|

시장보고서

상품코드

1683761

영국의 건축용 코팅 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)United Kingdom Architectural Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

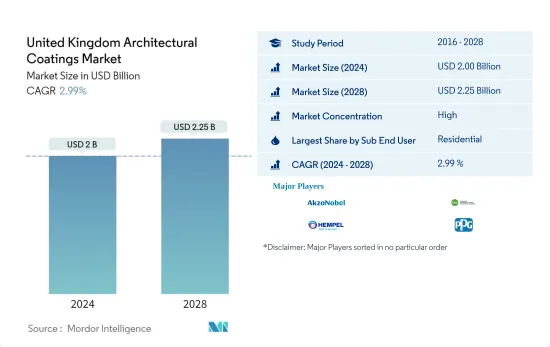

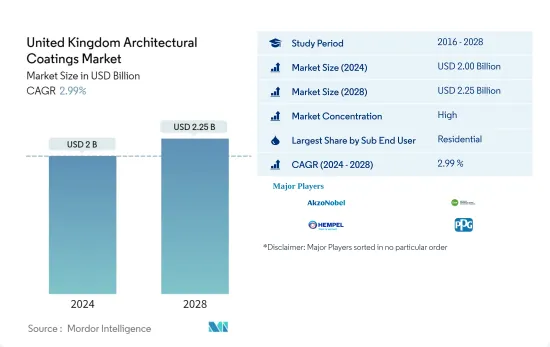

영국의 건축용 코팅 시장 규모는 2024년에 20억 달러에 달했고, 2028년에는 22억 5,000만 달러에 달할 것으로 예상되며, 예측 기간(2024-2028년)의 CAGR은 2.99%를 나타낼 것으로 예상됩니다.

주요 하이라이트

- 최종 사용자별 최대 부문 - 주택 : 주택 재고 증가 외에도 DIY 및 재배치 분야에서의 호조로 판매가 주택 코팅제 소비를 증가 시켰습니다.

- 기술별 최대 부문 - 수성 페인트 : 엄격한 VOC 규제와 LEED 인증 건축물 및 낮은 VOC로 친환경 수성 페인트에 대한 인식이 높아짐으로써 수성 페인트 소비에 기여했습니다.

- 수지별 최대 부문 - 아크릴 : 영국의 EU 이탈 후, 아크릴 페인트는 용매계 페인트보다 저렴한 가격으로 VOC 배출량이 적기 때문에 소비량이 증가했습니다.

영국 건축용 코팅 시장 동향

서브 최종사용자별로는 주택이 최대 부문

- 영국에서는 2016년부터 2021년까지 건축용 코팅 소비량이 연평균 성장률을 기록했습니다. 이 증가는 2016년 투자액이 2% 증가한 반면, 2017년은 4% 증가했기 때문입니다. 민간 주택 부문의 현저한 성장과 상업 부문의 혼합 성장도 이러한 증가에 기여했습니다.

- 2020년의 건축용 코팅 소비량의 성장이 둔화된 후, 2021년에는 주택 및 상업 부문의 신축 회복에 의해 성장이 회복되었습니다. 그러나 2020년에는 주택 부문에서 DIY 부문의 신축이 감소했습니다.

- 2021년에는 주택 및 상업 부문의 회복에 의해 소비가 회복되었습니다. 정부는 식료품 및 접객업에 대한 감세와 같은 정책을 발표하고 있으며, 이는 앞으로 수 년간 건설 부문의 성장에 박차를 가할 수 있습니다.

영국 건축용 코팅 산업 개요

영국의 건축용 코팅 시장은 세분화되어 있으며 상위 5개사에서 36.87%를 차지하고 있습니다. 이 시장 주요 기업은 다음과 같습니다. AkzoNobel NV, DAW SE, Hempel A/S, PPG Industries, Inc. and The Sherwin-Williams Company(sorted alphabetically).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약과 주요 조사 결과

제2장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제3장 주요 산업 동향

- 바닥면적 동향

- 규제 프레임워크

- 밸류체인과 유통채널 분석

제4장 시장 세분화

- 서브 최종 사용자

- 상업

- 주택

- 기술분야

- 용제계

- 수성

- 수지

- 아크릴

- 알키드

- 에폭시

- 폴리에스테르

- 폴리우레탄

- 기타 수지 유형

제5장 경쟁 구도

- 주요 전략적 움직임

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- AkzoNobel NV

- Bailey Paints

- Beckers Group

- Bedec Products Ltd

- DAW SE

- DGH Manufacturing Ltd(Andura Coatings)

- GLIXTONE

- Hempel A/S

- Jotun

- PPG Industries, Inc.

- RPM International Inc.

- SACAL INTERNATIONAL GROUP LTD

- The Sherwin-Williams Company

제6장 CEO에 대한 주요 전략적 질문

제7장 부록

- 세계 개요

- 개요

- Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 정보원과 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The United Kingdom Architectural Coatings Market size is estimated at USD 2 billion in 2024, and is expected to reach USD 2.25 billion by 2028, growing at a CAGR of 2.99% during the forecast period (2024-2028).

Key Highlights

- Largest Segment by End-user - Residential : The rise in the country's housing stock, accompanied by strong sales in the do-it-yourself (DIY) and repaint segments, has increased the consumption of residential coatings.

- Largest Segment by Technology - Waterborne : The strict VOC regulations and growing awareness of LEED-certified buildings and low-VOC, eco-friendly waterborne coatings contributed to waterborne coating consumption.

- Largest Segment by Resin - Acrylic : The lower price of acrylic coatings than solvent-based coatings, after the UK's exit from the European Union, and low VOC emissions have increased their consumption levels.

UK Architectural Coatings Market Trends

Residential is the largest segment by Sub End User.

- In the United Kingdom, architectural paint consumption from 2016 to 2021 recorded a CAGR of . This increase was seen due to a 4% increase in investment in 2017 compared to 2% in 2016. Significant growth in the private housing sector and mixed growth in the commercial sector also contributed to this increase.

- The slow growth in the architectural coating consumption in 2020 was followed by a growth recovery in 2021 due to the recovery in new constructions in the residential and commercial sectors. However, in 2020, there was a decline in new construction in the DIY segment from the residential sector.

- The consumption recovered in 2021 due to a rebound from the residential and commercial sectors. The government announced policies such as tax cuts on food and hospitality, which may add to the construction sector's growth in the coming years.

UK Architectural Coatings Industry Overview

The United Kingdom Architectural Coatings Market is fragmented, with the top five companies occupying 36.87%. The major players in this market are AkzoNobel N.V., DAW SE, Hempel A/S, PPG Industries, Inc. and The Sherwin-Williams Company (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 INTRODUCTION

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 KEY INDUSTRY TRENDS

- 3.1 Floor Area Trends

- 3.2 Regulatory Framework

- 3.3 Value Chain & Distribution Channel Analysis

4 MARKET SEGMENTATION

- 4.1 Sub End User

- 4.1.1 Commercial

- 4.1.2 Residential

- 4.2 Technology

- 4.2.1 Solventborne

- 4.2.2 Waterborne

- 4.3 Resin

- 4.3.1 Acrylic

- 4.3.2 Alkyd

- 4.3.3 Epoxy

- 4.3.4 Polyester

- 4.3.5 Polyurethane

- 4.3.6 Other Resin Types

5 COMPETITIVE LANDSCAPE

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Landscape

- 5.4 Company Profiles

- 5.4.1 AkzoNobel N.V.

- 5.4.2 Bailey Paints

- 5.4.3 Beckers Group

- 5.4.4 Bedec Products Ltd

- 5.4.5 DAW SE

- 5.4.6 DGH Manufacturing Ltd (Andura Coatings)

- 5.4.7 GLIXTONE

- 5.4.8 Hempel A/S

- 5.4.9 Jotun

- 5.4.10 PPG Industries, Inc.

- 5.4.11 RPM International Inc.

- 5.4.12 SACAL INTERNATIONAL GROUP LTD

- 5.4.13 The Sherwin-Williams Company

6 KEY STRATEGIC QUESTIONS FOR ARCHITECTURAL COATINGS CEOS

7 APPENDIX

- 7.1 Global Overview

- 7.1.1 Overview

- 7.1.2 Porter's Five Forces Framework

- 7.1.3 Global Value Chain Analysis

- 7.1.4 Market Dynamics (DROs)

- 7.2 Sources & References

- 7.3 List of Tables & Figures

- 7.4 Primary Insights

- 7.5 Data Pack

- 7.6 Glossary of Terms