|

시장보고서

상품코드

1683964

남미의 LED 조명 : 시장 점유율 분석, 산업 동향, 성장 예측(2025-2030년)South America LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

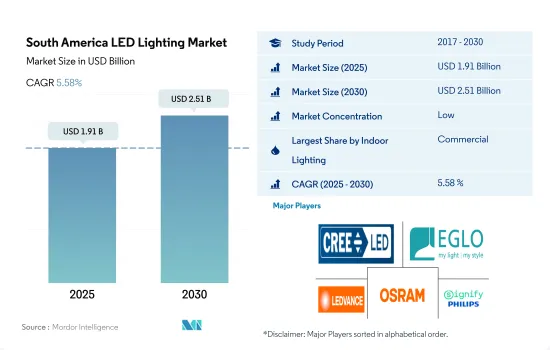

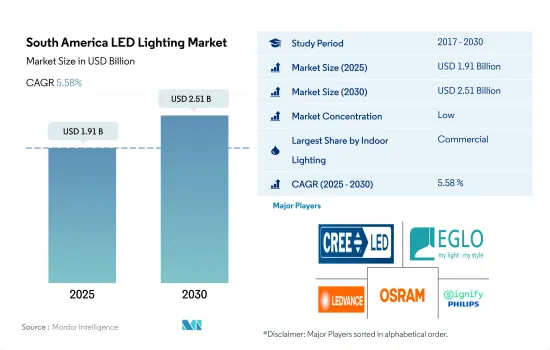

남미의 LED 조명 시장 규모는 2025년에 19억 1,000만 달러로 추정되고, 2030년에는 25억 1,000만 달러에 이를 것으로 예측되며, 예측 기간 2025년부터 2030년까지 CAGR 5.58%로 성장할 전망입니다.

가처분소득 증가, 정부투자 및 상업시설 건설 증가 등 지역 LED 조명 시장 성장 촉진

- 수량 기준이든 금액 기준이든 상업 부문이 2023년 최대 점유율을 차지하였고, 주택, 산업, 창고 및 농업용 조명이 이어질 것으로 예측됩니다. 남미의 실내 상업용 시장은 앞으로 수년간 성장할 전망입니다. 2020년, COVID-19의 대유행은 상업 건축업계에 큰 영향을 미쳤고, 사무실과 상업 공간은 폐쇄되어야 했으며, 그 후 개조와 새로운 현실에 대한 적응이 필요하게 되었습니다. 팬데믹에 의해 큰 타격을 입은 시장 부문은 사무실과 상업시설의 건설이었고, 그러한 공간에 대한 수요는 감소했습니다. 그러나 경제 회복과 함께 남미 시장에서는 추가 개발이 진행되고 있습니다. 브라질 월수입은 2016년 12월 4,272.3달러에서 2017년 12월 4,779.7달러로 증가했습니다. 브라질과 아르헨티나에서는 가처분 소득이 증가하고 있으며, 그 결과 개인 구매력이 높아지고 소매 상품에 더 많은 돈을 사용할 수 있게 되었습니다.

- 또한 멕시코는 2017년 푸에블라 학교 인프라 개선에 1억 달러 이상을 투자했습니다. 이 나라에서 건설 활동의 활성화로 LED 조명의 사용이 증가하고 있습니다. 이 성장은 궁극적으로 건물 수 증가와 LED 조명 기구의 사용 증가로 이어졌습니다.

- 또한 칠레 정부는 2023년 총 46억 달러에 해당하는 14건의 컨세션 계약의 일반 입찰을 시작한다는 목표를 내걸었습니다. 이 프로젝트에는 3억 9,800만 달러의 공항 라이트 레일과 국제 공항 및 산티아고를 연결하는 12km의 라이트 레일 건설이 포함되었습니다. 이 노력은 산티아고 지하 지하철 시스템과 공항을 연결합니다. 이러한 상업 분야의 개발로 이 지역에서는 LED 조명의 이용 확대가 요구되고 있습니다.

남미의 LED 조명 시장 동향

자동차 생산이 LED 조명 시장을 밀어 올립니다.

- 2021년 시점에서 6억 5,600만 명을 보유한 라틴아메리카는 세계 인구의 약 8.37%를 차지하고 있습니다. 2022년 라틴아메리카 인구는 2021년에 비해 거의 0.9% 증가했습니다. 2019년에 비해 라틴아메리카와 카리브해 국가의 총 특수 출생률은 2020년에도 큰 변화가 없었으며, 여성 1인당 어린이 수는 약 1.99명에 그쳤습니다. 인구가 증가함에 따라 많은 고용과 교육 가능성을 추구하는 많은 사람들이 대도시 지역으로 이주했습니다. 도시 인구가 증가함에 따라 라틴아메리카의 도시에서는 주택 수요가 증가했습니다. 라틴아메리카의 일부 정부는 특히 주택과 관련하여 빈곤층을 돕는 도시 인프라 정비에 종사하고 있습니다. 주택 수요 증가는 남미의 LED 수요를 증가시킬 것으로 보입니다.

- 남미에서는 2022년에 총 963만 대의 자동차가 생산되었고, 2023년에는 983만 대까지 증가할 것으로 예측되고 있습니다. 라틴아메리카에서는 EV의 대수가 증가하고 있습니다. 예를 들어 전기차 판매량 증가는 라틴아메리카 프리미엄 자동차 구매자가 견인하고 있습니다. 이 지역에서는 2021년에 약 2만 5,000대의 EV가 판매되었으며, 이는 2020년의 2배 이상이었습니다. 지역 차이는 있지만, 2021년의 EV 판매 대수는 멕시코에서 칠레까지의 전 자동차 판매 대수의 0.7%였습니다. 가장 판매량이 많고(1만 3,000대), 비율이 가장 높은(판매된 자동차 전체의 2.7%가 플러그 포함) 국가는 코스타리카였습니다. 그 결과, 자동차 업계에서는 LED 조명 수요가 증가할 것으로 예측되고 있습니다.

이 지역의 인구 증가와 저가 주택 계획이 LED 조명 시장의 성장을 견인

- 남미에서는 브라질, 콜롬비아, 아르헨티나가 수익과 인구 측면에서 주요 국가입니다. 이 지역에서는 브라질이 2억 1,250만 명으로 큰 점유율을 차지하였고, 그 다음 콜롬비아는 2020년에 5,080만 명이 되었습니다. 인구의 85.5%는 도시 지역에 살고 있습니다. 이 지역의 인구는 0.8%의 변화율로 증가하고 있습니다. 이 때문에 인구 증가로 LED의 보급이 진행되고 조명에 대한 요구가 높아질 것으로 예상됩니다.

- 브라질에서는 가처분 소득이 증가하고 있으며, 그 결과 개인의 소비력이 높아지고 새로운 거주 공간에 더 많은 자금을 투입할 수 있게 되었습니다. 브라질 월수입은 2016년 12월 4,272.3달러에서 2017년 12월 4,779.7달러로 증가했습니다. 아르헨티나에서는 월수입이 2021년 12월 3,539.2달러에서 2022년 12월 4,354.6달러로 증가했습니다.

- 브라질의 저렴한 주택 프로그램이 부활하고 있습니다. 브라질 대통령은 2023년 2월 저소득자를 위한 전국 연방 주택 프로그램을 재개할 계획을 발표했습니다. 대통령은 당초 2009년에 'Minha Casa, Minha Vida'(마이홈, 마이라이프)라고 명명된 이 프로그램을 창설했습니다. 주택 판매는 증가하고 건설 공사도 활발해지고 있습니다. 2022년 1-3분기 상파울루 전체의 주택 판매 호수는 전년 동기 대비 7.9% 증가한 50,728호, 발매 호수는 4.3% 증가한 51,715호였습니다. 위의 예는 앞에서 설명한 바와 같이 정부가 주택 프로그램을 제공하고, 주택을 판매하며, 주택을 신축하는 것이 증가하기 때문에 향후 몇 년동안 주택 소유율이 증가할 것임을 시사합니다. 이러한 사례로 인해 지역의 LED 조명 수요가 급증할 것으로 예상됩니다.

남미의 LED 조명 산업 개요

남미의 LED 조명 시장은 세분화되어 상위 5개사에서 27.57%를 차지하고 있습니다. 이 시장 주요 기업은 다음과 같습니다. Cree LED(SMART Global Holdings, Inc.), EGLO Leuchten GmbH, LEDVANCE GmbH(MLS), OSRAM GmbH. 및 Signify(Philips).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약 및 주요 조사 결과

제2장 보고서 제안

제3장 서문

- 조사 전제조건 및 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 자동차 생산 대수

- 인구

- 1인당 소득

- 자동차 대출 금리

- 충전소 수

- 자동차 보유 대수

- LED 총 수입량

- 조명 소비 전력

- #가구수

- 도로망

- LED 보급률

- #경기장수

- 원예 면적

- 규제 프레임워크

- 실내 조명

- 아르헨티나

- 브라질

- 옥외 조명

- 아르헨티나

- 브라질

- 자동차용 조명

- 아르헨티나

- 브라질

- 실내 조명

- 밸류체인 및 유통채널 분석

제5장 시장 세분화

- 실내 조명별

- 농업용 조명

- 상업용 조명

- 사무실

- 소매

- 기타

- 산업 및 창고

- 주택 조명

- 옥외 조명별

- 공공시설

- 도로

- 기타

- 자동차용 유틸리티 조명별

- 데이터임 러닝 라이트(DRL)

- 방향 지시기

- 헤드라이트

- 리버스 라이트

- 스톱라이트

- 테일 라이트

- 기타

- 자동차용 조명별

- 이륜차

- 상용차

- 승용차

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일(세계 수준 개요, 시장 수준 개요, 주요 사업 부문, 재무, 직원 수, 주요 정보, 시장 순위, 시장 점유율, 제품 및 서비스, 최근 동향 분석 포함)

- Cree LED(SMART Global Holdings, Inc.)

- EGLO Leuchten GmbH

- HELLA GmbH & Co. KGaA

- KOITO MANUFACTURING CO., LTD.

- LEDVANCE GmbH(MLS Co Ltd)

- OPPLE Lighting Co., Ltd

- OSRAM GmbH.

- Signify(Philips)

- Stanley Electric Co., Ltd.

- Valeo

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계의 개요

- 개요

- Porter's Five Forces 분석 프레임워크

- 세계 밸류체인 분석

- 시장 역학(DROs)

- 정보원 및 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The South America LED Lighting Market size is estimated at 1.91 billion USD in 2025, and is expected to reach 2.51 billion USD by 2030, growing at a CAGR of 5.58% during the forecast period (2025-2030).

Increasing disposable incomes, government investments, and rising commercial constructions to drive the growth of the regional LED lighting market

- In terms of volume and value, the commercial segment was expected to hold the largest share in 2023, followed by residential, industrial and warehouse, and agricultural lighting. The South American indoor commercial market is expected to grow over the coming years. In 2020, the COVID-19 pandemic had a major impact on the commercial construction industry as offices and commercial spaces had to be closed and later needed to be refurbished or adapted to the new reality. The market segment that was hit badly by the pandemic was office and commercial construction, as demand for such spaces declined. However, further developments are occurring in the South American market as the economy regains strength. Monthly income in Brazil increased to USD 4,779.7 in December 2017, up from USD 4,272.3 in December 2016. In Brazil and Argentina, disposable income is increasing, which, in turn, increases the purchasing power of individuals, enabling them to spend more money on retail goods.

- Additionally, Mexico invested more than USD 100 million in improving school infrastructure in Puebla in 2017. Increased construction activity in the country has increased the use of LED lighting. The growth will ultimately lead to an increase in the number of buildings and an increase in the use of LED lighting fixtures.

- In addition, the Chilean government had set a goal of opening public tenders for 14 concession contracts worth a total of USD 4.6 billion in 2023. The project includes a USD 398 million airport light rail and the construction of a 12 km light rail linking the international airport with Santiago. The effort will connect Santiago's underground metro system to the airport. These developments in the commercial sector are demanding greater use of LED lighting in the region.

South America LED Lighting Market Trends

Automobile production to boost the LED lighting market

- With 656 million people as of 2021, Latin America made up around 8.37% of the world's population. The population of Latin America increased by almost 0.9% in 2022 compared to 2021. Compared to 2019, the total fertility rate in Latin America and the Caribbean did not significantly change in 2020 and stayed at about 1.99 children per woman. Many people are relocating to metropolitan regions as the population grows in search of better employment and educational possibilities. The demand for residential properties in Latin American cities is rising as a result of the growing urban population. Some Latin American governments have taken action to support pro-poor urban infrastructure, particularly with respect to housing. The increase in the demand for residential properties will increase the demand for LED in South America.

- In South America, a total of 9.63 million cars were produced in 2022, and that number is projected to rise to 9.83 million in 2023. The number of EVs is rising in Latin America. For instance, a rise in the sales of electric vehicles is being driven by premium car purchasers in Latin America. In the region, about 25,000 EVs were sold in 2021, more than twice as many as were sold in 2020. With regional differences, EV sales in 2021 were 0.7% of all auto sales from Mexico to Chile. The country with the biggest sales (13,000 units) and the highest percentage (2.7% of all sold automobiles had a plug) was Costa Rica. As a result, it is predicted that the demand for LED lighting is expected to increase in the automotive industry.

Increasing population and affordable housing plans in the region to drive the growth of the LED lighting market

- In South America, Brazil, Colombia, and Argentina are the main countries in terms of revenue and population. In this region, Brazil occupied a major share of the population, which accounted for 212.5 million, followed by Colombia with 50.8 million in 2020. 85.5 % of the population lives in urban areas. The population in this region is growing at a rate of 0.8% change. Thus, the increase in population is expected to create more LED penetration and increase the need for illumination in the country.

- In Brazil, disposable income is growing, which results in the rising spending power of individuals and affording more money on new residential spaces. Brazil's monthly earnings increased up to USD 4,779.7 in December 2017 from USD 4,272.3 in December 2016. In Argentina, monthly earnings increased to USD 4,354.6 in December 2022 from USD 3,539.2 in December 2021.

- Brazil's affordable housing program is making a return. Brazil's president announced plans to restart the nationwide federal housing program for low-income individuals in February 2023. President initially created the program, named "Minha Casa, Minha Vida," which translates to "My Home, My Life," in 2009. Sales of homes are increasing, and construction work is picking up. The overall number of residential sales in Sao Paulo increased by 7.9% year-over-year to 50,728 units in the first three quarters of 2022, and the number of launches increased by 4.3% to 51,715 units. The above instance suggests that the rate of house ownership will increase in the coming years because, as stated above, the government offering housing programs, sales of homes, and new constructions of homes are increasing. Such instances are expected to surge the demand for LED lighting in the region.

South America LED Lighting Industry Overview

The South America LED Lighting Market is fragmented, with the top five companies occupying 27.57%. The major players in this market are Cree LED (SMART Global Holdings, Inc.), EGLO Leuchten GmbH, LEDVANCE GmbH (MLS Co Ltd), OSRAM GmbH. and Signify (Philips) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Automotive Production

- 4.2 Population

- 4.3 Per Capita Income

- 4.4 Interest Rate For Auto Loans

- 4.5 Number Of Charging Stations

- 4.6 Number Of Automobile On-road

- 4.7 Total Import Of Leds

- 4.8 Lighting Electricity Consumption

- 4.9 # Of Households

- 4.10 Road Networks

- 4.11 Led Penetration

- 4.12 # Of Stadiums

- 4.13 Horticulture Area

- 4.14 Regulatory Framework

- 4.14.1 Indoor Lighting

- 4.14.1.1 Argentina

- 4.14.1.2 Brazil

- 4.14.2 Outdoor Lighting

- 4.14.2.1 Argentina

- 4.14.2.2 Brazil

- 4.14.3 Automotive Lighting

- 4.14.3.1 Argentina

- 4.14.3.2 Brazil

- 4.14.1 Indoor Lighting

- 4.15 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Indoor Lighting

- 5.1.1 Agricultural Lighting

- 5.1.2 Commercial

- 5.1.2.1 Office

- 5.1.2.2 Retail

- 5.1.2.3 Others

- 5.1.3 Industrial and Warehouse

- 5.1.4 Residential

- 5.2 Outdoor Lighting

- 5.2.1 Public Places

- 5.2.2 Streets and Roadways

- 5.2.3 Others

- 5.3 Automotive Utility Lighting

- 5.3.1 Daytime Running Lights (DRL)

- 5.3.2 Directional Signal Lights

- 5.3.3 Headlights

- 5.3.4 Reverse Light

- 5.3.5 Stop Light

- 5.3.6 Tail Light

- 5.3.7 Others

- 5.4 Automotive Vehicle Lighting

- 5.4.1 2 Wheelers

- 5.4.2 Commercial Vehicles

- 5.4.3 Passenger Cars

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 Cree LED (SMART Global Holdings, Inc.)

- 6.4.2 EGLO Leuchten GmbH

- 6.4.3 HELLA GmbH & Co. KGaA

- 6.4.4 KOITO MANUFACTURING CO., LTD.

- 6.4.5 LEDVANCE GmbH (MLS Co Ltd)

- 6.4.6 OPPLE Lighting Co., Ltd

- 6.4.7 OSRAM GmbH.

- 6.4.8 Signify (Philips)

- 6.4.9 Stanley Electric Co., Ltd.

- 6.4.10 Valeo

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms