|

시장보고서

상품코드

1851867

레이저 센서 시장 : 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Laser Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

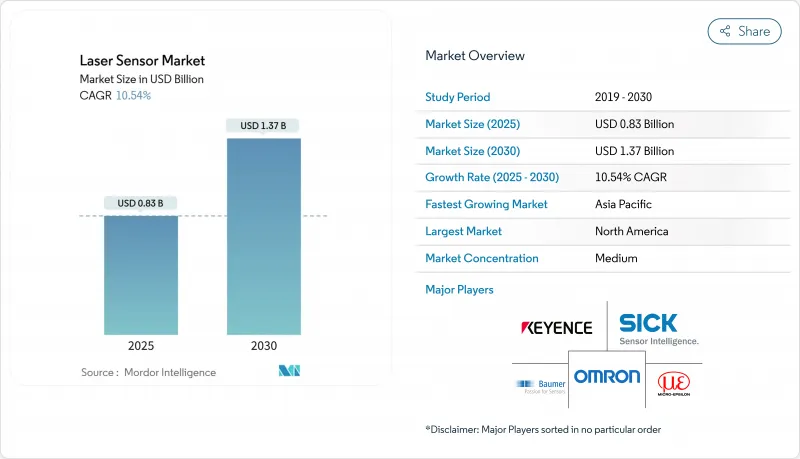

레이저 센서 시장 규모는 2025년에 8억 3,000만 달러, 2030년에는 CAGR 10.54%로 13억 7,000만 달러에 이를 것으로 예측됩니다.

마이크론 수준의 정확도를 필요로 하는 측정 작업을 공장이 자동화함에 따라 수요가 높아지고 있으며, 또한 고체 LiDAR의 가격 하락으로 자율주행차, 로봇, 인프라 검사에 새로운 비즈니스 기회가 확산되고 있습니다. 유럽의 인프라 프로젝트에서는 디지털 트윈 문서의 사용이 의무화되고 있으며, 아시아태평양에서는 전기자동차(EV)용 배터리 라인의 치수 공차의 엄격화가 추진되고 있기 때문에 성장이 강화되고 있습니다. 교정, 예지보전, 분석에 대한 서비스 제공은 하드웨어 판매보다 빠르게 확대되고 있으며, 센서 조달과 마찬가지로 장기적인 성능이 중요한 생태계의 성숙을 시사합니다.

세계 레이저 센서 시장 동향과 통찰

자동차용 EV 배터리 조립품의 정밀 갭 폐쇄

0.1mm의 치수 오차는 배터리용량을 최대 5% 깎을 수 있으므로 레이저 변위 센서는 EV 배터리 라인의 접촉 게이지를 대체합니다. 스펙클 프리 블루 레이저 시스템은 접착제 비드와 용접 피팅를 실시간으로 확인하여 스크랩과 재가공을 줄입니다. 아시아의 셀 제조업체는 스택 높이, 탭 정렬 및 용접 녹음을 동시에 측정하는 인라인 멀티 센서 장비를 도입하여 새로운 화학물질의 시동 시간을 단축하고 있습니다.

반도체 패키지용 3D AOI 급증

고급 패키징에는 보이드 및 코플러너리티 결함을 허용하지 않는 고대역폭 칩이 탑재되어 있습니다. 라인 스캔 3D 레이저 센서는 요철 표면의 5 미크론 결함을 감지하고 딥러닝과 결합하여 SinceVision 에러 거부율을 40% 줄입니다. 통합된 다중 파장 헤드는 반사성 성형 재료 내부의 간섭을 줄이고 택트 타임 내에서 전체 영역 스캔을 가능하게 합니다.

고온 주조 라인에서의 열 드리프트 감도

반도체 주조 공정에서는 극단적인 온도 변화와 첨단 노드 제조 공정의 정밀 요구에 따라 레이저 변위 센서에 독특한 과제가 있습니다. 가혹한 환경을 위해 설계된 실리콘 카바이드 압력 센서는 -50°C - 600°C의 작동 범위에서 풀 스케일 출력 0.18% 이내의 정확도를 유지하면서 열 안정성을 해결하는 데 필요한 재료 과학의 발전을 보여줍니다. 그러나 레이저 기반 시스템은 주조 환경에서 측정 정확도를 손상시킬 수 있는 광학 부품의 열팽창과 파장 드리프트로 인한 새로운 과제에 직면하고 있습니다.

부문 분석

2024년 레이저 센서 시장 규모는 하드웨어가 82%의 수익 점유율을 차지했고, 세계 생산 라인에서 견고한 거리 및 변위 유닛에 대한 지속적인 수요를 지원합니다. 공급업체는 다중 파장 헤드, 온도 안정화 모듈, M12 커넥터를 번들로 통합하는 번거로움을 줄입니다. 동시에, 사용자는 ISO9001의 감사에 대응하기 위해 재교정의 간격을 엄격히 하고 있으며, 제3자 실험실이나 OEM의 현장 팀은 기기의 인증을 2회가 아니라 연 4회 실시하도록 촉구하고 있습니다.

1급 공급업체가 센서 수명을 통해 2µm의 성능을 보장하는 다년간의 교정과 예비 유지보수 계약을 맺기 때문에 2030년까지 서비스의 CAGR은 12.5%에 달할 전망입니다. 새로운 플러그인은 하이브리드 LADAR 헤드를 엔터프라이즈 품질 플랫폼에 연결하여 통계 프로세스 제어 대시보드에서 몇 분 이내에 드리프트 이상을 표시할 수 있도록 합니다. 계측 전문 지식을 아웃소싱하는 중견기업이 늘어남에 따라 경상수익이 설비투자의 주기성을 평준화하고 시장경쟁의 우선순위가 재구성되고 있습니다.

2024년 레이저 센서 시장 점유율은 자동문, 컨베이어 유무 체크, 기본적인 부품 위치결정에 힘입어 거리·레인지 장치가 30%를 유지했습니다. 그러나 3D 프로파일 유닛은 복잡한 형상을 매핑하기 때문에 전자기기 어셈블러가 솔더의 팽창을 측정하거나 자동차 라인이 흐름을 멈추지 않고 용접 너겟을 검사할 수 있기 때문에 CAGR14%로 확대하고 있습니다.

기계 제조업체는 프로파일 헤드를 로봇 컨트롤러에 직접 통합하여 스크랩을 20% 줄이는 동기화 툴 패스 수정을 가능하게 합니다. 변위 모델의 레이저 센서 시장 규모는 두께의 검증을 공차 5µm 이하로 억제할 필요가 있는 안전성이 중시되는 EV 배터리 생산에서도 상승합니다. 진동 센서와 에너지 센서는 구조적 건강 상태를 모니터링하는 틈새 역할을 유지하며, 삼각 측량은 빛을 예상대로 산란시키는 무광택 표면에서 일반적으로 남아 있습니다.

지역 분석

북미에서는 높은 인건비와 성숙한 안전 기준에 도움이 되고 자동화가 급속히 진행되고 있습니다. 초음파 모듈을 레이저 레인지 센서로 대체한 창고에서는 정확도가 50배 향상되고 슬롯 이용률이 개선되고 바닥 면적의 15%가 해방되어 로봇 투자의 선순환을 지원하고 있습니다. 캐나다의 새로운 배기가스 규제를 필두로 하는 규제에 대한 경계는 조기의 컴플라이언스 대응을 강요시키고 중소기업의 진입을 지연시키지만, 궁극적으로는 평균적인 솔루션의 질을 향상시킵니다.

아시아태평양은 EV 배터리, 일렉트로닉스 및 일반 제조업의 클러스터에 밀려 있어 수량 기준으로 레이저 센서 시장을 선도하고 있습니다. 이 지역의 포토닉스 투자는 2025년까지 50억 달러에 이르고, 리드 타임을 단축하고, 용도에 특화된 설계를 촉진하는 컴포넌트 에코시스템을 육성하고 있습니다. 중국, 일본, 한국은 공동으로 인라인 계측의 채택을 선도하고, 동남아시아는 인더스트리 4.0에의 대응에 관련한 인센티브로 생산 능력 확대를 유치하고 있습니다.

유럽은 자동차 엔지니어링의 힘과 인프라의 디지털 트윈 만데이트를 통해 계속 영향력을 갖고 있습니다. 솔리드 스테이트 LiDAR의 비용 절감은 독일과 스칸디나비아 공장에서의 AGV 도입을 가속화하고 견고한 머신 비전 공급망은 2025년 8-9%의 수익 성장을 예측합니다. 안전 기준의 조화로 인해 벤더는 인터록 하우징 및 페일 세이프 회로를 중심으로 기술 혁신을 추진하여 지역 전체 시장 액세스를 유지합니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 자동차용 EV 배터리의 정밀 갭 폐쇄가 아시아에서의 레이저 변위 센서의 채택을 촉진

- 반도체 패키징 부스팅 3D 라인 레이저 센서를 위한 3D AOI 급증

- 북미의 스마트 창고에서 초음파에서 레이저 레인지 센서로의 전환

- 유럽 AGV에서 ToF 센서를 가능하게 하는 솔리드 스테이트 라이다 비용 감소

- 장거리 프로파일링 센서를 지원하는 EU 인프라 프로젝트에서 의무적인 디지털 트윈 문서화

- 의료기기 제조에 있어서의 클린 룸 비접촉 측정 기준

- 시장 성장 억제요인

- 고온 주조 라인에 있어서의 열 드리프트 감도

- 클래스 3B와 클래스 4의 전력 배출에 관한 규제 제한

- CMOS ToF 카메라 대체 제품에 의한 가격 압력

- 고반사 표면의 신호 노이즈

- 가치/공급망 분석

- 기술의 전망

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 규모와 성장 예측

- 구성요소별

- 하드웨어

- 소프트웨어

- 서비스

- 센서 유형별

- 거리/레인지 센서

- 변위 센서

- 프로파일링/라인 센서

- 진동·에너지 센서

- 삼각측량 센서

- 기타

- 측정 범위별

- 100mm 미만(쇼트 레인지)

- 100-300mm(미디엄 레인지)

- 300mm 이상(롱 레인지)

- 출력별

- 1mW 미만

- 1-100mW

- 101-500mW

- 500mW 이상

- 치수별

- 1D 포인트 센서

- 2D 에리어 센서

- 3D 프로파일 센서

- 최종 사용자 업계별

- 일렉트로닉스 제조

- 자동차 모빌리티

- 항공우주

- 건축 및 건설

- 헬스케어 및 의료기기

- 식품 및 음료 가공

- 물류, 창고 관리, 로보틱스

- 기타 산업

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 기타 아시아태평양

- 중동

- 이스라엘

- 사우디아라비아

- 아랍에미리트(UAE)

- 튀르키예

- 기타 중동

- 아프리카

- 남아프리카

- 이집트

- 기타 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Keyence Corporation

- SICK AG

- OMRON Corporation

- Micro-Epsilon Messtechnik GmbH and Co. KG

- IFM Electronic GmbH

- Baumer Electric AG

- SmartRay GmbH

- Rockwell Automation Inc.

- Dimetix AG

- First Sensor AG(TE Connectivity)

- Banner Engineering Corp.

- Panasonic Industry Co.

- Cognex Corporation

- FARO Technologies Inc.

- Honeywell International Inc.

- Polytec GmbH

- OMS Corporation

- Teledyne DALSA

- Acuity Laser(Schmitt Measurement)

- Hokuyo Automatic Co. Ltd.

- Datalogic SpA

제7장 시장 기회와 장래의 전망

SHW 25.11.25The laser sensor market size is valued at USD 0.83 billion in 2025 and is forecast to reach USD 1.37 billion by 2030 at a 10.54% CAGR.

Demand is rising as factories automate measurement tasks that require micron-level accuracy, while falling solid-state LiDAR prices open new opportunities in autonomous vehicles, robots and infrastructure inspection. Growth is reinforced by the mandatory use of digital twin documentation on European infrastructure projects and by Asia-Pacific's push to tighten dimensional tolerances in electric-vehicle (EV) battery lines. Service offerings around calibration, predictive maintenance and analytics are expanding faster than hardware sales, signalling a maturing ecosystem in which long-term performance matters as much as sensor procurement.

Global Laser Sensor Market Trends and Insights

Precision-gap closure in automotive EV battery assembly

Laser displacement sensors are replacing contact gauges on EV battery lines because 0.1 mm dimensional error can trim battery capacity by up to 5%. Speckle-free blue-laser systems now verify glue beads and weld seams in real time, cutting scrap and rework. Asian cell makers are installing in-line multi-sensor rigs that measure stack height, tab alignment and weld penetration simultaneously, shortening ramp-up times for new chemistries.

Surge in 3D AOI for semiconductor packaging

Advanced packages house high-bandwidth chips that cannot tolerate voids or coplanarity defects. Line-scan 3D laser sensors detect 5-micron faults on uneven surfaces and, when paired with deep learning, lower false-reject rates by 40% SinceVision. Integrated multi-wavelength heads reduce interference inside reflective molding compounds, enabling full-area scans within takt times.

Thermal drift sensitivity in high-temperature foundry lines

Semiconductor foundry operations present unique challenges for laser displacement sensors due to extreme temperature variations and the precision requirements of advanced node production processes. Silicon carbide pressure sensors designed for harsh environments demonstrate the material science advances needed to address thermal stability, with operational ranges extending from -50°C to 600°C while maintaining accuracy within 0.18% full-scale output. However, laser-based systems face additional challenges from thermal expansion of optical components and wavelength drift that can compromise measurement accuracy in foundry environments.

Other drivers and restraints analyzed in the detailed report include:

- Migration from ultrasonic to laser range sensors in smart warehousing

- Solid-state LiDAR cost decline enabling ToF sensors in European AGVs

- Regulatory restrictions on Class 3B & 4 power emissions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware dominated the laser sensor market size with an 82% revenue share in 2024, anchored by continued demand for ruggedized distance and displacement units on global production lines. Vendors are bundling multi-wavelength heads, temperature stabilization modules and M12 connectors to reduce integration effort. At the same time, users are tightening recalibration intervals to meet ISO 9001 audits, pushing third-party labs and OEM field teams to certify equipment four times per year rather than twice.

Services post a 12.5% CAGR to 2030 as tier-one suppliers lock in multi-year calibration and predictive-maintenance contracts that guarantee +-2 µm performance across sensor lifespan. Software sales ride this wave; new plug-ins link hybrid LADAR heads to enterprise quality-platforms, allowing statistical-process-control dashboards to surface drift anomalies within minutes. As more mid-cap firms outsource metrology expertise, recurring revenue smooths the cyclicality of capital expenditure, reshaping competitive priorities within the laser sensor market.

Distance and range devices retained a 30% laser sensor market share in 2024, underpinned by automatic doors, conveyor presence checks and basic part positioning. Yet 3D profile units expand at 14% CAGR because they map complex geometries, letting electronics assemblers measure solder bulges and automotive lines inspect weld nuggets without halting flow.

Machine builders integrate profile heads directly with robot controllers, enabling synchronous toolpath corrections that cut scrap by 20%. The laser sensor market size for displacement models also rises in safety-critical EV battery production, where thickness verification must stay below 5 µm tolerance. Vibration and energy sensors preserve niche roles in structural-health monitoring, while triangulation remains common on matte surfaces that scatter light predictably.

The Laser Sensors Market Report is Segmented by Component (Hardware, Software, Services), Sensor Type (Distance/Range, Displacement, Profiling, and More), Measurement Range (Less Than 100 Mm, 100 - 300 Mm, and More), Power Output (Less Than 1mW, 1 - 100mW, and More), Dimensionality (1D, 2D, 3D), End-User Industry (Electronics, Automotive, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America adopts automation quickly, aided by high labor costs and mature safety standards. Warehouses replacing ultrasonic modules with laser range sensors achieve 50 X accuracy gains and slot utilization improvements that free 15% floor space, supporting a virtuous cycle of robotics investment. Regulatory vigilance, highlighted by new Canadian emission rules, forces early compliance spending that can slow smaller entrants but ultimately raises average solution quality.

Asia-Pacific leads the laser sensor market on volume, propelled by EV battery, electronics and general manufacturing clusters. Regional photonics investment is reaching USD 5 billion by 2025, nurturing component ecosystems that shorten lead times and encourage application-specific designs. China, Japan and South Korea jointly spearhead in-line metrology adoption, while Southeast Asia lures capacity expansions with incentives linked to Industry 4.0 readiness.

Europe remains influential due to automotive engineering strength and infrastructure digital-twin mandates. Falling solid-state LiDAR costs accelerate AGV deployments in German and Scandinavian plants, and a robust machine-vision supply chain forecasts 8-9% revenue growth for 2025. Harmonized safety codes push vendors to innovate around interlocked housings and fail-safe circuits, preserving market access across the region.

- Keyence Corporation

- SICK AG

- OMRON Corporation

- Micro-Epsilon Messtechnik GmbH and Co. KG

- IFM Electronic GmbH

- Baumer Electric AG

- SmartRay GmbH

- Rockwell Automation Inc.

- Dimetix AG

- First Sensor AG (TE Connectivity)

- Banner Engineering Corp.

- Panasonic Industry Co.

- Cognex Corporation

- FARO Technologies Inc.

- Honeywell International Inc.

- Polytec GmbH

- OMS Corporation

- Teledyne DALSA

- Acuity Laser (Schmitt Measurement)

- Hokuyo Automatic Co. Ltd.

- Datalogic S.p.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Precision-Gap Closure in Automotive EV Battery Assembly Driving Laser Displacement Sensors Adoption in Asia

- 4.2.2 Surge in 3D AOI for Semiconductor Packaging Boosting 3D Line Laser Sensor

- 4.2.3 Migration from Ultrasonic to Laser Range Sensors in Smart Warehousing in North America

- 4.2.4 Solid-State LiDAR Cost Decline Enabling ToF Sensors in European AGVs

- 4.2.5 Mandatory Digital Twin Documentation in EU Infrastructure Projects Fueling Long-Range Profiling Sensors

- 4.2.6 Clean-room Non-Contact Gauging Standards in Medical Device Manufacturing

- 4.3 Market Restraints

- 4.3.1 Thermal Drift Sensitivity in High-Temperature Foundry Lines

- 4.3.2 Regulatory Restrictions on Class 3B and 4 Power Emissions

- 4.3.3 Price Pressure from CMOS ToF Camera Alternatives

- 4.3.4 Signal Noise on Highly Reflective Surfaces

- 4.4 Value / Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Sensor Type

- 5.2.1 Distance / Range Sensors

- 5.2.2 Displacement Sensors

- 5.2.3 Profiling / Line Sensors

- 5.2.4 Vibration and Energy Sensors

- 5.2.5 Triangulation Sensors

- 5.2.6 Others

- 5.3 By Measurement Range

- 5.3.1 Less than 100 mm (Short-Range)

- 5.3.2 100 - 300 mm (Medium-Range)

- 5.3.3 Greater than 300 mm (Long-Range)

- 5.4 By Power Output

- 5.4.1 Less than 1 mW

- 5.4.2 1 - 100 mW

- 5.4.3 101 - 500 mW

- 5.4.4 Greater than 500 mW

- 5.5 By Dimensionality (Volume)

- 5.5.1 1D Point Sensors

- 5.5.2 2D Area Sensors

- 5.5.3 3D Profile Sensors

- 5.6 By End-user Industry

- 5.6.1 Electronics Manufacturing

- 5.6.2 Automotive and Mobility

- 5.6.3 Aerospace and Aviation

- 5.6.4 Building and Construction

- 5.6.5 Healthcare and Medical Devices

- 5.6.6 Food and Beverage Processing

- 5.6.7 Logistics, Warehousing and Robotics

- 5.6.8 Other Industries

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 United Kingdom

- 5.7.2.2 Germany

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 India

- 5.7.3.4 South Korea

- 5.7.3.5 Rest of Asia-Pacific

- 5.7.4 Middle East

- 5.7.4.1 Israel

- 5.7.4.2 Saudi Arabia

- 5.7.4.3 United Arab Emirates

- 5.7.4.4 Turkey

- 5.7.4.5 Rest of Middle East

- 5.7.5 Africa

- 5.7.5.1 South Africa

- 5.7.5.2 Egypt

- 5.7.5.3 Rest of Africa

- 5.7.6 South America

- 5.7.6.1 Brazil

- 5.7.6.2 Argentina

- 5.7.6.3 Rest of South America

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Keyence Corporation

- 6.4.2 SICK AG

- 6.4.3 OMRON Corporation

- 6.4.4 Micro-Epsilon Messtechnik GmbH and Co. KG

- 6.4.5 IFM Electronic GmbH

- 6.4.6 Baumer Electric AG

- 6.4.7 SmartRay GmbH

- 6.4.8 Rockwell Automation Inc.

- 6.4.9 Dimetix AG

- 6.4.10 First Sensor AG (TE Connectivity)

- 6.4.11 Banner Engineering Corp.

- 6.4.12 Panasonic Industry Co.

- 6.4.13 Cognex Corporation

- 6.4.14 FARO Technologies Inc.

- 6.4.15 Honeywell International Inc.

- 6.4.16 Polytec GmbH

- 6.4.17 OMS Corporation

- 6.4.18 Teledyne DALSA

- 6.4.19 Acuity Laser (Schmitt Measurement)

- 6.4.20 Hokuyo Automatic Co. Ltd.

- 6.4.21 Datalogic S.p.A.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment