|

시장보고서

상품코드

1683772

인도네시아의 건축용 코팅 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Indonesia Architectural Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

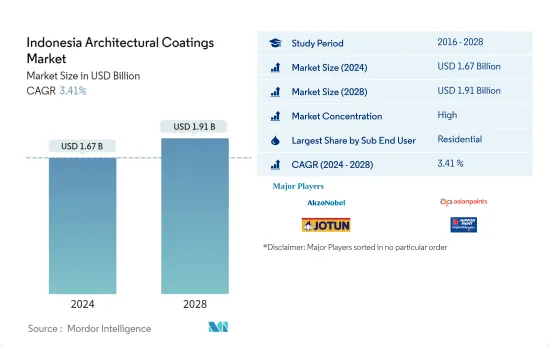

인도네시아의 건축용 코팅 시장 규모는 2024년 16억 7,000만 달러로, 2028년에는 19억 1,000만 달러에 이르고, 예측 기간 중(2024-2028년) CAGR 3.41%로 성장할 것으로 예측됩니다.

주요 하이라이트

- 최종 사용자별 최대 부문 - 주택 : 인구 급증에 따른 주택 건설에 대한 정부의 지속적인 노력으로 주택 분야가 시장을 독점

- 기술별 최대 부문 - 수성 : VOC 배출에 대한 의식으로 인해 수성 도료가 다소 우세하지만, 정부 규제의 부족이 시장의 발판이 되고 있습니다.

- 수지별 최대 부문 - 아크릴: 이 나라에서는 주택의 외벽에 아크릴 페인트가 사용되기 때문에 아크릴 페인트는 건축용 코팅의 소비를 지배합니다.

인도네시아 건축용 코팅 시장 동향

서브 최종 사용자별로는 주택이 최대

- 인도네시아의 건축용 코팅 소비량은 판매 및 신규 출시의 영향을 받아 2016년과 2017년에 감소했습니다. 또한 인도네시아 부동산 부문은 특히 프리미엄 부문 구매 희망자들이 세금 사면을 기다리기 위해 구매를 늦추기 때문에 부문 내 자금 순환이 줄어들고 2016년 둔화를 경험했습니다.

- 소비는 급속히 회복되어 2018년에 피크를 맞았지만, 이는 주택 부문의 바닥 면적 증가로 인한 것으로, 이는 국가가 100만 호의 주택 건설 목표를 달성했기 때문이며, 2018년에는 국가의 주택 채무 잔고 삭감 노력의 일환으로 113만 호가 건설되었습니다. 건축용 코팅의 소비는 2019년에 완만한 성장이 보였지만, 2020년에는 COVID-19 만연과 50일간의 전국적인 일부 봉쇄 때문에 주택과 상업 부문 모두에서 신규 건설이 감소했기 때문에 감소로 전환했습니다.

- 2022년과 예측기간에는 인도네이사 인구 증가와 급성장 건설 부문에 대한 적극적인 투자로 소비와 판매 증가가 현저한 성장을 보일 것으로 예상됩니다. 세계 인구 조사에 따르면 인도네시아는 현재 연간 약 273만 명 증가하고 있습니다.

인도네시아 건축용 코팅 산업의 개요

인도네시아의 건축용 코팅 시장은 세분화되어 상위 5개사에서 17.22%를 차지하고 있습니다. 이 시장 주요 기업은 다음과 같습니다. AkzoNobel N.V., Asian paints, Jotun, Nippon Paint Holdings Co., Ltd., TOA Paint Public Company Limited.(알파벳순).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약과 주요 조사 결과

제2장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제3장 주요 산업 동향

- 바닥면적 동향

- 규제 프레임워크

- 밸류체인과 유통채널 분석

제4장 시장 세분화

- 서브 최종 사용자

- 상업

- 주택

- 기술

- 용제계

- 수성

- 수지

- 아크릴

- 알키드

- 에폭시

- 폴리에스테르

- 폴리우레탄

- 기타 수지 유형

제5장 경쟁 구도

- 주요 전략적 움직임

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- AkzoNobel NV

- Asian paints

- Avian Brands

- DAI NIPPON TORYO CO.,LTD.

- Guangdong Maydos building materials limited company

- Jotun

- Kansai Paint Co.,Ltd.

- Mowilex

- Nippon Paint Holdings Co., Ltd.

- PT Propan Raya

- SKK(S)Pte. Ltd

- TOA Paint Public Company Limited.

제6장 CEO에 대한 주요 전략적 질문

제7장 부록

- 세계 개요

- 개요

- Porter's Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 정보원과 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The Indonesia Architectural Coatings Market size is estimated at USD 1.67 billion in 2024, and is expected to reach USD 1.91 billion by 2028, growing at a CAGR of 3.41% during the forecast period (2024-2028).

Key Highlights

- Largest Segment by End-user - Residential : The residential sector dominated the market due to the continuous efforts by the government to build houses to accompany the fast growing population in the country

- Largest Segment by Technology - Waterborne : The waterborne coatings has slightly dominated the segment due to the awareness for VOC emissions, however lack of government regulations still hinders the market.

- Largest Segment by Resin - Acrylic : The acrylic coating has dominated the architectural coating consumption as the country has its houses coated with acrylic coating on the outer surface of the houses.

Indonesia Architectural Coatings Market Trends

Residential is the largest segment by Sub End User.

- The architectural coating consumption in Indonesia dipped in 2016 and 2017 due to the affected sales and new launches. Furthermore, The Indonesian property sector experienced a slowdown in 2016 as prospective buyers, especially in the premium segment, delayed their purchase to wait for the tax amnesty realisation, therefore leading to the less circulation of money in the sector.

- The consumption recovered quickly and peaked in 2018 due to the higher addition of floor area in the residential sector as the country met its target for the construction of 1 million homes, with 1.13m built in 2018 as part of efforts to reduce the country's housing backlog. The slow growth in the architectural coating consumption was observed in 2019 followed by a decline in 2020 due to lower new constructions in both residential cand commercial sector owing to the spread of covid-19 in the country and partial lockdown of 50 days across the country.

- The increase in consumption and sales is expected to grow at a significant rate in 2022 and the forecasted period due to the rising population in the country and positive investment in the rapid growing construction sector. According to the world population review, Indonesia currently grows by about 2.73 million people per year.

Indonesia Architectural Coatings Industry Overview

The Indonesia Architectural Coatings Market is fragmented, with the top five companies occupying 17.22%. The major players in this market are AkzoNobel N.V., Asian paints, Jotun, Nippon Paint Holdings Co., Ltd. and TOA Paint Public Company Limited. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 INTRODUCTION

- 2.1 Study Assumptions & Market Definition

- 2.2 Scope of the Study

- 2.3 Research Methodology

3 KEY INDUSTRY TRENDS

- 3.1 Floor Area Trends

- 3.2 Regulatory Framework

- 3.3 Value Chain & Distribution Channel Analysis

4 MARKET SEGMENTATION

- 4.1 Sub End User

- 4.1.1 Commercial

- 4.1.2 Residential

- 4.2 Technology

- 4.2.1 Solventborne

- 4.2.2 Waterborne

- 4.3 Resin

- 4.3.1 Acrylic

- 4.3.2 Alkyd

- 4.3.3 Epoxy

- 4.3.4 Polyester

- 4.3.5 Polyurethane

- 4.3.6 Other Resin Types

5 COMPETITIVE LANDSCAPE

- 5.1 Key Strategic Moves

- 5.2 Market Share Analysis

- 5.3 Company Landscape

- 5.4 Company Profiles

- 5.4.1 AkzoNobel N.V.

- 5.4.2 Asian paints

- 5.4.3 Avian Brands

- 5.4.4 DAI NIPPON TORYO CO.,LTD.

- 5.4.5 Guangdong Maydos building materials limited company

- 5.4.6 Jotun

- 5.4.7 Kansai Paint Co.,Ltd.

- 5.4.8 Mowilex

- 5.4.9 Nippon Paint Holdings Co., Ltd.

- 5.4.10 PT Propan Raya

- 5.4.11 SKK(S) Pte. Ltd

- 5.4.12 TOA Paint Public Company Limited.

6 KEY STRATEGIC QUESTIONS FOR ARCHITECTURAL COATINGS CEOS

7 APPENDIX

- 7.1 Global Overview

- 7.1.1 Overview

- 7.1.2 Porter's Five Forces Framework

- 7.1.3 Global Value Chain Analysis

- 7.1.4 Market Dynamics (DROs)

- 7.2 Sources & References

- 7.3 List of Tables & Figures

- 7.4 Primary Insights

- 7.5 Data Pack

- 7.6 Glossary of Terms