을 훨씬 상회하는 속도로 상승해 왔습니다. 예를 들어, 독일에서는 단기 주차장의 주차 요금이 5년 동안 평균 2.9% 상승했습니다. 영국은 3.6%, 노르웨이는 4.6% 증가했습니다.

- 이 시장은 기술적 개선과 지방정부와 기술 공급업체와의 협력 관계로부터도 이익을 얻고 있습니다. 예를 들어, 2019년 9월, 피어 투 피어 렌터카 회사이자 공항 기반 카셰어링 경제의 선구자인 Car &Away는 영국 개인 투자자로부터 350만 파운드의 자본을 조달했다고 밝혔습니다. 이번 투자는 영국에서 사업을 확장하고 세계에서 가장 스마트한 P2P 카셰어링 커뮤니티를 구축한다는 목표를 달성하는 데 도움이 될 것으로 기대됩니다.

- 유럽의 주차장 사업은 코로나 바이러스 확산으로 인한 폐쇄로 인해 타격을 받고 있습니다. 수요 감소는 교통 체증의 급격한 감소와 자동차 판매 감소 등으로 인한 것입니다. 그러나 봉쇄 해제 후에는 수요가 증가하고 대중교통의 안전에 대한 우려로 인해 자동차 판매량도 증가할 것으로 예상됩니다. 팬데믹 이후 주차장 관리는 물리적 안전, 정보 보안, 사람들의 행복감에 더 중점을 두고 성장할 가능성이 높습니다.

유럽의 주차장 시장 동향

기술 발전으로 시장 성장 촉진

- 이동성과 안전성을 향상시키기 위해 차량, 인프라, 대중교통이 스마트 기술과 빠르게 연계되고 있습니다. 도로에는 센서가 설치되어 자동차나 휴대폰을 통해 도로상의 데이터를 추적하여 교통 흐름 패턴, 통행금지, 도로 공사, 도로 상황 등을 파악할 수 있게 되었습니다.

- 사물인터넷(IoT), 주차 센서, 전자 결제 방식과 같은 기술 발전도 시장 성장을 뒷받침하고 있습니다. 기업들은 더 나은 고객 경험을 제공하고 번거로움 없는 주차 공간을 제공함으로써 경쟁 우위를 점하고자 노력하고 있습니다. 기업은 실시간 데이터와 분석을 활용하여 주차 공간을 할당하고, 출입을 통제하고, 주차에 소요되는 관리 오버헤드를 줄일 수 있습니다.

- 또한, 노상 주차는 가장 안전한 선택으로 여겨지지 않기 때문에 주차장 관리는 고객에게 안심감을 줄 수 있습니다. 그럼에도 불구하고 주차장 관리를 통해 매장 방문자 수와 체류 시간을 늘릴 수 있습니다.

- 또한, 주차 관리 기술은 빈 주차 공간을 최적화함으로써 전반적인 수익 향상에 기여합니다. 동시에 전체 운영 비용과 자본 지출(OPEX 및 CAPEX)(CAPEX)을 줄이는 데 중요한 역할을 합니다. 전 세계 모든 정부는 인구에 충분한 주차 공간을 제공함으로써 교통 혼잡을 완화하기 위해 노력하고 있습니다.

자동차 구매 증가

- 유럽에서는 지난 몇 달 동안 신차 등록대수의 전체 성장률이 계속 하락하고 있지만, 신규 구매량은 상당히 많습니다. 유럽 27개 시장의 JATO Dynamics 통계에 따르면 유럽(EU, EFTA, 영국 포함)의 2021년 3월 승용차 신차 등록량은 111만 6,419대로 19% 감소했습니다. 2020년 3월부터 2019년 3월까지 등록량은 33% 증가했습니다. COVID-19 사태 이전 수준으로 돌아가지 못하고 2019년 3월에는 37% 아래로 떨어졌습니다.

- 2022년 3월 유럽 승용차 신차 등록대수가 5분의 1로 감소했고, 최근 자동차 판매량은 2022년 1분기 11% 감소해 1985년 이후 최저치를 기록했습니다. 2022년 3월 유럽에서 전기자동차가 점유율을 높여 디젤차를 다시 넘어섰습니다. 2022년 3월 테슬라 모델 3는 유럽에서 가장 많이 팔린 차종이자 가장 많이 팔린 배터리 전기자동차이며, 푸조 208은 1분기 유럽에서 가장 많이 팔린 차종이었습니다.

유럽의 주차장 산업 개요

유럽의 주차장 시장은 상당히 세분화되어 있으며, 많은 업체들이 시장에서 큰 점유율을 차지하고 있습니다. 주차장 시장에서 저명한 기업으로는 JustPark, Parkeon S.A, Park Rite, Urbiotica 등이 있습니다.

- 2021년 9월 - JustPark와 Octopus Energy, 전기자동차 보급의 큰 걸림돌로 여겨지는 집 주차장과 충전 기회를 이용할 수 없는 영국 차량 운전자들에게 더 나은 도심 충전 기회를 제공하는 것을 목표로 충전 제휴를 시작했습니다.

- 2020년 6월, 어비오티카는 Worldsensing의 주차 관리 솔루션 Fastprk의 인수를 발표했으며, Fastprk의 합류로 어비오티카의 스마트 주차 솔루션 포트폴리오가 완성되어 이 분야의 선두주자로서의 입지를 강화할 수 있게 되었습니다. 의 입지를 강화하는 한편, Fastprk의 기술이 제공하는 듀얼 감지 및 LoRa 통신 프로토콜의 보완성을 통해 새로운 시장 진입 기회를 열어줄 것으로 기대됩니다.

기타 특전:

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월 애널리스트 지원

목차

제1장 소개

- 조사 가정과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 업계 이해관계자 분석

- 업계의 매력 - Porter's Five Forces 분석

- 공급 기업의 교섭력

- 구매자·소비자의 협상력

- 신규 참여업체의 위협

- 대체품의 위협

- 경쟁 기업 간의 경쟁 관계

- 국내의 결제 환경의 진화

- 국내의 캐시리스 거래 확대 관련 주요 시장 동향

- COVID-19가 동국 결제 시장에 미치는 영향

제5장 시장 역학

- 시장 성장 촉진요인

- 주차 공간 확보가 우려되는 자동차의 꾸준한 증가

- 기술의 진보와 지방 의회와 테크놀러지 프로바이더와의 지속적인 협력 관계

- 시장 과제

- 비용과 인프라에 대한 우려

- 유럽의 주차장 업계의 주요 규제와 기준

- 주요 사례와 사용 사례 분석

- 유럽의 주차장 산업에 관한 주요 인구 동향과 패턴 분석

- 유럽의 현금 치환과 자동차 구입 증가에 관한 분석

제6장 시장 세분화

- 응용 분야별

- 주차장 사업자/주차장 관리 회사

- 인프라 프로바이더(하드웨어 & 소프트웨어)

- P2P 주차장 앱 프로바이더

- 국가별

- 영국

- 독일

- 프랑스

- 이탈리아

- 기타 유럽

제7장 경쟁 구도

- 기업 개요

- JustPark

- Euro Car Parks Limited

- National Car Parks Limited(NCP)

- NSL Limited, a Marston Holdings Company

- ParkingEye Ltd

- Parkeon S.A

- Indigo Group

- Paris France Parking

- Park Rite

- RFC

- IPairc

- Munster Car Park Services Ltd

- Nationwide Controlled Parking Systems

- Tazbell

- Urbiotica

제8장 투자 분석

제9장 시장 향후 전망

ksm 25.02.27The Europe Car Parking Market is expected to register a CAGR of 10.05% during the forecast period.

Key Highlights

- It is expected to see significant growth in prices/parking charges across all European countries. The willingness of car users to pay for parking is increasing significantly - while the average duration of use is decreasing. In the past, parking charges have increased at a rate well above the inflation rate. For example, in Germany, parking charges for short-stay car parks increased by an average of 2.9 % in five years. In the UK, they increased by 3.6 %, and in Norway by 4.6%.

- The market also benefits from technological improvements and collaborations between local governments and technology suppliers. For example, in September 2019, Car & Away, the peer-to-peer car rental company and pioneer of the airport-based car-sharing economy, revealed that it had raised GBP 3.5 million in capital from private investors in the United Kingdom. This investment is expected to help the company expand in the United Kingdom and, further, it's objective to build the world's smartest peer-to-peer (P2P) car-sharing community.

- The European car parking business has been harmed as a result of the lockdown imposed due to the spread of the coronavirus. Reduced demand is due to a sharp reduction in traffic congestion and a decrease in car sales, among other factors. However, after the lockdown is lifted, demand is projected to rise, and vehicle sales are expected to increase due to concerns about public transportation safety. Post-pandemic car parking management will likely grow, focusing more on physical safety, information security, and people's perceived well-being.

Europe Car Parking Market Trends

Technological Advancements to Boost the Market Growth

- Vehicles, infrastructure, and public transportation are rapidly linked with smart technology to improve mobility and safety. Streets are equipped with sensors that track data on the roads and through cars and mobile phones to acquire insight into traffic flow patterns, roadblocks, roadwork, and road conditions, among other things.

- Technological advancements such as the Internet of Things (IoT), parking sensors, and electronic payment methods also support the market's growth. Firms are trying to deliver an enhanced customer experience and offer hassle-free parking that can help them gain a competitive advantage over others. With the help of real-time data and analytics, organizations can allocate spaces, provide access control, and reduce administrative overhead spent on parking.

- Additionally, car parking management gives customers a sense of security as parking on the street is not considered the safest option. Still, with the car parking management, there can be an increase in the number of customers and the time they spend at any outlet.

- Furthermore, by optimizing vacant parking spaces, parking management technologies assist in raising overall revenue. Simultaneously, they play a critical role in lowering overall operational and capital expenditures (OPEX and CAPEX) (CAPEX). All governments worldwide attempt to reduce traffic congestion by providing enough parking spots for their population.

Increase in purchase of Cars

- Though the overall growth rate of new car registrations has kept declining over the past few months in Europe, there is a significant number of new purchases. Total new passenger vehicle registrations in Europe (including the EU, EFTA, and the UK) were down 19% in March 2021, according to JATO Dynamics statistics for 27 European markets, with 1,116,419 new passenger cars registered. While registrations grew by 33% from March 2020 to March 2019, the market has failed to return to pre-pandemic levels, falling 37% short of March 2019.

- In March 2022, new passenger vehicle registrations in Europe fell by a fifth, with recent automobile sales falling 11% in the first quarter of 2022 to the lowest levels since 1985. EVs increased market share in Europe in March 2022, outselling diesel vehicles once more. In March 2022, the Tesla Model 3 was Europe's best-selling car model and best-selling battery-electric vehicle, but the Peugeot 208 was Europe's favorite automobile during the first quarter.

Europe Car Parking Industry Overview

The Europe Car Parking Market is moderately fragmented, with many players accounting for significant amounts of shares in the market. Some of the prominent companies in the car parking market are JustPark, Parkeon S.A, Park Rite, Urbiotica, and others.

- September 2021 - JustPark and Octopus Energy launch charging cooperation. They aim to help provide better urban charging opportunities for fleet drivers in the UK who do not have access to their parking and charging opportunities at home, which is suspected to be a large hurdle for EV adoption.

- In June 2020, Urbiotica announced the acquisition of Fastprk, a parking management solution from Worldsensing. The addition of Fastprk completes Urbiotica's portfolio of smart parking solutions, strengthening its leadership position in the sector and opening up new opportunities to penetrate new markets due to the complementarity that Fastprk's technology offers with its dual detection and LoRa communication protocol.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Industry Attractiveness-Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Evolution of the payments landscape in the country

- 4.5 Key market trends pertaining to the growth of cashless transaction in the country

- 4.6 Impact of COVID-19 on the payments market in the country

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Steady rise in vehicles leading to concerns over availability of parking space

- 5.1.2 Technological advancements and ongoing collaborations between local councils and technology providers

- 5.2 Market Challenges

- 5.2.1 Cost & Infrastructural Concerns

- 5.3 Key Regulations and Standards in the Europe Car Parking Industry

- 5.4 Analysis of major case studies and use-cases

- 5.5 Analysis of key demographic trends and patterns related to car parking industry in Europe

- 5.6 Analysis of cash displacement and rise of purchase of vehicles in Europe

6 Market Segmentation

- 6.1 By Application Area

- 6.1.1 Parking Operators/Parking Management Companies

- 6.1.2 Infrastructure Providers (Hardware & Software)

- 6.1.3 P2P Parking Apps Provider

- 6.2 By Country

- 6.2.1 UK

- 6.2.2 Germany

- 6.2.3 France

- 6.2.4 Italy

- 6.2.5 Rest of Europe

7 Competitive Landscape

- 7.1 Company Profiles

- 7.1.1 JustPark

- 7.1.2 Euro Car Parks Limited

- 7.1.3 National Car Parks Limited (NCP)

- 7.1.4 NSL Limited, a Marston Holdings Company

- 7.1.5 ParkingEye Ltd

- 7.1.6 Parkeon S.A

- 7.1.7 Indigo Group

- 7.1.8 Paris France Parking

- 7.1.9 Park Rite

- 7.1.10 RFC

- 7.1.11 IPairc

- 7.1.12 Munster Car Park Services Ltd

- 7.1.13 Nationwide Controlled Parking Systems

- 7.1.14 Tazbell

- 7.1.15 Urbiotica

8 Investment Analysis

9 Future Outlook of the Market

샘플 요청 목록