|

시장보고서

상품코드

1849812

인덕터 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Inductor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

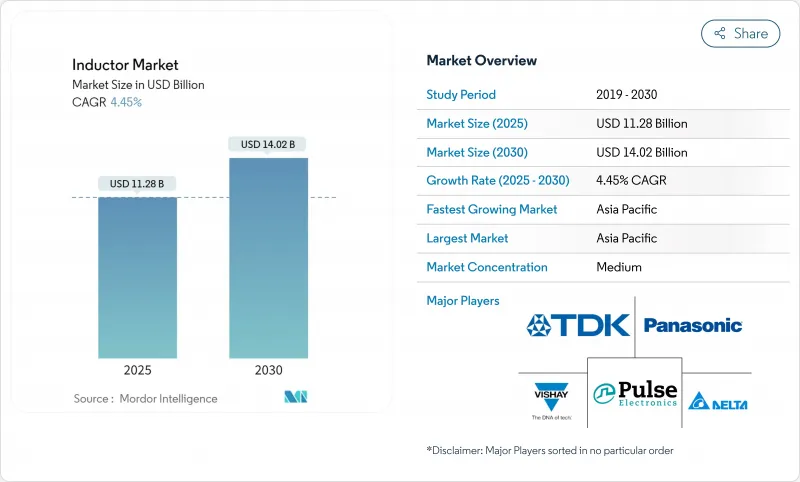

인덕터 시장 규모는 2025년에 112억 8,000만 달러로 추정되며, 2030년에는 140억 2,000만 달러에 이를 것으로 예측되며, 기간 중 CAGR은 4.45%를 나타낼 전망입니다.

이산 부품이 집적 패시브 디바이스의 디자인 인 압력에 직면하면서도 자동차의 전동화, 지속적인 5G 기지국 건설, 전력 밀도가 높은 데이터센터 하드웨어가 성장의 기반이 되고 있습니다. 수요는 대량 생산의 범용 코일에서 고주파 스위칭, 열적으로 가혹한 자동차 파워트레인, 초소형 웨어러블에 최적화된 전용 부품으로 이동하고 있습니다. 자동차 인증(AEC-Q200)은 차별화 요인에서 진입 요건으로 이행하여 표면 실장 파워 인덕터가 신설계의 대부분을 차지하고, 대전류 레일에서는 페라이트 대신 금속 합금 코어가 꾸준히 사용되도록 되어 있습니다. 공급망의 다양화와 지역화(특히 중국 본토에서)는 공급업체가 최저 랜디드 비용보다 탄력성을 요구하게 되어 세계 생산의 발자취를 바꿉니다.

세계의 인덕터 시장 동향과 인사이트

소형화된 소비자 일렉트로닉스에 대한 수요 증가

초소형 웨어러블, 히어러블, 차세대 스마트폰은 PCB 실적를 이전보다 작게 만드는 전력 효율적인 수동 부품이 필요합니다. TDK의 0.25×0.125×0.2mm 칩과 같은 획기적인 제품은 보통 0.6-3.6nH의 인덕턴스 값을 희생하지 않고 50% 가까운 공간 절약화를 실현함으로써 이 제약에 대처하고 있습니다. 스마트폰에서 AR 안경이나 센서가 풍부한 건강 모니터로 설계의 승기가 이행해, 휴대 단말의 교체 사이클이 길어져도, 2024년의 소비자용 전자 기기의 점유율은 42.4%를 유지했습니다. 벤더는 Q팩터를 유지하면서 직류 저항을 낮게 억제하는 리소그래피 패터닝, 미세 분말 페라이트, 다층 소결에 의해 차별화를 도모하고 있습니다.

자동차 분야의 전동화(EV)

각 배터리 전기자동차에는 DC-DC 컨버터, 자동차 충전기, 트랙션 인버터용으로 100개 이상의 인덕터가 집적되어 있어 스마트폰에서 일반적인 20개 이하의 인덕터 수보다 크게 많아지고 있습니다. AEC-Q200을 준수하면 진동, 온도 충격 및 습도에 대한 테스트가 강화되고 진입 장벽이 높아지고 적격 공급업체에 점유율이 흐릅니다. 실리콘 카바이드 인버터는 40kHz 이상에서 작동하므로 높은 자속 밀도 하에서 인덕턴스를 유지하는 금속 합금 또는 분말 성형 코어가 필요합니다. 세계 자동차 제조업체들이 중국, 유럽, 미국에서 병행하여 개발을 진행하고 있으며, 2030년까지의 부문 CAGR은 9.2%를 나타낼 전망입니다.

구리와 페라이트의 가격 변동

구리는 권선을 구성하고 페라이트와 합금 파우더는 자로를 형성하기 때문에 가격이 급등하면 그대로 수익원가에 파급됩니다. 시장 옵저버는 광산 공급이 전기의 슈퍼사이클을 늦추고 2030년 이후 구조적 적자가 될 위험이 있다고 경고합니다. TDK의 새로운 CLT32 시리즈는 50% 이상의 재생 원료를 사용합니다. 위험 회피를 위한 규모가 부족한 소규모 공장은 마진을 압박하고 생산 능력 증설을 지연시키는 위험에 노출되어 있습니다.

부문 분석

2024년 인덕터 시장 점유율은 파워 인덕터가 42.1%를 차지했으며, 전압 조정 모듈, DC-DC 컨버터, 자동차 충전기에 우수합니다. 고주파 설계용 인덕터 시장 규모에서는 밀리미터파 5G 노드를 배경으로 하위 부문이 2030년까지 연평균 복합 성장률(CAGR) 6.3%를 나타낼 전망입니다. 권선 유형은 차량용 48V 레일을 지배하며 박막 구조는 휴대용 단말기의 RF 필터에 사용됩니다. 결합 코일은 GPU에 공급하는 다상 VRM의 과도 응답을 개선하고 AI 서버 출하에 따라 수요가 확대됩니다. 성형품은 내진동성, 열전도성, EMI 실드성이 원재료 비용을 능가하는 분야에서 대두하고 있습니다. 벤더는 엄격한 인덕턴스 공차를 유지하기 위해 자동 광학 검사 및 X-레이 공정 제어를 도입합니다.

레조낙의 2세대 금속 분말 성형 컴파운드는 2MHz 이상의 코어 손실을 줄이고 벅 컨버터에서 95% 이상의 효율을 유지하면서 자기 회로의 축소를 가능하게 합니다. 실리콘 카바이드 MOSFET의 게이트 전하가 떨어지면 스위칭 주파수가 증가하고 인덕터의 부피 밀도가 설계상의 주요 제약이됩니다. 양방향 배터리 팩을 위한 듀얼 액티브 브리지 컨버터와 같은 새로운 토폴로지는 포화 전류가 60A를 초과하는 저손실 인덕터의 필요성을 더욱 높여줍니다.

페라이트는 그 비용과 투자율의 균형에 의해 2024년 매출의 54.7%를 차지했지만, 금속 합금의 슬라이스는 연률 5.4%의 성장이 예측됩니다. 인덕터 시장에서는 금속 합금 분말 코어가 1T를 초과하는 자속 밀도를 허용하여 코일 수의 감소와 온도에 의한 인덕턴스 드리프트의 축소를 가능하게 하고 있습니다. Proterial의 FINEMET과 같은 나노결정 스트립 제품은 삽입 손실이 100kHz에서 200mW 미만으로 차재 양방향 온보드 충전기에 호소합니다. 공심 코일은 자성 재료에서 와전류 손실이 발생하는GHz RF 경로에 사용됩니다. 세라믹 기판은 열 제한과 엄격한 폼 팩터 캡을 양립시키는 소형화된 Bluetooth 모듈로 채용되고 있습니다. 제조업체는 최종 용도에 맞는 BH 루프를 조정하기 위해 소결 곡선과 입자 크기를 조정합니다.

코어 구성이 복잡해짐에 따라 신뢰성 스크리닝이 엄격해지고, 부분 방전 테스트 및 주파수 스위프 임피던스 테스트가 기존 포화 전류 검사를 보완합니다. 라이프사이클 탄소 회계를 향한 움직임은 재활용 철분과 클로즈드 루프 페라이트 재생 시스템에 대한 관심을 높여 환경 목표와 버진 재료 가격의 변동에 대한 헤지가 융합하고 있습니다.

지역 분석

기타 라틴아메리카, 중동 및 아프리카를 포함한 세계 기타 지역은 큰 성장 가능성을 지닌 인덕터의 신흥 시장입니다. 이 지역 시장 특징은 산업 자동화에 대한 투자 증가와 스마트 시티 개념의 채택 확대입니다. 라틴아메리카는 통신 인프라의 확대와 IoT 기술의 채용 증가로 특히 유망시되고 있습니다. 중동 시장은 석유 및 가스 부문의 자동화와 재생에너지 프로젝트에 대한 대규모 투자에 의해 견인되고 있습니다. 이 지역의 자동차 부문, 특히 UAE와 사우디아라비아에서는 전기자동차와 하이브리드 자동차에 대한 관심이 커지고 있으며 인덕터 제조업체에게 새로운 비즈니스 기회를 제공합니다. 이 시장은 또한 제조 능력에 대한 투자 증가와 다양한 산업 분야에서 첨단 전자 제품의 채택 확대로 이익을 얻고 있습니다. 스마트 인프라의 개발과 에너지 효율의 중요성 증가는 이 지역 전반에 걸쳐 다양한 유형의 인덕터에 대한 추가 수요를 창출하고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 소형 가전제품 수요 증가

- 자동차 부문의 전동화(EV)

- 5G와 고속 통신 확대

- 재생에너지 및 전력 일렉트로닉스의 성장

- AI 서버나 IoT 모듈에 내장된 인덕터

- 데이터센터의 고주파 전력 변환기

- 시장 성장 억제요인

- 구리와 페라이트의 가격 변동

- 세계공급망의 혼란

- 임베디드 인덕터의 열 관리 문제

- 집적 수동 디바이스가 개별 수요를 침식

- 업계 생태계 분석

- 기술 전망

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁도

- 거시 경제 동향의 영향

제5장 시장 규모와 성장 예측(가치)

- 유형별

- 전력 인덕터

- RF/고주파 인덕터

- 결합 인덕터

- 다층 인덕터

- 박막 인덕터

- 성형/권선 인덕터

- 코어 재료별

- 공기/세라믹 코어

- 페라이트 코어

- 철 및 금속 합금 코어

- 나노 결정 및 비정질 코어

- 장착 기술별

- 표면 실장 기술(SMT)

- 관통 홀 기술(THT)

- 내장형/통합 PCB 인덕터

- 차폐 방식별

- 차폐형

- 비차폐형

- 인덕턴스별

- 고정 인덕터

- 가변/조정가능 인덕터

- 최종 사용자별

- 자동차

- 항공우주 및 방위

- 통신 및 5G 인프라

- 가전제품 및 컴퓨팅

- 산업 및 전력

- 헬스케어 및 의료기기

- 재생에너지 시스템

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 한국

- 인도

- 대만

- 동남아시아

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 중동

- 사우디아라비아

- 아랍에미리트(UAE)

- 튀르키예

- 기타 중동

- 아프리카

- 남아프리카

- 이집트

- 나이지리아

- 기타 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- TDK Corporation

- Murata Manufacturing Co. Ltd

- Vishay Intertechnology Inc.

- Panasonic Holdings Corporation

- Taiyo Yuden Co. Ltd

- Samsung Electro-Mechanics Co. Ltd

- Pulse Electronics(Yageo Corporation)

- Delta Electronics Inc.

- Coilcraft Inc.

- Bourns Inc.

- Wurth Elektronik GmbH & Co. KG

- Sumida Corporation

- TE Connectivity Ltd

- Chilisin Electronics Corporation

- AVX Corporation(Kyocera AVX)

- Bel Fuse Inc.

- Sunlord Electronics Co. Ltd

- Eaton Corporation(Coiltronics)

- KEMET Corporation(Yageo)

- API Delevan Inc.

제7장 시장 기회와 향후 전망

KTH 25.11.03The inductors market size is estimated at USD 11.28 billion in 2025 and is forecast to reach USD 14.02 billion by 2030, expanding at a 4.45% CAGR over the period.

Electrification of vehicles, continued 5G base-station build-outs, and power-dense data-center hardware form the bedrock of growth even as discrete components face design-in pressure from integrated passive devices. Demand is shifting from high-volume commodity coils toward purpose-built parts optimized for high-frequency switching, thermally challenging automotive powertrains, and ultra-compact wearables. Automotive qualification (AEC-Q200) has moved from differentiator to entry requirement, surface-mount power inductors dominate new designs, and metal-alloy cores are steadily displacing ferrite in high-current rails. Supply-chain diversification and regionalization-especially out of mainland China-are rewriting the global production footprint as vendors seek resilience rather than the lowest landed cost.

Global Inductor Market Trends and Insights

Rising demand for miniaturized consumer electronics

Ultra-compact wearables, hearables, and next-generation smartphones rely on power-efficient passives that occupy ever-smaller PCB footprints. Breakthroughs such as TDK's 0.25 X 0.125 X 0.2 mm chip addressed this constraint by delivering space savings near 50% without sacrificing inductance values, typically 0.6-3.6 nH. Design wins migrate from smartphones to AR glasses and sensor-rich health monitors, sustaining the 42.4% 2024 consumer-electronics share even as handset replacement cycles lengthen. Vendors differentiate through lithographic patterning, fine-powder ferrites, and multilayer sintering that keep direct current resistance low while maintaining Q-factor.

Electrification of automotive sector (EVs)

Each battery-electric vehicle integrates more than 100 inductors for DC-DC converters, onboard chargers, and traction inverters, sharply higher than the sub-20 count typical in smartphones. AEC-Q200 compliance elevates testing for vibration, temperature shock, and humidity, raising barriers to entry and channeling share to qualified suppliers. Silicon-carbide inverters operate above 40 kHz, demanding metal-alloy or powder-molded cores that maintain inductance under elevated flux density. Global automakers' parallel pushes in China, Europe, and the United States sustain a 9.2% segment CAGR through 2030.

Volatility in copper and ferrite prices

Copper comprises the winding while ferrite or alloy powders form the magnetic path, so any spike ripples straight to cost of goods sold. Market observers warn that mine supply lags the electrification super-cycle, risking structural deficits after 2030. Manufacturers respond with recycled metal initiatives-TDK's new CLT32 series uses more than 50% reclaimed feedstock-and with long-term offtake agreements. Smaller fabs lacking scale for hedging remain exposed, squeezing margins and slowing capacity adds.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of 5G and high-speed communications

- Growth in renewable energy and power electronics

- Global supply-chain disruptions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Power inductors delivered 42.1% of inductors market share in 2024, an advantage anchored in voltage-regulation modules, DC-DC converters, and onboard chargers. Within the inductors market size for high-frequency designs, the sub-segment climbs at 6.3% CAGR to 2030 on the back of millimeter-wave 5G nodes. Wire-wound formats dominate automotive 48 V rails, whereas thin-film structures serve handset RF filters. Coupled coils improve transient response in multiphase VRMs that feed GPUs, and demand scales with AI-server shipments. Molded products gain ground where vibration resistance, thermal conductivity, and EMI shielding trump raw cost. Vendors layer in automatic optical inspection and X-ray process control to sustain tight inductance tolerances.

Second-generation metal-powder molding compounds from Resonac cut core losses above 2 MHz, enabling buck converters to shrink magnetics while preserving >=95% efficiency. As silicon-carbide MOSFET gate charges fall, switching frequencies climb, and inductor volumetric density becomes a primary design constraint. Emerging topologies such as dual-active-bridge converters for bidirectional battery packs further amplify the need for low-loss inductors with saturation currents above 60 A.

Ferrite continued to own 54.7% of 2024 revenue thanks to its balance of cost and permeability, yet the metal-alloy slice is forecast to grow 5.4% per year. In the inductors market, metal-alloy powder cores tolerate flux densities beyond 1 T, enabling coil counts to fall and inductance drift over temperature to shrink. Nanocrystalline strip products, such as Proterial's FINEMET, post insertion losses below 200 mW at 100 kHz, appealing to automotive bidirectional on-board chargers. Air-core coils persist in GHz RF paths where magnetic materials would introduce eddy-current loss. Ceramic substrates gain purchase in miniaturized Bluetooth modules that juggle thermal limits and strict form-factor caps. Manufacturers calibrate sintering curves and particle sizes to dial in B-H loops tailored to final applications.

Reliability screening tightens as core composition complexity grows; partial-discharge and frequency-swept impedance tests now complement legacy saturation-current checks. A move toward lifecycle carbon accounting drives interest in recycled iron powders and closed-loop ferrite reclaim systems, merging environmental goals with hedging against virgin-material price swings.

The Inductor Market Report is Segmented by Type (Power, RF/High Frequency, and More), Core Material (Air/Ceramic Core, Ferrite Core, and More), Mounting Technique (Surface-Mount Technology, and More), Shielding (Shielded and Unshielded), Inductance (Fixed, Variable/Tunable), End-User Vertical (Automotive, Aerospace and Defense, Communications, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

The Rest of the World region, encompassing Latin America, the Middle East, and Africa, represents an emerging market for inductors with significant growth potential. The region's market is characterized by increasing investments in industrial automation and the growing adoption of smart city initiatives. Latin America has shown particular promise with its expanding telecommunications infrastructure and increasing adoption of IoT technologies. The Middle Eastern market is driven by automation in the oil and gas sector, along with significant investments in renewable energy projects. The region's automotive sector, particularly in the UAE and Saudi Arabia, is showing increased interest in electric and hybrid vehicles, creating new opportunities for inductor manufacturers. The market is also benefiting from increasing investments in manufacturing capabilities and the growing adoption of advanced electronics in various industries. The development of smart infrastructure and the increasing focus on energy efficiency are creating additional demand for various types of inductors across the region.

- TDK Corporation

- Murata Manufacturing Co. Ltd

- Vishay Intertechnology Inc.

- Panasonic Holdings Corporation

- Taiyo Yuden Co. Ltd

- Samsung Electro-Mechanics Co. Ltd

- Pulse Electronics (Yageo Corporation)

- Delta Electronics Inc.

- Coilcraft Inc.

- Bourns Inc.

- Wurth Elektronik GmbH & Co. KG

- Sumida Corporation

- TE Connectivity Ltd

- Chilisin Electronics Corporation

- AVX Corporation (Kyocera AVX)

- Bel Fuse Inc.

- Sunlord Electronics Co. Ltd

- Eaton Corporation (Coiltronics)

- KEMET Corporation (Yageo)

- API Delevan Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for miniaturized consumer electronics

- 4.2.2 Electrification of automotive sector (EVs)

- 4.2.3 Expansion of 5G and high-speed communications

- 4.2.4 Growth in renewable energy and power electronics

- 4.2.5 Embedded inductors in AI servers and IoT modules

- 4.2.6 High-frequency power converters in data centers

- 4.3 Market Restraints

- 4.3.1 Volatility in copper and ferrite prices

- 4.3.2 Global supply-chain disruptions

- 4.3.3 Thermal management issues in embedded inductors

- 4.3.4 Integrated passive devices eroding discrete demand

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

- 4.7 Impact of Macroeconomic Trends

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Type

- 5.1.1 Power Inductors

- 5.1.2 RF/High-Frequency Inductors

- 5.1.3 Coupled Inductors

- 5.1.4 Multilayer Inductors

- 5.1.5 Thin-Film Inductors

- 5.1.6 Molded/Wire-wound Inductors

- 5.2 By Core Material

- 5.2.1 Air/Ceramic Core

- 5.2.2 Ferrite Core

- 5.2.3 Iron and Metal-Alloy Core

- 5.2.4 Nanocrystalline and Amorphous Core

- 5.3 By Mounting Technique

- 5.3.1 Surface-Mount Technology (SMT)

- 5.3.2 Through-Hole Technology (THT)

- 5.3.3 Embedded/Integrated PCB Inductors

- 5.4 By Shielding

- 5.4.1 Shielded

- 5.4.2 Unshielded

- 5.5 By Inductance

- 5.5.1 Fixed Inductors

- 5.5.2 Variable/Tunable Inductors

- 5.6 By End-user Vertical

- 5.6.1 Automotive

- 5.6.2 Aerospace and Defense

- 5.6.3 Communications and 5G Infrastructure

- 5.6.4 Consumer Electronics and Computing

- 5.6.5 Industrial and Power

- 5.6.6 Healthcare and Medical Devices

- 5.6.7 Renewable Energy Systems

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Spain

- 5.7.2.6 Russia

- 5.7.2.7 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 South Korea

- 5.7.3.4 India

- 5.7.3.5 Taiwan

- 5.7.3.6 South East Asia

- 5.7.3.7 Rest of Asia-Pacific

- 5.7.4 South America

- 5.7.4.1 Brazil

- 5.7.4.2 Argentina

- 5.7.4.3 Rest of South America

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 Saudi Arabia

- 5.7.5.1.2 United Arab Emirates

- 5.7.5.1.3 Turkey

- 5.7.5.1.4 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 South Africa

- 5.7.5.2.2 Egypt

- 5.7.5.2.3 Nigeria

- 5.7.5.2.4 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 TDK Corporation

- 6.4.2 Murata Manufacturing Co. Ltd

- 6.4.3 Vishay Intertechnology Inc.

- 6.4.4 Panasonic Holdings Corporation

- 6.4.5 Taiyo Yuden Co. Ltd

- 6.4.6 Samsung Electro-Mechanics Co. Ltd

- 6.4.7 Pulse Electronics (Yageo Corporation)

- 6.4.8 Delta Electronics Inc.

- 6.4.9 Coilcraft Inc.

- 6.4.10 Bourns Inc.

- 6.4.11 Wurth Elektronik GmbH & Co. KG

- 6.4.12 Sumida Corporation

- 6.4.13 TE Connectivity Ltd

- 6.4.14 Chilisin Electronics Corporation

- 6.4.15 AVX Corporation (Kyocera AVX)

- 6.4.16 Bel Fuse Inc.

- 6.4.17 Sunlord Electronics Co. Ltd

- 6.4.18 Eaton Corporation (Coiltronics)

- 6.4.19 KEMET Corporation (Yageo)

- 6.4.20 API Delevan Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment