|

시장보고서

상품코드

1851561

액화천연가스(LNG) : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Liquefied Natural Gas (LNG) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

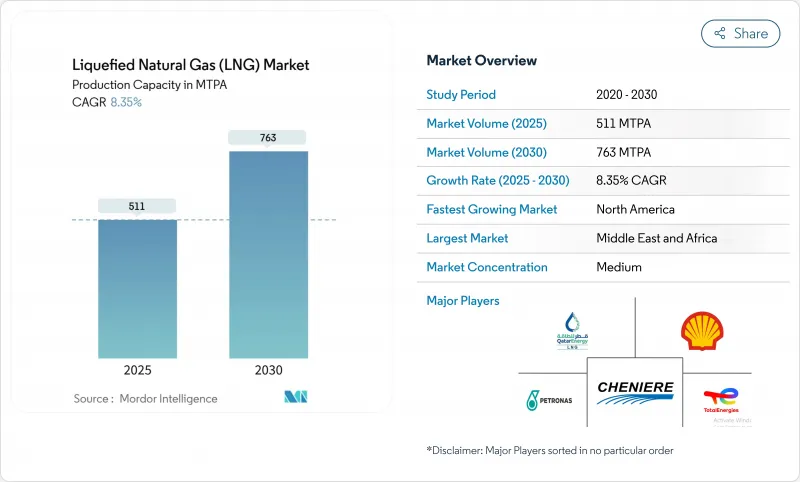

액화천연가스(LNG) 시장의 생산능력 규모는 2025년 511MTPA에서 2030년 763MTPA로 확대되며, 예측 기간(2025-2030년)의 CAGR은 8.35%를 나타낼 전망입니다.

에너지안보의 목표와 탈탄소화의 의무화에 의해 정부와 전력회사는 과도연료로서 LNG에 조타를 끊고 있으며, 부유식 LNG 기술의 급속한 채용에 의해 공급옵션이 넓어져 지금까지 좌초했던 해양자원이 개방됩니다. 북미 수출 터미널은 퍼미언 베이스로부터 저가의 피드 가스를 즐길 수 있으며, 해운은 유황 캡 준수를 위해 LNG로 축발을 옮기고 있으며, 전기 및 탄소 포착 업그레이드는 운영의 지속가능성을 추진하고 있습니다. 기술 주도의 비용 관리와 유연한 계약 구조가 거래 패턴을 재구축하고 있지만, EPC 인플레이션의 장기화와 재생가능한 수소의 상승이 액화천연가스(LNG) 시장의 주목점이라는 점은 변함이 없습니다.

세계의 액화천연가스(LNG) 시장 동향과 인사이트

아시아태평양의 전력용 가스 프로젝트가 급증, LNG의 중류 인수 계약을 요구

아시아태평양 전력회사는 100bcm 이상의 재기화 능력을 새로 추가하고 있으며, 인도에서는 2030년까지 가스 소비량을 60% 끌어올릴 계획입니다. 국가의 탈탄소화 목표는 석탄에서 가스로의 전환을 가속화하고 LNG 공급과 전력 구매 계약을 직접 연결하는 통합 계약을 촉진하고 있습니다. 이러한 꽉 가스의 연결은 자금 조달 위험을 줄이고 프로젝트의 융통성을 향상시키고 액화천연가스(LNG) 시장의 장기 수요를 강화합니다.

유럽에서 IMO-2020의 유황 캡을 받아 해상 벙커 연료로서 LNG가 급속히 보급

세계 LNG 연료선대는 2024년에 33% 증가한 638척으로 2028년에는 1,200척을 넘을 것으로 예측됩니다. 컨테이너선은 LNG 적재 중량 톤수의 60%를 차지하며, 198항에서 벙커 인프라 정비가 가속되고 있습니다. 액화천연가스(LNG) 시장은 미래 배출규제에 대한 적합성을 확대하는 바이오LNG의 노력으로 더욱 기세를 늘리고 있습니다.

EPC 비용 상승과 모듈 제조 병목 현상으로 인한 FID 지연의 장기화

2024년 FID에 도달한 생산 능력은 불과 14.8 MTPA로 20-30%의 비용 상승과 노동력 부족 가운데 크게 감소했습니다. 모듈 건설은 설비 가격의 상승에도 불구하고 인기를 끌고 있지만, 지연이 2027-2029년에 공급 갭을 넓혀 액화천연가스(LNG) 시장 전체의 변동을 유발할 가능성이 있습니다.

부문 분석

액화 플랜트는 2024년 매출의 43%를 차지하며 액화천연가스(LNG) 시장에서 가장 높았습니다. 카타르, 미국, 호주의 능력 증강이 2030년까지 CAGR 11.1%를 나타낼 전망입니다. 전기 압축기와 탄소 포집는 배출량을 줄이고 종합 측정의 경쟁력을 강화합니다.

이 부문의 생태계에는 현재 904척의 LNG선이 포함되어 있으며, 그 대부분은 온실가스 배출을 억제하는 저메탄 가스 엔진을 탑재하고 있습니다. FSRU는 2021년 이후 77백만톤/년의 재기화 능력을 추가하고 액화천연가스(LNG) 시장으로의 모듈 전개를 검증함으로써 특히 유럽에서의 수입 증가를 가속화하고 있습니다.

발전은 2024년 수요의 38%를 유지하며 아시아에서는 LNG-전력 통합 프로젝트를 통해 확대되었습니다. 이러한 설정은 터미널, 저장, 발전 자산을 통합하고 신용 위험을 줄이고 액화천연가스(LNG) 시장의 발자국을 깊게합니다.

해양 벙커링은 용도 중 가장 빠른 CAGR 14%를 나타낼 전망입니다. 선박 수, 항만 벙커링 네트워크, 바이오 LNG 파일럿은 지속적인 성장을 시사하며 해운은 액화천연가스(LNG) 시장에 역동적인 기여자로 자리매김하고 있습니다.

액화천연가스(LNG) 시장 보고서는 인프라 유형(LNG 액화 플랜트, LNG 재기화 시설, LNG 선대), 최종 용도(발전, 산업 및 제조, 기타), 규모(대규모, 중규모, 소규모), 장소(육상·해상), 지역(북미, 유럽, 아시아태평양, 남미, 중동 및 아프리카)으로 구분하고 있습니다.

지역 분석

중동 및 아프리카는 2024년 시장의 28%를 차지했습니다. 카타르의 북유전은 2027년까지 77 MTPA에서 126 MTPA로 증강되어 지역 리더십을 확고히 하는 것과 동시에 유럽과 아시아 간의 라우팅 유연성을 향상시킵니다. UAE와 모리타니아의 새로운 벤처기업은 액화천연가스(LNG) 시장에 두께를 더하지만, 홀름스를 통한 유조선 보험 비용은 여전히 운영상의 우려 사항입니다.

북미는 풍부한 셰일 가스와 2025년 운행을 시작하는 13.3MTPA의 수출 트레인 덕분에 2030년까지 CAGR이 10.5%를 나타낼 전망입니다. 캐나다의 키티 매트 스타트업과 헨리 허브에 연결한 계약은 구매자의 관심을 높이고 있지만 일시적인 허가 중단은 10년대 중반 FID 전망을 약화시키고 있습니다.

아시아태평양은 여전히 가장 큰 수입 센터이며 중국은 2024년에 7,864만 톤을 구매했습니다. 필리핀과 베트남 최초 수입국이 고객 기반을 확대하고 소규모 LNG 유통이 열도 공급의 견인 역할을 합니다. 일본과 한국의 신재생에너지 성장과 수소 조종사 사업은 지역 소비에 장기적인 불확실성을 가져옵니다.

유럽은 2021년 이후 러시아 파이프라인을 대체하는 여러 FSRU를 도입해 재가스 공급 능력을 44% 확대했습니다. 계절적인 수요 급증이 프리미엄 가격을 유지하고 임박한 EU의 메탄 규제가 액화천연가스(LNG) 시장 전체공급망 감시를 강화합니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 아시아태평양 가스 발전 프로젝트가 급증, LNG 오프 테이크 계약을 요구

- 유럽에서의 IMO-2020 유황 캡에 수반하는 해상 벙커 연료로서의 LNG의 급속한 보급

- 파미안 베이스의 수반 가스 생산량이 미국 멕시코 걸프 수출 터미널용 저비용 원료 가스를 해방

- 부유식 LNG 기술이 아프리카의 좌초한 해양 가스전을 해방

- 중국의 산업용 보일러에서 석탄에서 가스로의 전환 정책이 LNG 스폿 수입을 촉진

- OECD 시장의 에너지 집약형 데이터센터로부터의 저탄소 공급에 대한 수요 증가

- 시장 성장 억제요인

- EPC 비용 인플레이션과 모듈 제조의 병목에 의한 FID 지연의 장기화

- 재생 가능 수소 경쟁이 동북아의 LNG 장기 계약 의욕을 저하

- 미국과 캐나다에서 신규 LNG 수출 허가에 대한 규제 모라토리엄

- 중요한 초크 포인트에서의 지정학적 리스크(홀름스, 수에즈)가 LNG선 보험 비용을 상승

- 공급망 분석

- 규제 전망

- 기술 전망

- Porter's Five Forces

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

제5장 시장 규모와 성장 예측

- 인프라 유형별

- LNG 액화 플랜트(육상 액화, 부유식 LNG(FLNG), 중규모(1-5mtpa), 소규모(1mtpa 미만))

- LNG 재기화 설비(육상 수입 터미널, 부유식 저장 및 재기화 설비(FSRU))

- LNG 선대 (LNG 선형별(모스, 멤브레인), 운반선 규모별(Q-Max, Q-Flex, 표준), LNG 벙커링 선)

- 최종 용도별

- 발전 사업

- 산업 및 제조

- 주택 및 상업

- 운송(해상 벙커링, 대형 도로 운송 및 철도)

- 규모별

- 대규모(5mtpa 이상)

- 중규모(1-5mtpa)

- 소규모(1mtpa 미만)

- 지역별

- 육상

- 해상(FLNG 및 FSRU)

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 영국

- 독일

- 프랑스

- 스페인

- 북유럽 국가

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- ASEAN 국가

- 호주

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 콜롬비아

- 기타 남미

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 카타르

- 남아프리카

- 이집트

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 움직임(M&A, 파트너십, PPA)

- 시장 점유율 분석(주요 기업의 시장 순위/점유율)

- 기업 프로파일

- QatarEnergy LNG(Qatargas)

- Shell plc

- Cheniere Energy Inc.

- TotalEnergies SE

- Petronas

- Novatek

- Chevron Corporation

- Exxon Mobil Corporation

- Woodside Energy Group

- Equinor ASA

- Sempra Infrastructure

- Venture Global LNG

- ENI SpA

- KOGAS

- Mitsui OSK Lines

- Golar LNG

- BW LNG

- Technip Energies

- Bechtel Corporation

- Fluor Corporation

- KBR Inc.

제7장 시장 기회와 향후 전망

KTH 25.11.21The Liquefied Natural Gas Market size in terms of production capacity is expected to grow from 511 MTPA in 2025 to 763 MTPA by 2030, at a CAGR of 8.35% during the forecast period (2025-2030).

Energy-security goals and decarbonization mandates are steering governments and utilities toward LNG as a transitional fuel, while the rapid adoption of floating LNG technology broadens supply options and unlocks previously stranded offshore resources. North American export terminals enjoy low-cost feedgas from the Permian Basin, marine shipping is pivoting to LNG for sulfur-cap compliance, and electrification plus carbon-capture upgrades are advancing operational sustainability. Technology-driven cost management and flexible contract structures are reshaping trade patterns, yet prolonged EPC inflation and the rise of renewable hydrogen remain watchpoints for the liquefied natural gas market.

Global Liquefied Natural Gas (LNG) Market Trends and Insights

Surge in Asia-Pacific Gas-to-Power Projects Seeking Midstream LNG Offtake Agreements

Asia-Pacific utilities are adding over 100 bcm of new regasification capacity, and India plans to lift gas consumption 60% by 2030. National decarbonization targets are accelerating coal-to-gas switching and prompting integrated contracts that link LNG supply directly to power-purchase deals. This tight coupling lowers financing risk, improves project bankability, and reinforces long-run demand for the liquefied natural gas market.

Rapid Uptake of LNG as Marine Bunker Fuel Following IMO-2020 Sulfur Cap in Europe

The global LNG-fueled fleet grew 33% in 2024 to 638 vessels and is expected to exceed 1,200 ships by 2028. Container lines represent 60% of LNG-propelled deadweight tonnage, driving accelerated bunker-infrastructure rollout in 198 ports. The liquefied natural gas market is picking up additional momentum from bio-LNG initiatives that extend compliance into future emissions-control regimes.

Prolonged FID Delays Owing to EPC-Cost Inflation & Module Fabrication Bottlenecks

Just 14.8 MTPA of capacity reached FID in 2024, down sharply amid 20-30% cost jumps and labor shortages. Modular construction is gaining favor despite higher equipment prices, yet delays could open a supply gap in 2027-2029, inducing volatility across the liquefied natural gas market.

Other drivers and restraints analyzed in the detailed report include:

- Permian Basin Associated Gas Output Unlocks Low-Cost Feedgas for U.S. Gulf-Coast Export Terminals

- Floating LNG Technology Unlocking Stranded Offshore Gas Fields in Africa

- Competitiveness of Renewable Hydrogen Eroding Long-Term LNG Contract Appetite in Northeast Asia

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Liquefaction plants held 43% of 2024 revenues, the highest within the liquefied natural gas market. Capacity boosts in Qatar, the United States, and Australia underpin a forecast 11.1% CAGR to 2030. Electrified compressors and carbon capture trim emissions and sharpen competitive edges for integrated majors.

The segment's ecosystem now includes 904 LNG carriers, many fitted with low-methane-slip engines that curb greenhouse-gas intensity. FSRUs are accelerating import growth, especially in Europe, adding 77 MMtpy of regas capacity since 2021 and validating modular deployment for the liquefied natural gas market.

Power generation retained 38% of demand in 2024 and is expanding through integrated LNG-to-power projects in Asia. These setups consolidate terminal, storage, and generation assets, lowering credit risk and deepening the liquefied natural gas market footprint.

Marine bunkering is poised for a 14% CAGR, the fastest among applications. Fleet counts, port bunkering networks, and bio-LNG pilots signal durable growth, positioning shipping as a dynamic contributor to the liquefied natural gas market.

The Liquefied Natural Gas (LNG) Market Report is Segmented by Infrastructure Type (LNG Liquefaction Plants, LNG Regasification Facilities, and LNG Shipping Fleet), End-Use Application (Power Generation, Industrial and Manufacturing, and Others), Scale (Large-Scale, Mid-Scale, and Small-Scale), Location (Onshore and Offshore), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa).

Geography Analysis

The Middle East & Africa held 28% of the 2024 market. Qatar's North Field build-out from 77 MTPA to 126 MTPA by 2027 cements regional leadership and improves routing flexibility between Europe and Asia. New UAE and Mauritanian ventures add depth, though tanker insurance costs through Hormuz remain an operational concern for the liquefied natural gas market.

North America is set for a 10.5% CAGR through 2030 thanks to abundant shale gas and 13.3 MTPA of export trains entering service in 2025. Canada's Kitimat start-up and Henry-Hub-linked contracts amplify buyer interest, although temporary permitting pauses temper mid-decade FID outlooks.

Asia-Pacific remains the largest import center, with China purchasing 78.64 million t in 2024. First-time importers in the Philippines and Vietnam broaden the customer base, while small-scale LNG distribution gains traction for archipelagic supply. Renewable energy growth and hydrogen pilots in Japan and South Korea inject longer-term uncertainty into regional consumption.

Europe expanded regas capacity by 44% since 2021, installing multiple FSRUs to replace Russian pipeline volumes. Seasonal demand spikes sustain premium pricing, and impending EU methane rules will intensify supply-chain monitoring across the liquefied natural gas market.

- QatarEnergy LNG (Qatargas)

- Shell plc

- Cheniere Energy Inc.

- TotalEnergies SE

- Petronas

- Novatek

- Chevron Corporation

- Exxon Mobil Corporation

- Woodside Energy Group

- Equinor ASA

- Sempra Infrastructure

- Venture Global LNG

- ENI SpA

- KOGAS

- Mitsui O.S.K. Lines

- Golar LNG

- BW LNG

- Technip Energies

- Bechtel Corporation

- Fluor Corporation

- KBR Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in Asia-Pacific Gas-to-Power Projects Seeking Midstream LNG Offtake Agreements

- 4.2.2 Rapid Uptake of LNG as Marine Bunker Fuel Following IMO-2020 Sulfur Cap in Europe

- 4.2.3 Permian Basin Associated Gas Output Unlocks Low-Cost Feed-gas for U.S. Gulf-Coast Export Terminals

- 4.2.4 Floating LNG Technology Unlocking Stranded Offshore Gas Fields in Africa

- 4.2.5 China's Coal-to-Gas Switching Policies for Industrial Boilers Driving Spot LNG Imports

- 4.2.6 Growing Demand from Energy-Intensive Data Centres for Firm Low-Carbon Supply in OECD Markets

- 4.3 Market Restraints

- 4.3.1 Prolonged FID Delays Owing to EPC-Cost Inflation & Module Fabrication Bottlenecks

- 4.3.2 Competitiveness of Renewable Hydrogen Eroding Long-Term LNG Contract Appetite in N.E. Asia

- 4.3.3 Regulatory Moratoria on New LNG Export Permits in U.S. & Canada

- 4.3.4 Geopolitical Risk at Key Chokepoints (Hormuz, Suez) Escalating LNG Shipping Insurance Costs

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Infrastructure Type

- 5.1.1 LNG Liquefaction Plants [Onshore Liquefaction, Floating LNG (FLNG), Mid-Scale (1-5 mtpa), and Small-Scale (<1 mtpa)]

- 5.1.2 LNG Regasification Facilities [Onshore Import Terminals, and Floating Storage & Regasification Units (FSRU)]

- 5.1.3 LNG Shipping Fleet [LNG Carriers by Containment (Moss and Membrane), Carrier Size (Q-Max, Q-Flex and Standard), LNG Bunkering Vessels]

- 5.2 By End-Use Application

- 5.2.1 Power Generation

- 5.2.2 Industrial and Manufacturing

- 5.2.3 Residential and Commercial

- 5.2.4 Transportation (Marine Bunkering, Heavy-Duty Road Transport and Rail)

- 5.3 By Scale

- 5.3.1 Large-Scale (Above 5 mtpa)

- 5.3.2 Mid-Scale (1 to 5 mtpa)

- 5.3.3 Small-Scale (Below 1 mtpa)

- 5.4 By Location

- 5.4.1 Onshore

- 5.4.2 Offshore (FLNG and FSRU)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Spain

- 5.5.2.5 Nordic Countries

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 ASEAN Countries

- 5.5.3.6 Australia

- 5.5.3.7 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Qatar

- 5.5.5.4 South Africa

- 5.5.5.5 Egypt

- 5.5.5.6 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 QatarEnergy LNG (Qatargas)

- 6.4.2 Shell plc

- 6.4.3 Cheniere Energy Inc.

- 6.4.4 TotalEnergies SE

- 6.4.5 Petronas

- 6.4.6 Novatek

- 6.4.7 Chevron Corporation

- 6.4.8 Exxon Mobil Corporation

- 6.4.9 Woodside Energy Group

- 6.4.10 Equinor ASA

- 6.4.11 Sempra Infrastructure

- 6.4.12 Venture Global LNG

- 6.4.13 ENI SpA

- 6.4.14 KOGAS

- 6.4.15 Mitsui O.S.K. Lines

- 6.4.16 Golar LNG

- 6.4.17 BW LNG

- 6.4.18 Technip Energies

- 6.4.19 Bechtel Corporation

- 6.4.20 Fluor Corporation

- 6.4.21 KBR Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment