|

시장보고서

상품코드

1683934

중국의 실내 LED 조명 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)China Indoor LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

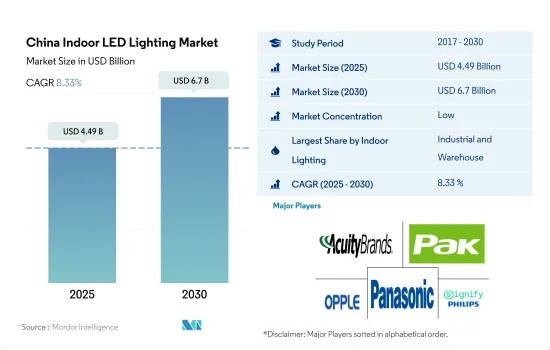

중국의 실내 LED 조명 시장 규모는 2025년에 44억 9,000만 달러에 달할 것으로 추정됩니다. 2030년에는 67억 달러에 이르고, 예측 기간(2025-2030년)의 CAGR은 8.33%를 나타낼 것으로 예측됩니다.

스타트업 증가, 제조시설 증가, 소매판매 증가가 실내 조명 수요를 높일 것으로 예상

- 2023년에는 산업·창고(I&W)가 점유율의 대부분(79.6%)을 차지했고 상업, 농업, 주택이 그 뒤를 이었습니다. 시장 점유율은 향후 몇 년 동안 모든 용도에서 최소한의 감소에 머물며(I&W)에서 증가할 것으로 예상됩니다. 중국 산업은 국내 소비 침체, 경기감 감소, COVID-19의 급증으로 인한 공급망 혼란 등 여러 안팎의 역풍에 직면했습니다. 또한 중국은 2021년 산업 생산을 유지했습니다. 2021년 중국의 총 생산액은 4조 8,658억 달러로 2020년 대비 26.04% 증가했습니다. 따라서 산업 생산 증가는 향후 몇 년동안 실내 조명에 대한 수요를 창출합니다.

- 중국 전역에서 자동차 제조 공장과 창고 수요가 높아지고 있는데, 이는 세계 자동차 시장이 저렴한 부품이나 완성차 공급원 등의 이유로 중국에 의존하고 있기 때문입니다. 이러한 사례로부터 조사 기간 동안 실내용 LED 수요가 높아질 것으로 예상됩니다. BMW는 심양시에 신공장을 개설하고, 아우디는 창춘시의 신EV공장에서 생산을 시작했습니다.

- 중국의 소매 부문은 여전히 강력한 성장 징후를 보이고 있으며 2023년 5월 소매 매출은 전년 대비 12.7% 증가했습니다. 온라인 쇼핑 이용자의 급증으로 이 지역에서는 새로운 창고의 필요성이 더욱 높아져 실내 조명 수요가 높아질 것으로 예상됩니다.

- 중국은 10억 달러 규모의 신흥 기업을 창출하는 최고 기업 중 하나입니다. 2022년 중국은 새롭게 74개의 유니콘을 배출해 미국에 뒤를 잡았습니다. 새로운 유니콘의 약 70%는 의료 및 스마트 물류 분야에서 태어났으며 상업 공간 수요가 급증하고 있습니다. 이상과 같은 사례가 내년 실내 LED 수요를 견인할 것으로 예상됩니다.

중국의 실내 LED 조명 시장 동향

1인당 소득 증가가 가구 성장을 보완

- 중국의 평균 가구 인원수는 2017년 3.03명을 기록했습니다. 2021년에는 2.7명으로 감소하였으며, 개인가구/주택소유 증가를 보였습니다. 1998년 이후 기존의 공공 주택이 민영화되어 소지자를 중심으로 한 민간 주택이 대량으로 공급되었기 때문에 중국은 공적 임대 주택이 대부분을 차지하는 나라에서 소유주율이 가장 높은 국가가 되었습니다. 2020년까지 중국에서는 90% 이상의 가구가 주택을 소유했습니다(도시 지역에서는 87%, 농촌 지역에서는 96%). 많은 풍부한 국가와는 대조적으로 중국 가구의 20% 이상이 여러 부동산을 소유하고 있습니다. 따라서 부동산 수가 증가함에 따라 국내 조명 요구에 대한 LED의 보급이 진행될 것으로 예상됩니다.

- 중국에서는 가처분 소득이 증가하고 있으며, 그 결과 새로운 거주 공간에 더 많은 돈을 소비하는 개인의 소비력이 높아지고 있습니다. 중국 1인당 소득은 2021년 12월 12,615.7달러에 비해 2022년 12월 12,732.5달러에 달했습니다. 인도 1인당 소득은 2022년 3월 기준 2,301.4달러로 중국보다 낮았습니다.

- 중국에서는 농촌 지역의 1인당 주택건축지면적이 2019년 48.900㎡로 보고되어 전년 47.300㎡에서 증가했습니다. 도시 지역에서는 소규모 아파트/원룸 아파트에 대한 투자가 증가했기 때문에 2020년에는 38.600㎡로 2019년 39.800㎡에서 감소했습니다. 이것은 국내 LED 조명의 성장을 뒷받침하고 있습니다. 예를 들어, 중국 사람들은 중국의 작은 도시의 저가 아파트에 투자하고 있습니다. 2012년 중국 가정은 에너지 절약 전구 및 LED 사용에 대한 22억 위안(3,100만 달러) 보조금 프로그램을 제공했습니다. 이러한 사례는 국내 LED 조명 수요가 증가할 것으로 예상됩니다.

중국의 에너지 절약 이니셔티브는 이 나라의 LED 조명 시장을 홍보할 수 있습니다.

- 2021년 중국 가정은 약 1,170 테라와트 시간의 전력을 사용했습니다. 약 5,610 테라와트 때 제조업을 포함한 2차 산업 부문이 가장 에너지를 소비했습니다. 주택부문과 상업부문은 2위와 3위였습니다. 부동산 시장 침체로 인해 시장 성장은 부정적입니다. 신규 건설은 감소하고 있으며, 기존 건축물의 개수와 그린빌의 건설에는 큰 성장의 가능성이 있어 중국에서의 LED 시장의 확대로 이어집니다.

- 정상적인 운영 시간 동안 상업시설의 전력 사용량은 최고점에 도달합니다. 일반적으로 매일 10시간에서 12시간 지속됩니다. 산업 부문의 전력 소비는 낮과 연중 변동이 없습니다. 예를 들어, 제조 시설은 하루 24시간, 1년 365일 가동됩니다. 주택 부문은 저녁에 전력 수요의 피크를 맞이하는 경우가 많으며, 그 시간은 5.5시간에서 7시간입니다.

- 2021년 4월 14차 문화관광개발 5개년 계획은 200개의 지능형 등대 프로젝트를 설치하여 야간 경제 발전과 야간 문화 관광 국가 클러스터 건설을 장려하고 LED 조명 시장의 성장을 촉구했습니다.

- 2022년까지 새로운 기준에 따라 도시의 신건축물의 70%를 그린건축물로 인정했습니다. 이 계획에 따르면 모든 공공시설, 20,000 평방미터 이상의 건축물 및 기타 대규모 공공 건물은 중국의 녹색 건축 평가 라벨의 3 별 녹색 건축 기준을 준수해야합니다. LED 조명의 개발은 중국의 에너지 절약 중시에 의해 가속화되고 있습니다.

중국의 실내 LED 조명 산업 개요

중국의 실내 LED 조명 시장은 세분화되어 상위 5개사에서 28.16%를 차지하고 있습니다. 이 시장 주요 기업은 다음과 같습니다. ACUITY BRANDS, INC., Guangdong PAK Corporation, OPPLE Lighting, Panasonic Holdings Corporation and Signify(Philips)(알파벳순 정렬).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 인구

- 1인당 소득

- LED 총 수입량

- 조명 전력 소비량

- 가구수

- LED 보급률

- 원예 면적

- 규제 프레임워크

- 중국

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 실내 조명

- 농업용 조명

- 상업 조명

- 사무실

- 소매

- 기타

- 산업 및 창고

- 주택

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일(세계 수준 개요, 시장 수준 개요, 주요 사업 부문, 재무, 직원 수, 주요 정보, 시장 순위, 시장 점유율, 제품 및 서비스, 최근 동향 분석 포함)

- ACUITY BRANDS, INC.

- Anhui Shilin Lighting Co., Ltd.

- Guangdong PAK Corporation Co.,Ltd.

- Hengdian group tospo lighting co. ltd.

- NVC INTERNATIONAL HOLDINGS LIMITED

- OPPLE Lighting Co., Ltd

- Panasonic Holdings Corporation

- Signify(Philips)

- TCL Lighting(TCL Group)

- Zhejiang Yankon Group Co.,Ltd

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계의 개요

- 개요

- Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 정보원과 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The China Indoor LED Lighting Market size is estimated at 4.49 billion USD in 2025, and is expected to reach 6.7 billion USD by 2030, growing at a CAGR of 8.33% during the forecast period (2025-2030).

Growing star-ups, rising manufacturing facilities, and increasing retail sales are expected to raise the demand for indoor lighting

- In 2023, industrial and warehouse (I&W) accounted for the majority of the share (79.6%), followed by commercial, agricultural, and residential. The market share is expected to have a minimal reduction in all applications and a gain in (I&W) in the coming years. Chinese industries faced several internal and external headwinds, such as weak domestic consumption, declining business confidence, and supply chain disruptions caused by the surge of COVID-19. Further, China sustained its industrial production in 2021. In 2021, China produced a total of USD 4865.8 billion, an increase of 26.04% compared to 2020. Thus, the growing industrial production will create demand for Indoor lighting in the coming years.

- The demand for automotive manufacturing plants and warehouses across China is rising, and this is due to the global auto market relying on China because of its cheap components, source of finished cars, and others. Such instances necessitate more requirements for Indoor LEDs during the study period. BMW opened a new factory in the city of Shenyang, and Audi started production at a new EV factory in the city of Changchun.

- China's retail sector continues to show signs of robust growth, with retail sales surging by 12.7% in May 2023 from a year earlier. The rapid increase in online shoppers is further expected to boost the need for new warehouses in the region, resulting in more demand for indoor lighting.

- China is one of the top players in creating billion-dollar start-ups. In 2022, China added 74 new unicorns, falling behind the United States. Around 70% of its new unicorns come from the healthcare and smart logistics sectors, which surges the demand for commercial spaces. The above instances are expected to drive the demand for Indoor LEDs in the coming year.

China Indoor LED Lighting Market Trends

The rising per capita income complements the growth of households

- The average household size in China registered 3.03 persons in 2017. By 2021, it reduced to 2.7, indicating an increase in private households/housing ownerships. After 1998, China went from being a nation dominated by public renters to one with the highest homeownership rates, owing to the privatization of existing public housing and the vast provision of private housing, primarily in the ownership sector. By 2020, more than 90% of households in China owned their homes (87% in urban areas and 96% in rural areas). In contrast to many affluent countries, more than 20% of Chinese households own several properties. Thus, the increase in the number of properties is expected to create more LED penetration for the need for illumination in the country.

- In China, disposable income is growing, resulting in the rising spending power of individuals who spend more money on new residential spaces. China's per capita income reached USD 12,732.5 in December 2022 compared to USD 12,615.7 in December 2021. India's per capita income was USD 2,301.4 as of Mar 2022, which is lower than China's.

- In China, the floor area of residential buildings per capita for rural areas was reported at 48.900 sq. m in 2019, an increase from the previous year of 47.300 sq. m. In urban areas, it was 38.600 sq. m in 2020, a decrease from 39.800 sq. m in 2019 due to an increase in the investment in small-size apartments/studio apartments. This is propelling the growth of LED lighting in the country. For instance, people in China invested in low-cost apartments in small Chinese cities. In 2012, households in China were offered a subsidy program of CNY 2.2 (USD 0.31) billion for the use of energy-conserving light bulbs and LEDs. Such instances are expected to increase the demand for LED lighting in the country.

China's energy conservation initiatives could propel the LED lighting market in the country

- In 2021, Chinese households used approximately 1,170 terawatt hours of electricity. At around 5,610 terawatt hours, the secondary sector, which includes the manufacturing industries, consumed the most energy. The residential and commercial sectors came in second and third. Market growth is negative as a result of the real estate market slump. Despite the decline in new construction, chances for significant growth exist in the renovation of the existing structures and the creation of green buildings, leading to the expansion of the LED market in China.

- During normal business hours, commercial electricity use is at its peak. It usually lasts between 10 and 12 hours every day. Electricity consumption in the industrial sector does not vary during the day or year; for example, manufacturing facilities operate 24 hours a day, 365 days a year. The residential sector often has peak electricity demand in the evenings, ranging from 5.5 to 7 hours.

- The 14th Five-Year Plan for the Development of Culture and Tourism in April 2021 encouraged the development of the night-time economy and the construction of national clusters for culture and tourism at night by installing 200 intelligent lamp post projects, driving the growth of the LED lighting market.

- By 2022, 70% of new urban buildings must be recognized as green buildings, according to the new standards. According to the Plan, all public facilities, structures larger than 20,000 sq. m, and other sizable public structures must adhere to China's Green Building Evaluation Label's 3-Star Green Building Standards. The development of LED lighting is being accelerated by China's emphasis on energy conservation.

China Indoor LED Lighting Industry Overview

The China Indoor LED Lighting Market is fragmented, with the top five companies occupying 28.16%. The major players in this market are ACUITY BRANDS, INC., Guangdong PAK Corporation Co.,Ltd., OPPLE Lighting Co., Ltd, Panasonic Holdings Corporation and Signify (Philips) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 Per Capita Income

- 4.3 Total Import Of Leds

- 4.4 Lighting Electricity Consumption

- 4.5 # Of Households

- 4.6 Led Penetration

- 4.7 Horticulture Area

- 4.8 Regulatory Framework

- 4.8.1 China

- 4.9 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Indoor Lighting

- 5.1.1 Agricultural Lighting

- 5.1.2 Commercial

- 5.1.2.1 Office

- 5.1.2.2 Retail

- 5.1.2.3 Others

- 5.1.3 Industrial and Warehouse

- 5.1.4 Residential

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ACUITY BRANDS, INC.

- 6.4.2 Anhui Shilin Lighting Co., Ltd.

- 6.4.3 Guangdong PAK Corporation Co.,Ltd.

- 6.4.4 Hengdian group tospo lighting co. ltd.

- 6.4.5 NVC INTERNATIONAL HOLDINGS LIMITED

- 6.4.6 OPPLE Lighting Co., Ltd

- 6.4.7 Panasonic Holdings Corporation

- 6.4.8 Signify (Philips)

- 6.4.9 TCL Lighting (TCL Group)

- 6.4.10 Zhejiang Yankon Group Co.,Ltd

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms