|

시장보고서

상품코드

1683770

일본의 건축용 코팅 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Japan Architectural Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

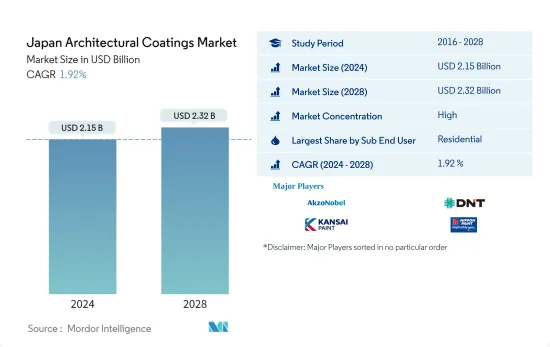

일본의 건축용 코팅 시장 규모는 2024년 21억 5,000만 달러로, 2028년에는 23억 2,000만 달러에 이를 것으로 예측되며, 예측 기간 중(2024-2028년) CAGR 1.92%로 성장할 것으로 예측됩니다.

주요 하이라이트

- 최종 사용자별 최대 부문 - 주택: 상업용 바닥 면적에 비해 일본에서는 주택 바닥 면적이 많기 때문에 주택 분야에서 건축용 코팅의 소비량이 많습니다.

- 기술별 최대 부문 - 수성: 일본은 VOC 자주 규제를 마련하고 있기 때문에 다른 지역에 비해 용제계 기술의 소비량이 많지만, 기술별로는 수성 기술이 최대 부문입니다.

- 수지별 최대 부문 - 아크릴: 일본에서는 아크릴이 주요 수지입니다. 또한 일본에서는 에폭시 수지와 폴리우레탄 수지의 소비 비율이 다른 지역에 비해 높습니다.

일본 건축용 코팅 시장 동향

서브 최종 사용자별로는 주택이 가장 큰 부문입니다.

- 일본의 건축용 코팅의 성장률은 2016년 이후 하락하고 있지만, 2020년에는 다시 급상승했습니다. 2020년 성장은 COVID에 의한 주택 리노베이션 활동의 강화에 영향을 받은 DIY 부문의 매출 증가로 인한 것입니다. 또, 일본의 주택 구조는 세계의 다른 주택 구조와 비교해, 주택의 스타일이 크게 다르기 때문에 도료의 소비량도 높아집니다.

- 일본 주택 부문의 점유율은 가장 높으며 약 80%를 차지합니다. 이 때문에 2016-2021년의 건축용 페인트 및 코팅의 총소비량은 상업부문이 수년간 마이너스 성장을 보였지만 CAGR 2.48%를 기록했습니다.

- 일본에서는 인구감소와 노동력의 고령화와 함께 주택분야 수요가 지속되고 있기 때문에 예측기간 중 상업분야 점유율은 저하될 것으로 예상됩니다. 게다가 일본은 고도 선진국이며 디플레이션이 장기화하고 있기 때문에 국가 전체의 성장에 영향을 미치고 있으며, 마찬가지로 건축용 페인트 및 코팅 시장은 2022-2028년까지 CAGR 1.3%로 계속될 것으로 예상됩니다.

일본 건축용 코팅 산업 개요

일본의 건축용 코팅 시장은 적당히 통합되어 상위 5개사에서 61.38%를 차지하고 있습니다. 이 시장 주요 기업은 다음과 같습니다. AkzoNobel N.V., DAI NIPPON TORYO CO.,LTD., Kansai Paint Co.,Ltd., Nippon Paint Holdings Co., Ltd., SKK(S) Pte. Ltd(알파벳순).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약과 주요 조사 결과

제2장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제3장 주요 산업 동향

- 바닥면적 동향

- 규제 프레임워크

- 밸류체인과 유통채널 분석

제4장 시장 세분화

- 서브 최종 사용자

- 상업

- 주택

- 기술

- 용제계

- 수성

- 수지

- 아크릴

- 알키드

- 에폭시

- 폴리에스테르

- 폴리우레탄

- 기타 수지 유형

제5장 경쟁 구도

- 주요 전략적 움직임

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- AGC Cortec Co., Ltd.

- AkzoNobel NV

- AS PAINT CO., LTD.

- BASF SE

- Chuo Paint Co., Ltd

- DAI NIPPON TORYO CO.,LTD.

- FUJIKURA KASEI CO.,LTD

- Jotun

- Kansai Paint Co.,Ltd.

- Nippon Paint Holdings Co., Ltd.

- SKK(S)Pte. Ltd

제6장 CEO에 대한 주요 전략적 질문

제7장 부록

- 세계 개요

- 개요

- Porter's Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 정보원과 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The Japan Architectural Coatings Market size is estimated at USD 2.15 billion in 2024, and is expected to reach USD 2.32 billion by 2028, growing at a CAGR of 1.92% during the forecast period (2024-2028).

Key Highlights

- Largest Segment by End-user - Residential : Compared to commercial floor area, Japan has been observing higher volume of residential building floor area resulting in high architectural paint consumption from the residential sector.

- Largest Segment by Technology - Waterborne : Japan has Voluntary VOC requirements, hence compared to the other regions consumption of Solventborne technology is higher, though Waterborne technology is largest segment by technology.

- Largest Segment by Resin - Acrylic : Acrylic is a leading type of resin in Japan. Further, Epoxy resins and Polyurethane resins in Japan has higher percentage of consumption in comparison to other regions.

Japan Architectural Coatings Market Trends

Residential is the largest segment by Sub End User.

- The growth rate of architectural coatings in Japan has been on decline since 2016 before observing a spike back in 2020. The growth registered in 2020 is due to sales increase from the DIY segment, influenced by COVID enhanced home improvement activity. The Japanese home structures also warrants a higher paint consumption as in comparison to other housing structure around world, Japan has different specifications as their style of houses are drastically different.

- Japan's residential sector held the highest share, which oscillates around 80%. This has enabled the total architectural paint and coatings consumption to witness a CAGR of 2.48% in the period 2016-2021, even though the commercial sector has observed a few negative growth rate years in the said period.

- The commercial sector's share in Japan is expected to reduce during the forecast period, due to sustained demand in the residential segment, coupled with declining population and aging labor force. Additionally, Japan is a highly developed country coupled with country observing deflation for a prolonged period of time, this has affected the overall growth of the country, similarly, the overall architectural paints and coatings market is expected to continue but at a mere CAGR of 1.3% between the period 2022-2028.

Japan Architectural Coatings Industry Overview

The Japan Architectural Coatings Market is moderately consolidated, with the top five companies occupying 61.38%. The major players in this market are AkzoNobel N.V., DAI NIPPON TORYO CO.,LTD., Kansai Paint Co.,Ltd., Nippon Paint Holdings Co., Ltd. and SKK(S) Pte. Ltd (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 INTRODUCTION

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 KEY INDUSTRY TRENDS

- 3.1 Floor Area Trends

- 3.2 Regulatory Framework

- 3.3 Value Chain & Distribution Channel Analysis

4 MARKET SEGMENTATION

- 4.1 Sub End User

- 4.1.1 Commercial

- 4.1.2 Residential

- 4.2 Technology

- 4.2.1 Solventborne

- 4.2.2 Waterborne

- 4.3 Resin

- 4.3.1 Acrylic

- 4.3.2 Alkyd

- 4.3.3 Epoxy

- 4.3.4 Polyester

- 4.3.5 Polyurethane

- 4.3.6 Other Resin Types

5 COMPETITIVE LANDSCAPE

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Landscape

- 5.4 Company Profiles

- 5.4.1 AGC Cortec Co., Ltd.

- 5.4.2 AkzoNobel N.V.

- 5.4.3 AS PAINT CO., LTD.

- 5.4.4 BASF SE

- 5.4.5 Chuo Paint Co., Ltd

- 5.4.6 DAI NIPPON TORYO CO.,LTD.

- 5.4.7 FUJIKURA KASEI CO.,LTD

- 5.4.8 Jotun

- 5.4.9 Kansai Paint Co.,Ltd.

- 5.4.10 Nippon Paint Holdings Co., Ltd.

- 5.4.11 SKK(S) Pte. Ltd

6 KEY STRATEGIC QUESTIONS FOR ARCHITECTURAL COATINGS CEOS

7 APPENDIX

- 7.1 Global Overview

- 7.1.1 Overview

- 7.1.2 Porter's Five Forces Framework

- 7.1.3 Global Value Chain Analysis

- 7.1.4 Market Dynamics (DROs)

- 7.2 Sources & References

- 7.3 List of Tables & Figures

- 7.4 Primary Insights

- 7.5 Data Pack

- 7.6 Glossary of Terms