|

시장보고서

상품코드

1910883

셀프 레벨링 콘크리트 : 시장 점유율 분석, 업계 동향 및 통계, 성장 예측(2026-2031년)Self Leveling Concrete - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

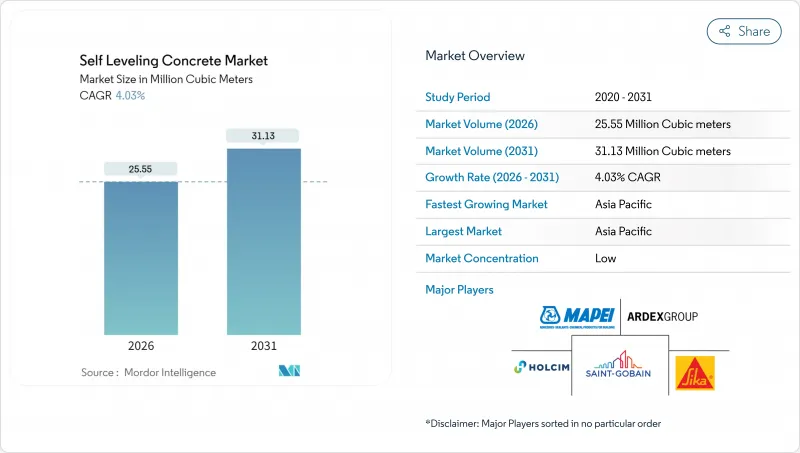

2026년 셀프 레벨링 콘크리트 시장 규모는 2,555만 입방미터로 추정되며, 2025년 2,456만 입방미터에서 성장할 전망입니다. 2031년 예측치는 3,113만 입방미터로 2026년부터 2031년까지 연평균 복합 성장률(CAGR) 4.03%를 나타낼 것으로 예상됩니다.

이 꾸준한 성장 궤도는 지속적인 리노베이션 활동, 저탄소 결합재 채택, 신속한 시공이 가능한 바닥재 솔루션에 대한 수요 증가를 반영합니다. 전자상거래 전액센터에서의 강한 수요, 공공건축물의 지속적인 리노베이션, VOC 프리 제품을 장려하는 정부 인센티브가 사용자층 확대를 계속 추진하고 있습니다. 또한, 시공업체도 펌프 트럭에 의한 공급 시스템을 대규모 타설에 있어서 노동력 삭감과 균일성 유지의 수단으로 파악하고 있어 이것이 한층 더 수량 증가를 촉진하고 있습니다. 한편, 특수 시멘트의 가격 변동, 시공 기술자의 부족 확대, 습기 관련의 클레임 대응이 단기적인 성장을 억제하고 있어 연수나 코스트 관리 시책의 중요성이 부각되고 있습니다.

세계의 셀프 레벨링 콘크리트 시장 동향과 전망

유행 후 상업 리노베이션 프로젝트의 급속한 회복

상업 빌딩 소유자는 2024년 이후 신규 건설보다 내장 개수를 우선하고 있으며, 데이터센터·의료·교육 분야에서의 자산 재배치 전략이 이를 뒷받침하고 있습니다. 전미건설업협회(AGC)의 조사에 따르면 42%의 기업이 2025년에 데이터센터 관련 공사 증가를 전망해 의료·교육 분야가 이어졌습니다. 이러한 프로젝트는 일반적으로 기존의 기초가 매우 불균일하기 때문에 시공을 신속하게 하고 엄격한 재입주 기한에 대응하기 위해, 셀프 베벨링 기초재가 최적의 제품으로서 선택되고 있습니다. 레거시 오피스 타워의 용도 전환에 의한 재이용도 수요를 더욱 확대하고 있습니다. 이것은 기초의 요철이 모듈러 카펫 타일이나 탄성 바닥재의 시공을 방해하기 때문입니다. 미국 연방 정부의 인프라 자금은 공공 건축물의 개수를 가속화하고 있으며, 셀프 벨벳 컴파운드는 기존 구조물을 유지하면서 정부 기관이 엄격한 건설 일정을 달성하는 데 도움이 됩니다.

