|

시장보고서

상품코드

1683208

자동차 OEM 인테리어 코팅 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Automotive OEM Interior Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

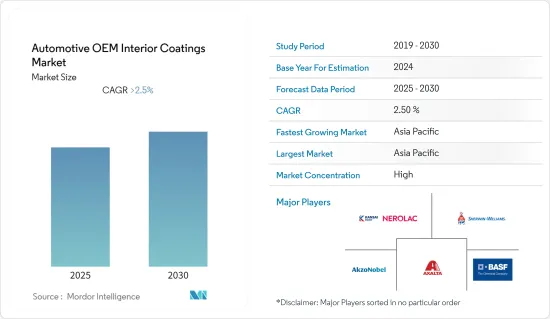

자동차 OEM 인테리어 코팅 시장은 예측 기간 동안 2.5% 이상의 CAGR을 나타낼 것으로 예상됩니다.

코로나19의 발생은 자동차 산업에 단기적, 장기적으로 여러 가지 영향을 미칠 것이며, OEM 인테리어 페인트 시장에도 영향을 미칠 가능성이 높습니다. 중국에서 많은 부품공급이 지연되고 있습니다. OICA에 따르면 2020년 세계 자동차 생산량은 2019년 대비 약 16% 감소하여 자동차 산업은 전 세계적으로 생산 재료가 부족합니다. 많은 OEM이 유럽 생산의 대부분을 중단하고 있으며, 그 중 독일의 주요 제조업체는 유럽 제조 부문의 대부분을 중단했으며 다른 OEM도 장기적으로 폐쇄했습니다. 자동차 생산이 둔화되고 코로나19가 업계 상황을 더욱 악화시키면서 OEM 자동차 내장재 페인트 시장은 단기 및 중기적으로 부정적인 영향을 받을 것이며, 예측 기간 후반에는 회복 속도가 둔화될 것입니다.

주요 하이라이트

- 장기적으로 볼 때, 팬데믹 위기로 인한 개인 이동에 대한 선호도가 시장을 주도하는 주요 요인으로 작용하고 있습니다. 도로 및 인프라의 개선, 렌터카 업계의 신생 기업의 혁신, 중산층이 이용할 수 있는 저렴한 가격의 자동차의 가용성 등으로 인해 최근 개인 이동 수단에 대한 소비자의 선호도가 높아지고 있습니다.

- 중동 및 아프리카의 투자 기회 증가와 전기자동차에 대한 향후 수요는 향후 기회가 될 가능성이 높습니다.

- 아시아태평양은 중국, 인도, 일본, 한국 등 국가들의 소비가 가장 많아 세계 시장을 독점하고 있습니다.

자동차 OEM 인테리어 코팅 시장 동향

승용차 부문은 시장에 큰 수요를 가져옵니다.

- 승용차 부문은 조사 대상 시장에서 가장 큰 수요를 보이고 있습니다.

- 승용차 내장재에는 ABS, 폴리카보네이트 등 다양한 기판을 코팅하기 위해 다양한 유형의 단일 성분, 다성분, 용제 및 수성 도료가 사용됩니다. 또한, 레이저 에칭이 가능한 코팅도 이러한 목적으로 사용되고 있습니다.

- 센터 클러스터, 계기판, 계기판, 스피커 그릴, 팔걸이 및 팔걸이 베젤, 스티어링 휠, 도어 트림, 스티어링 휠, 도어 트림, 스티어링 휠 등 다양한 인테리어 코팅에 사용됩니다. 이 코팅의 중요한 특징은 높은 광택과 매끄러운 마감입니다.

- 세계 승용차 생산량은 2017년 이후 꾸준히 감소하고 있으며, 코로나19는 2020년 이러한 감소세를 더욱 심화시켜 2020년에는 총 5,583만 대의 자동차가 생산되어 2019년 6,715만 대, 2018년 7,175만 대로 꾸준히 감소했습니다.

- OICA에 따르면 2021년 상반기(1-6월) 세계 승용차 생산량은 2020년 동기 대비 26% 이상 증가했습니다. 상반기 생산량은 2020년 2,231만 4,111대에서 증가하여 2021년에는 약 2,814만 8,90대에 달했습니다. 그러나 생산량은 3,324만 8,444대로 2019년에 비해 여전히 15% 적습니다.

- 그러나 자동차 OEM 인테리어 코팅는 사회적 거리두기 조치에 따른 개인 이동수단에 대한 선호도 변화로 인해 회복 이후 상용차 및 기타 차량 부문에 비해 승용차 부문 수요가 더 높은 비율로 증가할 것으로 예상됩니다.

아시아태평양이 시장을 장악합니다.

- 아시아태평양은 자동차 OEM 인테리어 코팅의 최대 시장입니다. 이 지역 시장의 성장은 거대한 자동차 생산 기반과 중국, 인도, 아세안 국가와 같은 주요 경제권에서 아시아태평양에 대한 투자 증가에 기인합니다.

- OICA에 따르면 중국, 일본, 한국, 인도에서 각각 약 2,523만대, 807만대, 351만대, 339만대의 자동차가 생산되어 2020년 세계 자동차 생산량의 50% 이상에 기여했습니다.

- 중국의 자동차 제조 산업은 세계 최대 규모입니다. 이 산업은 2018년에 생산과 판매량이 감소하는 둔화를 보였습니다. 2019년에도 비슷한 추세가 이어져 생산량은 7.5% 감소했습니다. 자동차 산업의 실적은 경제 변화와 중국의 미국과의 무역 전쟁의 영향을 받았습니다.

- 중국 정부는 2025년까지 최소 5,000대, 2030년까지 100만 대의 연료전지 전기차를 도입할 계획을 세우고 있습니다. 정부가 전기자동차, 하이브리드 자동차, 연료전지 전기자동차의 이용을 장려하고 있어 향후 시장이 성장할 것으로 예상됩니다.

- 인도는 경제 성장 국가이며, 미래 시장 기회로 큰 잠재력을 가지고 있습니다. 인도의 경제는 향후 몇 년동안 더욱 성장할 것으로 예상됩니다. 악마 추방과 GST 개혁이 국내 생산량에 영향을 미쳤음에도 불구하고, 이러한 개혁의 영향은 점차 사라지고 있습니다. 또한, 인도 정부는 인도를 제조업의 허브로 만들기 위해 제조업에 외국인 직접투자(FDI)를 유치하기 위한 이니셔티브를 취하고 있습니다.

- 자동차 산업은 인도에서 가장 큰 제조업 중 하나이며, 3,700만 명 이상의 근로자를 고용하여 인도 GDP의 약 7.5%를 차지하고 있으며, 2018년 인도는 세계 4위의 자동차 시장이자 7위의 상용차 제조업체가 되었습니다.

- DPIIT(Department of Promotion Industry and Internal Trade)에 따르면, 2000년 4월부터 2020년 6월까지 인도 자동차 시장에는 약 2,450만 달러 상당의 FDI가 유치되었습니다. 이러한 요인은 인도 자동차 OEM용 내장 도료 시장에 큰 영향을 미칠 것으로 보입니다.

- 인도 정부는 최근 코로나19 사태로 인한 수요 충격에 대응하기 위해 자동차 산업에 대한 감세 및 재정적 조치와 함께 전기자동차 부품 수입 관세를 15-30%에서 10-15%로 인하했습니다.

- 전반적으로, 자동차 OEM 인테리어 도료 수요는 예측 기간 동안 중등도에서 낮은 수준을 유지할 것으로 예상되지만, 국내 자동차 산업은 향후 몇 년동안 이 위기에서 회복할 것으로 보입니다.

자동차 OEM 인테리어 코팅 산업 개요

자동차 OEM 인테리어 코팅 세계 시장은 부분적으로 통합되어 있으며, 주요 기업들이 세계 시장의 약 50%를 점유하고 있습니다. 주요 기업으로는 PPG Industries Inc, Akzo Nobel N.V., Kansai Nerolac Paints Limited, BASF SE, Axalta Coating Systems, LLC 등이 있습니다.

기타 특전:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 산업 밸류체인 분석

- Porter의 Five Forces 분석

- 공급 기업의 교섭력

- 소비자의 교섭력

- 신규 진출업체의 위협

- 대체품의 위협

- 경쟁 정도

제5장 시장 세분화

- 수지별

- 에폭시 수지

- 폴리우레탄

- 아크릴

- 기타 수지

- 레이어별

- 프라이머

- 베이스 코트

- 클리어 코트

- 차량 유형별

- 승용차

- 소형 상용차

- 대형 상용차

- 기타 차량 유형

- 지역별

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 이란

- 남아프리카공화국

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- 인수합병(M&A)/합작투자(JV)/협업/협정

- 시장 점유율 분석**/순위 분석

- 주요 기업의 전략

- 기업 개요

- Akzo Nobel N.V.

- Axalta Coating Systems

- BASF SE

- Fujikura Kasei Co. Ltd

- Kansai Nerolac Paints Limited

- NB Coatings

- PPG Industries

- The Sherwin-Williams Company

- KCC Corporation

제7장 시장 기회와 향후 동향

LSH 25.03.27The Automotive OEM Interior Coatings Market is expected to register a CAGR of greater than 2.5% during the forecast period.

The outbreak of COVID-19 is likely to bring several short-term and long-term consequences in the automotive industry, which is likely to affect the OEM interior coatings market. The supply of many components from China has been delayed. This has resulted in the automotive industry, globally, running out of materials for production. According to OICA, the global production of automotive fell by around 16% in the year 2020, compared to 2019. Many OEMs shut down the majority of their European production, which includes leading German manufacturers shutting down the majority of their manufacturing units in Europe with other OEMs closing for a longer time. With automotive production slowing down and the COVID-19 pandemic further worsening the situation for the industry, the market for OEM automotive interior coatings is negatively affected in the short-/mid-term with a sluggish recovery rate during the latter part of the forecast period.

Key Highlights

- Over the long term, the major factor driving the market studied is the preference for personal transport owing to the pandemic crisis. The consumer preference for personal transport has grown over the recent years due to better development of roads and infrastructure, startup innovations in the car rental industry, and availability of low-cost cars that are affordable for the middle-class people.

- Rise in investment opportunities in the Middle East and Africa and upcoming demand for electric vehicles are likely to act as opportunities in the future.

- Asia-Pacific dominated the market across the world, with the largest consumption from countries, such as China, India, Japan, and South Korea.

Automotive OEM Interior Coatings Market Trends

Passenger Car Segment to Contribute Significant Demand to the Market

- The passenger cars segment has the largest demand in the market studied.

- In passenger car interiors, various types of single and multi-component and solvent-borne and waterborne coatings are used for coating various substrates, such as ABS and polycarbonate materials. Laser etchable coatings are also used for these purposes.

- They are used for coating various interiors, such as center clusters, meter clusters, instrument panels, speaker grills, armrest and armrest bezels, steering wheels, door trim, and handles. The important characteristics of these coatings are high gloss and a smooth finish.

- The world passenger car production has been in a steady decline since 2017. The COVID-19 has further aggravated this decline in 2020, as a total of 55.83 million cars were produced in 2020, a steady decline from 67.15 million units and 71.75 million units in 2019 and 2018, respectively, was registered.

- According to OICA, in the first half of 2021 (January-June), the global passenger vehicle production has increased by more than 26% when compared to the same period in 2020. In the first six months, the production has increased from 2,23,14,111 units in 2020, to reach about 2,81,48,90 in 2021. However, the production is still less by 15% compared to 2019, which is 3,32,48,444 units.

- However, the demand for automotive OEM interior coatings from the passenger cars segment is expected to increase with a higher rate relative to the commercial and other vehicles segments post-recovery, owing to the change in mobility preferences for personal mode of transport in the wake of social distancing measures.

Asia-Pacific Region to dominate the Market

- Asia-Pacific is the largest market for automotive OEM interior coatings. Growth in the regional market is driven by the huge automotive production base coupled with increased investments in the Asia-Pacific region, primarily from major economies, such as China, India, and ASEAN countries.

- According to OICA, around 25.23 million, 8.07 million, 3.51 million, and 3.39 million units of vehicles were produced in China, Japan, South Korea, and India, respectively, contributing to over 50% of the global automobile production in the year 2020.

- The Chinese automotive manufacturing industry is the largest in the world. The industry witnessed a slowdown in 2018, wherein the production and sales declined. A similar trend continued, with the production witnessing a 7.5% decline during 2019. The performance of the automotive industry was affected by the economic shifts and China's trade war with the United States.

- The Chinese government is planning to have a minimum of 5,000 fuel cell electric vehicles by 2025 and 1 million by 2030. With government promoting the use of electric, hybrid, and fuel cell electric vehicles, the market is expected to grow in the future.

- India is a growing economy and holds great potential for future market opportunities. The country's economy is expected to further grow in the coming years. Despite demonetization and GST reforms affecting the national production volume, the impact of these reforms is slowly waning. Moreover, the country's government has been taking initiatives to attract Foreign Direct Investments (FDIs) in the manufacturing sector, to make India a manufacturing hub.

- The automotive industry is one of the largest manufacturing sectors in the country and contributes about 7.5% to the nation's GDP, by employing more than 37 million workers. In 2018, India became the fourth-largest automobile market in the world and the seventh-largest commercial vehicle manufacturer.

- According to the Department of Promotion Industry and Internal Trade (DPIIT) around USD 24.5 million worth FDIs were attracted by the Indian automobiles market between the period of April 2000 to June 2020. Factors such as these will show a significant impact on the automotive OEM interior coatings market in the country.

- The Indian government has recently reduced customs duty on the import of components for electric vehicles from a range of 15-30% to 10-15%, along with tax breaks and fiscal packages for the automotive industry, to fight the recent demand shocks amid COVID-19 crisis.

- Overall, the demand for the automotive OEM interior coatings is expected to be moderate to low during the forecast period, while the automotive industry in the country will try to recover from this crisis in the coming years.

Automotive OEM Interior Coatings Industry Overview

The global automotive OEM interior coatings market is partially consolidated in nature, with the top players accounting for around 50% of the global market. The major companies include PPG Industries Inc, Akzo Nobel N.V., Kansai Nerolac Paints Limited, BASF SE, and Axalta Coating Systems, LLC, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Mobility Preference for Personal Transport

- 4.1.2 Growing Demand for Better Interiors in Vehicles

- 4.2 Restraints

- 4.2.1 Detrimental Impact of COVID-19

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Resin

- 5.1.1 Epoxy

- 5.1.2 Polyurethane

- 5.1.3 Acrylic

- 5.1.4 Other Resins

- 5.2 Layer

- 5.2.1 Primer

- 5.2.2 Base Coat

- 5.2.3 Clear Coat

- 5.3 Vehicle Type

- 5.3.1 Passenger Car

- 5.3.2 Light Commercial Vehicles

- 5.3.3 Heavy Commercial Vehicles

- 5.3.4 Other Vehicle Types

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Iran

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Akzo Nobel N.V.

- 6.4.2 Axalta Coating Systems

- 6.4.3 BASF SE

- 6.4.4 Fujikura Kasei Co. Ltd

- 6.4.5 Kansai Nerolac Paints Limited

- 6.4.6 NB Coatings

- 6.4.7 PPG Industries

- 6.4.8 The Sherwin-Williams Company

- 6.4.9 KCC Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rise in Investment Opportunities in the Middle-East and Africa

- 7.2 Upcoming Demand for Electric Vehicles