|

시장보고서

상품코드

1683755

미국의 건축용 코팅 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)United States Architectural Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

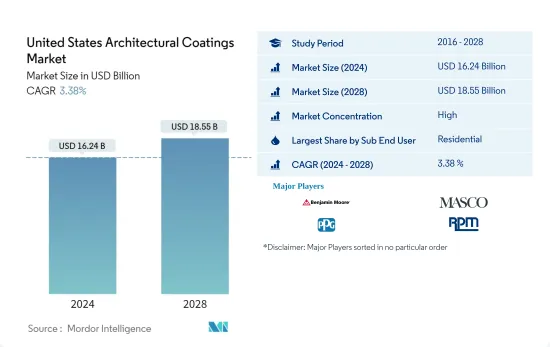

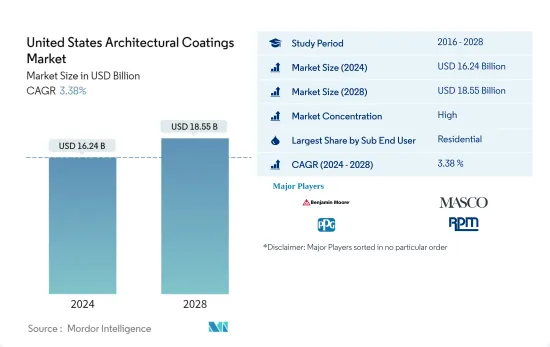

미국의 건축용 코팅 시장 규모는 2024년에 162억 4,000만 달러에 달했고, 2028년에는 185억 5,000만 달러에 이를 것으로 예측되며, 예측 기간(2024-2028년)의 CAGR은 3.38%를 나타낼 것으로 예상됩니다.

주요 하이라이트

- 최종 사용자별 최대 부문 - 주택 : 상업용 건물에 비해 주택용 건물의 양이 많기 때문에 주택 분야에서 건축용 페인트의 소비량이 많습니다.

- 기술별 최대 부문 - 수성 페인트 : 미국에서는 환경보호청(EPA) 규정이 엄격하고 환경 친화적이고 건강한 제품을 선호하는 소비자가 많기 때문에 수성 페인트의 소비와 성장이 큽니다.

- 수지별 최대 부문 - 아크릴 : 아크릴은 저비용으로 수성 페인트에 많이 사용되기 때문에 수지의 선도적인 유형이 되고 있습니다. 미국 시장에서도 수성 페인트의 사용이 점점 증가하고 있습니다.

미국 건축용 코팅 시장 동향

서브 최종사용자별로는 주택이 최대.

- 건축용 페인트의 성장률은 2016년 이후 하락했지만 2020년에는 회복되었습니다. 2020년에 기록된 성장은 소비자가 집에서 '둥지 모모리', DIY 프로젝트를 완성함으로써 DIY 부문으로부터의 매출이 크게 증가한 것에 기인합니다. 주택 스톡의 노후화는 2001년 약 31년부터 2019년 평균 41년으로 증가한 노후 주택 재고는 시장 수요의 주요 동력이 되었습니다.

- 이 나라의 주택부문이 가장 높은 점유율을 차지해 약 78-79%를 기록했습니다. 그러나 이 동향은 2020년에 크게 바뀌었고, 주택부문의 교체 수요가 대폭 증가하여 상업부문이 대폭 감소했기 때문에 상업부문의 점유율은 17.4% 이하로 감소했습니다.

- 예측 기간 동안 상업 부문의 점유율은 회복될 것으로 예상되지만, 주택 부문 수요가 지속되고 있기 때문에 단기적으로는 팬데믹 전 수준에 도달하지 않을 수도 있습니다.

미국 건축용 코팅 산업 개요

미국의 건축용 코팅 시장은 상당히 통합되어 상위 5개사에서 77.70%를 차지하고 있습니다. 이 시장 주요 기업은 다음과 같습니다. Benjamin Moore & Co., Masco Corporation, PPG Industries, Inc., RPM International Inc. and The Sherwin-Williams Company(sorted alphabetically).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약과 주요 조사 결과

제2장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제3장 주요 산업 동향

- 바닥면적 동향

- 규제 프레임워크

- 밸류체인과 유통채널 분석

제4장 시장 세분화

- 서브 최종 사용자

- 상업

- 주택

- 기술분야

- 용제계

- 수성

- 수지

- 아크릴

- 알키드

- 에폭시

- 폴리에스테르

- 폴리우레탄

- 기타 수지 유형

제5장 경쟁 구도

- 주요 전략적 움직임

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- Beckers Group

- Benjamin Moore & Co.

- Diamond Vogel

- Dunn-Edwards Corporation

- Kelly-Moore Paints

- Masco Corporation

- PPG Industries, Inc.

- RPM International Inc.

- The Sherwin-Williams Company

제6장 CEO에 대한 주요 전략적 질문

제7장 부록

- 세계 개요

- 개요

- Five Forces 분석 프레임워크

- 글로벌 가치 사슬 분석

- 시장 역학(DROs)

- 정보원과 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The United States Architectural Coatings Market size is estimated at USD 16.24 billion in 2024, and is expected to reach USD 18.55 billion by 2028, growing at a CAGR of 3.38% during the forecast period (2024-2028).

Key Highlights

- Largest Segment by End-user - Residential : Compared to commercial building stock, the country's high volume of residential building stock resulted in high architectural paint consumption from the residential sector.

- Largest Segment by Technology - Waterborne : High EPA regulations and consumer preference toward green and healthy products contributed to the high consumption and growth of waterborne coatings in the United States.

- Largest Segment by Resin - Acrylic : Acrylic is a leading type of resin, owing to its low cost and high usage in waterborne coatings. Waterborne coatings are also increasingly used in the US market.

US Architectural Coatings Market Trends

Residential is the largest segment by Sub End User.

- The growth rate of architectural coatings declined since 2016 before bouncing back in 2020. The growth registered in 2020 was due to a huge sales increase from the DIY segment, driven by consumers "nesting" at home and completing DIY projects. The aging housing stock, which reached an average age of 41 years in 2019 from around 31 years in 2001, was a major driver for the market demand.

- The country's residential sector held the highest share, registering around 78-79%. However, this trend changed drastically in 2020 due to a major increase in residential repaint demand in parallel with a huge decline in the commercial sector, thus reducing the commercial sector's share to less than 17.4%.

- Though the commercial sector's share is expected to recover during the forecast period, it may not reach the pre-pandemic levels in the short term due to sustained demand in the residential segment.

US Architectural Coatings Industry Overview

The United States Architectural Coatings Market is fairly consolidated, with the top five companies occupying 77.70%. The major players in this market are Benjamin Moore & Co., Masco Corporation, PPG Industries, Inc., RPM International Inc. and The Sherwin-Williams Company (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 INTRODUCTION

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 KEY INDUSTRY TRENDS

- 3.1 Floor Area Trends

- 3.2 Regulatory Framework

- 3.3 Value Chain & Distribution Channel Analysis

4 MARKET SEGMENTATION

- 4.1 Sub End User

- 4.1.1 Commercial

- 4.1.2 Residential

- 4.2 Technology

- 4.2.1 Solventborne

- 4.2.2 Waterborne

- 4.3 Resin

- 4.3.1 Acrylic

- 4.3.2 Alkyd

- 4.3.3 Epoxy

- 4.3.4 Polyester

- 4.3.5 Polyurethane

- 4.3.6 Other Resin Types

5 COMPETITIVE LANDSCAPE

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Landscape

- 5.4 Company Profiles

- 5.4.1 Beckers Group

- 5.4.2 Benjamin Moore & Co.

- 5.4.3 Diamond Vogel

- 5.4.4 Dunn-Edwards Corporation

- 5.4.5 Kelly-Moore Paints

- 5.4.6 Masco Corporation

- 5.4.7 PPG Industries, Inc.

- 5.4.8 RPM International Inc.

- 5.4.9 The Sherwin-Williams Company

6 KEY STRATEGIC QUESTIONS FOR ARCHITECTURAL COATINGS CEOS

7 APPENDIX

- 7.1 Global Overview

- 7.1.1 Overview

- 7.1.2 Porter's Five Forces Framework

- 7.1.3 Global Value Chain Analysis

- 7.1.4 Market Dynamics (DROs)

- 7.2 Sources & References

- 7.3 List of Tables & Figures

- 7.4 Primary Insights

- 7.5 Data Pack

- 7.6 Glossary of Terms