|

시장보고서

상품코드

1683971

영국의 LED 조명 시장 : 시장 점유율 분석, 산업 동향, 성장 예측(2025-2030년)UK LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

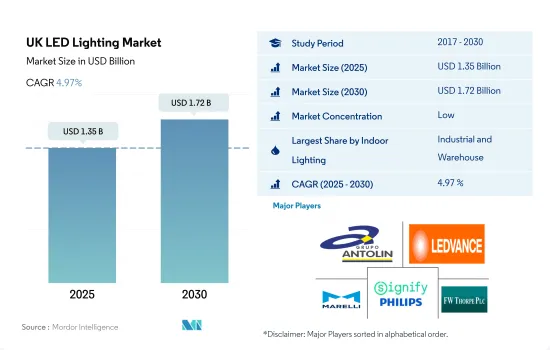

영국의 LED 조명 시장 규모는 2025년에 13억 5,000만 달러로 추정되고, 2030년에는 17억 2,000만 달러에 이를 것으로 예측되며, 예측 기간 중 2025년부터 2030년까지 CAGR 4.97%로 성장할 전망입니다.

산업 생산 확대 및 기술 신흥 기업 투자는 시장 성장을 견인

- 금액 점유율에서는 2023년 산업 및 창고(I&W) 분야가 가장 높은 시장 점유율(46.8%)을 차지했으며, 상업(33.8%), 주택(19.2%), 농업이 이어졌습니다. I&W 부문과 주택 부문 시장 점유율은 향후 수년간 확대될 것으로 예상됩니다. 영국 산업은 칩 압박, 공장 폐쇄, COVID-19 팬데믹 시 공급망의 혼란 등 내외의 일부 역풍에 직면했습니다. 그러나 이 나라는 2021년에도 공업 생산을 유지해 2020년 대비 16.57% 증가한 2,748억 7,000만 달러를 생산했습니다. 그러므로 산업 생산의 확대는 향후 몇 년동안 실내 조명에 대한 수요를 창출할 것으로 보입니다.

- EV와 자율주행기술, 커넥티드기술 등의 신기술은 정부에 의해 지원되고 있으며, 이것이 업계를 크게 뒷받침하고 있습니다. 이들은 조사 기간 동안에도 실내용 LED 수요를 밀어 올릴 것으로 보입니다. 2023년 4월 재규어 랜드로버는 영국 제조 공장에 향후 5년간 수십억 달러를 투자해 EV와 플렉서블의 생산을 강화할 계획을 발표했습니다.

- 생활비 위기가 악화의 일도를 따르는 가운데, 2023년 5월의 영국 소매 매출액은 감소 페이스가 둔화되었습니다. 2023년 5월 소매 매출은 전월의 0.5% 증가에서 0.3% 증가했습니다. 온라인 쇼핑 이용자의 급증으로 국내 신규 창고가 증가하고 실내 조명 수요가 높아질 것으로 예상됩니다.

- 영국에서는 기술 신흥 기업이 눈부신 성장률을 기록하고 있습니다. 2021년에만 영국 기술 신흥기업에 의해 241억 달러 상당의 주식거래가 발표되었습니다. 이러한 개발은 상업 부문 수요를 끌어올립니다. 이러한 요인으로 인해 향후 몇 년동안 실내 LED 수요가 증가할 것으로 예상됩니다.

영국의 LED 조명 시장 동향

주택용 부동산 증가가 LED 시장 성장을 견인할 가능성

- 2021년 잉글랜드에 사는 인구는 5,650만 명으로 1.56명의 자녀가 태어났습니다. 2019년부터 2021년까지 0.1포인트 감소했습니다. 2020년 영국 사망률은 인구 1,000명 당 9.7명까지 떨어졌고, 2021년에는 인구 1,000명 당 0.4명(-3.96%) 감소로 돌아섰습니다. 영국에서는 인구 증가와 사망률 감소로 LED 수요가 증가할 것으로 예상됩니다.

- 잉글랜드의 주택 스톡은 꾸준히 증가하고 있으며, 2021년 총 주택 수는 약 2,500만 호에 달했습니다. 2022년 2분기 시점에 7만 1,400호의 계획 주택 중 약 4만 4,500호가 건설 예정인 임대주택이었습니다. 영국의 주택 부동산 시장은 2021년에 활황을 보인 후 팬데믹에 의한 정체를 거쳐 2022년에 침체했습니다. 40,000파운드(50,475.20달러) 이상의 거래 건수는 2020년 약 100만 호에서 2021년에는 150만 호 이상, 2022년에는 130만 호 이상으로 증가했습니다. 거래 건수 증가가 예상에 따라 부동산 평균 가격도 전국적으로 상승할 것으로 예상됩니다. 평균 거래 가격 상승으로 미래에 주택을 구매하는 사람이 늘어나 LED 수요가 높아질 가능성이 높습니다.

- 영국에서는 2021년에 유효한 면허가 있는 자동차가 3,288만 9,462대였습니다. 영국 가정에는 2020년에 평균 1.24대의 자동차가 있었습니다. 이 나라에서는 2021년에는 전기차가 163만 2,997대로 2014년부터 6.9대 증가했습니다. 2021년 말 현재 국내 자동차의 약 5%가 전부 또는 일부를 전기로 구동했습니다. 하이브리드 전기차가 압도적으로 많아 2021년에는 93만 2,335대가 달렸습니다. 자동차나 EV 증가에 따라 국내에서는 더 많은 LED가 사용될 것으로 예상됩니다.

1인당 소득 증가 및 에너지 효율적인 조명 사용을 전개하는 정부 정책은 LED 사용을 뒷받침할 수 있습니다.

- 2022년 영국 가구 수는 1,940만 가구에 이른 것으로 평가되었으며, 2012년 1,840만 가구에서 5.7% 증가했습니다. 2022년 영국 가구 수는 2,820만 가구로 평가되었으며, 2012년(2,660만 가구)보다 6.1% 증가했습니다. 따라서 가족 수와 가구 수가 증가하면 국내 LED 수요가 증가할 수 있습니다. 2021년부터 2022년까지 주택 소유가구는 1,560만 가구로 국내 전체 가구의 64%를 차지했습니다. 이 비율은 2016-2017년의 63%에서 증가했지만, 2020-2021년은 일정했습니다. 지난 10년간 일관되게 영국의 가처분 소득은 높아 개인의 소비력이 상승하고 새로운 거주 공간에 대한 지출도 증가하고 있습니다. 이 나라의 1인당 소득은 2021년 12월 36,516.3달러에 비해 2022년 12월 3만 3,138달러에 달했습니다. 일부 선진국에 비해 영국은 2021년 1인당 소득이 전년보다 감소했음에도 불구하고 높은 구매력을 가졌습니다. 예를 들어 브라질에서는 7732.4달러, 프랑스에서는 2021년 현재 25337.7달러였습니다.

- 국내 주택 착공 호수는 2022년 3분기 43,140호에서 2022년 4분기에 39,220호로 감소했습니다. 주택 프로젝트가 감소했지만 LED에 대한 수요가 존재했습니다. 그러나 주택 분야에서는 전 분기에 비해 감소했습니다. 정부는 에너지 효율적인 조명의 새로운 제안에 대한 협의의 시작을 발표했습니다. 이 제안에서는 오래된 할로겐 전구 대신 저에너지 소비 LED 등의 조명이 도입되어 전구의 내용연수로 2,000파운드(2523.76달러)에서 3,000파운드(3785.64달러)를 절약할 수 있다고 합니다. 이러한 사례는 미래에 이 나라에서 LED 조명 수요를 높일 것으로 기대됩니다.

영국의 LED 조명 산업 개요

영국의 LED 조명 시장은 세분화되어 상위 5개사에서 29.96%를 차지하고 있습니다. 이 시장 주요 기업은 다음과 같습니다. GRUPO ANTOLIN IRAUSA, SA, LEDVANCE GmbH(MLS), Marelli Holdings, Signify(Philips) 및 Thorlux Lighting(FW Thorpe Plc)(알파벳순 정리).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약 및 주요 조사 결과

제2장 보고서 제안

제3장 서문

- 조사 전제조건 및 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 자동차 생산 대수

- 인구

- 1인당 소득

- 자동차 대출 금리

- 충전소 수

- 자동차 보유 대수

- LED 총 수입량

- 조명 소비 전력

- #가구수

- 도로망

- LED 보급률

- #경기장수

- 원예 면적

- 규제 프레임워크

- 실내 조명

- 영국

- 옥외 조명

- 영국

- 자동차용 조명

- 영국

- 실내 조명

- 밸류체인 및 유통채널 분석

제5장 시장 세분화

- 실내 조명별

- 농업용 조명

- 상업용 조명

- 사무실

- 소매

- 기타

- 산업 및 창고

- 주택 조명

- 옥외 조명별

- 공공시설

- 도로

- 기타

- 자동차용 유틸리티 조명별

- 데이터임 러닝 라이트(DRL)

- 방향 지시기

- 헤드라이트

- 리버스 라이트

- 스톱라이트

- 테일 라이트

- 기타

- 자동차용 조명별

- 이륜차

- 상용차

- 승용차

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일(세계 수준 개요, 시장 수준 개요, 주요 사업 부문, 재무, 직원 수, 주요 정보, 시장 순위, 시장 점유율, 제품 및 서비스, 최근 동향 분석 포함)

- ACUITY BRANDS, INC.

- Crompton Lamps Limited(GCH Corporation Limited)

- Dialight PLC

- GRUPO ANTOLIN IRAUSA, SA

- HELLA GmbH & Co. KGaA(FORVIA)

- LEDVANCE GmbH(MLS Co Ltd)

- Marelli Holdings Co., Ltd.

- OSRAM GmbH.

- Signify(Philips)

- Thorlux Lighting(FW Thorpe Plc)

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계의 개요

- 개요

- Porter's Five Forces 분석 프레임워크

- 세계 밸류체인 분석

- 시장 역학(DROs)

- 정보원 및 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The UK LED Lighting Market size is estimated at 1.35 billion USD in 2025, and is expected to reach 1.72 billion USD by 2030, growing at a CAGR of 4.97% during the forecast period (2025-2030).

The growing industrial production and investments in technology startups driving the market's growth

- In terms of value share, in 2023, the industrial and warehouse (I&W) segment accounted for the highest market share (46.8%), followed by commercial (33.8%), residential (19.2 %), and agricultural. The market share of the I&W and residential segments is expected to grow in the coming years. UK industries faced several internal and external headwinds, such as chip crunch, plant closures, and supply chain disruptions during the COVID-19 pandemic. However, the country sustained its industrial production in 2021 and produced a total of USD 274.87 billion, a 16.57% increase over 2020. Thus, the growing industrial production will generate demand for indoor lighting in the coming years.

- New technologies such as EVs, as well as autonomous and connected technology, are supported by the government, which is a major boost to the industry. These will continue to boost the demand for indoor LEDs during the study period. In April 2023, Jaguar Land Rover announced plans to invest billions over the next five years in its UK manufacturing plants to ramp up EV and flexible production.

- As the cost-of-living crisis continued to worsen, UK retail sales declined at a slower pace in May 2023. Retail sales rose by 0.3% in May 2023 after growing by 0.5% in the previous month. The rapid increase in online shoppers is expected to boost new warehouses in the country, resulting in more demand for indoor lighting

- In the UK, technology startups have recorded a remarkable growth rate. In 2021 alone, USD 24.10 billion worth of announced equity deals were raised by UK technology startups, compared to USD 10.80 billion in 2020, a massive 123% surge. Such developments boost the demand in the commercial segment. These factors are expected to generate more demand for indoor LEDs over the coming years.

UK LED Lighting Market Trends

An increase in residential real estate may drive the growth of the LED market

- In 2021, there were 56.5 million people living in England, and 1.56 children were born in the country. There was a 0.1-point decrease from 2019 to 2021. In 2020, the death rate in the United Kingdom dropped to 9.7 fatalities per 1,000 people, which translated to a decrease of 0.4 fatalities per 1,000 people (-3.96%) in 2021. In the United Kingdom, the demand for LEDs is expected to increase due to population growth and a drop in the death rate.

- England's housing stock has steadily grown, reaching a total of about 25 million homes as of 2021. There were around 44,500 build-to-rent homes in the country's 71,400 planned residences as of the second quarter of 2022. The UK residential real estate market experienced a rise in activity in 2021 before seeing a dip in 2022 after stagnating due to the epidemic. The number of transactions with a value of at least GBP 40,000 (USD 50475.20) increased from about 1 million units in 2020 to over 1.5 million units in 2021 and 1.3 million units in 2022. The average property price is anticipated to rise across the country, along with the anticipated rise in transactions. As a result of the increase in average price transactions, more people will likely buy homes in the future, thus increasing the demand for LEDs.

- In the United Kingdom, there were 32,889,462 automobiles with valid licenses in 2021. English homes had an average of 1.24 vehicles in 2020. In the country, there were 1,632,997 electric vehicles in 2021, a 6.9 increase from 2014. About 5% of vehicles in the country were powered by electricity entirely or in part at the end of 2021. Hybrid electric vehicles are by far the most common, with 932,335 units on the road in 2021. More LEDs are expected to be used in the country as the number of vehicles and EVs increases.

Increasing per capita income and the government policy to roll out the use of energy-efficient lighting may boost the use of LEDs.

- In 2022, the number of UK families was projected to reach 19.4 million, an increase of 5.7% from 18.4 million in 2012. The expected number of households in the United Kingdom in 2022 was 28.2 million, 6.1% more than that in 2012 (26.6 million). Thus, the increasing number of families and households may create more demand for LEDs in the country. During 2021-2022, there were 15.6 million owner-occupied households, representing 64% of all households in the country. This percentage increased from 63% during 2016-2017 but remained constant during 2020-2021. It has been consistent throughout the past 10 years. The disposable income in the United Kingdom is high, resulting in rising spending power of individuals and more spending on new residential spaces. The country's per capita income reached USD 33,138.0 in December 2022 compared to USD 36,516.3 in December 2021. Compared to some developed nations, the United Kingdom had high purchasing power in 2021, even though per capita income decreased compared to the previous year. For instance, in Brazil, it was USD 7732.4, while in France, it was USD 25,337.7 as of 2021.

- Housing starts in the country decreased to 39,220 units in Q4 2022 from 43,140 units in Q3 2022. Even though housing projects declined, the demand for LEDs existed. However, it was less in the residential segment compared to previous quarters. The government announced the launch of a consultation on a new energy-efficient lighting proposal. Under this proposal, lighting such as low energy-use LEDs will be rolled out to replace old halogen bulbs, which could save households between GBP 2,000 (USD 2523.76) and GBP 3,000 (USD 3785.64) over the lifetime of the bulbs. Such instances are further expected to boost the demand for LED lighting in the country in the future.

UK LED Lighting Industry Overview

The UK LED Lighting Market is fragmented, with the top five companies occupying 29.96%. The major players in this market are GRUPO ANTOLIN IRAUSA, S.A., LEDVANCE GmbH (MLS Co Ltd), Marelli Holdings Co., Ltd., Signify (Philips) and Thorlux Lighting (FW Thorpe Plc) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Automotive Production

- 4.2 Population

- 4.3 Per Capita Income

- 4.4 Interest Rate For Auto Loans

- 4.5 Number Of Charging Stations

- 4.6 Number Of Automobile On-road

- 4.7 Total Import Of Leds

- 4.8 Lighting Electricity Consumption

- 4.9 # Of Households

- 4.10 Road Networks

- 4.11 Led Penetration

- 4.12 # Of Stadiums

- 4.13 Horticulture Area

- 4.14 Regulatory Framework

- 4.14.1 Indoor Lighting

- 4.14.1.1 United Kingdom

- 4.14.2 Outdoor Lighting

- 4.14.2.1 United Kingdom

- 4.14.3 Automotive Lighting

- 4.14.3.1 United Kingdom

- 4.14.1 Indoor Lighting

- 4.15 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Indoor Lighting

- 5.1.1 Agricultural Lighting

- 5.1.2 Commercial

- 5.1.2.1 Office

- 5.1.2.2 Retail

- 5.1.2.3 Others

- 5.1.3 Industrial and Warehouse

- 5.1.4 Residential

- 5.2 Outdoor Lighting

- 5.2.1 Public Places

- 5.2.2 Streets and Roadways

- 5.2.3 Others

- 5.3 Automotive Utility Lighting

- 5.3.1 Daytime Running Lights (DRL)

- 5.3.2 Directional Signal Lights

- 5.3.3 Headlights

- 5.3.4 Reverse Light

- 5.3.5 Stop Light

- 5.3.6 Tail Light

- 5.3.7 Others

- 5.4 Automotive Vehicle Lighting

- 5.4.1 2 Wheelers

- 5.4.2 Commercial Vehicles

- 5.4.3 Passenger Cars

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ACUITY BRANDS, INC.

- 6.4.2 Crompton Lamps Limited (GCH Corporation Limited)

- 6.4.3 Dialight PLC

- 6.4.4 GRUPO ANTOLIN IRAUSA, S.A.

- 6.4.5 HELLA GmbH & Co. KGaA (FORVIA)

- 6.4.6 LEDVANCE GmbH (MLS Co Ltd)

- 6.4.7 Marelli Holdings Co., Ltd.

- 6.4.8 OSRAM GmbH.

- 6.4.9 Signify (Philips)

- 6.4.10 Thorlux Lighting (FW Thorpe Plc)

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms