|

시장보고서

상품코드

1683853

독일의 의약품 콜드체인 물류 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Germany Pharmaceutical Cold Chain Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

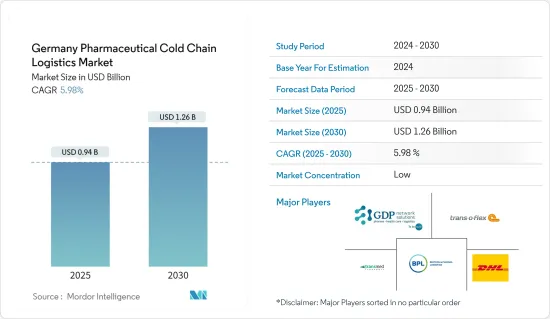

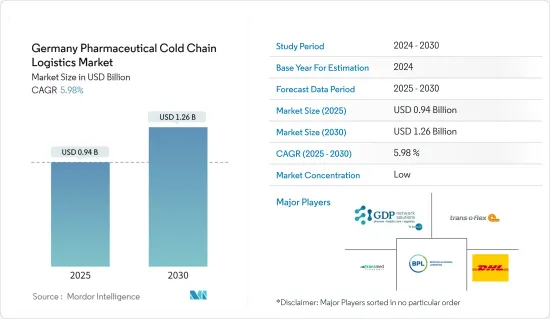

독일의 의약품 콜드체인 물류 시장 규모는 2025년에 9억 4,000만 달러에 이를 것으로 추정됩니다. 예측 기간(2025-2030년)의 CAGR은 5.98%를 나타내고, 2030년에는 12억 6,000만 달러에 달할 것으로 예상됩니다.

주요 하이라이트

- 독일에서는 온도 변화에 민감한 의약품에 대한 수요 증가, 전자상거래 부문의 급성장, 신선한 식품에 대한 소비자의 선호도 증가가 시장을 뒷받침하고 있습니다. 게다가, 기술의 진보는 이러한 급증에 매우 중요한 역할을 하고 있습니다. IoT(사물인터넷) 장비, 첨단 온도 모니터링 시스템, 자동화된 냉장 창고와 같은 기술 혁신은 콜드체인 물류의 효율성과 신뢰성을 높입니다.

- 유럽 연합(EU)에서는 현재 의약품의 약 80%를 온도 관리하에 운송해야 합니다. 대부분의 국가의 의약품에 관한 법률은 오랫동안 제조업체의 사양에 따라 제품을 보관할 의무가 있었습니다.

- 그러나 EU는 인간용 의약품의 안전한 유통 절차에 관한 가이드라인을 발표하고, 운송에 관한 온도 관리의 필요성을 확대하고, 시판약에도 적용 범위를 넓히고 있습니다. 이러한 요구에 부응하기 위해 온도에 민감한 제품의 보관 및 운송에 최적의 조건을 보장하는 콜드체인 시스템을 갖춘 창고가 많이 만들어져 있습니다.

- 독일의 화학 부문은 국내 3위 산업이며 약 50만 명의 직원을 보유한 주요 고용주이지만 지속적인 문제에 직면하고 있습니다. 장기간의 경기 불투명감을 경계하는 고객은 신규 주문을 주저하고 있습니다. 원재료와 에너지 가격의 상승이 계속되는 가운데, 이러한 경계감이 탄생하고 있습니다.

- 업계 전문가의 보고에 따르면 2024년 7월 업계 단체 VCI는 독일 화학 산업이 2024년 상반기에 1,120억 유로(1,210억 달러)의 매출을 달성했다고 보고했습니다. 이는 지난해 1,140억 유로에서 1% 감소했으며 업계에 퍼지는 신중한 심리를 반영합니다.

독일의 의약품 콜드체인 물류 시장 동향

온도 관리 솔루션에 대한 수요 급증

온도 변화에 민감한 의약품에 대한 효율적이고 신뢰할 수 있는 물류 솔루션에 대한 수요가 점점 높아지고 있으며, 이 분야에서 적절한 보관 및 운송의 중요성이 부각되고 있습니다. 예를 들어, 최근 적정 유통 규범(GDP) 인증을 받은 부다페스트 지점은 리스트 페렌츠 국제공항에 인접한 전략적 위치에 있습니다. 이 좋은 위치는 항공화물 운송의 관리 능력을 향상시킵니다. 이 지점은 최첨단 온도 관리 시설을 갖추고 있으며, 2℃에서 8℃로 설정된 보관 구역(냉장)과 15℃에서 25℃의 일정 온도를 유지하는 보관 구역의 2개를 제공합니다. 일본통운홀딩스가 2024년 8월에 발표한 바와 같이 NX그룹의 국제정온운송 서비스와 보관 솔루션을 융합시킴으로써 NX그룹은 의약품 물류의 견고하고 프리미엄 플랫폼을 확립했습니다.

의약품 부문의 운송 요구에 부응하기 위해 냉장 차량의 능력 확대에 대한 요구가 높아지고 있습니다. 예를 들어, 냉각 솔루션 제공업체인 쁘띠 포레스티에는 특히 독일 시장을 대상으로 7.2톤, 12톤, 18톤급의 대여 냉동차를 100대 이상 추가 도입했습니다.

게다가 2024년 8월 Parc and Postal Technology International은 Trans-o-flex와 PostNL Pharma & Care Benelux가 지리적 존재 확대를 목표로 제약 업계를 위한 서로의 온도 관리 물류 솔루션을 통합하기 위해 협력했다고 보도했습니다. 결론적으로 의약품 물류 분야는 첨단 온도 관리 솔루션의 필요성에 따라 빠르게 진화하고 있습니다. 증가하는 수요에 부응하고 의약품의 안전하고 효율적인 운송을 보장하기 위해서는 전략적 제휴와 냉장 차량 능력의 확대가 필수적입니다.

시장 확대에 기여하는 바이오의약품

생물학적 제약은 제약 업계의 상황을 크게 바꿨습니다. 독일, 특히 남부 지역은 EU에서 승인한 바이오 의약품의 유효 성분의 절반 이상을 생산하고 있으며, 유럽 의약 시장을 선도하는 생산국으로서의 지위를 확고히 하고 있습니다. 예를 들어, 독일의 물류 공급자인 Fligho Trans는 머터슈타트의 거점에 냉동 보존 창고를 건설할 계획을 발표했습니다.

보덴 호수와 울름 호수는이 활동의 주요 기지가되었습니다. 이 작은 지역에는 다양한 연구 기관과 함께 생명 공학, 제약 및 의료 기술에 걸쳐 100 개 이상의 기업이 있습니다. 독일은 일관되게 유럽에서 중요한 지위를 차지하고 있지만, 세계 랭킹에서는 제조 능력으로 5위가 되고 있습니다. 이 지연은 경쟁력 있는 세제를 뒷받침하는 기타 국가가 바이오 의약품 생산 투자에서 독일을 능가하는 것이 주요 원인입니다. 그럼에도 불구하고 생물 제제는 탁월한 치료 가능성으로 독일 제약 업계의 발판을 크게 확장하고 있습니다.

독일은 일반적인 의약품 제조뿐만 아니라 바이오 의약품 기업에 역동적 인 환경을 키우고 있습니다. 베터, 테바, 비베라흐 사이트, 베링거 인겔하임 등 기업이 최전선에 서서 국가의 제약 의욕을 높이는 혁신을 도입하고 있습니다. 이러한 붐비는 시장을 탐색하는 유로데브는 북미 제약 기업에 흔들리지 않는 아군이며 독일의 의약품 시장 진입에 관한 견해를 제공해 왔습니다. 유로데브의 전문 지식은 독일 의약품 분야에서 현행 규제, 시장 동향, 경쟁 구도, 잠재적 과제에 대한 실시간 지침을 제공합니다.

독일의 의약품 콜드체인 물류 산업 개요

독일의 의약품 콜드체인 물류 시장은 매우 세분화되어 있으며, 세계 선수와 지역 기업이 혼합되어 업계를 지배하고 있습니다. 이 시장의 주요 기업으로는 Trans-o-flex(ThermoMed), DHL, Biotech and Pharma Logistics, GDP Network Solutions GmbH, Transmed Transport GmbH 등이 있습니다. 의약품 물류에는 첨단 전문성, 정부 승인, 최첨단 기술, 광범위한 네트워크 및 많은 노하우가 필요하기 때문에 운송품의 섬세함을 고려하면 동 시장의 기업 수는 비교적 적습니다.

예를 들어 독일 바인하임에 본사를 둔 대기업 트랜스 오플렉스는 2024년 3월 자회사인 트랜스 오플렉스 써모메드 오스트리아(TMA)가 슈타이어마르크주 레블링에 새로운 물류센터를 개설했다고 발표했습니다. TMA는 의약품 및 헬스케어 분야에 특화된 정온 운송 서비스를 제공합니다. 이 전략적 확장은 트랜스 오플렉스의 서비스 능력과 비즈니스 효율성 향상에 대한 헌신을 강조합니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 성과

- 조사의 전제

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 현재의 시장 시나리오

- 시장 역학

- 성장 촉진요인

- 온도에 민감한 의약품에 대한 수요 증가

- 엄격한 규제

- 성장 억제요인

- 높은 인프라 비용

- 공급망의 혼란

- 기회

- 디지털화와 IoT

- 지속 가능한 콜드체인 서비스

- 성장 촉진요인

- 업계의 매력 - Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

- 냉장 창고의 기술 동향 및 자동화

- 정부의 규제와 대처

- 밸류체인/공급망 분석

- 콜드체인 업계에서의 배출 기준 및 규제 영향

- 냉장 창고에서 사용되는 냉매와 포장재료에 대한 인사이트

- 주요 의약품 허브/지역 스포트라이트

- 지정학과 팬데믹이 시장에 미치는 영향

제5장 시장 세분화

- 서비스별

- 보관

- 운송

- 도로

- 철도

- 항공

- 해상

- 부가가치 서비스

- 온도 유형별

- 냉장

- 냉동

- 주변 환경

- 제품별

- 일반 의약품

- 브랜드 의약품

- 용도별

- 바이오 제약

- 화학 제약

- 전문 제약

제6장 경쟁 구도

- 시장 집중도 개요

- 기업 프로파일

- Trans-o-flex(ThermoMed)

- DHL

- Transmed Transport GmbH

- GDP Network Solutions GmbH

- Kuehne Nagel

- Biotech and Pharma Logistics

- Rhenus Logistics

- Ceva Logistics

- DB Schenker

- Pfenning Logistics

- FedEx Logistics

- MSK Pharma Logistics

- Eurotranspharma*

- 기타 기업

제7장 시장의 미래

제8장 부록

- 거시경제지표(GDP분포, 활동별)

- 경제 통계 - 운수·창고업의 경제 기여도

- 대외무역 통계 - 품목별, 목적지·원산지별 수출입 현황

The Germany Pharmaceutical Cold Chain Logistics Market size is estimated at USD 0.94 billion in 2025, and is expected to reach USD 1.26 billion by 2030, at a CAGR of 5.98% during the forecast period (2025-2030).

Key Highlights

- In Germany, the market is being propelled by a rising demand for temperature-sensitive pharmaceuticals, a swift growth in the e-commerce sector, and a heightened consumer preference for fresh and perishable foods. Furthermore, technological advancements are playing a pivotal role in this surge. Innovations like IoT (Internet of Things) devices, sophisticated temperature monitoring systems, and automated cold storage facilities are bolstering the efficiency and reliability of cold chain logistics.

- Approximately 80% of pharmaceutical items in the European Union currently need to be transported under temperature control. Pharmaceutical laws in the majority of nations for years merely required that products be stored according to the manufacturer's specifications.

- However, the EU has published guidelines on safe distribution procedures for pharmaceuticals intended for human use, extending the need for transportation-related temperature control and broadening coverage to embrace over-the-counter medications. In order to meet these demands, a number of warehouses with cold chain systems are created to guarantee the best conditions for the storage and transportation of temperature-sensitive goods.

- Germany's chemicals sector, the nation's third-largest industry and a major employer of around half a million workers, faces ongoing challenges. Customers, wary of the prolonged economic uncertainty, are hesitating to place new orders. This caution comes as high prices for raw materials and energy persist.

- As reported by industry experts, in July 2024, industry lobby VCI reported that Germany's chemical industry achieved sales of EUR 112 billion (USD 121 billion) in the first half of 2024. This marked a 1% decline from last year's 114 billion EUR, reflecting a cautious sentiment prevailing in the industry.

Germany Pharmaceutical Cold Chain Logistics Market Trends

Surge in Demand for Temperature-Controlled Solutions

Efficient and reliable logistics solutions for temperature-sensitive pharmaceutical products are increasingly in demand, underscoring the importance of proper storage and transportation in this sector. For example, the Budapest Branch, recently certified for Good Distribution Practice (GDP), is strategically located next to Liszt Ferenc International Airport. This prime location enhances its capability to manage air freight transport. The branch features a state-of-the-art temperature-controlled facility, offering dual storage zones: one set between 2°C to 8°C (refrigerated) and another maintaining a constant temperature of 15°C to 25°C. By merging NX Group's international temperature-controlled transport services with its storage solutions, the Group, as highlighted by Nippon Express Holdings in August 2024, has established a robust and premium platform for pharmaceutical logistics.

To cater to the pharmaceutical sector's transportation needs, there's a growing requirement for expanded capacities in refrigerated fleets. For instance, Petit Forestier, a cooling solutions provider, has introduced over 100 additional rental refrigerated vehicles in the 7.2, 12, and 18-ton classes, specifically targeting the German market.

Moreover, in August 2024, Parcel and Postal Technology International reported that Trans-o-flex and PostNL Pharma & Care Benelux have collaborated to integrate each other's temperature-controlled logistics solutions for the pharmaceutical industry, aiming to broaden their geographical presence. In conclusion, the pharmaceutical logistics sector is evolving rapidly, driven by the need for advanced temperature-controlled solutions. Strategic collaborations and expansions in refrigerated fleet capacities are essential to meet the growing demands and ensure the safe and efficient transport of pharmaceutical products.

Biopharmaceuticals to Contribute in Market Expansion

Biological medicines have significantly reshaped the landscape of the pharmaceutical industry. Germany, particularly its southern region, produces over half of the EU-approved active biopharmaceutical ingredients, solidifying its position as the leading producer in the European pharmaceutical market. For instance, Frigo-Trans, a German logistics provider, has unveiled its plans to build a cryopreservation warehouse at its Mutterstadt site.

Lake Constance and Ulm serve as the primary hubs for this activity. This small region is home to over 100 companies spanning biotech, pharmaceuticals, and medical technology, alongside various research organizations. While Germany has consistently held a prominent position within Europe, global rankings place it fifth in manufacturing capacity. This lag is largely attributed to other nations, bolstered by competitive tax structures, outpacing Germany in biopharmaceutical production investments. Nevertheless, biologics, given their remarkable therapeutic potential, have significantly expanded their foothold in Germany's pharmaceutical landscape.

Germany fosters a dynamic environment not just for general drug production but also for biopharmaceutical enterprises. Companies such as Vetter, Teva, Biberach Site, and Boehringer Ingelheim are at the forefront, introducing innovations that bolster the nation's pharmaceutical ambitions. Navigating these intricate markets, EuroDev has been a steadfast ally for North American producers, offering insights on market entry into Germany's pharmaceutical realm. Their expertise encompasses real-time guidance on prevailing regulations, market trends, competitive landscape, and potential challenges in the German pharmaceutical arena.

Germany Pharmaceutical Cold Chain Logistics Industry Overview

The German pharmaceutical Cold Chain Logistics Market is highly fragmented, with a mix of global and regional players dominating the industry. Some of the key players in the market are Trans-o-flex (ThermoMed), DHL, Biotech and Pharma Logistics, GDP Network Solutions GmbH, Transmed Transport GmbH etc,. As pharmaceutical logistics requires a high level of specialization, government approvals, cutting-edge technology, a wider network coverage, and a lot of know-how, given the delicacy of the goods transported, the market has a comparatively moderate number of players.

For instance, in March 2024, trans-o-flex, a prominent player headquartered in Weinheim, Germany, announced that its subsidiary, trans-o-flex ThermoMed Austria (TMA), has inaugurated a new logistics center in Lebring, Styria. TMA specializes in temperature-controlled transport services tailored for the pharmaceutical and healthcare sectors. This strategic expansion underscores trans-o-flex's commitment to enhancing its service capabilities and operational efficiency.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 Rising Demand for Temperature Sensitive Drugs

- 4.2.1.2 Stringent Regulatory Compilance

- 4.2.2 Restraints

- 4.2.2.1 High Infrastructure Costs

- 4.2.2.2 Suplly Chain Disruptions

- 4.2.3 Opportunities

- 4.2.3.1 Digitalization and IoT

- 4.2.3.2 Sustainable Cold Chain Services

- 4.2.1 Drivers

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technological Trends and Automation in Cold Storage Facilities

- 4.5 Government Regulations and Initiatives

- 4.6 Value Chain / Supply Chain Analysis

- 4.7 Impact of Emission Standards and Regulations in the Cold Chain Industry

- 4.8 Insights into Refrigerants and Packaging Materials used in Refrigerated Warehouses

- 4.9 Spotlight on Major Pharmaceutical Hubs/Regions

- 4.10 Impact of Geopolitics and Pandemic on the Market

5 MARKET SEGMENTATION

- 5.1 By Service

- 5.1.1 Storage

- 5.1.2 Transportation

- 5.1.2.1 Road

- 5.1.2.2 Rail

- 5.1.2.3 Air

- 5.1.2.4 Sea

- 5.1.3 Value-added Services

- 5.2 By Temperature Type

- 5.2.1 Chilled

- 5.2.2 Frozen

- 5.2.3 Ambient

- 5.3 By Product

- 5.3.1 Generic Drugs

- 5.3.2 Branded Drugs

- 5.4 By Application

- 5.4.1 Biopharma

- 5.4.2 Chemical Pharma

- 5.4.3 Specialized Pharma

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Trans-o-flex (ThermoMed)

- 6.2.2 DHL

- 6.2.3 Transmed Transport GmbH

- 6.2.4 GDP Network Solutions GmbH

- 6.2.5 Kuehne + Nagel

- 6.2.6 Biotech and Pharma Logistics

- 6.2.7 Rhenus Logistics

- 6.2.8 Ceva Logistics

- 6.2.9 DB Schenker

- 6.2.10 Pfenning Logistics

- 6.2.11 FedEx Logistics

- 6.2.12 MSK Pharma Logistics

- 6.2.13 Eurotranspharma*

- 6.3 Other Companies

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 Macroeconomic Indicators (GDP Distribution, by Activity)

- 8.2 Economic Statistics - Transport and Storage Sector Contribution to Economy

- 8.3 External Trade Statistics - Exports and Imports by Product and by Country of Destination/Origin