|

시장보고서

상품코드

1683456

동남아시아의 수력발전 시장 : 시장 점유율 분석, 산업 동향과 통계, 성장 예측(2025-2030년)Southeast Asia Hydropower - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

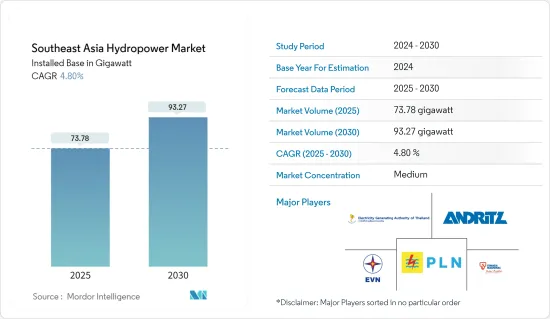

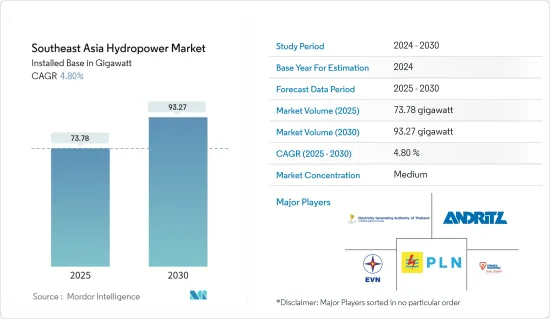

동남아시아의 수력발전 시장 규모는 2025년 73.78기가와트에서 2030년에는 93.27기가와트로 확대될 것으로 예상되며, 예측기간 중(2025-2030년) CAGR은 4.8%로 성장할 것으로 전망됩니다.

주요 하이라이트

- 장기적으로 수력 발전소에 대한 투자 증가와 재생 에너지 수요 증가와 같은 요인이 시장의 성장을 견인할 것으로 예상됩니다.

- 그러나 태양열 및 풍력 에너지와 같은 다른 형태의 재생 에너지에 비해 수력 발전의 높은 초기 비용은 시장의 성장을 제한할 것으로 예상됩니다.

- 그럼에도 불구하고 효율성의 기술 발전과 수력 발전 프로젝트의 생산 비용 감소는 동남아시아의 시장 참여자들에게 충분한 기회를 창출할 것으로 예상됩니다.

- 베트남은 이 부문에 대한 투자 증가와 이 지역에서 가장 높은 수력 에너지 설치 용량으로 인해 이 지역에서 가장 큰 수력 발전 시장이 될 것으로 예상됩니다.

동남아시아의 수력 발전 시장 동향

대규모 수력 발전 부문이 시장을 독점하는 전망

- 대규모 수력 발전소는 흐르는 물을 사용하여 거대한 수력 터빈을 구동하고 재생 에너지를 생산합니다. 상당한 양의 수력 발전을 위해서는 호수, 저수지, 댐에 물을 저장하고 조절하여 나중에 발전, 관개, 가정용 및 산업용 용도로 방출해야 합니다.

- 대규모 수력발전소는 기존 수력 발전 댐, 양수 발전, 유수력 발전, 조력 발전의 네 가지 유형으로 분류할 수 있습니다. 대규모 수력발전소는 설치 비용이 많이 들지만, 특히 대도시에서 저렴한 비용으로 전기를 생산할 수 있습니다. 국제재생에너지기구에 따르면 2022년 신규 수력 발전 프로젝트의 전 세계 가중 평균 균등화 발전 비용(LCOE)은 0.048달러/kWh였습니다.

- 라오스 전력 개발 계획 2020-2030에 따르면 라오스의 수력 발전 용량은 2025년까지 14기가와트를 초과할 것으로 예상됩니다. 2025년에는 재생 에너지가 전체 에너지 믹스의 30%를 차지할 것으로 예상되며, 수력 발전이 이러한 성장의 주요 구성 요소가 될 것으로 전망됩니다.

- 2021-2025년 동남아시아국가연합(ASEAN) 에너지 협력 행동 계획(APAEC)의 일환으로 2025년까지 설치 전력 용량에서 재생에너지 발전 비중을 35% 달성하는 것이 목표이며, 이를 위해서는 35-40GW가 필요할 수 있습니다. 인도네시아 정부는 2023년 3월 멘타랑 인덕 수력발전소 건설 공사를 시작했으며, 이 프로젝트에는 26억 달러가 투자될 예정입니다. 1.3GW 이상의 용량을 가진 이 발전소는 PT Adaro Energy Indonesia, PT Kayan Patria Pratama Group, Sarawak Energy의 합작회사인 PT Kayan Hydropower Nusantara에 의해 개발됩니다.

- 또한 2023년 베트남, 캄보디아, 미얀마, 필리핀 등 동남아시아 국가의 수력 발전 설비 용량은 22.639GW, 1.791GW, 3.269GW, 3.826GW입니다. 2023년 11월 필리핀에 본사를 둔 신재생에너지 생산회사인 Repower Energy Development Corporation은 Pure Energy Holdings Corporation의 수력발전회사로 REDC 포트폴리오에서 8번째인 140만kW의 최신 유수식 수력발전소를 가동하였습니다.퀘존주 레알에 위치한 어퍼 라바야트 수력발전소와 티백 수력발전소 사이에 있는 로워 라바야트 발전소는 라바야트 강의 하류 흐름을 이용해 연간 시간당 8기가와트를 생산할 수 있을 것으로 예상됩니다.

- 위와 같은 점으로 인해 대형 수력 발전소가 시장을 지배할 것으로 예상됩니다.

베트남이 시장을 독점할 전망

- 베트남은 동남아시아 최대의 수력 발전 시장 중 하나입니다. 베트남 전력청(EVN)에 따르면, 2023년 시점에서 베트남의 수력발전은 2263만9,000kW로, 이 나라의 총 설비 용량의 30% 가까이를 차지하고 있습니다.

- 수력 발전은 베트남 총 발전량의 30.77%에 육박하는 상당한 비중을 차지하며 국가 총 발전량 구성에서 큰 비중을 차지하고 있습니다. 베트남 경제는 국내 수요를 충족하기 위해 수력발전에 크게 의존해 왔습니다. 그러나 국내 수요가 급격히 증가하면서 전력에서 석탄 화력 발전이 차지하는 비중이 높아졌고, 다른 재생 에너지는 꾸준히 성장했지만 전체 발전 믹스에서 차지하는 비중은 상대적으로 작아졌습니다.

- 전통적으로 수력발전에 대한 의존도가 높은 베트남은 이미 전체 수력 발전 잠재량의 60% 가량을 개발하여 성숙한 수력 발전 시장으로 자리 잡았습니다. 베트남 에너지 전망에 따르면, 베트남은 대규모 및 중규모 수력 발전(일반적으로 저수지가 연결된 30MW 이상)의 잠재력을 완전히 활용하기 직전 단계에 이르렀습니다. 그러나 약 11GW에 달하는 소규모 하천 수력 발전의 잠재력은 아직 개발되지 않은 상태입니다.

- 그럼에도 불구하고 베트남 정부는 2021-2030년 동안 약 6-7% 증가할 것으로 예상되는 전력 수요 증가에 대처하는 동시에 배출량 감축 목표를 실현하기 위해 베트남에 남아 있는 대규모 수력 잠재력을 개발하는 데 투자하고 있습니다.

- 2024년 1월 베트남 전력(EVN)은 하노이에서 개최된 제46회 베트남 라오스 양국 협력 정부 간 위원회에서 라오스의 26개 수력 발전소에서 2,689MW의 전력을 구매하기 위한 19개 전력 구매 계약을 체결했습니다. 이 계약 체결로 베트남과 라오스 간 전력 분야 협력이 더욱 공고해졌습니다.

- 위에서 언급한 요인으로 인해 베트남은 2024년부터 2029년 사이에 이 시장을 지배할 것으로 예상됩니다.

동남아시아의 수력 발전 산업 개요

동남아시아의 수력발전시장은 적당히 세분화되어 있습니다. 이 시장의 주요 기업으로는 Vietnam Electricity Construction JSC, Electricity Generating Authority of Thailand, PT Perusahaan Listrik Negara, Tenaga Nasional Berhad, Andritiz AG 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 조사 방법

제3장 주요 요약

제4장 시장 개요

- 소개

- 2029년까지의 수력 발전 설비 용량과 예측(단위 : GW)

- 재생 가능 에너지 믹스(2023년)

- 주요 국가 별 주요 예정 수력 발전 프로젝트 목록(동남아시아 주요 국가별)

- 진행 중 및 예정된 수력 발전 입찰 목록(동남아시아)

- 동주요 수력 발전 컨설팅 회사 및 컨소시엄 목록(동남아시아)

- 최근 동향과 개발

- 정부 정책 및 규제

- 시장 역학

- 성장 촉진요인

- 수력 발전소에 대한 투자 증가

- 유리한 정부 정책

- 억제요인

- 다른 대체 청정 에너지원의 채택

- 성장 촉진요인

- 공급망 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 세분화

- 유형별

- 대형 수력 발전

- 소수력 발전

- 양수 발전

- 지역별

- 베트남

- 인도네시아

- 말레이시아

- 라오스

- 필리핀

- 태국

- 기타 동남아시아 국가

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 주요 기업의 전략

- 기업 프로파일

- Vietnam Electricity Construction JSC

- Andritz AG

- Electricity Generating Authority of Thailand

- PT Perusahaan Listrik Negara

- Tenaga Nasional Berhad

- Toshiba Corporation

- General Electric Company

- Aboitiz Power Corporation

- Power Construction Corporation of China Ltd

- 시장 랭킹 분석

제7장 시장 기회와 앞으로의 동향

- 효율적인 수력 발전 터빈의 기술 혁신

The Southeast Asia Hydropower Market size in terms of installed base is expected to grow from 73.78 gigawatt in 2025 to 93.27 gigawatt by 2030, at a CAGR of 4.8% during the forecast period (2025-2030).

Key Highlights

- In the long term, factors such as increasing investments in hydropower plants and increasing demand for renewable energy are expected to drive the market's growth.

- However, the high initial cost of hydropower compared to other forms of renewable energies like solar and wind energy is expected to restrain the growth of the market.

- Nevertheless, technological advancements in efficiency and a decrease in the production cost of hydropower projects are expected to create ample opportunities for market players in Southeast Asia.

- Vietnam is expected to be the region's largest hydropower market due to increasing investment in the sector and the highest installed capacity of hydropower energy in the region.

Southeast Asia Hydropower Market Trends

The Large Hydropower Segment is Expected to Dominate the Market

- Large-scale hydropower plants use flowing water to drive huge water turbines and generate renewable energy. To generate significant amounts of hydroelectricity, lakes, reservoirs, and dams must store and regulate water for later release for power generation, irrigation, domestic use, and industrial use.

- Large-scale hydropower plants can be classified into four types: conventional hydroelectric dams, pumped storage, run-of-the-river, and tidal. Although large hydropower plants are expensive to install, they produce electricity at a low cost, especially in large cities. According to the International Renewable Energy Agency, the global weighted average levelized cost of energy (LCOE) of newly commissioned hydropower projects in 2022 was USD 0.048/kWh.

- According to the Laos Power Development Plan 2020 -2030, the hydropower capacity of Laos is expected to exceed 14 gigawatts by 2025. By 2025, renewable energy may represent 30% of the total energy mix, and hydropower is anticipated to be a major component of this growth.

- As part of the Association of Southeast Asian Nations (ASEAN) Plan of Action for Energy Cooperation (APAEC) 2021-2025, the aim is to reach 35% renewable generation in installed power capacity by 2025, which may require the deployment of 35-40 GW. In March 2023, the Indonesian government began construction works for the Mentarang Induk hydropower plant, and the project requires a USD 2.6 billion investment. With more than 1.3 GW of capacity, the power plant will be developed by PT Kayan Hydropower Nusantara, a joint venture of PT Adaro Energy Indonesia, PT Kayan Patria Pratama Group, and Sarawak Energy.

- Moreover, in 2023, hydropower installed capacity in Southeast Asian Countries such as Vietnam, Cambodia, Myanmar, and the Philippines stood at 22.639 GW, 1.791 GW, 3.269 GW, and 3.826 GW. In November 2023, Philippine-based renewable energy producer Repower Energy Development Corporation, the hydropower subsidiary of Pure Energy Holdings Corporation, launched its newest 1.4 MW run-of-river hydropower plant, the eighth of its kind in REDC's portfolio. Located in Real, Quezon, between the Upper Labayat and Tibag hydropower plants, the Lower Labayat plant is estimated to generate 8 gigawatts per hour annually, utilizing the downstream current of the Labayat River.

- Owing to the above points, large hydropower plants are expected to dominate the market.

Vietnam is Expected to Dominate the Market

- Vietnam is one of the largest hydropower markets in Southeast Asia. According to the Electricity Authority of Vietnam (EVN), as of 2023, Vietnam had 22.639 GW of hydropower, accounting for nearly 30% of the country's total installed capacity.

- Hydropower has accounted for a significant share of the country's gross electricity generation mix, accounting for nearly 30.77% of the country's total electricity generation. The Vietnamese economy relied heavily on hydroelectricity to satiate domestic demand. However, as domestic demand increased rapidly, the share of coal-fired generation in electricity rose, along with other renewables, which have grown steadily but occupy a relatively smaller share of the total electricity generation mix.

- Due to its traditional dependence on hydroelectricity, Vietnam has already developed nearly 60% of its total hydropower potential, making it a mature hydropower market. According to the Vietnam Energy Outlook, the country is close to fully utilizing its potential for large-scale and medium-scale hydropower (defined as greater than 30 MW and typically with a connected reservoir). However, there is still untapped potential for run-of-river small-scale hydro of around 11 GW.

- Despite this, as the government tries to deal with the growing power demand, which is projected to grow by nearly 6-7% during 2021-2030 while realizing its emission reduction targets, the Vietnamese government is investing in the development of the remaining large-scale hydro potential in the country.

- In January 2024, State utility Vietnam Electricity (EVN) entered into 19 power purchase agreements for the acquisition of 2,689 MW of electricity from 26 hydropower plants in Laos during the 46th meeting of the Vietnam-Laos Intergovernmental Committee for Bilateral Cooperation in Hanoi. The signing of the agreements demonstrated deeper cooperation in electricity between Vietnam and Laos.

- Due to the above-mentioned factors, Vietnam is expected to dominate the market studied between 2024 and 2029.

Southeast Asia Hydropower Industry Overview

The Southeast Asian hydropower market is moderately fragmented. Some of the key players in this market are Vietnam Electricity Construction JSC, Electricity Generating Authority of Thailand, PT Perusahaan Listrik Negara, Tenaga Nasional Berhad, and Andrtiz AG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Hydropower Installed Capacity and Forecast in GW, till 2029

- 4.3 Renewable Energy Mix, 2023

- 4.4 List of Major Upcoming Hydropower Projects, By Major Countries, Southeast Asia

- 4.5 List of On-going and Upcoming Hydropower Tenders, Southeast Asia

- 4.6 List of Major Hydropower Consulting Companies and Consortiums, Southeast Asia

- 4.7 Recent Trends and Developments

- 4.8 Government Policies and Regulations

- 4.9 Market Dynamics

- 4.9.1 Drivers

- 4.9.1.1 Increasing Investments in Hydropower Generation

- 4.9.1.2 Favorable Government Policies

- 4.9.2 Restraints

- 4.9.2.1 Adoption of Other Alternative Clean Energy Sources

- 4.9.1 Drivers

- 4.10 Supply Chain Analysis

- 4.11 Porter's Five Forces Analysis

- 4.11.1 Bargaining Power of Suppliers

- 4.11.2 Bargaining Power of Consumers

- 4.11.3 Threat of New Entrants

- 4.11.4 Threat of Substitutes Products and Services

- 4.11.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Large Hydropower

- 5.1.2 Small Hydropower

- 5.1.3 Pumped Storage

- 5.2 By Geography

- 5.2.1 Vietnam

- 5.2.2 Indonesia

- 5.2.3 Malaysia

- 5.2.4 Laos

- 5.2.5 Philippines

- 5.2.6 Thailand

- 5.2.7 Rest of Southeast Asia

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Vietnam Electricity Construction JSC

- 6.3.2 Andritz AG

- 6.3.3 Electricity Generating Authority of Thailand

- 6.3.4 PT Perusahaan Listrik Negara

- 6.3.5 Tenaga Nasional Berhad

- 6.3.6 Toshiba Corporation

- 6.3.7 General Electric Company

- 6.3.8 Aboitiz Power Corporation

- 6.3.9 Power Construction Corporation of China Ltd

- 6.4 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Innovations in Efficient Hydropower Turbines