|

시장보고서

상품코드

1683455

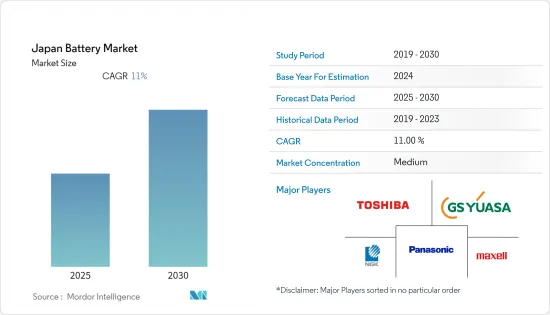

일본의 배터리 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Japan Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

일본의 배터리 시장은 예측 기간 동안 CAGR 11%를 기록할 전망입니다.

COVID-19의 발생은 시장에 부정적인 영향을 미쳤습니다. 현재 시장은 팬데믹 이전 수준에 도달했습니다.

주요 하이라이트

- 전기자동차의 채택 증가, 가전제품 수요 증가, 재생 에너지 설치 증가와 같은 요인이 시장을 견인할 것으로 예상됩니다.

- 그러나 특히 전기자동차에서 리튬이온 배터리에 대한 수요가 증가함에 따라 광물 가격이 크게 상승하고 있습니다. 경우에 따라 광물 공급이 부족하여 예측 기간 동안 시장 성장에 제약 요인으로 작용할 가능성이 있습니다.

- 배터리 화학의 연구 및 개발의 발전은 향후 일본의 배터리 시장에 중요한 성장 기회가 될 것으로 예상됩니다.

일본의 배터리 시장 동향

시장을 독점할 것으로 예상되는 이차 배터리 부문

- 이차 배터리에서는 전극 반응이 가역적이어서 외부 전압을 가하면 전극이 원래 상태로 재구성됩니다. 따라서 이차 배터리는 에너지원과 에너지 저장 시스템의 역할을 모두 수행합니다. 일반적으로 이차 배터리는 용량과 초기 전압이 낮고 자체 방전율이 높으며 재충전 수명이 다양합니다. 또한 이러한 배터리는 개별 배터리가 상대적으로 더 비쌀 수 있지만 장기적으로 비용 효율적입니다.

- 일본에서 널리 사용되는 이차 배터리에는 납축전지, 알카라인축전지, 리튬이온 배터리가 있습니다.

- 납축전지는 운송, 산업, 상업, 주거, 전력망 저장 등 다양한 최종 사용 용도에 가장 많이 사용되는 충전식 배터리입니다. 그러나 엄격한 납 배출 기준과 비용 이점, 경량화, 지속적인 개선 등의 장점으로 인해 라튬이온 배터리는 가전제품, 배터리 에너지 저장 시스템, 전기자동차, 무선 전동 공구 등 전력 소모가 많은 용도에 점점 더 많이 사용되고 있습니다.

- 그러나 납축전지는 낮은 비에너지, 제한된 사이클 수명, 낮은 중량 대 에너지 비율로 인해 이차 배터리 부문에서 완만한 성장세를 보일 것으로 예상됩니다. 일본의 충전식 납축전지 수출액은 2018년 1억 2,800만 달러에서 2021년에는 8,300만 달러로 30% 이상의 대폭적인 감소를 기록했습니다.

- 일본에서 가장 인기 있는 이차 배터리는 라튬이온 배터리입니다. 리튬이온 배터리는 다른 배터리에 비해 충전 속도가 빠르고 수명이 길기 때문입니다. 일본의 배터리 협회에 따르면 차량용 라튬이온 배터리의 판매량은 최근 몇 년 동안 크게 성장했습니다.

- 기후 변화에 대한 관심이 높아지면서 전국적으로 전기자동차(EV) 보급이 증가함에 따라 이차 배터리 제조업체에 긍정적인 비즈니스 시나리오가 형성될 것으로 보입니다.

- 일본은 2050년까지 에너지 공급과 차량 혁신에 중점을 두고 배기가스 배출을 없애려는 전 세계적인 노력에 발맞춰 '웰투휠 제로 에미션' 정책을 실현하는 것을 목표로 하고 있습니다. 모든 차량을 전기자동차로 교체하면 승용차 한 대당 온실가스 배출량을 약 80%까지 줄일 수 있으며, 승용차 한 대당 약 90%까지 감축할 수 있습니다.

- 따라서 위와 같은 점으로 인해 이차 배터리 부문은 예측 기간 동안 일본 시장을 지배할 것으로 예상됩니다.

재생 에너지 설치 증가가 시장을 견인할 전망

- 일본은 아시아태평양 지역에서 가장 큰 재생 에너지 시장 중 하나입니다. 일본의 재생 에너지 설치 용량은 2021년 111.86GW에 달했으며, 이는 전년 대비 4.67% 이상 증가한 수치입니다.

- 태양열, 수력, 풍력, 바이오 에너지는 필리핀의 주요 재생 에너지원입니다. BP의 세계 에너지 통계에 따르면, 2021년 재생 에너지원은 일본 전체 발전 믹스의 약 12%, 1차 에너지 믹스의 6.6%를 차지했습니다.

- 지난 10년간 일본의 태양광 발전 설비 용량은 2011년 489만kW에서 2021년 약 7,400만kW로 증가했습니다. 그러나 일본의 에너지 믹스에서 차지하는 태양 에너지의 비율은 여전히 낮습니다. BP Statistical Review of World Energy 2022에 따르면, 2021년 태양광 발전량은 86.3 TWh로 총 발전량의 약 8.5%를 차지하는 것에 지나지 않습니다.

- 태양 에너지는 간헐적이고 밤에는 사용할 수 없기 때문에 옥상 태양광(PV) 및 대규모 유틸리티 태양광 프로젝트에서 태양 에너지를 제대로 활용하려면 유능한 배터리 저장 시스템이 필요합니다. 배터리 저장 시스템은 일조량이 적거나 없는 시간대에 전력을 공급하고 갑작스러운 전압 서지 및 전압 저하를 방지하여 그리드 안정성을 제공합니다.

- 일본은 여러 대규모 배터리 저장 프로젝트가 추진 중이거나 건설 중이며, 그리드 연결형 배터리 저장 프로젝트의 글로벌 리더 중 하나가 될 것으로 예상됩니다. 예를 들어, 2022년 7월, 오릭스와 간사이 전기(KEPCO)의 합작회사는 일본 서부에 대규모 배터리 저장 시스템을 구축 및 운영할 것이라고 발표했습니다. 이 프로젝트의 용량은 48MW/113MWh로 2024년까지 운전을 시작할 예정입니다.

- 에너지부는 10-50kW 용량의 태양광 시스템에 대해 0.096달러/kWh의 고정 FIT를, 50-250kW 설치에 대해서는 0.087달러/kWh의 FIT를 책정했습니다. 따라서 일본의 에너지 믹스에서 재생 에너지 비중이 증가함에 따라 예측 기간 동안 일본의 에너지 저장 배터리 시장이 성장할 것으로 보입니다.

- 따라서 위의 점으로 인해 재생 에너지 설치가 증가함에 따라 배터리 에너지 저장 시스템에 대한 수요가 증가하여 예측 기간 동안 일본의 배터리 시장을 주도 할 것입니다.

일본의 배터리 산업 개요

일본의 배터리 시장은 부문화되어 있습니다. 이 시장의 주요 기업(특정함 순서 없음)에는 Panasonic Corporation, Maxell, Ltd., GS Yuasa International Ltd, NGK Insulators Ltd., Toshiba Corporation 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 소개

- 2028년까지 시장 규모와 수요 예측(단위 : 10억 달러)

- 최근 동향과 개발

- 정부 정책 및 규제

- 시장 역학

- 성장 촉진요인

- 억제요인

- 공급망 분석

- PESTLE 분석

제5장 시장 세분화

- 배터리 유형

- 일차 배터리

- 이차 배터리

- 기술

- 라튬이온 배터리

- 납축전지

- 기타

- 용도

- 자동차 배터리(HEV, PHEV, EV)

- 산업용 배터리(동력용, 거치형(텔레콤, UPS, 에너지 저장 시스템(ESS) 등))

- 휴대용 배터리(소비자 가전 제품 등)

- SLI 배터리

- 기타

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 주요 기업의 전략

- 기업 프로파일

- Panasonic Corporation

- Maxell, Ltd.

- GS Yuasa International Ltd

- NGK Insulators Ltd

- Toshiba Corporation

- Contemporary Amperex Technology Co Ltd

- LG Energy Solution

- EEMB Battery

- B & B Battery Co. Ltd

- Furukawa Battery Co. Ltd

제7장 시장 기회와 앞으로의 동향

HBR 25.04.01The Japan Battery Market is expected to register a CAGR of 11% during the forecast period.

The outbreak of COVID-19 negatively impacted the market. Currently, the market has reached pre-pandemic levels.

Key Highlights

- Factors such as the increasing adoption of electric vehicles, along with the increasing demand for consumer electronics and increasing renewable energy installations, are expected to drive the market.

- However, with the increasing demand for lithium-ion batteries, especially in electric cars, there is a substantial growth in mineral prices. In some cases, there is a shortage of mineral supply, which is likely to act as a restraint for the market growth during the forecast period.

- Advancements in the research and development of battery chemistries are expected to be a significant growth opportunity for the Japan Battery market in the future.

Japan Battery Market Trends

Secondary Battery Segment Expected to Dominate the Market

- In secondary batteries, electrode reactions are reversible, implying that applying an external voltage reconstructs the electrodes to their original state. Accordingly, secondary batteries act as both energy sources and energy storage systems. In general, secondary batteries have a low capacity and initial voltage, high self-discharge rates, and varying recharge life ratings. Moreover, these batteries are cost-efficient over the long term, even though individual batteries can be comparatively more expensive.

- Secondary batteries that are widely used in Japan include lead-acid batteries, alkaline storage batteries, and lithium-ion batteries.

- Lead-acid batteries are the most frequently used and available rechargeable batteries for various end-use applications, such as transportation, industrial, commercial, residential, and grid storage. However, due to stringent lead emission standards and benefits (such as cost advantages, lightweight, and ongoing improvements), lithium-ion batteries are increasingly deployed in high-drain applications, such as consumer electronics, battery energy storage systems, electric vehicles, and cordless electric power tools.

- However, lead-acid batteries are set to witness moderate growth in the secondary battery segment owing to their low specific energy, limited cycle life, and poor weight-to-energy ratio. The export value of rechargeable lead-acid batteries in Japan registered a considerable decline of more than 30%, from USD 128 million in 2018 to USD 83 million in 2021.

- The most popular secondary battery in Japan is the lithium-ion battery. It has a fast charging ability and offers longer life when compared to its counterparts. According to the Battery Association of Japan, sales of lithium-ion batteries for vehicles in terms of volume witnessed significant growth in recent years.

- The rising adoption of electric vehicles (EVs) across the country, coupled with a growing focus on climate change, is likely to create a positive business scenario for secondary battery manufacturers.

- By 2050, Japan aims to realize a 'Well-to-Wheel Zero Emission' policy, in line with the global efforts to eliminate emissions, with a focus on energy supply and vehicle innovation. Replacing all vehicles with EVs can reduce greenhouse gas emissions by around 80% per vehicle, including an approximate 90% reduction per passenger vehicle.

- Therefore, owing to the above points, the secondary battery segment is expected to dominate the Japanese market during the forecast period.

Increasing Renewable Energy Installations Expected to Drive the Market

- Japan is one of the largest renewable energy markets in the Asia-Pacific region. The country's renewable energy installed capacity reached 111.86 GW in 2021, representing an increase of over 4.67% compared to the previous year's value.

- Solar, hydro, wind, and bioenergy are the major renewable energy sources in the country. According to the BP statistical review of World Energy, in 2021, renewable energy sources accounted for approximately 12% of the total electricity generation mix and 6.6% of the primary energy mix in the country.

- Over the last decade, Japan's installed solar energy capacity has grown from 4.89 GW in 2011 to approximately 74 GW in 2021. However, the share of solar energy in the country's energy mix is still low. According to the BP Statistical Review of World Energy 2022, solar generation was 86.3 TWh in 2021, accounting for only about 8.5% of its total electricity generation.

- As solar energy is intermittent and unavailable at night, competent battery storage systems are necessary to properly utilize solar energy from rooftop photovoltaic (PV) and large-scale utility solar projects. Battery storage systems provide power during low and no sunlight hours and provide grid stability, preventing sudden voltage surges and sags.

- Japan is expected to become one of the global leaders in grid-connected battery storage projects, with several large-scale battery storage projects in the pipeline and under construction. For instance, in July 2022, a joint venture of Orix and Kansai Electric (KEPCO) announced that it would build and operate a large-scale battery storage system in western Japan. The project will have a capacity of 48MW/113MWh and will begin operation by 2024.

- In February 2022, the Ministry of Economy, Trade and Industry (METI) published the feed-in tariffs (FITs) that it proposes to apply to solar installations with a capacity of 10 to 250 kW, as well as the feed-in premiums (FIPs) to solar projects over 250 kW selected through the auction scheme in 2022. The ministry set a fixed FIT of USD 0.096/kWh for PV systems with capacities between 10 kW and 50 kW and a FIT of USD 0.087/kWh for installations between 50 kW and 250 kW. Thus, increasing renewable energy share in the country's energy mix is likely to drive the battery market in Japan for energy storage applications during the forecast period.

- Therefore, owing to the above points, increasing renewable energy installations fuelling the demand for battery energy storage systems, thus, in turn, driving the Japan battery market during the forecast period.

Japan Battery Industry Overview

The Japan battery market is fragmented. Some of the major players in the market (in no particular order) include Panasonic Corporation, Maxell, Ltd., GS Yuasa International Ltd, NGK Insulators Ltd., and Toshiba Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Primary Battery

- 5.1.2 Secondary Battery

- 5.2 Technology

- 5.2.1 Lithium-ion Battery

- 5.2.2 Lead-Acid Battery

- 5.2.3 Others

- 5.3 Application

- 5.3.1 Automotive Batteries (HEV, PHEV, EV)

- 5.3.2 Industrial Batteries (Motive, Stationary (Telecom, UPS, Energy Storage Systems (ESS), etc.)

- 5.3.3 Portable Batteries (Consumer Electronics, etc.)

- 5.3.4 SLI Batteries

- 5.3.5 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Panasonic Corporation

- 6.3.2 Maxell, Ltd.

- 6.3.3 GS Yuasa International Ltd

- 6.3.4 NGK Insulators Ltd

- 6.3.5 Toshiba Corporation

- 6.3.6 Contemporary Amperex Technology Co Ltd

- 6.3.7 LG Energy Solution

- 6.3.8 EEMB Battery

- 6.3.9 B & B Battery Co. Ltd,

- 6.3.10 Furukawa Battery Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

샘플 요청 목록