|

시장보고서

상품코드

1683862

아시아태평양의 NMC 배터리 팩 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2029년)Asia-Pacific NMC Battery Pack - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2029) |

||||||

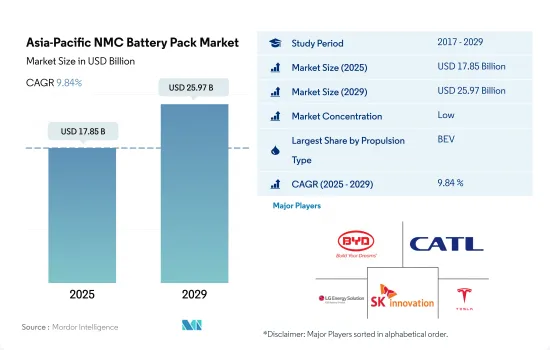

아시아태평양의 NMC 배터리 팩 시장 규모는 2025년 178억 5,000만 달러로 추정 및 예측되고, 2029년에는 259억 7,000만 달러에 이르고, 예측 기간 중(2025-2029년) CAGR 9.84%로 성장할 것으로 예측됩니다.

정부 규제와 BEV와 PHEV 시장 증가로 아시아태평양에서 NCM 배터리 수요 증가, CATL, LG Chem, Samsung SDI 등 아시아를 거점으로 하는 제조업체가 주도권을 잡습니다.

- 지난 몇 년동안 많은 아시아태평양에서 전동 이동성이 빠르게 성장한 결과, 다양한 유형의 배터리에 대한 수요가 증가하고 있습니다. BEV나 PHEV 모델에 NCM 배터리를 선택하는 자동차 제조업체는 적지만, 이 배터리 유형은 LFP나 NMC와 같은 다른 배터리에 비해, 자동차에 대한 전개는 아직 초기 단계입니다. 정부의 규제가 엄격하고 화석연료차의 금지가 눈앞에 다가서 BEV나 PHEV를 선택하는 개인이 늘고 있습니다. 이러한 고려를 통해 2017년부터 2021년까지 APAC 지역의 일부 자동차에서 NCM 배터리 유형이 약간 증가했습니다.

- 일본과 중국은 아시아태평양에서 PHEV와 BEV용 NCM 배터리 수요가 증가하고 있는 국가 중 하나입니다. 또한 CATL, LG Chem, Samsung SDI 등 NCM 배터리의 주요 생산자 중 일부는 아시아 출신입니다. BEV와 PHEV 수요는 인도, 태국, 한국을 포함한 다양한 국가에서 점차 증가하고 있으며, 이는 또한 APAC 지역 전체에서 NCM 배터리 수요를 증가시키는 데 도움이 됩니다. 그 결과 전기차에 사용되는 NCM 배터리의 지역 시장은 2022년에 2021년 대비 증가했습니다.

- 다양한 자동차 제조업체들이 신제품을 발표하고 있으며 배터리 산업 강화가 기대되고 있습니다. 2023년 2월 중국 자동차 제조업체 BYD는 NCM 배터리 팩을 동력원으로 하는 플러그인 하이브리드 시스템을 탑재한 2023년 모델 Tang을 발표했습니다. 이와 같은 기타 국가의 발표는 이 지역의 예측 기간 동안 BEV와 PHEV의 NCM 배터리 수요와 판매가 가속될 것으로 예상했습니다.

일본, 한국, 인도, 태국이 아시아태평양 NCM 배터리 팩 시장 확대에 기여

- 아시아태평양은 정부의 지원, 왕성한 내수, 전기자동차 도입에 대한 주력 등의 요인에 의해 배터리 팩 시장이 활황을 보이고 있습니다. 전기자동차 수요가 계속 증가하고 배터리 팩의 기술 진보가 계속되고 있는 가운데, 아시아태평양은 세계 전기자동차 산업의 미래를 형성하는데 있어 매우 중요한 역할을 할 것으로 예상됩니다.

- 중국은 배터리 팩 시장의 지배적인 국가로 눈에 띄고 있으며 항상 높은 시장 가치를 가지고 있습니다. 중국의 급성장은 전기차에 대한 정부 지원, 대규모 소비자 시장, 견고한 국내 제조 생태계 등 여러 요인 때문입니다. 이 나라는 전기자동차 생산에 많은 투자를 하고 있으며 배터리 팩 수요 증가로 이어지고 있습니다.

- 일본과 한국도 아시아태평양의 배터리 팩 시장에 크게 기여하고 있습니다. 양국 모두 오랫동안 시장 가치가 꾸준히 성장하고 있습니다. 이들 국가들은 확립된 자동차 산업, 기술적 전문 지식, EV 도입에 대한 정부의 강력한 지원을 갖고 있으며 배터리 팩 수요를 견인하고 있습니다. 인도의 배터리 팩 시장은 전기자동차 도입과 신재생 에너지 목표에 주력하는 가운데 기세를 늘리고 있습니다. 정부 지원 정책과 소비자 의식 증가로 인해 배터리 팩 수요가 증가하는 경향이 있습니다. 또한 전기 이동성의 지역 리더가 되기 위한 태국의 노력은 배터리 팩 시장의 성장에 충분한 기회를 제공합니다.

아시아태평양의 NMC 배터리 팩 시장 동향

TOYOTA, TESLA, WULING이 시장을 견인해 다양한 자동차 제조업체가 참가

- APAC의 전기자동차 시장은 수많은 경쟁업체들로 붐빕니다. 톱을 달리는 것은 BYD로, 이 지역의 EV 판매 대수의 20.93%를 차지합니다. BYD의 강력한 재무 기반은 첨단 R&D 인프라와 결합하여 BYD를 강호 기업으로 자리매김하고 있습니다. 경쟁력있는 가격 설정과 광대 한 판매 및 판매 판매 네트워크는 신규 소비자에게 효과적으로 호소합니다.

- BYD에 이은 2위는 Toyota Group으로 시장의 약 12.88%를 차지하고 있습니다. BYD는 APAC 지역에서 높은 평가를 받고 있으며, 그 광범위한 판매·서비스 체제가 소비자의 신뢰를 얻어 그 지위를 더욱 견고하게 하고 있습니다. 3위는 Tesla로 시장의 8.27%를 차지하고 있습니다. 아방가르드 기술이 주도한 제품으로 유명한 Tesla는 중국과 호주를 비롯한 각국을 가로지르는 원활한 공급망을 즐길 수 있습니다.

- 4위는 Wuling으로 시장의 약 7.10%를 차지하고 있습니다. 모회사인 Liuzhou Wuling Automobile Industry Co. Ltd,에서 운영되고 있는 Wuling는 중국, 인도네시아 등 국가에서 틈새 시장을 열고 다양한 EV 라인업으로 다양한 고객을 수용하고 있습니다. 톱 5의 마지막은 Honda이며 시장 점유율은 3.85%입니다. APAC의 EV 시장에서는 그 밖에 Nissan, Chery, Changan, Neta 등의 브랜드가 경쟁하고 있습니다.

2022년에는 Wuling, Tesla, BYD가 아시아태평양에서 가장 큰 배터리 팩 수요 제조업체가 되었습니다.

- 자동차, 버스, 트럭을 포함한 전기자동차는 지난 몇 년동안 아시아 각국에서 뚜렷한 분위기를 보이고 있습니다. 전기자동차에 대한 의욕은 지역과 국가에 따라 다르지만 SUV가 중국, 인도, 일본 등 주요 시장에서 틈새 시장을 구축하고 있다는 것은 분명합니다. 유틸리티의 높이와 넓이를 이유로 아시아에서는 기존 세단보다 SUV를 선호하는 경향이 강해지고 있습니다.

- 최근 아시아인들 사이에서 컴팩트 SUV에 대한 인기가 급상승하고 있습니다. Tesla의 모델 Y는 완전 전기화의 드라이브 트레인, 5성급 NCAP 안전성, 7인승, 항속거리 등에서 두드러지며, 특히 중국을 비롯한 아시아태평양의 주요 시장에서 인기있는 선택지가 되고 있습니다. BYD의 Song DM은 경쟁력있는 가격 설정과 효율적인 연비 성능으로 아시아 전역의 고객들에게 지지를 받고 있습니다.

- 2022년에는 Tesla의 Model 3이 아시아 지역에서 톱셀러 중 하나로 빛났으며, 이것은 순수한 전기차라는 점과 매력적인 기능성의 여러가지가 평가되었습니다. 다이나믹한 APAC의 EV 분야에서는 기존의 세계·제조업체에 의한 무수한 전동 SUV나 세단의 선택사항도 있습니다. 2022년에는 Toyota의 Yaris Cross와 BYD의 Dolphin 같은 자동차의 호조 판매가 예상됩니다. Toyota의 Corolla와 Wuling의 Hongguang MINIEV와 같은 다른 제조업체들은 APAC의 EV 생태계에서 강력한 라인업을 형성하고 있습니다.

아시아태평양의 NMC 배터리 팩 산업 개요

아시아태평양의 NMC 배터리 팩 시장은 단편화되어 있으며 상위 5개사에서 29.02%를 차지하고 있습니다. 이 시장 주요 기업은 다음과 같습니다. BYD Company Ltd., Contemporary Amperex Technology(CATL), LG Energy Solution Ltd., SK Innovation and Tesla Inc.(알파벳순).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 전기자동차 판매 대수

- OEM별 전기자동차 판매 대수

- 판매 LINE EV 모델

- 선호되는 배터리 화학을 가진 OEM

- 배터리 팩 가격

- 배터리 재료 비용

- 각 배터리 화학의 가격표

- 누가 누구에게 공급하는지

- EV 배터리의 용량과 효율

- EV의 발매 모델수

- 규제 프레임워크

- 중국

- 인도

- 인도네시아

- 일본

- 태국

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 차체 유형

- 버스

- LCV

- M&HDT

- 승용차

- 추진 유형

- BEV

- PHEV

- 용량

- 15-40 kWh

- 40-80 kWh

- 80kWh 이상

- 15kWh 미만

- 배터리 형상

- 원통형

- 파우치

- 각형

- 방식

- 레이저

- 와이어

- 컴포넌트

- 애노드

- 캐소드

- 전해액

- 세퍼레이터

- 재료 유형

- 코발트

- 리튬

- 망간

- 천연 흑연

- 니켈

- 기타 재료

- 국가

- 중국

- 인도

- 일본

- 한국

- 태국

- 기타 아시아태평양

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- BYD Company Ltd.

- Contemporary Amperex Technology Co. Ltd.(CATL)

- EVE Energy Co. Ltd.

- Exide Industries Ltd.

- Gotion High-Tech Co. Ltd.

- GS Yuasa International Ltd.

- Hebei Chinaust Automotive Plastics Co. Ltd.

- LG Energy Solution Ltd.

- Ningbo Tuopu Group Co. Ltd.

- Panasonic Holdings Corporation

- Resonac Holdings Corporation

- Samsung SDI Co. Ltd.

- SK Innovation Co. Ltd.

- SVOLT Energy Technology Co. Ltd.(SVOLT)

- Tesla Inc.

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 개요

- 개요

- Porter's Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 정보원과 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The Asia-Pacific NMC Battery Pack Market size is estimated at 17.85 billion USD in 2025, and is expected to reach 25.97 billion USD by 2029, growing at a CAGR of 9.84% during the forecast period (2025-2029).

Growing demand for NCM batteries in APAC due to government regulations and increase in BEV and PHEV markets, with Asia-based producers such as CATL, LG Chem, and Samsung SDI Leading the charge

- The demand for different types of batteries has increased as a result of the rapid growth of electric mobility in numerous APAC nations over the past few years. Few automakers are choosing NCM batteries for BEV and PHEV models, although the battery type is still in the early stages of deployment to vehicles compared to other batteries like LFP and NMC. Due to government regulations that are strict and the impending prohibition on fossil fuel vehicles, more individuals are choosing BEVs and PHEVs. These considerations have led to a small increase in the NCM battery type in a few vehicles in the APAC region from 2017 to 2021.

- Japan and China are among the countries with a growing demand for NCM batteries for PHEV and BEV in Asia-Pacific. In addition, some of the leading producers of NCM batteries, such as CATL, LG Chem, and Samsung SDI, are from Asia. The demand for BEV and PHEV is rising gradually in various countries, including India, Thailand, and South Korea, which has also helped to increase the demand for NCM batteries throughout the APAC region. As a result, the regional market for NCM batteries used in electric vehicles increased in 2022 over 2021.

- Various automakers are launching new products which are expected to enhance the battery industry. In February 2023, Chinese automaker BYD unveiled the 2023 model Tang, which is equipped with a plug-in hybrid system powered by the NCM battery pack. Such launches in other countries are expected to accelerate the demand and sales of NCM batteries in BEV and PHEV during the forecast period in the region.

Japan, South Korea, India, and Thailand contribute to the expansion of the Asia-Pacific NCM battery pack market

- Asia-Pacific presents a thriving market for battery packs, driven by factors such as government support, strong domestic demand, and a focus on electric vehicle adoption. As the demand for electric vehicles continues to rise and technology advancements in battery packs continue, Asia-Pacific is expected to play a pivotal role in shaping the future of the global electric vehicle industry.

- China stands out as a dominant player in the battery pack market, with consistently high market values. China's rapid growth can be attributed to several factors, including government support for electric vehicles, a large consumer market, and a robust domestic manufacturing ecosystem. The country has made substantial investments in electric vehicle production, leading to increased demand for battery packs.

- Japan and South Korea also contribute significantly to the Asia-Pacific battery pack market. Both countries have experienced steady growth in market value over the years. These countries have well-established automotive industries, technological expertise, and strong government support for EV adoption, driving the demand for battery packs. India's battery pack market is gaining momentum as the country focuses on electric vehicle adoption and renewable energy targets. With supportive government policies and increasing consumer awareness, the demand for battery packs is on the rise. Additionally, Thailand's commitment to becoming a regional leader in electric mobility presents ample opportunities for the growth of the battery pack market.

Asia-Pacific NMC Battery Pack Market Trends

A VARIETY OF AUTOMAKERS ARE PRESENT IN THE MARKET, MAJORLY DRIVEN BY TOYOTA, TESLA, AND WULING

- The APAC electric vehicle market is bustling with numerous competitors, but its momentum is chiefly steered by five dominant corporations, collectively grasping over 50% of the 2022 market share. Leading the charge is BYD, securing a remarkable 20.93% of EV sales in the region. Its potent financial standing, coupled with its advanced R&D infrastructure, has positioned BYD as a powerhouse. The company's competitive pricing, coupled with its vast sales and after-sales network, effectively appeals to new consumers.

- Following BYD, the Toyota Group clinches the second spot, with about 12.88% of the market. Its well-established reputation across the APAC region, bolstered by its extensive sales and service framework, instills trust among consumers, further cementing its footprint. Tesla claims the third position, seizing 8.27% of the market. Renowned for its avant-garde, tech-driven offerings, Tesla enjoys a seamless supply chain across nations, notably China and Australia.

- Wuling comes in fourth, holding approximately 7.10% of the market. Operating under its parent company, Liuzhou Wuling Automobile Industry Co. Ltd, Wuling has carved a niche in countries like China and Indonesia, catering to a diverse clientele with its varied EV lineup. Rounding out the top five is Honda, with a 3.85% market share. Other notable contenders in the APAC EV market encompass brands like Nissan, Chery, Changan, and Neta, among others.

IN 2022, WULING, TESLA, AND BYD WERE THE BIGGEST BATTERY PACK DEMAND GENERATORS IN APAC

- The electric vehicle landscape, encompassing cars, buses, and trucks, has witnessed a notable upswing across various Asian countries in the past few years. While the appetite for electric vehicles fluctuates across regions and nations, it is evident that SUVs have carved a niche in major markets like China, India, and Japan. As a direct reflection of Asia's growing preference for SUVs over traditional sedans, due to their enhanced utility and spaciousness, electric SUVs have seen a parallel surge across the Asia-Pacific belt.

- Recent times have spotlighted a burgeoning affinity for compact SUVs among the Asian populace. Tesla's Model Y stands out with its all-electric drivetrain, sterling 5-star NCAP safety rating, seven-seat capacity, commendable range, and other features, making it a sought-after option in pivotal APAC markets, notably China. BYD's Song DM, with its competitive pricing and efficient fuel dynamics, has resonated well with customers across several Asian territories.

- The year 2022 saw Tesla's Model 3 clinching accolades as one of the top sellers in the Asian domain, a testament to its purely electric mechanism, paired with an array of attractive functionalities. The dynamic APAC EV arena also presents a myriad of electric SUV and sedan alternatives from established global manufacturers. The year 2022 anticipated robust sales for vehicles like Toyota's Yaris Cross and BYD's Dolphin. Other players, such as the Toyota Corolla and Wuling's Hongguang MINIEV, also form a robust lineup in the APAC EV ecosystem.

Asia-Pacific NMC Battery Pack Industry Overview

The Asia-Pacific NMC Battery Pack Market is fragmented, with the top five companies occupying 29.02%. The major players in this market are BYD Company Ltd., Contemporary Amperex Technology Co. Ltd. (CATL), LG Energy Solution Ltd., SK Innovation Co. Ltd. and Tesla Inc. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Electric Vehicle Sales

- 4.2 Electric Vehicle Sales By OEMs

- 4.3 Best-selling EV Models

- 4.4 OEMs With Preferable Battery Chemistry

- 4.5 Battery Pack Price

- 4.6 Battery Material Cost

- 4.7 Price Chart Of Different Battery Chemistry

- 4.8 Who Supply Whom

- 4.9 EV Battery Capacity And Efficiency

- 4.10 Number Of EV Models Launched

- 4.11 Regulatory Framework

- 4.11.1 China

- 4.11.2 India

- 4.11.3 Indonesia

- 4.11.4 Japan

- 4.11.5 Thailand

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Body Type

- 5.1.1 Bus

- 5.1.2 LCV

- 5.1.3 M&HDT

- 5.1.4 Passenger Car

- 5.2 Propulsion Type

- 5.2.1 BEV

- 5.2.2 PHEV

- 5.3 Capacity

- 5.3.1 15 kWh to 40 kWh

- 5.3.2 40 kWh to 80 kWh

- 5.3.3 Above 80 kWh

- 5.3.4 Less than 15 kWh

- 5.4 Battery Form

- 5.4.1 Cylindrical

- 5.4.2 Pouch

- 5.4.3 Prismatic

- 5.5 Method

- 5.5.1 Laser

- 5.5.2 Wire

- 5.6 Component

- 5.6.1 Anode

- 5.6.2 Cathode

- 5.6.3 Electrolyte

- 5.6.4 Separator

- 5.7 Material Type

- 5.7.1 Cobalt

- 5.7.2 Lithium

- 5.7.3 Manganese

- 5.7.4 Natural Graphite

- 5.7.5 Nickel

- 5.7.6 Other Materials

- 5.8 Country

- 5.8.1 China

- 5.8.2 India

- 5.8.3 Japan

- 5.8.4 South Korea

- 5.8.5 Thailand

- 5.8.6 Rest-of-Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 BYD Company Ltd.

- 6.4.2 Contemporary Amperex Technology Co. Ltd. (CATL)

- 6.4.3 EVE Energy Co. Ltd.

- 6.4.4 Exide Industries Ltd.

- 6.4.5 Gotion High-Tech Co. Ltd.

- 6.4.6 GS Yuasa International Ltd.

- 6.4.7 Hebei Chinaust Automotive Plastics Co. Ltd.

- 6.4.8 LG Energy Solution Ltd.

- 6.4.9 Ningbo Tuopu Group Co. Ltd.

- 6.4.10 Panasonic Holdings Corporation

- 6.4.11 Resonac Holdings Corporation

- 6.4.12 Samsung SDI Co. Ltd.

- 6.4.13 SK Innovation Co. Ltd.

- 6.4.14 SVOLT Energy Technology Co. Ltd. (SVOLT)

- 6.4.15 Tesla Inc.

7 KEY STRATEGIC QUESTIONS FOR EV BATTERY PACK CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms