|

시장보고서

상품코드

1683854

스페인의 의약품 물류 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Spain Pharmaceutical Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

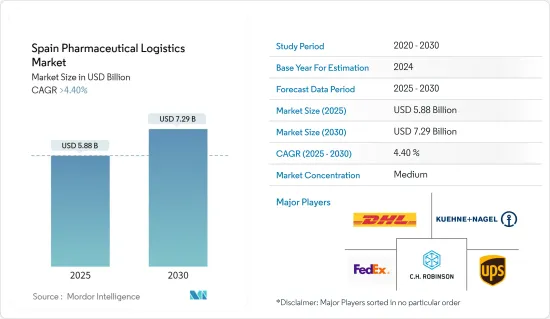

스페인의 의약품 물류 시장 규모는 2025년 58억 8,000만 달러로 추정되며, 예측 기간 중(2025-2030년) CAGR 4.4%로 성장해 2030년에는 72억 9,000만 달러에 달할 것으로 예측됩니다.

스페인은 2024년 '의약품 성장 잠재력'에서 세계를 선도할 예정이며, 바르셀로나는 생명공학 투자에서 유럽에서 두 번째로 뛰어난 기지로 부상하고 있습니다.

바르셀로나와 그 도시권에 주목하는 국제적인 바이오테크놀러지 신흥기업과 기업의 수가 증가하고 있으며, 카탈루냐의 수도는 바이오테크놀러지의 거점으로서의 지위를 굳히고 있습니다. 보고에 의하면, 2024년까지 스페인은 「의약품의 잠재 성장력」에 있어서 세계 제6위, 유럽 제3위에 등극할 것으로 예측됐습니다.

스페인 제약업계의 활황은 이 나라의 의약품 물류 시장을 강화하고 온도 변화에 민감한 의약품과 일반적인 의약품의 운송·보관에 있어서 유리한 기회로 길을 열어 나갈 것입니다.

스페인에는 인간에 사용되는 의약품의 제조에 특화된 공장이 103곳 있으며, 그 중 11곳은 생물 제제에 특화되어 있습니다. 유효성분용 46공장과 동물용 24공장을 추가하면 총 173공장이 되어 122개의 사업그룹에 걸쳐 있습니다. 이 공장은 총 183,000명의 고용을 창출(직접 고용, 간접 고용, 유발 고용 포함), 160억 유로(167억 9,000만 달러) 상당의 제품을 생산하며(75%는 수출용) 경쟁력과 환경 지속가능성의 양면에서 선도하고 있습니다.

2023년 스페인 의약품 시장은 의료용 의약품이 매출의 거의 70%를 차지하며 압도적인 점유율을 차지했습니다. 시판약이 12.4%로 뒤를 이었고 영양제품이 약 3%를 차지했습니다. 올해 스페인은 약 22,261개의 약국을 자랑하며, 주민 2,130명에게 1개의 약국이 있는 계산이 됩니다.

2023년 스페인 의약품 수입액은 약 220억 달러로 2022년 240억 달러에서 약간 감소했습니다. 주목할 점은 분석 기간 동안 수입이 4.2배 이상으로 급증한 것입니다.

이러한 스페인 제약 업계의 강력한 성장은 국내 온도 변화에 민감한 의약품과 일반적인 의약품의 운송·보관에 많은 기회를 만들어 스페인의 의약품 물류 시장의 발전을 지원할 것으로 보입니다.

효율적인 물류 솔루션에 대한 수요 증가는 인프라, 기술 및 서비스에 대한 투자를 촉진하고 의약품의 안전하고 적시 배송을 보장합니다. 그 결과, 스페인의 의약품 물류 시장은 큰 성장을 이루고 있으며, 세계의 의약품 공급망의 중요한 구성 요소로서의 지위를 확고하게 할 것으로 예상됩니다.

스페인 의약품 물류 시장 동향

창고·보관 시장 확대

스페인 의약품 물류 시장에서 창고는 공급망의 효율성과 신뢰성을 높이는 매우 중요한 존재입니다.

전략적으로 배치된 창고는 의약품의 신속한 운송을 보장하는 유통 허브 역할을 합니다. 최적의 배치로 운송 시간이 단축되므로 제약 회사는 의료 서비스 제공업체, 약국 및 환자에게 신속하게 서비스를 제공할 수 있습니다. 이 적시성은 특히 응급 의약품 및 의료 응급 상황에 필수적입니다.

병원에서 클리닉에 이르기까지 건강 관리 기관은 의약품의 요구를 창고에 의존합니다. 이 창고는 정확하고 완전한 운송을 보장하고 건강 관리 시스템의 원활한 운영을 지원합니다.

의약품 부문은 일반적인 시판 약에서 특수하고 비싼 의약품에 이르기까지 광범위한 스펙트럼을 다룹니다. 창고는 이러한 다양성을 능숙하게 관리하며 백신 및 기타 온도에 민감한 품목을 위한 냉장 공간과 같은 개별 보관 조건을 제공합니다.

창고는 수요 변동, 신제품 출시, 유통 전략 진화 등 시장 변화에 대응하는 데 필요한 유연성을 제공합니다. 이러한 적응성은 시장 변화에 신속하게 대응하는 것이 가장 중요한 업계에서 필수적입니다.

최첨단 물류공원을 전문으로 하는 범유럽의 선두 기업인 VGP Group과 협력하여 신창고는 2023년 1분기에 조업을 시작할 예정입니다.

2023년 1월 UPS의 자회사인 Bomi Group은 1,800만 유로(1,934만 달러)의 투자를 배경으로 마드리드에 새로운 보관 및 배송 허브를 개설했습니다. 27,578제곱미터에 달하는 이 GMP 및 GDP 준수 로지스틱스 센터는 60,000개 팔레트의 수용 능력을 자랑하며, 유럽 최대의 의약품 창고 중 하나에 자리잡고 있으며 150명의 숙련된 고용을 창출하고 있습니다.

생물제제, 특수의약품, 개인화의 진보로 유럽에서는 현재 의약품의 80%가 온도관리된 운송을 필요로 하고 있으며, 마드리드의 시설은 이 수요에 대응할 수 있는 설비를 갖추고 있습니다.

다양한 온도 제어 저장 옵션(-30℃, 2-8℃, 15-25℃)을 제공하며 0.02% 이하라는 경이적인 오류율을 자랑하는 최첨단의 자동 주문 피킹 시스템을 갖추고 있습니다. BREEAM 기준에 따라 건설된 이 시설은 지속 가능한 운영에 중점을 둡니다.

스페인 의약품 물류 시장에서 창고 및 보관 능력 증가는 효율적이고 신뢰할 수 있는 공급망 솔루션에 대한 수요 증가를 반영합니다. 제약 업계가 신제품 혁신과 시장 역학으로 계속 진화하면서 창고의 역할은 점점 더 중요 해지고 있습니다.

창고 관리 기능을 강화함으로써 제약 회사는 의료 제공업체와 환자가 증가하는 요구에 확실하게 대응할 수 있으며, 궁극적으로 스페인의 건강 관리 시스템 전반적인 개선에 기여합니다.

제네릭 의약품 시장 확대

스페인 정부는 특정 규제를 완화하고 유럽에서 제네릭 의약품의 급증에 기여하고 있습니다.

제네릭 의약품은 브랜드 의약품에 비해 제조 비용이 낮기 때문에 제조업체 각 회사는 이 업계에 대한 투자를 유치하고 있습니다. 또한 물류 회사는 새로운 서비스를 배포하고 사용자가 주문에 대한 최신 정보를 확실하게 얻을 수 있도록 지원하며 기타 부가 가치 서비스도 제공합니다.

스페인은 제네릭 의약품의 보급률이 유럽에서 가장 높은 국가 중 하나이며 의료 제공업체와 환자 모두에서 높은 지지를 얻고 있습니다. 스페인의 바이오시밀러에 대한 헌신의 증거는 인플릭시맙이나 리툭시맙과 같은 류마티스 관절염과 특정 암과 같은 질병의 치료에 매우 중요한 생물학적 제형의 바이오시밀러 버전의 수용입니다.

그 주요기업이 Kern Pharma나 Cinfa Biotech입니다. Kern Pharma의 바이오시밀러인 Remsima(인플릭시맙)는 치료 프로토콜에 원활하게 통합되어 환자에게 경제적인 선택을 제공합니다.

스페인의 제네릭 의약품 사정은 Laboratorios Normon과 Teva Pharmaceuticals를 중심으로 활기차고 있습니다. Laboratorios Normon은 다양한 포트폴리오를 자랑하며 심장혈관에서 종양에 이르는 다양한 치료 분야를 지원합니다. 한편, Teva Pharmaceuticals는 제네릭 의약품의 제공을 확대하여 스페인 환자가 저렴한 가격으로 의약품을 입수할 수 있도록 하고 있습니다.

스페인의 의약품 및 의료기기청(AEMPS)은 이러한 의약품의 규제와 승인을 감독하여 엄격한 안전성과 유효성의 벤치마크를 유지하고 있습니다. 이러한 상황의 변화에 따라 바이오시밀러와 제네릭 의약품은 스페인의 건강 관리 시스템을 강화하고 환자의 결과를 향상시키는 데 매우 중요한 역할을 합니다.

2024년 5월 세계 제약기업인 히쿠마 파마스티칼즈 PLC(히쿠마)는 HIKMA ESPANA, SLU(히쿠마 스페인)를 발표했습니다. 이 전략적 움직임은 약 8억 6,000만 달러로 평가되는 스페인의 유리한 제네릭 주사제 시장으로의 히쿠마의 첫 진출을 의미합니다. 히쿠마는 지금까지 36개 품목의 승인을 받았으며 스페인에서 순환기, 종양, 중추신경, 항감염증을 포함한 다양한 치료 영역에서 25개 품목의 상시에 성공하고 있습니다.

스페인에서는 제네릭 의약품의 보급이 진행되고 있으며, 의약품 물류 시장에 큰 영향을 미치고 있습니다. 이러한 비용 효율적인 의약품에 대한 수요가 증가함에 따라 물류 공급자는 물류를 효율적으로 관리하는 능력을 향상시키고 있습니다.

여기에는 고급 추적 시스템 채택, 공급망 최적화, 종합적인 부가가치 서비스 제공 등이 포함됩니다. 그 결과 제네릭 의약품 시장의 성장은 의약품 산업을 변화시킬 뿐만 아니라 물류 산업의 혁신과 효율성을 증진시켜 환자가 필수적인 의약품을 적시에 확실하게 얻을 수 있도록 합니다.

스페인 의약품 물류 산업 개요

스페인 의약품 물류 산업은 경쟁력 있고 역동적이지만 국민 경제에서 더 중요한 역할을 수행하는 데는 여전히 상당한 여유가 있습니다. 이 시장의 기존 대기업에는 DHL Supply Chain, FedEx, Kuehne + Nagel International AG, United Parcel Service, CH Robinson 등이 있습니다. 이 회사들은 자동화, 인공지능, 머신러닝(AI 및 ML), 블록체인, 운송 관리 시스템 등 차세대 물류 솔루션 기술을 자체 서비스에 도입하여 공급망 생산성을 높이고 비용을 절감하며 오류를 피합니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 성과

- 조사의 전제

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학과 인사이트

- 현재의 시장 시나리오

- 시장 성장 촉진요인

- 의약품 판매 증가가 시장을 견인

- 인구 증가가 시장을 견인

- 시장 성장 억제요인

- 의약품의 안전성 확보

- 노동력 부족

- 시장 기회

- 냉장창고 증가

- 업계공급 체인/밸류 체인 분석

- 업계의 매력 - Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 시장에서의 정부의 대처와 규제

- 시장의 기술 동향

- 스페인의 3PL 시장에 대한 통찰

- 지정학과 팬데믹이 시장에 미치는 영향

제5장 시장 세분화

- 서비스별

- 수송

- 도로

- 철도

- 항공

- 해상 수송

- 창고 보관

- 부가가치 서비스

- 수송

- 온도 관리

- 온도 관리/콜드체인

- 비온도관리/비콜드체인

- 제품별

- 제네릭 의약품

- 브랜드 의약품

- 용도별

- 바이오의약품

- 화학의약품

제6장 경쟁 구도

- 시장 집중도 개요

- 기업 프로파일

- DHL

- FedEx

- Kuehne Nagel International AG

- United Parcel Service

- CH Robinson

- CEVA Logistics

- DB Schenker

- Movianto

- Agility Logistics

- Eurotranspharma

- CSP*

- 기타 기업

제7장 시장 기회와 앞으로의 동향

제8장 부록

- 거시경제지표(GDP분포, 활동별)

- 경제 통계-운수·창고업의 경제에 대한 공헌

The Spain Pharmaceutical Logistics Market size is estimated at USD 5.88 billion in 2025, and is expected to reach USD 7.29 billion by 2030, at a CAGR of greater than 4.4% during the forecast period (2025-2030).

Spain is set to lead the world in 'pharma growth potential' in 2024, with Barcelona emerging as Europe's second-best hub for biotech investment.

With a growing number of international biotech startups and companies eyeing Barcelona and its metropolitan area, the Catalan capital is solidifying its position as a biotech stronghold. Reports indicate that by 2024, Spain will rank sixth globally and third in Europe for 'pharma growth potential.'

The booming pharmaceutical industry in Spain is poised to bolster the country's pharmaceutical logistics market, paving the way for lucrative opportunities in transporting and storing both temperature-sensitive and general pharmaceutical products.

Spain boasts 103 factories dedicated to producing medicines for human use, with 11 specializing in biologics. When factoring in 46 facilities for active ingredients and 24 for veterinary use, the total rises to 173 factories, spread across 122 distinct business groups. Collectively, they generate 183,000 jobs (encompassing direct, indirect, and induced employment), produce goods worth EUR 16 billion (USD 16.79 billion) (with 75% earmarked for export), and lead in both competitiveness and environmental sustainability.

In 2023, prescription medications dominated Spain's pharmaceutical market, accounting for nearly 70% of the revenue. Over-the-counter medications followed at 12.4%, while nutritional products made up about 3%. That year, Spain boasted approximately 22,261 pharmacies, translating to one pharmacy for every 2,130 residents.

In 2023, Spain's pharmaceutical imports were valued at around USD 22 billion, a slight dip from the USD 24 billion in 2022. Notably, over the analyzed period, imports surged by more than 4.2 times.

This robust growth of the pharmaceutical industry in Spain will support the advancement of the Spanish pharmaceutical logistics market by creating tremendous opportunities for the transport and storage of temperature-sensitive and general pharmaceutical products in the country.

The increasing demand for efficient logistics solutions will drive investments in infrastructure, technology, and services, ensuring the safe and timely delivery of pharmaceutical products. Consequently, the Spanish pharmaceutical logistics market is expected to experience significant growth, solidifying its position as a critical component of the global pharmaceutical supply chain.

Spain Pharmaceutical Logistics Market Trends

Expansion in Warehousing and Storage Market

In Spain's pharmaceutical logistics market, warehouses are pivotal, enhancing the supply chain's efficiency and reliability.

Strategically positioned, warehouses act as distribution hubs, ensuring the swift transportation of pharmaceuticals. Their optimal placement reduces transit times, allowing pharmaceutical companies to promptly serve healthcare providers, pharmacies, and patients. This timeliness is vital, especially for urgent medications and medical emergencies.

Healthcare entities, from hospitals to clinics, depend on warehouses for their pharmaceutical needs. These warehouses guarantee accurate and complete shipments, bolstering the healthcare system's smooth operation.

The pharmaceutical sector encompasses a broad spectrum, from common over-the-counter drugs to specialized, high-value medications. Warehouses adeptly manage this variety, offering tailored storage conditions, such as refrigerated spaces for vaccines and other temperature-sensitive items.

Warehouses offer the necessary flexibility to navigate market shifts, be it demand fluctuations, new product launches, or evolving distribution strategies. Such adaptability is vital in an industry where swift responses to market changes are paramount.

In collaboration with the VGP Group, a top pan-European firm specializing in cutting-edge logistics parks, a new warehouse is set to commence operations in the first quarter of 2023.

In January 2023, Bomi Group, a subsidiary of UPS, inaugurated its new storage and distribution hub in Madrid, backed by an EUR 18-million (USD 19.34 million)investment. Spanning 27,578m2, this GMP and GDP-compliant logistics center boasts a capacity for 60,000 pallets, positioning it among Europe's largest pharmaceutical warehouses and generating 150 skilled jobs.

With 80% of pharmaceutical products in Europe now needing temperature-controlled transport due to advancements in biologics, specialty drugs, and personalized medicine, the Madrid facility is equipped to cater to this demand.

It offers diverse temperature-controlled storage options (-30 °C, +2+8 °C, +15+25 °C) and features a cutting-edge automated order-picking system, boasting an impressive error rate of under 0.02%. Built to BREEAM standards, the facility emphasizes sustainable operations.

The increase in warehousing and storage capacity in Spain's pharmaceutical logistics market reflects the growing demand for efficient and reliable supply chain solutions. As the pharmaceutical industry continues to evolve with new product innovations and market dynamics, the role of warehouses becomes increasingly critical.

Enhanced warehousing capabilities ensure that pharmaceutical companies can meet the rising needs of healthcare providers and patients, ultimately contributing to the overall improvement of the healthcare system in Spain.

Increasing in Generic Drugs market

The Spanish government is relaxing certain regulations, contributing to the surge of generic drugs in Europe.

Low production costs of generic drugs, compared to branded counterparts, are luring manufacturers to invest in the industry. Additionally, logistics companies are rolling out new services, ensuring users stay updated on their orders, complemented by other value-added offerings.

Spain boasts one of the highest rates of generic drug penetration in Europe, underscoring robust backing from both healthcare providers and patients. A testament to Spain's dedication to biosimilars is its embrace of biosimilar versions of biologic drugs, such as infliximab and rituximab, pivotal in treating ailments like rheumatoid arthritis and specific cancers.

Leading this charge are companies like Kern Pharma and Cinfa Biotech. Kern Pharma's biosimilar, Remsima (infliximab), has seamlessly integrated into treatment protocols, offering patients a more economical choice.

Spain's generic drug landscape is vibrant, with Laboratorios Normon and Teva Pharmaceuticals at the helm. Laboratorios Normon boasts a diverse portfolio, catering to therapeutic areas from cardiovascular health to oncology. Meanwhile, Teva Pharmaceuticals is broadening its generic drug offerings, ensuring Spanish patients have access to affordable medications.

The Spanish Agency of Medicines and Medical Devices (AEMPS) oversees the regulation and approval of these drugs, upholding rigorous safety and efficacy benchmarks. As the landscape shifts, both biosimilars and generics are poised to play pivotal roles in bolstering Spain's healthcare system and enhancing patient outcomes.

In May 2024, Hikma Pharmaceuticals PLC (Hikma), a global pharmaceutical entity, proudly unveiled HIKMA ESPANA, S.L.U. (Hikma Spain). This strategic move marks Hikma's inaugural foray into Spain's lucrative generic injectable market, valued at around USD 860 million. With 36 product approvals under its belt, Hikma has successfully launched 25 products across diverse therapeutic domains in Spain, including cardiovascular, oncology, central nervous system, and anti-infectives.

The increasing penetration of generic drugs in Spain is significantly impacting the pharmaceutical logistics market. As demand for these cost-effective medications rises, logistics providers are enhancing their capabilities to manage the distribution efficiently.

This includes adopting advanced tracking systems, optimizing supply chains, and offering comprehensive value-added services. Consequently, the growth of the generic drugs market is not only transforming the pharmaceutical landscape but also driving innovation and efficiency within the logistics sector, ensuring that patients receive timely and reliable access to essential medications.

Spain Pharmaceutical Logistics Industry Overview

Spain's pharmaceutical Logistics industry is competitive and dynamic, but it still has a considerable margin to achieve a more relevant role in the national economy. A few existing major players in the market include DHL Supply Chain, FedEx, Kuehne + Nagel International AG, United Parcel Service, and CH Robinson. These companies are implementing next-generation logistics solution technologies into their services, such as automation, artificial intelligence, machine learning (AI and ML), blockchain, transportation management systems, and others, to increase supply chain productivity, reduce costs, and avoid errors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Current Market Scenario

- 4.2 Market Drivers

- 4.2.1 Increase In Pharmaceutical Sales Is Driving The Market

- 4.2.2 Rise In Population Is Driving The Market

- 4.3 Marrket Restraints

- 4.3.1 Ensure The Safety Of Medications

- 4.3.2 Labor Shortage

- 4.4 Market Opportunities

- 4.4.1 Increase in Cold Storage Warehouses

- 4.5 Industry Supply Chain/Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Government Initiatives and Regulations in the Market

- 4.8 Technological Trends in the Market

- 4.9 Insights Into The 3PL Market in Spain

- 4.10 Impact of Geopolitics and Pandemic on the Market

5 MARKET SEGMENTATION

- 5.1 By Services

- 5.1.1 Transportation

- 5.1.1.1 Road

- 5.1.1.2 Rail

- 5.1.1.3 Air

- 5.1.1.4 Sea

- 5.1.2 Storage and Warehousing

- 5.1.3 Value Added Services

- 5.1.1 Transportation

- 5.2 By Temperature Control

- 5.2.1 Temperature Controlled/Cold Chain

- 5.2.2 Non-Temperature Controlled/Non-Cold Chain

- 5.3 By Product

- 5.3.1 Generic Drugs

- 5.3.2 Branded Drugs

- 5.4 By Application

- 5.4.1 Biopharma

- 5.4.2 Chemical Pharma

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 DHL

- 6.2.2 FedEx

- 6.2.3 Kuehne+Nagel International AG

- 6.2.4 United Parcel Service

- 6.2.5 C.H. Robinson

- 6.2.6 CEVA Logistics

- 6.2.7 DB Schenker

- 6.2.8 Movianto

- 6.2.9 Agility Logistics

- 6.2.10 Eurotranspharma

- 6.2.11 CSP*

- 6.3 Other Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 APPENDIX

- 8.1 Macroeconomic Indicators (GDP Distribution, by Activity)

- 8.2 Economic Statistics - Transport and Storage Sector Contribution to Economy