|

시장보고서

상품코드

1683931

아시아태평양의 실내 LED 조명 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Asia Pacific Indoor LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

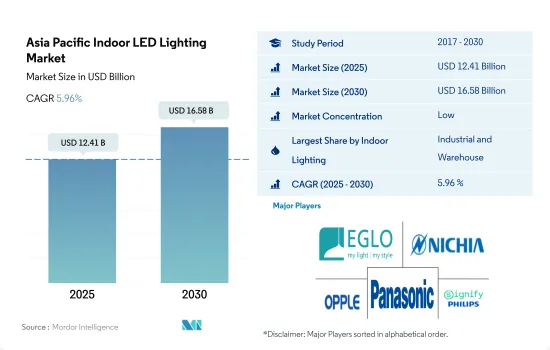

아시아태평양의 실내 LED 조명 시장 규모는 2025년에 124억 1,000만 달러에 달할 것으로 추정됩니다. 2030년에는 165억 8,000만 달러에 이를 것으로 예상되며, 예측 기간 중(2025-2030년) CAGR은 5.96%를 나타낼 것으로 전망됩니다.

산업부문과 주택부문 개발 증가로 시장성장 견인

- 금액 점유율에서는 2023년에는 공업과 창고가 점유율의 대부분을 차지했습니다. 중국은 2022년 기준 세계 2위 경제대국이었습니다. 중국의 창고 공간 비용은 COVID-19 이전에는 평방미터당월평균 44.3 위안(6.15 USD)이었습니다. 중국에서는 창고에 대한 수요가 꾸준히 증가하고 유행 후 임대 비용이 상승하고 있습니다. 중국의 창고업계 수익은 5년간 연률 4.3% 증가할 것으로 전망됩니다.

- 마찬가지로 인도에서는 제조업이 팬데믹 전에 인도의 GDP의 16-17%를 벌어들여, 가장 급성장하는 섹터의 하나가 될 것으로 예상되고 있습니다. 인도의 산업·창고 부문에서는 약 1,100만 평방 피트의 견조한 흡수가 보고되고 있으며, 수요의 77%를 Tier-I 도시가 견인하고 있습니다. 이러한 요인으로 LED의 보급 수요 증가가 기대됩니다.

- 수량 점유율에서는 2023년에는 주택이 점유율의 대부분을 차지했습니다. 지난 30년 동안 아시아는 높은 도시화율을 경험했습니다. 급속한 도시화는 경제 성장을 가속하는 일조가 되었지만, 주택에 대한 큰 수요를 초래해, 주택가격의 상승을 초래했습니다. 일본에서는 인구 감소에 따른 정부의 주택정책의 영향도 있어, 2023년에는 1,000만호 공급 과잉이 되었습니다. 가구 수는 2023년에 5,419만 가구에서 피크를 맞았습니다. 이러한 요인은 주요 LED 수요에 대응하는 것입니다.

- 새로운 주택의 도입에는 정부 보조금이 큰 역할을 합니다. 인도에서는 정부가 몇 가지 에너지 절약 프로그램을 도입하고 있습니다. 예를 들어, 중앙정부의 야심찬 PMAY(Pradhan Mantri Awas Yojana) 프로그램은 2022년까지 전국에서 2,000만 호의 저렴한 도영 주택을 건설하는 것을 목표로 한 바 있습니다. 이러한 요인이 큰 매출로 이어지고 향후 일정 기간 LED 수요가 증가할 수 있습니다.

산업 생산 수 증가와 가처분 소득이 시장 수요 견인

- 금액 점유율과 수량 점유율은 중국이 2023년 실내 LED 조명 점유율의 대부분을 차지했습니다. 금액 점유율에서 2023년 중국에서는 산업 및 창고(I&W)가 점유율의 대부분을 차지했습니다. 중국은 2021년에 산업 생산을 유지했습니다. 2021년 중국의 총 생산액은 4조 8,658억 달러로 2020년에 비해 26.04% 증가했습니다. 2022년 산업 생산은 3.6% 증가했습니다. 2023년 3월 중국의 산업 생산은 전년 대비 3.9% 증가했습니다. 이와 같이 유행 후 산업 생산 증가는 앞으로 수년간 실내 조명에 대한 수요를 창출하고 있습니다.

- 또한 이 회사는 2021년 인베스터 데이에서 향후 5년간 물류망을 45에서 50개의 물류센터로 확대할 의향이라고 발표했습니다. 2022년 동국의 수출 총액은 과거 최고를 기록했으며 2021년 대비 7.7% 증가한 42조 700억 위안(6조3,000억 달러)을 차지했습니다. 반면 수입은 1.1% 증가했습니다. 물류센터 수요가 증가함에 따라 LED 수요도 증가할 것으로 예상됩니다.

- 인도는 금액 점유율, 수량 점유율 모두 2위를 차지하고 있습니다. 수량 점유율의 경우 2022년에는 주택 조명이 가장 큰 점유율을 차지했습니다. 2022년 전국 등록자를 포함한 평균 가구 인원은 4.4명으로, 개인 가구와 소지자가 증가했습니다. 인도에서는 가처분 소득이 증가하고 있습니다. 인도의 1인당 소득은 2021년 3월 1971.6달러에 비해 2022년 3월 2301.4달러에 달했습니다. 이는 인도인들의 구매력이 이들 국가들보다 낮을 가능성을 시사합니다. 그 결과, 더 많은 주택이 구매되고 LED 조명의 사용이 증가할 것으로 보입니다.

아시아태평양의 실내 LED 조명 시장 동향

인구 증가, 1인당 소득 증가, 정부 보조금이 LED 시장 견인

- 아시아태평양에는 세계 인구의 59.7%에 해당하는 약 47억명이 살고 있으며, 중국과 인도 등 세계에서 가장 인구가 많은 국가들이 포함되어 있으며, 인구의 46.3%는 도시 인구입니다(2019년에는 21억 4,000만명). 이 지역 전체의 출생률은 여성 1인당 2.1명에 가깝습니다. 가족 인원수는 동아시아에서는 여성 1인당 1.7명까지 감소하고 있지만, 남아시아에서는 여성 1인당 2.5명의 높은 수준을 유지하고 있습니다. 또한 이 지역에서는 현재 5명 중 2명이 도시에 살고 있습니다. 수백만 명이 고용과 더 나은 기회를 찾고 시골에서 마을이나 도시로 이주하기 때문에 이 비율은 앞으로 크게 증가할 것으로 보입니다. 따라서 도시 지역의 가구 수가 증가함에 따라 이 지역의 조명 요구에 대한 LED의 보급이 진행될 것으로 예상됩니다.

- 이 지역에는 여러 신흥 국가들이 포함되어 있으며 유통에도 불구하고 가처분 소득은 개발 도상국에서 성장하고 있습니다. 중국 1인당 소득은 2021년 12월 12,615.7달러에 비해 2022년 12월 12,732.5달러에 달했습니다. 인도의 1인당 소득은 2021년 3월 1971.6달러에 비해 2022년 3월 2301.4달러에 달했습니다. 일본의 1인당 소득은 2021년 12월 39,916.1달러에 비해 2022년 12월 33,911.2달러에 달했습니다. 그 결과 개인의 소비력이 높아지고 새로운 주거 공간에 더 많은 자금이 투입됩니다. 가정용으로 2012년 중국 정부는 에너지 절약 전구 및 LED 사용에 22억 위안 보조금을 제공했습니다. 일본 정부는 2010년 4월 에코포인트 제도를 도입했습니다. 이용자는 에코포인트를 이용하여 2대 1의 에코포인트 비율로 LED 램프를 구입할 수 있어 LED 조명 수요가 더욱 높아질 것으로 예상됩니다.

인프라 개발에 대한 노력과 에너지 효율적인 조명의 보급이 LED 조명의 성장을 견인

- 아시아태평양에서는 2021년에는 산업부문이 최대의 에너지 소비량이 되었고, 이어서 주택부문과 상업부문이 이어졌습니다. 게다가 아시아태평양은 현재 진행 중 및 미래의 인프라 구상, 특히 스마트 시티 프로젝트로 알려져 있으며, 건물 운영에 대한 수요를 창출할 수 있습니다. 산업·상업 부문도 급속히 확대되고 있습니다. 도쿄와 인도는 2022년 세계 인프라 개발 프로젝트에서 협력했습니다. 네팔과 같이 양국이 이미 프로젝트를 하고 있는 국가에서는 인프라 프로젝트의 계획, 설계, 실시를 공동으로 실시하는 것으로, 뉴델리와 도쿄가 최대한의 효과를 발휘할 수 있을지도 모릅니다. 이러한 개발의 결과, 이 지역의 LED 수요는 증가할 것으로 예상됩니다.

- 상업 부문의 전력 수요는 11-13시간 정도가 되는 경향이 있습니다. 산업 부문의 전력 사용량은 하루 또는 일년 내내 변동하지 않는 경향이 있습니다. 주택 부문의 전력 수요는 조명이 점등하는 저녁에 가장 높아지는 경향이 있으며, 평균 점등 시간은 약 6-8시간 변동합니다. 또한 코친 스마트 미션사(CSML)는 2022년 인도 고치에 LED 조명을 설치하여 차량과 보행자의 안전을 보장하는 40칼로르 루피 프로젝트를 준비했습니다. 이 프로그램은 LED 분야의 확대에 박차를 가하고 있습니다.

- 아시아태평양 국가들은 LED를 사용하여 에너지 절약을 촉진하고 있습니다. 예를 들어 호주 정부는 2018년 1월 조명 에너지 효율 규제를 더욱 개선하는 방법으로 EU 요구사항을 준수하는 LED 전구의 최소 기준을 호주 및 뉴질랜드에 도입하여 비효율적인 할로겐 램프를 단계적으로 폐지하기로 결정했습니다. 이 노력은 국가의 전력 사용량을 줄이고 LED 조명의 사용을 촉진합니다.

아시아태평양의 실내 LED 조명 산업 개요

아시아태평양의의 실내 LED 조명 시장은 세분화되어 있으며 주요 기업 5개사에서 26.26%를 차지하고 있습니다. 이 시장 주요 기업은 다음과 같습니다. EGLO Leuchten GmbH, Nichia Corporation, OPPLE Lighting, Panasonic Holdings Corporation and Signify(Philips)(알파벳순 정렬).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 인구

- 1인당 소득

- LED 총 수입량

- 조명 전력 소비량

- 가구수

- LED 보급률

- 원예 면적

- 규제 프레임워크

- 중국

- 인도

- 일본

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 실내 조명

- 농업용 조명

- 상업 조명

- 사무실

- 소매

- 기타

- 산업 및 창고

- 주택

- 국가

- 중국

- 인도

- 일본

- 기타 아시아태평양

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일(세계 수준 개요, 시장 수준 개요, 주요 사업 부문, 재무, 직원 수, 주요 정보, 시장 순위, 시장 점유율, 제품 및 서비스, 최근 동향 분석 포함)

- ACUITY BRANDS, INC.

- ams-OSRAM AG

- EGLO Leuchten GmbH

- Endo Lighting Corporation

- Guangdong PAK Corporation Co.,Ltd.

- Nichia Corporation

- OPPLE Lighting Co., Ltd

- Panasonic Holdings Corporation

- Signify(Philips)

- Toshiba Corporation

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계의 개요

- 개요

- Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 정보원과 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The Asia Pacific Indoor LED Lighting Market size is estimated at 12.41 billion USD in 2025, and is expected to reach 16.58 billion USD by 2030, growing at a CAGR of 5.96% during the forecast period (2025-2030).

Increasing development in the industrial sector and residential sector drives the market growth

- In terms of value share, in 2023, industrial and warehouse accounts for most of the share. China is the second-largest economy in the world as of 2022. Warehouse space in China cost an average of CNY 44.3 (USD 6.15) per square meter per month during pre-COVID-19. In China, there has been a steady rise in the demand for warehouses, raising the cost of renting them post-pandemic. Revenue for the storage industry in China is expected to increase at an annualized 4.3% over the five years.

- Similarly, in India, manufacturing generated 16-17% of India's GDP before the pandemic and is expected to be one of the fastest-growing sectors. India's industrial and warehousing sector reported a nearly 11 million square feet robust absorption, with tier-I cities driving 77% of the demand. Such factors are expected to increase the LED penetration demand.

- In terms of volume share, in 2023, residential accounts for most of the share. Over the past three decades, Asia experienced a high urbanization rate. While rapid urbanization helped to fuel economic growth, it has led to major demand for housing, resulting in high housing prices. Japan will likely see an excess supply of 10 million dwelling units in 2023, partly due to government housing policy with a shrinking population. The number of households will peak at 54.19 million in 2023. Such a factor caters to a major LED demand.

- Government subsidy plays a major role in the adoption of new housing. In India, the government has introduced several energy-saving programs. For example, the central government's ambitious Pradhan Mantri Awas Yojana (PMAY) program aims to build 20 million affordable metropolitan housing units nationwide by 2022. Such factors might lead to major sales, leading to more LED demand in the coming period.

Growing number of industrial production and disposable income drive the demand for market

- In terms of value and volume share, China stood with the majority of the share in indoor LED lighting in 2023. In terms of value share, in 2023, industrial and warehouse (I&W) accounted for the majority of the share in China. China sustained its industrial production in 2021. In 2021, China produced a total of USD 4865.8 billion, an increase of 26.04% compared to 2020. In 2022, industrial production grew by 3.6%. China's industrial production increased by 3.9% year-on-year in March 2023. Thus, the growing industrial production post-pandemic is creating demand for indoor lighting in the coming years.

- In addition, during its Investor Day in 2021, the company announced that it intends to expand its logistics network over the following five years to 45 to 50 distribution centers. The country's total exports hit an all-time high in 2022, accounting for CNY 42.07 trillion (USD 6.3 trillion), up 7.7% from 2021. On the other hand, imports increased by 1.1%. With the increasing demand for distribution centers, the LED demand is expected to rise.

- India stands at the second spot in terms of value and volume share. Regarding volume share, residential lighting had the largest share in 2022. In 2022, the average household size, including all registrants nationwide, was 4.4, leading to an increase in private households and homeowners. In India, disposable income is increasing. India's per capita income reached USD 2301.4 in March 2022, compared to USD 1971.6 in March 2021. This suggests that people in India may have lower purchasing power than those countries. As a result, more homes will be purchased and the use of LED lighting will increase.

Asia Pacific Indoor LED Lighting Market Trends

The LED market is driven by increasing population, rising per capita income, and government subsidies

- Asia-Pacific is home to 59.7% of the world's population, which is around 4.7 billion people, and includes the world's most populous countries, such as China and India, and 46.3 % of the population is urban (2.14 billion people in 2019). The region's overall fertility rate is close to 2.1 births per woman. Family size has decreased to 1.7 children per woman in East Asia while maintaining a high of 2.5 children per woman in South Asia. Further, two out of every five people in the region currently live in urban areas. This ratio will increase significantly in the coming as millions move from the countryside to towns and cities in search of employment and better opportunities. Thus, the increase in the number of households in urban areas is expected to create more LED penetration for the need for illumination in the region.

- This region includes several developing nations, and despite the pandemic, disposable income is growing in developing countries. China's per capita income reached USD 12,732.5 in December 2022, compared to USD 12,615.7 in December 2021. India's per capita income reached USD 2301.4 in March 2022, compared to USD 1971.6 in March 2021. Japan's per capita income reached USD 33,911.2 in December 2022, compared to USD 39,916.1 in December 2021. Such instances result in the rising spending power of individuals and affording more money for new residential spaces. For households, in 2012, the Chinese government offered a subsidy of CNY 2.2 billion for the use of energy-conserving light bulbs and LEDs. The Japanese government introduced a consumer rebate program known as the "Eco-Point" program in April 2010. Users may use their Eco-Points to purchase LED lamps at a 2 to 1 Eco-point ratio, which is further expected to surge the demand for LED lighting.

Initiatives related to infrastructure development and increasing use of energy-efficient lighting to drive the growth of LED lights

- The industrial sector in the Asia-Pacific had planned to have the biggest energy consumption in 2021, followed by the residential and commercial sectors. Additionally, Asia-Pacific is known for its ongoing and future infrastructure initiatives, notably smart city projects, which could generate demand for building operations. The industrial and commercial sector is also expanding quickly. Tokyo and India will collaborate on global infrastructure development projects in 2022. In countries like Nepal, where both countries are already working on projects, joint planning, design, and implementation of infrastructure projects might help New Delhi and Tokyo maximize their impact. The demand for LED in the area is anticipated to rise as a result of these developments.

- Electricity demand in the commercial sector tends to be around 11-13 hours. Electricity use in the industrial sector tends not to fluctuate through the day or year. Electricity demand in the residential sector tends to be highest in the evenings, when lights are turned on, and the average lighting time varies for about 6 to 8 hours. Additionally, Cochin Smart Mission Limited (CSML) is preparing an INR 40 crore project to install LED lighting in Kochi, India, to guarantee the security of vehicles and pedestrians in 2022. These programs fuel the expansion of the LED sector.

- Countries in Asia-Pacific have expedited energy savings through the use of LEDs. For instance, the Australian Government decided in January 2018 to introduce minimum LED bulb standards in Australia and New Zealand that comply with EU requirements and phase out inefficient halogen lamps as a way to improve lighting energy efficiency regulation further. The effort will reduce the nation's electricity use and encourage the usage of LED lighting.

Asia Pacific Indoor LED Lighting Industry Overview

The Asia Pacific Indoor LED Lighting Market is fragmented, with the top five companies occupying 26.26%. The major players in this market are EGLO Leuchten GmbH, Nichia Corporation, OPPLE Lighting Co., Ltd, Panasonic Holdings Corporation and Signify (Philips) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 Per Capita Income

- 4.3 Total Import Of Leds

- 4.4 Lighting Electricity Consumption

- 4.5 # Of Households

- 4.6 Led Penetration

- 4.7 Horticulture Area

- 4.8 Regulatory Framework

- 4.8.1 China

- 4.8.2 India

- 4.8.3 Japan

- 4.9 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Indoor Lighting

- 5.1.1 Agricultural Lighting

- 5.1.2 Commercial

- 5.1.2.1 Office

- 5.1.2.2 Retail

- 5.1.2.3 Others

- 5.1.3 Industrial and Warehouse

- 5.1.4 Residential

- 5.2 Country

- 5.2.1 China

- 5.2.2 India

- 5.2.3 Japan

- 5.2.4 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ACUITY BRANDS, INC.

- 6.4.2 ams-OSRAM AG

- 6.4.3 EGLO Leuchten GmbH

- 6.4.4 Endo Lighting Corporation

- 6.4.5 Guangdong PAK Corporation Co.,Ltd.

- 6.4.6 Nichia Corporation

- 6.4.7 OPPLE Lighting Co., Ltd

- 6.4.8 Panasonic Holdings Corporation

- 6.4.9 Signify (Philips)

- 6.4.10 Toshiba Corporation

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms