|

시장보고서

상품코드

1683805

그린 수소 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Green Hydrogen - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

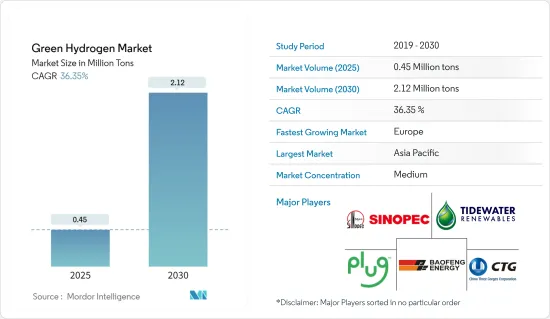

그린 수소 시장 규모는 2025년에는 45만톤으로 추계되며, 2030년에는 212만톤에 달할 것으로 예측되고, 예측기간 중(2025-2030년)의 CAGR은 36.35%를 나타낼 것으로 전망됩니다.

COVID-19 팬데믹은 생산 중단과 공급망의 혼란으로 인해 그린 수소 산업의 전반적인 성장에 어느 정도 영향을 미쳤습니다. 그러나 팬데믹 이후 운송 부문에서 그린 수소에 대한 수요가 증가하면서 업계의 성장을 촉진했습니다.

중기적으로는 화학 산업에서 그린 수소에 대한 수요와 탄소 배출에 대한 환경 우려가 커지면서 그린 수소에 대한 수요가 증가할 것으로 예상됩니다.

반면에 그린 수소의 높은 투자 비용, 기술 및 인프라에 대한 제한된 접근성, 높은 에너지 손실은 업계의 전반적인 성장을 저해할 가능성이 높습니다.

그린 수소 사용을 촉진하는 우호적인 정책과 규제는 시장에 새로운 성장 기회를 제공할 것으로 예상됩니다.

아시아태평양이 시장을 지배할 것으로 예상되며, 유럽은 예측 기간 동안 가장 높은 연간 성장률을 보일 것으로 보입니다.

그린 수소 시장 동향

전력 및 기타 최종 사용자 산업 부문이 시장을 지배 할 전망

- 수소는 에너지 시스템의 탈탄소화에 중요한 역할을 할 수 있는 잠재력을 지닌 매우 다재다능한 에너지 운반체입니다.

- 풍력이나 태양광 발전소를 통해 생산된 재생 에너지는 압축 가스로 저장됩니다. 수소 에너지 저장 시스템은 전기를 그린 수소로 변환하는 수전해 장치, 수소를 압축 가스로 저장하는 저장 시설, 그린 수소를 전기로 변환하는 연료 전지로 구성됩니다.

- 전 세계 주요 국가들은 탈탄소화를 위해 주로 발전 부문을 타깃으로 수소 저장 용량을 늘리고 있습니다.

- 이러한 움직임은 보조금 및 인센티브와 같은 다양한 이니셔티브를 통해 분명하게 드러납니다. 예를 들어, 미국 정부는 2023년 16개 프로젝트에 약 4,800만 달러를 할당하고 클린 수소 기술, 특히 연료전지 및 저장 촉진에 주력하고 있습니다.

- 전 세계 주요 국가들이 기후 목표를 달성하기 위해 통합 그린 수소 기반 발전 솔루션의 채택을 개선하기 위한 혁신적인 솔루션 개발에 뛰어들고 있습니다. 2023년 9월, 인도 신재생에너지부는 그린 수소 저장소를 사용하여 24시간 내내 100MW의 전력을 생산하는 시범 프로젝트 계획을 발표했습니다.

- 또한, 2024년 4월에는 인도 최초의 다목적 그린 수소 시범 프로젝트인 히마찰의 자크리에 20Nm3/hr 전해조 및 25kW 연료전지 용량 기반 그린 수소 시범 프로젝트인 나트파 자크리 수력발전소(NJHPS)를 시운전한다고 발표했습니다(SJVN, Satluj Jal Vidyut Nigam).

- 마찬가지로 중국은 2023년 7월 간쑤성 간난저우 협력시에 12MW/2MWh 규모의 그린 수소 기반 에너지 저장 시설을 개장하며 진전을 이루었습니다.

- 수많은 시장 참여자들이 그린 수소를 발전 시설에 통합하기 위한 혁신적인 솔루션을 개발하고 있습니다. 예를 들어 Siemens Energy와 Siemens Gamessa는 그린 수소를 직접 제조하는 단일 동기화 시스템으로 해상 풍력 터빈을 개발하기 위해 향후 5년간 총액 약 1억 2,000만 유로의 투자를 목표로 하고 있으며, 2025-2026년까지 본격적인 해상 실증이 이루어질 예정입니다.

- 건물 및 전력 부문의 적극적인 탈탄소화 노력과 함께 그린 수소의 채택이 증가함에 따라 향후 몇 년간 견고한 성장이 예상되는 유망한 시장 전망이 그려지고 있습니다.

- 또한 2050년까지 온실가스 순배출량 제로를 목표로 하는 글로벌 에너지 시스템에서 그린 수소(H2)와 같은 저탄소 연료는 핵심적인 구성 요소가 될 것입니다.

- 국제재생가능에너지기구(IRNA)의 보고서에 의하면,전 세계적으로 새로운 전력-수소 프로젝트의 수는 매년 변화하고 있습니다. 예를 들어, 2022년에는 5개의 프로젝트가 있었고 2023년에는 2개의 프로젝트만 있었습니다.

- 따라서 앞서 언급한 요인으로 인해 전력 및 기타 최종 사용자 에너지 산업에서 그린 수소 소비가 증가할 것으로 예상됩니다.

아시아태평양이 시장을 독점할 전망

- 아시아태평양 지역이 시장을 지배할 것으로 예상됩니다. 중국은 이 지역에서 가장 큰 GDP를 보유하고 있으며, 중국과 인도는 세계에서 가장 빠르게 부상하는 경제대국 중 하나입니다.

- 2022년 3월 중국은 2021-2035년까지 최초의 장기 수소 계획을 밝혔습니다. 이 전략적 로드맵은 기술 발전과 제조 역량 강화를 통해 국내 수소 산업의 성장을 우선시하는 단계적 접근 방식을 강조합니다. 특히 이 계획은 2025년까지 재생 가능한 자원으로부터 연간 10만-20만 톤의 수소를 생산하는 것을 목표로 하며, 2035년까지 중국의 그린 에너지 전환을 강화하기 위해 경제에서 재생 가능한 수소를 주류화한다는 보다 광범위한 목표를 세우고 있습니다. 또한, 이 계획은 향후 15년 동안 다양한 재생 에너지원의 혼합을 촉진하는 다양한 기술 경로를 지지합니다.

- 중국 철강업체들은 용광로 운영과 같은 공정에서 화석 연료를 대체하는 것을 목표로 그린 수소로의 전환을 주도하고 있습니다. 특히 대형 철강 제조업체인 Baowu는 광둥성 잔장에 그린 수소 연료 전기 아크로 건설을 시작했습니다.

- 탄소 배출량이 많은 것으로 알려진 철강, 시멘트, 비료와 같은 산업은 탈탄소화에 대한 압박이 가중되고 있습니다. 2030년까지 화석연료의 수입을 1,000억 루피 삭감하고, 연간 약 5,000만 톤의 CO2 배출량을 삭감하는 것을 목표로 하는 「그린 수소 국가 미션」의 야심적인 목표와, 인도의 일치 단결한 노력에 의해 그린 수소는 그 이행에 있어서의 희망의 빛이 되고 있습니다.

- 마찬가지로 NTPC Limited는 2023년 1월부터 인도 구자라트주 수랏에 위치한 카와스 타운십의 PNG 네트워크에 최대 8%의 그린 수소를 혼합하는 중요한 발걸음을 내디뎠습니다.

- 도도쿄는 뒤처지지 않고 공공 소유 토지에 그린 수소 시설을 개발하는 데 진전을 보이고 있습니다. 도쿄도는 2024년까지 3기를 건설하여 그해 말까지 1기를 가동하는 것을 목표로 하고 있다고 발표했습니다. 그러나 정부의 추가 세부 사항이 발표되기를 간절히 기대하고 있습니다.

- 2024년 1월, SK에코플랜트는 블룸에너지와 손잡고 획기적인 그린 수소 전략을 시작했습니다. 한국남부발전 및 지자체와 협력하여 대규모 수소 발전 도입을 목표로 하고 있습니다. SK에코플랜트는 블룸의 최첨단 고체산화물 수전해(SOEC) 기술을 활용해 대한민국 제주도에서 수송용 연료로 그린 수소를 생산할 계획입니다. 2025년 말에 시작될 예정인 이 프로젝트에는 1.8메가와트 규모의 전해조 기술이 적용될 예정입니다.

- 따라서 위의 요인은 아시아태평양에서 그린 수소의 소비를 증가시킬 것으로 예상됩니다.

그린 수소 산업 개요

세계의 그린 수소 시장은 부분적으로 통합되어 있습니다. 시장의 주요 기업으로는 China Petroleum &Chemical Corporation, Ningxia Baofeng Energy Group, Plug Power Inc., China Three Gorges Corporation(CTG), Tidewater Renewables Ltd. 등이 있습니다(특정한 순서 없음).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 성장 촉진요인

- 화학 산업의 잠재력 실현

- 탄소 배출에 대한 환경 문제 증가

- 시장 성장 억제요인

- 그린 수소의 높은 투자 비용

- 기타 억제요인

- 산업 밸류체인 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁도

- 기술 스냅샷

제5장 시장 세분화

- 최종 사용자 산업

- 정제

- 화학

- 철강

- 운수

- 전력 및 기타 최종 사용자 산업

- 지역

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 기타 유럽

- 세계 기타 지역

- 남미

- 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 시장 점유율(%) 분석

- 주요 기업의 전략

- 기업 프로파일

- Air Products and Chemicals Inc.

- Air Liquide

- BP PLC

- China Petroleum & Chemical Corporation

- China Three Gorges Corporation

- Engie

- Fortescue Future Industries

- Green Hydrogen International Corp.

- Iberdrola SA

- Intercontinental Energy

- LHYFE

- Linde PLC

- Ningxia Baofeng Energy Group Co. Ltd

- Plug Power Inc.

- Reliance Industries Limited

- Tidewater Renewables Ltd

- Uniper SE

- Yara

제7장 시장 기회와 앞으로의 동향

- 그린 수소의 이용을 촉진하는 유리한 규제와 정책

The Green Hydrogen Market size is estimated at 0.45 million tons in 2025, and is expected to reach 2.12 million tons by 2030, at a CAGR of 36.35% during the forecast period (2025-2030).

The COVID-19 pandemic moderately impacted the overall growth of the green hydrogen industry, owing to a halt in production and disruption in the supply chain. However, after the pandemic, the demand for green hydrogen increased in the transportation segment, which, in turn, has propelled the industry's growth.

Over the medium term, the demand for green hydrogen in the chemical industry and growing environmental concerns regarding carbon emissions are expected to drive the demand for green hydrogen.

On the flip side, the high investment cost of green hydrogen, limited access to technology and infrastructure, and high energy losses will likely hinder the industry's overall growth.

Favorable policies and regulations promoting the usage of green hydrogen are projected to offer new growth opportunities to the market.

Asia-Pacific is expected to dominate the market, and Europe will likely witness the highest annual growth rate during the forecast period.

Green Hydrogen Market Trends

The Power and Other End-user Industries Segment is Expected to Dominate the Market

- Hydrogen is a very versatile energy carrier that has the potential to play a significant role in decarbonizing the energy system.

- Renewable energy produced via wind or solar farms is stored as compressed gas. The hydrogen energy storage system consists of an electrolyzer to convert electricity to green hydrogen, a storage facility to store hydrogen as a compressed gas, and a fuel cell to convert green hydrogen to electricity.

- Leading economies worldwide are ramping up their hydrogen storage capacities, primarily targeting the power generation sector for decarbonization.

- This push is evident through various initiatives, such as grants and incentives. For example, in 2023, the US government allocated nearly USD 48 million across 16 projects, focusing on advancing clean hydrogen technologies, notably fuel cells and storage.

- Major economies around the globe are foraging into the field of developing innovative solutions to improve the adoption of integrated green hydrogen-based power generation solutions to meet climate goals. In a significant move, in September 2023, India's Ministry of New & Renewable Energy unveiled plans for a pilot project to generate 100 MW of round-the-clock power using green hydrogen storage.

- Moreover, in April 2024, Satluj Jal Vidyut Nigam (SJVN) announced the commissioning of India's first multi-purpose green hydrogen pilot project, a 20 Nm3/hr electrolyzer and 25 kW fuel cell capacity-based green hydrogen pilot project, Nathpa Jhakri Hydro Power Station (NJHPS) in Himachal's Jhakri.

- Similarly, China made strides in July 2023, inaugurating a 12 MW/2 MWh green hydrogen-based energy storage facility in Gannanzhou Cooperation City, Gansu Province.

- Numerous market players are developing innovative solutions to integrate green hydrogen into power generation facilities. For instance, Siemens Energy and Siemens Gamesa target a total investment of around EUR 120 million in the coming five years to develop an offshore wind turbine as a single synchronized system to directly produce green hydrogen, with a full-scale offshore demonstration expected by 2025/2026.

- The rising adoption of green hydrogen, coupled with aggressive decarbonization efforts in the building and power sectors, paints a promising picture for the market under study, projecting robust growth in the coming years.

- Additionally, low-carbon fuels, like green hydrogen (H2), will be a key component of the global energy system, which aims to achieve net zero greenhouse gas (GHG) emissions by 2050.

- According to the report of the International Renewable Energy Agency (IRNA), the number of new power-to-hydrogen projects worldwide has changed yearly. For instance, in 2022, there were five projects, and in 2023, there were only two.

- Therefore, the aforementioned factors are projected to boost the consumption of green hydrogen in the power and other end-user energy industries.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific is expected to dominate the market. China has the largest GDP in the region, and China and India are among the fastest-emerging economies in the world.

- In March 2022, China revealed its first long-term hydrogen plan from 2021 to 2035. This strategic roadmap emphasizes a phased approach, prioritizing the growth of the domestic hydrogen industry through technological advancements and enhanced manufacturing capabilities. Notably, the plan targets producing 100,000 to 200,000 tons of hydrogen annually from renewable sources by 2025, with a broader goal of mainstreaming renewable hydrogen in the economy to bolster China's green energy transition by 2035. Additionally, the plan advocates for a diverse technology pathway, promoting a varied mix of renewable sources over the next 15 years.

- Chinese steelmakers spearhead the shift toward green hydrogen, aiming to replace fossil fuels in processes like Blast Furnace operations. Notably, Baowu, a major player, initiated the construction of a green hydrogen-fueled electric arc furnace in Zhanjiang, Guangdong.

- Industries like steel, cement, and fertilizers, known for their high carbon footprint, face mounting pressure for decarbonization. However, with India's concerted efforts and the ambitious targets set by the National Green Hydrogen Mission, which aims to slash INR 1 lakh crore worth of fossil fuel imports and nearly 50 million metric tons (MMT) of CO2 emissions annually by 2030, green hydrogen emerges as a beacon of hope in their transition.

- Similarly, NTPC Limited took a significant step starting in January 2023, blending up to 8% green hydrogen into the PNG Network at its Kawas Township in Surat, Gujarat, India.

- Tokyo is making strides in developing its green hydrogen facilities on publicly owned land rather than falling behind. The metropolitan government announced intentions to begin constructing three units by the fiscal year 2024, aiming to have one operational by the end of that year. However, further details from the government are eagerly anticipated.

- In January 2024, SK Ecoplant partnered with Bloom Energy for a groundbreaking green hydrogen initiative. Teaming up with Korea Southern Power and local authorities, they aim to introduce hydrogen power on a significant scale. SK Ecoplant will leverage Bloom's cutting-edge solid oxide electrolyzer (SOEC) technology to produce green hydrogen as a transport fuel on Jeju Island, South Korea. The upcoming presentation, scheduled to commence in late 2025, will involve the implementation of 1.8 megawatts of electrolyzer technology.

- Hence, the above-mentioned factors are expected to boost the consumption of green hydrogen in Asia-Pacific.

Green Hydrogen Industry Overview

The global green hydrogen market is partially consolidated. Some of the major players in the market include China Petroleum & Chemical Corporation, Ningxia Baofeng Energy Group Co. LTD, Plug Power Inc., China Three Gorges Corporation (CTG), and Tidewater Renewables Ltd (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Realizing the Potential in the Chemical Industry

- 4.1.2 Growing Environmental Concerns Regarding Carbon Emissions

- 4.2 Market Restraints

- 4.2.1 High Investment Cost of Green Hydrogen

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Technological Snapshot

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 End-user Industry

- 5.1.1 Refining

- 5.1.2 Chemicals

- 5.1.3 Iron and Steel

- 5.1.4 Transportation

- 5.1.5 Power and Other End-user Industries

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 France

- 5.2.3.4 Italy

- 5.2.3.5 Rest of Europe

- 5.2.4 Rest of the World

- 5.2.4.1 South America

- 5.2.4.2 Middle East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Air Products and Chemicals Inc.

- 6.4.2 Air Liquide

- 6.4.3 BP PLC

- 6.4.4 China Petroleum & Chemical Corporation

- 6.4.5 China Three Gorges Corporation

- 6.4.6 Engie

- 6.4.7 Fortescue Future Industries

- 6.4.8 Green Hydrogen International Corp.

- 6.4.9 Iberdrola SA

- 6.4.10 Intercontinental Energy

- 6.4.11 LHYFE

- 6.4.12 Linde PLC

- 6.4.13 Ningxia Baofeng Energy Group Co. Ltd

- 6.4.14 Plug Power Inc.

- 6.4.15 Reliance Industries Limited

- 6.4.16 Tidewater Renewables Ltd

- 6.4.17 Uniper SE

- 6.4.18 Yara

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Favorable Policies and Regulations Promoting the Usage of Green Hydrogen