|

시장보고서

상품코드

1683951

인도의 실내 LED 조명 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)India Indoor LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

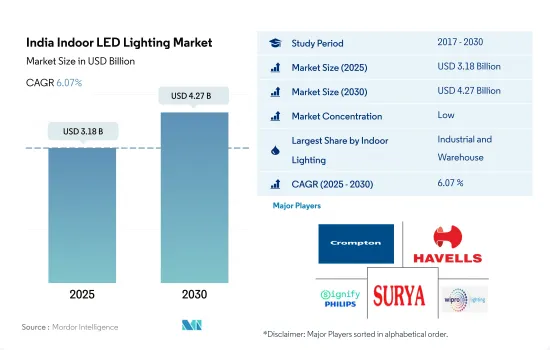

인도의 실내 LED 조명 시장 규모는 2025년에 31억 8,000만 달러에 달할 것으로 추정됩니다. 2030년에는 42억 7,000만 달러에 이를 것으로 예상되며, 예측 기간 중(2025-2030년) CAGR은 6.07%를 나타낼 것으로 전망됩니다.

산업분야의 개발과 주택수 증가가 LED 조명 시장의 성장을 견인

- 금액 점유율에서는 2023년 산업·창고가 최대 점유율(58%)을 차지했고 주택(24.4%), 상업(15.2%), 농업 조명(2%)이 뒤를 이었습니다. 인도는 2030년까지 1조 달러 상당의 상품을 수출할 수 있는 능력을 갖고 있으며 세계의 주요 제조 거점이 되고자 합니다. 게다가 2025년까지 GDP에 차지하는 제조업의 비율을 25%까지 끌어올리는 것을 목적으로 한 국가 제조업 정책 등 다양한 프로그램과 정책의 실시도 진행되고 있습니다. 이 노력은 핵심 제조업의 개발을 더욱 가속화하는 것을 목표로 합니다. 산업용 조명 수요는 창고업, 물류업, 공업 작업에서 꾸준히 성장하고 있습니다. 예를 들어 창고·산업·물류(WIL) 부문은 2025년도까지 5조 달러의 경제 규모가 되는 인도의 비전을 실현하는 데 있어서 매우 중요할 것으로 예상되고 있습니다. 이러한 요인으로 인해 국내 창고 및 산업에서 LED 조명 판매가 증가하고 있습니다.

- 수량 점유율에서는 2023년에는 주택용 조명이 최대 점유율(68%)을 차지했고, 상업용(28.4%), 산업용·창고용 조명(2%), 농업용 조명(2%)으로 이어졌습니다. 2022년 전국 등록자를 포함한 평균 가구 인원은 4.4명으로 개인 가구와 소지자 증가로 이어졌습니다. 인도에서는 50% 이상의 사람이 자신의 집에 살고, 30% 가까이가 차용에 살고, 13%가 부모의 집에 살고 있습니다. 또한 인도의 부동산 부문은 사무실과 주택 공간에 대한 수요 증가로 최근 현저한 성장을 이루고 있습니다. 2021년도 4분기 인도 7개 도시의 주택 판매는 29% 증가했으며, 신규 부동산 수는 2020년도 4분기 대비 51% 증가했습니다. 이러한 개발로 주택의 LED 조명 요구가 증가하고 있습니다.

인도의 실내 LED 조명 시장 동향

핵가족화, 도시화, 1인당 소득 증가가 주택분야 성장을 견인

- 2014년 인도의 평균 가구 인원은 가구당 4.8명이었습니다. 많은 주와 연방 직할령에서는 도시의 세대보다 농촌의 세대에 사는 사람이 많습니다. 전체 등록 가구를 포함한 평균 가구 인원수는 2022년까지 4.4명이 되었고, 그 결과 개인 가구 소유가 증가했습니다. 인도에서는 50% 이상의 사람이 자신의 집에 살고 있지만 30% 가까이 임대하고 13%가 부모의 집에 살고 있습니다. 도시 지역의 총 인구에서 차지하는 이민자의 비율은 큽니다. 이민자 증가로 조명 요구를 충족시키는 LED의 보급이 예상됩니다.

- 인도에서는 가처분 소득이 증가하고 있으며, 그 결과 개인의 소비력이 상승하고 새로운 거주 공간에 대한 지출이 증가하고 있습니다. 인도의 1인당 소득은 2021년 3월 1,971.6달러에 비해 2022년 3월 2,301.4달러에 이르렀습니다. 일부 개발도상국에 비해 인도의 1인당 소득은 적습니다. 예를 들어 2022년 일본 1인당 소득은 33,911.2달러, 베트남은 3,716.8달러, 중국은 12,732.5달러였습니다. 이는 인도의 개인 구매력이 기타 국가보다 낮을 가능성을 시사합니다.

- 인도의 부동산 부문은 최근 주택뿐만 아니라 사무실에 대한 수요도 높아지고 높은 성장을 이루고 있습니다. 21년도 4분기 인도 7개 도시의 주택 판매 호수는 20년도 4분기 대비 29% 증가했으며 신규 발매 호수는 51% 증가했습니다. 정부는 여러 에너지 절약 제도를 도입했습니다. 전력부는 UJALA(Unnat Jyoti by Affordable LEDs for All) 프로그램 하에 7년간 3678억개의 LED 조명을 배포하여 연간 477억 7,800만 유닛의 전력을 절약했습니다. 이 프로그램은 2015년 1월 5일에 시작되었습니다. 이러한 사례로 국내 LED 조명 수요가 더욱 높아질 것으로 기대됩니다.

FDI 증가와 효율적인 조명의 중시가 LED 도입을 뒷받침

- 2021년에는 산업 부문이 총 에너지의 41%를 소비한 다음 가정 부문(26%)과 상업 부문(8%)이 이어졌습니다. 또한 건설 부문이 급속히 확대되고 있습니다. 2021년 3월, 국회는 타운십, 몰/쇼핑센터, 상업용 건물의 운영 및 관리에 대한 자동 경로를 통해 인도 건설 부문에 100%의 직접 투자를 인정하도록 승인했습니다. 이것은 더 많은 건물이 건설되고 LED의 필요성이 증가한다는 것을 시사합니다.

- 상업 부문의 전력 수요는 11-13시간 정도가 되는 경향이 있습니다. 산업 부문의 전력 사용량은 하루 또는 일년 내내 변동하지 않는 경향이 있습니다. 주택 부문의 전력 수요는 조명이 점등하는 저녁에 가장 높아지는 경향이 있으며, 평균 점등 시간은 약 6-8시간 변동합니다. 게다가 밝기가 개선되어 어두운 부분이 줄어들어 가로조명 국가계획에 의해 시민의 야간 생산성이 향상되어 운전자와 보행자에게 차도의 안전성이 높아졌습니다. 1조 300억 개의 스마트 LED가 설치된 주에서는 전기 요금이 최대 50% 절감되었습니다. 이러한 자동 조명은 일출과 일몰에 맞게 점등·소등하는 것으로, 낭비를 최소한으로 억제합니다.

- 2021년에는 재생가능 에너지 발전이 총 발전량의 약 20%를 차지했습니다. 국가는 2030년까지 재생가능 에너지 용량은 500기가와트에 달할 것으로 예측됩니다. 또한 UJALA 이니셔티브의 일환으로 361억 3,000만개 이상의 LED 조명이 인도 전역에 배포되었습니다. 그 결과 연간 469억 2,000만 kWh의 에너지가 절약되어 연간 3,800만 CO2의 온실가스가 절감된 것으로 추정되고 있습니다. 이 노력은 인도에서 전력 사용량을 줄이고 LED 사용을 촉진했습니다.

인도의 실내 LED 조명 산업 개요

인도의 실내 LED 조명 시장은 단편화되어 상위 5개사에서 11.62%를 차지하고 있습니다. 이 시장 주요 기업은 다음과 같습니다. Crompton Greaves Consumer Electricals Limited, Havells India Ltd., Signify(Philips), Surya Roshni Limited and Wipro Lighting Limited(Wipro Enterprises Ltd.)(알파벳순 정렬).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 인구

- 1인당 소득

- LED 총 수입량

- 조명 전력 소비량

- 가구수

- LED 보급률

- 원예 면적

- 규제 프레임워크

- 인도

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 실내 조명

- 농업용 조명

- 상업용 조명

- 사무실

- 소매

- 기타

- 산업 및 창고

- 주택

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일(세계 수준 개요, 시장 수준 개요, 주요 사업 부문, 재무, 직원 수, 주요 정보, 시장 순위, 시장 점유율, 제품 및 서비스, 최근 동향 분석 포함)

- Bajaj Electrical Ltd

- Crompton Greaves Consumer Electricals Limited

- Eveready Industries India Limited

- Havells India Ltd.

- OPPLE Lighting Co., Ltd

- Orient Electric Limited

- Signify(Philips)

- Surya Roshni Limited

- Syska Led Lights Private Limited

- Wipro Lighting Limited(Wipro Enterprises Ltd.)

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계의 개요

- 개요

- Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 정보원과 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The India Indoor LED Lighting Market size is estimated at 3.18 billion USD in 2025, and is expected to reach 4.27 billion USD by 2030, growing at a CAGR of 6.07% during the forecast period (2025-2030).

Increasing development in the industrial sector and increase in the number of residential houses to drive the growth of the LED lighting market

- In terms of value share, industrial and warehouse will have the largest share (58%) in 2023, followed by residential (24.4%), commercial (15.2%) and agricultural lighting (2%). India is on track to become a major manufacturing hub in the world, with the ability to export USD 1 trillion worth of goods by 2030. Further, the implementation of various programs and policies, such as the National Manufacturing Policy, which aims to increase the manufacturing share of GDP to 25% by 2025. The effort is aimed at further accelerating the development of the core manufacturing industry. Demand for industrial lighting has grown steadily in warehousing, logistics, and industrial operations. For example, the Warehousing, Industry, and Logistics (WIL) sector is expected to be crucial to realizing India's vision of becoming a USD 5 trillion economy by FY2025. These factors are increasing sales of LED lighting in domestic warehouses and industries.

- In terms of volume share, residential lighting will have the largest share (68%) in 2023, followed by commercial (28.4%), industrial and warehouse lighting (2%), and agricultural lighting (2%). The average household size, including all registrants nationwide, in 2022 was 4.4, leading to an increase in private households and homeowners. Over 50% of people in India live in their own homes, nearly 30% live in rented houses, and 13% live in their parents' homes. In addition, the Indian real estate sector has recently experienced significant growth due to increased demand for office and residential space. Home sales in seven Indian cities increased by 29% in Q4 FY2021, with new listings up 51% compared to Q4 FY2020. These developments cater to the need for LED lights in houses.

India Indoor LED Lighting Market Trends

Increasing nuclear families, urbanization, and increasing per capita income are driving the growth of the housing sector

- The average household size in India in 2014 was 4.8 people per household. In many states and union territories, more people live in rural households than in urban households. The average household size, including all registered households, was 4.4 by 2022, which resulted in increased private household/own housing ownership. More than 50% of people in India live in their own houses, while almost 30% live on a rental basis and 13% in their parents' houses. A large share of the total urban population are migrants. The increase in the number of migrants is expected to create LED penetration in the country to meet the need for illumination.

- In India, disposable income is growing, resulting in the rising spending power of individuals and spending on new residential spaces. India's per capita income reached USD 2,301.4 in March 2022, compared to 1,971.6 USD in March 2021. Compared to some developing nations, India's per capita income is less. For instance, in 2022, Japan's per capita income was USD 33,911.2, Vietnam's was USD 3,716.8, and China's was USD 12,732.5. This suggests that the purchasing power of individuals in India may be lower than those of other nations.

- The Indian real estate sector has witnessed high growth in recent times with a rise in demand for office as well as residential spaces. Housing sales in seven Indian cities increased by 29% and new launches by 51% in Q4 FY21 over Q4 FY20. The government introduced a few energy-saving schemes. The Power Ministry distributed 36.78 crore LED lights under the Unnat Jyoti by Affordable LEDs for All (UJALA) program in seven years, which saved 47,778 million units of electricity per annum. The program was launched on January 05, 2015. Such instances are further expected to raise the demand for LED lighting in the country.

Increasing FDI and emphasis on efficient lighting is pushing the implementation of LEDs

- In 2021, the industrial sector consumed 41% of all energy, followed by the household sector (26%) and the commercial sector (8%). Additionally, the construction sector is expanding quickly. In March 2021, the Parliament approved allowing 100% FDI in India's construction sector through the automatic route for the operation and management of townships, malls/shopping centers, and commercial buildings. This suggests that more buildings will be built, raising the need for LEDs.

- Electricity demand in the commercial sector tends to be around 11-13 hours. Electricity use in the industrial sector tends not to fluctuate through the day or year. Electricity demand in the residential sector tends to be highest in the evenings, when lights are turned on, and the average lighting time varies for about 6 to 8 hours. Further, due to improved brightness and fewer dark areas, the Street Lighting National Program has allowed citizens to increase their productivity at night and made roadways safer for drivers and pedestrians. The electricity costs in the states where 1.03 crore smart LEDs have been installed are reduced by up to 50%. These automatic lights minimize waste by turning on and off at sunrise and sunset.

- In 2021, renewable energy accounted for around 20% of total electricity generation. The nation is slated to reach a renewable energy capacity of 500 gigawatts by 2030. Additionally, more than 36.13 billion LED lights have been distributed throughout India as part of the UJALA initiative. As a result, there have been estimated annual energy savings of 46.92 billion kWh and reductions in greenhouse gas emissions of 38 million CO2 annually. This initiative has reduced electricity use and promoted LED use in the country.

India Indoor LED Lighting Industry Overview

The India Indoor LED Lighting Market is fragmented, with the top five companies occupying 11.62%. The major players in this market are Crompton Greaves Consumer Electricals Limited, Havells India Ltd., Signify (Philips), Surya Roshni Limited and Wipro Lighting Limited (Wipro Enterprises Ltd.) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 Per Capita Income

- 4.3 Total Import Of Leds

- 4.4 Lighting Electricity Consumption

- 4.5 # Of Households

- 4.6 Led Penetration

- 4.7 Horticulture Area

- 4.8 Regulatory Framework

- 4.8.1 India

- 4.9 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Indoor Lighting

- 5.1.1 Agricultural Lighting

- 5.1.2 Commercial

- 5.1.2.1 Office

- 5.1.2.2 Retail

- 5.1.2.3 Others

- 5.1.3 Industrial and Warehouse

- 5.1.4 Residential

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 Bajaj Electrical Ltd

- 6.4.2 Crompton Greaves Consumer Electricals Limited

- 6.4.3 Eveready Industries India Limited

- 6.4.4 Havells India Ltd.

- 6.4.5 OPPLE Lighting Co., Ltd

- 6.4.6 Orient Electric Limited

- 6.4.7 Signify (Philips)

- 6.4.8 Surya Roshni Limited

- 6.4.9 Syska Led Lights Private Limited

- 6.4.10 Wipro Lighting Limited (Wipro Enterprises Ltd.)

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms