|

시장보고서

상품코드

1683962

남미의 실내 LED 조명 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)South America Indoor LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

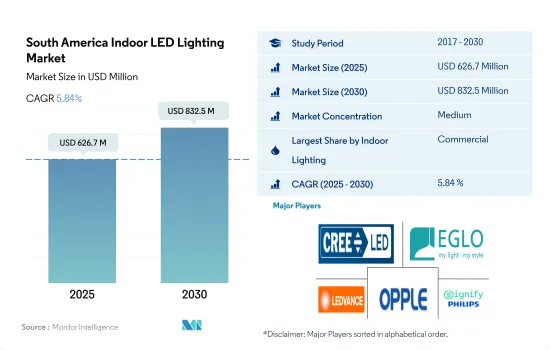

남미의 실내 LED 조명 시장 규모는 2025년에 6억 2,670만 달러에 달할 것으로 추정됩니다. 2030년에는 8억 3,250만 달러에 이를 것으로 예상되며, 예측 기간(2025-2030년)의 CAGR은 5.84%를 나타낼 것으로 전망됩니다.

가처분소득 증가, 정부투자, 상업건설 증가 등 지역 실내 LED 조명시장 성장 견인

- 수량과 금액은 2023년 상업 부문이 최대 점유율을 차지하고 주택, 산업, 창고 및 농업 조명이 뒤를 이었습니다. 남미의 실내 상업용 시장은 향후 몇 년동안 성장할 것으로 예상됩니다. 2020년, COVID-19의 대유행은 상업 건축업계에 큰 영향을 미쳤고, 사무실과 상업 공간은 폐쇄되어야 하고, 그 후 개조와 새로운 현실에의 적응이 필요하게 되었습니다. 유행에 의해 큰 타격을 입은 시장 부문은 사무실과 상업시설의 건설이었고, 그러한 공간에 대한 수요는 감소했습니다. 그러나 경제 회복과 함께 남미 시장에서는 추가 개발이 진행되고 있습니다. 브라질 월수입은 2016년 12월 4,272.3달러에서 2017년 12월 4,779.7달러로 증가했습니다. 브라질과 아르헨티나에서는 가처분 소득이 증가하고 있으며, 그 결과 개인 구매력이 높아지고 소매 상품에 더 많은 돈을 사용할 수 있게 되었습니다.

- 또한 멕시코는 2017년 푸에블라 학교 인프라 개선에 1억 달러 이상을 투자했습니다. 이 나라에서 건설 활동의 활성화로 LED 조명의 사용이 증가하고 있습니다. 이 성장은 궁극적으로 건물 수 증가와 LED 조명기구의 사용 증가로 이어집니다.

- 또한 칠레 정부는 2023년 총 46억 달러에 해당하는 14건의 컨세션 계약의 일반 입찰을 시작한다는 목표를 내걸었습니다. 이 프로젝트에는 3억 9,800만 달러의 공항 라이트 레일과 국제 공항과 산티아고를 연결하는 12km의 라이트 레일 건설이 포함됩니다. 이 노력은 산티아고 지하 지하철 시스템과 공항을 연결합니다. 이러한 상업분야의 개발로 이 지역에서는 LED 조명의 이용 확대가 요구되고 있습니다.

남미의 실내 LED 조명 시장 동향

이 지역의 인구 증가와 저렴한 주택 계획이 실내 LED 조명 시장의 성장을 견인

- 남미에서는 브라질, 콜롬비아, 아르헨티나가 수익과 인구 측면에서 주요 국가입니다. 이 지역에서는 브라질이 2억 1,250만 명으로 큰 점유율을 차지했고, 그 다음 콜롬비아는 2020년에 5,080만 명이 되었습니다. 인구의 85.5%는 도시 지역에 살고 있었습니다. 이 지역의 인구는 0.8%의 변화율로 증가했습니다. 이 때문에 인구 증가로 LED의 보급이 진행되고 조명의 요구가 높아질 것으로 예상됩니다.

- 브라질에서는 가처분 소득이 증가하고 있으며, 그 결과 개인의 소비력이 높아지고 새로운 거주 공간에 더 많은 자금을 투입할 수 있게 되었습니다. 브라질 월수입은 2016년 12월 4,272.3달러에서 2017년 12월 4,779.7달러로 증가했습니다. 아르헨티나에서는 월수입이 2021년 12월 3,539.2달러에서 2022년 12월 4,354.6달러로 증가했습니다.

- 브라질의 저렴한 주택 프로그램이 부활하고 있습니다. 브라질 대통령은 2023년 2월 저소득자를 위한 전국 연방 주택 프로그램을 재개할 계획을 발표했습니다. 대통령은 당초 2009년에 "Minha Casa, Minha Vida"(마이홈, 마이라이프)라고 명명된 이 프로그램을 창설했습니다. 주택 판매는 증가하고 건설 공사도 활발해지고 있습니다. 2022년 1-3분기 상파울루 전체의 주택 판매 호수는 전년 동기 대비 7.9% 증가한 50,728호, 발매 호수는 4.3% 증가한 51,715호였습니다. 위의 예는 앞에서 설명한 바와 같이 정부가 주택 프로그램을 제공하고, 주택을 판매하고, 주택을 신축하는 것이 증가하기 때문에 향후 몇 년 동안 주택 소유율이 증가할 것임을 시사합니다. 이러한 사례에 의해 이 지역에서는 실내 LED 조명 수요가 급증할 것으로 예상됩니다.

LED 조명 시장은 조명 전력 소비를 줄이기 위한 파트너십과 정부 이니셔티브 증가로 추진되고 있습니다.

- 주택 소비는 남미 총 에너지 사용량의 42%를 차지합니다. 이 나라의 건설 생산량은 증가할 것으로 예상됩니다. 이 지역에서 가장 큰 국가인 브라질은 2021년 팬데믹 이전보다 높은 수준으로 호조를 보였습니다. 또한 남미 인프라 프로젝트를 개발하기 위해 미국 무역개발청(USTDA)과 라틴아메리카 개발은행(CAF)은 2022년 7월 제휴를 재확인했습니다. 이 지역의 LED 시장은 건설 활동 증가로 확대되고 있습니다.

- 상업 부문의 전력 수요는 8-10시간 정도입니다. 산업 부문의 전력 사용량은 하루 또는 일년 내내 변동하지 않는 경향이 있습니다. 주택 부문의 전력 수요는 약 7-9시간 변동합니다. 게다가 가로등 프로그램은 2022년에 2개의 다른 주기에서 최대 15개의 관민 파트너십(PPP) 계약을 구성해야 했습니다. 이미 5개의 시정촌이 서비스 제공을 강화하기 위해 1단계에서 민간 파트너와 PPP 컨세션 계약을 체결했습니다. 이를 통해 38만 9000개의 가로등을 LED 기술로 교체하기 위해 약 1억 600만 달러를 지출했습니다.

- 에너지 및 광업성은 2022년에 효과적인 공공 조명 프로그램을 설립했습니다. 이 프로그램의 지원으로 전국의 다양한 지역사회가 에너지 사용량이 적은 LED 가로등으로 전환하게 됩니다. 지능형 조명 시스템과 같은 에너지 효율적인 기술의 사용을 촉진하는 노력도 이 계획에 포함되어 있습니다. 이러한 노력은 이 지역에서 LED 조명의 판매로 이어질 수 있습니다.

남미의 실내 LED 조명 산업 개요

남미의 실내 LED 조명 시장은 적당히 통합되어 상위 5개사에서 54.41%를 차지하고 있습니다. 이 시장 주요 기업은 다음과 같습니다. Cree LED(SMART Global Holdings, Inc.), EGLO Leuchten GmbH, LEDVANCE GmbH(MLS), OPPLE Lighting and Signify(Philips)(알파벳순 정렬).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 인구

- 1인당 소득

- LED 총 수입량

- 조명 전력 소비량

- 가구수

- LED 보급률

- 원예 면적

- 규제 프레임워크

- 아르헨티나

- 브라질

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 실내 조명

- 농업용 조명

- 상업 조명

- 사무실

- 소매

- 기타

- 산업 및 창고

- 주택

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일(세계 수준 개요, 시장 수준 개요, 주요 사업 부문, 재무, 직원 수, 주요 정보, 시장 순위, 시장 점유율, 제품 및 서비스, 최근 동향 분석 포함)

- ACUITY BRANDS, INC.

- ams-OSRAM AG

- Cree LED(SMART Global Holdings, Inc.)

- EGLO Leuchten GmbH

- LEDVANCE GmbH(MLS Co Ltd)

- NVC INTERNATIONAL HOLDINGS LIMITED

- OPPLE Lighting Co., Ltd

- Signify(Philips)

- Thorn Lighting Ltd.(Zumtobel Group)

- Toshiba Corporation

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계의 개요

- 개요

- Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 정보원과 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The South America Indoor LED Lighting Market size is estimated at 626.7 million USD in 2025, and is expected to reach 832.5 million USD by 2030, growing at a CAGR of 5.84% during the forecast period (2025-2030).

Increasing disposable incomes, government investments, and rising commercial constructions to drive the growth of the regional indoor LED lighting market

- In terms of volume and value, the commercial segment was expected to hold the largest share in 2023, followed by residential, industrial and warehouse, and agricultural lighting. The South American indoor commercial market is expected to grow over the coming years. In 2020, the COVID-19 pandemic had a major impact on the commercial construction industry as offices and commercial spaces had to be closed and later needed to be refurbished or adapted to the new reality. The market segment that was hit badly by the pandemic was office and commercial construction, as demand for such spaces declined. However, further developments are occurring in the South American market as the economy regains strength. Monthly income in Brazil increased to USD 4,779.7 in December 2017, up from USD 4,272.3 in December 2016. In Brazil and Argentina, disposable income is increasing, which, in turn, increases the purchasing power of individuals, enabling them to spend more money on retail goods.

- Additionally, Mexico invested more than USD 100 million in improving school infrastructure in Puebla in 2017. Increased construction activity in the country has increased the use of LED lighting. The growth will ultimately lead to an increase in the number of buildings and an increase in the use of LED lighting fixtures.

- In addition, the Chilean government had set a goal of opening public tenders for 14 concession contracts worth a total of USD 4.6 billion in 2023. The project includes a USD 398 million airport light rail and the construction of a 12 km light rail linking the international airport with Santiago. The effort will connect Santiago's underground metro system to the airport. These developments in the commercial sector are demanding greater use of LED lighting in the region.

South America Indoor LED Lighting Market Trends

Increasing population and affordable housing plans in the region to drive the growth of the indoor LED lighting market

- In South America, Brazil, Colombia, and Argentina are the main countries in terms of revenue and population. In this region, Brazil occupied a major share of the population, which accounted for 212.5 million, followed by Colombia with 50.8 million in 2020. 85.5 % of the population lives in urban areas. The population in this region is growing at a rate of 0.8% change. Thus, the increase in population is expected to create more LED penetration and increase the need for illumination in the country.

- In Brazil, disposable income is growing, which results in the rising spending power of individuals and affording more money on new residential spaces. Brazil's monthly earnings increased up to USD 4,779.7 in December 2017 from USD 4,272.3 in December 2016. In Argentina, monthly earnings increased to USD 4,354.6 in December 2022 from USD 3,539.2 in December 2021.

- Brazil's affordable housing program is making a return. Brazil's president announced plans to restart the nationwide federal housing program for low-income individuals in February 2023. President initially created the program, named "Minha Casa, Minha Vida," which translates to "My Home, My Life," in 2009. Sales of homes are increasing, and construction work is picking up. The overall number of residential sales in Sao Paulo increased by 7.9% year-over-year to 50,728 units in the first three quarters of 2022, and the number of launches increased by 4.3% to 51,715 units. The above instance suggests that the rate of house ownership will increase in the coming years because, as stated above, the government offering housing programs, sales of homes, and new constructions of homes are increasing. Such instances are expected to surge the demand for indoor LED lighting in the region.

The LED lighting market is propelled by increasing partnerships and government initiatives to decrease lighting electricity consumption

- Residential consumption accounts for 42% of total energy use in South America. The nation's construction production is anticipated to rise. The largest nation in the area, Brazil, did well in 2021, with levels greater than before the pandemic. Additionally, to develop infrastructure projects in South America, the United States Trade and Development Agency (USTDA) and the CAF-Development Bank of Latin America (CAF) reaffirmed their partnership in July 2022. The region's LED market is expanding as a result of the rise in construction activities.

- Electricity demand in the commercial sector tends to be around 8-10 hours. Electricity use in the industrial sector tends not to fluctuate through the day or year. Electricity demand in the residential sector varies for about 7 to 9 hours. In addition, the streetlight program required structuring up to 15 public-private partnership (public-private partnership (PPP) agreements in two different cycles in 2022. Five municipalities have already entered into PPP concession agreements with private partners in the first phase to enhance service delivery. This will necessitate spending about USD 106 million to replace 389,000 streetlights with LED technology. This will result in better illumination.

- The Ministry of Energy and Mining established an effective Public Lighting program in 2022. With the help of this program, various communities around the nation will switch over to LED street lighting that uses less energy. Initiatives to promote the use of energy-efficient technologies, such as intelligent lighting systems, are included in this plan. These initiatives could lead to the sales of LED lights in the region.

South America Indoor LED Lighting Industry Overview

The South America Indoor LED Lighting Market is moderately consolidated, with the top five companies occupying 54.41%. The major players in this market are Cree LED (SMART Global Holdings, Inc.), EGLO Leuchten GmbH, LEDVANCE GmbH (MLS Co Ltd), OPPLE Lighting Co., Ltd and Signify (Philips) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 Per Capita Income

- 4.3 Total Import Of Leds

- 4.4 Lighting Electricity Consumption

- 4.5 # Of Households

- 4.6 Led Penetration

- 4.7 Horticulture Area

- 4.8 Regulatory Framework

- 4.8.1 Argentina

- 4.8.2 Brazil

- 4.9 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Indoor Lighting

- 5.1.1 Agricultural Lighting

- 5.1.2 Commercial

- 5.1.2.1 Office

- 5.1.2.2 Retail

- 5.1.2.3 Others

- 5.1.3 Industrial and Warehouse

- 5.1.4 Residential

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ACUITY BRANDS, INC.

- 6.4.2 ams-OSRAM AG

- 6.4.3 Cree LED (SMART Global Holdings, Inc.)

- 6.4.4 EGLO Leuchten GmbH

- 6.4.5 LEDVANCE GmbH (MLS Co Ltd)

- 6.4.6 NVC INTERNATIONAL HOLDINGS LIMITED

- 6.4.7 OPPLE Lighting Co., Ltd

- 6.4.8 Signify (Philips)

- 6.4.9 Thorn Lighting Ltd. (Zumtobel Group)

- 6.4.10 Toshiba Corporation

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms