|

시장보고서

상품코드

1683229

MEMS 에너지 수확 장치 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)MEMS Energy Harvesting Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

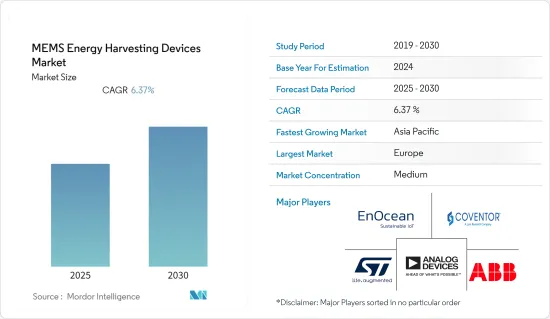

MEMS 에너지 수확 장치 시장은 예측 기간 동안 CAGR 6.37%를 나타낼 것으로 예상됩니다.

주요 하이라이트

- 에너지 수확은 수십년동안 자전거의 다이너모와 태양광 패널에 사용되어 왔습니다. 그러나 이 기술은 건물 및 산업 자동화, 자동차, 스마트 시티, 보안 시스템 등 놀라운 응용 분야를 가진 혁명입니다. 에너지 수확은 증가하는 에너지 수요를 충족하고 에너지를 절약할 수 있는 중요한 도구입니다. 또한, 빅데이터와 IoT 기술은 배터리에 비해 유지보수가 적고 설치가 쉬운 자율형 에너지 수확 장치로 이어졌습니다.

- 또한, 상업용 빌딩 자동화 시장도 활기를 띠고 있으며, 스마트시티 개념 증가와 함께 큰 성장이 예상되고 있습니다. 에너지 수확 무선 솔루션은 설치 및 유지보수 비용을 절감할 수 있어 빌딩 및 홈 오토메이션 분야에서 빠르게 성장하고 있습니다. 구리 배선이나 배터리와 비교했을 때, 에너지 수확 무선 기술은 수천 개의 빌딩 장치를 상호 연결하고 새로운 모니터링 및 제어 용도를 찾는 데 이상적인 통신 표준입니다.

- MEMS는 센서/액추에이터, 정보처리 및 무선 주파수 통신을 위한 전자회로, 안테나, 에너지 수확기 등을 하나의 칩이나 패키지에 집적화하기 쉽기 때문에 IoT 센싱 노드 구현에 가장 적합한 기술로 평가받고 있습니다. 이러한 장치는 유체와의 상호 작용을 포함하여 생물학적, 화학적, 열적 현상과 상호 작용할 수 있습니다. 동시에 이러한 장치는 일반적으로 기계력, 압전력, 열전력과 같은 비전자기장 및 힘과 상호 작용하며, MEMS 기술은 에너지 수확기를 소형화할 수 있는 훌륭한 도구입니다.

- 최근 기계적인 진동, 열 구배, 전자기 복사, 태양 복사로부터의 에너지 수확에 대한 많은 발전이 이루어지고 있습니다. 이러한 발전은 기존의 배터리를 대신하여 휴대용 기기 및 개인용 기기를 작동시키기 위한 대체 전원을 제공하기 위해 이루어졌습니다. 그 결과, 초저전력 소비 전자 장치의 제작은 MEMS 기반 하베스팅 장치의 채택률을 제한하는 주요 과제 중 하나가 되었습니다.

- 코로나19는 환자 중심의 접근 방식을 더욱 가속화하여 원격 의료, 원격 진료 기기, 웨어러블과 같은 원격 환자 모니터링의 필요성을 증가시켰습니다. 사람들의 체온과 혈압을 추적할 수 있는 능력으로 인해 에너지 수확기 웨어러블에 대한 수요가 증가하고 있습니다. 이러한 추세는 압력, 관성, 관성, 마이크, 써모파일과 같은 통합 MEMS 센서와 마찬가지로 웨어러블 시장에 새로운 기회를 창출하고 있습니다.

MEMS 에너지 수확 디바이스 시장 동향

빌딩 및 홈 오토메이션이 주요 점유율을 차지합니다.

- MEMS 에너지 수확 장치 시장에서 빌딩 및 홈 오토메이션의 최종 용도는 MEMS 기반 에너지 수확 장치의 사용을 의미합니다. 이 장치는 주거 및 상업용 건물 내의 다양한 자동화 시스템 및 장치에 전력을 공급하고 강화합니다.

- MEMS 에너지 수확 장치 시장의 빌딩 및 홈 오토메이션 최종 사용자용도는 다양한 응용 분야를 포괄하고 있습니다. 온도, 습도, 공기질, 거주지, 조명 수준과 같은 매개변수를 모니터링하는 무선 센서 네트워크, 에너지 효율적인 LED 조명 시스템, 스마트 온도 조절기, 구역 기반 HVAC 제어, 보안 및 모니터링 시스템에 전력을 공급하는 MEMS 에너지 수확 장치 등이 있습니다. 보안 및 감시 시스템에도 전력을 공급합니다. 또한, 무선 보안 카메라 및 출입 통제 시스템도 포함됩니다. 또한, 스마트 잠금장치, 가전제품, 음성비서, 엔터테인먼트 시스템 등 스마트 홈 기기를 작동시킬 수 있습니다.

- 또한, 미국 Hippo Holdings의 최근 조사에서 강조된 바와 같이, 빌딩 및 홈 오토메이션의 트렌드는 편의성을 중시하는 경향이 강화되고 있다는 배경을 가지고 있습니다. 이 조사에 따르면, 편의성이 스마트 홈 기기 이용률의 46%를 차지하고 있으며, MEMS 에너지 수확 장치는 이러한 수요를 충족시키기 위해 빌딩 및 홈 오토메이션 시스템에 채택될 수 있는 잠재적인 솔루션이 될 수 있습니다. MEMS 에너지 수확 장치는 조명 제어, HVAC 시스템, 보안 시스템, 스마트 홈 장치와 같은 자동화 시스템에 전력을 공급함으로써 거주자의 편안함과 편리함을 향상시키는 매끄럽고 개인화된 경험을 제공할 수 있습니다.

- 또한, 북미에서는 미국, 캐나다 등의 국가에서 스마트홈 기술의 급속한 보급이 예상됩니다. 기술에 정통한 소비자의 존재, 에너지 효율에 대한 관심, 정부의 적극적인 노력 등이 시장 성장의 잠재적 요인으로 작용할 수 있습니다.

- 빌딩 및 홈 오토메이션 시장에서는 에너지 효율, 지속가능성, 스마트 기기 최적화에 대한 관심이 높아지면서 MEMS 에너지 수확 장치를 통합하는 추세가 강화되고 있습니다. 전반적으로 빌딩 및 홈 오토메이션의 성장 궤적은 MEMS 에너지 수확 기술의 발전과 함께 더욱 확대될 것으로 예상됩니다.

아시아태평양이 급성장

- 아시아 국가, 특히 중국, 일본, 한국, 대만은 MEMS 기술 개발 및 제조에서 큰 진전을 이루었습니다. 이들 국가는 첨단 연구 개발 시설을 갖추고 있어 기술 혁신을 촉진하고 MEMS 수확 장치의 능력의 한계를 넓혀가고 있습니다.

- 아시아는 스마트폰, 웨어러블, IoT 기기 등 휴대용 기기에 대한 수요가 높은 대규모 소비자 가전 시장의 제조 거점이며, MEMS 수확 장치는 주변 에너지를 이용하여 이러한 기기에 전력을 공급할 수 있는 매력적인 솔루션을 제공합니다. 기존 배터리에 대한 의존도를 줄일 수 있는 매력적인 솔루션을 제공합니다.

- 또한, MEMS 센서는 배기가스와 연료 소비를 줄이고, 안정성과 안전성을 높이며, 승객의 편안함과 편리함을 향상시키는 능력으로 인해 자동차의 가장 중요한 구성 요소 중 하나가되었습니다. 가속도계, 자이로스코프, 복사 및 온도 센서, 압력 및 진동 센서 등이 있습니다.

- 이러한 장치는 자동차의 안전성을 향상시키는 데 중요한 역할을 하고 있습니다. 2022년 9월, SiTime Corporation은 첨단 MEMS 기술을 기반으로 한 새로운 차량용 발진기 제품군을 출시하여 시장 성장의 촉매제로 작용하고 있습니다. 이 새로운 차동 발진기는 10배의 내결함성을 가지고 있으며, 극한의 도로 상황과 온도에서도 ADAS의 안정적인 작동을 보장합니다.

- 또한, 아시아 각국 정부는 청정에너지 기술을 촉진하고 화석연료 의존도를 낮추기 위한 정책과 이니셔티브를 시행하고 있습니다. 예를 들어, 2023년 1월에는 제1회 한-인도 환경주간이 개최되었습니다. 인도는 2070년까지 넷제로를 달성하겠다는 야심찬 목표를 세웠습니다. 일본은 2050년까지 넷제로를 달성하겠다는 목표를 세웠습니다. 이러한 시책에는 재정적 혜택, 연구 보조금, 업계 관계자들과의 협력 등이 포함되는 경우가 많으며, 환경을 조성할 수 있습니다. 청정 에너지에 대한 정부의 이러한 노력은 MEMS 에너지 수확 디바이스 시장의 성장을 가속할 것으로 보입니다.

MEMS 에너지 수확 디바이스 산업 개요

MEMS 에너지 수확 장치 시장은 후방 및 전방 통합이 가능한 많은 대규모 공급업체로 구성되어 있으며, 큰 수익 창출 능력을 가지고 있습니다. 시장은 비교적 통합되어 있으며, 벤더들은 기술력과 다른 기업에 대한 경쟁력을 확보하기 위해 연구개발에 대한 지출을 늘리고 있습니다. 시장의 벤더들은 가격보다 기술과 품질로 경쟁하고 있습니다. 이 시장 특징은 제품 차별화가 중간에서 높은 수준이고, 제품 보급 수준이 높아지고 있으며, 경쟁이 많다는 것입니다. 일반적으로 제공되는 제품에는 고객 맞춤화가 포함되어 있습니다. 주요 시장 기업으로는 EnOcean Gmbh, STMicroelectronics NV, Coventor Inc.(Lam Research Corporation), Analog Devices Inc. 등이 있습니다.

- 2023년 5월 - ST마이크로일렉트로닉스는 산업 시장을 위한 10년 장수명 프로그램을 선언한 최초의 MEMS 방수/방액 절대압 센서를 발표했습니다.

- 2023년 4월 - EnOcean의 혁신적인 에너지 수확 무선 기술이 이산화탄소 배출량을 크게 줄였으며, 2023년 4월 말 1,900만 개 이상의 장치가 판매되어 140만 3,302톤의 CO2를 절감할 수 있습니다. 이는 주로 배터리와 케이블의 필요성을 없애고 건물의 에너지 효율을 높이는 자가발전형 솔루션 덕분입니다.

기타 특전:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 업계의 매력 - Porter의 Five Forces 분석

- 공급 기업의 교섭력

- 바이어의 교섭력

- 신규 진출업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 업계 밸류체인 분석

- 시장에 대한 COVID-19의 영향

제5장 시장 역학

- 시장 성장 촉진요인

- 시장 성장 억제요인

제6장 시장 세분화

- 기술별

- 진동에너지 수확

- 열에너지 수확

- RF 에너지 수확

- 기타 에너지 수확

- 최종사용자용도별

- 자동차

- 산업

- 군 및 항공우주

- 빌딩 및 홈오토메이션

- 소비자 일렉트로닉스

- 기타 최종사용자 용도

- 지역별

- 북미

- 유럽

- 아시아태평양

- 세계 기타 지역

제7장 경쟁 구도

- 기업 개요

- EnOcean Gmbh

- STMicroelectronics NV

- Coventor Inc.(Lam Research Corporation)

- Analog Devices Inc

- ABB Ltd

- Cymbet Corp

- Micropelt(EH4GmbH)

제8장 투자 분석

제9장 시장 기회와 향후 동향

LSH 25.03.27The MEMS Energy Harvesting Devices Market is expected to register a CAGR of 6.37% during the forecast period.

Key Highlights

- Energy harvesting is used for decades for bicycle dynamos or solar panels. However, this technology is a revolution with staggering applications in building and industry automation, automotive vehicles, smart cities, and security systems. Notably, governments and favorable public initiatives are the major drivers for energy harvesting demand growth as public actors consider energy harvesting a crucial tool for meeting the increasing energy demand and saving energy. In addition, Big Data and IoT technologies led to autonomous energy-harvesting devices that require less maintenance and are easier to install than batteries.

- Moreover, the market for commercial building automation is also booming and is expected to experience significant growth with rising smart city initiatives. Energy harvesting wireless solutions find surging applications in building and home automation owing to their high cost-saving potential in installation and maintenance. Compared to copper wiring or batteries, energy-harvesting wireless technology is the ideal communication standard to interconnect thousands of building devices and find new monitoring and control applications.

- Microelectromechanical systems (MEMS) are considered the most suitable technology to realize IoT-sensing nodes. It facilitates the integrated fabrication of sensors/actuators, electronic circuits for information processing and radio frequency communication, antennas, and energy harvesters on a single chip or package. They may interact with biological, chemical, and thermal phenomena, including fluid interaction. At the same time, these devices usually interact with non-electromagnetic fields and forces, such as mechanical forces, piezoelectric and thermoelectric forces, among others. It promoted MEMS technology as an excellent tool for miniaturizing energy harvesters.

- In recent years, much development is made in energy harvesting from mechanical vibrations, thermal gradients, electromagnetic radiations, and solar radiations. This progress is made to provide alternative power sources to operate portable and personal gadgets instead of traditional batteries. As a result, the creation of ultra-low-power electronic devices became one of the main challenges likely to limit the adoption rate of MEMS-based harvesting devices.

- COVID-19 accelerated the pace towards a more patient-centric approach and increased the need for remote patient monitoring, including telehealth, point-of-care devices, and wearables. There is a growing demand for energy harvesters' wearables owing to their ability to track peoples' temperature and blood pressure. This trend created new opportunities in the wearables market, as well as for integrated MEMS sensors, such as pressure, inertial, microphones, thermopiles, etc.

MEMS Energy Harvesting Devices Market Trends

Building and Home Automation to Hold Major Share

- Building and home automation end-user application in the MEMS energy harvesting devices market refers to using MEMS-based energy harvesting devices. The devices power and enhance various automated systems and devices within residential and commercial buildings.

- The building and home automation end-user application in the MEMS energy harvesting devices market encompasses many applications. These include wireless sensor networks for monitoring parameters such as temperature, humidity, air quality, occupancy, and lighting levels. MEMS energy harvesting devices also power energy-efficient LED lighting systems, smart thermostats, zone-based HVAC controls, and security and surveillance systems. It also includes wireless security cameras and access control systems. Additionally, they enable the operation of smart home devices such as smart locks, appliances, voice-activated assistants, and entertainment systems.

- Further, the trend of building and home automation is driven by the increasing emphasis on convenience, as highlighted by Hippo Holdings' recent survey in the United States. It stated that convenience accounts for 46% of the utilization of smart home devices across all demographics. MEMS energy harvesting devices could be a potential solution to be adopted in building and home automation systems to meet this demand. By powering automated systems such as lighting controls, HVAC systems, security systems, and smart home devices, MEMS energy harvesting devices provide seamless and personalized experiences, enhancing occupants' comfort and convenience.

- Moreover, in North America, countries such as the United States and Canada are expected to witness rapid adoption growth of smart home technologies. Factors such as the presence of tech-savvy consumers, a strong emphasis on energy efficiency, and favorable government initiatives might be potential factors responsible for the market's growth.

- The building and home automation market is witnessing a growing trend towards integrating MEMS energy harvesting devices, owing to the rising emphasis on energy efficiency, sustainability, and the optimization of smart devices. Overall, the growth trajectory of building and home automation, coupled with advancements in MEMS energy harvesting technology, is expected to witness further expansion.

Asia-Pacific to Witness Fastest Growth

- Asian countries, particularly China, Japan, South Korea, and Taiwan, made significant strides in developing and manufacturing MEMS technologies. These countries include advanced research and development facilities, fostering innovation and pushing the boundaries of MEMS harvesting device capabilities.

- Asia is a manufacturing hub for a large consumer electronics market, with a high demand for portable devices such as smartphones, wearables, and IoT devices. MEMS harvesting devices provide an attractive solution for powering these devices by harnessing ambient energy, reducing the dependence on traditional batteries.

- Also, MEMS sensors became one of the most important components in automobiles due to their ability to reduce emissions and fuel consumption, increase stability and safety, and improve the comfort and convenience of passengers. The cost-effective capability of MEMS sensors led to the development of several sensors for automotive applications. It includes accelerometers, gyroscopes, radiation and temperature sensors, and pressure and vibration sensors.

- These devices play a critical role in improving the safety of vehicles. This factor acts as the catalyst for the growth of the market. In September 2022, SiTime Corporation introduced a new automotive oscillator family based on its advanced MEMS technology. The new differential oscillators are 10x more resilient and ensure reliable operation of ADAS across extreme road conditions and temperatures.

- Moreover, governments across Asia implemented policies and initiatives to promote clean energy technologies and reduce reliance on fossil fuels. For instance, in January 2023, the first India-Japan environment week took place during the event. India set an ambitious target of achieving net zero by 2070. Japan initiated a goal of becoming net zero by 2050. These measures often include financial incentives, research grants, and collaborations with industry players, creating a conducive environment. These initiatives by the government for clean energy will increase the growth of the MEMS harvesting device market.

MEMS Energy Harvesting Devices Industry Overview

The MEMS energy harvesting device market comprises many large-scale vendors capable of backward and forward integration and commands significant revenue generation capabilities. The market is relatively consolidated, and vendors increasingly spend on R&D to gain technological capabilities and a competitive edge over other enterprises. The vendors in the market are competing on technology and quality rather than on price. This market is characterized by moderate-to-high product differentiation, growing levels of product penetration, and high levels of competition. Generally, the products offered include customer customizations. Some of the major market players are EnOcean Gmbh, STMicroelectronics NV, Coventor Inc. (Lam Research Corporation), Analog Devices Inc., and ABB Ltd.

- May 2023- STMicroelectronics introduced the first MEMS water/liquid-proof absolute pressure sensor with a declared 10-year longevity program for the industrial market.

- April 2023- EnOcean's innovative energy-harvesting wireless technology significantly reduces carbon emissions. As of the end of April 2023, with over 19,000,000 devices sold, the company could save a remarkable 1,403,302 tons of CO2. It is primarily because of its self-powered solutions that eliminate the need for batteries or cables and helps make buildings more energy efficient.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth of Smart Cities

- 5.1.2 Commercial Applications are Slowly Getting into the Market for Industrial Applications and Home Automation Appliances

- 5.2 Market Restraints

- 5.2.1 Ultra Low Power Electronics

- 5.2.2 Wireless Data Transmissions Rates and Standards

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Vibration Energy Harvesting

- 6.1.2 Thermal Energy Harvesting

- 6.1.3 RF Energy Harvesting

- 6.1.4 Other Types of Energy Harvesting

- 6.2 By End-user Applications

- 6.2.1 Automotive

- 6.2.2 Industrial

- 6.2.3 Military and Aerospace

- 6.2.4 Building and Home Automation

- 6.2.5 Consumer Electronics

- 6.2.6 Other End-user Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 EnOcean Gmbh

- 7.1.2 STMicroelectronics NV

- 7.1.3 Coventor Inc. (Lam Research Corporation)

- 7.1.4 Analog Devices Inc

- 7.1.5 ABB Ltd

- 7.1.6 Cymbet Corp

- 7.1.7 Micropelt (EH4 GmbH)