자기 건조형, 저탄소 CSA 바인더 통합

칼슘 설포알루미네이트 바인더는 일반 포틀랜드 시멘트에 비해 제품에 내재된 탄소 배출량을 최대 40%까지 줄여 시공 당일 바닥재 설치를 가능하게 합니다. 이러한 특성은 LEED v4.1 포인트와 넷 제로 목표를 추구하는 소유자의 요구에 부합합니다. 시공업자에게는 공기 단축, 제습 비용 절감, 수분 함량 검사 리스크 저감 등의 장점이 가져옵니다. BASF와 Sika는 굽힘 강도와 내마모성을 향상시키기 위해 CSA 기술과 고급 고분자 경화제의 조합을 시작했으며, 성능과 지속가능성을 양립시키는 협업 접근법을 보여줍니다. 캘리포니아의 "Buy Clean"프로그램에서는 CSA 기반의 셀프 플레벨링 재료가 유틸리티의 권장 사양으로 이미 자리 잡고 있으며 브리티시 컬럼비아 주와 유럽 연합에서도 유사한 조달 규칙을 검토 중입니다.

특수 시멘트 및 혼화제 가격의 변동성

탄소가격제도에 따라 2024년 유럽 클링커 비용은 톤당 18달러 상승하고 특수 시멘트 가격은 전년 대비 약 11% 높았습니다. 또한 날씨 관련 광산 폐쇄로 고분자계 유동조정제와 탄산리튬도 급격한 공급부족에 빠져 고정가격계약에 있어서 계약자의 입찰위험이 나타났습니다. 다국적 기업은 리드 타임 단축을 위해 혼화제 생산의 지역화를 추진하고 있지만, 중소의 배합 제조업체는 여전히 수입 원료에 의존하고 있어 코스트 전가는 피할 수 없습니다. 구매자는 콘크리트 계약에 철강 산업과 같은 가격 상승 조항을 도입하기 시작했지만 모든 공공 기관이 이를 인정하는 것은 아니며 자금 조달 불일치가 발생하여 프로젝트 시작이 지연 될 수 있습니다.

부문 분석

기초 재료는 거의 모든 건축 유형에서 허용 범위를 벗어난 기판을 균일화하는 표준 솔루션으로서의 역할에서 2025년에는 셀프 레벨링 콘크리트 시장의 64.58% 점유율을 차지했습니다. 벌크 생산업체는 유동성·경화시간·비용의 균형을 최적화한 배합 설계에 의해 이 카테고리를 범용품에 가까운 상태에 가깝게 하고 있습니다. 그러나 작업자가 프라이머의 접착 중요성과 수량 관리를 과소평가하는 경우가 빈번하고, 재시공에 의한 계약자의 수익성 저하를 초래하기 때문에 지속적인 훈련 부족이 과제가 되고 있습니다.

절대적인 수량이 적은 것, 토핑재는 급속히 보급이 진행되고 있어 2026년부터 2031년에 걸쳐 CAGR 4.34%를 나타낼 것으로 예측되고 있습니다. 연마 마무리의 토핑재는 소매 체인점, 부티크 호텔, 기업 어메니티 스페이스에 채용되어, 종래의 시드 방식의 비용이나 시공의 복잡함을 수반하지 않고 테라조풍의 미관을 제공합니다. 디지털 프린트 대응 표면, 반투명 착색 오버레이, 하이브리드 PU-시멘트 마모층 등의 혁신 기술이 디자인의 유연성을 촉진하고 있습니다. 소유자가 한정된 예산 내에서 독특한 마무리를 요구하는 가운데, 창의성과 고성능을 겸비한 토핑재를 대규모로 공급할 수 있는 제조업체가 명확한 우위성을 획득하고 있습니다.

셀프 레벨링 콘크리트 보고서는 제품별(토핑재와 기초재), 최종 용도분야별(상업시설, 산업·공공시설, 인프라, 주택), 지역별(아시아태평양, 북미, 유럽, 남미, 중동 및 아프리카)으로 분류됩니다. 시장 예측은 수량(입방 미터)으로 제공됩니다.

지역별 분석

아시아태평양은 2025년 시장 규모의 38.34%를 차지했으며, 중국의 '일대일로' 프로젝트, 인도의 '스마트 시티 구상', 동남아 공장 확장 붐이 이를 지지했습니다. 정부가 대중교통, 공항, 데이터센터 사업에 지출을 집중시키는 가운데 이 지역 시장 규모는 2031년까지 연평균 복합 성장률(CAGR) 4.14%를 나타낼 것으로 예측되고 있습니다. 중국 단독으로도 2025년에는 3,940억 달러 이상을 절반 수준의 인프라에 투입했으며, 콩코스의 오버레이나 터미널 확장에는 셀프 벨벳링 제품이 지정되었습니다. 홀심의 SMARTFlow 시뮬레이션 프로그램은 고층 건축을 위해 예측 가능한 펌프 적성 모델을 중시하는 건설업자로부터 지지를 얻고 있으며 싱가포르와 한국에서 받아들여지고 있습니다.

북미는 성장 둔화가 보이는 것, 여전히 주요 시장입니다. 인프라 투자·고용 창출법에 의한 연방 자금이 정부 청사, 교량, 대중 교통 허브 수요를 밀어 올리고 있지만, 민간 상업 프로젝트의 착공은 오피스 섹터의 불투명감에 의해 억제되고 있습니다. 2025년 말 인하로 인해 특히 생명과학연구시설·캠퍼스 및 첨단 제조업 분야에서 연기된 프로젝트의 일부가 재개되었습니다.

유럽에서는 지역마다 다른 동향을 볼 수 있습니다. 서유럽시장에서는 지속가능성의 리더십을 추구하고 있으며, 독일과 프랑스에서는 공공조달 리스트에 탄소 삭감형 CSA 제품을 채용하고 있습니다. 한편, 스페인과 이탈리아에서는 2030년 관광 목표를 향해 노후화된 호텔의 개수가 진행되고 있습니다. 동유럽에서는 계속 EU의 결속기금에 의존해, 자기 수평화 교량 바닥 오버레이를 포함한 도로·철도의 개량에 조성금이 투입되고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 애널리스트 서포트(3개월간)

자주 묻는 질문

목차

제1장 서론

- 조사 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 팬데믹 후의 상업시설 개수 프로젝트의 급속한 회복

- 자기 건조형 저탄소 CSA 바인더의 통합

- 전자상거래 완성 센터에서의 고속화 바닥재 공정

- 대형 프로젝트에 있어서 펌프 트럭식 고용량 SLU 시스템의 채용

- VOC 프리 실내 제품에 대한 정부의 우대 조치

- 시장 성장 억제요인

- 특수 시멘트 및 혼화제의 가격 변동성

- 시공 스킬의 부족에 의한 성능 부전

- 고속 시공 슬래브에 있어서 습기 관련의 클레임

- 밸류체인 분석

- Porter's Five Forces

- 신규 참가업체의 위협

- 공급기업의 협상력

- 구매자의 협상력

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

제5장 시장 규모와 성장 예측

- 제품별

- 탑핑

- 언더레이먼트

- 최종 용도 분야별

- 상업용

- 산업 및 기관용

- 인프라

- 주거용

- 지역별

- 아시아태평양

- 중국

- 인도

- 한국

- 일본

- ASEAN 국가

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 프랑스

- 독일

- 이탈리아

- 러시아

- 스페인

- 영국

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율/순위 분석

- 기업 프로파일

- ARDEX Group

- Arkema

- BASF

- Cemex SAB DE CV

- Duraamen Engineered

Products, Inc.

- Flowcrete

- H.B. Fuller Company

- HOLCIM

- LATICRETE International, Inc.

- MAPEI S.p.A.

- Maxxon, Inc.

- PurEpoxy

- Saint-Gobain

- Sika AG

- Target Products Ltd

- TCC Materials

제7장 시장 기회와 향후 전망

KTH 26.01.26Self Leveling Concrete market size in 2026 is estimated at 25.55 Million Cubic meters, growing from 2025 value of 24.56 Million Cubic meters with 2031 projections showing 31.13 Million Cubic meters, growing at 4.03% CAGR over 2026-2031.

This steady trajectory reflects sustained renovation activity, the adoption of low-carbon binders, and rising demand for rapid-install flooring solutions. Strong uptake in e-commerce fulfillment centers, ongoing public-building refurbishment, and government incentives that reward VOC-free products continue to widen the user base. Contractors also view pump-truck delivery systems as a route to reduce labor requirements and maintain consistency on large pours, further propelling volume growth. At the same time, price volatility in specialty cement, a widening installation skill gap, and moisture-related callbacks temper near-term gains, underscoring the importance of training and cost-management initiatives.

Global Self Leveling Concrete Market Trends and Insights

Rapid Rebound of Commercial Renovation Projects Post-Pandemic

Commercial building owners have prioritized interior upgrades over ground-up construction since 2024, bolstered by asset-repositioning strategies in data centers, healthcare, and education. The Associated General Contractors survey shows 42% of firms anticipate more data-center work in 2025, with healthcare and education following close behind. These projects typically involve highly variable existing substrates, making self-leveling underlayments the product of choice to speed installation and meet tight re-occupancy deadlines. Adaptive-reuse conversions of legacy office towers further expand demand because substrate irregularities hinder the installation of modular carpet tiles and resilient floor coverings. U.S. federal infrastructure funding accelerates public-building refurbishment, and self-leveling compounds help agencies meet aggressive construction timetables while preserving existing structures.

Integration of Self-Drying, Low-Carbon CSA Binders

Calcium sulfoaluminate binders cut embodied-carbon emissions by up to 40% versus ordinary Portland cement and unlock same-day flooring readiness, attributes that resonate with owners pursuing LEED v4.1 points and net-zero goals. Contractors benefit from shorter project schedules, fewer dehumidification costs, and reduced moisture-testing risk. BASF and Sika have begun pairing CSA technology with advanced polymer hardeners to improve flexural strength and abrasion resistance, illustrating a collaborative approach to performance and sustainability. California's Buy Clean program has already positioned CSA-based self-levelers as a preferred specification in public work, and similar procurement rules are under review in British Columbia and the European Union.

Volatility in Specialty Cement and Admixture Prices

Carbon-pricing schemes added USD 18/tons to European clinker costs in 2024, pushing specialty cement prices up by nearly 11% year-on-year. Polymer-based flow modifiers and lithium carbonate also experienced abrupt shortages following weather-related mine closures, exposing contractors to bid risk on fixed-price jobs. Multinationals have responded by regionalizing admixture production to shorten lead times, but smaller formulators remain reliant on imported ingredients, making cost pass-through unavoidable. Owners have begun to implement steel-like escalation clauses in concrete contracts, yet not all public entities accept such provisions, creating a funding mismatch that can delay project starts.

Other drivers and restraints analyzed in the detailed report include:

- Fast-Track Flooring Schedules in E-Commerce Fulfillment Centers

- Adoption of Pump-Truck High-Volume SLU Systems on Megaprojects

- Installation Skill-Gap Causing Performance Failures

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Underlayments held 64.58% self-leveling concrete market share in 2025, thanks to their role as the default solution for leveling out-of-tolerance substrates across virtually every building type. Bulk producers have optimized mix designs to balance flow, set time, and cost, drawing the category closer to commodity status. However, recurring training deficits frequently show up here, since crews may underestimate the importance of bonding primers and controlled water addition, leading to callbacks that dent contractor profitability.

Toppings, though smaller in absolute volume, are moving quickly toward mass adoption, projected to expand at a 4.34% CAGR over 2026-2031. Polished toppings now appear in retail chains, boutique hotels, and corporate amenity spaces, offering terrazzo-like aesthetics without the cost and installation complexity of traditional seeded systems. Innovations such as digital print-ready surfaces, translucent pigmented overlays, and hybrid PU-cement wear layers foster design flexibility. With owners hunting for unique finishes that still respect lean budgets, suppliers that can deliver creative, high-performance toppings at scale gain a clear advantage.

The Self Leveling Concrete Report is Segmented by Product (Topping and Underlayment), End-Use Sector (Commercial, Industrial and Institutional, Infrastructure, and Residential), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Cubic Meters).

Geography Analysis

Asia-Pacific accounted for 38.34% of 2025 volume, supported by China's Belt and Road projects, India's Smart Cities Mission, and Southeast Asia's factory-expansion wave. Regional volume is projected to increase at a 4.14% CAGR through 2031 as governments channel spending into mass transit, airport, and data center programs. China alone is pouring more than USD 394 billion into provincial infrastructure in 2025, with self-leveling products specified for concourse overlays and terminal expansions. Holcim's SMARTFlow simulation program has found receptive audiences in Singapore and South Korea, where contractors value predictive pumpability models for high-rise construction.

North America remains a heavyweight, albeit with slower growth. Federal funding from the Infrastructure Investment and Jobs Act elevates demand in government buildings, bridges, and public-transit hubs, but private commercial starts are dampened by office-sector uncertainty. Interest-rate cuts expected in late 2025 should unlock some deferred projects, particularly in life-science research and campuses and advanced manufacturing.

Europe shows divergent trends. Western markets pursue sustainability leadership; Germany and France employ carbon-reduced CSA products on public procurement lists, while Spain and Italy refurbish aging hotels ahead of 2030 tourism goals. Eastern Europe continues to rely on EU cohesion funds, channeling grants into roadway and rail upgrades that include self-leveling bridge-deck overlays.

- ARDEX Group

- Arkema

- BASF

- Cemex S.A.B DE C.V.

- Duraamen Engineered Products, Inc.

- Flowcrete

- H.B. Fuller Company

- HOLCIM

- LATICRETE International, Inc.

- MAPEI S.p.A.

- Maxxon, Inc.

- PurEpoxy

- Saint-Gobain

- Sika AG

- Target Products Ltd

- TCC Materials

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid rebound of commercial renovation projects post-pandemic

- 4.2.2 Integration of self-drying, low-carbon CSA binders

- 4.2.3 Fast-track flooring schedules in e-commerce fulfillment centers

- 4.2.4 Adoption of pump-truck high-volume SLU systems on megaprojects

- 4.2.5 Government incentives for VOC-free indoor products

- 4.3 Market Restraints

- 4.3.1 Volatility in specialty cement and admixture prices

- 4.3.2 Installation skill-gap causing performance failures

- 4.3.3 Moisture-related callbacks in fast-track slabs

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product

- 5.1.1 Topping

- 5.1.2 Underlayment

- 5.2 By End Use Sector

- 5.2.1 Commercial

- 5.2.2 Industrial and Institutional

- 5.2.3 Infrastructure

- 5.2.4 Residential

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 South Korea

- 5.3.1.4 Japan

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 France

- 5.3.3.2 Germany

- 5.3.3.3 Italy

- 5.3.3.4 Russia

- 5.3.3.5 Spain

- 5.3.3.6 United Kingdom

- 5.3.3.7 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, and Recent Developments)

- 6.4.1 ARDEX Group

- 6.4.2 Arkema

- 6.4.3 BASF

- 6.4.4 Cemex S.A.B DE C.V.

- 6.4.5 Duraamen Engineered

Products, Inc.

- 6.4.6 Flowcrete

- 6.4.7 H.B. Fuller Company

- 6.4.8 HOLCIM

- 6.4.9 LATICRETE International, Inc.

- 6.4.10 MAPEI S.p.A.

- 6.4.11 Maxxon, Inc.

- 6.4.12 PurEpoxy

- 6.4.13 Saint-Gobain

- 6.4.14 Sika AG

- 6.4.15 Target Products Ltd

- 6.4.16 TCC Materials

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment